Research from the International Monetary Fund (IMF) notes that crypto assets have emerged from the fringe to become intertwined with the traditional system, posing new risks and questions.

In its report titled “Cryptic Connections: Spillovers between Crypto and Equity Markets,” the IMF says that the widespread adoption of cryptocurrencies could pose financial stability risks given their volatility, high amounts of leverage, and financial institutions increasing direct and indirect exposure to them

“Because of the relatively unregulated nature of the crypto ecosystem, any significant disruption to financial conditions driven by crypto price volatility could potentially be largely outside the control of central banks and regulatory authorities.”

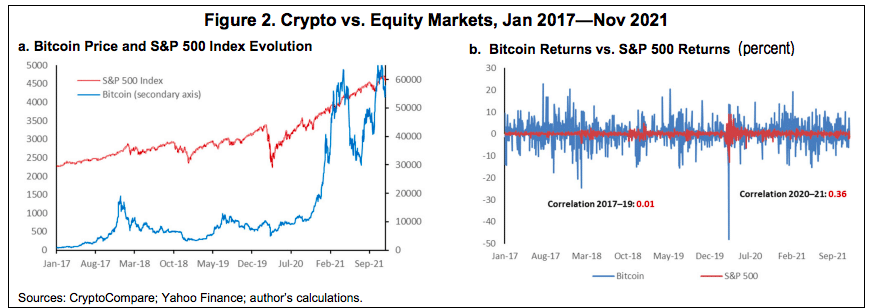

The IMF’s research finds an increasing interconnectedness between crypto and traditional markets. For example, the organization finds that the correlation between Bitcoin’s price volatility and the S&P 500 has increased by four-fold. Similarly, Bitcoin’s contribution to the variation in the S&P’s volatility is estimated to have gone up by 16%.

“For returns, the pattern is similar, with a significant increase in the correlation between Bitcoin and S&P 500 returns, as well as in the spillovers from Bitcoin returns to S&P 500 returns.”

IMF

IMF

The financial institution also brings up the classic argument against Tether (USDT) in regards to whether or not its reserves are sufficiently backed by dollars.

“While it is interesting that stablecoins such as Tether could play a risk diversification role, other potential risks exist, including that they may not be fully backed by reserves in certain times and the high observed failure rate of these digital currencies.”

The IMF suggests that the increased interconnectedness between crypto and traditional finance means that regulators can no longer afford to give the “light touch” strategy for overseeing them. The organization says that crypto regulations need to be strengthened in order to accommodate to the space’s rapid expansion into traditional markets.

The IMF’s research comes after a long history of giving “TradFi warnings” against crypto, including a report in October that highlighted things like stablecoins and decentralized finance (DeFi).

“Challenges posed by the crypto ecosystem include operational and financial integrity risks from crypto asset providers, investor protection risks for crypto assets and DeFi [decentralized finance], and inadequate reserves and disclosure for some stablecoins.”