The MIT Digital Currency Initiative (DCI) is well known for disclosing a hashing vulnerability in IOTA earlier in August.

This was disputed by the IOTA developers and the debate has continued since then.

However, the MIT DCI has come out again to critique IOTA and in particular, have issued a public statement that aimed to refute report that was published by their very own institution at the MIT Technology Review.

Mixed Messages from MIT

On the 14th of December, the MIT Technology review published an article that was positive on IOTA. They went over the benefits of a cryptocurrency that did not rely on a blockchain and even wondered if it could outperform Bitcoin.

The piece also touched on a number of the partnerships that IOTA has entered into this year as further evidence for the institutional use case of the technology.

When this was published, the researchers at DCI and MIT media attempted to refute these findings from the review. They took issue with a number of supposed inaccurate statements in the piece.

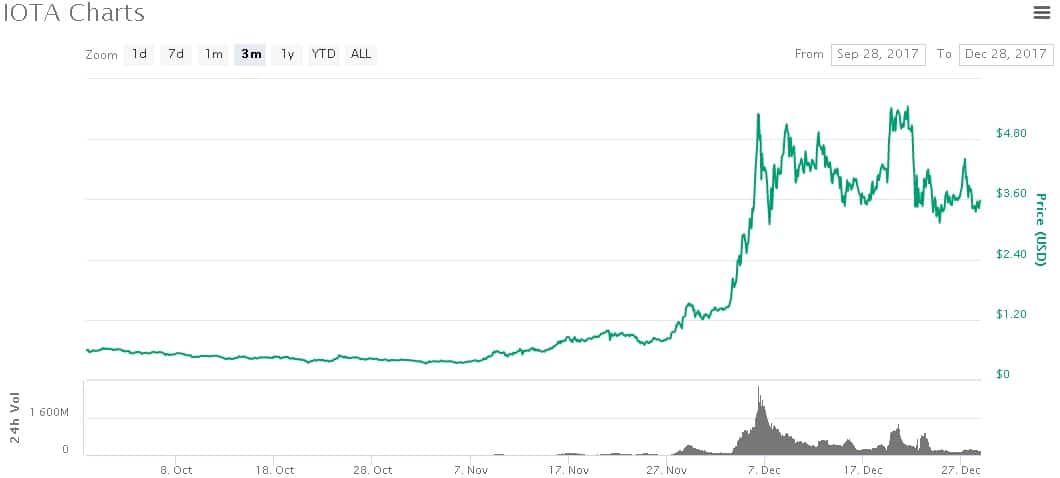

They cantered their argument around the claimed partnerships that they had entered into. It was the announcement of the Microsoft partnership, for example, that led to an IOTA token rally.

IOTA Rally after Partnerships. Source: Coinmarketcap.com

Since then, there have been several other announcements of "partnerships" with IOTA at companies such as Bosch and Fujitsu.

However, the DCI said that the partnerships were never really secured. They used the words of the founder, Dominik Schiener as an example of this. During a recent interview he claimed that:

We have never mentioned that any of the companies which are participating in the marketplace are our 'partners'. We call them participants.

The researchers pointed out that the correction in the partnership disclosure came only after it was firt reported. They viewed this as "misleading" marketing practices.

Technical Concerns Raised Again

While designating a participant as a partner is an issue of semantics, the researchers took issue with some of the points raised about IOTA's technology.

More specifically, they thought that the description of IOTA as a "tamper decentralised ledger" was incorrect. For example, they mentioned that the entire network was down in November this year.

During this down time, no transactions could take place. The researchers noted that although they had slower transaction times, popular cryptocurrencies based on Blockchain technology have never had a similar outage.

This was most likely down to their being a single point of failure in the IOTA called the "coordinator". The centralised nature of this concerned the researchers.

One of the most important points of contention comes from the whole "0 fees" claim. Unlike with other blockchain based cryptocurrencies, there is no proof-of-work (POW) consensus protocol with IOTA.

When users want to process a transaction, they are relying on their devices to do the POW. Hence, although they are not paying miners to do the "work", energy is still being expended to process the transactions. According to the researchers:

the work required is a fee, whether or not it requires a monetary payment. Restricting the ways in which the fee can be paid, requiring that the work be done on a user’s own device, doesn’t make it go away

IOTA Responds in Kind

IOTA developers have made it known what they thought of the initial study by the researchers into their hash function.

Hence, upon these statements by the MIT team, the developers accused them of conducting "academic fraud". They even mentioned that they would be taking two of the researchers to court stating:

actually, MIT has nothing to do with that as was found out by lawyers working on a case related to academic fraud conducted by two DCI employees who authored the linked blog post

The developers viewed the criticism as an example of outside groups trying to defame the IOTA product and the foundation. They wanted to see further proof of the claims from the researchers.

Whether the researchers have a case to make or whether IOTA is being wrongly accused, this back and forth is likely to continue for the foreseeable future.

Featured Image via Fotolia