Bitcoin's 2009 launch from the ashes of the Great Recession marked the birth of the first true cryptocurrency. This first generation of crypto wasn't all that exciting with participants focusing on making the nascent technology better. That all changed with the Ethereum blockchain's launch in 2015.

Bitcoin may have been the first cryptocurrency, but Ethereum has proven to be a tour de force in the crypto world. While Bitcoin is considered the currency of the future to some and a store of value to others, Ethereum is seen as the next evolution of the internet, often referred to as Web3. In other words, the Ethereum blockchain goes beyond mere transactions; it functions as a robust ecosystem.

The prospect of investing in Ethereum can be exciting and daunting for both crypto pros and newbies. With so many cryptocurrency exchanges available (Blockspot counts over 1,500 across the world), choosing the right one is important for secure trading.

Whether you're planning to HODL for the long term or trade actively, this article aims to serve as your North Star in this vast sea of options, guiding you toward the best exchanges to buy ETH.

What is Ethereum?

The initial wave of blockchains, exemplified by Bitcoin, offered secure transfers of cryptocurrencies but lacked the versatility for intricate deal settlements and the creation of DApps. Vitalik Buterin, a co-founder of the Ethereum project, envisioned a future beyond the limitations of Bitcoin's blockchain.

Ethereum marked a significant leap forward by addressing these limitations. It provided advanced solutions for creating and executing smart contracts, application development, and enabling the generation of various token types. This innovative approach not only bridged the existing gaps but also led to widespread adoption, giving Ethereum a dominant position in the crypto sphere.

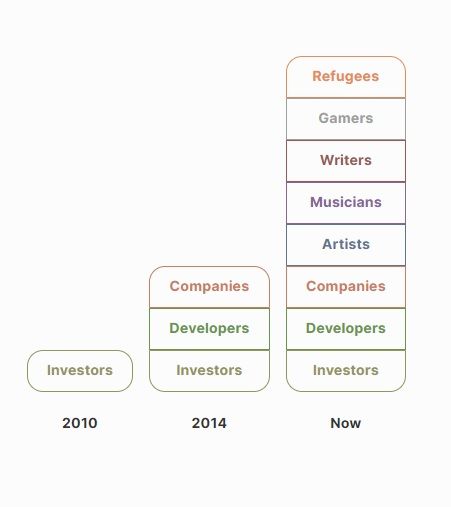

Since The Early Days, Virtually Everyone Has Now Joined Ethereum. Image via Ethereum.org

Since The Early Days, Virtually Everyone Has Now Joined Ethereum. Image via Ethereum.orgEthereum's early days garnered attention from investors and developers. Now, it appears everyone is piling into the project. Consider the following facts about Ethereum:

- The number of ETH owners increased by 21% to 105 million from 87 million in the first half of 2023.

- ETH is the second-largest cryptocurrency after Bitcoin.

- Over 10,000 projects have been built on Ethereum.

- There are more than 96 million wallets with an ETH balance.

Interested in a deep dive into Ethereum? We cover everything in our in-depth Ethereum review.

Why Investors Are Bullish on ETH

To investors, Ethereum's allure lies in its versatility and uncapped upside potential.

Ethereum's whitepaper in 2014 saw developers push the envelope, harnessing the blockchain network for the second generation of crypto. The Ethereum network was the first project to expand the use cases of blockchain, opening doors to various applications, including DApps, initial coin offerings, and non-fungible tokens.

