Money has been going virtual and your investments should also be going virtual.

Of course I’m referring to the increasing adoption of cryptocurrencies, not only by blockchain enthusiasts, but by the average retail investor, and by the traditional institutional investors. The trend in cryptocurrency adoption has picked up massive momentum in 2020 and 2021, and the popularity of digital forms of currency continues to grow.

It’s not so long ago that Bitcoin was unveiled and embraced by a small group of technological anarchists known as the Cypherpunks. Since then, just a dozen years, Bitcoin has grown to be worth hundreds of billions of dollars, and the overall cryptocurrency market encompasses thousands of currencies and projects, with a total market cap of over $1 trillion.

And as the ecosystem grows it is being embraced by global banks and corporations, and even by those who once called it a “fraud” and said it would never survive.

JPMorgan CEO Jamie Dimon’s Bitcoin moments of regret. Image via Marketwatch.com

JPMorgan CEO Jamie Dimon’s Bitcoin moments of regret. Image via Marketwatch.com Now those same individuals are going all in on blockchain investing, and it’s probably time for you to also consider blockchain investing as part of your overall financial strategy. After all, Bitcoin and other major cryptocurrencies make financial headlines daily, and fortunes have been made in the emerging blockchain space, yet it is still very early in their development and growth. Think of cryptocurrency investing like investing in technology firms in the early and mid 1990s.

Another indication of the growing strength of the cryptocurrency markets comes from the financial powerhouse S&P Dow Jones Indices, who publish the popular S&P 500 Index among others. That group has recently added new indices that increase the mainstreaming of blockchain assets. The new indexes, S&P Bitcoin Index, S&P Ethereum Index and S&P Crypto Mega Cap Index, will measure the performance of digital assets tied to them.

Not only does this increase the visibility of cryptocurrencies, it also adds an air of legitimacy to the entire industry.

However, even though blockchain assets have made massive strides in adoption, “crypto” remains mystifying and confusing for many. Which is why we’ve put together this basic guide to blockchain investing. It will help explain the basics of cryptocurrencies, how they might fit in your investing portfolio, and clear up some misconceptions while also reinforcing some best practices when it comes to personal investing.

As you are interested in learning about the basics of blockchain investing, you may also be interested in checking out our guide to cryptocurrency investing.

Let’s get started!

What is cryptocurrency?

A cryptocurrency is a type of decentralized money. It can serve a number of purposes, but is typified by the fact that it is not created or controlled by a government or any other centralized organization.

The various forms of money over the years.

The various forms of money over the years. Unlike the traditional government issued currencies, also known as “fiat” currencies, cryptocurrencies have no physical form. They are strictly digital assets that are secured by cryptography – hence the name “crypto”currency.

Blockchains use cryptography to encode the information used in the creation, transfer, and storage of the currencies. This is how blockchain currencies avoid counterfeiting and double spending. And this is how the blockchain ledger, which records all the transactions of the blockchain, is kept secure as well.

One of the major benefits to cryptocurrencies is that by decentralizing they can avoid interactions with third-parties and government agencies, putting the control of wealth back into the hands of the individual. Some blockchains even allow for anonymous processing of transactions, which some privacy-concerned individuals see as another huge benefit.

And of course, since they have value, cryptocurrencies have become increasingly popular for speculation and investing.

Most popular cryptocurrencies

There are literally thousands of cryptocurrencies in existence, and hundreds of different public blockchains. Obviously that makes investing a bit more complicated, however it is possible to narrow the scope a bit by focusing on the most popular cryptocurrencies. The two that are most popular by far are Bitcoin and Ethereum. Also very popular are the stablecoins such as Tether (USDT) and the U.S. Dollar Coin (USDC).

Just a small selection of the popular cryptocurrencies available.

Just a small selection of the popular cryptocurrencies available.

- Bitcoin (BTC): Both the first and by far the most popular crypto, Bitcoin was created by the pseudonymous Satoshi Nakamoto, who described it as a "peer-to-peer electronic cash system." The creation of Bitcoin sparked a financial revolution that’s still playing out a dozen years later.

- Ethereum (ETH): The second-largest cryptocurrency, Ethereum is a digital coin and computing platform that uses a system of “smart contracts” to automatically execute transactions. The Ethereum blockchain is the most commonly used worldwide as it is the backbone for many decentralized finance (DeFi) platforms, and for the increasingly popular non-fungible tokens (NFTs).

