Monero stands as the last serious proof-of-work cryptocurrency viable for home mining in 2026. This is thanks to its unique RandomX algorithm, which enforces strong ASIC resistance and optimizes for everyday CPUs rather than industrial hardware farms. Unlike Bitcoin or Litecoin, where ASICs dominate and exclude small-scale miners, Monero's design levels the playing field, allowing a modern desktop CPU to compete meaningfully against the network's total hashrate.

This CPU-friendly approach is sustained by RandomX, which demands 2GB of fast RAM per thread, executes randomly generated programs, and favors CPU-native instructions like integer math and cache operations. This effectively penalizes GPUs and renders ASICs uneconomical.

Miners benefit from Monero's tail emission, a fixed 0.6 XMR per block introduced in May 2022 to sustain miner incentives indefinitely, supplemented by transaction fees. However, solo-mining yields highly erratic results due to block finds being Poisson-distributed; therefore, joining a pool is essential for converting variance into a steady, predictable stream of income.

This comprehensive guide delivers everything you need to start mining XMR profitably today: a direct comparison of the top pools, detailed profitability breakdowns with realistic CPU examples, step-by-step setup instructions, and updated 2026 rankings.

For a no-fluff introduction to Monero and its technology, read our article: What is Monero?

Quick Verdict

Best For

- Home CPU miners who want steady payouts instead of “lottery mining”

- Anyone optimizing for efficiency (RandomX loves strong CPUs and fast RAM)

- Miners with higher power costs who need low fees and minimal stale shares

- Privacy-conscious users who want non-custodial payouts to their own wallet

- People splitting hashrate across pools to support healthier network distribution

Not Ideal For

- Users expecting guaranteed profits after electricity and hardware wear

- Anyone unwilling to tune basics (threads, huge pages, RAM, and thermals)

- Miners who only want one-click simplicity but also maximum transparency

- People who plan to park all hashrate in a single >50% pool indefinitely

- Those uncomfortable managing wallet security (seed phrase, subaddresses, backups)

Key Takeaways (TL;DR)

- Why pools win: Solo mining is a Poisson lottery; pools turn “rare jackpots” into smooth, predictable payouts.

- RandomX reality: Monero stays home-minable because RandomX favors CPU instructions and demands lots of fast memory per thread.

- Tail emission: The fixed 0.6 XMR block reward (plus fees) keeps miner incentives alive long-term.

- Fees are the quiet leak: A 0.6% vs 1% pool fee looks tiny daily, then becomes real money over months.

- Centralization matters: Mega-pools reduce variance but concentrate hashpower; consider rotating or splitting across mid-sized pools.

- Latency = lost shares: Higher ping increases stale shares, which effectively lowers your hashrate and earnings.

- Payment models: PPLNS is best for long, steady mining; PPS/PPS+ is smoother but typically costs more; PROP is swingy.

- Best beginner path: Start with a reliable, low-variance pool, then graduate to diversification or P2Pool if decentralization is your priority.

- P2Pool in one line: A trust-minimized, decentralized “pool of solo miners” with direct payouts, but it asks more of your setup.

Quick Comparison: Top Monero Mining Pools (2026)

Selecting the right pool hinges on its network hashrate share, fee structure, minimum payout threshold, geographic server availability, payment model, and niche strengths.

Below is a curated table of leading pools based on December 2025 data, prioritizing those with a network share of more than 0.5% for reliability, while also including critical decentralization options.

| Pool | Hash Rate | Fee | Minimum Payout | Servers / Region | Payment Method | Best For |

|---|---|---|---|---|---|---|

| SupportXMR | 3.18 GH/s (52.6%) | 0.6% | 0.1 XMR | Global (EU, US, Asia) | PPLNS | High stability, beginners |

| NanoPool | 1.28 GH/s (21.1%) | 1% | 0.11 XMR | EU, US, Asia | PPLNS | Multi-coin, established users |

| P2Pool | 403.60 MH/s (6.7%) | 0% | 0.00185 XMR | Decentralized P2P | PPLNS | Decentralization purists |

| MoneroOcean | 296.78 MH/s (4.9%) | 0% | 0.003 XMR | Global | PPLNS | Algo-switching, low fees |

| C3Pool | 337.93 MH/s (5.6%) | 0% | 0.001 XMR | EU, US, Asia | PPLNS | Low latency, reliability |

| HashVault | 219.99 MH/s (3.6%) | 0.9% | Adjustable | EU-focused | PPLNS | Privacy-focused miners |

| Kryptex | 354.96 MH/s (5.9%) | 1% | 0.01 XMR | Global | PPS+ | Easy setup, multi-platform |

| HeroMiners | 40.12 MH/s (0.7%) | 0.9% | 0.001 XMR | Global (20+ locations) | PROP | Worldwide servers, solo options |

| XMRPool.eu | 44.65 MH/s (0.7%) | 0.9% | 2 XMR | EU | PPLNS | Low-profile privacy |

| 2Miners | 170 MH/s (est.) | 1% | 0.1 XMR | Global | PPLNS | Variable payouts, PROP gamblers |

| Skypool | 38.11 MH/s (0.6%) | 1% | 0.01 XMR | Asia-focused | PPS+ | Low-power, Asia users |

Data updated Jan. 1, 2026.

Monero Mining Profitability in 2026

Profitability from Mining Monro in 2026. Image via Shutterstock

Profitability from Mining Monro in 2026. Image via ShutterstockProfitability stems from a careful balance of block rewards against electricity costs, hardware depreciation, and operational expenses such as pool fees.

How Monero Mining Rewards Are Calculated

Monero targets a block every two minutes. Each block produces a fixed reward of 0.6 XMR, plus transaction fees that usually add between 2% and 5% on top.

Your earnings depend on how much of the total network hashrate you control. For example, if the entire network is producing 6.8 gigahashes per second and your rig contributes 10 kilohashes per second, your share is extremely small but predictable.

Over time, that share averages out to roughly 0.003 XMR per day under normal conditions when mining in a pool.

Most pools use a pay-per-last N shares system. This means rewards are calculated over a rolling window of recent shares, smoothing luck across days or weeks instead of paying instantly per share.

Check out our detailed guide on Monero mining.

Example Earnings by Hash Rate

Realistic 2025 CPU benchmarks highlight the efficiency of AMD processors on the RandomX algorithm. The table below assumes an XMR price of $457, a 0.6% pool fee, and 24/7 uptime.

| Hash Rate | Daily XMR | Monthly XMR | USD Equivalent | Typical Hardware Example |

|---|---|---|---|---|

| 5 KH/s | 0.0015 | 0.045 | $20.50 | Intel i5-12400 (65W TDP) |

| 10 KH/s | 0.003 | 0.09 | $41 | Ryzen 5 5600X (105W) |

| 15 KH/s | 0.0045 | 0.135 | $62 | Ryzen 7 5700X (105W) |

| 25 KH/s | 0.0075 | 0.225 | $103 | Ryzen 9 5950X (140W) |

| 40 KH/s | 0.012 | 0.36 | $165 | EPYC 7413 (180W/server) |

| 100 KH/s | 0.03 | 0.9 | $411 | Threadripper 3970X (280W) |

Note: Efficiency on top AMD CPUs can reach 0.15-0.25 KH/s per Watt.

