In the summer of 2021, a craze hit the crypto world called NFTs. Unlike JPEGs or GIFs, these digitally generated unique images have something that gives them value: ownership verification. In other words, you can see who owned what at any point in time from creation until its most current owner.

Due to its uniqueness, not only are you the only one in the world who owns it, but you also have the right to do (almost) anything with it as its legitimate owner. This legitimacy goes unchallenged (unless you have a counterfeit in your possession). Starting first as an image, various types of NFTs soon emerged. Aside from the art-based ones, there are media/music NFTs, gaming NFTs, and NFTs representing real-world assets.

In this article, we're going to explore what makes an NFT an NFT, how to gauge its value using certain criteria, and whether it's worth investing in it.

What is an NFT?

NFT is short for non-fungible token, meaning unique tokens that cannot be exchanged with another token of the same type. Think of a dollar bill that has a serial number printed on each of them. The serial number is mainly used as identification, but it doesn't affect the value of the dollar from one to another. The dollar bill is considered fungible because one is interchangeable with another. An NFT is the exact opposite.

The token is in the form of a digital file, so if you want, you can imagine a piece of paper with some information on it. The most valuable part of the file is a link to a media file stored in a computer somewhere, and a record of who used to own or currently owns this token.

The information cannot be changed as it is stored on the blockchain. This record is valuable because it gives the token provenance, i.e. the ability to trace all previous owners. We'll see later why this is valuable.

Of the few known types of NFTs currently in the market, they consist of image, music, video, and data types. 90% of the NFTs people talk about are the image kind, specifically the profile-picture type, also known as PFP. That's because these often come in a collection, usually around 10,000, and are traded the most.

These can be static images or with a bit of animation in it. These NFTs are traded on either individual marketplaces such as OpenSea and Magic Eden or exchange-based marketplaces, such as Coinbase's NFT marketplace.

What NFTs brought to Crypto

Before NFTs came along, the crypto world was mostly about philosophy, speculating on token prices, and DeFi, which is mainly about borrowing and lending money.

Honestly, that was enough to keep people busy for quite a while. However, those who got into crypto at the time or before were mostly attracted to the concept of decentralisation, privacy, full ownership, etc. These are people who had some kind of tech or finance background and were mostly male.

When NFTs came onto the scene, the types of people who joined the crypto world started to look a bit different. More women came, and also non-technical / non-geeky people who were attracted to the NFTs themselves. it quickly became a thing of culture and inserted itself neatly into our all-things-fast-becoming-digital kind of world. It also brought on board a new class of traders where 90% of its value was in speculation.

With that, a new asset class was born and the world of crypto would never be the same again.

Collections such as Wold of Women attract more diversity to the crypto-bro space. Image via NFTEvening.com

Collections such as Wold of Women attract more diversity to the crypto-bro space. Image via NFTEvening.comWho buys NFTs?

There are two and a half types of people who would want to buy an NFT. Huh? Half-type? A typo? Ahem, I can assure you, it's not. Please hear me out.

The first type is the Collector. People like to collect and own what they collect, be it Beanie Babies, baseball trading cards or sets of McDonald's Happy Meal toys.

Some like to inform the world of their collection. Doing so gives the ego a chance to collect comments of praise and envy amongst others. Knowing we have something coveted by others somehow makes us feel special. Others though, prefer to keep their collections a secret, only to be enjoyed by their own eyes in private. The Collector treats the NFT as a prized possession.

The second type is the Trader, someone who buys with the sole purpose of offloading it to the next buyer at a higher price than what they paid for. The buying and selling intervals can be measured in days, months, or years. As a trader, they will be paying close attention to a number of factors, which we will go into in some detail, in order to maximize their chances of selling at the highest possible price. The trader treats the NFT as a product.

The half type is the Investor who buys with an eye for the potential appreciation in value and looks at it as an asset. The Investor is interesting in this context because this role takes on traits of the Trader and can also be adopted by the Collector.

That's because the Investor will eventually sell the NFT when the price is right and won't be too keen to keep it for its own sake. This is close to Trader behaviour. On the other hand, a Collector who buys an NFT may consider it an asset in addition to purely liking it on its own merits. This is known as the Investor-Collector, under which the majority of Collectors likely fall under.

