Enter the 2023 Bitcoin Miami conference. Two talented developers and Bitcoin OGs, Udi Wertheimer and Eric Wall, go up on the main stage dressed as… wizards and proceed to do a… Fortnite dance? Now that’s something I sure didn’t have in my crypto 2023 predictions.

The Bitcoin Miami wizard appearance Source: Twitter/udiWertheimer

The Bitcoin Miami wizard appearance Source: Twitter/udiWertheimerThere is context to this. The duo co-founded Taproot Wizards, one of the first-ever NFT projects in the Bitcoin blockchain. Udi and Eric started the project as a response to the reluctant-to-change reaction from some Bitcoin community members after ordinals first entered the scene. Many defended that Bitcoin should be used for financial transactions exclusively, as Satoshi intended, and anything else may add complexities that damage its ethos and may harm decentralization.

On the other side of the coin, the duo believes in growth by embracing change and creating products that people want. They wanted to make Bitcoin “fun” again. Their vision is shared with a large part of the crypto community (and so is their troll-ish posturing toward the more dogmatic Bitcoin Maximalists).

So why do I bring this up? Well, firstly, the ludicrousness is quite entertaining. Secondly, it illustrates the two sides of sentiment within the Bitcoin community. Since people started using ordinals in mid-January 2023, discussions have shown different views within the community on how the Bitcoin blockchain should be used regarding its technical applications and larger narrative.

But I also bring it up because the act symbolizes a much more critical phenomenon – Bitcoin is changing. You can get Guy's take on Bitcoin's evolution below if you are interested:

Bitcoin Ordinals have changed the Bitcoin network’s status quo - Bitcoin can now be used for more than simple peer-to-peer transfers, and there’s a large community behind this movement.

The novelty of ordinals-enabled use cases in the Bitcoin blockchain has led to unprecedented network activity. Earlier this year, interest in ordinals propelled Transaction fees in the network to a two-year high. Over 15 million ordinals have been minted to date, with their growth being the unquestionable highlight in the Bitcoin Network this year. So far, the primary uses of ordinals are non-fungible tokens (NFTs) and memecoins that use the new BRC-20 token standard for semi-fungible tokens in Bitcoin.

Source: Twitter/udiWertheimer

Source: Twitter/udiWertheimerWhile the surge in activity may have been a momentary craze and current use cases may be shallow, we shouldn’t judge ordinals by its current cover of questionable “artworks” and memecoins – the underlying idea is quite powerful.

Ordinals are fully on-chain and inherit the security characteristics of Bitcoin itself. They have enabled the most immutable network in the world to secure more than just digital money. Existing ordinals could be the canary in the coal mine for what may be coming, a world where we leverage Bitcoin for ownership of digital items with next-level data immutability characteristics. Think of things like deeds, legal contracts, land title ownerships, basically, anything “real-world” that could potentially be digitized and secured/verifiable on the Bitcoin blockchain.

This article will explain what Bitcoin ordinals are, how they have emerged from seemingly nothing, how they work and differ from Ethereum NFTs, the new use cases they may unlock, how they might benefit Bitcoin’s security, and what the future of ordinals might hold.

What are Bitcoin Ordinals?

There appears to be confusion around the terminology used surrounding ordinals. This is because the community is using the terms ordinals, inscriptions, and Bitcoin NFTs interchangeably, while there are distinctions between the three.

What is an Ordinal?

The traditional definition of an Ordinal originates from “Ordinal Theory,” a methodology where individual satoshis can be labelled and tracked. So, the most traditional definition of an ordinal is a singular individual satoshi that can be identified thanks to a numbering scheme.

What is a Satoshi?

Named after Bitcoin’s pseudonymous creator Satoshi Nakamoto, a satoshi (sat for short) is the very smallest unit of denomination of a Bitcoin, with every Bitcoin consisting of 100 million satoshis (sats). Sats make up a Bitcoin in a similar way that cents make up a dollar.

What is an Inscription?