Costs That Impact Profitability

- Electricity: Power consumption is the biggest expense. A 100-watt system consumes about 2.4 kilowatt hours per day. At an electricity price of $0.10 per kilowatt hour, that costs roughly $0.24 per day. High-efficiency CPUs that reach around 0.2 kilohashes per watt tend to remain profitable below roughly $0.08 per kilowatt hour.

- Pool Fees: Fees range from zero to one percent. Over a year, the difference between a 0.6% pool and a 1% pool can add up to $20 or more for moderate miners.

- Network Difficulty: Difficulty adjusts frequently and can swing 5% to 15% week to week, depending on price and miner activity. Profitability should be monitored regularly.

Monero Mining Calculator

For personalized calculations, miners should use an external tool to factor in their specific electricity cost and hardware hash rate.

- Recommended Calculator: Minerstat Profitability Calculator

- Alternatives: Minerstat, WhatToMine, and CoinWarz all support Monero and RandomX.

Top Monero Mining Pools Reviewed (2026)

The following detailed reviews follow a uniform template for apples-to-apples comparison, drawing from live statistics, user feedback, and operator transparency.

SupportXMR

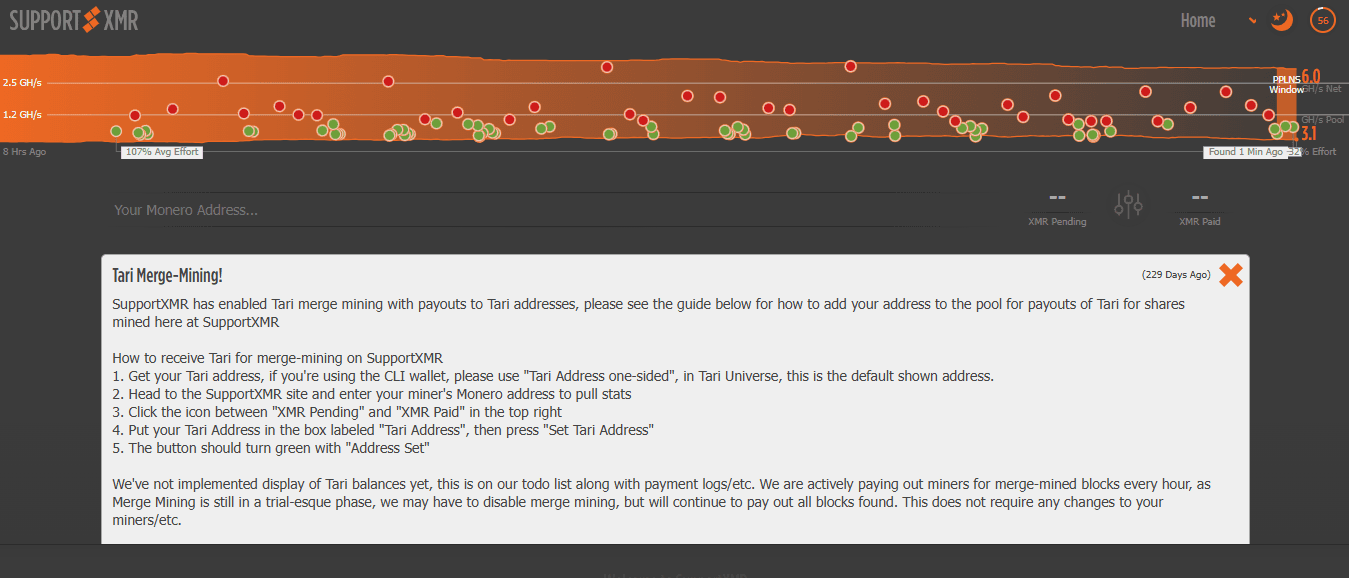

Snaphot of SupportXMR Pool. Image via Support XMR

Snaphot of SupportXMR Pool. Image via Support XMRSupportXMR is best for high stability and beginners seeking predictable payouts. This dominant pool commands over half the network, virtually eliminating variance for small contributors.

- Hash Rate: 3.18 GH/s (52.6% share), Largest by far, ensuring frequent block finds.

- Fees: 0.6% PPLNS; highly transparent with no hidden charges.

- Minimum Payout: 0.1 XMR, reachable daily on 10+ KH/s rigs.

- Payment Method: PPLNS (Pay Per Last N Shares).

- Server Locations: Global, with primary servers in the EU, and points in the US and Asia.

- Uptime & Reliability: Exceptional 99.99% uptime over 2025, robust worker stats dashboard.

- Who This Pool Is Best For: Home miners prioritizing steady, low-variance income over decentralization ideology.

P2Pool

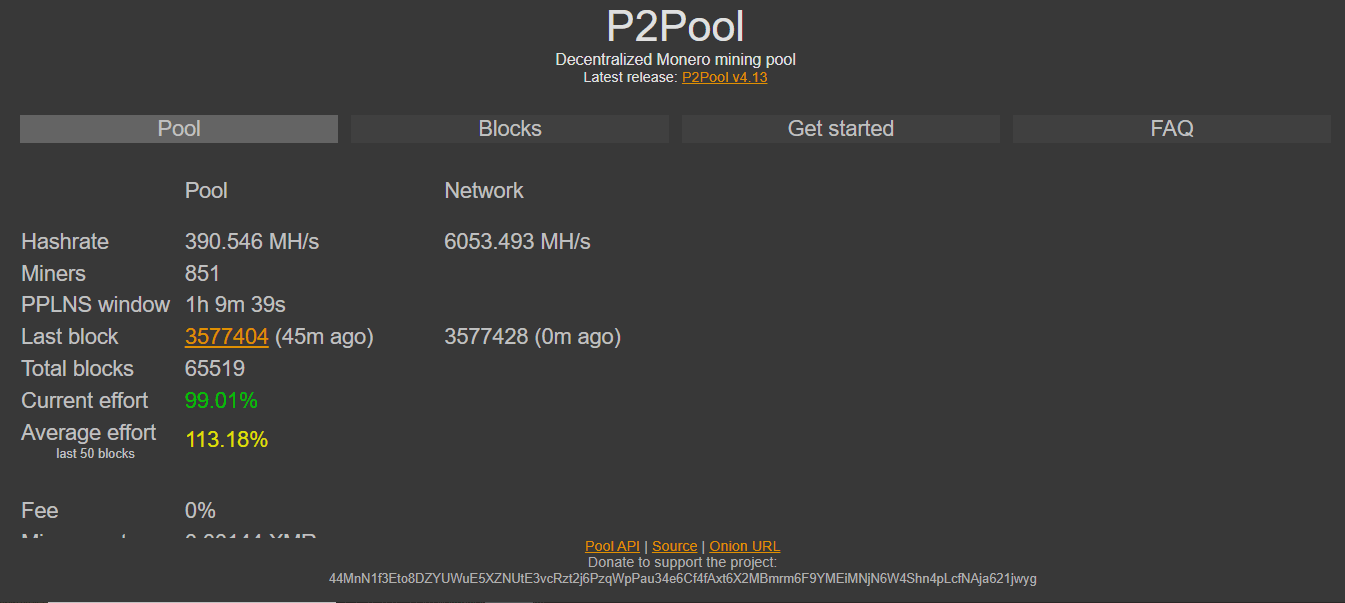

P2P is a Decentralised Mining Pool. Image via P2P Pool.

P2P is a Decentralised Mining Pool. Image via P2P Pool.P2Pool creates peer-to-peer mini-pools that merge into the full network's security without a central operator or point of failure.

- Hash Rate: 403.60 MH/s (6.7% share), Solid and growing network share for a decentralized option.

