Today, Web3 stands at the intersection of technology, finance, governance, entertainment, and communication, with Ethereum the common thread connecting it all. This article focuses on the upcoming trends and innovations poised to shape Ethereum in the times ahead.

The world of blockchain technology is rife with new ideas. Innovators are discovering unprecedented utilities for Web3, attracting new users to an unending competition for cheap, secure, and accessible block space. This article aims to analyze the evolution of Ethereum amid such rapid dynamics thoroughly.

The ensuing sections will navigate Ethereum’s core innovations and delve into its vibrant ecosystem, including NFTs, DeFi, the rapid ascendance of Layer 2s, and much more, highlighting critical regulatory and economic trends unfolding with time.

In a 2022 post on X (then Twitter), Vitalik unveiled the new Ethereum protocol roadmap, highlighting several network improvements. He also wrote about some transitions the Ethereum tech stack needs to make to open its global use for average users.

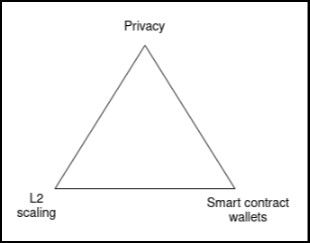

Vitalik’s three crucial transitions essential for Ethereum are -

- The L2 scaling transition - everyone moving to rollups.

- The wallet security transition - everyone moving to smart contract wallets.

- The privacy transition - Privacy-preserving transactions, social recovery of wallets, on-chain identities, and much more.

These ideas are the backdrop for the trends we will explore for the Ethereum ecosystem’s future.

A Modular Ethereum Stack Can Achieve All Three Pillars Without Tradeoffs | Source: Vitalik’s Blog

A Modular Ethereum Stack Can Achieve All Three Pillars Without Tradeoffs | Source: Vitalik’s Blog The Ethereum Roadmap

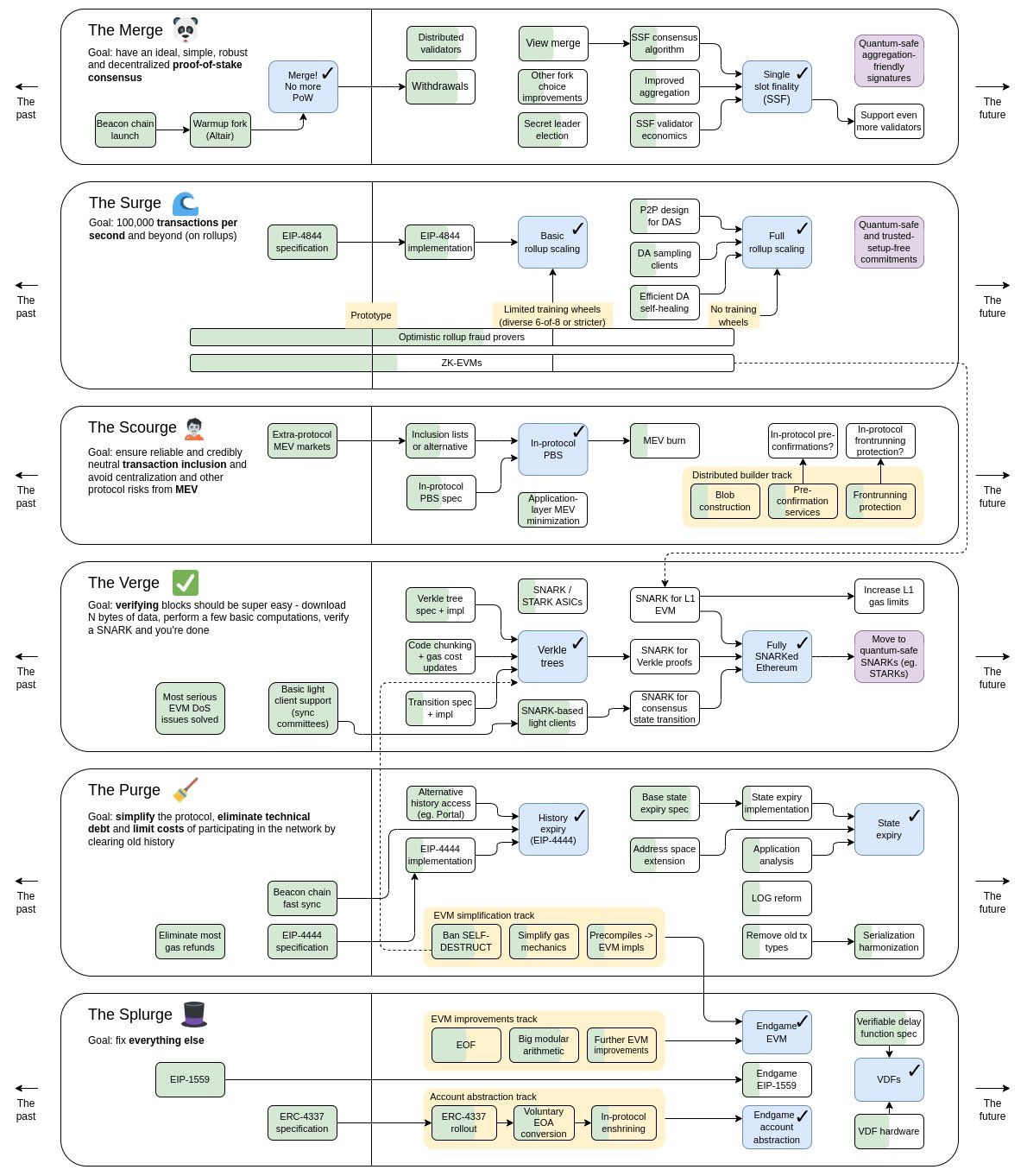

Earlier this year, the Ethereum blockchain underwent ‘The Merge,’ which marked its transition to Proof of Stake. The Merge is the first step toward Ethereum’s rollup-centric roadmap, which defines Ethereum’s maturing role as more users join the ecosystem, and the need for block space goes up with time.

The scalability trilemma dictates how much a Layer-1 blockchain can scale without compromising security and decentralization, and Ethereum is at the precipice of that limit. Vitalik introduced the updated Ethereum roadmap earlier last year to circumvent the scalability bottleneck. The roadmap seeks to transition the Ethereum mainnet from an environment to execute transactions and smart contracts to one leveraged for security. Let's discuss how.

The Surge

The Surge marks the next phase of updates to the Ethereum mainnet, which will depend on Layer-2 blockchains to meet the industry’s growing demand for throughput by achieving 100,000 TPS without sacrificing security or decentralization, but this will require a seismic shift in the relationship between Ethereum and its Layer-2s/Rollup.

The Updated Ethereum roadmap | Source: X

The Updated Ethereum roadmap | Source: XThe idea behind layer-2s like Optimism and zkSync is to inherit the security of Ethereum in the high throughput transaction execution environment, which typically entails a few steps:

- Sequencers compress Layer-2 transactions into a batch and post it on Ethereum.

