In what appears to be the second major attack this year, Italian cryptocurrency exchange BitGrail suffered a major loss to the tune of almost $200 million. The hackers that targeted the site took a recently rebranded currency called Nano (formerly Raiblocks).

BitGrail itself has been embroiled in controversy for the last few months since back in December when they began to severely restrict users abilities to make withdrawals. Some in the cryptocurrency community had begun to question the solvency of BitGrail, and suspected that the exchange may have already been insolvent for several months prior to the most recent hack.

In this article, we're going to go over what's been happening with BitGrail in the last few months leading up to the hack.

"The Bomber" bombs out

The leader of the BitGrail exchange, Francesco "The Bomber" Firano, enabled a restriction on withdrawals late last year. The restriction requires that all users pass a verification before they can make any withdrawals. The exchange also announced that the company would cease doing business with any non-EU person.

This doubtlessly infuriated many BitGrail users as their funds were essentially locked against their will. According to a Reddit post by Troy Retzer of the Nano team, some BitGrail users had been waiting for over two months for their accounts to be verified. Retzer noted that according to Bomber, he had thousands of accounts to verify, and only himself and one other person are doing it all manually.

Some users on the Reddit thread even postulated that perhaps Bomber had invested people's money somewhere and lost it. While there is no direct proof of this so far, this sentiment is echoed several more times across various internet forums. The Nano team itself does not seem fully convinced that this was a hack.

BitGrail gets hacked

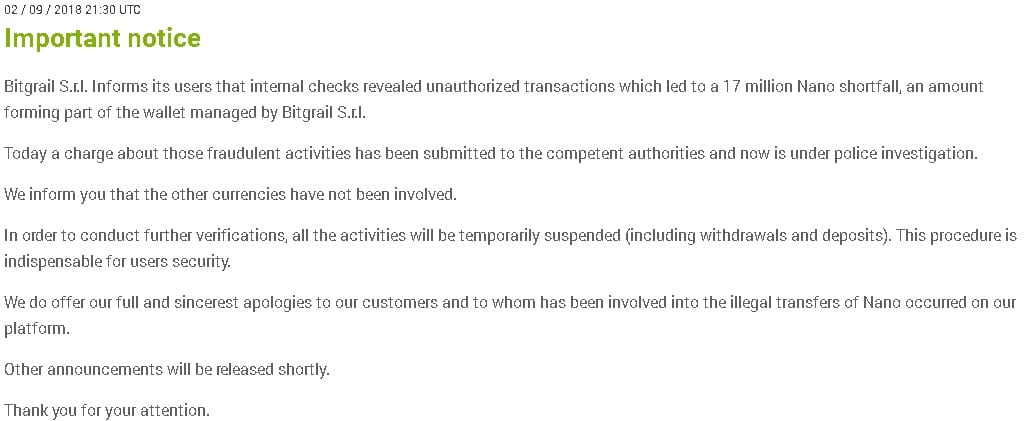

In an announcement posted to the official BitGrail news feed (below image), the company notes that "internal checks revealed unauthorized transactions which led to a 17 million Nano shortfall". The post also notes that no other currencies were affected by the hack. The message ends with an apology and a note that "all the activities will be temporarily suspended (including withdrawals and deposits)".

Announcement of Alleged "Hack"

The announcement came out on the 9th of February. On that day, Nano was trading for around $11 each. Since then, prices have dropped slightly to around $8 each. The price in bitcoin dropped by almost 50%.

Community anger deepens

After months of waiting, BitGrail users are now faced with the reality that all activities on the entire exchange have been completely halted. Since the announcement on the ninth, the company has made one further announcement, but it is only available in Italian.

According to an unofficial translation, the post makes several seemingly argumentative statements defending BitGrail and accusing the Nano development team of refusing to help. The post also notes that BitGrail had requested Nano to perform a hard fork in order to undo the supposed theft. So far, Nano appears to not be willing to perform such a fork.

In a post released on the Nano official medium page, titled "BitGrail Insolvency Update", the team claims that they have been actively investigating what happened since February 8th. They claim that BitGrail has "ceased communication with the Nano team" since February 9th. According to their research, it is possible that the theft began sometime in October 2017. Interestingly enough, the post refers to the hack as "alleged".

In the BitGrail post, the company notes that they feel the Nano development team has "deliberately accused the CEO of BitGrail to want to cover up the incident". As a result, BitGrail says that they have filed a complaint for "aggravated defamation in the press" against the Nano development team.

BitGrail might be history, what's next for Nano?

Image Source: nano.org

It seems that by and large, the community is behind Nano and not BitGrail. While prices have slipped somewhat this month, overall they are still much higher than they were just back in December when Nano (under its former name RaiBlocks) was worth well under half a dollar.

Prices for Nano have generally followed the downward trend starting from mid-January onwards that the majority of cryptocurrencies have experienced.

Much like the hack where NEM was stolen from a Japanese exchange, the community blames the exchange for not taking proper security measures. In the case of Nano, the development team firmly asserts that the reason the hack was successful was not at all related to their own software.

Nano has been picking up a lot of steam recently due to its features and growing community support. Cryptocurrencies usually survive hacks like this, even if their prices dip somewhat in the short term. It is likely that this pack will not have a significant effect on nano prices long-term.

Featured Image via Fotolia