Cardano, the sixth-largest cryptocurrency by market cap, had the highest amount of developer activity in 2021 out of any other digital asset, according to a new report.

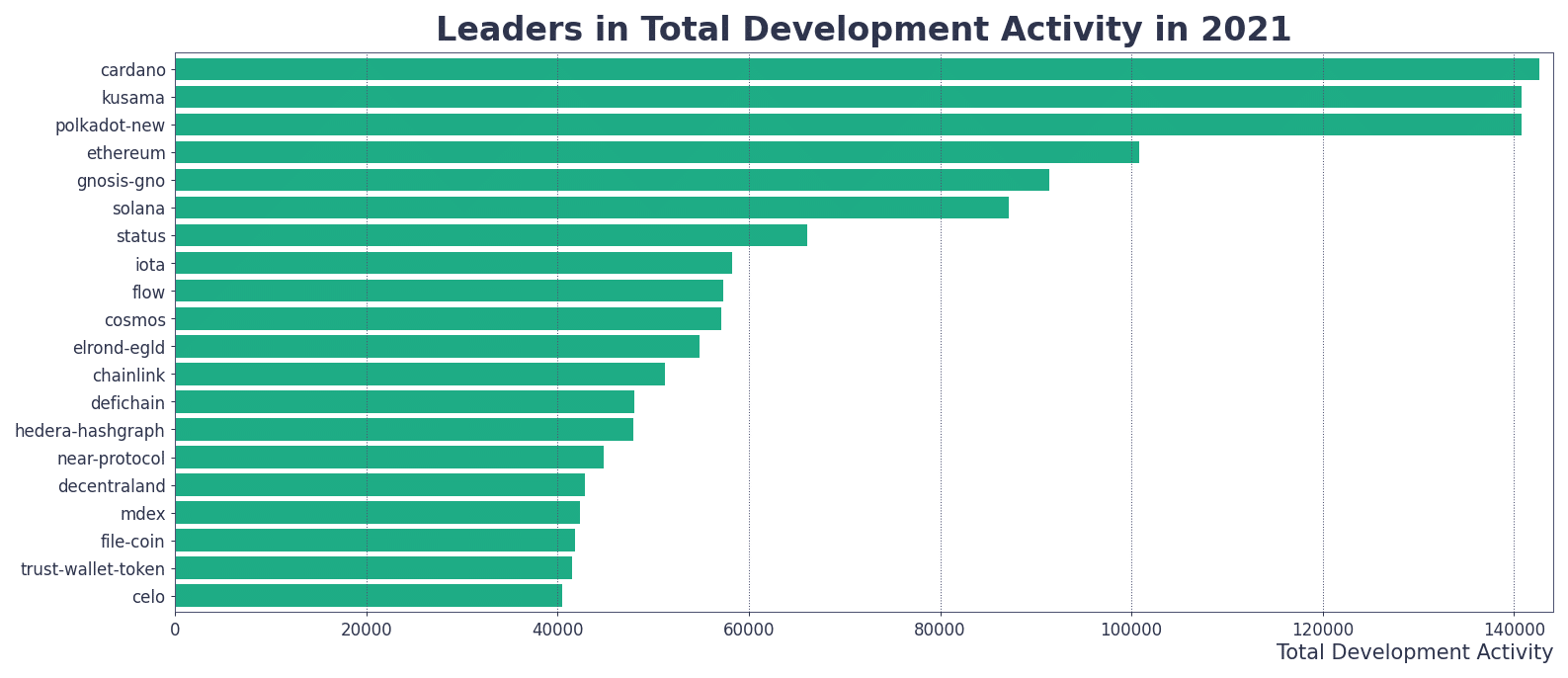

Based on data in a new report from crypto analytics company Santiment, Cardano led the markets last year with the amount of development activity, closely followed by Kusama (KSM) and Polkadot (DOT).

“As evident, the top 3 projects - Cardano, Kusama and Polkadot are virtually neck and neck, followed by Ethereum at #4 and Gnosis at #5. For the first time on one of these end-of-year development reports, we also have an NFT-centric project in Flow to round out the top 10, highlighting the meteoric growth of the NFT sector in the last year."