- Stablecoins: Unlike Bitcoin and Ethereum, stablecoins are often backed by local currencies or other assets in an effort to avoid the volatility experienced in most blockchain assets. Because of this the stablecoins typically have their value pegged to $1 and fluctuate very little away from that value.

Why Cryptocurrencies are Different from Fiat

Fiat currencies, such as the U.S. dollar and the Pound Sterling, are issued by government central banks. As you might guess from the name “central” bank, this means there is a centralized authority that controls the money supply, interest rate, and ultimately the value of a given country’s currency.

Cryptocurrencies arose from the belief that this type of centralized government control over currency is both manipulation and a dangerous attempt to manage an incredibly complex global economic system. Fiat currencies and the central bank control is also thought to be the source of inflation in the world that blocks the average person from ever being able to build a store of wealth.

Decentralized currencies are vastly superior for the average person.

Decentralized currencies are vastly superior for the average person. Being decentralized, cryptocurrencies have no central authority controlling them. The full control of the money is left in the hands of the individual. Adding in that many cryptocurrencies have a deflationary mechanism that actually promotes the value of the currency increasing rather than being eroded over time, and you can see where these blockchain assets are superior to the archaic fiat currencies.

Why Cryptocurrency has Value

So, considering that these blockchain assets are decentralized how can you be sure that they will actually have value in the future?

Ultimately anything only has value because people agree that it does. Often this comes from the utility of the item or asset, such as gold being a store of value. In the case of gold, and of any government issued fiat currency, there is only value to them because people agree that they have value. Fiat currencies are backed by the tax-debts of the issuing government, which supports the notion of them having value.

Generally an asset such as cryptocurrency or gold has value for a few potential reasons—although not all have to be true at once:

- People want to hold the asset to store value or as an investment;

- People think the asset is generally scarce with a reasonable assurance that it will remain scarce;

- People believe that it serves some useful function either as money, a commodity, or a tradable good.

Bitcoin has been called "Digital Gold" because it functions as a store of value similar to physical gold.

Bitcoin has been called "Digital Gold" because it functions as a store of value similar to physical gold. Taking a look specifically at Bitcoin, it has value for a few different reasons:

- The mining process. The same economic incentives that drive people to dig up gold or drill for oil are at work. Because Bitcoin has value people are willing to dedicate time and resources to create new Bitcoin.

- The network effect. Bitcoin was the first cryptocurrency and it remains the most dominant cryptocurrency. It’s market capitalization is roughly half of the entire cryptocurrency market. So even though there are many alternatives people continue to use it because it remains the most widely adopted and secure network.

- Scarcity. There will only ever be 21 million Bitcoins produced. That scarcity was intentionally baked into Bitcoin as a deflationary measure. Comparatively, modern fiat currency is a product of monetary policy that is controlled by central banks. As we’ve see all over the globe, time and again, it’s pretty easy for central banks to get that monetary policy wrong and cause all kinds problems.

In short, people are attracted to Bitcoin’s value proposition because it offers an alternative to traditional assets and is based on computer code that is global, apolitical, censorship-resistant, and inherently scarce.

Approaching Crypto Investing as a Newcomer

The very first investment you need to make when entering the cryptocurrency space as a newcomer is an investment of time. You should definitely understand the basics of how blockchain technology and cryptocurrencies work. Fortunately information on the various cryptocurrencies has become far easier to find and access, and there are many people putting time and effort into making cryptocurrencies easily understood. Since you’re here at Coin Bureau have a look around at our comprehensive resources as a beginning.

You can also check out our cryptocurrency guy – who is appropriately named Guy – over at our Youtube channel. You’ll find a wealth of information and ongoing educational resources. We’re biased, but it is one of the best, unbiased and most comprehensive blockchain and crytocurrency resources you’re likely to find.

Next, buy some Bitcoin and get comfortable with the process. Now you’re already a blockchain investor, congratulations!

Investing in Cryptocurrency

Before taking a deeper dive into blockchain investing it’s important that you know there are good reasons for getting involved, and there are poor reasons. It’s equally important that you know your own reasons.

Good Reasons to Invest in Cryptocurrency

- You believe that cryptocurrencies are the way of the future and will likely replace the traditional fiat money — if this happens, you want to be educated, prepared, and experienced.

- You support the social vision behind cryptocurrencies— that currency should be decentralized and under full control of the people who use it.

- You understand and appreciate how blockchain technology works— you value the peer-to-peer aspect of transactions, their security, and confidentiality.

While it’s true that fortunes have been made investing in cryptocurrencies, it’s also true that fortunes have been lost. Remember that cryptocurrencies (outside stablecoins) are extremely volatile and high-risk investments.

