Kavita Gupta, founder of the Delta Blockchain Fund and FINTECH.TV, believes crypto has officially entered a ‘winter’ which will last for a significant amount of time.

Speaking in an interview with Bloomberg Technology, Gupta said she thought it was “just the beginning of a crypto winter to be very honest” and was surprised at how many people believed Bitcoin would hold support at $30,000.

“I do expect it to go down to somewhere between $14k, $18k, maybe $22k as a stable point but remember we have seen this the past two times. This is nothing new right, every time it goes up to an all-time high there is a point when it comes down to and finds the new lower point as a base point to stand around.

I still feel that we have already entered crypto winter and we're gonna stay here for at least a year to a year and a half.”

Gupta, who started the Delta Fund in 2021 after receiving $50 million in commitments, said that she isn’t expecting Bitcoin to get back above $45,000 for another year or so.

“I believe this is the time when people are gonna build and they're gonna have a lot of technology with major adoption. Look at what FTX just announced which is going to bring a lot more people into the space and that adoption is going to trigger us back to another big high cycle.”

Image via Shutterstock

Image via Shutterstock

Gupta isn’t alone in her bearish outlook for crypto, and there are classic technical indicators that back her sentiment up, including the “death cross.” A death cross occurs when the 50 period moving average crosses below the 200 moving average. The opposite is called a “golden cross.”

While a death cross is generally considered a confirmation of a bearish trend by some technical analysts, some argue that it is a lagging indicator or something that simply tells everyone what they already know.

Pseudonymous crypto analyst Rekt Capital said in a thread that death crosses can either signal further capitulation or occasionally catch traders off guard and give completely false signals.

With the death cross already occurring in Bitcoin, the analyst gave a complete summary of what happened during each death cross in Bitcoin’s history.

"Summary:

2013:

• BTC drops -73% pre-Death Cross

• BTC drops extra -70% post-DC

2017:

• -70% pre-DC

• -65% post-DC

2019:

• -53% pre-DC

• -55% post-DC

2020:

• -63% pre-DC

• +1581% post-DC

2021:

• -56% pre-DC

• +141% post-DC

2022:

• -43% pre-DC

• ? post-DC"

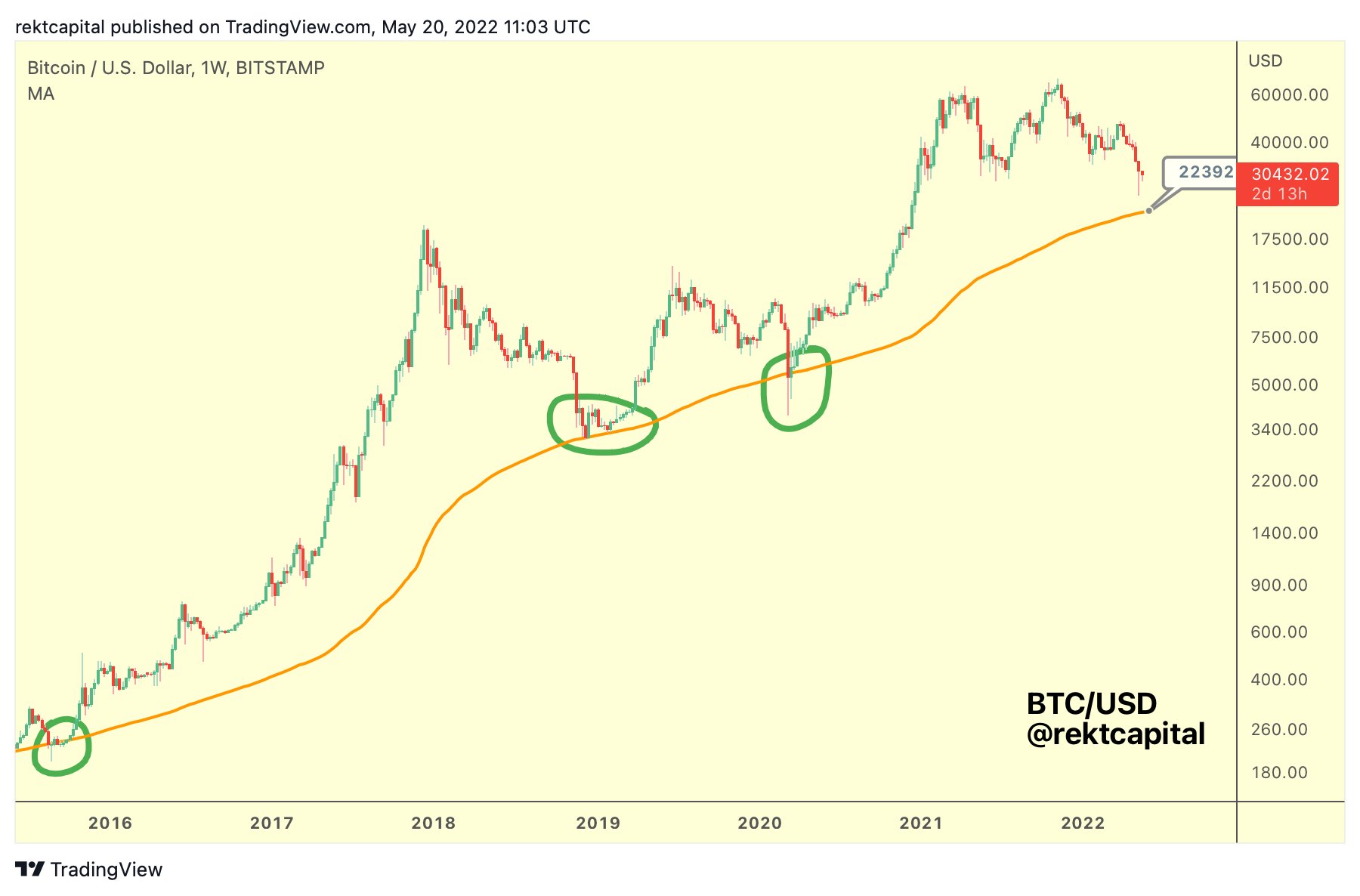

“What's interesting about the scenario of a -43% post-Death Cross crash however is that it would result in a $22000 BTC,” he said. “Which ties in with the 200-SMA (orange) which tends to offer fantastic opportunities with outsized ROI for $BTC investors (green circles highlight this)”

Rekt Capital

Rekt Capital