In today's edition, we'll take a closer look at the recent surge in Bitcoin, its impact on altcoins, and the evolving narratives in the crypto market. From Bitcoin's dominance to the rise of memecoins and gaming tokens, along with promising projects and notable developments, we've got you covered on all the key insights driving the crypto landscape. So, let's dive into the headlines and explore the fascinating dynamics shaping the crypto market today.

L1s, L2s & DeFi

State Of The Market: We Are So Back

TLDR

- Bitcoin surged from $38K to nearly $44K, affecting altcoins and BTC dominance.

- The primary narrative revolved around ordinals, led by $ORDI and other BRC-20 tokens.

- Memecoins and gaming tokens like $DOGE, $BONK, and $IMX gained traction.

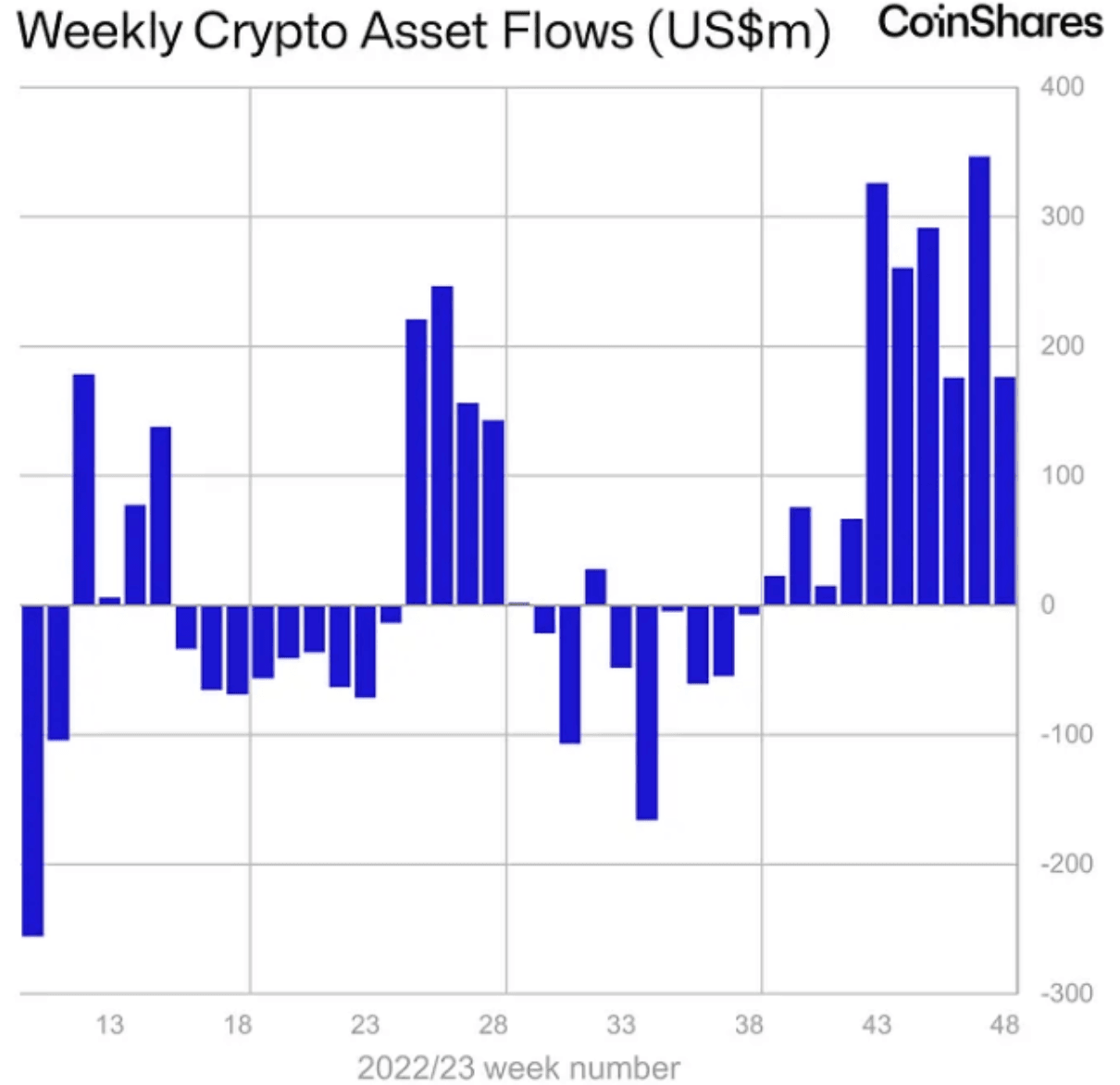

- Digital asset investments saw significant inflows of $176M in the past week.

- Stacks' ecosystem and native token STX experienced remarkable growth.

- Solana-based projects like Jito and token airdrops attracted users amidst Solana's resurgence.

Bitcoin witnessed a significant surge this week, breaking through the $38K resistance and reaching nearly $44K. This rally had a substantial impact on altcoins, causing liquidity to flow into BTC. BTC dominance fluctuated during recent weeks, influenced by factors like the anticipation of a BTC ETF.

The market is at a crossroads, with the potential for either stable BTC and rising altcoins or a BTC downturn affecting altcoins. The main narrative of the week revolved around ordinals, led by $ORDI, which saw a significant surge, tripling its market cap in a week. Other BRC-20/ordinal coins like $SATS, $TRAC, $MUBI, and $PIZA also saw notable pumps.

Memecoins $ Gaming Gain Momentum: Memecoins gained traction, especially established ones available on centralized exchanges.

