At press time, 99Bitcoins’ infamous “Bitcoin Obituary” has no less than 186 Bitcoin obituaries.

These are light-hearted and sarcastic obituaries, of course, only referring to incidents in which high-profile pundits claimed Bitcoin had died.

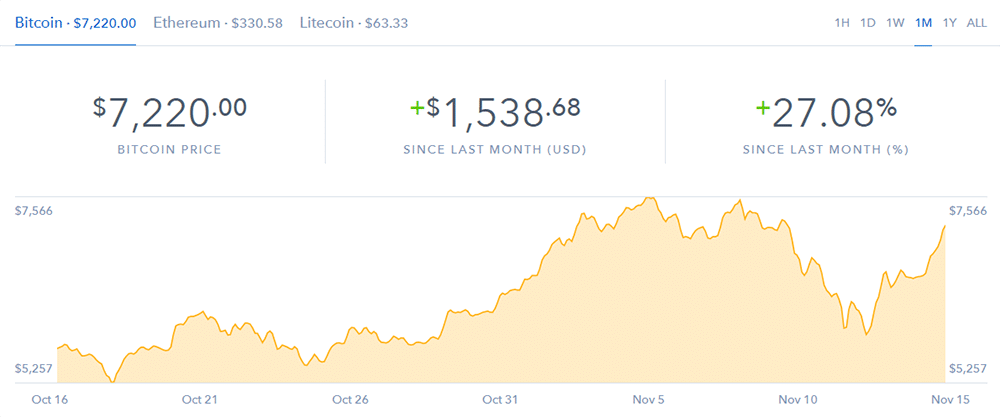

The tongue-in-cheek joke is that these pundits couldn’t have been more wrong. Bitcoin—even despite the SegWit2x cancellation drama and the scaling wars—is currently hovering around an impressive $7,200, which is a price point not far from the coin’s all-time high of $7566.

Will BTC hit $8k soon? – Image via Coinbase

So, Bitcoin is clearly not dead, and it’ll take a lot more than some acute weekend sparring with Bitcoin Cash for Bitcoin to really go down.

But it’s worth it to see just how wrong others were and are being. It’s worth it to note the “Bitcoin Obituaries” of naysayers so us enthusiasts can fine-tune our own perspectives in the crypto space, knowing that we ourselves must be less inflexible to capitalize.

Let’s take a look at some of the more provocative Bitcoin “deaths,” then, to refresh our perspectives.

Bitcoin’s very first “death”

Back in 2010 when Bitcoin was only a fledgling project, a publication by the name of The Underground Economist earned the distinction of being 99Bitcoins’ first Bitcoin obituary writer.

When BTC was still hovering around $0.23 cents, The Underground Economist wrote a scathing treatise titled “Why Bitcoin can’t be a currency.”

In it, the author declared Bitcoin “will remain a novelty forever or it will transition from novelty status to dead faster than you can blink.”

CNN op-ed projects Bitcoin’s “disintegration”

In 2014, a CNN editorial was published entitled “Where did Bitcoin go wrong?” when BTC was still sitting at approximately $330.

In the piece, the writer went as far as to say that the Cuban Peso was superior to Bitcoin:

[Start block quote] “Bitcoin is not [the future]. It is a step along the way and will eventually disintegrate … As a currency [Bitcoin] is almost negligible against anything. It can’t stand toe-to-toe with the Cuban Peso … With Bitcoin the pretend currency, what you see is not what you get.” [End]

Think the author feels the same today?

Jamie Dimon says Bitcoin can’t last

JPMorgan CEO Jamie Dimon is now a known Bitcoin-hater, but one of his earliest comments against the #1 cryptocurrency came back in 2015 when the cryptocoin was consolidating at $395.

In a talk given at the Fortune Global Forum, Dimon said government regulations would kill Bitcoin and anything like it:

“This is my personal opinion, there will be no real, non-controlled currency in the world. There is no government that’s going to put up with it for long … there will be no currency that gets around government controls.”

LinkedIn post says BTC bursts on Dec. 12, 2016

In a column for LinkedIn, cloud architect Jim Kram called Bitcoin a “fundamentally flawed virtual currency,” going on to say that “Bitcoin is a bubble that like Tulip, South Sea, Dot.com or Subprime will burst … Bitcoin was a great experiment that provided a lot of useful learning.”

Well, Kram may feel differently now, but we’re certainly comfortable in saying that Bitcoin’s definitely passed the experiment stage by now.

Forbes says China “crushed” Bitcoin

When China banned crypto exchanges and ICOs just a few weeks ago, the crypto space was shocked.

Forbes went a little overboard, though, describing China’s move as a “crushing” blow to Bitcoin – even though BTC rebounded stronger than ever in the days after the bans began:

“Bitcoin’s buzz is gone … It was crushed by the heavy-handed intervention of the Chinese government, which is cooling off investor enthusiasm for the digital currency.”

Bitcoin’s certainly held tough

Through thick and thin, Bitcoin’s held tough through it all so far.

Could BTC be brought to its knees one day? It’s possible—anything’s possible.

Yet short of an inscrutable and catastrophic black-swan event that hits the space unexpectedly, it’s not clear what could dethrone Bitcoin at this point.

It surely wont’ surrender it’s #1 market capitalization position to Ethereum or Bitcoin Cash without one hell of a fight.

In the meantime, Bitcoin’s naysayers will have plenty of time to reconsider their positions on the bellwether cryptocurrency.

Featured Image via Fotolia