Institutional investors sent yearly records of capital flows to the crypto markets last week, with an overwhelming focus on Bitcoin (BTC).

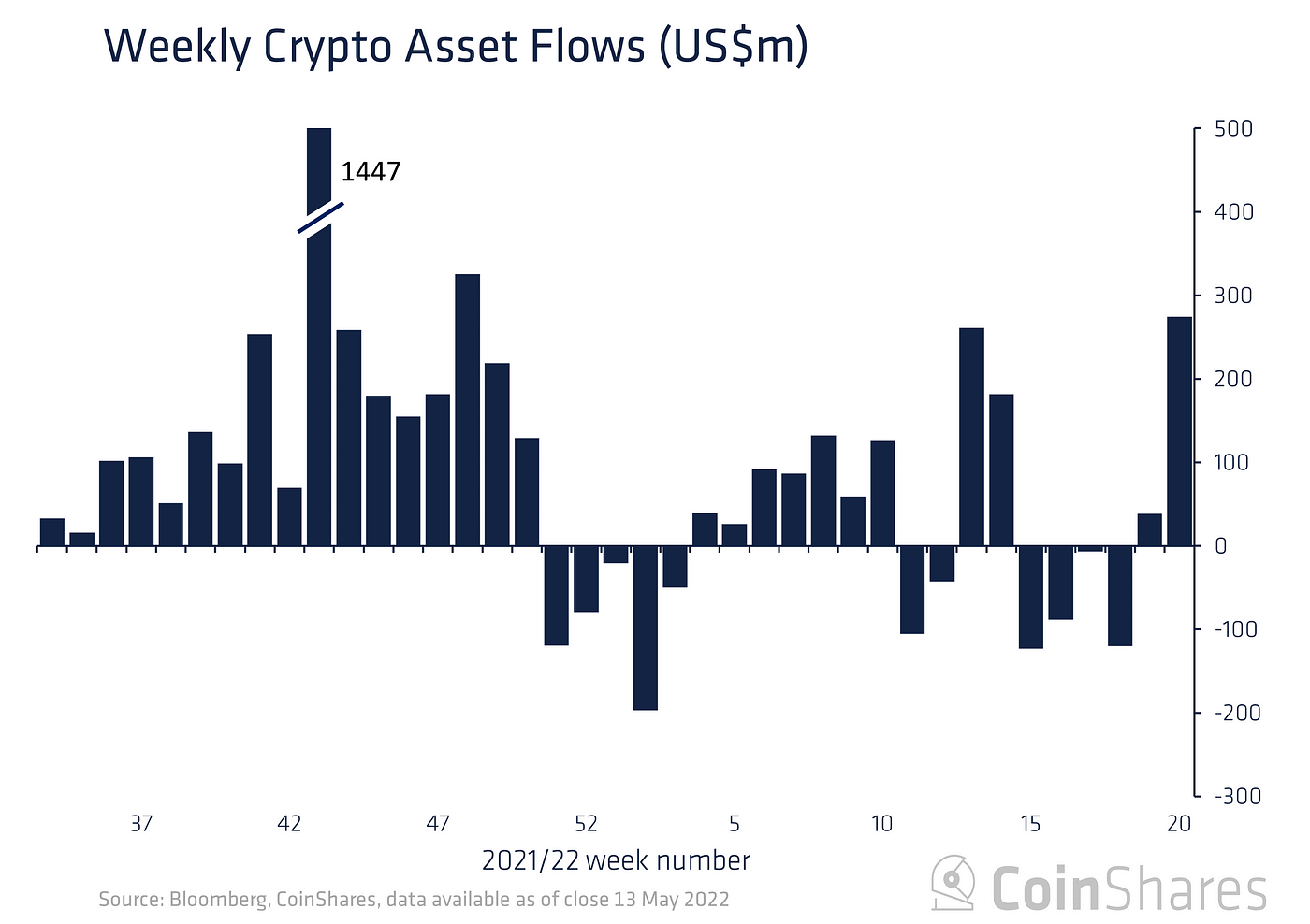

According to the newest weekly report from digital asset manager CoinShares, crypto investment products saw total inflows of $274 million, the most out of any week this year.

Bitcoin saw $299 million in inflows, suggesting a flight to safety mentality from investors, but also a potential opportunity to buy into cheap prices as the TerraUSD (UST) collapse rattled markets. Speaking of UST, CoinShares says UST saw its assets under management fall by 99%, despite some investors adding slightly to their positions, presumably on a gamble that it would re-peg to $1.00.

While Bitcoin saw the largest inflows of the year, blockchain equity investors apparently panicked during the market calamity. Blockchain equities saw record outflows on the year, as per the report.

CoinShares

CoinShares“Multi-asset investment products saw inflows totalling US$8.6m suggesting investors saw a diversified approach as an opportunity to buy into this recent price weakness,” CoinShares said.

Altcoins like Tron (TRX), Cardano (ADA), Solana (SOL), and XRP saw negligible amounts of inflows.

As crypto asset prices remain lower than what bulls have hoped for, some market participants have questioned the narrative of institutional capital triggering parabolic bull runs. It’s possible that due to regulatory uncertainty, institutions have instead put more focus on crypto infrastructure rather than investing in the assets directly.

Last week, banking titans Barclays and Goldman Sachs invested $70 million in UK-based trading software company Elwood Technologies in a round that valued the company at $500 million.

James Stickland, CEO of Elwood Technologies said,

“$1.14tn worth of cryptocurrencies were traded by institutional clients in 2021, up from $120bn the year before…Aside from major financial institutions, large companies and even some governments are entering the market.

There has been a major shift in the perception of cryptocurrencies among institutions and the ecosystem continues to mature in a very exciting way despite the current crypto run. While they are still perceived as a risky asset, an understanding of the industry’s prospects is prevailing.”

However, these institutional investors lack a sufficient understanding of how these assets work. Ultimately, crypto trading is still in its infancy.”