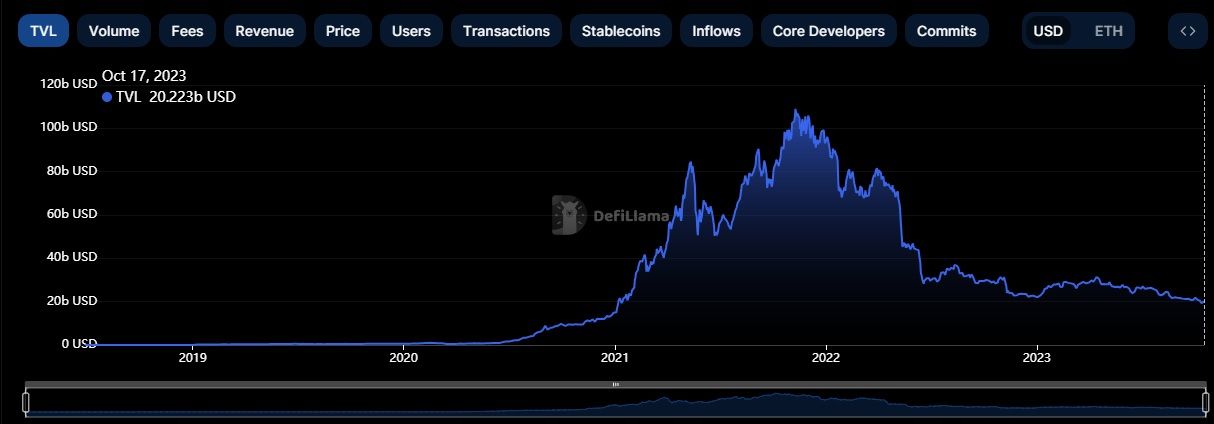

Ethereum TVL is Far Ahead of Other Blockchains. Image via DefiLlama

Ethereum TVL is Far Ahead of Other Blockchains. Image via DefiLlamaMany feel that Ethereum's dominant position can be attributed to the following factors:

- Smart Contracts: A conventional contract requires individuals to follow through. Smart contracts, on the other hand, offer automatic execution, the outcome is predictable, and the terms are visible. The Ethereum blockchain has been used to create over 53 million smart contracts.

- First-Mover Advantage: At the time of Ethereum's launch, Bitcoin mainly served as a digital currency. Buterin sought to improve on Bitcoin's shortcomings with his Ethereum project. As the first blockchain to successfully implement smart contracts, Ethereum became a dominant leader. This first-mover advantage led to rapid growth and market recognition.

- Robust Ecosystem: Ethereum's success is tied to the growth and diversity of its ecosystem. Its DApps landscape is diverse, running the gamut from decentralized exchanges, gaming platforms, and social networks to supply chain management systems, and then some.

- Network Effect: Ethereum has a vibrant developer community, and this large presence further attracts others to the ecosystem, helping to create a network effect. As of Oct. 1, the Ethereum ecosystem had roughly 6,000 total developers, far more than any other network.

Ethereum Criticism

Ethereum is often criticized for its scalability bottleneck, high fees and perceived centralization. Let's explore!

Scalability Issues

Many industry observers believe Ethereum is an example of the "blockchain trilemma," a term popularized by Buterin, who said a blockchain can't achieve scalability, decentralization, and security without weakening one.

The Ethereum blockchain supports thousands of applications and transactions, but it failed to shake off the scalability issues that have plagued it for a long time. The Ethereum network has the capacity to process about 30 transactions per second, but it has a target of 100,000 TPS.

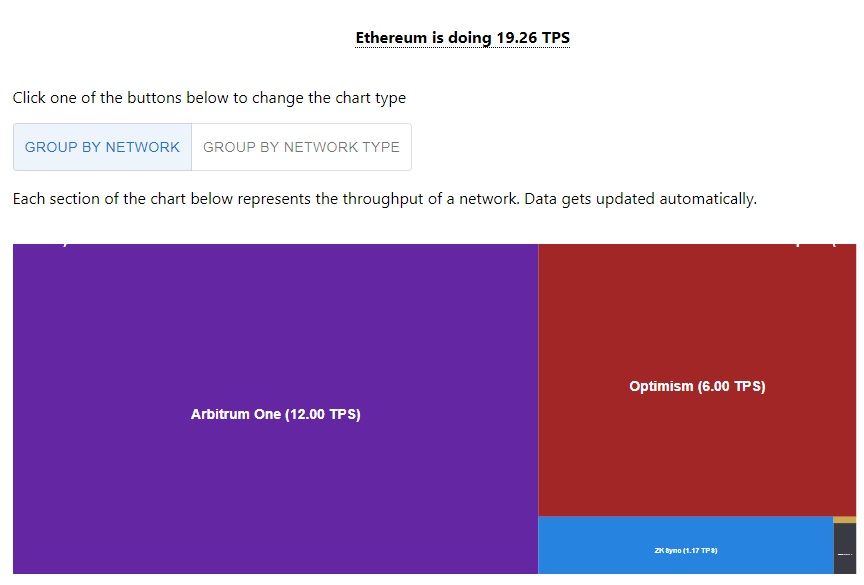

Ethereum's Current TPS is Far Below its Target of 100,000. Image via ethtps.info

Ethereum's Current TPS is Far Below its Target of 100,000. Image via ethtps.infoFor example, the network is currently processing 19 transactions per second. Ethereum's 2022 upgrade, called "the Merge," was widely expected to solve Ethereum's scalability, but it did address the issue in a meaningful manner.