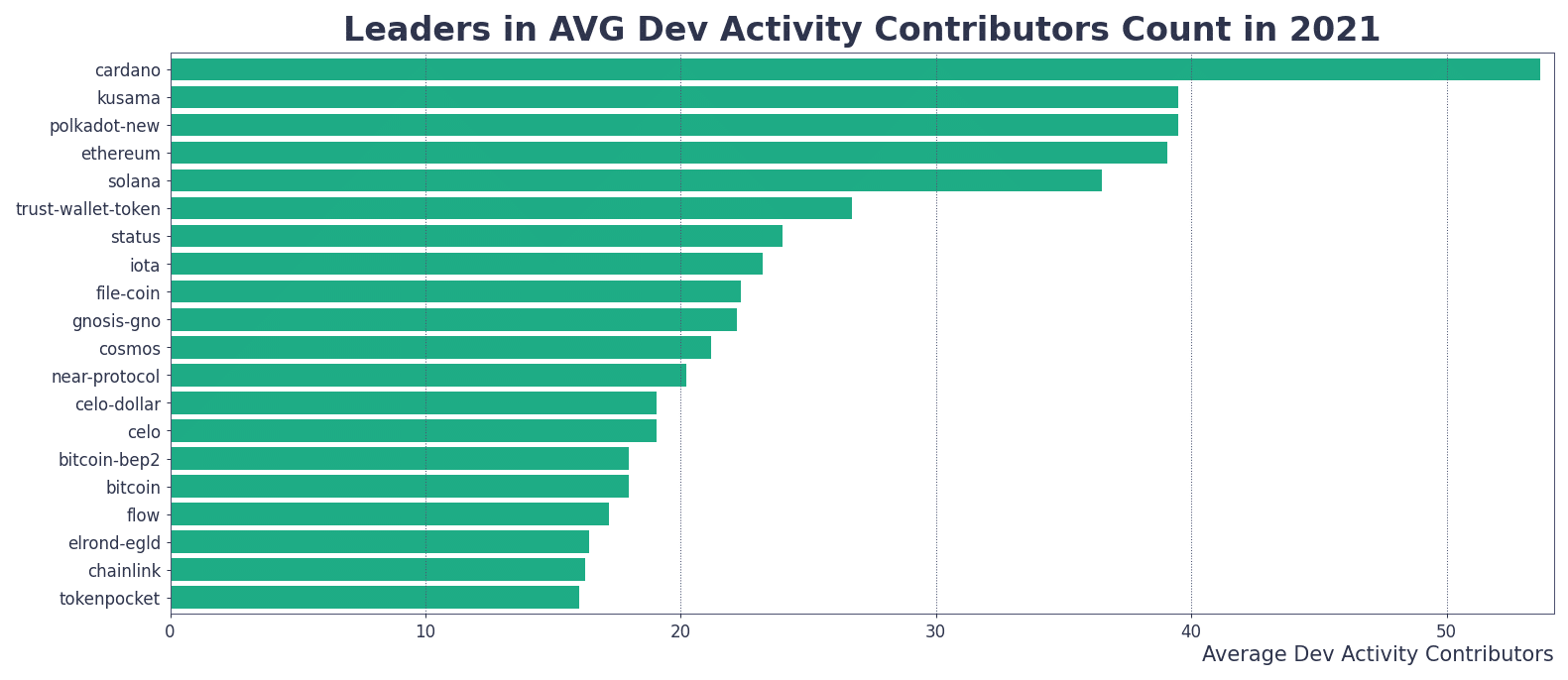

Santiment also breaks down Cardano’s development activity by looking at the average daily number of GitHub contributions. By this metric, the firm says Cardano’s lead isn’t even close.

“While the top positions remain unchanged, Cardano now towers above the rest, with an average of 53 daily contributors to their Github repo throughout the last year. The amount of active contributors also sees a few interesting changes within the top 10, which now includes the Trust Wallet Token and Filecoin, to name a few.”

In a recent tweet, Cardano creator Charles Hoskinson addressed the statistics and attributed them to his project’s focus on being open source and focused on "hard problems."

“There’s a reason we’re number one in Github commits it’s not that some person sitting in a warehouse somewhere just randomly clicking a button it’s because there are so many people so much stuff so much effort that’s going on... The work we do is beneficial to everyone it’s patent-free it’s open-source and we as a community are solving the hard problems.”

Santiment also looked at development activity within the decentralized finance (DeFi) sector. Based on the firm’s data, DeFiChain, followed by Mdex and SifChain claim the top three spots for most amount of development activity within the DeFi segment.