The cryptocurrency markets are incredibly volatile, this is self evident.

This volatility is being seen as one of the largest hindrances to the mass adoption of crypto. One cannot expect to replace fiat currency if your alternative is not seen as a "store of value".

So what can be done?

While cryptocurrency volatility is driven by numerous factors, one of the biggest contributors is lack of risk management products and hedging instruments.

Yes, we have some Futures products but these are centralised, standardised, complicated and only cover a limited number of crypto assets.

A protocol level solution is required...

MARKET Protocol Overview

MARKET Protocol is a decentralised derivative protocol that allows users to program their own derivatives through the use of smart contracts and blockchain technology. It will provide users with a mechanism to hedge price risk for numerous different assets.

It will also give one the opportunity to trade volatility in the underlying asset. Not only will users be able to leverage their positions but they can do so without the risks posed by counterparty default.

In essence, MARKET Protocol is developing a decentralised exchange (DEX) protocol that will allow people to trade derivative products. You can think of it as a derivative counterpart to the 0x (ZRX) protocol.

Interview with Seth Rubin (CEO)

After reading the whitepaper we were quite intrigued by the project. We decided to reach out to the team with a bunch of questions on the technology, project, their latest DEX and the broader crypto derivatives ecosystem.

MARKET Protocol CEO, Seth Rubin, was happy to answer our questions in depth.

Project Overview, Crypto Markets and the DEXs

MARKET Protocol CEO, Seth Rubin. Image via GitHub

MARKET Protocol CEO, Seth Rubin. Image via GitHubHow did the MARKET Protocol idea come about? How long have you guys been working on it?

Together my cofounders and I have run and managed a number of market making and algorithmic trading desks. Collins Brown and I have been working together for much of the last 13 years, and our CTO and third cofounder, Phil Elsasser, has been working with us for the last 7 of those.

We originally entered crypto in 2015 with a focus on trading crypto assets, but in 2016 we became more interested in the underlying blockchain technology itself. We began learning about decentralized exchanges and what we could do with them, and this led us down the path that eventually became MARKET Protocol.

We started working full-time on MARKET Protocol in June of 2017 after we realized we could replace custodians and clearing firms with a blockchain solution that could also address the problem of volatility in the crypto space.

You are trying to develop a DEX protocol for derivative contracts. You have listed a number of problems with centralized exchanges. If you had to choose one main issue you have with these exchanges, what would it be?

The fundamental issue with centralized exchanges is custody of funds. Coming from the traditional finance world, we were shocked to see how custody of funds was handled in the crypto space.

The main manifestation of this problem is the best practice of not leaving funds on an exchange, due to the risk of theft by hackers or the exchange itself. Additionally, derivatives traders on centralized exchanges like BitMEX and OKEx are constantly exposed to risks such as auto-deleveraging and socialized losses.

The most interesting thing about decentralized exchanges is that there is no centralized custody of funds, this is a very powerful user protection that prevents the abuse of user funds.

The markets are obviously in a pretty bad state at the moment. Are you concerned with the potential for a big drop in trading / hedging activity and hence less incentive to operate a DEX?

Price volatility is really limiting the adoption of crypto assets in general, no matter how you view them, as a store of value, medium of exchange, unit of account, or in the context of token applications.

Crypto assets are currently too volatile to be used in any of these capacities. This is an opportunity for MARKET Protocol, since price volatility is the main problem that we are addressing. With MARKET Protocol, you can hold and use a token without worrying about a decline in its price, effectively separating the price volatility from the utility of the token.

Throughout this bear market we’ve seen a huge amount of interest in hedging and shorting crypto assets, however users currently have very limited access to these types of trading opportunities. This is the problem that we are addressing with MARKET Protocol and our decentralized exchange, MPX.

Your protocol will allow other developers to create their own DEXs. Can you take us through some of the most exciting projects that you are already working with? How far along are they on their products?

We have partnered with a few DEXs so far, the most well know of which is DDEX, a top Ethereum-based DEX and the also the top 0x relayer by volume. By implementing MARKET Protocol, DDEX will be able to offer new and unique trading relationships, for example, price exposure to cross-chain and off-chain assets.

One of the things we focused on from the beginning was making sure that we mapped to 0x endpoints so that relayers can easily implement MARKET Protocol. This is a part of our strategy to encourage applications and exchanges to build on MARKET Protocol, but we’ve also built and released our own decentralized exchange to show what can be built with the protocol.

Right now we’re focused on releasing a production version of MPX alongside the mainnet launch of MARKET Protocol, then at that point we can focus more on supporting our partners and their projects.