However, Ethereum is self-aware and is considering multiple on- and off-chain solutions:

- Sharding: Sharding is the process of splitting a database.

- Layer 2 scaling: A specific layer 2 instance may be open and shared by many applications, or may be deployed by one project and dedicated to supporting only their application. Layer 2 scaling should reduce transaction speed and gas prices.

- Rollups: Rollups perform transaction execution outside layer 1 and then the data is posted to layer 1 where consensus is reached. As transaction data is included in layer 1 blocks, this allows rollups to be secured by native Ethereum security.

- State Channels: State channels utilize multisig contracts to enable participants to transact quickly and freely off-chain, and then settle finality with Mainnet. This minimizes network congestion, fees, and delays.

- Sidechains: A sidechain is an independent EVM-compatible blockchain that runs in parallel to Mainnet. These are compatible with Ethereum via two-way bridges and run under their own chosen rules of consensus and block parameters.

High Gas Fees

The high gas fee is a byproduct of Ethereum's popularity.

If there's too much demand, users must offer higher fee amounts to try and outbid other users' transactions. This can make it more likely for your transaction to get into the next block. The popularity of DeFi platforms and NFTs has also increased the number of transactions on the Ethereum network, making them consume a lot of gas.

This was evident recently when Binance-connected crypto wallets sent fees skyrocketing. As a result, the cost of processing transactions rose to over $10 from about 40 cents.

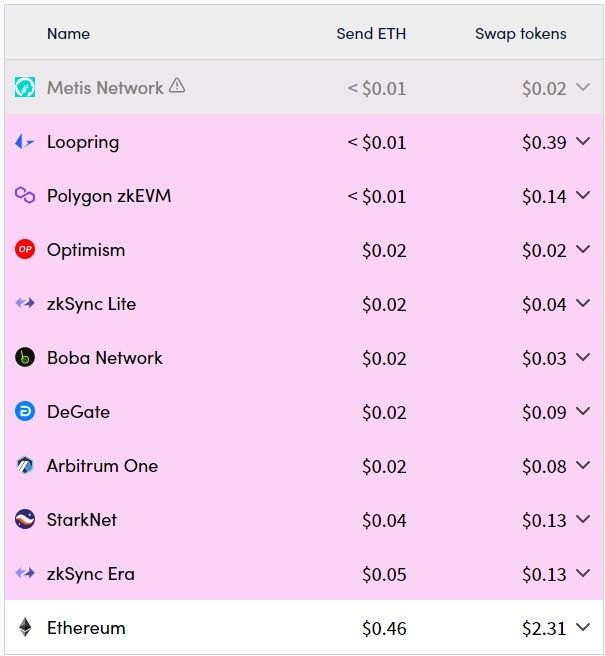

Ethereum's scalability issues and high gas fees have spurred the rise of Layer-2 (L2) solutions, which have been a hit with the masses.

TVL in Layer-2 Solutions Stood at $10.49 Billion as of Oct. 18. Image via L2Beat

TVL in Layer-2 Solutions Stood at $10.49 Billion as of Oct. 18. Image via L2BeatThese solutions are built on top of the mainnet to ease network congestion, which ultimately helps to lower fees. For example, sending ETH via Metis Network costs less than $0.01, and a token swap will set you back a mere 2 cents. By comparison, the average gas fee on the Ethereum blockchain is currently 46 cents, and a token swap costs $2.

L2s Ease Network Congestion, Which Helps to Lower Network Fees. Image via L2Fees

L2s Ease Network Congestion, Which Helps to Lower Network Fees. Image via L2FeesPolygon, Optimism are Arbitrum are all examples of L2s.

