There are a lot of different cryptocurrencies out there that you can mine. Some are easier to mine, and some are more profitable, but all of them get you started in the world of blockchain and cryptocurrencies.

The coin and mining pools I want to look at today is Electroneum (ETN).

Electroneum is extremely interesting from a mining perspective because it was designed to be mineable using little more than a mobile phone. With over 2 billion mobile phones in use, and that number growing rapidly, it’s a very powerful proposition for the advancement of cryptocurrency adoption by the average person.

It’s a privacy based coin similar to Monero (XMR), and it runs on the CryptoNight algorithm for solid security and initially to keep it ASIC resistant. I mean it really isn’t beneficial to those mining with a mobile phone if ASIC rigs are also allowed to mine.

So, when the blockchain forked back in May 2018 to keep itself ASIC resistant following the release of CryptoNight ASIC miners it seemed like a good thing. It turned out not to be however, as the network saw too few GPU miners to remain secure. That led to the reintroduction of ASIC miners in July 2018.

Solo Mining or Pool Mining Electroneum

Obviously with the reintroduction of ASIC miners solo mining for individual users becomes somewhat out of the question. I mean, you could do it if you’re feeling lucky, or if you don’t mind not finding a block for months and months. It’s really just better to take the pool mining route and ensure you’ll get some coins for your troubles.

Pool mining combines your resources with that of other miners, in some cases it could even be thousands of miners, to make it easier to find blocks and collect mining rewards. The downside of the mining pool is that you have to split the block reward with all the others mining in the pool. This means much smaller rewards for you, but at far more regular intervals, perhaps as often as every day.

And surprisingly given the reintroduction of ASIC mining to Electroneum, when I checked at Whattomine.com it looks as if you can be profitable mining with GPUs, if you’ve got a pretty powerful rig, preferably with multiple GPUs.

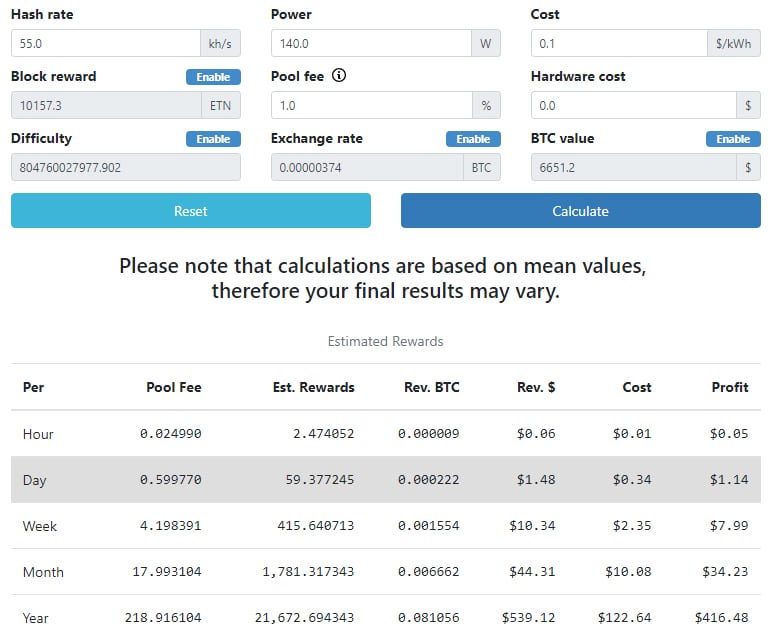

Estimated returns from Electroneum Mining. Source: What to Mine

Estimated returns from Electroneum Mining. Source: What to MineSo, there’s no need to avoid this coin because of ASIC mining. You can be profitable already, and with the price of Electroneum on the rise you could find yourself sitting on even more valuable coins than you thought.

Below I’ll go through several Electroneum pools to see what they offer and how they stand out from their peers. But first, I want to have a brief explanation of what you should be looking for when choosing an Electroneum mining pool, and in fact any mining pool for any coin.