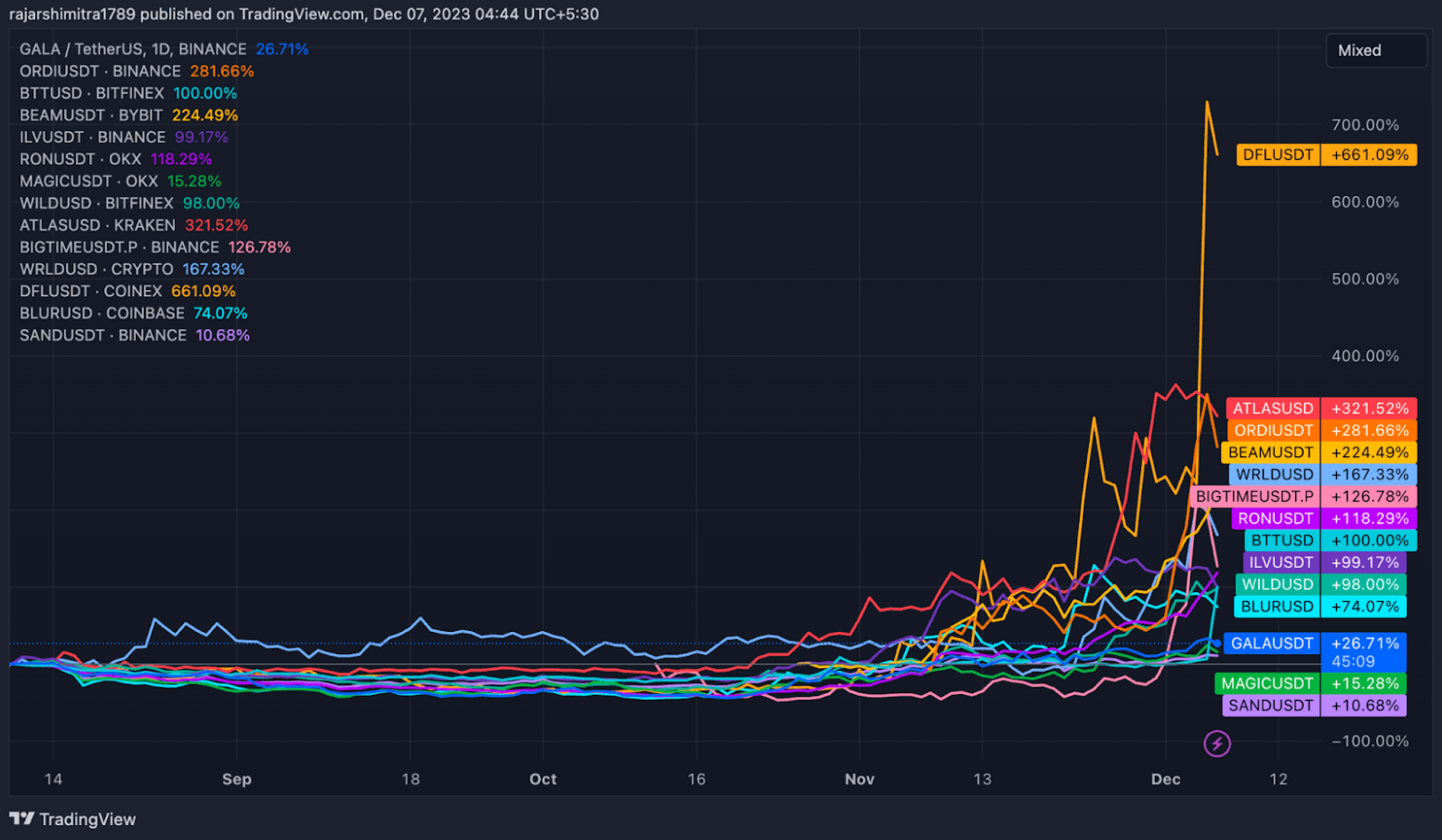

Coins like $DOGE, $BONK, $PEPE, $SHIB, $MEME, $FLOKI, $TOKEN, and $BITCOIN experienced significant price increases. While major gaming coins like $IMX, $ILV, and $GALA didn't outperform BTC, several gaming-related coins, including $SUPER, $RON, $SHRAP, $SIPHER and $WILD posted impressive gains.

Inflows surge: Digital asset investments experienced significant inflows of $176M last week. Over the past 10 weeks, total inflows reached $1.76B, accounting for 4% of assets under management. This 10-week streak of inflows is the largest since October 2021 when the US launched futures-based ETFs for digital assets.

Despite the recent increase, total AuM remains at $46.2B, well below the all-time high of $86.6B in 2021. The majority of inflows were in Canada, Germany, and the US, with minor outflows observed in Hong Kong. Bitcoin attracted $133M in inflows, while Ethereum received $31M.

Source

SourceThe Stacks ecosystem, a Bitcoin layer 2 solution, is making waves in the crypto market. A key driver of this surge is the popularity of Ordinals, a protocol introduced on January 21st. Since its launch, Stacks' native token, STX, has witnessed remarkable growth. STX's price has soared, and its market capitalization has surged from $370M to $1.2B. Daily trading volume for STX has seen an astonishing 14,925% increase, climbing from $4M to $601M.

Emerging Trends and Projects: Exciting developments such as the Runes token standard and the Trac/Tap protocol are pushing the boundaries of what's possible within the Bitcoin ecosystem. These innovations aim to enhance functionality and interoperability in the network. Additionally, noteworthy projects like Udi's project, Taproot Wizards, and Nodemonkes, alongside the emergence of new memecoin standards, indicate a rapidly evolving space that attracts both developers and investors.