If you're wondering why you want or should buy an NFT, it's worth asking yourself what do you plan to do with it. If you buy it purely because you like it, that means you're collecting it. Otherwise, you'll likely be wanting to sell it and make some (easy) cash, joining the hordes of people you heard who've "made it big". Before your wonderful dreams grow any bigger, I have a duty to warn you that the opposite may be true, i.e. you bought something no one wants to buy, or you could only sell it at a loss.

In order to mitigate the risk of something like that happening, pay close attention to the factors that determine the value of an NFT.

What Makes an NFT valuable?

There are numerous factors to study when considering whether to invest in NFTs or not. We've listed them based on categories for easier understanding.

The People Involved

Creator / Project Team

All creative ideas start with the Creator, and NFTs are no exception. In this case, we will broaden our definition of Creator to include not just an individual, i.e. the person with the idea but also the team behind the NFT project.

There are two components to an NFT: the content and the coding. While the content might come from an individual, it takes a few more people to do the coding. Then there are also the other ones involved in the periphery, such as the supporting team, marketing, etc.

Projects, where the creator has done similar stuff in the past, give new investors an idea of what's possible / what to expect. For example, Yuga Labs was famous for the Bored Apes collection, so when they launched Otherside, it caused a network congestion and huge spikes in ETH gas fees. Yet when Bored Apes first launched, it had less than a fraction of the fanfare that Otherside garnered. That's the difference between having a famed vs an unknown team.

Bored Apes looking from the Otherside. Image via coindailynews and nfts.wtf

Bored Apes looking from the Otherside. Image via coindailynews and nfts.wtfSometimes, the creator's value stems from his own fame, such as Gary Vaynerchuk and his Vee Friends collection. Gary was the main reason why the NFTs he created became valuable.

His followers bought them to support him and for their other benefits, thus creating demand.

Even Donald Trump has jumped on the NFT bandwagon as he recently launched his Collect Trump Cards collection. Not only is this a great way for him to raise more funds for his lawyers, but his fans also get to own a piece graced by him with the certificates to prove it!

Speaking of which, there has also been a recent trend in name brands getting into the NFT space. From Gucci, being the first big-name brand to athletic brands like Nike and Adidas, fashion has embraced NFTs at breakneck speeds. Not only are NFTs for digital avatars, but there are also "phygital" NFTs, where owning one gives you the opportunity to own the real thing too.

While it's tempting to do a launch-grab-n' go-style campaign, it's the projects with an eye on future plans that will have the longest staying power. Are the NFTs part of a bigger plan for the team or just a one-off? This also influences the price of the current NFTs.

Owner

Sometimes the NFT itself is a bit on the "meh" side, but if one of its past owners happened to be an influencer/celebrity, the value of that NFT would differ greatly from another within the same collection.

This is where the provenance part comes in. If you have the opportunity to own something that used to belong to someone you're a fan of, you're more likely to pay just a bit more than the average person to have it.

Due to the utilisation of the blockchain technology, the record of past owners can be traced, and the information is more than likely to be true. I think Kevin O'Leary was one of the first who saw the value in NFTs based on this factor when applied to watch collections.

Seller

Another key player in the exchange of NFTs is the seller. A known seller might not cause the NFT to increase much, but it certainly prevents the buyer from getting conned.

There are heaps of sellers selling JPEGs of known NFTs out there, so it pays to be extra careful about who you buy from. Sometimes, if something seems too good to be true, it most likely is.

Aside from the seller's trustworthiness, the seller's history can also reveal some interesting information that is of use to the investor or buyer. Those who sell often and have a good track record of profit-making probably have a more discerning eye towards their wares, i.e. knowing what are good assets worth stocking up on to sell.

Community size

Like most decentralised projects, support for these projects often relies on the community to help each other out. Here are some of the benefits of a thriving and engaged community:

- Good FAQ list with prompt answering from the platform's moderators

- News shared with the community gets amplified easily, generating buzz and, subsequently, demand

- A sense of "we're all in this together" (for good or bad), fostering a truer sense of belonging and being part of a tribe

When you have a healthy community with a high level of engagement, it creates a positive flywheel effect for everyone involved. The project team gets mental support to make the project better; a better project leads to higher-quality NFTs that in turn incentivise people to want to own it. Those who own it are then incentivised to support the project for a better outcome.