Also, check out our complete guide to crypto network fees, where we dissect these fees, list networks with the lowest fees and provide tips on how to save on these fees.

Centralization

Crypto assets were created around the idea of decentralization where no one entity calls the shots. Decentralization is central to crypto for a variety of reasons.

- It enhances security by removing central points of control, making it harder for bad actors to compromise the system.

- It ensures censorship resistance, allowing for transactions and information flow without the interference of centralized authorities.

- It facilitates trustless transactions to occur, meaning users don't need to rely on intermediaries.

Ethereum's “decentralization” is a contentious topic, with many outspoken critics becoming disappointed in how centralized the project has become.

In a recent report, American megabank JPMorgan raised the alarm on Ethereum's centralization. It directed attention to how the top-five liquid staking providers — Lido, Coinbase, Figment, Binance and Kraken — control over 50% of Ether staking, with Lido controlling nearly one-third. Interestingly, in May 2022, Buterin said no liquid staking service should exceed 15%.

“Needless to say that centralization by any entity or protocol creates risks to the Ethereum network as a concentrated number of liquidity providers or node operators could act as a single point of failure or become targets for attacks or collude to create an oligopoly that would promote their own interests at the expense of the interests of the community, e.g. by censoring certain transactions or by front running on end users' transactions.” - Theblock

Ethereum Price

Over the years, many crypto "pundits" have made outlandish claims about where a crypto asset's price was headed.

In 2018, Tim Draper expected Bitcoin's price to reach $250,000 by the end of 2022 (BTC closed the year at $16,547.50). Crypto lender Nexo expected BTC to surge to $100,000 by April 2023 (BTC's price at the end of the month was 29,268.81). Guido Buehler, the former CEO of Swiss bank Seba, expected the coin to reach between $50,000 and $75,000 in 2022.

As you're aware, Bitcoin is the most famous crypto, and when its price rises, so do most altcoins, including Ethereum. Speaking of, British lender Standard Chartered expects ETH to reach $8,000 by the end of 2026 thanks to the Ethereum network's dominant position in gaming and tokenization. Whether this too will fail to materialize, only time will tell.

Ethereum is Currently Down over 68% From Its All-Time High. Image via CoinGecko

Ethereum is Currently Down over 68% From Its All-Time High. Image via CoinGeckoFor now, ETH is trading at $1,550, representing a decline of over 68% from its all-time high price of $4,878 in November 2021.

Best Places to Buy Ethereum

Ethereum is one of the most popular cryptocurrencies, which means you can easily buy it via exchanges both small and big, centralized or decentralized.

If you're looking to purchase ETH, you can check out crypto exchanges such as Binance, Bybit, Bitget, Coinbase, Kraken or eToro.

If you're in the market for a reliable exchange, head over to our article that examines the best crypto exchanges.

As for Decentralized Exchanges (DEX), Uniswap and Sushiswap are solid bets, you can also consider using an aggregator like 1inch to find the best price. Many people also choose to buy Ethereum using a non-custodial exchange like ChangeNow or SimpleSwap.

What are the Fees to Buy Ethereum?

A number of factors influence the fees you have to pay to purchase ETH. This includes the platform of your choice, the payment method and the amount of Ethereum you're looking to buy. You should keep the following things in mind before buying ETH:

- Exchange Fees: You will incur a fee for buying, selling and trading Ethereum. These fees are charged by the exchange and can either be a percentage of the total transaction amount, or a fixed amount. Some of the lowest-fee centralized exchange platforms include Binance, KuCoin and OKX.

- Payment Method: How you choose to pay has a bearing on the fees as well. Using a credit card or PayPal might incur higher fees compared to bank transfers or cryptocurrency deposits.

- Withdrawal Fees: Looking to transfer Ethereum to a personal wallet? Additional withdrawal fees may kick in along with network fees that will vary depending on network congestion.

According to CryptoFeeSaver, Binance charges a trading fee of 0.1% and a withdrawal fee of 0.005 ETH. At 0.5%, Coinbase's trading fee is higher than Binance's and it charges a withdrawal fee of 0.002058 ETH. Over at Kraken, the trading fee ranges between 0.16% and 0.26%, while its withdrawal fee is 0.0035 ETH.