- Ethereum validators process the transactions to calculate the rollup block, lending their security.

- The calculated state is finalized on the rollup blockchain.

The scalability bottleneck lies in Ethereum validators having to execute all rollup transactions to calculate the rollup block, which, although faster than storing those transactions on the mainnet, still needs to achieve sub-second finality.

The developers at Ethereum had an exciting revelation - The Ethereum protocol lends its security to rollups not by processing their transactions but by ensuring data availability.

**What is data availability?** Data availability guarantees that all the transaction data is available to all the participating validators during consensus (including light nodes). Therefore, if rollup data is just made available to L1 validators, without them having to process those transactions to calculate the rollup block, the rollup security is still guaranteed by the layer-1 protocol.

EIP-4844: Proto-Danksharding

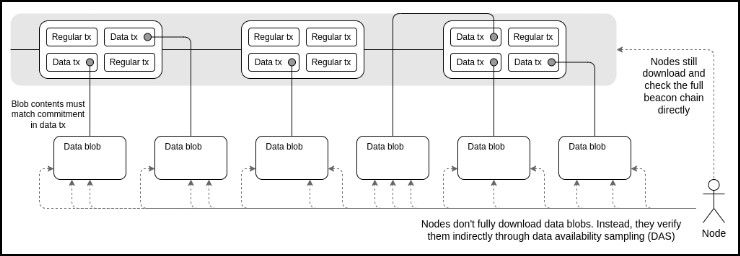

EIP-4844, also known as Proto-danksharding, is an Ethereum improvement proposal that lays the foundation to introduce data Blobs, a cheaper way to add rollup data to Ethereum blocks.

Binary Large Objects (Blobs)

The Surge will introduce Blobs in Ethereum. Blobs are packets of data that layer-1 validators will not try to interpret but will include in the block. Post-Surge layer-2s will witness rollup sequencers submit layer-2 data as Blobs on the Ethereum mainnet, ensuring data availability and inheriting Ethereum’s security.

With Ethereum validators no longer required to process rollup transactions in the Blob, rollup blocks can get bigger, include more transactions, and finally achieve the sub-second finality targets of the Ethereum roadmap. Furthermore, the added benefit of layer-1 validators not interpreting rollup data is their inability to front-run those transactions, eliminating MEV manipulation.

Data availability lets rollups include their blockchain data as Blobs into the mainnet block data without its validators performing the heavy-duty work of processing those transactions and still securing Ethereum’s guarantees.

Post Proto-Danksharding block propagation | Source: Ethereum.org

Post Proto-Danksharding block propagation | Source: Ethereum.orgDanksharding

Danksharding marks the full realization of Ethereum’s scalability potential. Proto-danksharding introduced a cheaper way for Ethereum rollups to add data to the Ethereum mainnet, where they committed block data as Blobs.

In full Danksharding, rollups would commit not 1 but 64 Blobs to each Ethereum block during consensus, effectively sharding the network. The main difference between traditional sharding proposals and Danksharding is while the former proposals defined ways to add more blocks, making more space for transactions, the latter creates more space for data. Danksharding relies on layer-2 protocols to leverage this space to support high-throughput transactions.

The Wider Context

The rollup-centric future forges the path for Ethreum’s role in Web3 as it matures into a decentralized and secure network capable of harboring millions of average users globally. The roadmap foresees that:

- Ethereum is the data and security layer for Web3.

- Users are accessing Ethereum via applications built on layer-2 execution environments frequently.

- Layer-2 ecosystems offer high throughput while harnessing the Ethereum mainnet’s security guarantees.

This roadmap addresses Vitalik’s first transition. The modularization of the Ethereum stack, where the mainnet evolves into the data layer of Web3 and decentralized applications live on rollups, accentuates the growing importance of layer-2 protocols in the future.

Extensive Use of Smart Contract Wallets

The rollup-centric roadmap solves the scalability problem, making the Ethereum ecosystem more accessible. The next transition calls for improving the experience of using Ethereum so that more people use its scalability capabilities.

“The whole point of digital technology, blockchains included, is to make it easier for humans to engage in very complicated tasks without having to exert extreme mental effort or live in constant fear of making mistakes” -Vitalik Buterin.

A smart contract wallet is managed by a contract rather than an Ethereum account (also called EOA, Externally Owned Account), users with a private key. Smart contract wallets deploy an on-chain wallet contract that can store funds like a typical wallet. The contract wallet is accessed with the owner’s private keys, which can sign transactions for the wallet contract.

Smart contract wallets are a familiar idea. To secure inter-chain transfers, cross-chain communication protocols use smart contract wallets like multi-sig and MPC (Multi-Party Computation) wallets. However, some novel applications for smart contracts wallets will mark essential pitstops on the road to the global adoption of Ethereum.

ERC-4337: Account Abstraction

In Ethereum, account abstraction enables smart contract functionality for wallets, opening doors to advanced wallet designs capable of upgrading abilities like social recovery and customization. The need for account abstraction arises from the limited capabilities of EOAs. While both EOAs and smart contracts can hold, send, or receive tokens, EOAs rely on private keys to sign such transactions.

ERC-4337 removes this limitation. An ERC-4337 wallet, or smart contract wallet, is managed by, as the name suggests, smart contracts and performs all the roles of an EOA without needing any protocol-level changes to work. With ERC-4337, Smart contract wallets will precipitate Vitalik’s transitions - Improving wallet security and innovations in privacy, enabling features that are crucial for making blockchains accessible for average users like:

- Easy wallet setup

- Account recovery

- User-friendly wallet operations

- Human error compensated security

- Flexibility to pay gas with any ERC-20 token.

Reforms in Address Management

Smart contract wallets will improve security by:

- Reducing complexity: Layer-2 blockchains that run EVM carry the advantage of reusing the same public address from the mainnet, limiting the need to manage multiple addresses. However, this hash equivalence is getting complicated with the emergence of novel layer-2 environments (typically zk-EVMs). Programming smart contract wallets to existing public addresses from the mainnet is comparatively easier than programming new EOAs in layer 2.

- Easing ownership changes: Where the loss of an EOA private key makes account recovery impossible, smart contracts wallets are programmable to new addresses, enabling social recovery facilities and enhanced security through key rotation.

**Note** WSocial recovery in blockchain refers to a wallet backup mechanism that allows users to designate trusted individuals who can collectively help them regain access to their wallet if they lose their private key.

Smart contract wallets will improve privacy by:

- Addressing multiplicity: Smart contract wallets will preserve privacy as users traverse several layer-2 systems. An ideally private setting will involve using new addresses for every transaction, the management of which will prove impractical without smart contracts.

- Addressing versatility: Privacy schemes that deploy novel cryptographic techniques like zk-SNARKs may follow different address generation standards. Smart contracts can help Ethereum link to these standards with limited overheads.