Don't be surprised if your blockchain investments take you on a bit of a wild ride.

Don't be surprised if your blockchain investments take you on a bit of a wild ride. For example, from mid-April 2021 to late June 2021 Bitcoin fell from nearly $65,000 to a low of just below $29,000. And even with that hair-raising drop it remains up by 270% over the prior 52-weeks. If you can’t stomach this type of volatility then blockchain investing might not be for you. And even if it is we recommend allocating only a small portion of your investing capital into crypto.

With that out of the way, if you are still genuinely interested in blockchain technology’s potential to change the financial landscape of the world we live in, and are willing to learn and to manage the risks presented, then keep reading.

General Investing Principles

Whether you’re investing in blockchain assets, stocks, bonds, or other asset classes there are always some general investing principles to keep in mind.

Look for value added opportunities. No matter what the asset is you should always direct your investment dollars towards things that make people’s lives easier or better in some way. Also look into the management behind any project you invest in to ensure they are knowledgeable, experienced, and talented. A combination of an excellent product and an excellent team should almost always yield an excellent investment.

Invest in your own education. There are so many great resources out there that can help you learn about investing. So buy the books, listen to the podcasts, watch the Youtube videos, and read the blogs. Seriously, there are so many resources out there that it’s impossible to run out of new things to learn about investing.

Investing in your knowledge and skills will always pay dividends.

Investing in your knowledge and skills will always pay dividends. Improve on your productivity. You can see this in action in the blockchain world with Ethereum, which makes developers more productive when creating dApps, and in Uniswap, which makes traders more productive thanks to its ease of use. Not only can those provide you with a good example in productivity, they can also be considered as good additions to your crypto portfolio. The fact of the matter is that things that increase productivity are often good investments as well.

Keep the long-term in mind when investing. Short term purchases are fine, but that’s trading, not investing. Investments are mode for the long term, and honestly it is far easier to see where something might play out over several years, versus how it will play out over several days or weeks. Smart investors are also patient investors who are willing to wait for their investments to mature.

Blockchain Investing Principles

When you’re getting started out with your blockchain investing portfolio it can make good sense to follow these 5 principles:

Getting started is the hardest part. We all procrastinate to some degree and taking the first step in investing in cryptocurrencies, when you aren’t sure about the process or the investment, and you could potentially lose money, makes getting started the hardest part. So why not take advantage of our special offer where you can receive $10 of free Bitcoin for your first $100 purchase. That’s an immediate 10% return on your investment, plus it gets you started easily. With institutional investors moving funds into blockchain assets the growth in the sector is only getting started. You need to get started as well.

Once you get started our Guy is happy to help you with your research.

Once you get started our Guy is happy to help you with your research. If you’re already investing in equities think of your blockchain investments in terms of your stock investing. While the two might be different in many respects they do share some similarities. For example, buying a token from a good blockchain project is akin to purchasing a stock in a good company. You can also bring in principles like value investing and dollar cost averaging, which are known to work well with stocks.

Take the time to understand the underlying benefits and utility of the project. You wouldn’t buy a stock without understanding what the company does, so why would you buy a cryptocurrency without understanding what the underlying project is trying to accomplish? Read the website, the whitepaper, Reddit comments, forum posts, and anything else you can get your hands on that explains the project. You should know whether there’s an actual product released, how the economics of the token work, and whether investors seem to be accumulating the token or not.