The NFT Itself

Having looked at all the various players involved, we now turn our attention to the product itself and the factors affecting its value.

Past Price Paid

Checking on the previous prices paid can give you an idea of the value of the NFT as perceived by others. In other words, what others were willing to pay for this NFT in the past.

It's easy and common to assume that NFT prices are up only, but that's not always the case. I've seen prices for an NFT go up and down before. There is a chance that your cost price might not be the highest selling price ever for the NFT.

If that happens, you have some leeway for setting your own price. After all, the executed price is what both sides are willing to agree to.

Also, if you noticed a particular NFT is quite volatile but the others in the collection aren't, then the volatility is tied to that NFT itself. If the collection has a number of pieces that also experience some price swings, it's likely there's a lot of FOMO going on with that collection.

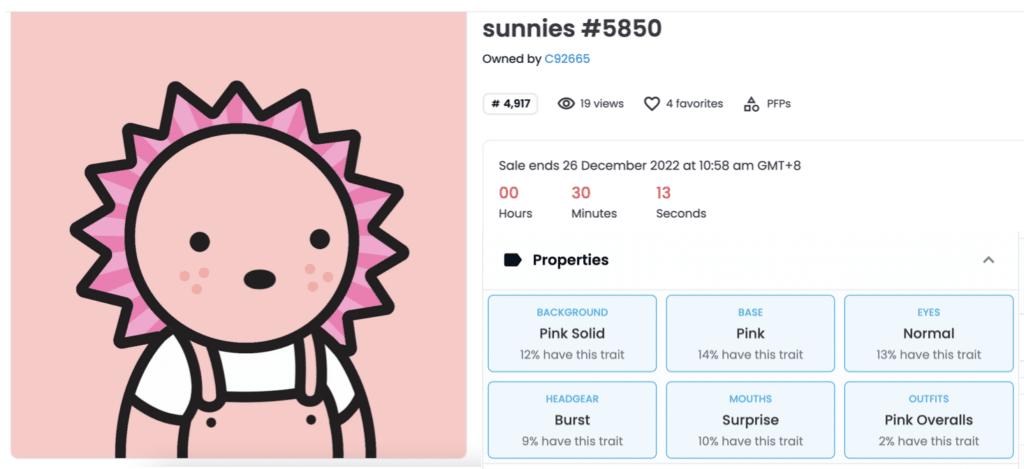

Uniqueness / Rarity

Probably the number one factor most NFT peeps are aware of is the rarity factor of the NFT. Here's how it works in the most general sense.

When it comes to PFP-type of NFTs, which is the majority of the ones traded, they come with a bunch of traits that are grouped according to rarity. Traits are basically any element that makes up the NFT image.

It can be just a few elements or everything in the NFT that can be changed to create a new one. There are a few ways these traits give value to the NFT.

- Everyone has it, but to varying degrees - certain variations appear less often than others.

- Not everyone has it - having it is rare.

- Various combinations of (1) and (2)

Example of a cute PFP with traits. Image modified from OpenSea

Example of a cute PFP with traits. Image modified from OpenSeaThis factor is mostly applicable to the PFP types but not so much for non-PFP types of NFTs.

Utility

As the popularity of the NFT increased and the initial excitement over the image type crested, people started asking questions about what else it can do. It wasn't enough for the NFTs to be valuable just by being an image, since that's just speculation and not really a productive way for money to be spent. It needed to have some kind of utility to justify being an investment for some.

Here are a few ways that NFTs give token holders benefits:

Gain access to a community or services

Example: VeeFriends token holders get a 3-year access pass for VeeCon for networking and learning new ways to better themselves. If you're lucky, you may even get to have a drink (or two) with Gary himself!

Enhance the gaming experience

Gaming NFTs bring a new dimension to games. Not only can these NFTs be traded with other players, but they can also be upgraded as players access higher levels of gameplay.