The regulatory framework around DEX’s is not immediately clear. For example, we have seen the penalties issued to EtherDelta by the SEC. Have you thought about the regulatory implications for the node or order book operators?

Regulatory implications will be different for different teams, depending on where they are located and how they are implementing MARKET Protocol. We don’t control who implements or how they implement, but the protocol itself is designed in a neutral way so that someone can implement it along with their own solutions for KYC, AML, and registration compliance.

We expect developers to remain compliant with the regulatory requirements of their applicable jurisdictions. This is somewhat complicated by the fact that many regulators are only beginning to provide guidance on how existing regulations apply to crypto, although we expect that this will be cleared up in the next couple of years.

In the meantime, it is important that developers carefully consider the regulations that are applicable to their projects.

The trust in stablecoins such as Tether are at rock bottom levels. There are a lot of other USD backed and fully regulated stablecoins that have recently hit the market (Gemini Dollar, USDC etc). You guys have rather chosen to make use of decentralized stablecoins as the reference coins in your contracts. Why is this?

We have built MARKET Protocol in such a way that any ERC-20 token can be selected as the collateral for a contract, including regulated U.S. dollar-backed stablecoins and also decentralized stablecoins like DAI.

We have a preference for decentralized stablecoins because they more closely align with the ethos of decentralization that is at the heart of both MARKET Protocol and MPX, however it is up to the individual contract’s creator to define which token will be used as collateral.

Each exchange or application built on MARKET Protocol can choose which contracts to list, so we expect to see the market consolidate around a number of preferred stablecoins used as collateral for MARKET Protocol contracts.

MPX Platform

Launch of first MARKET Protocol DEX. Image source: Market Protocol

Launch of first MARKET Protocol DEX. Image source: Market ProtocolMPX, your first Dapp, is officially in beta and on the Rinkeby testnet. How is the testing going? Has it garnered a lot of interest?

The feedback we’ve received from our users has been tremendous and supports what we already knew: users want more and better trading opportunities, including both on-chain and off-chain assets.

We’ve validated some of our initial product design choices and have gained valuable insight into how we can continue to improve our user experience, which is something we’re very focused on. Now we’re hard at work incorporating the feedback we’ve received into our updated beta, which we’ll release later this month.

You currently have 6 BETA derivatives on MPX. Is there a plan to include more at a later stage?

During our beta we are supporting six contracts, which we chose to demonstrate the range of contracts that can be created with MARKET Protocol, but in the future we will offer many more. Right now we are gathering feedback from our community and beta testers to understand which assets they want to trade and also which collateral tokens they prefer.

When could we see a live rollout of the MPX platform?

We are planning on releasing a production version of MPX alongside the mainnet launch of MARKET Protocol in Q2 of 2019.

MARKET Protocol Technology

You have developed on top of the Ethereum blockchain. Are you concerned about the scaling issues that the network has recently been facing? What technology are the Ethereum core developers working on that you are most excited about?

We understand the scaling issues that Ethereum is facing, but we are confident that they will be solved. One solution we are particularly excited about is Plasma. By moving transactions off chain, Plasma implementations will increase Ethereum’s total transactional capacity.

This will help decrease on-chain congestion until other scaling solutions can be implemented. In the meantime, we are not too concerned about fees, because high fees crowd out low value transactions, not high value transactions. For example, it doesn’t make sense to pay $5 for each move in a game, but it does make sense to pay $5 to hedge $1000 using MARKET Protocol.

In your whitepaper you talk about partnerships with Oracilize.It and Block1IQ. What sort of input could these oracles provide to your smart contracts?

For each MARKET Protocol contract there is a defined collateral token and also an underlying reference asset. Gains and losses on positions are calculated in the collateral token, but they are derived from the reference asset.

The protocol uses oracles to obtain price data for these reference assets, so that the protocol can calculate their change in value denominated in the collateral token. Our alpha product released earlier this year was written to Oraclize.It, which allowed us to fetch price data from a number of different sources.

One partnership we are particularly excited about is ChainLink, which is a very popular decentralized oracle. In the future, we could use decentralized oracles to bring other external data on-chain, for example, sports data.

Partnership with Chainlink to provide Oracle support

Partnership with Chainlink to provide Oracle supportLet’s talk about the derivative contract specifics. It seems that the contracts require a cap and a floor which makes it look like an option spread. Will there be scope for other types of derivative instruments to be constructed? For example, those that do not cap upside?

We didn't set out to create any particular type of derivative. We started out with the goal of addressing a number of problems, from custody and clearing firms, to volatility. We developed MARKET Protocol contracts to solve these problems, while providing the benefits of derivatives to everyone.