An inscription is general arbitrary data and metadata posted to a Bitcoin transaction. The metadata are instructions on how to read said data, whether it is an image, text, audio, or other.

Inscriptions themselves are nothing new. Since the Segregated Witness (SegWit) upgrade (BIP 141) to the Bitcoin Network in 2017, they have existed independently.

What are Bitcoin NFTs?

The marriage of the ideas behind ordinals and Inscriptions enables Bitcoin NFTs. An inscription is “bound” to an Ordinal, creating a sat with unique data attached, effectively creating an NFT.

Now that the distinction between the terms has been made, we note that seeing both Bitcoin NFTs, inscriptions, or simply ordinals to refer to Bitcoin NFTs may be expected. I believe the term ordinals will be the one to stick, given that it is the catchiest of the three and seems to have already been adopted by the community. Therefore, this article will refer to the idea of Bitcoin NFTs as ordinals.

The difference between Bitcoin Ordinals and Ethereum NFTs

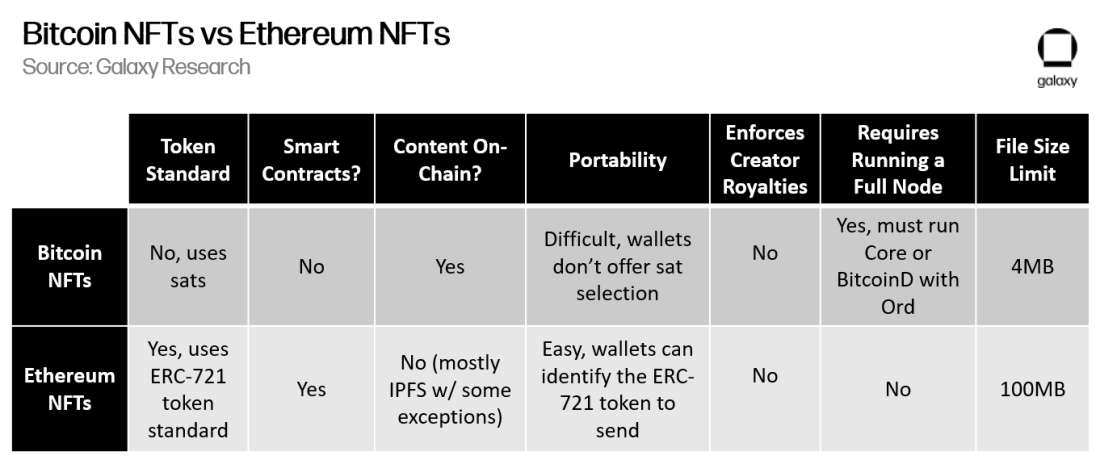

In practice, ordinals and Ethereum NFTs work similarly. They represent unique digital assets with associated data. However, the two have vital technological differences, as highlighted in the table below.

The tech differences between ordinals and Ethereum NFTs. Source: Galaxy Research

The tech differences between ordinals and Ethereum NFTs. Source: Galaxy ResearchThe most critical difference highlighted above is whether the content is on-chain. Unlike traditional NFTs that utilize smart contracts and store the data in external systems, Ordinal NFT data is stored on the Bitcoin blockchain. Fully on-chain content makes ordinals immutable. In contrast, Ethereum NFT data can sometimes be altered.

An additional essential difference not included above is that minting an ordinal is significantly more expensive than minting an NFT on Ethereum. At the average 2022 fee rate of 3 sats/vByte, inscribing a single Bored Ape NFT would cost 298,620 sats, which at the current Bitcoin price of around $30,000 per BTC equates to $89.59. This means the cost to mint the 10,000-unit BAYC collection would be close to $1 million. The high costs associated with ordinals are one of the reasons why most NFTs are simple pixelated artworks, as the minting fees vary proportionately with the size of the files being inscribed.

The features of higher costs and immutability make ordinals suited for differentiated use cases compared to Ethereum NFTs.

