Most of those who follow cryptocurrency will remember, or at least have heard, of the DeFi summer. This happened in 2020, and at that time, it looked like DeFi would be the prevailing use case for crypto and blockchain. However, a year later, some game resembling Pokémon took off. I believe everyone knows what I'm talking about, but to make sure, I'm talking about Axie Infinity. The native token of AXS went from a $200 million market cap to almost $10 billion market cap in under six months. At that time, the market cap was about one-fifth of Activision Blizzard's market cap, which is crazy considering Axie Infinity is only one game while Activision owns games like Call of Duty, Candy Crush, World of Warcraft, and many more.

This, plus all the metaverse hype after Facebook's rebranding, has made crypto people question whether GameFi could surpass DeFi. But, depending on which metrics you use, it already has. In this article, I'll go over some basics of GameFi and DeFi and look at which of these will be the true winner.

What Are DeFi and GameFi?

Decentralized finance is meant to replace centralized intermediaries in the financial sector. The thesis is that instead of a bank, you can have a smart contract that assures both parties play according to the rules. With these smart contracts, you eliminate the cost of using a centralized party. The best example is borrowing and lending. Currently, if you deposit to a bank, you'll receive almost no return while the bank makes money lending your assets. With DeFi, you can lend your assets peer-to-peer and receive the full interest directly. The rates are set directly by demand rather than by a central bank. Another heavily employed use case of DeFi is decentralized exchanges like Uniswap, where you can trade assets from one to another without relying on a centralized party like a broker. Currently, these are used mostly for swapping one crypto to another, but Kevin O'Leary did mention in an interview that the whole foreign exchange markets could be replaced with DeFi to make it both cheaper and more efficient. If you want to learn more about DeFi, you can start with this video by Coin Bureau.

Here's another good video on defi. Image via Finematics YouTube

Here's another good video on defi. Image via Finematics YouTube GameFi resembles DeFi in many ways, but the most significant difference is that all of it happens in a game. Essentially all games that have some economic ecosystem are included in GameFi. Often GameFi is linked to blockchain and crypto, but some could argue that it’s far older than that. However, the problem with GameFi without blockchain has been if you don’t own it, you’re not allowed (by the game companies) to sell it. Markets that have formed around selling in-game items have also been highly illiquid and, in many cases, untrustworthy. With crypto and NFTs, all of this has changed. Looking at what Axie Infinity has done, as an example, and the amount of popularity it has gained shows that it’s here to stay. But essentially, in one sentence, GameFi is gaming combined with finance (as the name implies).

GameFi vs DeFi: Follow the Money

When comparing two things and their popularity, two aspects often dominate - money and users. Let's begin with money, how much is invested and how much can be ultimately. The fast and easy answer would be that DeFi will dominate since, as its definition implies, it's here to take out the banks and all other financial intermediaries. However, no matter how bullish you are on cryptocurrencies, you need to understand that it's not going to happen, at least for a while. Therefore, it's a lot tighter if we think about how much capital each of these industries could realistically gather. There are just a few problems. First, where is the line drawn between GameFi and DeFi?

This is something I can't figure out, and let me elaborate on this. Think of The Sandbox, and think of The Sandbox as fully decentralized. Now on The Sandbox, you can buy land, lease land, show your NFTs, and more. Now, if I buy land through a decentralized platform (OpenSea isn't) and start leasing this to companies or private people who want to host events on my land (again through a decentralized service utilizing smart contracts), then is this DeFi or GameFi? I'm doing everything that DeFi represents, but because I'm doing it in a game, then it's GameFi? I don't think this is a problem per se since what does it matter what it classifies as, as long as I can make money doing it. It isn't easy to compare these two without a clear line. However, hopefully, you see my point in the difficulty of drawing a clear line between these two.

This is a metaverse only real estate company. Didn't think you'd see that did you. Image via Metaverse Property.

This is a metaverse only real estate company. Didn't think you'd see that did you. Image via Metaverse Property. Another problem we have is the measurement we use. In DeFi, measuring the popularity in total value locked (TVL) is typical, while GameFi often looks instead at transaction volume. However, we'll make the best of it and start with TVL. According to this article by Bloomberg, the top five DeFi dapps had a TVL of $130 billion, while the top 5 games only had $14 billion. Clearly, DeFi takes the edge here, but it's not an entirely fair comparison since the structure and meaning of these two services isn't the same. It's reasonable for someone to put millions in stablecoins and lend them to generate interest payments, but putting millions in Axies isn't something people do, or at least it's not that common and probably won't be anytime soon either.