How to Buy Ethereum with a Credit or Debit Card

Most, if not all, centralized cryptocurrency exchanges will let you use your credit or debit card to purchase Ethereum. However, exchanges will have you undergo the KYC process, designed to stop the illegal flow of money.

Here are the steps to buying ETH with your debit/credit card.

- Step 1: Log into the crypto platform of choice.

- Step 2: Select the crypto you want to buy, which is ETH in this case.

- Step 3: Enter the amount you'll be willing to pour in.

- Step 4: Choose your payment method (Visa, Mastercard, American Express etc.)

- Step 5: Choose your payment provider. The main consideration here at the fees; the lower they are, the more ETH you get.

- Step 6: Go through the payment process like your usual online shopping.

- Step 7: Head over to your wallet to see if funds have been deposited.

How to Buy Ethereum with a Bank Account

Buying Ethereum directly via the funds in your bank account comes with a few benefits over a card payment method.

- Lower fees: Buying Ethereum with a bank account typically incurs lower fees, compared to credit cards. This means you get more ETH with the same amount of money.

- Higher limits: Buying crypto with bank accounts often comes with higher daily spending limits.

Here's how can buy Ethereum instantly via your bank account.

- Step 1: Log into the crypto platform of choice.

- Step 2: Select the crypto you want to buy, which is ETH in this case.

- Step 3: Specify the amount of ETH you want to buy.

- Step 4: Choose bank transfer are your payment method.

- Step 5: Fill in information about your bank account.

- Step 6: Confirm the transaction and await the processing of your bank transfer.

- Step 7: The platform will automatically convert your fiat currency into ETH and transfer it to your wallet.

How to Send Ethereum to a Wallet

If you're using a custodial wallet, like the ones provided by a cryptocurrency exchange, you may want to consider sending your just-bought Ethereum off-exchange for a number of reasons:

- You do not have autonomy over your wallet. The custodian, aka the crypto exchange, has complete control over your funds.

- Hot custodial wallets, those connected to the internet, are an easy target for hackers.

- You'll always need an internet connection to log in and perform any transaction.

Here's a general step-by-step guide to sending Ethereum to another wallet.

- Step. 1: Open your wallet app. Check out our picks for the best Ethereum wallets

- Step. 2: Get the receiving address. Make sure you are connected to the same network as the recipient.

- Step 3: Click on the “Send” button in your wallet (or a similarly worded alternative).

- Step 4: Many assets exist on multiple networks. When transferring crypto tokens, make sure that the recipient is using the same network as you are, since these are not interchangeable.

- Step 5: Ensure that your wallet has sufficient ETH to cover the transaction fee. Most wallets will automatically add the suggested fee to the transaction which you can then confirm.

- Step 6: Once your transaction is processed, the corresponding crypto amount will show up in the recipient's wallet. This process can take up to 30 minutes depending on the network and congestion.

How to Sell Ethereum

Selling Ethereum is as easy as buying it. You can cash out your ETH for fiat currencies based on the prevailing exchange rate. Here's what the process looks like:

- Step 1: Log in to your crypto exchange

- Step 2: Link your bank account

- Step 3: Transfer your Ethereum to the exchange. If you're using a custodial wallet offered by the exchange, you can simply enter the amount of ETH you're looking to sell. If you are using a self-custodial wallet you will need to send your ETH to your exchange address.

- Step 4: Sell your Ethereum against the currency you prefer such as dollar, euro or pound.

- Step 5: Withdraw your money to your bank account

- Step 6: Pay the withdrawal fees

Buying Ethereum: Closing Thoughts

Ethereum's innovation, highlighted by its smart contract capabilities, has led to widespread adoption and a robust ecosystem of applications. However, the blockchain faces scalability issues and high gas fees, spurring the rise of Layer-2 solutions to enhance efficiency and reduce costs. Despite its dominance, Ethereum has been criticized for perceived centralization, raising concerns about the project's decentralization ideals.

When purchasing Ethereum, factors like exchange fees, payment methods, and wallet choices come into play, demanding careful consideration. While the crypto market offers exciting prospects, users must navigate these complexities, ensuring informed decisions and secure transactions.