Real Vision CEO and former Goldman Sachs executive thinks the nascent digital asset space will eventually turn out to be the biggest and fastest redistribution of wealth ever recorded.

Speaking in a new installment of Real Vision’s Adventures in Crypto, Pal says the wealth transfer that will occur through crypto will dwarf previous redistributions because of the sheer accessibility of the industry.

“We have never in all of human history been given an opportunity that an entire asset class, not a stock, not a single token, an entire asset class goes up 100x in value probably by the end of this decade…

This is I think the largest distribution of wealth, and the fastest distribution of wealth in all recorded history. Because, unlike most other wealth distributions, things like railroads, phones, even computers, and even the internet, they accrued to giant companies. This is accruing to tokens which anybody can participate in because you can own a fraction of the token.”

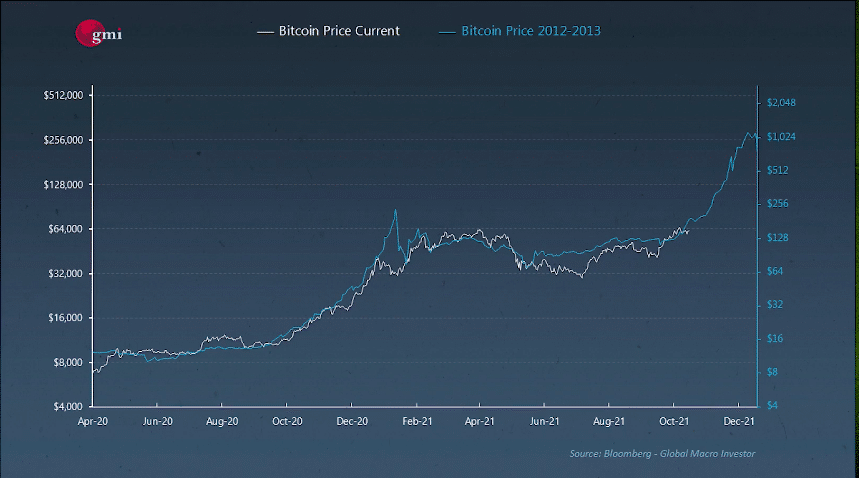

The Global Macro Investor founder has long been a proponent of using Metcalfe’s law, or network effects, to gauge where the crypto markets are headed. Metcalfe’s law, which stipulates that a network’s value is equal to its number of users, is what Pal thinks is the key component driving macro trends in most of the digital asset space. He also thinks it occurs in cyclical waves which ultimately start showing up in the price charts.

Global Macro Investor/Raoul Pal

Global Macro Investor/Raoul Pal

Pal says that right now, the “big disruptor” of the space that is permeating into other industries is the non-fungible token (NFT) sector, but that he thinks eventually it will be social tokens. He posits a reality where anyone can be involved in a certain community that has tokens, and if the community is vibrant and attractive, the value of the token goes up over time. This would, in Pal’s words, make it so your “cultural interests align with your investment interests align with your business interests align with all of your activities.”

He uses Chiliz (CHZ), which is the token that powers sports fintech platform socios.com as an example of where he thinks social tokens are headed.

“We’re seeing that with things like Chiliz, which is still pretty nascent, and its tokenization about sports clubs. Their token’s still not worth a lot of money considering… What does Manchester United have as a fan base? A billion people? And their token is probably worth $50 million. So it’s really early days as people are trying to understand how these tokenized communities can work, and how do you actually add value because it can’t be a cash grab, it’s got to be participation.”