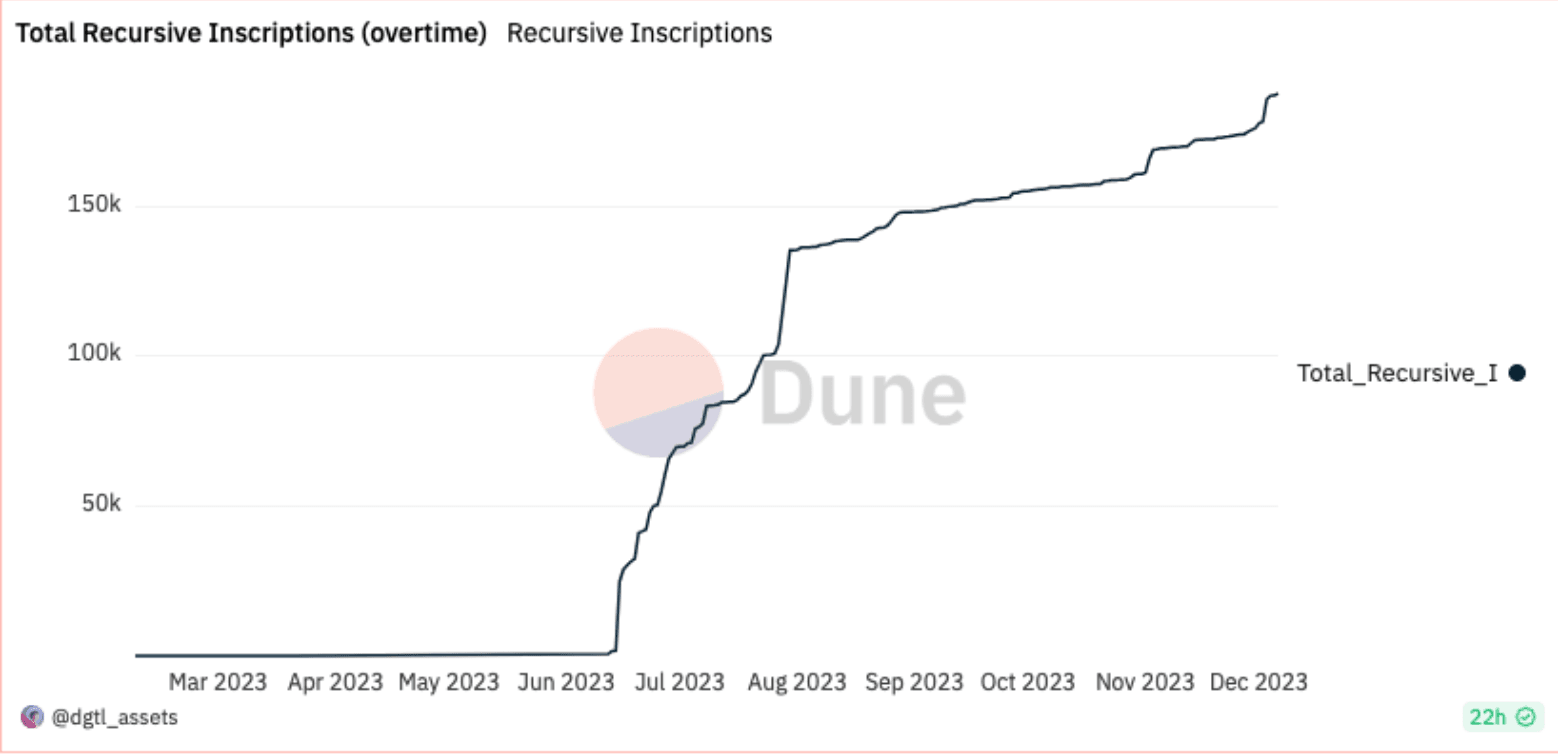

The number of inscriptions has continued to climb. The jump from July has been considerable. Source: Dune.