Reforms in On-Chain Payments

Security enhancements powered by smart contract wallets include:

- Flexible ownership: Smart contract wallets allow for changing ownership through private key changes, making them more adaptable to offer advanced recovery options in various scenarios, such as private key loss or theft.

- Asset management: A smart contract wallet can be programmed to track ETH transfers from EOAs and other contracts or track different standards like ERC-20 tokens and NFTs.

- Automation: Smart contract wallets can calculate the optimum path for asset transfers, mainly when cross-chain transactions are involved, and hide the complexity from users, limiting the possibility of errors.

Privacy enhancements powered by intelligent contract wallets include:

- Handling Privacy Schemes: Smart contract wallets may be more adept at integrating with different privacy protocols, making adopting privacy-preserving technologies easier for the user.

- Metadata Handling: In the future, smart contract wallets could better manage and securely store metadata necessary for transactions, like providing spending and encryption pubkeys, thus adding an extra layer of privacy.

- Compatibility: Smart contract wallets can embed code to support non-EVM privacy schemes, ensuring interoperability with ecosystems outside Ethereum.

Reforms in Key Recovery

Complete loss of funds in the event of security breaches or loss of private keys is an unacceptable limitation for global Ethereum inclusion. Smart contract wallets are programmable to support key recovery while preserving privacy, such as contracts with cryptographic techniques like keystore contracts to assign new keys and zk-SNARKs to preserve privacy during restoration.

Furthermore, smart contracts may also prove essential in making such restorations gas-friendly. One way to achieve this would be to run the restoration algorithm on a high through layer-2 rollups, offering a scalable and future-proof architecture. These capabilities make smart contract wallets an essential component of Ethereum’s security and privacy visions for the future.

Smart Contracts: The Wider Context

The extensive use of smart contract wallets points to a multi-chain future where addresses may potentially serve needs beyond settling transactions and may also protect additional information like:

- The connected layer-2 networks.

- Set of primitives to support zk-SNARKs to ensure privacy.

- Social recovery encryption keys.

- Infrastructure for on-chain identity.

Therefore, wallets in the future may be responsible for securing not just keys but data as well.

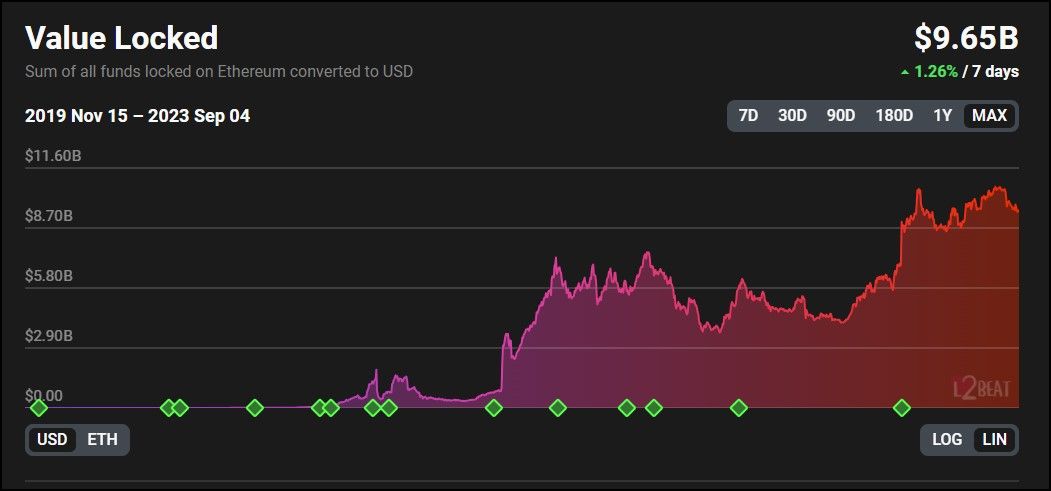

The Growing Relevance of Layer-2s

The two most prominent Layer-2 designs in Ethereum are Optimistic and zero-knowledge rollups. Optimistic rollups assume that transactions on the rollup are valid until a challenger proves otherwise by submitting fraud proof within the challenge period. In contrast, zk-rollups submit a validity proof for each block on the mainnet with the help of zero-knowledge proofs. Both scalability designs offer greater throughput than Ethereum without compromising security by bundling transactions together and submitting them on the mainnet.

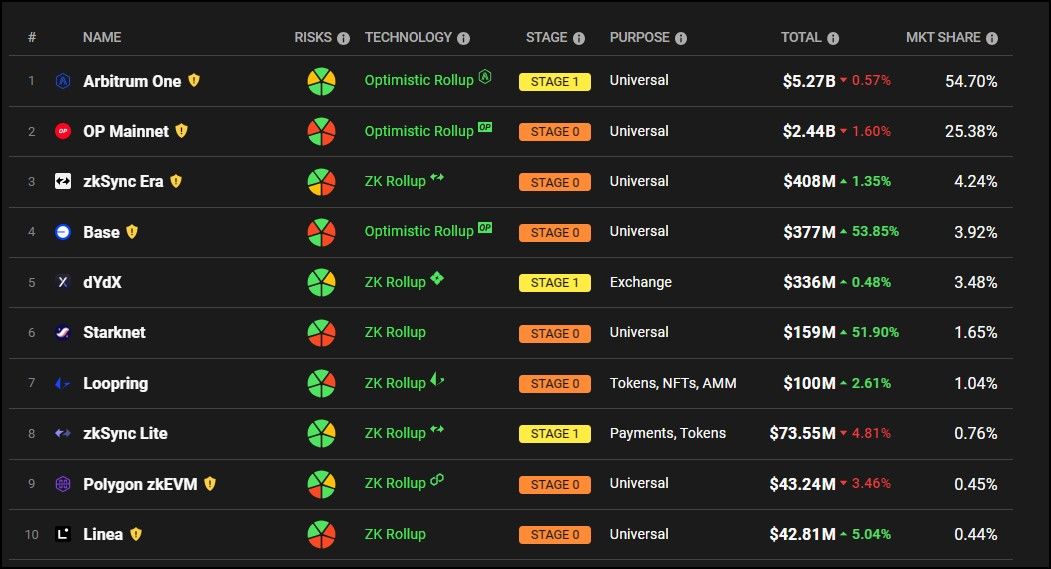

TVL Locked in Layer-2 | Source: L2Beat

TVL Locked in Layer-2 | Source: L2BeatOptimistic rollups like Arbitrum and Optimism have had the early mover advantage in gathering the bulk of the TVL residing in Layer 2. Despite a fairly recent entrant against optimistic rollups, zk-EVMS has quickly caught up to the race. As of writing this article, seven of the top ten rollup projects on Ethereum by TVL are ZK Rollups.