- Fees: 0% pure. You only pay the standard Monero transaction fees for transfers.

- Minimum Payout: 0.00185 XMR, paid directly to your wallet.

- Payment Method: Local PPLNS; global via a sidechain.

- Server Locations: Fully decentralized; you run your own local node.

- Uptime & Reliability: Self-reliant, requiring a local node with 4GB+ RAM. No single point of failure.

- Who This Pool Is Best For: Privacy maximalists and decentralization purists.

NanoPool

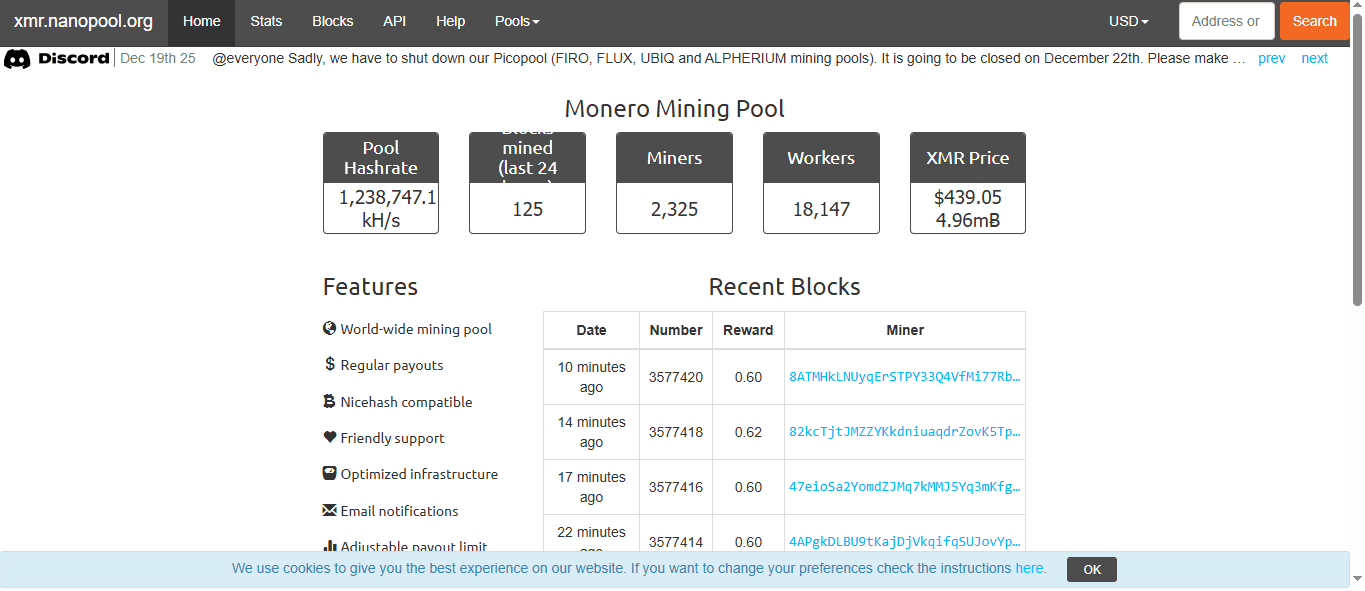

A Snapshot of Nano Pool. Image via Nanopool

A Snapshot of Nano Pool. Image via NanopoolNano Pool is best for multi-coin miners with established workflows. A veteran platform since 2016, NanoPool supports over 40 algorithms alongside XMR.

- Hash Rate: 1.28 GH/s (21.1% share), The second largest pool, battle-tested for years.

- Fees: 1% PPLNS; standard for a full-featured service.

- Minimum Payout: 0.11 XMR.

- Payment Method: PPLNS with reliable auto-payouts.

- Server Locations: EU, US, Asia, and Japan; also NiceHash friendly.

- Uptime & Reliability: Excellent uptime, dedicated API for monitoring, and a mobile app.

- Who This Pool Is Best For: Miners who switch between coins, or those looking for a robust, long-standing pool.

MoneroOcean

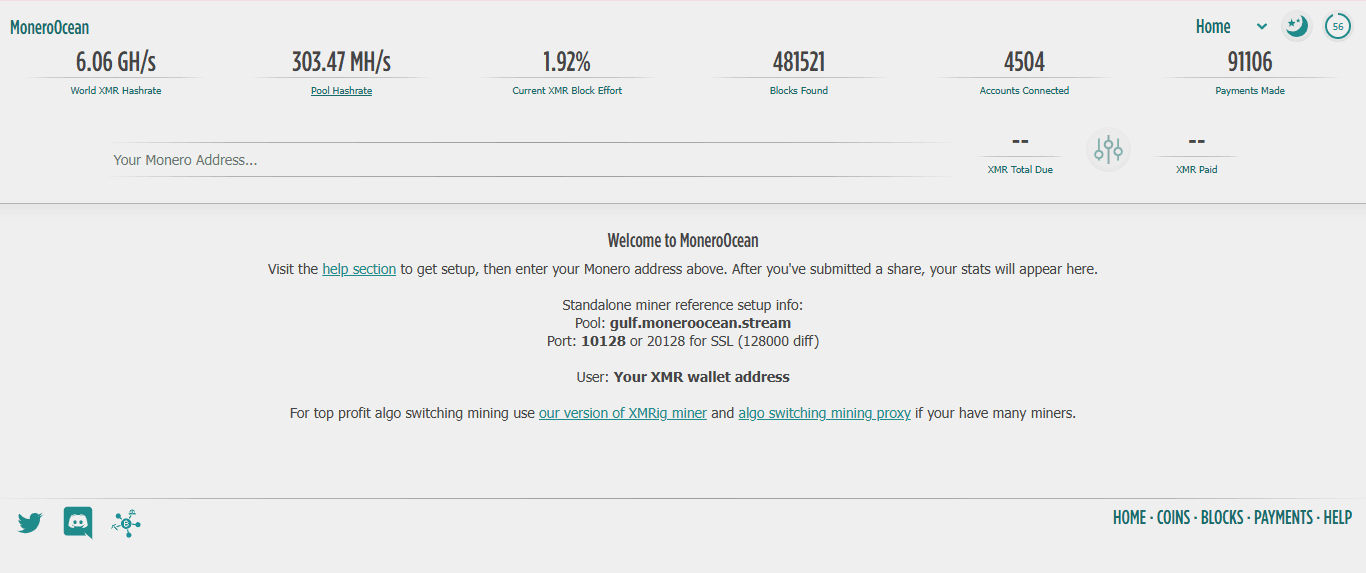

Mine Monero Via MoneroOcean Mining Pool. Image via MoneroOcean

Mine Monero Via MoneroOcean Mining Pool. Image via MoneroOceanMoneroOcean has the best for algo-switching to maximize yields. This pool automatically detects and mines the most profitable RandomX-compatible forks, but pays you in an XMR equivalent.

- Hash Rate: 296.78 MH/s (4.9% share).

- Fees: 0%. The pool earns its margin through smart switching and conversion.

- Minimum Payout: 0.003 XMR.

- Payment Method: PPLNS with a profit boost mechanism.

- Server Locations: Global stratum servers.

- Uptime & Reliability: High, with switching operations often adding a 10%-20% uplift versus mining pure XMR.

- Who This Pool Is Best For: Yield optimizers and power users in volatile markets.