In their current form, MARKET Protocol contracts provide guaranteed solvency and known downside, but at the cost of capped upside for someone who is long. However, this can be addressed by stripping together a series of contracts to replicate uncapped payoff structures, similar to a futures roll, and we expect to see exchanges and applications obfuscate this process so that it’s easy for traders to get this type of exposure.

In the whitepaper, you claim that current derivative settlement disputes are settled via a centralized process. You want to move to a decentralized mechanism though. Have you thought more about how this will look? What sort of technology would it make use of?

Upon expiration, a MARKET Protocol contract automatically settles using price data from its selected oracle. The problem is if the oracle returns an incorrect price, or even just no price at all.

We address this by including a time delay between the initial execution or expiration of the contract and the point in time when users can withdraw their funds. If a quorum of users initiate a settlement dispute, then the contract enters a disputed state, and a backup oracle or group of oracles will be used to get a final settlement value.

We are exploring a number of other ways to adjudicate settlement disputes, for example, by relying on MKT token holders to crowdsource the disputed value or by leveraging another project specializing in dispute resolution.

MKT Tokens

Let’s take a look at the MKT tokens. Are you still planning to raise a pre-sale? Do you have a bit more of a timeline as to when this is likely to take place?

We are still evaluating the best way to distribute MKT tokens. We are also planning on using MKT tokens as a mechanism to enhance liquidity across the protocol, beginning with MPX, to encourage the growth of the MARKET Protocol ecosystem.

Your whitepaper states that these tokens will confer voting rights for potential protocol improvements. Can you elaborate on this a bit more? What governance protocols is it likely to resemble?

MARKET Protocol is an open and decentralized protocol that will be governed by MKT holders, ensuring that the voices of the end users and the projects building on the protocol are both represented in the ongoing stewardship and development of the protocol.

The goal is a governance system that balances the voices of these two groups, however decentralized protocol governance is very much an unsolved problem in this space. There are a number of projects in an experimental phase, but it is going to take some time for viable solutions to emerge.

Looking Forward

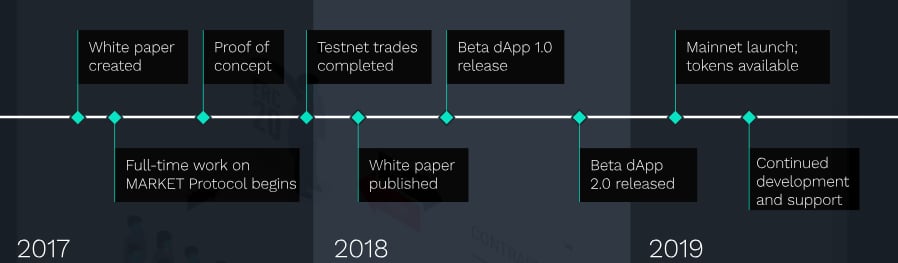

MARKET Protocol Roadmap

MARKET Protocol RoadmapWhat trends do you think we are likely to see in 2019 in the cryptocurrency markets?

Currently the overall crypto markets are correlated with the price movement of Bitcoin, but in 2019 we expect to see prices start to move more independently. Many teams were focused on building in 2018, so next year there will be more projects that go live and have real usage.

It’s going to be a really exciting time for the whole crypto space. More projects and users will translate into a greater need for risk management solutions, as well as more opportunities for traders, both of which MARKET Protocol can address.

As you continue rolling out updates, what most excites you about MARKET Protocol and the potential for decentralized derivatives?

The most exciting thing we’ve seen, and something that gives us a lot of confidence going forward, is the user feedback we’ve received so far, and also the huge amount of support we’ve received from our community, both of which indicate the need for the type of product we’re creating, as well as the quality of our team that is tirelessly working to make it better.

We see derivatives as a cornerstone of modern finance and essential for the blockchain space as a whole to grow and scale. And by decentralizing derivatives, we can enable safe, solvent, and trustless trading of any asset. We are working hard to make this a reality!

Our team is really excited to see what our community builds using MARKET Protocol, and how those projects change the world. In the meantime, the best way for us to predict the future is to build it, and that is the idea that guides us as we continue to prepare for the mainnet launch of MARKET Protocol and MPX.

Conclusion

While volatility is a by-product of most nascent financial markets, there have always been tools that could be used as a countermeasure to this volatility.

What MARKET protocol has done is combined the power of the decentralised blockchain with the risk management functionality of a financial derivative. They hope to give users the ability to manage their own individual risk without the need of a large centralised exchange or standardised contract.

It will be interesting to see how the roll-out of the MPX platform goes and what MARKET Protocol has in store for 2019. If you want to follow the latest updates on the project then you can head over to their website where they post their latest updates.