Digital Artifacts

Bitcoin Ordinal's properties make them perfect digital artifacts. What is a digital artifact? They are akin to physical artifacts, holding unique value in the digital sphere. They possess vital attributes: clear ownership, completeness, permissionless functionality, uncensorability, and immutability. Due to their intrinsic properties, Bitcoin ordinals perfectly embody these principles, thus standing as ideal digital artifacts.

Every Bitcoin Ordinal has a distinct owner, just like a rare physical artifact, differentiating it from unowned data. This explicit ownership lends significant value to these ordinals, heightening their appeal in the digital realm.

The attribute of completeness is crucial. Unlike some non-fungible tokens (NFTs) dependent on off-chain content, Bitcoin ordinals are complete entities within the blockchain itself. They carry all necessary information within the inscription, ensuring they are self-contained and not reliant on external data sources like Arweave or IPFS.

Permissionless operation is another cornerstone of digital artifacts. Bitcoin ordinals can be transferred freely without constraints such as royalty payments.

Finally, Bitcoin ordinals inherit the Bitcoin blockchain's immutability and censorship-resistant properties. They are resistant to change and censorship, offering a robust and unalterable record of existence. In this sense, they encapsulate the core principles of digital artifacts, preserving their integrity in the digital realm.

The History of Ordinal NFTs

Ordinals were made economically viable thanks to Bitcoin’s most recent major upgrade, Taproot (BIP 431), activated in November 2021. Combined with the 2017 SegWit upgrade, it made it possible to wrap data cheaply into a taproot script stored in a transaction's witness data section.

But blockchain updates generally only lay the groundwork for new-use cases. For them to be made accessible, additional work from the community is required. Bitcoin ordinals reaching the mainstream only happened in December 2022, when Casey Rodarmor, a Bitcoin developer, released the ordinals protocol software. The software runs on a Bitcoin full node on top of the Bitcoin core software, enabling minting and trading ordinals.