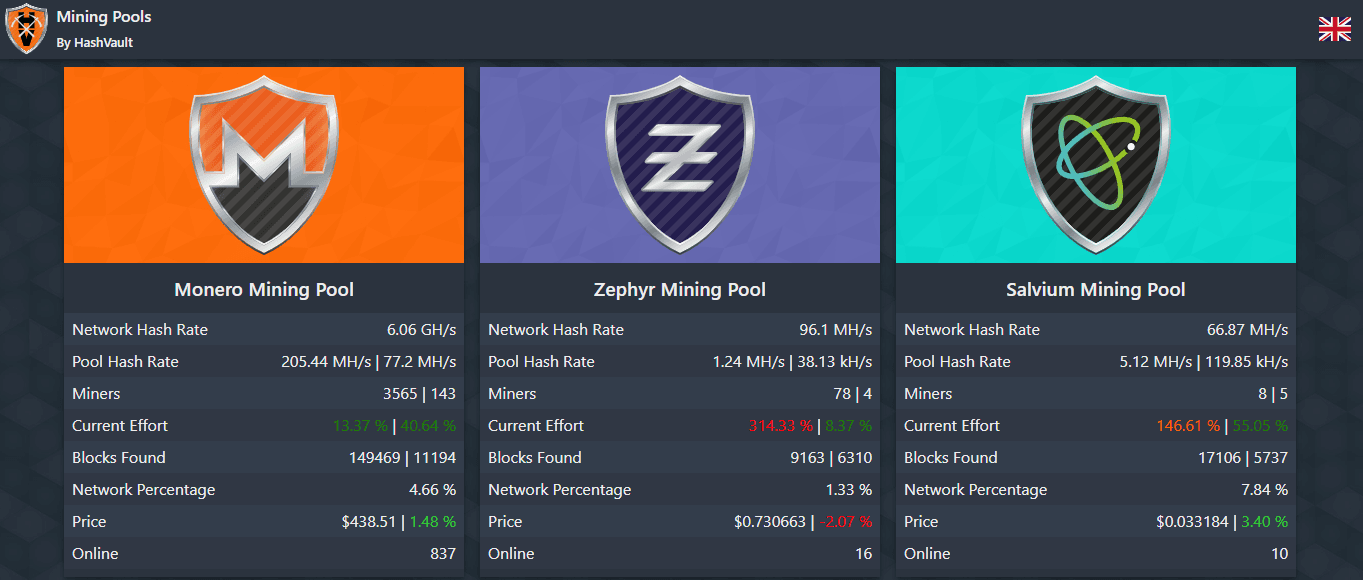

HashVault

A Snapshot of Hashvault Mining Pools. Image via Hashvault

A Snapshot of Hashvault Mining Pools. Image via HashvaultHashVault is a cryptocurrency mining pool that allows users to combine their computational power to mine various coins, including Monero (XMR). It supports Monero mining with a fee of 0.9% and a low minimum payout of 0.001 XMR.

- Hash Rate: 219.99 MH/s (3.6% share).

- Fees: 0.9% PPLNS.

- Minimum Payout: Adjustable, starting from 0.001 XMR.

- Payment Method: PPLNS, with an option to solo mine.

- Server Locations: Primarily EU-focused, maintaining a low profile.

- Uptime & Reliability: Strong, donation-based, and trusted by the community.

- Who This Pool Is Best For: Paranoid miners who want to avoid the largest pools and minimize their digital footprint.

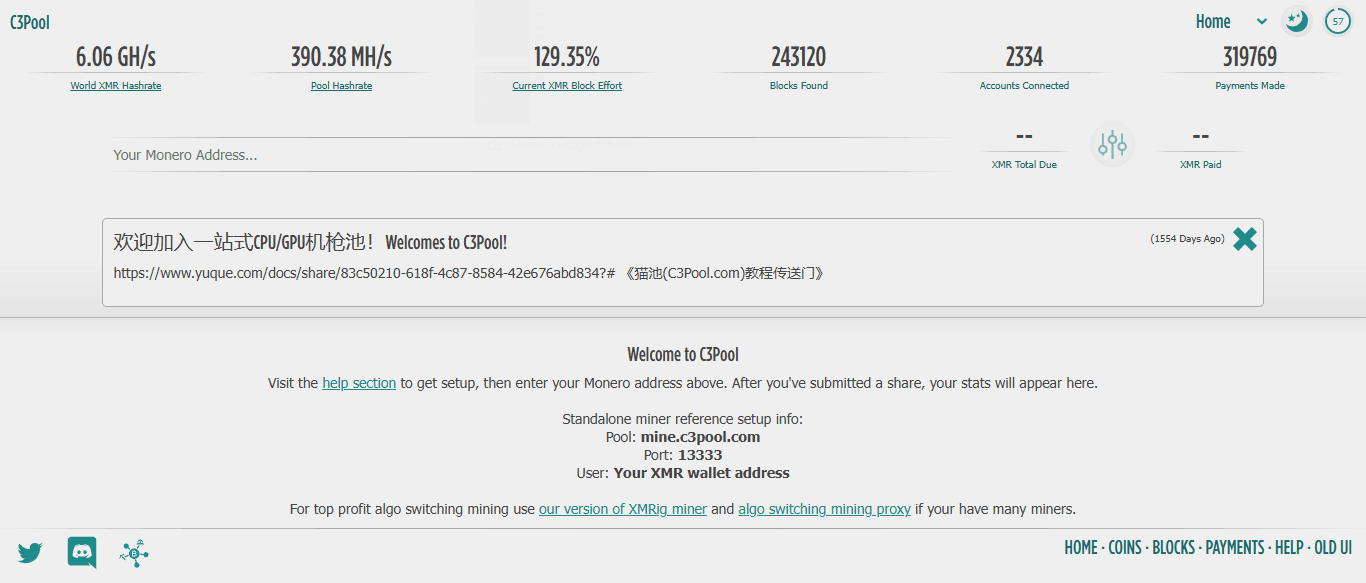

C3Pool

C3Pool is Known For Its Low Latency Setups. Image via C3Pool

C3Pool is Known For Its Low Latency Setups. Image via C3PoolBest for low latency in competitive setups. This efficiency-focused pool provides optimized routing.

- Hash Rate: 337.93 MH/s (5.6% share).

- Fees: 0%.

- Minimum Payout: 0.001 XMR.

- Payment Method: PPLNS.

- Server Locations: EU, US, and Asia. Known for optimized routing.

- Uptime & Reliability: 99.9% uptime with a detailed statistics API.

- Who This Pool Is Best For: Farms and competitive miners chasing every hash and minimizing share latency.