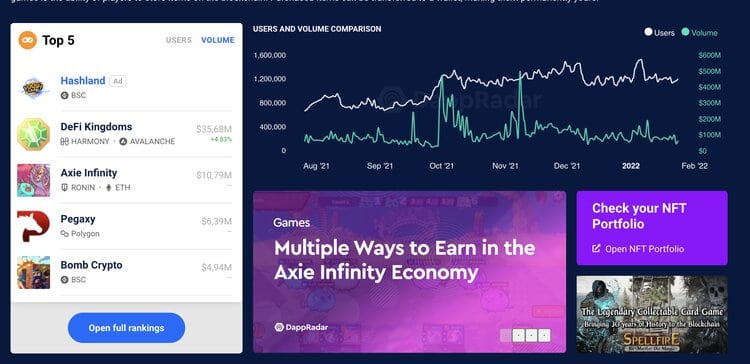

Comparing transactions, it's also a win for DeFi. GameFi has about $100 million transactions per day. In comparison, Raydium (an automated market maker on Solana) has over $800 million transactions in the last 24 hours at the time of writing, according to Dappradar. Also, it doesn't look like GameFi will surpass DeFi anytime soon. That's because the volume of game transactions hasn't grown at all since August 2021. There have been peaks with up to $350 million transactions per day, but any sustainable levels like this haven't occurred.

Here's a look at the statistics of GameFi from Dappradar. Image via Dappradar.

Here's a look at the statistics of GameFi from Dappradar. Image via Dappradar. However, one thing not counted in GameFi transactions, which at least to some extent should be included, is NFT sales. NFTs have seen massive growth, and many of them are game related. Just take a look at Gala Games, which consistently sells huge amounts of in-game NFTs. Some of these transactions are made via the game's native NFT market, while some trade on second-hand markets like OpenSea. It's hard to guess how much of all the NFT sales are game-related, but I would imagine that if OpenSea sees billions in volume each month, at least a few hundred million are game related. The Sandbox NFTs alone has over 24,000 ETH ($5-10 million depending on the ETH's price) of volume in the last 30 days.

We can see that DeFi dominates GameFi in terms of money, but what about the future? Now, let's look at traditional banks. The annual revenue is an estimated $2.3 trillion for retail banks, and it does make it seem impossible for some games to overtake that, if DeFi were to overtake traditional banks. However, as I mentioned earlier, it looks improbable that the underlying companies that run the world's money markets get entirely overtaken by smart contracts in the coming years. GameFi, on the other hand, has unimaginable potential, and all the trends are looking positive. For example, look at this metaverse report by Grayscale, which predicts revenue of up to $1 trillion for the metaverse sector in the future. Now I can't say for sure what's going to happen, but looking at all of this, I would say that while GameFi has a long way to go to catch up to DeFi (in money terms), it's not impossible.

GameFi vs DeFi: Users and Popularity

DeFi might have won the competition regarding money, but users and popularity is an entirely different game. Simply by reading the news, you might have noticed that the trend is clearly on GameFi’s side. There are consistently new articles about how GameFi and NFTs are growing, while articles about DeFi are about how all the tokens haven’t moved anywhere in the last year. GameFi is the new hot thing, which can be seen in the number of users.

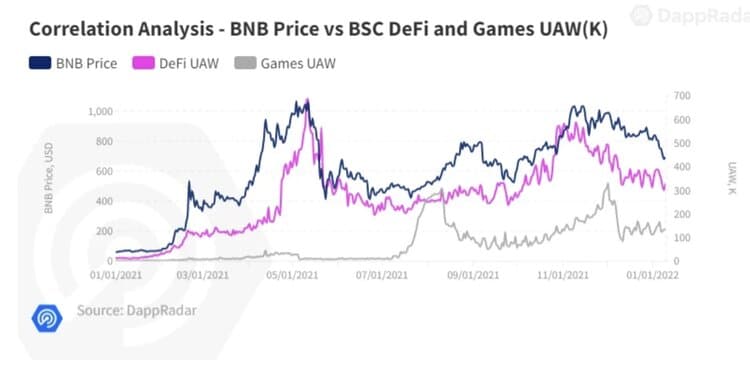

According to this Bloomberg article from the 7th of December 2021, GameFi has already surpassed DeFi in user popularity. Bloomberg used Dappradar as their source, so I will do the same and look at their most recent report from the 13th of January. According to the report, games now account for 52.4 % of all dapp user activity compared to DeFi, which only stands at 34.7 %. Another interesting statistic from the report is that DeFi has followed the global macro trend with reduced activity. On the other hand, game activity doesn’t seem to be bothered by the plunge in both crypto and equity prices; they just keep on growing. This is also one of the beauties with GameFi; it’s not meant for the elite to make more money. It’s just a way for average people who like to play games to enhance their gameplay by ownership and play-to-earn potential.