Ordinals Have Been a Hit, With Bitcoin Transaction Fees Surging

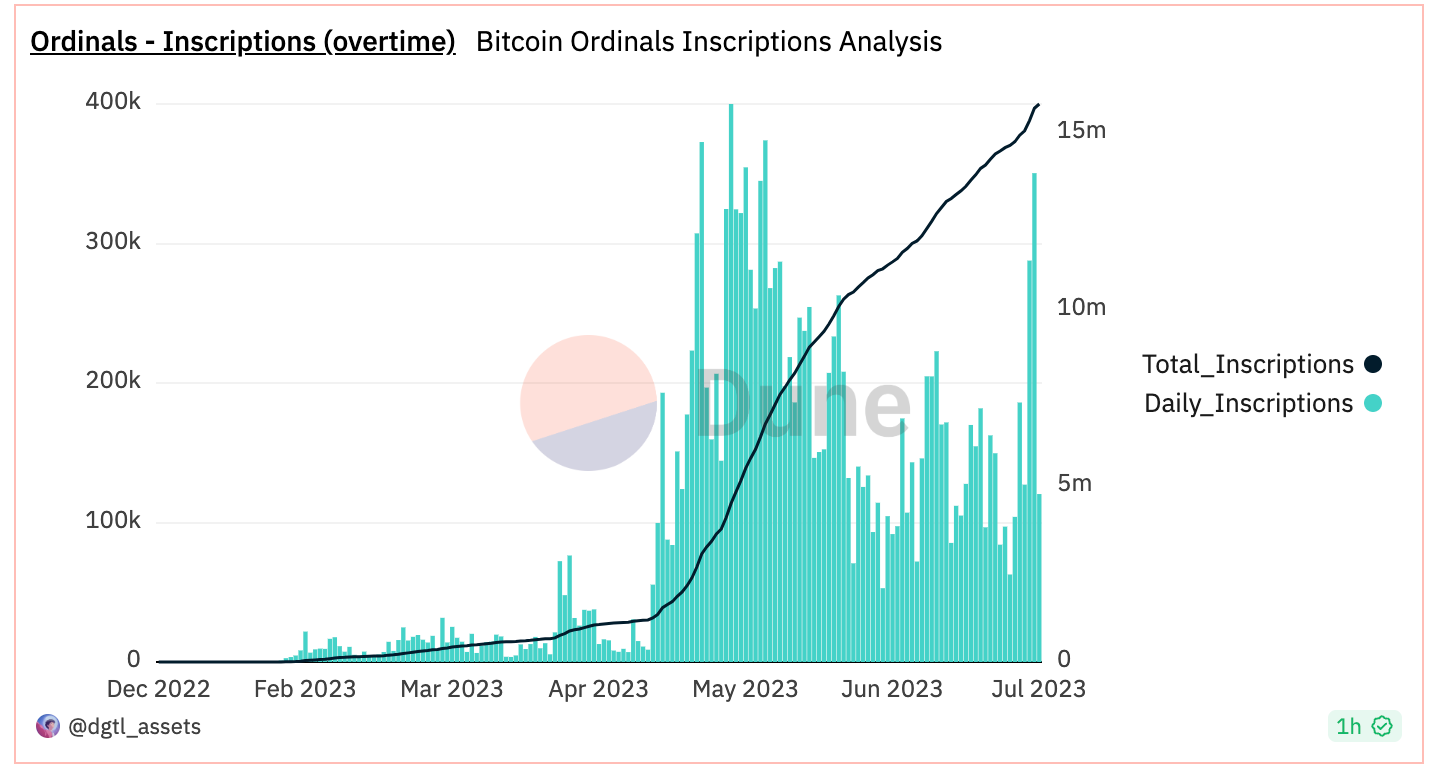

Once the Bitcoin ordinals protocol emerged, the idea of NFTs on the Bitcoin blockchain quickly caught the crypto community's attention. Since they came into the spotlight in January 2023, the growth of ordinals has been staggering. Over 15 million Bitcoin Ordinals have been created, and no signs of significant slowdowns exist.

A look at daily and total ordinals created. Source: @dgtl_assets Dune Analytics Dashboard