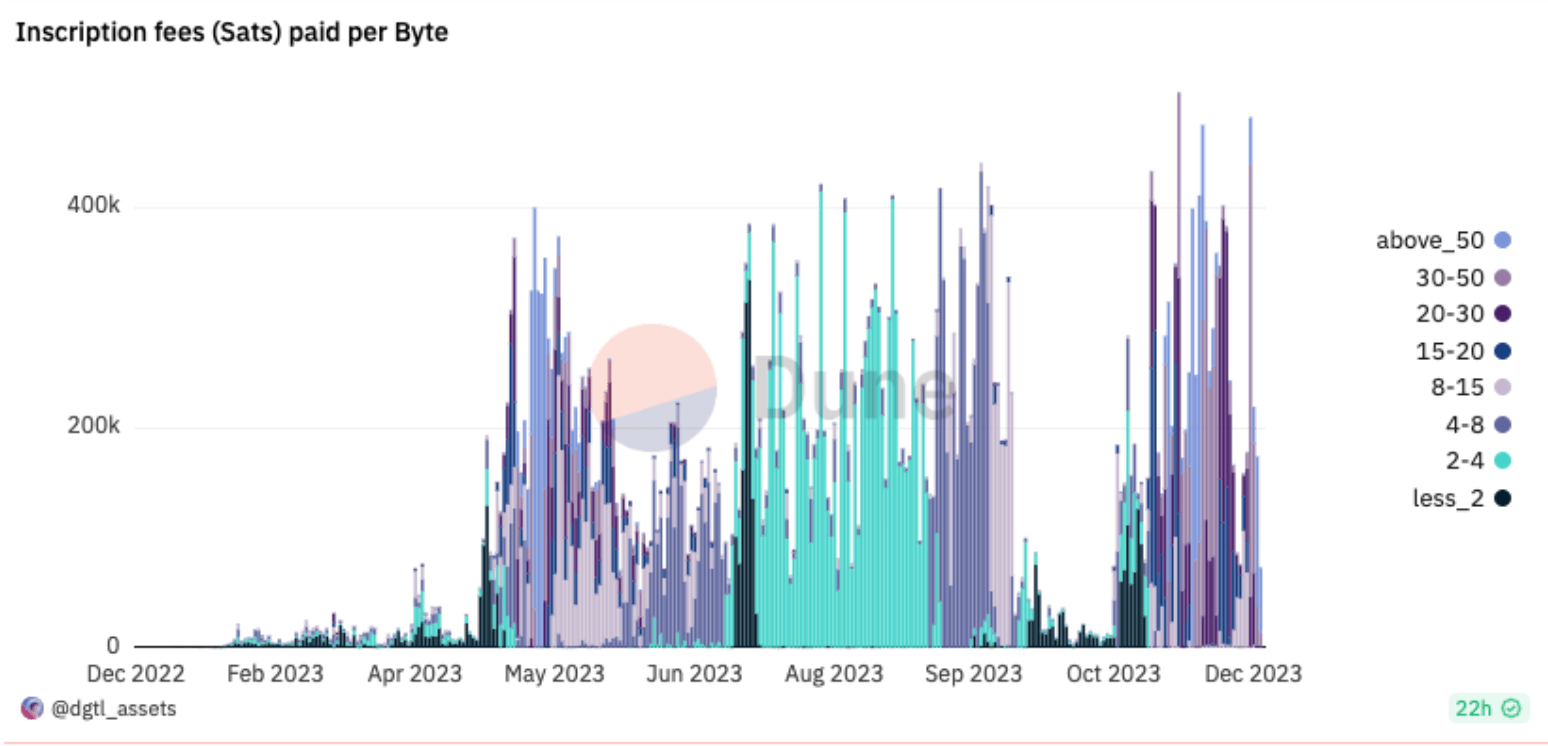

The number of inscriptions has continued to climb. The jump from July has been considerable. Source: Dune. Fees generated by Inscriptions continue to climb. Source: Dune.

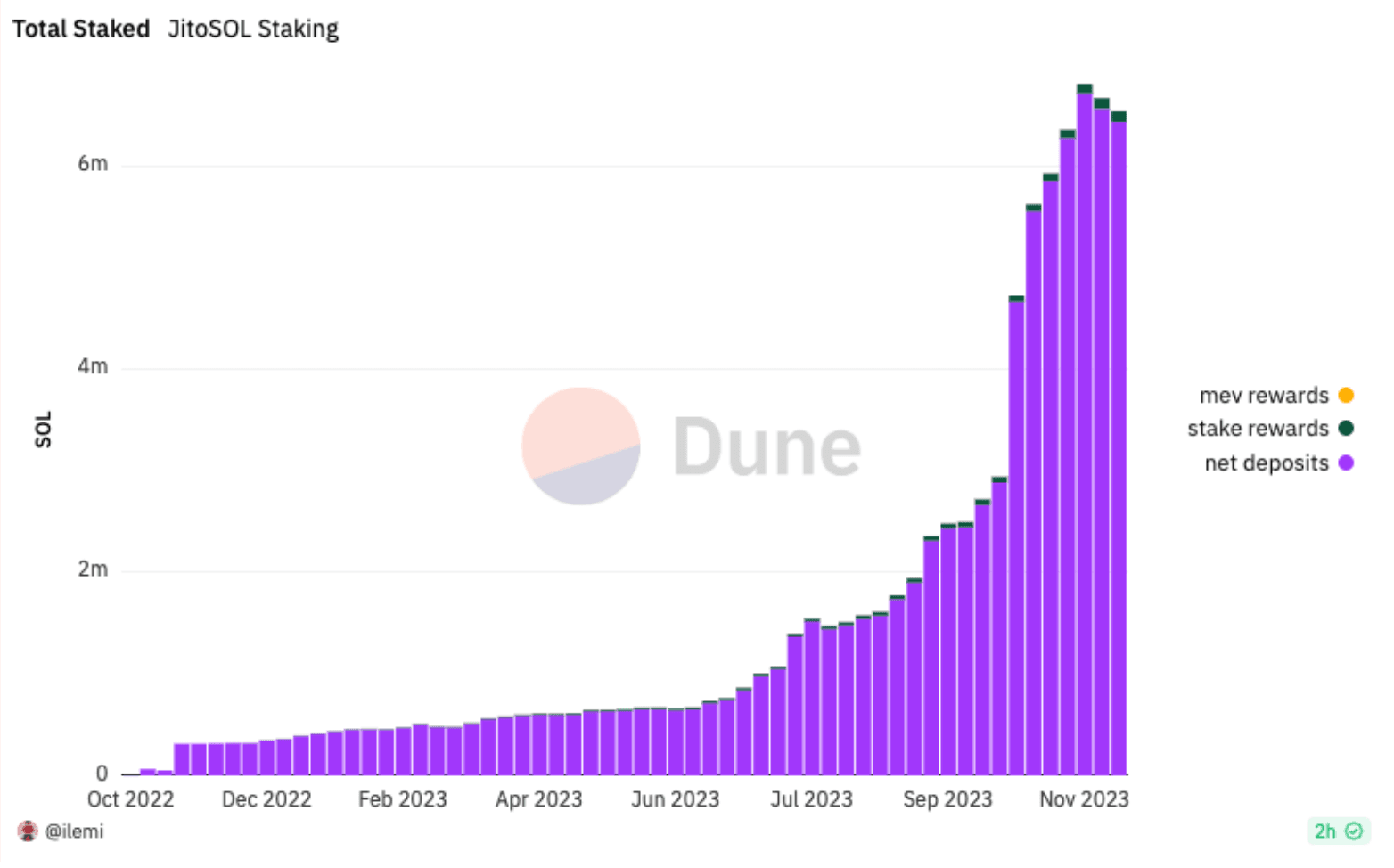

Fees generated by Inscriptions continue to climb. Source: Dune.Jito, a Solana-based crypto staking project, distributed its governance token, JTO, via airdrops to users of its liquid staking token protocol, jitoSOL. The JTO token started trading at $1.20 and quickly climbed towards $2 on Solana-based decentralized exchanges, defying prelaunch estimates. Major exchanges like Coinbase and Binance have plans to list JTO.