Here you can see how games keep growing despite everything else taking a beating. Image via Dappradar.

Here you can see how games keep growing despite everything else taking a beating. Image via Dappradar. Using Dappradar again, we can see that in the last seven days, GameFi does have more users than DeFi. Especially if you were to remove PancakeSwap from the count, it would be absolute dominance by GameFi. In the last 30 days, the victory has gone to DeFi, but that’s primarily because of the tremendous activity on PancakeSwap. However, in these statistics, there are some things I find a bit sketchy so let’s look at something else too.

According to Dune Analytics, the total number of DeFi users is a little over 4 million. This same statistic can’t be found for GameFi or blockchain games but let’s look at Axie Infinity alone. On November 14, 2021, Axie Infinity tweeted that over one million unique wallet addresses had interacted with the Ethereum sidechain Ronin created for Axie Infinity. That’s just one day and one game, and it pretty much shows the popularity and potential for GameFi.

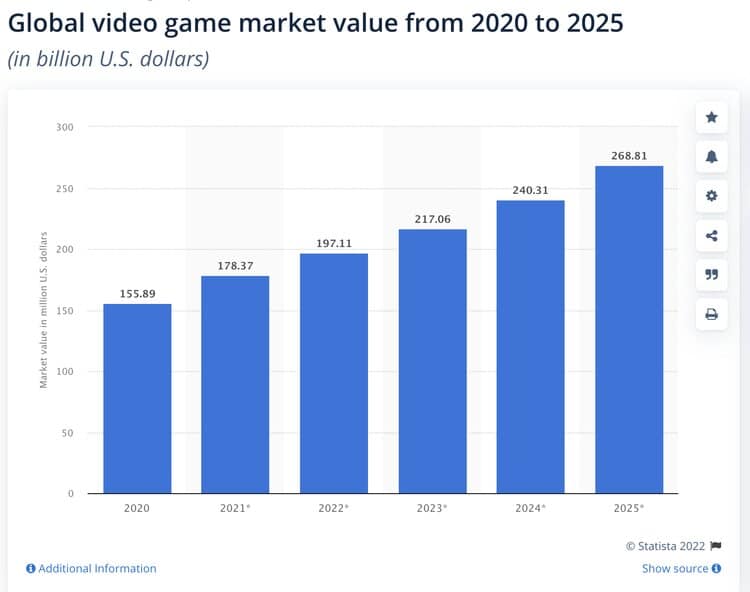

The last thing I want to talk about regarding users and popularity is the potential if compared to their traditional equivalents. DeFi is currently used to leverage your capital for additional income, which restricts the number of users it will attract. It’s true that many people use banks and have investments, although they don’t have much capital. However, I would argue that the threshold to dabble in DeFi is, for the time being, is quite high. There’s not much point in lending out $1000 in USDC and going through all the trouble and risk for a max $100 annual reward. GameFi, on the other hand, has the beauty of being available for anyone. Many games do require initial investments in the form of an NFT, but that too is being solved with scholarships and other options. According to Statista, there are over 3.2 billion gamers around the world. That’s a massive market and shows the potential of how many users this could reach.

GameFi vs DeFi: Development

Suppose we compare the traditional equivalents of GameFi and DeFi in development and the number of products out there. In that case, I could make an educated guess that there are more games than financial products out in the world (hopefully, I’m right, usually not). That’s because it’s easy to create a game, and there aren’t any rules or restrictions stifling creativity. Look at games from only a couple of years back, and you’ll see the massive development we’ve made. Not only have the graphics gotten better, but everything else is being improved too. This also ties back to the users. If you have a market of over 3.2 billion people, there’s no wonder developers and creators are rushing in to create the next hit. And while it’s true there’s a massive market for financial products, it’s a lot more difficult to serve these people due to the many regulations and laws.

As you can see the revenue is growing at a rapid rate too for the gaming industry in general. Image via Statista.