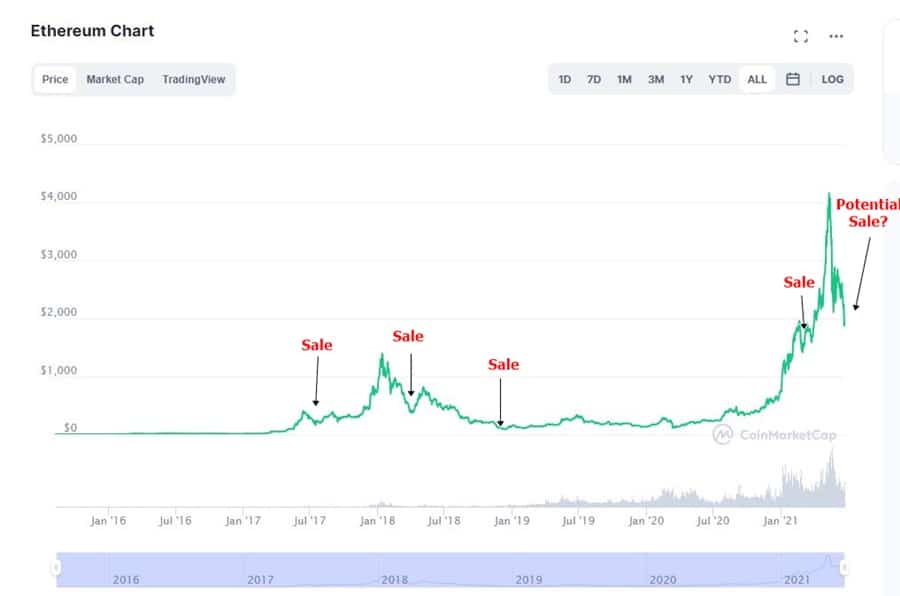

Try to buy your tokens when they are at a discount. This is no different than waiting for a pullback in the stock market. As I’m writing this Bitcoin has been flirting with $30,000, which is more than 50% below its price just two months earlier. Ethereum is currently trading right around $1,900 when it was over $4,000 two months ago. They are the same tokens they were two months ago, but market conditions have brought the prices down to more attractive levels.

Waiting for better prices can be a wise investing decision.

Waiting for better prices can be a wise investing decision. Make your blockchain investment just a portion of your overall investments. You wouldn’t put all your money into gold or a single stock. Neither should you put everything into cryptocurrencies. Diversification is always an important principle when investing. Avoid putting all your crypto investment capital into just one coin too – even Bitcoin. Diversification helps to even out volatility, and it’s a sensible investing decision.

Misconceptions about Blockchain Investing

One of the top misconceptions, that continues to persist and be perpetuated by those who oppose cryptocurrencies, is that they are somehow shady and linked to illegal activities. Much of that is down to the technology being new and not properly understood.

And it is true that in the early days Bitcoin was used for a number of illegal transactions involving drugs, guns, and other criminal activities. Yet no one seems to make the connection that prior to the creation of Bitcoin, and indeed even up to today, fiat currencies are used for the same illegal purposes.

Fortunately as cryptocurencies become more mainstream they are also gaining a better reputation. With Wall Street investors and big name funds entering the crypto space it has helped to improve the public image of Bitcoin and other cryptocurrencies. Now, with major companies like Tesla, Microsoft, and Paypal accepting Bitcoin, and some of the largest university endowments and Wall Street hedge funds invested in crypto, it has definitely transitioned into something more respectable.

Many major companies now accept crypto. Image via Cryptooa.com

Many major companies now accept crypto. Image via Cryptooa.com What’s interesting in all this is drawing the parallels between the growing acceptance of blockchain technologies now, and the evolution of internet technology in the mid-1990s, when many people believed it was only about gambling and pornography. Today we know nothing could be further from the truth.

Avoid the Reddit Pundits

While Reddit can be a fun and informative forum in some respects, it’s not the place to go for your financial advice. Those fools pumping meme stocks like AMC Theaters and Gamestop, or the dubious cryptocurrencies like Dogecoin and Shiba Inu, are a poor reflection on the entire sector.

While it’s true that the world of professional wealth managers and financial institutions may not have the best interests of the common man at heart, the Reddit crew is even worse. Sure they spout decentralization and the removal of these big, controlling interests in finance, but the facts are that anyone at all can post to Reddit and other online venues. There are no educational requirements, and no certifications required. Hell, they don’t even reveal their real names in most cases!

Following the fan theories promoted on Reddit and similar sites has nothing to do with investing, and if you do follow that advice and lose money you have no one to blame but yourself. Following the Reddit crowd is nothing more than the most base speculation, and typically only those who begin the pumping of the asset end up profitable.

Reddit can be great fun, but it's not great for investing advice. Image via CNBC

Reddit can be great fun, but it's not great for investing advice. Image via CNBC I’ve been researching and studying blockchain technology and cryptocurrencies for over four years. It’s my job to research blockchain projects, and even I only understand a minority of the projects that have been built. And I can tell you that some projects look really great on the surface.

They look like an easy 10-bagger or better, until you look deeper. Or even worse until you invest and are later hit by the news report explaining what went wrong. Consider the three following characteristics and you’ll understand why it is so important to get your blockchain investing information from someone you know and trust:

- There’s been an explosion of financial information on the internet.

- Much of this financial information lacks transparency. You have no idea who is behind it.

- Creating a new blockchain project can be as easy as clicking through a script.

This is a perfect recipe for investors to get scammed at worst, or at least to be fooled into losing large amounts of money.