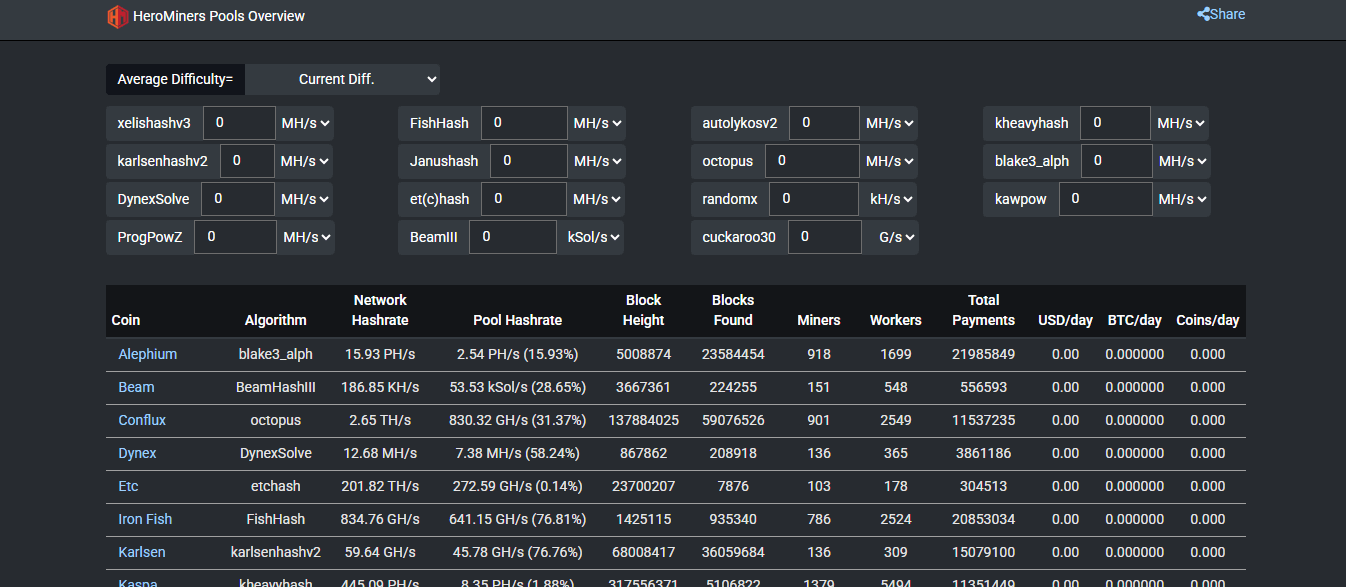

HeroMiners

HeroMiners Pool Overview. Image HeroMiners.

HeroMiners Pool Overview. Image HeroMiners. HeroMiners stands out with over 20 global stratum servers, making it ideal for miners in Asia, Australia, or remote areas where ping times to EU/US pools exceed 100ms, ensuring maximal effective hashrate through low stale shares.

- Hash Rate: 40.12 MH/s (0.7% network share as of December 2025), sufficient for consistent blocks without dominating the network.

- Fees: 0.9% for PROP mode; supports PPS+ and PROPX systems with no hidden payout or withdrawal charges, plus occasional fee-free promotions on new coins.

- Minimum Payout: 0.001 XMR, achievable in hours on a 10+ KH/s rig, with adjustable thresholds and direct exchange wallet support for instant liquidity.

- Payment Method: Flexible PROP (proportional per round), SOLO (full block jackpots), and PPS+ (stable pay-per-share); PROP suits variable luck, SOLO for high-hash gamblers.

- Server Locations: 20+ worldwide, including Asia (Singapore, Japan), Australia, EU (multiple), US East/West, South America—optimized for global low-latency via xmr-node-proxy and dynamic difficulty.

- Uptime & Reliability: 99.9%+ with TLS/SSL encrypted ports, real-time email/Telegram alerts for worker downtime, per-rig stats, and estimated earnings dashboard; proven stable across 50+ coins. No major incidents reported in 2025.

- Who This Pool Is Best For: Remote miners (e.g., India/Asia), solo enthusiasts, or those needing multi-payment flexibility without high fees; scales from single CPUs to farms.

XMRPool.eu

XMRPool.eu Focues On Minimal Overhead Costs. Image via XMRPool.eu

XMRPool.eu Focues On Minimal Overhead Costs. Image via XMRPool.euKnown for small-pool privacy, low-profile and steady operations. This EU-centric pool emphasizes minimal overhead and worker anonymity, appealing to miners avoiding large-pool visibility while maintaining reliable PPLNS payouts.

- Hash Rate: 44.65-46.95 MH/s (0.7-1.1% network share), small enough for lower variance spikes but consistent block finds (1-2 daily).

- Fees: 0.9% PPLNS, straightforward with no additional costs; competitive for its size and transparency.

- Minimum Payout: 2 XMR (higher threshold, suits 20+ KH/s rigs aiming for weekly payouts); some sources note a lower 0.7 XMR historically, but current is 2 XMR for efficiency.

- Realistic timeline: 1-2 weeks on mid-range CPU.

- Payment Method: Pure PPLNS, rewarding recent shares post-block for fair long-term convergence; no hybrids or solo to keep it simple.

- Server Locations: Primarily EU (stratum+tcp://xmrpool.eu:3333 and variants), with good ping for Europe/Middle East; Asia users may see 50-100ms latency.

- Uptime & Reliability: High reliability with detailed worker stats, exchange-integrated payouts, and low miner count (800 workers), reducing congestion; active since early RandomX era with no 2025 downtime flags.

- Who This Pool Is Best For: Privacy-conscious small-scale miners preferring EU servers, steady accumulation over frequent tiny payouts, or those diversifying from giants like SupportXMR.

2Miners

A Snapshot of 2Miners Mining Pool. Image via 2Miners

A Snapshot of 2Miners Mining Pool. Image via 2Miners2Miners appeals to risk-tolerant users with its "luck" statistic dashboard, where streaks can boost short-term yields in smaller rounds.

- Hash Rate: - 170 MH/s (est. 2-3% share based on 2025 trends; 58-170 MH/s reported variably), mid-tier for balanced block frequency (5-10 daily).

- Fees: 1-1.5% (1% PPLNS, 1.5% SOLO); transparent profit reporting shows 1% effective after ops, with $141K+ daily payouts network-wide.

- Minimum Payout: 0.01-0.1 XMR, hit in 1-3 days on 10 KH/s; regular 2-hour auto-payouts for qualifying balances.

- Payment Method: PPLNS (steady) and PROP/SOLO (high variance); PROP shines during lucky rounds, SOLO for full 0.6 XMR shots.

- Server Locations: Global stratum servers (EU, US, Asia), NiceHash compatible, with mobile monitoring apps for stats.

- Uptime & Reliability: Excellent, with monthly profit transparency (e.g., $26K pool profit on $2.59M payouts in past reports), 14K+ online miners, and node upgrades through 2025. Low downtime, API access.

- Who This Pool Is Best For: Variance lovers, multi-coin miners (supports 20+ alts), or those wanting frequent small payouts with occasional windfalls; great for app-monitored setups.