As you can see the revenue is growing at a rapid rate too for the gaming industry in general. Image via Statista. Creativity in the gaming industry was something Jason Brinks, the face of Gala Games, mentioned in an interview. He said that he joined a gaming company because he saw the industry as leading in creativity and with unprecedented growth potential. The funniest thing is that he actually had philanthropic ideas and still joined a gaming company. Philanthropy and gaming might not be something people often associate but just look at Axie Infinity. People in the Philippines who've lost their jobs due to the ongoing pandemic have had the chance to earn their income by playing the game. And not just some minimum salary, many earned substantially more than the average wage in the Philippines.

Then lastly, here are some statistics to back my claims. A few weeks ago, Coindesk reported about the growth of DeFi dapps. At that time, there were 400 active blockchain games and a total of almost 1200 games, including those that didn't have activity within the previous 24 hours. This might not seem like a lot, but it's important to remember that GameFi and blockchain games have only recently become a thing. The growth was also remarkable, with 91% year over year. Also, another factor to point out is that last year blockchain games gathered a total of $4 billion in venture capital. Not too bad.

Decentralized-Gaming-Finance (DeGameFi)

Although I’ve mentioned this multiple times in the article, I want to highlight it again: drawing a line between the two terms discussed is hard. It’s also unnecessary. Both of these are terrific use cases for blockchain technology, and by blending them, we have the opportunity to gather the best of both. Yes, I want to stake my in-game currencies for more rewards and then purchase some NFTs with it. Then maybe I want to borrow against that NFT to get some other currency. Or perhaps I want to lend out my rare NFT since I know I won’t be playing for a while. The possibilities are endless.

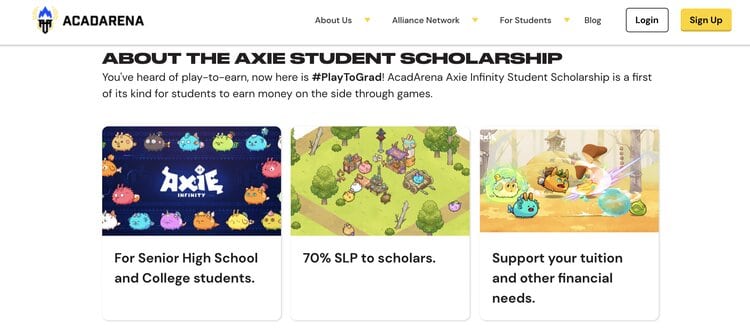

There's so much that can be done with GameFi and Axie Infinity and it's whole ecosystem with scholarships and everything else is a great showcase of that. Image via Arcadarena

There's so much that can be done with GameFi and Axie Infinity and it's whole ecosystem with scholarships and everything else is a great showcase of that. Image via Arcadarena The combination might be a huge deal for crypto. First, gaming is something many people understand, and it might be a thing that draws the masses to cryptocurrency and blockchain. Then if there’re built-in DeFi features in these games, it’s an opportunity for DeFi to attract people from the inflowing masses. And after that, we have people using and familiarizing themselves with crypto, which is what we want in the end.

Conclusion

GameFi is huge, and it will be even more prominent in the future. However, there are a few closing things I want to address. Not so many days ago, Coindesk published an article with the TL;DR that traditional game developers hate NFTs and crypto. This may seem like something which could significantly restrict the growth of GameFi, but I doubt it. That's because the gamers like the ownership aspect of NFTs and the play-to-earn from crypto. If enough people want it, someone will do it since you make money by making things the consumer wants. 3.2 billion gamers who want NFTs and crypto will eventually get it.

Another thing that I didn't mention is the amount of capital flowing into companies aimed at investing in GameFi. Popular exchanges like Binance and Crypto.com have unveiled funds that will be either fully or partially aimed at funding GameFi projects. On top of that, we have Solana Ventures, Galaxy Interactive, Gala Games and many more who have unveiled their own funds. Most of these funds are between the sizes of $100 million, and $500 million is quite a lot, even if you only count those I mentioned. And to top it all off, we have Animoca brands who raised a total of $360 million at a valuation of $5 billion.

After all these facts and statistics I've provided, it's up to you to decide what you believe about the future of GameFi. There's no denying that on many levels, it looks terrific, so good it has even managed to pass DeFi in users. It is hard to say whether it will pass in monetary terms, but it's definitely not impossible. And lastly, why not check out this article we've written about the top blockchain games with huge potential. It might give you a better understanding of where the GameFi industry is headed.