Top 10 Layer-2 Chains By TVL | Source: L2Beat

Top 10 Layer-2 Chains By TVL | Source: L2BeatTypes of ZK-EVMs

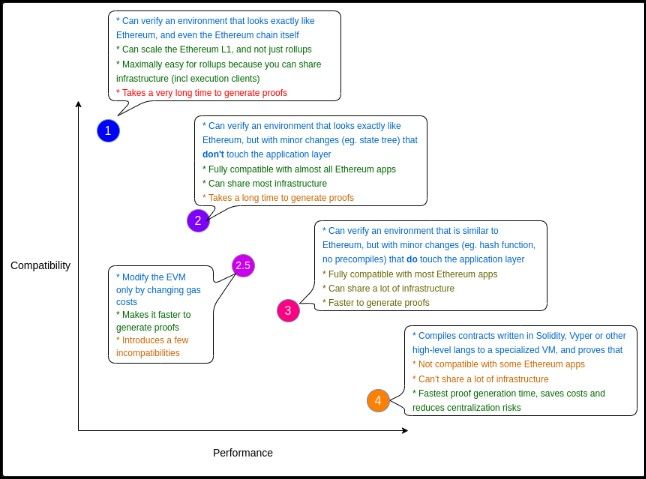

Not all ZK-EVMs are built the same. While all of them leverage zk-proofs like SNARKs or STARKs to make cryptographic proofs in EVM-like environments, they differentiate in how much they tradeoff efficiency for better Ethereum compatibility.

The complex cryptography behind making this possible is subject to a metric called Ethereum equivalence, which defines how compatible the rollup is with the Ethereum stack. A greater equivalence means the rollup can use more of Ethereum’s infrastructure to function, leading to faster development times and high compatibility.

The tradeoff

ZK-EVMs achieve Ethereum equivalence at the cost of time and resources needed to generate zk proofs. More time and resources may affect gas costs and network speed. Therefore, rollup designs differentiate by making this tradeoff between compatibility and performance.

Types of ZK-EVMs | Source: Vitalik’s Blog

Types of ZK-EVMs | Source: Vitalik’s BlogVitalik lists the ZK-EVMs along this spectrum to define 4 ZK-EVM types:

- Type -1: Completely Ethereum equivalent. These ZK-EVMs can verify Ethereum blocks as they are today. Deploying Ethereum applications on type-1 ZK-EVMs demands no additional overheads. Scroll and Taiko are some type-1 ZK-EVMs.

- Type -2: Completely EVM-equivalent. If not Ethereum, EVM equivalence ensures compatibility with Ethereum at the execution level. Most Ethereum Dapps will work perfectly on EVM-equivalent ZK-EVMs without any additional overheads. While still slow, proof generation time is better than that in type-1. Polygon zkEVM and ConsenSys are some type-2 ZK-EVMs.

- Type-3: Almost EVM-equivalent. Such ZK-EVMs designs value throughput over Ethereum compatibility. Faster proof generation is achieved at the cost of more incompatibility. Ethereum DApps may still work after minimal rewriting efforts from developers.

- Type-4: Only language level equivalent. Only high-level code, such as Solidity and Vyper, is made ZK-friendly. Porting DApps from Ethereum may face challenges like different contract addresses and extensive debugging requirements, but with very fast proving times. zkSync and StarkNet are building type-4 zk-EVMs.

Rollups in the Post-Danksharding World

Post Danksharding Ethereum will introduce Blobs, skyrocketing the scalability potential for rollups. Each rollup runs a rollup smart contract on the Ethereum mainnet. The rollup bundles transactions and sends them to the Ethereum mainnet via this smart contract.

After Danksharding, Ethereum will create a dedicated space for rollup transactions in the form of Blobs, which it will not interpret but only make available to validators during consensus (remember data availability from the above). The storage limit for these Blobs is set at 1MB.

Now, if you’re wondering if Blobs will lead to greater storage requirements, you’re right and wrong.

To keep the protocol light, Ethereum will delete all blobs over a month old (third-party APIs like blockchain explorers might still store Blob data). The mainnet will instead store a cryptographic commitment (which is fairly lightweight) to the Blob, which will offer the same data availability guarantee as storing Blobs physically. These guarantees, called KZG commitment schemes, will remain valid after deleting the Blobs.

Optimistic and ZK rollup designs will change slightly after Danksharding. Let's see how.

- Optimistic rollups assume the validity of transactions, they need not access blob data until a fraud-proof is submitted to the mainnet. Instead of the transaction data, the fraud-proof will now include a reference to the KZG commitment corresponding to the Blob to access it and continue the verification.

- ZK rollups submit validity proofs firsthand, they need not access blob data ever. Therefore, zk rollups will post two commitments to the mainnet:

- The zero-knowledge proof as before.

- A KZG commitment for the data in the blob with the corresponding data.

The Wider Context - Can Danksharding Complement ZK-Rollup Designs?

While implementing post-danksharding optimistic rollups remains largely the same, it creates a better case for type-2 and type-3 zk-EVMs. These ZK-EVMs balance Ethereum equivalence and proof generation efficiency. The accelerated rollup scalability post-danksharding may allow these rollups to push greater Ethereum equivalence and still maintain a generous throughout, increasing their ease of use. Danksharding could even help type-2 ZK-EVMs achieve full Ethereum equivalence and transition to type-1.