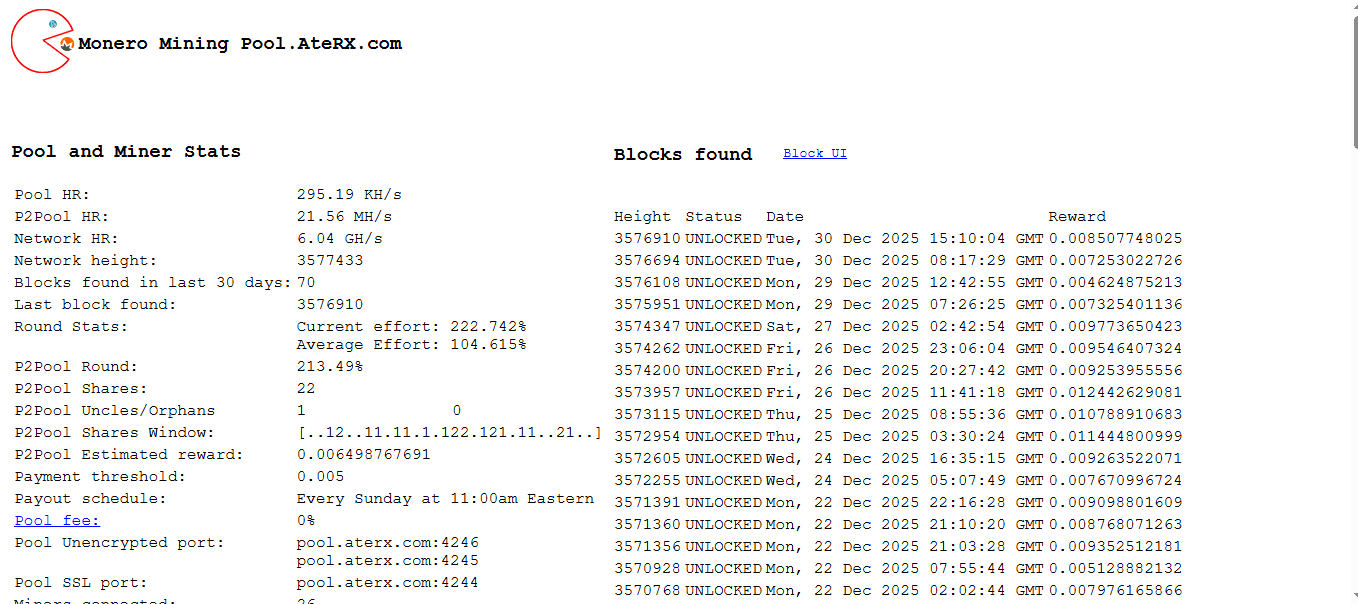

Pool.Aterx.com

Pool.Aterx.com Is a Niche Decentralized Option. Image via Pool.Aterx.com

Pool.Aterx.com Is a Niche Decentralized Option. Image via Pool.Aterx.com This Canadian-operated pool mines directly onto the P2Pool sidechain, offering a user-friendly gateway to trustless mining without running your own full P2Pool node, ideal for beginners testing deco without complexity.

- Hash Rate: Small niche (1-5 MH/s est., <0.1% network), as a P2Pool tributary; contributes to P2Pool's overall 400+ MH/s decentralized hashrate.

- Fees: 0% base (inherits P2Pool's model), potentially minor tx fees; fully non-custodial as funds route peer-to-peer.

- Minimum Payout: -0.00027 XMR (P2Pool standard), direct to wallet every few hours via local PPLNS—no operator hold.

- Payment Method: P2Pool PPLNS (merge-mined with Monero blockchain); uncle blocks counted, advanced mempool for optimal rewards.

- Server Locations: Canada-primary (NA-focused stratum), but P2P propagation global; low latency for Americas/EU.

- Uptime & Reliability: Highly stable via P2Pool failover (multi-node support), no central server risk; GitHub-backed (SChernykh/p2pool) with 1-second block times possible. Permissionless and trustless by design.

- Who This Pool Is Best For: Decentralization newcomers avoiding full node setup, low-hashrate users wanting P2Pool benefits (regular payouts, 0% fees, no 51% risk), or NA-based privacy advocates.

How to Choose the Right Monero Mining Pool

Steps To Choose the Right Monero Mining Pool. Image via Shutterstock

Steps To Choose the Right Monero Mining Pool. Image via ShutterstockSelecting the optimal pool involves more than just looking at the fee percentage. The most important factors are variance, decentralization, latency, and the payment model.

Pool Fees vs Long-Term Earnings

Fees add up quietly. If you earn about 0.9 XMR per month (roughly $411 at the same price assumptions), a 0.6% fee costs about $2.47. A 1% fee costs about $4.11. That gap looks small until you zoom out, where it becomes roughly $20 per year.

If you mine at a higher volume (more than 0.1 XMR per day), keeping fees under 0.9% starts to matter a lot. If you want long-term value without trusting a pool operator, P2Pool stands out because it charges zero pool fee.

Pool Size, Variance, and Decentralization

- Big pools reduce variance. If a pool controls more than half of the network's hashrate, you can expect payouts daily or every few days. The downside is the centralization risk. If too much hashrate sits in one place, the network becomes easier to influence or attack.

- Small pools improve decentralization, but payouts become unpredictable. With pools under 1% share, it’s normal to go weeks without a meaningful payout cycle.

A practical middle ground is pools that sit around 5% to 20% of network share. They usually strike a good balance between frequent payouts and healthier network distribution. P2Pool pushes decentralization furthest by spreading mining across thousands of small participants rather than concentrating it under one operator.

Server Location and Latency

Ping affects how many of your shares are accepted. If your ping is above 50 milliseconds, stale shares can rise and your effective hashrate can drop by roughly 10% to 20%.

For miners in higher latency regions, choosing pools with nearby servers matters. For example, miners in India usually benefit from pools with Asia or EU endpoints, such as HeroMiners or Skypool, to keep latency low.

Payment Methods Explained

The payment method decides how smooth your payouts feel and how much risk you absorb.

- PPLNS (Pay Per Last N Shares): The most common model. You get paid based on the shares you submitted over a recent window, after the pool finds a block. Fees are typically low, and results even out if you mine consistently for long periods.

- PPS (Pay Per Share): You’re paid for every share immediately, even if the pool has a bad luck streak. This removes variance for you, but pools charge more to cover that risk. It suits beginners, part-time miners, and anyone who wants predictable earnings.

- PROP (Proportional): Rewards are split based on how much you contributed during the current round. This can swing wildly depending on luck, so it fits miners who are fine with bigger variance and occasional lucky runs.