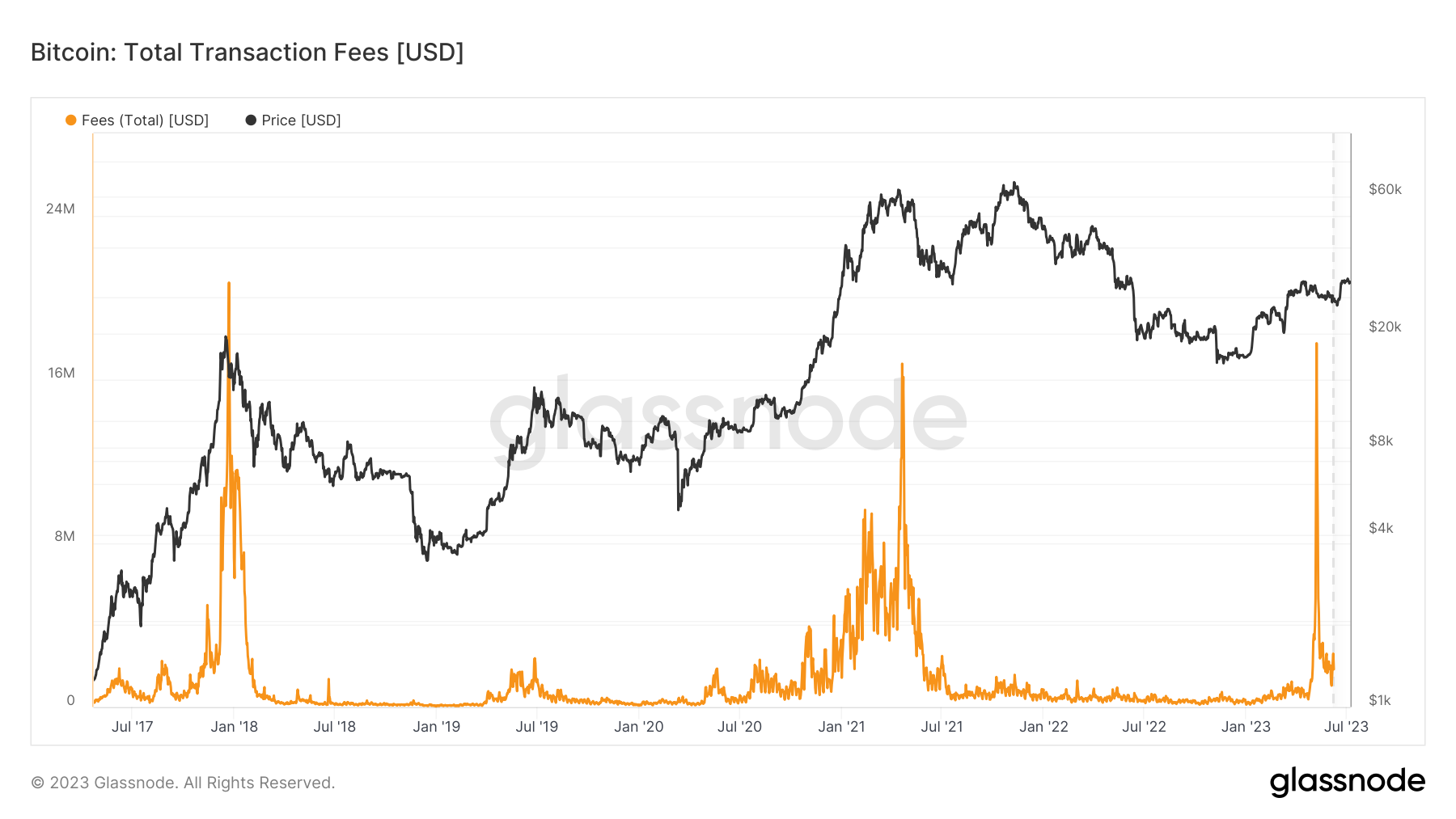

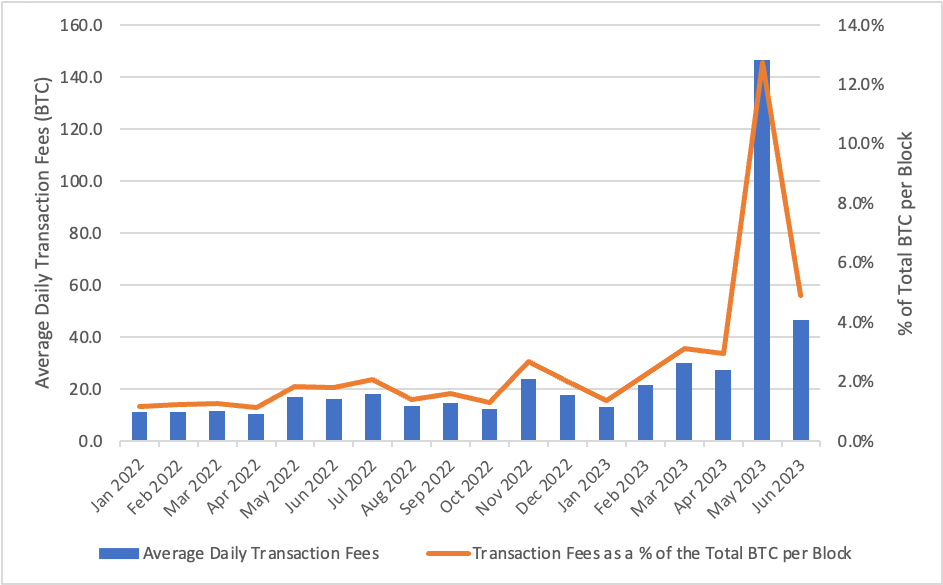

A look at daily and total ordinals created. Source: @dgtl_assets Dune Analytics DashboardAs a result, Bitcoin block space demand has also surged. Today, daily network fees are a steady 2-3 times higher than throughout 2022. At one point this last May, transaction fees even spiked to levels not seen since the top of the 2017 bull run after a Bitcoin NFT and meme-coin craze. During those days of fever, ordinals' interest and daily inscriptions soared, causing the Bitcoin network to become crowded with transactions.