Moving forward with cross-game transference of gaming assets, players can bring along their souped-up version to another game and gain any additional benefits incurred. This further incentivises gamers to invest their time in perfecting their skills and tools.

Gaming NFTs can be traded with other players or upgraded to have better specs. Image via medium.com

Gaming NFTs can be traded with other players or upgraded to have better specs. Image via medium.comNFTs as land deeds

As physical plots of land become more and more expensive on planet Earth, people are flocking to the metaverse to buy land there.

Virtual land requires virtual land deeds, and that's where NFTs shine. With its unique provenance feature, who owns which piece of land can easily be traced on the blockchain.

With the success of these types of NFTs, it points a way forward to how actual land deeds can be digitised. This lends strength to the NFT narration of offering a better alternative to the current way of doing things, thus benefiting everyone. This leads to another exciting development highly anticipated by the crypto community investors.

Real-world assets tokenisation

2022 has been a huge blow to the crypto community as negative events follow one after another. Confidence in the asset class is low, which leads to low liquidity in the market.

NFTs as representatives of real-world assets can be the much-hoped-for shot in the arm that everyone in crypto sorely needs. As more real-world assets get tokenised, the value of these assets will be able to flow into the crypto world, becoming the rising tide that lifts all ships.

NFT Platforms

Now that we've explored the what, who, how, and why of NFT purchases, the last (but not least) major component to review is the where. Not all NFT platforms are created equally, as some are more popular than others.

The types of blockchains supported also affect the popularity of the platform. Unfortunately, the popular platforms also attract fraudsters and scammers too.

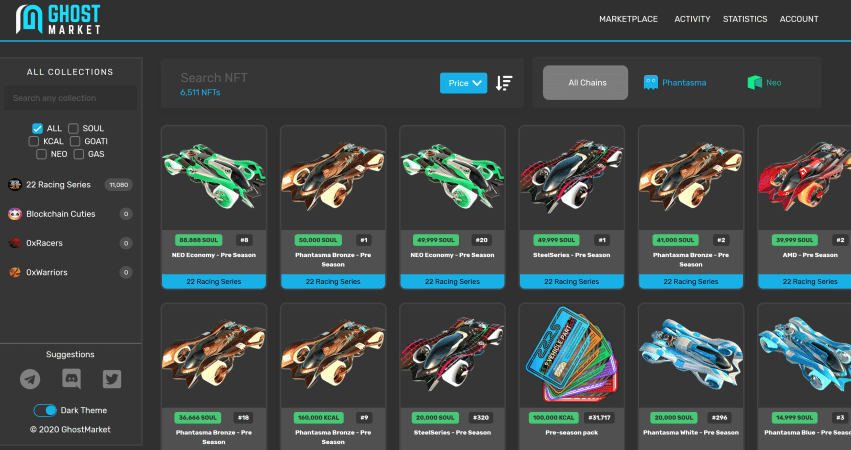

The most well-known and probably reputable ones are OpenSea (mainly for Ethereum) and Magic Eden (for Solana). Other NFT platforms include OpenSea's competitor LooksRare, and Objkt (for Tezos), known for the more alternative arts. This is by no means all there are as other blockchains might also have their own marketplaces, too.

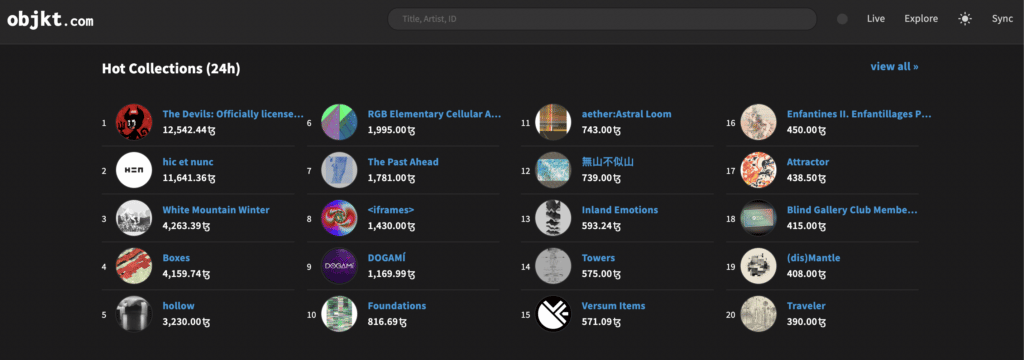

An interesting marketplace for some alternative NFTs Image via Objkt.com

An interesting marketplace for some alternative NFTs Image via Objkt.comTransaction Fees

A key consideration for which marketplace to use, in addition to where the NFTs are minted, is the amount of transaction fees charged by the marketplace.