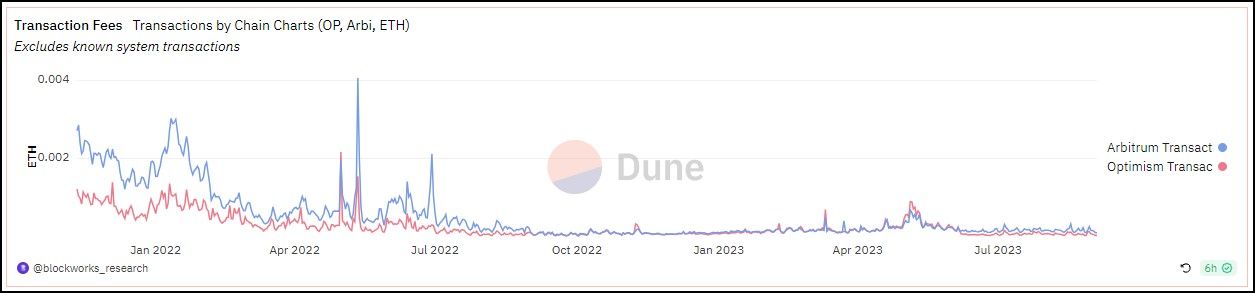

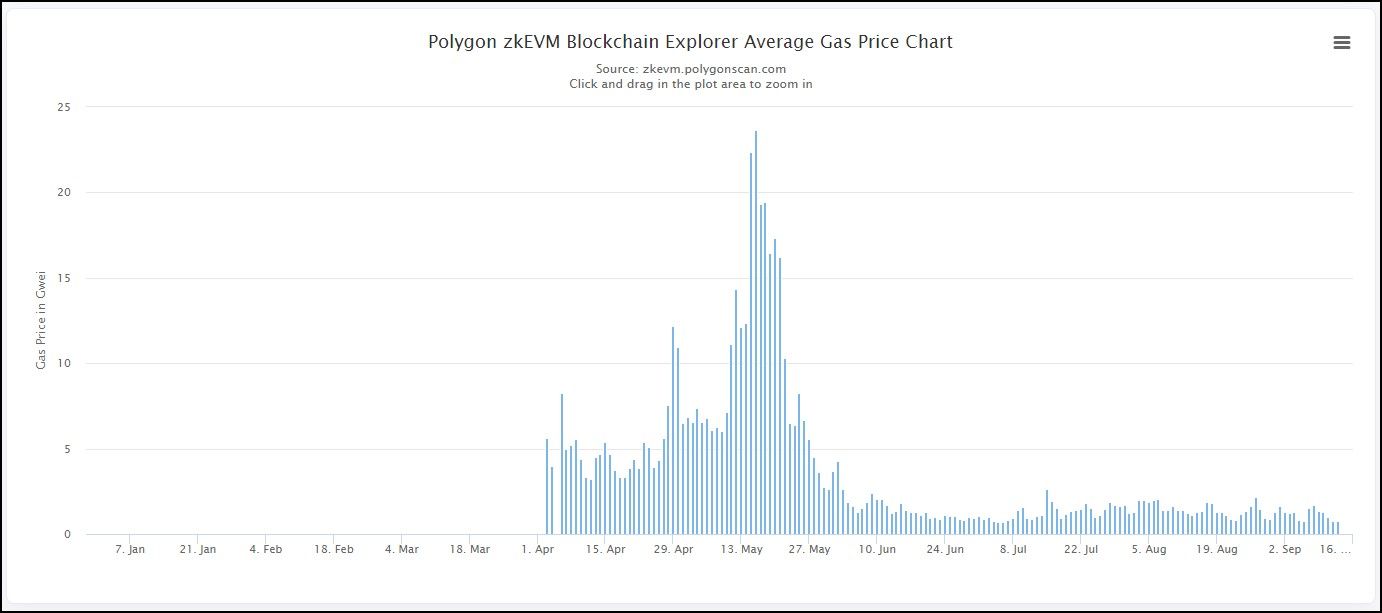

Here are the average Optimism, Arbitrum, and Polygon zkEVM transaction fees:

Average Transaction Fees on Optimism and Arbitrum | Source: Dune Analytics

Average Transaction Fees on Optimism and Arbitrum | Source: Dune Analytics

Average Gas Price on Polygon zkEVM | Source: Polygonscan

Average Gas Price on Polygon zkEVM | Source: Polygonscan

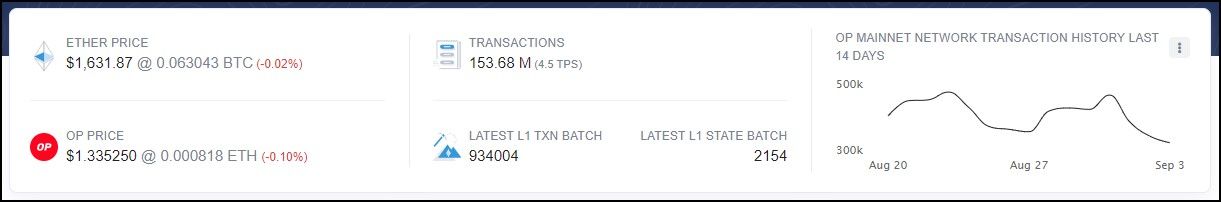

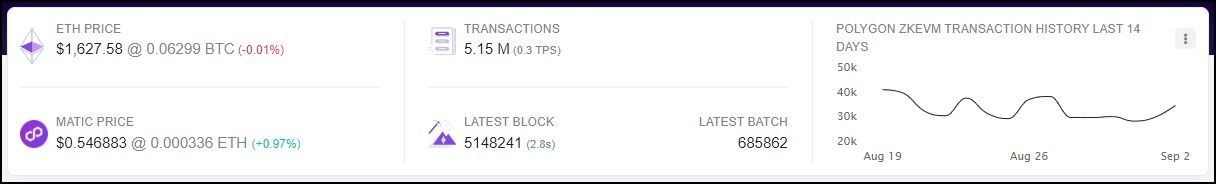

Transactions executed per second on Optimism and Polygon zkEVM:

Optimism Transaction Speed | Source: Etherscan

Optimism Transaction Speed | Source: Etherscan zkEVM Transaction Speed | Source: Polygonscan

zkEVM Transaction Speed | Source: PolygonscanThe metrics above suggest that Polygon’s zkEVM is already leagues ahead in efficiency than Optimism in performance. Danksharding is poised to accentuate this capability.

The Emergence of DeFi 2.0

There is no strict definition for DeFi 2.0. Rather, it refers to a new wave of decentralized protocols that address the limitations of the first generation of DeFi applications on Ethereum (Like Uniswap, Maker, and Curve).

DeFi 2.0 serves greater themes such as capital efficiency, cross-chain interoperability, risk management, user experience, and liquidity. Here is a list of emerging DeFi trends with novel business models in line with DeFi 2.0 standards:

DeFi Bonds

Ondo Finance

Ondo Finance facilitates borderless exposure to US securities in exchange for cryptocurrencies like USDC, enabling access to the security and yield provided by US securities for anyone around the world. The platform sells five products.

- OMMF: Exposure to the US money market. The bond invests in US government money market funds, which are deeply liquid and extremely stable.

- OUSG: Exposure to US treasuries. US treasury bills are widely considered the lowest-risk investment option available. OUSG invests in US Treasury bills ETF.

- OSTB: Exposure to an ETF of diversified, high-quality short-term bonds.

- OHYG: Tracks the results of an index of dollar-denominated high-yield corporate bonds.

- USDY: USD-backed stablecoin secured by short-term US Treasuries and bank demand deposits.

Ondo Finance will handle the custody of USDC and its conversion to fiat via Coinbase.