Total daily transaction fees in Bitcoin. Source: Glassnode

Total daily transaction fees in Bitcoin. Source: GlassnodeBitcoin Miners are Set to Benefit from the Ordinals Protocol.

Ordinal inscription transactions offer substantial benefits for Bitcoin miners. The higher transaction fees illustrated in the previous section are the most apparent benefit. As a result, since the ordinals protocol emerged, the amount of BTC in blocks originating from transactions is substantially higher.

For instance, in June 2023, 46.5 BTC per day coming for transactions were mined on average, almost 3x the amount in June 2022. The figures in May are even more pronounced. Fees now constitute a much higher % of the total BTC available per block, as shown in the chart below.

Daily Transaction Fee Revenue and the Share of the Total Block Rewards made by Transaction Fees Source: Coinbureau with data from Bitcoin Visuals

Daily Transaction Fee Revenue and the Share of the Total Block Rewards made by Transaction Fees Source: Coinbureau with data from Bitcoin VisualsThe second way ordinals benefit miners is by offering more consistent, more valuable blocks. This is because users minting ordinals can be buyers of blockspace when blocks are not whole. This can happen as inscribers can wait until average fee rates drop to finalize their transactions, as creating ordinals may not be as time-sensitive as financial transactions. If we see this pattern of behavior, blocks are likely to be full more consistently, thereby increasing the BTC per block floor.

How Do Ordinals Impact the Security of the Bitcoin Network?

The Bitcoin halving happening every 210,000 blocks, roughly every four years, is perceived positively. Traditionally, bitcoin’s price has rallied following a halving, and by more than a factor of 2. This is important because, for every halving, Bitcoin’s security budget also drops by around 50%, meaning a price increase of 2x or more is needed to ensure that the security budget of the network doesn’t fall.

However, the price of BTC increasing by a factor of 2 or more is not guaranteed, and with each halving, whether sooner or later, block rewards will be inevitably small given the math behind BTC supply. To ensure a healthy security budget, it is therefore critical that miners accrue a substantial amount of transaction fees.

Here is where ordinals could play a significant part. Ordinal fees can increase the profitability for miners and thus contribute positively to Bitcoin's security budget. Overall, Ordinal’s impact on miners and Bitcoin's long-term security model appears to be largely positive.

We have seen the first signs of block reward independence, shedding some light on a future where the Bitcoin security budget is less likely to be compromised.

How to Buy, Sell, and Trade Ordinals

The ordinals protocol uses the Bitcoin Taproot update; therefore, a taproot-compatible wallet with a taproot address is required. A wallet with “coin control” capabilities that prevent spending inscribed ordinal satoshis is also needed.

Note that many popular wallets may not be compatible due to these requirements. This is because many wallets may only support taproot or see all sats as the same, with ordinal inscription distinctions.

Popular taproot-compatible wallets are the Ordinals Wallet, Xverse, and Unisat. The typical user journey involved in buying Bitcoin ordinals is similar to purchasing non-Bitcoin NFTs, which is as follows:

- Create an ordinals wallet. This can be done through the webpage of one of the wallets mentioned.

- Take a backup of the recovery phrase for the wallet.

- Set up a password to access the wallet.

- Send some sats to the wallet using the address or buy some bitcoin via built-in onramp services.

- Go to an ordinals marketplace such as gamma.io

- Find your favorite ordinal.

- Buy the ordinal using the sats in the wallet.

Bitcoin ordinals marketplace Gamma. Source: Gamma.io

Bitcoin ordinals marketplace Gamma. Source: Gamma.io As a nascent technology, the tools around Bitcoin ordinals are still at a very early stage. With more users drawn to ordinals, the ecosystem, and the tooling will mature to provide a more intuitive user experience.