Part of this reason is also due to the blockchain used. As you can guess, Ethereum charges the most in fees compared to other blockchains. Bundle this with the platform's own fee, and you could be looking at quite a hefty bit of extra cash on top of what you're paying for the NFT itself.

It definitely pays to do a bit of research in this area while also keeping an eye on your own profit margins.

Liquidity of NFT marketplace

The size of the platform matters because it directly affects how easy or difficult it is for a seller to find a buyer. You could buy on one platform, move it to a wallet, and then deposit it into another marketplace and sell it there.

Each step of that incurs gas fees on the blockchain, which would drive up the cost of your asset. This would indirectly affect your selling price, too. Easier to just buy and sell on a single platform, which means that platform must have enough people trading on it to be worth considering.

Sometimes new platforms might have some kind of promotion to encourage traders to trade with them. It's also worth keeping an eye out for these as you might be able to make a quick buck if things line up your way.

Risks of Trading NFTs

As assets go, NFT trading seems fairly harmless. Trust your judgement and the homework you did in picking the right NFTs to invest in, and find a seller willing to pay what you ask for.

However, when reviewing the prices of the NFTs, aside from evaluating it from the various angles mentioned above, how do you know if the prices are part of a legit transaction? The answer is: you don't.

Money-Laundering and Wash-trading

It's a bit of an open secret that NFTs can be easily co-opted for money-laundering purposes. Someone has bags of cash that they manage to convert into crypto, use the funds to buy some NFTs, and after a couple of trades, money gets converted back into fiat, clean as a whistle. Pretty smooth, eh?

Combine this with wash-trading, where one person owns multiple wallet accounts and conducts trading transactions amongst the accounts, artificially inflating the price of the NFT.

This can also be done in collusion with multiple parties. The scale of it just becomes larger. At some point, a legit transaction occurs, but it's built on the backs of layers of fake transactions. You can see what a profitable enterprise this is for criminals.

As an investor, you'd need to dig a bit further to check that the NFT you have your eye on isn't part of any dodgy schemes. This is so that what you paid for is a real fair price. If you fell victim to something like this, you might also have difficulty finding a seller for it.

Counterfeits

This is fairly self-explanatory. Check that what you're buying is a real NFT and not a fake. Sellers' info is one of the most important determining factors. It's also worth looking up on a website like ismynftshit.com for additional verification. Note that this website only checks for NFTs on Ethereum and Solana.

Conclusion

The price tag attached to the NFT has basically factored in all of the above. Even more than art pieces, which at least have some guidelines as to what makes good/valuable art, although I admit when it comes to modern art, I am clearly in the "even a kid can do this" camp when confronted with a Rothko or Keith Haring, most NFT prices are largely driven by speculation on both sides.

If you're fairly confident that you've done your homework, then the prices you see are likely the free markets acting at optimum levels, under which are buffeted by strong FOMO winds. Let's hope you didn't get caught up in any NFTs with suspicious activity behind them.

If you really want to get in on a very popular NFT and ride the wave when it goes up but you don't have enough cash to own one outright, consider fractional NFTs. Certain platforms such as KuCoin allow you to purchase a fraction of a popular NFT, thus lowering the cost of entry. While you can't say "I own a Cryptopunk," you could still say that you own 1/600th of one. To learn more, check out Guy's video on this topic.

While you're at it, consider becoming an ethical NFT investor, i.e. someone who doesn't balk at paying royalty fees to the creators when purchasing an NFT. You might not be aware of this, but the royalty fees aren't built in into the NFT price. There has been some fierce debate going on about this. I encourage you to do the right thing, be a good egg!