NEM is an acronym for New Economy Movement, a blockchain platform that was build from the ground up.

The actual cryptocurrency trades with the symbol XEM. It was designed as an enterprise solution for the upcoming blockchain revolution and global economy.

The original thoughts of creating NEM appeared on a BitcoinTalk forum post by user UtopianFuture. While it was originally planned as a fork of the NXT blockchain, the creator(s) decided to go with a completely new codebase instead, and released an alpha version written in Java on June 25. 2014. The first stable version was released on March 31, 2015.

Currently NEM is being rewritten and the update, called “Catapult”, is expected to be released sometime in 2018. It will make NEM faster and more scalable, as well as adding Aggregated Transactions and Multi-Level Multisignature Accounts, two features that have never been implemented on a blockchain previously.

NEM Smart Asset System

One of the key features of NEM is what they call the Smart Asset System. This is the core of what makes NEM unique. It was developed as a customizable blockchain solution that will allow for dozens of use cases using powerful, yet simple API calls.

Like most decentralized blockchain solutions, the NEM network is secured by a global network of nodes, which is used as an API Gateway server by the platform.

This makes NEM very simple to use for developers, who can now build powerful DApps without any special software as all the functionality provided by NEM is easily available by accessing the API Gateway.

Designing the NEM platform in this way has allowed for a great degree of flexibility in terms of system design and the uses to which apps can be made. In addition to accessing the NEM API directly, apps can also access other servers while making requests to the NEM platform, and developers can even adapt existing servers and have them use NEM in background processes.

NEM Addresses and Mosaics

NEM addresses are basic containers used to hold assets, which can be both updated and changed. An address can be as simple as a wallet holding coins, or more complicated such as an election poll collecting votes, or even an entire asset trading system.

Once the addresses are defined, developers can go on to create “Mosaics”. Mosaics are defined as identical, transferable assets that represent the assets held in addresses. By creating a flexible address and mosaic system NEM becomes viable in a countless number of use cases.

The real magic comes from accessing functionality through the NEM API. Because of this design, anyone can build any app or system they might be able to dream up and then easily hook it into the NEM API system.

Image Source: docs.nem

Image Source: docs.nemLearn more about NEM use cases here.

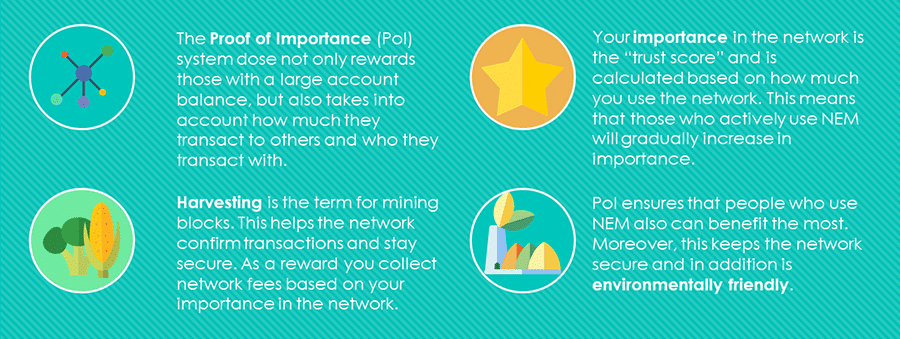

Proof-of-Importance and Harvesting

While Bitcoin and many other coins use Proof of Work as a consensus mechanism, and another group of coins has chosed Proof of Stake as their algorithm, NEM’s blockchain uses a unique algorithm known as Proof-of-Importance to achieve consensus.

Proof of Importance incentivizes active participation in the network by assigning an importance score to each node, which determines how often that node can harvest (which is similar to mining in PoW and staking in PoS systems) the XEM token. This makes for a decentralized network of nodes, all behaving as good participants.

Part of the system is similar to a PoS system. The difference is that coins need to become vested before they count towards the importance of your account or node. Any coins placed in your wallet begin as unvested coins.

Each day 10% of the coins in your account will vest. To become eligible for an importance score you need to have 10,000 vested coins in your wallet. (Worth ~$4,000 as of April 27, 2018 per Coinmarketcap.com). While this part is like staking in a PoS system it is just one part of the importance calculation.

Image Source: blog.nem.io

Image Source: blog.nem.ioThe other part of the importance calculation comes from the transaction graph of the NEM network, which is constantly monitored and analyzed to determine which nodes are providing the greatest contribution to the network.

This means the nodes that are using the network most are the ones that come to be the most important, fostering active network participation. The combination of the vesting score and transaction analysis makes up the total importance score, and those with the greatest importance score have the greatest probability of successfully harvesting XEM.