How to Create Bitcoin Ordinals

Until recently, the only way to create ordinals was with a fully synced Bitcoin node, which can be costly and requires a technically competent user. Now inscription services like Gamma and Ordinals Bot provide more user-friendly ways to inscribe Bitcoin ordinals suited for non-technical users.

1. Create an ordinals wallet. This can be done through the webpage of one of the wallets mentioned. Follow steps 1-4 above.

2. Connect to an inscription service like Gamma.io or Ordinalsbot

3. Select the type of file to inscribe. You can choose between an image, text, BRC-20 tokens, and even .sats, a name service similar to ENS. Remember that the file size will affect the transaction cost, anyone can view the file, and it cannot be changed or deleted.

4. Enter the taproot-compatible wallet address where you wish to receive the NFT.

5. Choose your transaction fee. The higher the payment, the more likely it will be that the ordinal will be created sooner. However, keep in mind that the time it will take to make an ordinal will depend on Bitcoin's network congestion, and it is not guaranteed that a high fee will mine the NFT sooner than a lower fee at a time of lower congestion.

6. Inscribe the Ordinal NFT by sending the BTC requested. You’ll need to own some BTC to pay the transaction.

Once the transaction is confirmed, you'll get a link to see your inscription on the ordinals explorer and transaction data details.

What is Next for Ordinals?

Bitcoin Ordinals are in their nascent stage, with continuous enhancements to the technology and associated tools. The earliest developments were driven by a need to rectify some issues, but more recently, enhancements focused on performance and user-friendliness.

The Cursed Ordinals Issue.

The term "cursed inscriptions" pertains to ordinals rendered invalid due to incorrect usage or intentional misuse of opcodes. These "cursed" entities could not be recognized or traded, limiting their usability within the ordinal's ecosystem. However, a new upgrade to the ordinals protocol, version 0.6.0, has started to address this issue by indexing these previously unrecognized Bitcoin ordinals.

The solution proposed by ordinals creator Casey Rodarmor involved transforming these cursed inscriptions into "blessed" ones. This transformation consists in introducing support for a subset of the different types of cursed ordinals, achieved by setting a block activation height at which specific types of previously invalid inscriptions would start being indexed as regular, valid ordinals. This transformation would solve some pain points around the 70,000 affected ordinals.

Ordinals Recursive Inscriptions

More recently, on the 4th of July, Bitcoin ordinals entered a new era with the introduction of the BRC-69 standard. This game-changing development reduces the cost of Bitcoin ordinals by 90% and removes the existing data limit, previously constrained by Bitcoin’s block size of 4 Mb.

This innovation is based on "recursive inscriptions," a process that allows inscriptions to request data from existing ones. This can be used in many ways. For instance, rather than inscribing 10,000 JPEG files for, let's say, the BAYC collection, which would be expensive, as we saw earlier, you could use recursive inscriptions to make everything more lightweight. It could be possible to inscribe the 200 traits from the collection and then make 10,000 low-memory inscriptions to request traits and programmatically render the image, resulting in significant cost savings.

The use cases are not limited to images, there have already been text and audio files also inscribed. Bitcoin is getting a more advanced file system, meaning that building more complex and elaborate systems will make pushing the innovation frontier even more attainable.

Ordinals Have Changed The Ethos of the Bitcoin Blockchain

What was traditionally a blockchain for peer-to-peer financial transactions is now evolving into a network that can do more, and Ordinals are the technology behind this movement. Many felt like Bitcoin was falling behind in blockchain innovation and relying too much on its previously-held narratives such as being a store of value, inflation hedge, and peer-to-peer payment system, but now the tides are changing. Recently, Vitalik Buterin spoke positively about the impact of ordinals on Bitcoin's future, stating:

“I definitely see signs of hope now that we have ordinals bringing back a culture of doing things. It feels like there’s an organic return to builder culture" (Source)

With a halving in sight, a potential US spot ETF approval, and ordinals to drive innovation, Bitcoin is set to have some action-packed months ahead.