Finding an Electroneum Mining Pool

If you’ve read any of our previous articles about mining other coins you know that the features to look for in mining pools are very similar from coin to coin. With that in mind I’ll give you the shortened version, but if you need more details about what features to look for in a mining pool you can check out the Bitcoin Gold mining pool piece for a more detailed description of each feature.

Fees: The average mining pool will have fees around the 1% level, with fees topping out at 3% at some pools, while dipping to 0% at others. Obviously if you’re saving on fees you’re making more for yourself.

Server Location(s): The closer the servers are to you, the better your hash power will be, and the more profitable your mining efforts will be. While it’s possible to mine from servers located on another continent, it’s best if you stick to pools located in the same geographic region in which you’re located, whether that’s Asia, Europe or North America.

Trustworthy: The more established pools are generally considered trustworthy, but if you’re considering a new pool do some research to see if the community has found the pool to be trustworthy in properly crediting your account and in paying on time.

Payout Scheme: There are various payout schemes, with some more geared towards luck, and others based strictly on even sharing of rewards. Which you choose is a personal preference because over the long term it all evens out.

Pool Uptime: You should look for a pool with uptime as close to 100% as possible.

Minimum Payout: The lower this is the better, because it means you’ll get paid sooner. There’s nothing worse than having to mine for weeks and weeks before getting paid.

Pool Hash Power: This is subjective and you’ll have to make your own decision, but in general it’s better for the network if you choose a pool that controls just 25% or less of the network hash power. This helps decentralization and network security. You can certainly mine with the largest pools if you like, but its better for the network if you choose a smaller pool.

Best ETN Mining Pools

Now that the basics are out of the way let’s have a look at the more popular Electroneum mining pools to get an idea of which might be the best fit for you.

F2Pool

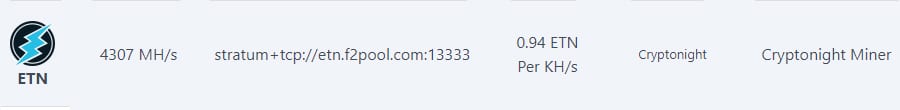

I wouldn’t recommend F2pool as an Electroneum mining pool, simply because they currently control nearly 70% of the network hashrate. They are a well known pool, and based on their history its almost certain that all of this hash power is coming from ASIC units.

F2Pool Electroneum Pool Statistics

F2Pool Electroneum Pool StatisticsThey also have the highest fee you’ll find for Electroneum pool mining at 3%. And they require registration and personal information to be able to mine, which is a bit against the privacy-features of a coin such as Electroneum.

Poolin

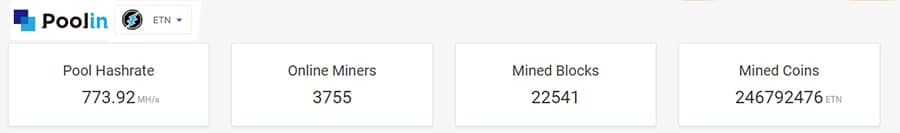

Poolin is the second largest Electroneum pool, with roughly 12% of the network hash power. Like F2pool it is based in China, and it also has a focus on ASIC rig mining. It also has a high mining fee of 2%. Payments are made once daily and there’s a minimum 100 ETN threshold for payments.

Poolin ETN Pool Key Figures

Poolin ETN Pool Key FiguresThey recently introduced California based servers, so they now have a global base of servers and you can mine with them from anywhere in the world. They are interesting in their use of a native token, the PIN, which is distributed to miners via airdrop on a daily basis.