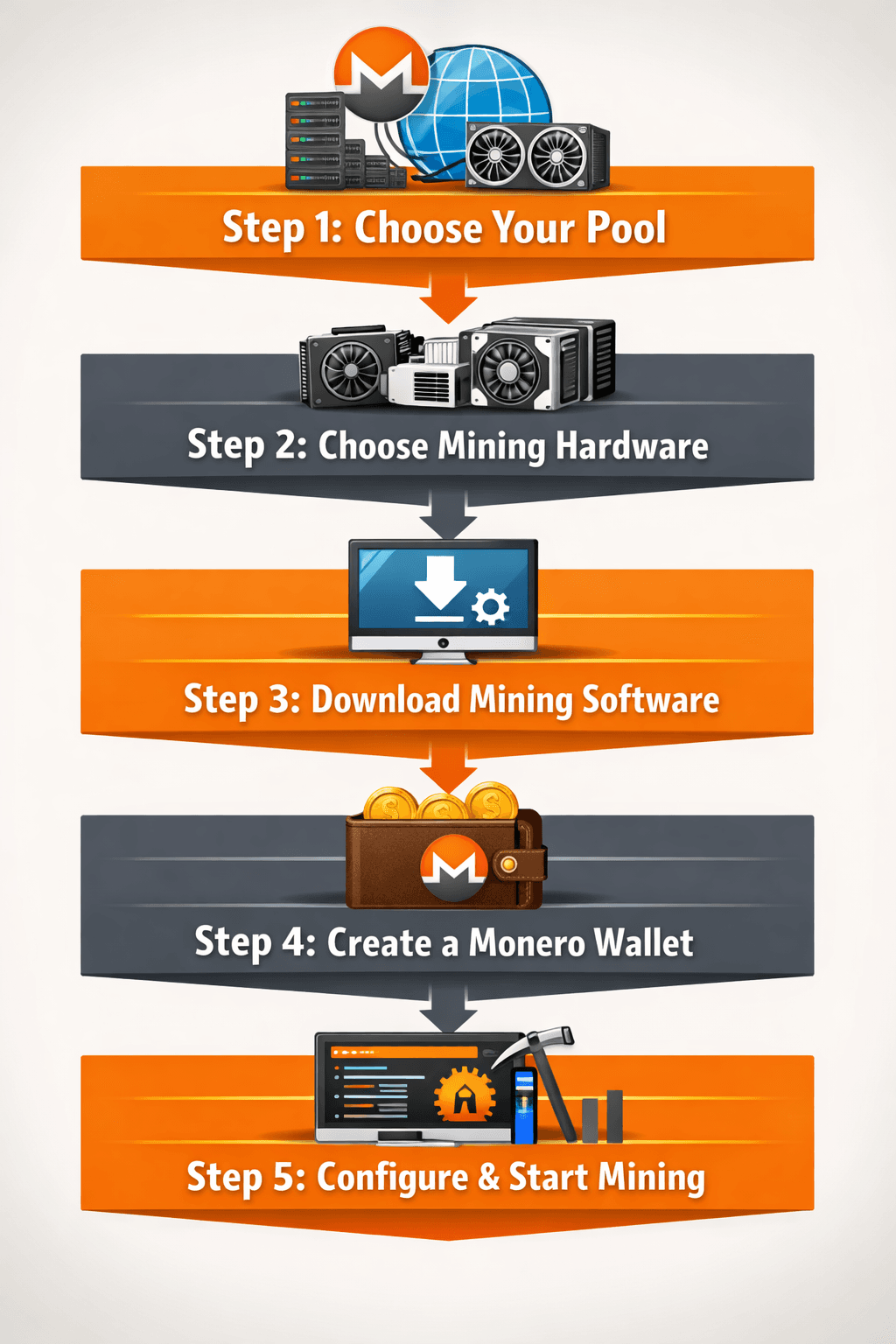

How to Join a Monero Mining Pool (Step-by-Step)

Step by Step Flow of Joining a Monero Mining Pool

Step by Step Flow of Joining a Monero Mining PoolThe process for joining most Monero pools is straightforward, primarily requiring a CPU and the correct mining software.

Step 1: Choose Your Pool

Use the comparison table and pool reviews above to select a pool based on your priorities (e.g., SupportXMR for stability, P2Pool for privacy). You can verify live stats at miningpoolstats.stream/monero.

Step 2: Choose Mining Hardware

Focus on CPUs, as they dominate RandomX. AMD Ryzen and EPYC chips typically yield more hashrate per Watt than Intel. GPUs are generally unviable.

Step 3: Download Mining Software

The industry standard is XMRig (open-source and 5%-10% faster). It supports Windows, Linux, Mac, and ARM. You can download it from xmrig.com/download.

Step 4: Create a Monero Wallet

You need a secure Monero wallet to receive payouts.

- Official GUI/CLI: Offers maximum security but requires a full node sync (which can take days). Available at getmonero.org/downloads.

- Cake Wallet/Feather Wallet: Popular, lightweight mobile/desktop options with built-in features like subaddresses and fiat ramps.

- Hardware Wallets: Ledger Nano S/X or Trezor Model T offer the best cold storage security for your mined XMR.

Step 5: Configure and Start Mining

- Unpack the Software: Unzip or extract the files from your XMRig download.

- Open the Settings: Find and open the config.json file inside the XMRig folder using a text editor (like Notepad or VS Code).

- Edit the Pool Details: Look for the part that says "pools": [...]. In this section, you need to make two crucial changes:

- Change the URL: Replace "pool.supportxmr.com:3333" with the specific server address (called the "stratum address") of the mining pool you chose.

- Add Your Wallet: Replace the placeholder Monero wallet address ("44tLjmXrQNrWJ5NBsEj2R77ZBEgDa3fY6...YOUR_WALLET") with your actual, full Monero wallet address.

- Save and Run: Save the changes to the config.json file. Then, run the mining program:

- On Windows, double-click the xmrig.exe file.

- On Linux or Mac, run the command ./xmrig.

- Check Your Progress: Go to your chosen pool's website (e.g., supportxmr.com). Enter your Monero wallet address in their search or stats page to monitor your hashrate and earnings.

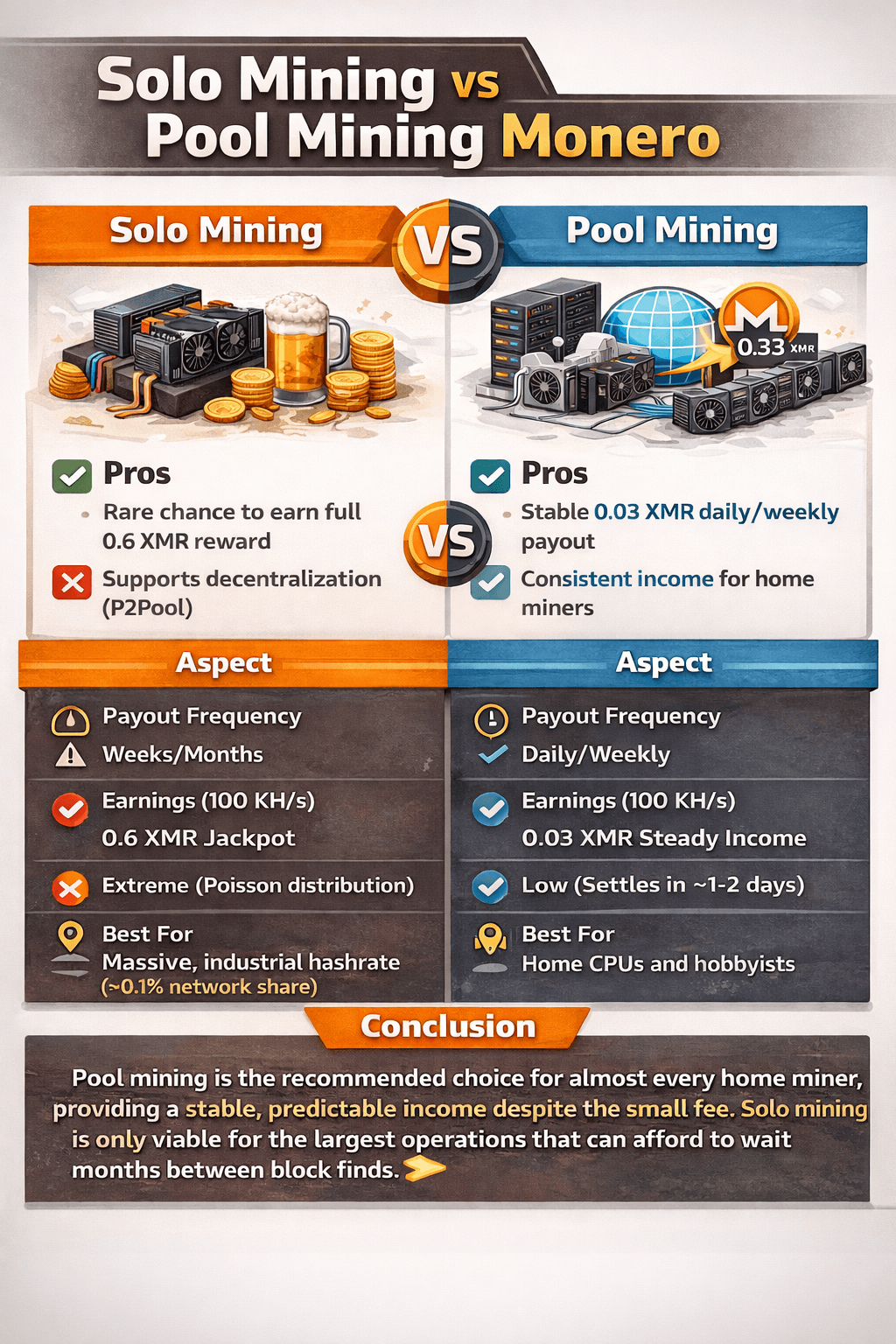

Solo Mining vs Pool Mining Monero

A Comaprison of Solo vs Pool Mining Monero

A Comaprison of Solo vs Pool Mining MoneroThe decision between solo and pool mining for Monero (XMR) is a fundamental trade-off between maximizing potential reward and securing a predictable income. For the vast majority of home miners, a pool is the only viable option due to Monero's current network difficulty.