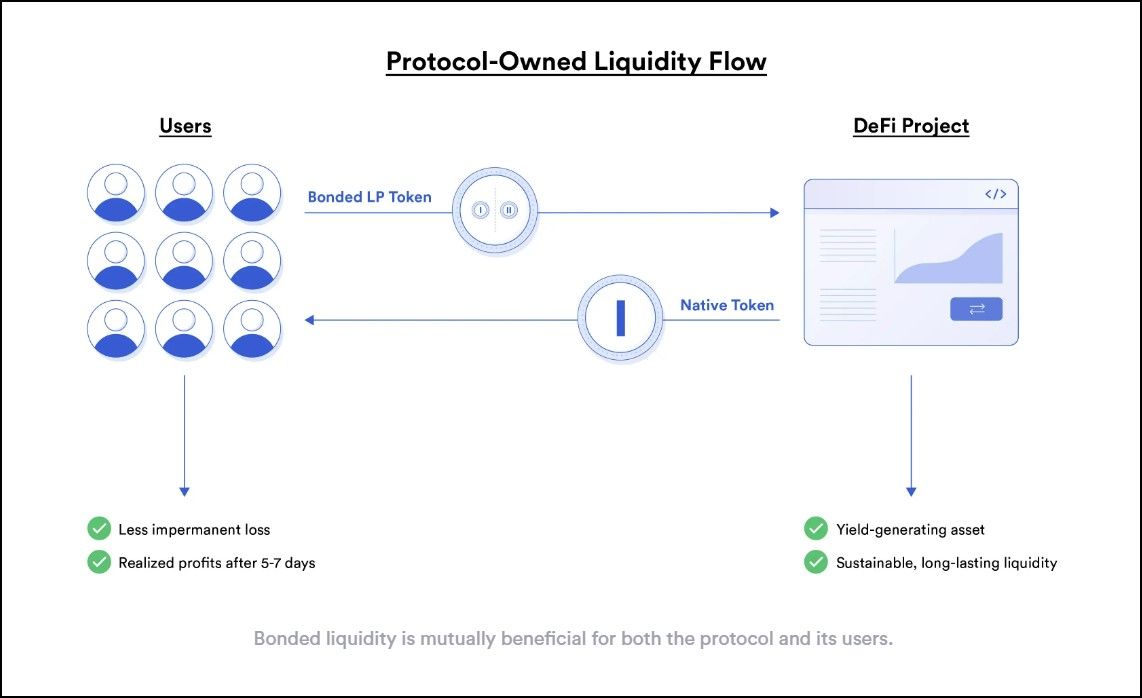

OlympusDAO

OlympusDAO is a DeFi-native bond protocol. The protocol exchanges LP tokens for its native token at a discount. Users are incentivized to exchange their LP tokens for the protocol's native token as the discount earns them a profit with every transaction and shields them from potential impermanent loss.

OlympusDAO Value Flow | Source: Chainlink

OlympusDAO Value Flow | Source: Chainlink

DeFi Bond protocol helps address the problems arising from excess LP token liquidity in the market, which reduces the incentives for liquidity providers and yield farmers.

DeFi Insurance

Nexus Mutual

Nexus Mutual is a decentralized insurance protocol built on Ethereum. Nexus offers cover products that insure different kinds of risks:

- Protocol cover is insurance against smart contracts and protocol risks that may comprise a DeFi protocol.

- ETH Slashing Cover secures against losses incurred from penalties in the Ethereum consensus process.

- Excess cover product allows the shift of a portion of the risk onto the protocol to mitigate against the loss of underwriting capital.

- Covered vaults use a portion of yield generation from the farming protocol to buy cover for the underlying assets. Covered vaults are built using the ERC-4626 token standard.

Liquid Staking Derivatives

Liquid Staking Derivatives (LSDs) are among the few DeFi native finance products that are soaring even in the bear market today. The idea that emerged from the Cosmos ecosystem really took off with the transition of Ethereum to Proof of Stake. While originally a bid to dent the staking mojo of centralized entities like Coinbase and Binance, decentralized LSD protocols are on the verge of becoming what they sought to destroy.

What is Liquid Staking?

In Ethereum, liquid staking refers to participating in Ethereum POS consensus via third-party nodes in exchange for a more liquid derivative. Where becoming an Ethereum validator requires participants to set up nodes and pledge 32ETH to the network, Liquid staking services allow network participation with any amount of ETH.

In exchange for the user’s stake, the liquid staking service mints a 1:1 representation of the staked tokens and sends it to the user as a liquid asset. This token is called a liquid staking derivative.

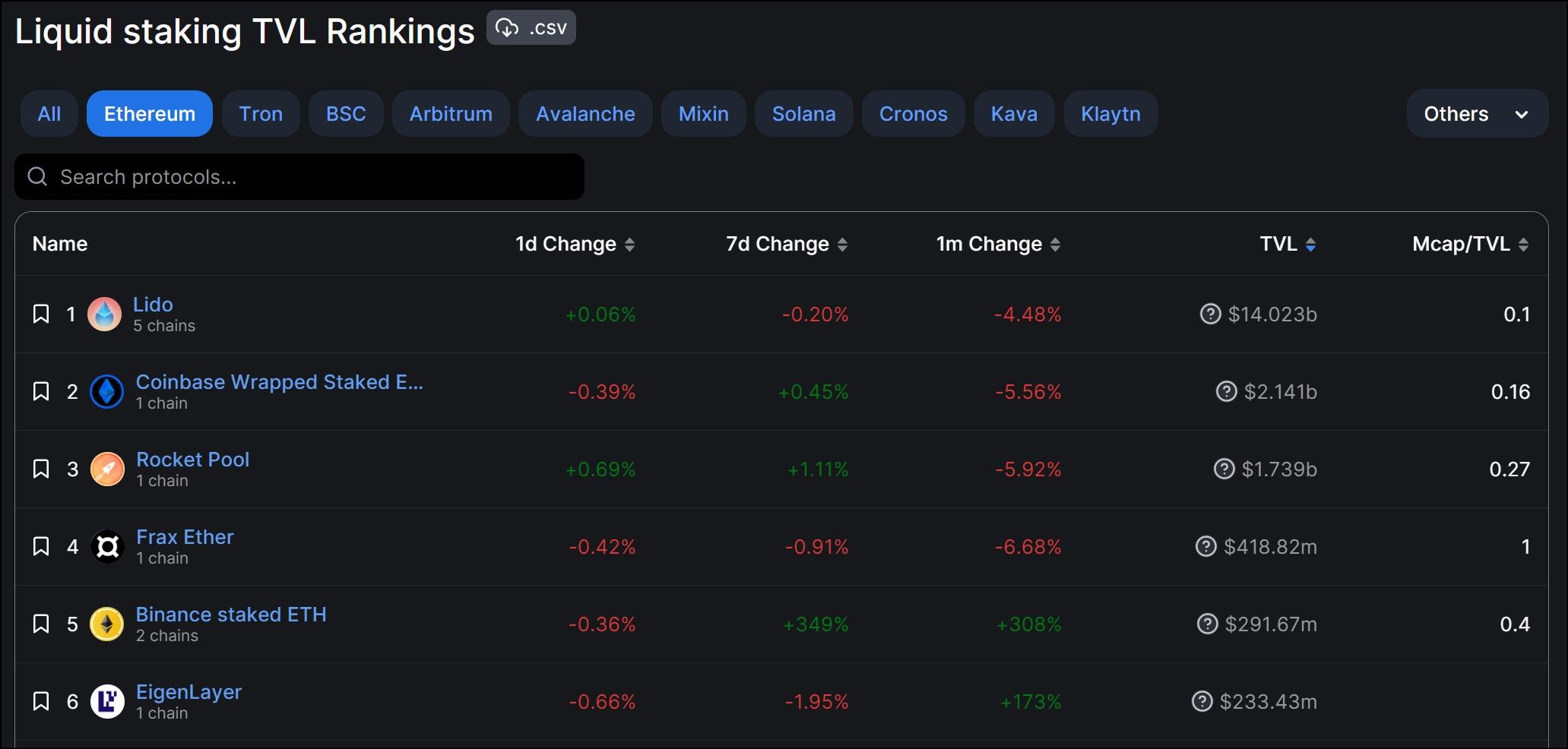

LSDs are Growing at an Alarming Rate

Top LSDfi protocols by TVL | Source: DeFiLlama

Top LSDfi protocols by TVL | Source: DeFiLlama

At the time of writing this piece:

- The top five LSD protocols have about $18.6 billion in TVL locked between them.

