Digital asset management giant Pantera Capital is set to close its new Blockchain Fund with $1.3 billion in funds raised, which is more than double the original target of $600 million.

The fund is described by Pantera as a “new all-in-one wrapper for the entire spectrum of blockchain assets.”

According to The Information, 75% of the capital going into Pantera’s fund comes from institutional investors and endowments, a stark contrast from its first $118 million fund from 2018 which was raised mostly from individual crypto investors.

Writing in a recent blog post, former Tiger Management executive and Pantera CEO Dan Morehead said that as far as he’s concerned, “we’re done with the bear market” in crypto, and expects a steady grind upward instead of volatile blow-off tops and crashes.

“I long advocated that as the market becomes broader, more valuable, and the more institutional ownership, that the amplitude of prices swings will moderate,” Morehead said.

The investment veteran says relative to the historical trendline, Bitcoin is currently very cheap.

And as BTC plunges below the $40,000 level, Morehead remains openly bullish.

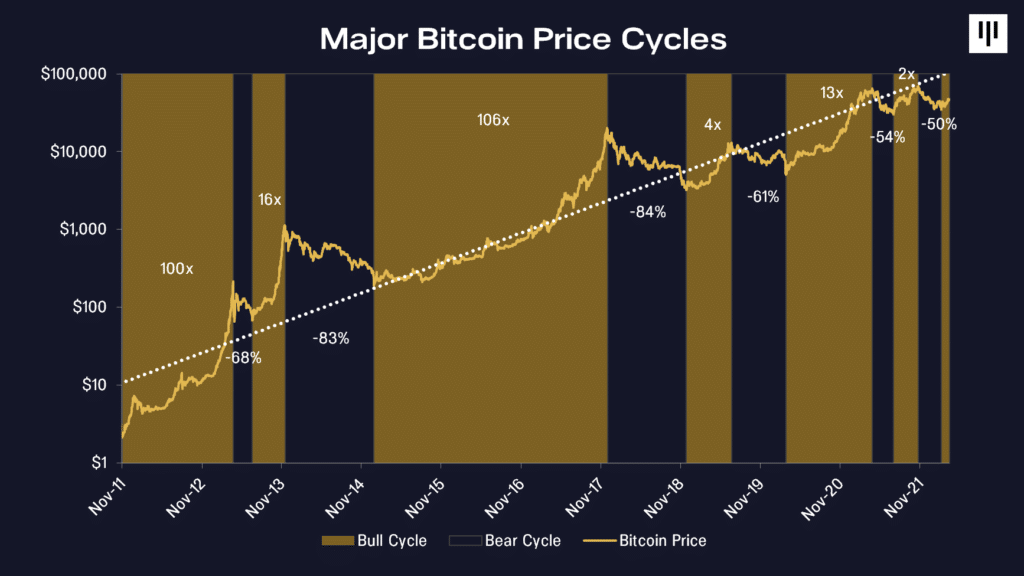

“While we’ve had two -80% bear markets already, I believe those are a thing of our primordial past. Future bear markets will be shallower. The previous two have been -61% and -54%. Unfortunately, there’s no free lunch. The flipside is we probably won’t see the 100x rallies anymore either. I think we’re done with the bear market -50% and we’re on to a new rally cycle. The next 6-12 months are likely to see a massive rally as investors flee stock, bond, and real estate markets – for blockchain.”

"I think that as institutions engage this space, all of those cycles will moderate, thankfully. 50% bear markets are probably all you’re going to get going forward,” Morehead told Yahoo Finance last month.