Pool Mining Pros and Cons

Pool mining involves grouping your hashrate with thousands of other miners to find blocks more frequently. The pool then distributes the block reward proportionally to each member's contributed shares.

| Aspect | Pros | Cons |

|---|---|---|

| Payout Frequency | Daily/weekly (highly stable) | Pays a fraction of the block reward |

| Variance | Low (settles in1-2 days) | Subject to pool fees $0%–1.0%) |

| Ideal For | Home CPUs and hobbyists (ideal for 99% of users) | Potential for pool to grow too large (50%) |

Pool mining is recommended for 99% of users, as it converts the highly erratic, Poisson-distributed block finds into a steady, reliable stream of XMR income, even after factoring in a small fee.

Solo Mining Pros and Cons

Solo mining means running your miner on your own and attempting to find a block by yourself. If successful, you receive the entire 0.6 XMR block reward (plus transaction fees).

| Aspect | Pros | Cons |

|---|---|---|

| Payout Frequency | Blocks found every weeks/months (highly erratic) | Extremely high variance (Poisson distribution) |

| Earnings | 0.6 XMR jackpot (rare chance) | Can go months without a payout |

| Variance | Extreme (Poisson distribution) | Requires significant hashrate and patience |

| Best For | Testnet practice, or massive, industrial hashrate (>0.1% network share) | Only viable for the largest operations |

The key drawback is variance: given the current network hashrate ($6.8 GH/s), a powerful 100 KH/s rig could expect to go weeks or months between block finds, making cash flow highly unpredictable.

When Solo Mining Makes Sense (Rare Cases)

Solo mining is generally not viable for home users, but it becomes a practical option in two specific scenarios:

- Massive Industrial Hashpower: For large-scale farms that can contribute over 0.1% of the total network hashrate, the time between block finds shrinks from months to days, making the full block reward worth the risk.

- Decentralization Purists (P2Pool): The P2Pool protocol acts as a hybrid. It offers the full-reward benefit of solo mining but works by chaining together thousands of micro-miners into a decentralized structure. It is a solo mining variant that is viable for smaller miners who want to support network decentralization.

The choice between pool and solo mining is a trade-off between variance and profit share.

| Aspect | Solo Mining | Pool Mining |

|---|---|---|

| Payout Frequency | Blocks found every weeks/months (highly erratic) | Daily/weekly (highly stable) |

| Earnings (100 KH/s) | 0.6 XMR jackpot (rare chance) | 0.03 XMR steady, reliable income |

| Variance | Extreme (Poisson distribution) | Low (settles in 1-2 days) |

| Best For | Testnet practice, or massive, industrial hashpower {>0.1%}network share) | Home CPUs and hobbyists (ideal for 99% of users) |

Conclusion: Pool mining is the recommended choice for almost every home miner, providing a stable, predictable income despite the small fee. Solo mining is only viable for the largest operations that can afford to wait months between block finds.

Monero's ASIC Resistance and Network Security

Monero’s ASIC Resistance and Network Security. Image via Shutterstock

Monero’s ASIC Resistance and Network Security. Image via Shutterstock The longevity of Monero as a home-minable coin is directly tied to its revolutionary defense against industrial mining hardware. This section details the technological breakthrough that protects the network and explains why this security model is uniquely beneficial for the individual miner.

RandomX and ASIC Resistance

The implementation of RandomX in 2019 was a monumental achievement in ASIC resistance. It mandates a minimum of 2GB L3 cache/RAM per thread, utilizes a Just-In-Time (JIT) compiler to generate random virtual machine code, and exclusively uses CPU-favored operations. This design effectively creates a mining environment where general-purpose CPUs are the most efficient hardware, causing specialized ASIC development to fail and GPUs to be non-competitive due to their memory bandwidth bottlenecks.

Why This Matters for Home Miners

This democratizes access to Monero mining. It ensures that the network is not dominated by multi-million dollar farms, allowing home users with standard desktop CPUs to remain 80%-90% efficient. This directly ties back to both your profitability and the core value of the Monero network: maximum decentralization and security.

Best Monero Wallets for Mining Rewards

After mining, you need a secure place to store your Monero. We recommend the following mix of hardware and software options:

- Official GUI/CLI: The most secure option, requiring a full node sync. Best for long-term holding.

- Ledger Nano S/X: Hardware wallet. The gold standard for cold storage; excellent for securing large amounts of mined XMR.

- Trezor Model T: Hardware wallet. Also excellent for cold storage, featuring Shamir backup for enhanced recovery.

- Cake Wallet: Mobile and desktop. Highly intuitive, offering integrated fiat ramps and coin swaps.

- Feather Wallet: Lightweight desktop. Focuses on privacy features like Tor and RPC support.

Security Considerations for Monero Miners

Miners Must follow Strict Security Practices. Image via Shutterstock

Miners Must follow Strict Security Practices. Image via ShutterstockMinimizing risk in Monero mining extends beyond hardware to encompass pool operations and secure coin storage. This section outlines the critical security best practices you must follow, from choosing a non-custodial pool to securing your mined XMR with cold storage.

Pool Risks

Always stick to the top 10 most reliable pools listed in our comparison. Only use non-custodial pools where the pool submits shares but does not hold your funds. Your funds are always paid directly to your wallet address. Never use a "fly-by-night" pool or one with suspicious security practices.

Wallet Security

Wallet security is the miner’s primary responsibility. Follow these best practices:

- Generate your seed offline.

- Store your 25-word seed on a physical medium (metal or encrypted offline storage).

- Use subaddresses for each pool you mine to, as this enhances privacy and obscures the link between your mining activity and your main wallet balance.

- Use hardware wallets (cold storage) for any mined XMR over 1 XMR.

Past Incidents

The Monero community has faced minor incidents, such as a 2018 MyMonero user-side phishing breach and a 2022 pool attack.

The lesson is simple: never share your seed, use two-factor authentication (2FA) where available, and always diversify your pool choice.

Final Verdict: Are Monero Mining Pools Worth It in 2026?

Monero mining is worth it in 2026, primarily as a hobbyist venture, a supplemental income source, or a method for individuals to support network decentralization. The best approach is undeniably through a mining pool.

Clear Recommendation Paths:

- For Beginners & Stability: SupportXMR (0.6% fee) provides the lowest variance and most frequent payouts due to its network size.

- For Privacy Maximalists: P2Pool (0% fee) is the only true decentralized option, minimizing trust requirements at the cost of requiring a local node.

- For Low-Power Miners: C3Pool (0% fee) or MoneroOcean (0% fee) offers good efficiency and low fees to maximize every hash you contribute.