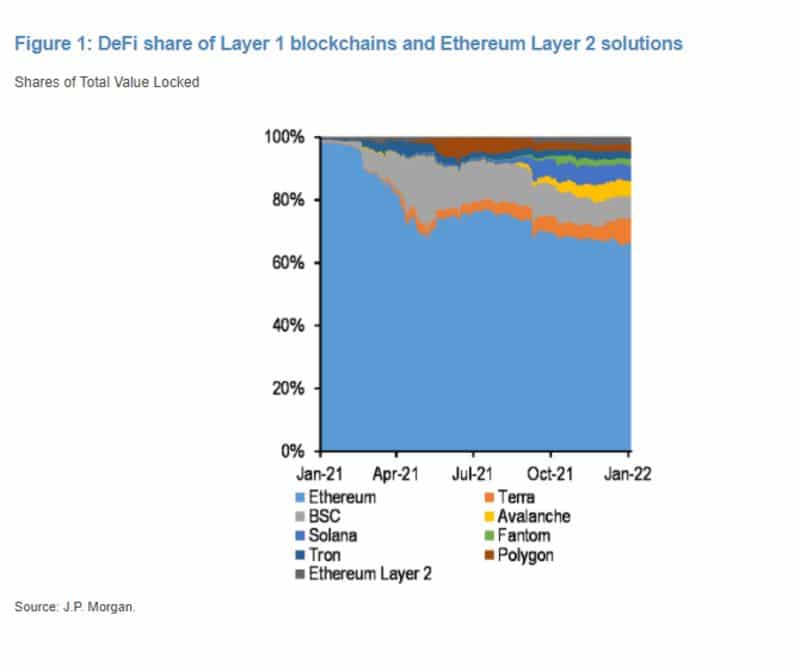

While the majority of decentralized finance (DeFi) is still happening on Ethereum, banking giant JPMorgan says this might not be a permanent thing.

In a note to Bloomberg, JPMorgan analysts led by Nikolaos Panigirtzoglou say that Ethereum’s DeFi dominance is at risk of being further eroded as more competitors start to enter the space.

According to the analysts, Ethereum’s Sharding process will be the “most critical” development for scaling its network. Until its completed, the bank says Ethereum will remain vulnerable to its rivals.

The “optimistic view about Ethereum’s dominance is at risk,” Panigirtzoglou wrote. Scaling, “which is necessary for the Ethereum network to maintain its dominance, might arrive too late.”

The analysts also point out Etheruem’s waning dominance in total value locked (TVL) within DeFi platforms.

JPMorgan/Bloomberg

JPMorgan/Bloomberg

Panigirtzoglou adds that a “rather problematic” aspect of Ethereum’s situation is that it’s losing market share mostly to independent blockchains, rather than those that rely on the Ethereum network for their security.

JPMorgan said that the chains gaining the most of Ethereum’s market share are Terra (LUNA), Binance Smart Chain (BSC), Avalance (AVAX) and Solana (SOL), which have all been receiving large amounts of funding and using incentives to boost their usage.

“In other words, Ethereum is currently in an intense race to maintain its dominance in the application space with the outcome of that race far from given, in our opinion,” according to the note.

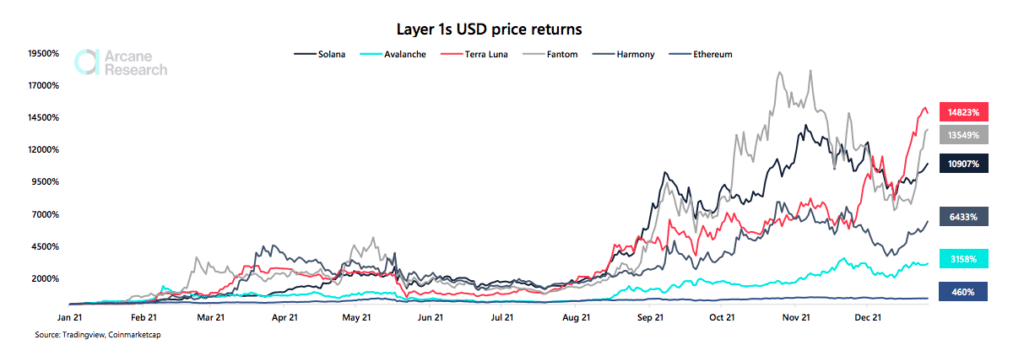

The future of Ethereum’s dominance over DeFi is debated, but currently, the bank’s theory is being supported by price performance of other layer-1 chains.

Last month, Arcane Research released a list of predictions for 2022, which included layer-1 Ethereum competitors continuing to outperform ETH throughout the year.

“We expect this trend to continue in the upcoming year as these other smart contract platforms continue to steal market share from Ethereum in terms of users and the amount of funds stored on the network. These networks have thriving and fast-growing ecosystems that continuously drive the price performances of their native tokens.”

Arcane Research

Arcane Research