A new report from Bitstamp reveals that the overwhelming majority of major investment firms have a strong conviction on the future of crypto markets.

The report gathered a significant sample size, surveying over 28,000 respondents, 5,000 institutional investment decision-makers, and 23,000 retail investors in 23 countries.

One of the counterintuitive highlights of the report is that institutions appear to be more trusting of cryptocurrency and related technology than retail investors.

Bitstamp found that eight out of every 10 institutional investors believe that cryptocurrency and blockchain will overtake traditional financial products within the next decade, while only 54% of retail investors agree with the same sentiment. 88% of institutional investors and 75% of retail investors believe crypto would see mainstream adoption in the same time frame, as per the survey.

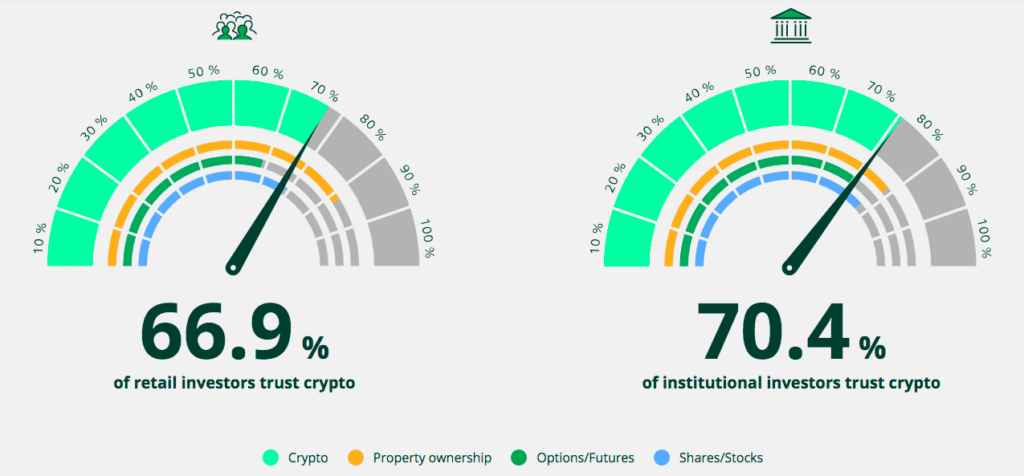

While survey respondents still believe crypto is a less trustworthy investment than property ownership and equities, 67% of retail investors and 70% of institutions deem digital assets as trustworthy. Decentralized finance (DeFi) products like non-fungible tokens (NFTs) and stablecoins are trusted by about 60% of both retail and institutional investors.

Bitstamp

Bitstamp

CEO of Bitstamp Julian Sawyer said:

“In the last few years, cryptocurrencies have moved from the outskirts of the financial ecosystem to find themselves front and center of mainstream investing, with many of the largest trading venues in the world now catering to both retail and institutional crypto needs.”

Sawyer says that the effects of the COVID-19 regime were one of the main catalysts that accelerated the legitimacy of cryptocurrency.

“We’ve seen interest propel in the years since the pandemic,” he said, adding that “crypto is now part of the wider conversation in global macro-economic matters.”

“Our survey shows something we have advocated over a long time: talking about survival of digital assets is firmly over — the question is now about evolution.”

Bitstamp US CEO Bobby Zagotta told Blockworks that the next major factor to help spur another wave of adoption is regulation, which he expects sooner rather than later. “The survey results show that crypto is a long game and we need to be building for the next 50 to 100 million customers,” Zagotta told Blockworks. “The industry needs to enable the infrastructure that supports that next wave of investors.”

“Given the executive order and recent legislative activity, the topic is certainly hot in Washington,” he said. “We expect more regulation…in the coming months.”