The launch of JTO coincides with the resurgence of Solana's popularity and price, with SOL surging 542% year-to-date. The Solana ecosystem has seen a wave of token airdrops aiming to capitalize on this favorable trend. Many are anticipating further airdrops in the Solana ecosystem, and this continues to attract considerable amounts of users to Solana.

Source: Dune

Source: DuneLastly, the on-chain Alpha landscape is witnessing increased activity. Crypto fundraising has experienced a notable uptick. Several developments, such as Frax Finance's Fraxchain Testnet, Celestia's Ethereum fallback for Layer 2 solutions, and Arbitrum DAO's funding for ecosystem projects, have contributed to this trend. Projects like Injective, Hashflow, Mantle, and Balancer are releasing updates and attracting attention. Additionally, the introduction of Aevo's aeUSD stablecoin are significant events. Empyreal's SDK v1 and Starknet Foundation's token airdrop snapshot have also added to the on-chain buzz.

Blue Chip and Majors Overview

Inscriptions

ORDI, based on the Bitcoin Ordinals and a BRC-20 token, has recently experienced a significant surge in its market value. As of the last week, ORDI's price has surged by an impressive 192%, surpassing the $50 mark. This remarkable growth represents an over 850% increase from its earlier price of around $6.80 on November 5th.

This surge has led ORDI becoming the first BRC-20 token to achieve a market capitalization of $1B on December 5. Currently, its market cap stands at $1.3B. Data from Dune Analytics indicates that over 48M Ordinals assets have been inscribed since the protocol's launch, generating over $146.9M in fees for the Bitcoin network. Interestingly, on November 20th, the transaction fees on the Bitcoin network exceeded those of Ethereum, largely due to a surge in the inscription of new NFTs and BRC-20 tokens like ORDI.

BTT

BTT has more than doubled in price recently. This surge aligns with growing optimism about the Tron blockchain, which has reached 200M users. Tron founder Justin Sun's announcement of this user milestone has positively influenced BTT's market. BitTorrent now has a market cap of $958M. Daily trading volume, meanwhile, increased by 540% to $256M.

- HNT has jumped by >20% in the last 24 hours as Helium launched its unlimited nationwide mobile plan in the US.

- LUNA is up 77% in the last 7 days as the price looks to reach $0.0003.

- TIA has jumped by a massive 65% this week due to the hype surrounding its upcoming airdrop.

- STX has experienced a significant 42% price increase, accompanied by a 615% surge in daily trading volume, a 90% rise in social volume, and an 83% increase in open interest.

- IOTA has jumped by 63% in the past two weeks following the establishment of the IOTA Ecosystem DLT Foundation in Abu Dhabi.

- AMP has registered a 32% daily and 41% weekly increase, accompanied by a dramatic 2369% surge in trade volume.

- BEAM has surged by 200% over the past month. Beam is a gaming-focused Avalanche subnet from the gaming guild Merit Circle. BEAM's surge is indicative of the GameFi sector's recovery.

- ILV has crossed $100, gaining 54% in the last 30 days. However, the price has since corrected by 5% over the last week. ILV has benefited from the bullish sentiment around GameFi.

- RON has jumped by 42% over the last week. Daily active users (DAU) on the Ronin chain have consistently risen.

- BIGTIME jumped by 235% over the past seven days. However, an unusually high number of liquidations has dumped the token by 18% in the past 24 hours.

Smart Money Movements

Tokens

- BRC-20 stands out as the premier narrative among Smart Money addresses, showcasing intriguing movements within this narrative. Noteworthy shifts are observed as smart money gradually departs from $Mubi while strategically entering $BSSB. This suggests that smart money from $Mubi is exploring avenues to reinvest profits into other tokens within the BRC-20 narrative, potentially triggering an upswing in those tokens.

- Another compelling token that has piqued the interest of smart money is $NCDT, an innovative cloud computing project enabling users to monetize their dormant computing power—an intriguing concept.

- Smart Money adopts a nuanced approach, securing profits incrementally across the market. This strategic maneuver aims to safeguard existing gains while positioning for potential future market upswings, illustrating a judicious balancing act.

- Furthermore, smart money has strategically amassed $MAP, a Bitcoin L2 and P2P omnichain infrastructure with a focus on cross-chain interoperability—an invaluable addition to the BRC20 narrative.

- $UNIT has also garnered the attention of smart money, functioning as a browser extension that doubles as a trading terminal and seamlessly integrates with trading tools like $GMX and $BANANA, showcasing its versatility in the eyes of astute investors.

Yield Farms

- Farming $PNP on Magpie XYZ involves boosting the rewards through Pendle's vlPNP pool, offering an attractive up to 73.5% APR (with a 60-day cooldown period).

- The practice of farming $VRTX on Vertex is gaining popularity among smart farmers seeking diversified opportunities.

- Among the various strategies, some smart farmers are actively engaged in farming vAMM-WETH/UNIDX on Aerodrome, where enticing rewards of 50% APR can be reaped.

- Prisma Finance and SPARK maintain their status as favorites among smart farmers, largely owing to their consistently stable APR.

- For those exploring additional options, it's worthwhile to check out the (agEUR/wstETH LP) and (agEUR+ARB LP) on Camelot. These LPs present enticing APRs, adding to the array of opportunities available in the dynamic landscape of yield farming.