One benefit of the Proof of Importance algorithm is that it is not processing intensive, and full nodes can be run on nearly any computer, thus avoiding centralization of mining by powerful machines or ASIC chips.

It also avoids a scenario where those with the most money immediately become the most important of the network since it requires a time commitment for coins to vest. Smaller players can get a foothold and become good earners on the system.

Networks like Bitcoin separate the mining and network node operations, but with NEM both run on the same software. This gives users an incentive to run a full node, since it’s needed for the PoI system, and over time the network becomes increasingly decentralized as more people join to take advantage of the profitable nature of the XEM coins.

While it will take time to prove, the PoI system is certainly unique among consensus algorithms and seems to be a fair and promising alternative to the traditional PoW and PoS consensus mechanisms.

Other Features of NEM

Image via Fotolia

Image via FotoliaNEM is also unique in using a custom Eigentrust++ algorithm which serves to create a reputation system for network nodes. In such a system each node tracks the information it gets from all other nodes (transactions, new blocks, etc.) and independently verifies the information.

When the information provided by other nodes is valid the providing node gets a boost to its reputation, but if the information is invalid the reputation decreases. Reputations are constantly passed around the network and kept updated in each participating node.

Such a system provides and excellent mechanism for removing bad nodes, and for load balancing the network. Thus the network is kept running efficiently as possible.

Other NEM Features:

- Built-in spam filters that prevent garbage transactions from flooding the network and clogging up the works

- A P2P time synchronization system that allows the network to maintain accurate timestamps without relying on any outside servers for checking the time

- Encrypted messaging on the blockchain without hacking transaction fields to carry data like other coins

- Multisignature addresses allow developers to define shared addresses and multiparty control over assets and containers

For more information regarding the technology behind the NEM network and blockchain see their technical reference document.

Public vs. Private Blockchain

It’s possible for anyone to create apps on the public NEM blockchain through the use of its APIs. However some applications and organizations desire additional privacy measures, and for this an in-house version of NEM can be provisioned.

This solution can be run on internal servers, with the nodes used in the blockchain predefined by the user. Even better, because this is a closed, private setup, some of the public network features which are in place to prevent bad nodes from causing problems can be deactivated, thus improving the speed of the network by thousands of transactions per second.

There’s no limit to the uses for such a closed, private blockchain network. This solution could be used for transportation logistics, loyalty programs, medical records and many other possibilities. Enterprises can see unparalleled transaction speed and security, all without ever exposing transaction data to a public facing network.

It’s a perfect solution for organizations looking to benefit from the power of a blockchain solution without the added overhead of a public chain.

Buying XEM

Several major exchanges offer the XEM coin, but unless you’re Japanese you’ll need to use Bitcoin to purchase the coin, as none of the other exchanges offer fiat currency purchases.

If you are Japanese you can buy XEM using Yen on the Zaif Exchange. You’ll also find XEM listed on Binance and Bittrex as well as Upbit, HitBTC, Huobi, Poloniex and many other smaller exchanges.

Coincheck XEM Hack

Image via Coincheck.com

Image via Coincheck.comSome investors have no doubt been put off by the January 2018 Coincheck hack that resulted in 523 million XEM coins, worth about $530 million at the time of the hack, being stolen. While the hack was unfortunate, it has nothing to do with the security of the NEM platform of blockchain.

The fault for the hack lies with Coincheck, who had apparently held the coins in a hot wallet rather than the industry standard cold storage. Coincheck has promised to reimburse all 260,000 customer affected by the hack, and the price of XEM has been recovering since the beginning of April 2018.

Storing XEM

NEM has a proprietary wallet called the Nano Wallet that can be used to store, transfer and receive XEM. It is compatible with Windows, Linux and OSX and gives full functionality, including support for Changelly Instant Exchange and Trezor hardware wallet. There is also a mobile version available for both Android and iOS.

If you’re interested in vesting your XEM and harvesting you’ll need a full node client.

All of these can be downloaded from the NEW website here.

In Conclusion

The NEM platform is a unique and promising addition to the blockchain ecosystem. It promises to become a major player with the upcoming Catapult update, providing an enterprise-level solution for any use case a developer can come up with, which is pretty impressive.

The ease of developing on the NEM platform is sure to be a major draw, and the flexibility and unique Proof of Importance consensus mechanism are sure to be attractive to developers for both public and private applications.

While there’s never a way to guarantee adoption of any technology or blockchain, NEM seems to be taking the right steps to ensure future growth and adoption. And with prices still depressed following the January 2018 Coincheck hack this could a good time to get into the coin.

Of course, you should do your own research, but this is most definitely a project to keep an eye on.