ARK Invest has created a whitepaper designed to help investors grasp Bitcoin’s on-chain data.

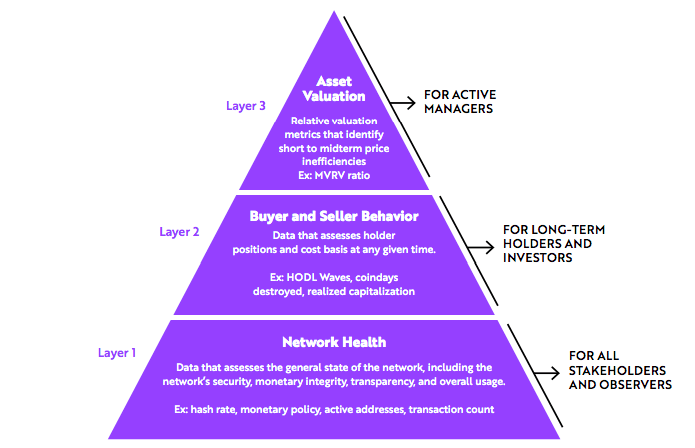

The paper, authored by ARK analyst Yassine Elmandjra and Glassnode researcher David Puell, breaks Bitcoin’s chain into three main categories: Network health, buyer and seller behavior, and asset valuation.

ARK Invest

ARK Invest

As per the paper, the bottom layer assesses things like network security, monetary integrity, transparency, and usage. The middle layer looks at wallet addresses to look at things like each holder’s positions and cost basis, while the top later leverages off the two previous layers to provide relative valuation metrics that identify short-term inefficiencies in Bitcoin’s price.

ARK gives three reasons why Bitcoin is the most auditable, open, and transparent blockchains around.

1. Simple Accounting System: In contrast to traditional account-based accounting

systems. Bitcoin’s UTXO-based accounting system makes tracking supply and auditing

monetary policy simple.

2. Verifiable Code: The implementation of Bitcoin’s protocol lives in code that has been

scrutinized more than any other open-source software code.

3. Efficient Nodes: Bitcoin nodes, or volunteer computers running software to verify

the network’s integrity, are much more cost-efficient than alternative cryptocurrency

network nodes.

Other key metrics that the paper focuses on include hash rate, miner revenue, address supply distribution, coin time, HODL waves and more.

ARK says that because Bitcoin doesn’t resemble a traditional financial asset, most investors have trouble analyzing it fundamentally, not realizing that conventional analytical frameworks aren’t suitable.

“The Bitcoin blockchain offers a unique set of tools that investors can leverage to assess its fundamentals. In the same way that a government statistical agency publishes data about a country’s population and economy, or a public company publishes quarterly financial statements disclosing growth rates and earnings, Bitcoin provides a real-time, global ledger that publishes data about the network’s activity and inner economics.

Without central control, Bitcoin’s blockchain provides open-source data, its integrity a function of the network’s transparency. In our view, investors increasingly will appreciate bitcoin’s investment merits through the lens of a completely new framework: on-chain data.”

ARK CEO Cathie Wood predicted in September that Bitcoin would reach a price somewhere around $500,000 within 5 years. She remains a big supporter of BTC and rejects the idea of BTC becoming archaic or out of date. With that said, the hedge fund manager is also bullish on Ethereum and the decentralized finance (DeFi) space.

"Ether, however, is seeing an explosion in developer activity thanks to NFTs and DeFi...I'm fascinated with what's going on in DeFi, which is collapsing the cost of the infrastructure for financial services in a way that I know that the traditional financial industry does not appreciate right now."