This is just a preview of our L1, L2 and DeFi Weekly report, be sure to check out the full version of this report here.

NFTs & Gaming

The NFT market is undeniably picking up steam once more. It appears that NFTs from various ecosystems are gaining popularity. The highlight of the week has been the remarkable surge in activity related to Bitcoin inscriptions. It will be intriguing to observe how inscriptions spread to other blockchain networks after drawing inspiration from the Bitcoin ecosystem.

Project Updates

- Fxhash has launched. A generative art platform that emphasizes openness is launching the 2.0 version of its site. The evolution will see the project go multichain, expanding from its Tezos roots to now additionally supporting mints on Ethereum

- Developers of Axie Infinity have partnered with gaming development company, ‘Foonie Magus’, to launch their new game.

- Sound partner with Coinbase to launch music quest collection.

- Team Liquid, a leading esports organization, is partnering with Illuvium to beta-test Illuvium: Arena.

- Buterin Cards have completed its mining process.

- Echelon has scheduled the launch of Sanctuary for Dec 11, a customized Parallel marketplace.

- Fren Pets has unveiled its latest roadmap.

- Ethereum gaming NFT marketplace Aqua shuts down citing slow industry growth.

- Animoca Brands is one of the biggest investors in the crypto space. One of the sectors they are most heavily invested in is GameFi. DeFi_Mochi dives into some projects in their gaming portfolio.

Blue Chip Overview

Recent weeks have seen a significant surge in various collections, showcasing the dynamic and often unpredictable nature of this market. Pudgy Penguins has soared in the last week, while other collections have also seen notable increases in value. Kanpai Pandas rose by 69%, Azuki by 13%, World of Women by 52%, and Cool Cats by 29%.

Source: CoinGecko

Source: CoinGeckoMad Lads: The standout performer in this recent NFT surge is Mad Lads on the Solana blockchain. This marks a significant increase from its value in early November. Mad Lads has also been the top seller in the 24-hour NFT sales volume chart, surpassing even the popular Bored Ape Yacht Club on Ethereum during the same period. Factors contributing to Mad Lads' success include the recent rise in Solana's price and unique features such as its connection to the Backpack app and executable NFTs (xNFTs). Additionally, Coral, the startup behind Mad Lads, is launching its own crypto exchange, adding further value to the collection.

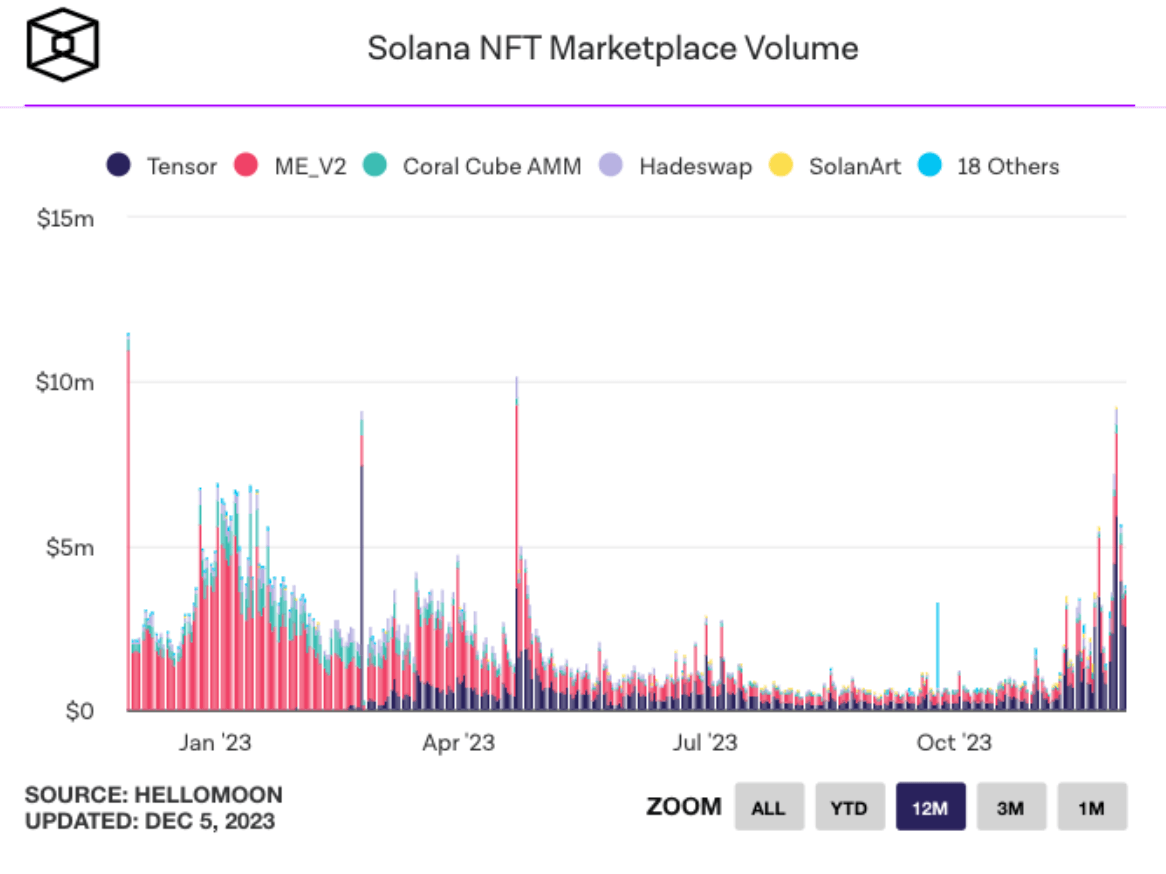

November witnessed $605M in Ethereum-based NFT trading, a significant increase from the previous month. Solana-based NFT marketplaces have also seen increased trading volumes in November and December, reaching $9.3M on November 30, with Tensor being a significant contributor.