- ETH trading at $1,622 amounts to about 11.47 million ETH locked in LSD protocol.

- This makes up about 39.2% of the 29 million ETH staked in Ethereum under the control of liquid staking protocols.

- Lido alone harbors 29.5% of the Ethereum staking muscle.

Ethereum 2.0 Total Value Staked | Source: Glassnode

Ethereum 2.0 Total Value Staked | Source: Glassnode

Risks of Liquid Staking - Cartelization

Different consensus thresholds grant varying degrees of control over the network in a Proof of Stake (PoS) network like Ethereum 2.0. The percentages refer to the proportion of the total staked tokens controlled by a single entity or a colluding group of entities. Below are explanations for 33%, 51%, and 66% attack scenarios:

- 33% attack: An entity with over ⅓ of ETH under control can cause a liveness failure in the network, where the network cannot achieve block finality.

- 51% attack: With over ½ of total ETH staked under control, attackers can exclude or censor certain transactions. They may also double-spend tokens by creating new chain forks and affect equitable mining with coordinated MEV extraction.

- 66% attack: At above ⅔ of staked ETH under control, the attacker effectively owns the network and exerts absolute control, including reversing previous finalities and transactions.

Ethereum’s expansive node network had kept worries of such attacks at bay out of unfavorable economic interests of coordinating at this extent. However, these discussions are back on the table with the advent of POS consensus and liquid staking.

**Note** Lido Finance is exploring solutions to combat the growing collective staking power of its node network. One solution proposed in the community is to dilute the powers of LidoDAO by assigning veto powers to stETH holders (ETH providers) over the LidoDAO, preventing their collusion.

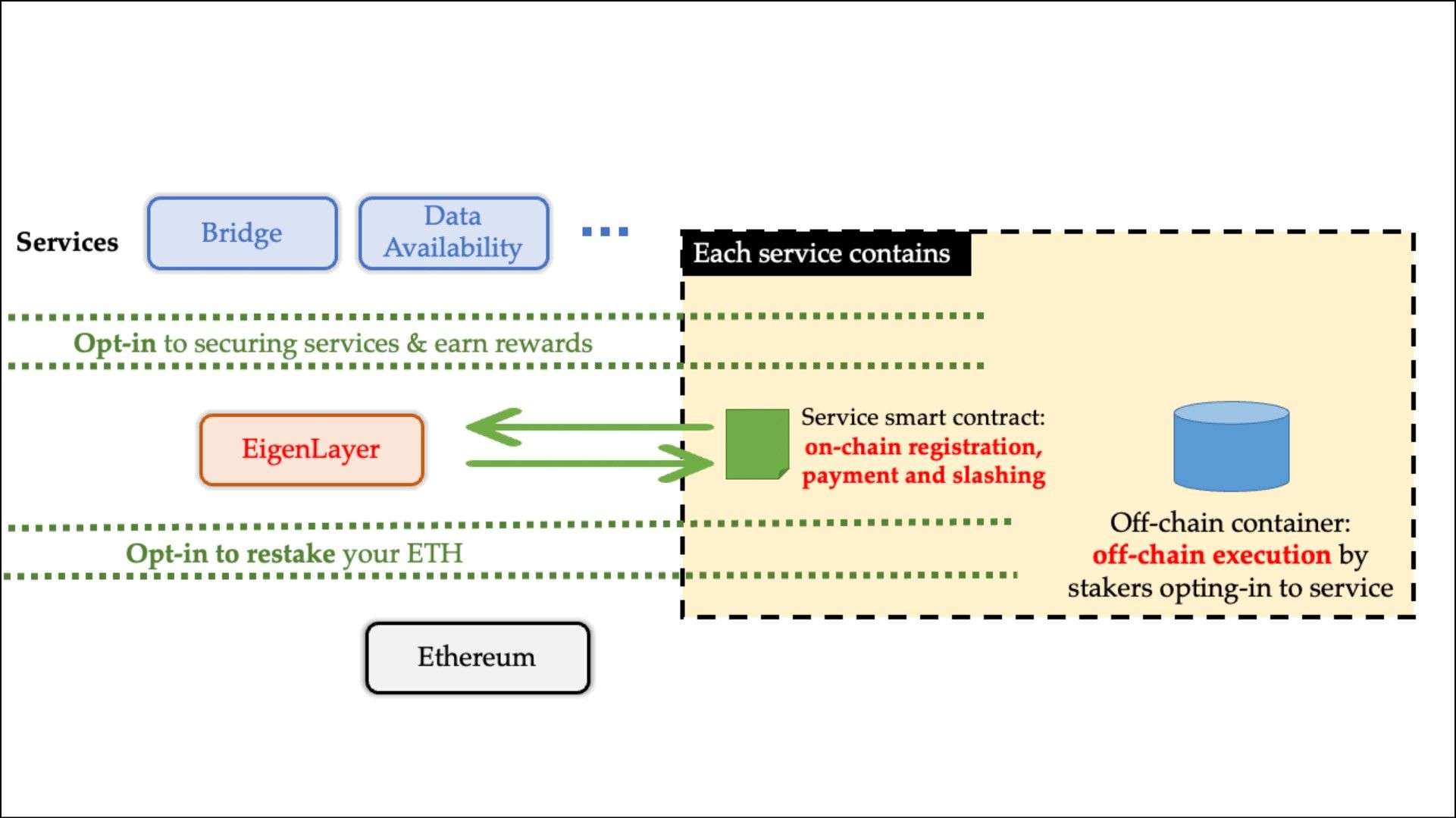

Security as a Service - EigenLayer

EigenLayer is a DeFi 2.0 project that is helping ETH stakers earn additional rewards from their staked with the concept of restaking. Restaking refers to using the staked ETH to secure additional networks and earn more interest from the same capital.

EigenLayer Logic | Source: EigenLayer Docs

EigenLayer Logic | Source: EigenLayer DocsEigenLayer’s Security Marketplace

EigenLayer achieves restaking by allowing users to submit raw ETH, LSDs, or LP tokens on EigenLayer smart contracts. These contracts act as a middle layer that pools all the funds, creating a market for decentralized trust. Other blockchain services in need of security may use these funds to secure their networks instead of creating their own token.