Spacepools

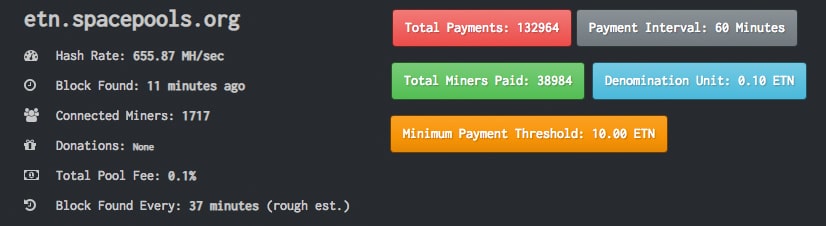

Spacepools is one of the oldest Electroneum mining pools and it was previously hosted at http://pool.electroneum.space. It isn’t the largest pool by far, but it also isn’t the smallest, with well over 1,000 miners controlling a bit less than 10% of the network hash rate. This has them finding a block roughly every hour.

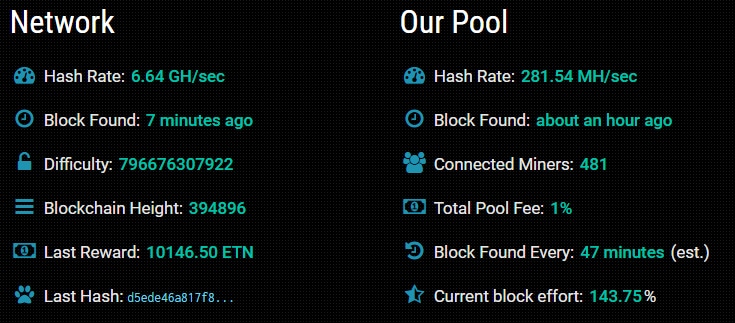

Spacepool Electroneum statistics and key Figures

Spacepool Electroneum statistics and key FiguresOne big benefit of mining with Spacepools is the ultra-low 0.1% mining fee. They also feature a 100 ETN minimum payout and global servers.

Fairhash

Fairhash – This is a Russian based pool, but has global servers. Like Spacepools above they have just under 10% of the network hash rate, and tend to find a block roughly every hour or so.

Electroneum Market Stats and Fairhash ETN Pool Numbers

Electroneum Market Stats and Fairhash ETN Pool NumbersThe mining fee is an average 1%, and they support mining directly to an exchange wallet, which is convenient if you’re planning on simply selling your mining profits.

Nanopool

Nanopool – Nanopool has mining pools for several privacy focused coins, and Electroneum is just one of them. They also control roughly 10% of the network hash rate, but are a bit more expensive as they charge a 2% mining fee.

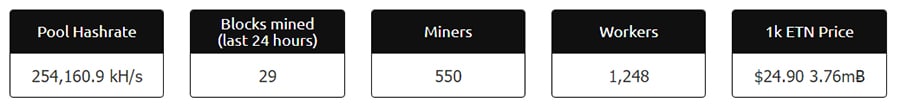

Headline Numbers at Nanopool's ETN Pool

Headline Numbers at Nanopool's ETN PoolOne nice feature at Nanopool is a quick start guide that should have you up and mining in just minutes. It’s a good choice from a trust and decentralization standpoint.

Other Electroneum Pools

There are other pools outside these five, but they have very few miners, and the hashrates are very low and can be quite choppy as well. You could try some, such as Easyhash, Miningpoolhub, Superpools and Hashvault to keep the hash power more decentralized, but understand that you might have to wait longer to find blocks and for payouts.

Conclusion

Choosing a good altcoin to mine can be confusing with so many options, but you could certainly do worse than choosing Electroneum. Despite allowing ASIC mining it remains a profitable coin if you have a high end GPU.

Similarly, given that it can be mined with nothing more than a smart phone it’s accessible to billions of people across the globe. To be sure you won’t earn more than a penny or two a day with a smart phone, but in some areas of the world that’s all that’s needed to make a difference in someone’s life.

The price of Electroneum has also seen a nice boost higher in September and October 2018, despite the overall cryptocurrency markets remaining weak. This could be a sign of more good things to come, and having some Electroneum in your wallet if it rallies in 2019 could be a smart move.

I would caution to avoid F2pool as an Electroneum mining pool, but any of the others I covered would be good choices to make some ETN for yourself, while also helping to strengthen the network.