This surge was not confined to a single blockchain but was seen across various platforms, indicating a broad-based recovery in the market. Bitcoin Ordinals, NFTs inscribed on the Bitcoin blockchain, led the way with a trading volume of $370M, marking a 2163% increase. Ethereum-based NFT collections followed closely with a trading volume of $344M, a 51.70% increase. Other Solana-based NFTs and collections on Mythos Chain and Polygon also recorded significant trading activities, with increases in sales volume of 162%, 29%, and 34%, respectively.

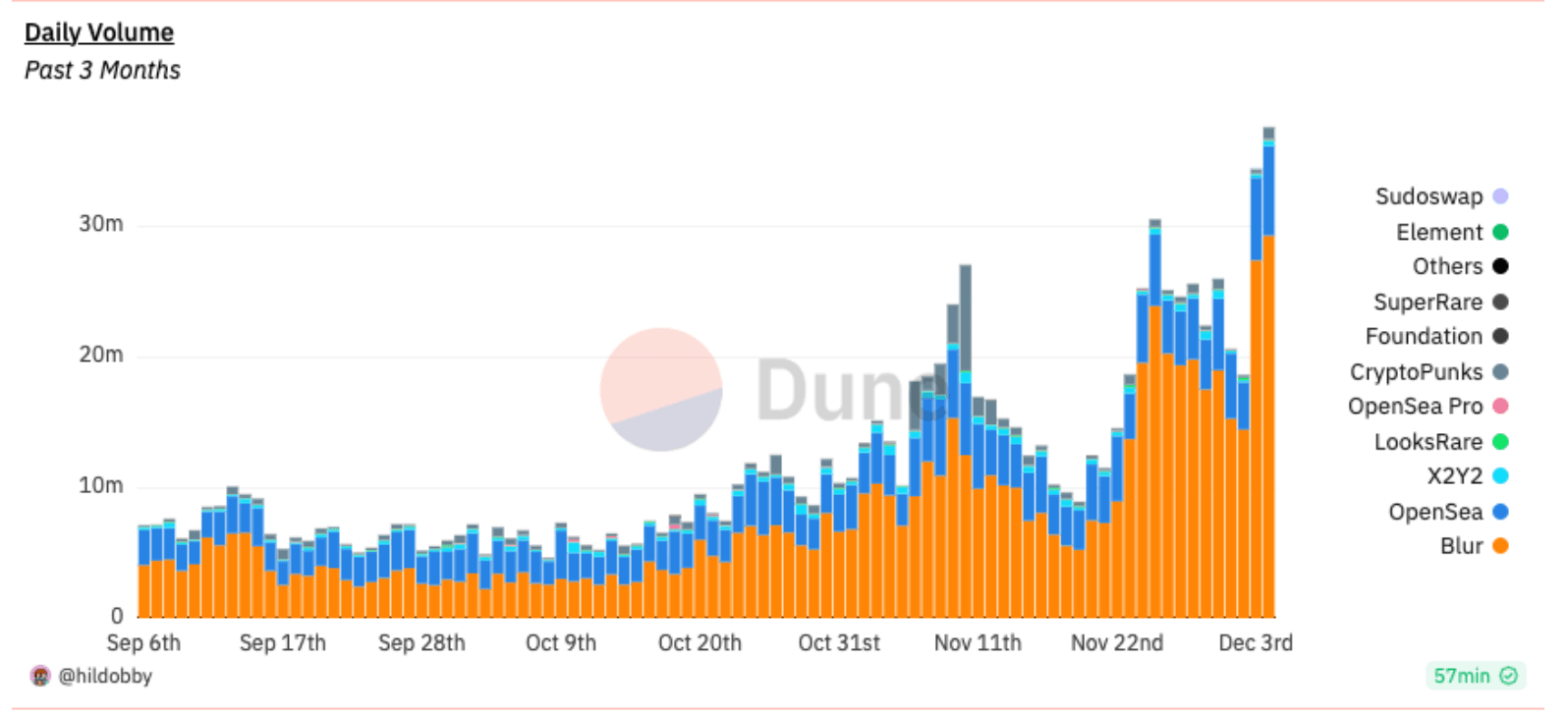

Daily NFT volume is picking up significantly: Source: Dune

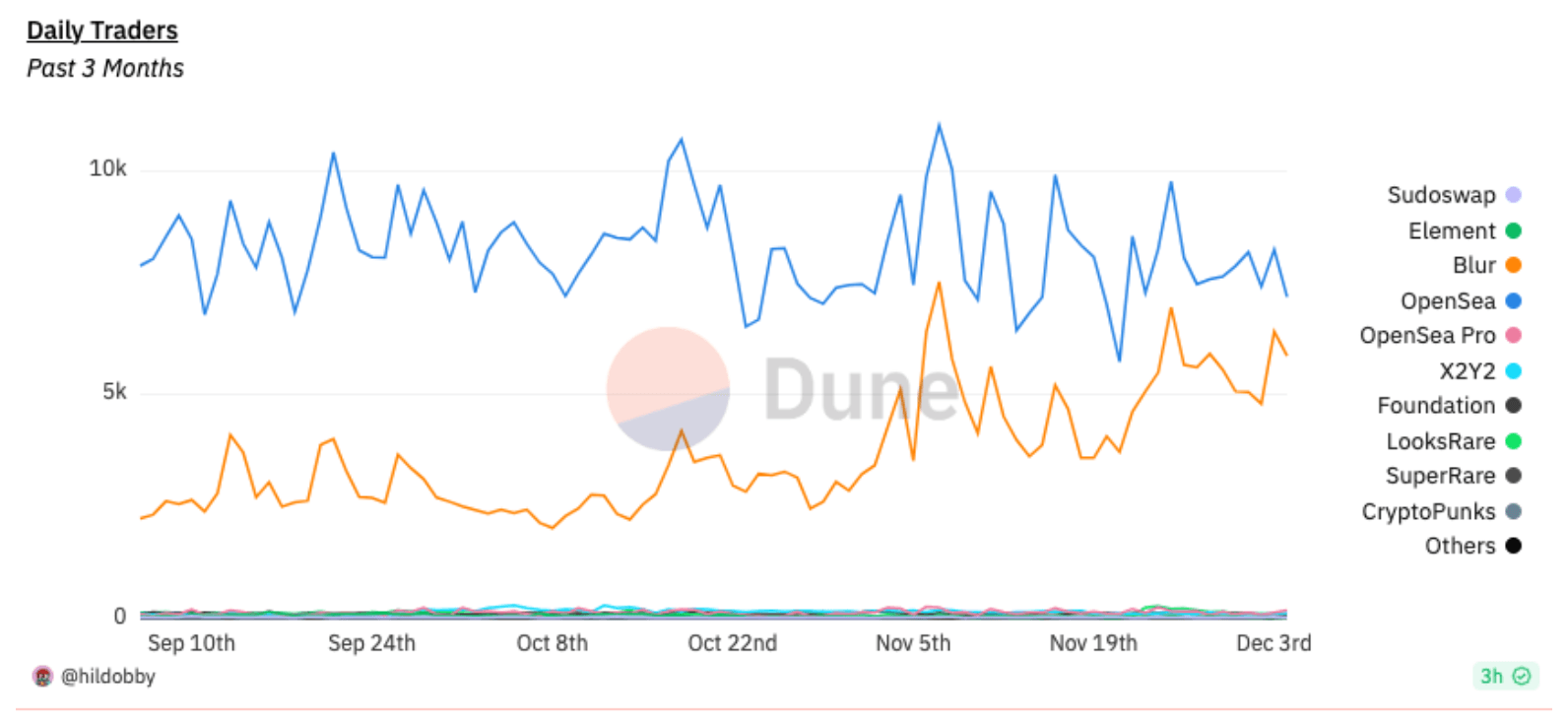

Daily NFT volume is picking up significantly: Source: DuneShifts in Trading Platforms and Market Dynamics: A significant development in the NFT market has been the shift in trading volume from OpenSea to Blur. As of late 2023, Blur dominates almost 80% of the NFT trading volume, a dramatic rise from its inception in October 2022. This shift indicates changing preferences among NFT traders and collectors, favoring platforms that cater more to their needs. OpenSea, once the dominant marketplace, now holds around only 17% of the total NFT trading volume.

Despite Blur controlling 80% of the volume, most daily trades occur on Opensea.

Despite Blur controlling 80% of the volume, most daily trades occur on Opensea.Degen Corner

- Cradles, a dinosaur-themed MMO, has introduced its game token CRDS and is offering players the opportunity to earn rewards by holding or staking these tokens. Additionally, players can obtain CRDS tokens through in-game activities.

- The Bruce Lee: Year of The Dragon digital collectible series will be released exclusively on EthernityChain on December 16th.

- Join the waitlist to experience Wanderers.AI, a game supported by prominent backers including Animoca, OpenSea, and GameFive. Sign up here.

- Parallel Season 5 is now underway, offering exciting opportunities to acquire the latest Legendary Cards and Battle Pass Cosmetics.

- Animoca Brands is collaborating with Pixels to enable players with a Moca ID to earn Realm Points by completing introductory quests in the multiplayer farming game. Additionally, Moca ID holders can use their Moca NFT as an in-game avatar and access various benefits and rewards within the Mocaverse ecosystem. Get your Mocaverse ID here.