EigenDA is an off-chain data availability middleware solution offered by Eigenlayer. EigenDA can guarantee that data was made available for EigenLayer nodes during consensus. Where post-danksharding Ethereum assumes the DA role for rollups in its ecosystem, EigneDA can provide ETH-powered offer off-chain DA services to EVM and non-EVM protocols.

DeFi 2.0: The Wider Context

DeFi 2.0 is shaping into a multi-faceted evolution of the Ethereum ecosystem, addressing inefficiencies in capital use, liquidity, and risk management. It aligns well with Vitalik Buterin's envisioned transitions for Ethereum, particularly in its focus on security and complexity. Platforms like Ondo Finance and OlympusDAO introduce innovative financial products like DeFi bonds, while Nexus Mutual and EigenLayer tackle risk and security. However, the rise of Liquid Staking Derivatives brings new governance challenges, echoing Vitalik's caution about transitions in governance and complexity. DeFi 2.0 pushes the envelope but also brings to light critical issues that Ethereum must navigate for long-term stability and success.

What's Up With NFTs?

Ethereum improvement proposals are formal proposals to improve the Ethereum blockchain. Anyone in the Ethereum community may submit a proposal, which enters the mainnet after extensive discussions and review. Some improvement proposals are in the works to enable new functionality for non-fungible tokens, summarized as follows:

- ERC - 5496: Shareable multi-privileges for NFTs. The proposal argues that standard NFT contracts only track the ownership and transfer of NFTs, and any utility built over the NFT is typically tracked off-chain. This proposal will allow NFT owners to manage privileges on-chain. For instance, if an NFT grants access to a special event, this proposal could allow its owner to sell this exclusive access while maintaining ownership over the NFT. Such customizability facilitates a great possibility for NFTs to have practical usefulness.

- ERC - 5725: Transferable vesting NFTs. Utility token releases often accompany a vesting schedule, a timelock contract that unlocks tokens over time. With this proposal, such vesting schedules can link to an NFT instead of a particular private key so that assets like ERC-20 tokens have a standardized and transferable interface to enter the market.

- ERC - 5585: Allow NFT owners to authorize other users to use their NFTs. The idea is to separate NFT ownership and user rights to enhance its commercial value. Abstracting ownership and usage will allow NFT owners to authorize the creation of its derivatives, distribute authorized copies, and sell display grants, allowing for the commercialization of NFTs.

- ERC - 5604: NFT Lien. Liens are a way to financialize an asset, typical in traditional finance for assets like cars and real estate. This proposal brings the same concept on-chain for NFTs.

- ERC - 5643: Subscription NFTs. It proposes an interface for acquiring NFTs as a recurring and expirable subscription.

- ERC - 6551: Non-fungible Token bound accounts. Technically, NFTs are smart contracts with no owner (an associated private key). This proposal aims to achieve exactly that by binding an account to a single NFT, giving it the power to transact and own digital assets. The proposal argues this ability will open up real-world use cases, such as investment portfolios and memberships associated with NFTs.

- ERC - 7401: Parent-Governed Non-Fungible Tokens Nesting. Simply put, this proposal establishes a framework for an NFT to own other NFTs. One real-world use case described in the proposal is representing shipping containers as NFTs, which would collect child tokens along their journey.

- ERC - 7432: Role management for NFTs. This proposal defines a standard to establish on-chain roles within NFTs, which can help DApps implement access control for privileged actions.

**Note** EIP, which stands for Ethereum Improvement Proposal, and ERC, short for Ethereum Request for Comment, are both vital components in fostering the development of the Ethereum ecosystem. An Ethereum Improvement Proposal represents the primary proposal for introducing technical changes within the Ethereum network. Once an EIP gains approval through the on-chain governance model, it transitions into an ERC.

It's crucial to note that these proposals are still under review and must be implemented on the Ethereum mainnet. However, the active development and fervent interest they are generating within the Ethereum community indicate that there's a strong likelihood for many of these innovations to become part of the platform's evolving standards, dramatically widening the utility and applicability of NFTs in the process.

NFTs: The Wider Context

The collective thrust of these improvement proposals suggests an effort to unlock the dormant potential within NFTs as a basis to build products with practical utility, including but not limited to financial, governance, and role management products, which transcends well beyond its current application in the art and collectible market.

Developers are keen to transform NFTs into programmable assets with embedded logic and capabilities by decentralizing their control and ownership, giving owners more granular control over their assets. These proposals signify a trajectory that could see NFTs transition from static assets to dynamic tokens with multifaceted applications, priming it for inculcating real-world use cases and bridging the divide between Web3 and traditional finance.

Closing Thoughts

As we delve into the intricacies of DeFi 2.0, emerging NFT standards, and innovative protocols like liquid staking, it's clear that Ethereum's ecosystem is at a tipping point. Vitalik Buterin's insights into the Ethereum roadmap—particularly the shift towards rollups and Danksharding—offer a fitting backdrop for this explosion of innovation. Here are some points where the dots connect:

Expanding Utility and Complexity

Vitalik's comments on the programmability and complexity of Ethereum resonate well with the burgeoning field of DeFi 2.0 and NFT proposals. DeFi 2.0 seeks to solve issues like capital efficiency, risk management, and cross-chain interoperability—challenges that are deeply embedded within the architecture that Ethereum is planning to optimize. Similarly, the multiple ERC proposals aim to make NFTs more than just collectible assets, adding layers of functionality that could make them as versatile as any financial instrument. This aligns with Ethereum's goal to evolve into a more complex yet efficient system.

The Path to DeFi Self-Sustainability

Vitalik predicts the extensive use of smart contract wallets in offering enhanced security, privacy, and complex DeFi products. DeFi 2.0 outlines the potential of smart contracts in creating truly DeFi-native financial products. DeFi bonds and insurance, liquid staking, and security services can improve the organic liquidity of Web3 and pave the path to financial self-sustainability.

Improving Blockchain Cryptography

The Ethereum stack is leveraging advanced cryptographic techniques to address the industry’s growing needs:

- Data availability sampling ensures that necessary block data is available to all nodes (including light nodes) without downloading the entire block. The resultant lighter node requirements will promote Ethereum’s decentralization.

- ZK-Proofs for layer-2s allow for much higher throughput and less on-chain data, aligning well with a rollup-centric future where most of the activity takes place off-chain but retains a high level of security and decentralization by periodically publishing proofs to the main chain.

- Kzg commitments ensure efficient and lightweight state management, especially after introducing Danksharding.

These advanced cryptographic methods are all fundamentally aimed at solving problems related to scalability, efficiency, and data availability problems—issues central to Vitalik’s vision for Ethereum.

The innovative projects and trends mentioned in this report should serve as a backdrop to guide the reader’s own research into the evolving Web3 landscape. Markets in this space are notoriously volatile and subject to rapid advancements, so there's no guarantee that the discussed projects will find long-term success. However, the prevailing trends make it evident that the Ethereum community is strategically priming the stack for real-world adoption, focusing on scalability, efficiency, and practical utility. Be vigilant and stay updated to capitalize on emerging opportunities.