Crypto insights company Arcane Research has released a new report with a list of predictions for the digital asset industry next year.

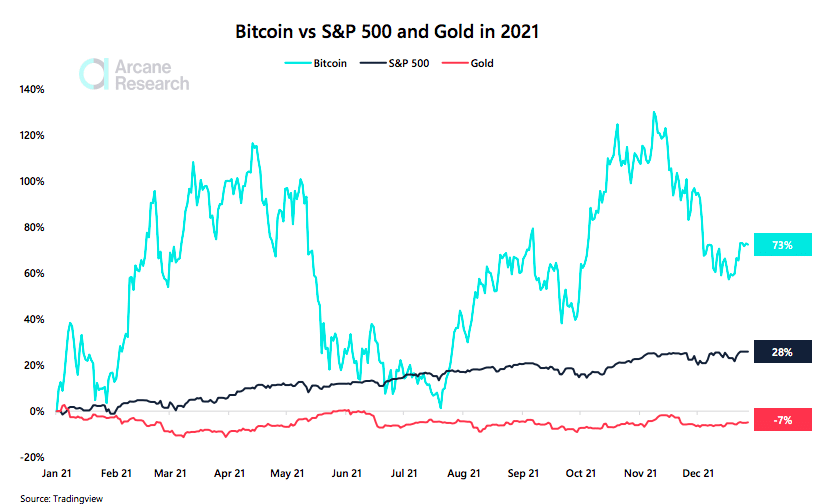

In a weekly update, Arcane summarizes the highlights of 2021, first noting that despite not meeting some of the more optimistic expectations, Bitcoin still managed to vastly outperform both gold and the S&P 500.

Arcane Research

Arcane Research

Arcane also says that BTC is playing its part as an inflation hedge, while also managing to be a risk-on asset that reacts to statements from the Federal Reserve.

“Inflation has been running high throughout the year, and overall, bitcoin has proven to be a good inflation hedge. Nevertheless, bitcoin has also proven to be sensitive to hawkish FED statements and fear in the broad financial markets. In that regard, bitcoin has behaved like a risk-on asset.

However, while bitcoin shows risk-on traits in the short run, there is no doubt that central bankers and politicians worldwide will have a very hard time dampening the increasing inflation without causing harm to the economy.”

Moving into 2022, Arcane predicts that Bitcoin will outperform the S&P 500 again, but remain closely linked to the VIX.

“Risk-on will prevail, shocks in tradfi -> Shocks in bitfi”

While looking at the top three cryptocurrencies by market capitalization, Arcane points out that Binance Coin (BNB) takes the cake as far as yearly performance, eclipsing Ethereum, which eclipsed Bitcoin. Next year, Arcane predicts that Cardano (ADA) and XRP fall out of the top ten crypto assets by market cap.

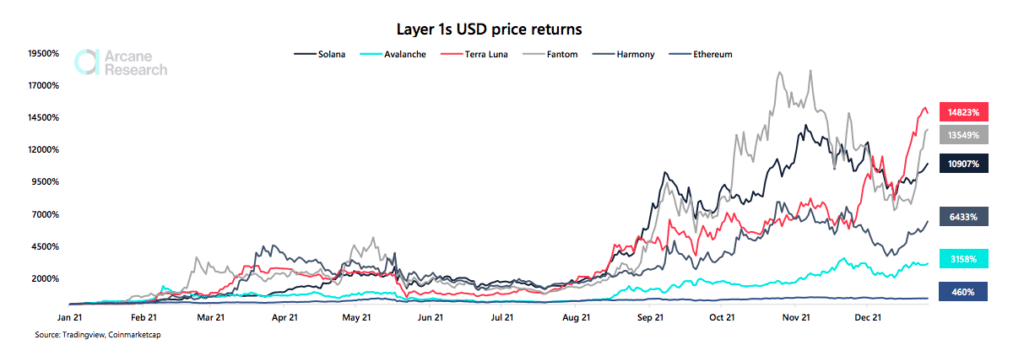

For a few things, the firm believes that what has been will be again. For instance, the firm doesn’t share the same predictions as many crypto investors who believe the “flippening” will occur next year. Arcane predicts that Ethereum will continue outperforming Bitcoin (BTC), but won’t be able to surpass it by market cap. It also says that as ETH outperforms Bitcoin, layer-1 networks will continue to outperform Ethereum.

“We expect this trend to continue in the upcoming year as these other smart contract platforms continue to steal market share from Ethereum in terms of users and the amount of funds stored on the network. These networks have thriving and fast-growing ecosystems that continuously drive the price performances of their native tokens.”

Another major prediction that Arcane makes in its report is the end of meme coins. While DOGE and SHIB’s price performance has been nothing less than spectacular, the firm says that meme coins will fade into obscurity, ultimately becoming a “historical relic” of 2021.

Arcane Research

Arcane Research