- NFTfi is heating up and progressing. Hyperliquid has introduced a new NFTI index, marking a significant step in the evolving NFT market. Meanwhile, LooksRare is undertaking a significant transition with its LOOKS rewards migration, a move that reflects the platform's evolving strategy and user engagement approach. Additionally, NFTfi.com has rolled out its Rewards Season 2 campaign.

- BitsCrunch, the NFT data platform, is scheduled for a token sale on Coinlist, set to take place on December 14th. To participate, registration must be completed by December 11th. During the sale, 6% (equivalent to 60 million BCUT tokens) of the total token supply will be offered at a price of $0.055 per token, with a total valuation of $55M FDV.

- MAGIC has jumped by 24% over the past two weeks. However, the price has corrected by 4% over the last 24 hours and settled around $0.88.

- WILD has jumped by a staggering 36% this past week as Wilder World prepares to unveil its multiplayer metaverse at Gateway Miami.

- ATLAS has increased by 20% this past week as the overall market cap nears $100M.

- WRLD surged by 165% in the last 14 days as the token looked to touch $0.1. Following this, NFT Worlds has been given a “high risk, high reward” rating by Investors Observer.

- DFL has also been on a tear, jumping by >50% over this past week. Overall marketcap has exceeded $25M.

- GALA has dropped below the $0.03 psychological level because of a short-term correction.

- BLUR has dipped below $0.5 following an 8% correction. Marketcap still remains above $560M.

- SAND spiked by 8% this past week, going up from $0.40 to $0.445. There is some speculation on X that The Sandbox might be potentially moving to Ronin.

This is just a preview of our NFT Weekly report, be sure to check out the full version of this report here

Enjoyed this article?

- Subscribe to Crypto Pragmatist by M6 Labs newsletter for crypto-native industry insights and research read by 30k+ subscribers

- Follow us on Twitter for Tweets providing top-notch insights and bridging the gap between users, builders, and leaders in the crypto space