Don't become the victim of a crypto scam.

Don't become the victim of a crypto scam. And while it’s most likely to happen to newcomers, it can just also happen to those of us with more experience in the space. There are a number of times I’ve spent several days researching a project only to ultimately find out that there’s no way to know who is behind the project, or that the smart contracts hold some code that would allow for a rug pull by the developers.

Blockchain is gaining mainstream adoption, but beyond the top 20 projects or so it is still very much a Wild West out there.

What’s the Best Time To Buy?

Just like the stock market, there’s no real way to time the cryptocurrency market. It’s obviously not a good idea to buy at the peak of a bubble, but unfortunately there’s also no way to know when that peak occurs. It’s also not good to buy when prices are falling sharply. If you’re looking for the best time it would be when prices are low and stable, however if you do buy at those times you’ll likely need some patience to see the benefit of your investment.

Choosing the right time to buy and sell can help your investing returns.

Choosing the right time to buy and sell can help your investing returns. Trading the cryptocurrency markets is a huge topic all by itself, and here at Coin Bureau we’ve already done the fundamental research into many different blockchain projects. In the coming months you can also expect us to expand on our coverage of technical analysis, giving you a better insight into how to read the charts, and what trading methods might be useful in various market scenarios.

While not an exact science, this type of investment research can help in determining when to buy a particular cryptocurrency. It might even help with determining tops and bottoms in the market, although those can be very subjective. For example, back in late March 2017 most people were avoiding buying Bitcoin as it passed the $1,000 mark because they felt it was a top for the market. Of course in hindsight we know that was a massive bargain, and we won’t ever have the chance to buy Bitcoin at such a low price again.

Here are some basic guidelines you might want to keep in mind when you’re considering a blockchain investment:

- Don’t compare crypto bubbles with bubbles in traditional markets. In crypto a 10% move is normal volatility, and a 100% move is often just the start of a far larger move. In traditional markets a 100% move nearly always indicates a bubble.

- Don’t immediately buy in on a dip because it could end up being far larger. Remember that cryptocurrency moves are often quite large.

- Don’t necessarily buy in just because you see a huge spike in price. Manipulation does happen in the cryptocurrency markets, especially with smaller projects, and “pump-and-dump” schemes are a reality. Get educated on the project you’re considering and buy when it seems price is good.

- Don’t get shaken out of your positions by the wild swings you might see in cryptocurrency prices. You need to have conviction and understand that the cryptocurrency revolution is still in its very early days.

- While some blockchain investment is necessary, it is only a slice of the overall investing pie. Plan on allocating somewhere between 2-10% of your investing money to cryptocurrencies when you are just getting started. The rest of your money should be in stocks, bonds, commodities or even fiat currencies to maintain a fully diversified portfolio.

- Stick to the top blockchain projects when starting out. Bitcoin and Ethereum make a good foundation for any portfolio, and beyond them you may want to stick within the top 20 cryptocurrencies initially. Remember, it isn’t easy to get rich quick, but it is far easier to get rich steadily and slowly.

- With that in mind, consider a strategy like dollar-cost-averaging where you make regular investments – weekly or monthly – and slowly grow your portfolio.

- When you experience a loss, and you will, consider it to be a lesson and learn from it. Examine what may have gone wrong with the investment, and strive to avoid a similar occurrence in the future.

Conclusion

Blockchain assets are an emerging asset class, and they are certain to continue evolving and growing in importance to the global financial industry in the coming years. Naturally we have no idea which tokens will thrive, but that’s true for any asset. Owning some cryptocurrencies should be a part of any savvy investor’s portfolio.

As a decentralized asset cryptocurrencies have remained protected from third-party interference and government agencies. However that might always be the case. We do know that blockchain technology can give us a highly secure, and even anonymous asset class however, both of which are likely to be increasingly important in the future.

And while blockchain purists shun the involvement of governments in the cryptocurrency space, the truth of the matter is that governmental regulations will lend an air of respectability and trust to the asset class for many traditional investors. In turn that should increase adoption and make various cryptocurrencies more valuable, as we’ve already seen occurring in 2021.

You should now have a basic understanding of why investing in blockchain projects is important, and even how to get started. However we’ve only just scratched the surface of investing in cryptocurrencies. There are many emerging ways in which you can profit from cryptocurrencies, including staking, DeFi protocols, yield farming, crypto lending, leverage, and others. Each deserves a deeper investigation, and in the coming months we will be doing just that so make sure to bookmark us and come back often to increase your blockchain investing knowledge.