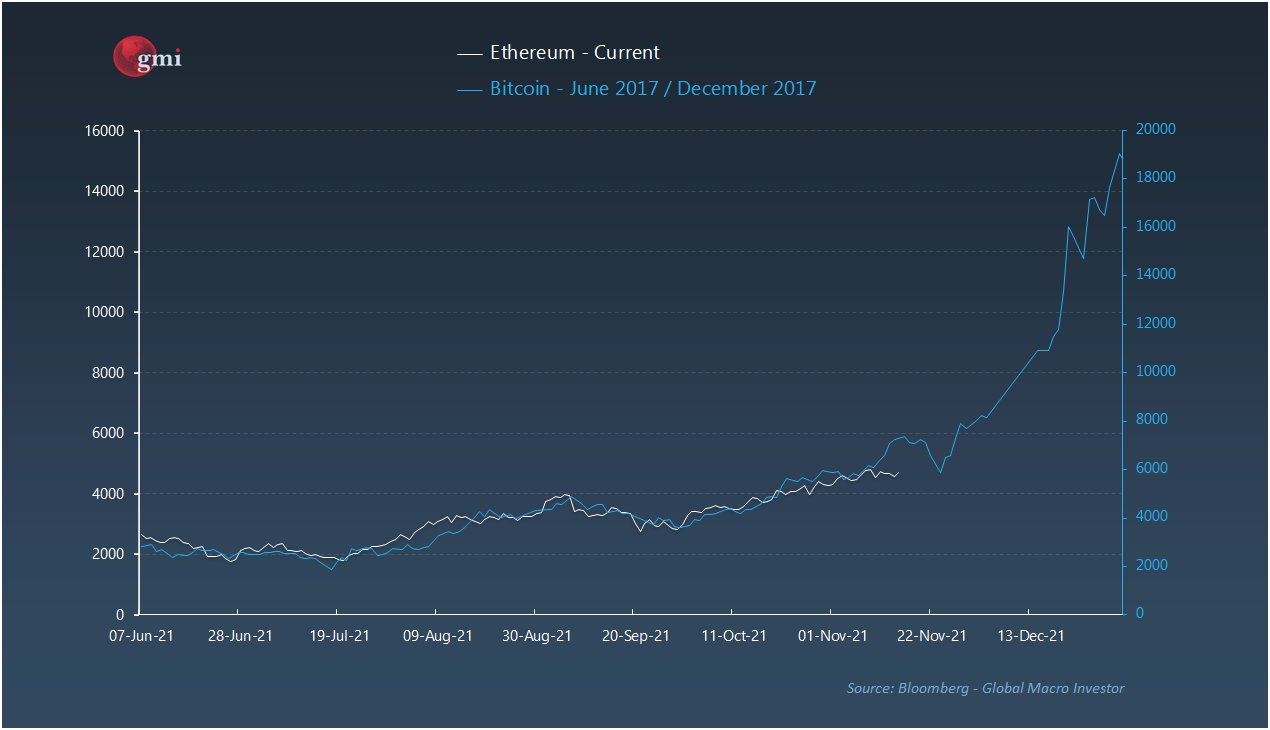

Former Goldman Sachs executive Raoul Pal has a “spooky” chart that suggests a gigantic rally for Ethereum this quarter is imminent.

Pal has been gauging Ethereum’s current bull cycle from the perspective that it is at the same point in its adoption cycle that Bitcoin was between 2013 and 2017. Being a relatively newer technology, earlier on in its introduction to the world means a more parabolic upward move for ETH than BTC, according to the Real Vision CEO.

Pal suggests that the backbone of macro price movement for crypto is network effects, or the concept of a network growing in value as its users grow. To him, network effects happen in waves with recognizable patterns, and this is what explains the staggeringly similar price movements between Bitcoin back then, and Ethereum today.

Raoul Pal/Twitter

Raoul Pal/Twitter

Zooming in on the day-to-day price action, the macro investor says Ethereum just went through a sell-off that was, according to his chart, exactly on cue. What’s even more interesting, is what comes next.

“I have been showing this spooky chart of ETH now vs BTC in 2017 in various forms. This is my live CIX on Bloomberg.... even nailed this sell off....to the day and price. What happened next? A 300% rally. From tomorrow (ish).”

Raoul Pal/Twitter

Raoul Pal/Twitter

Pal says he doesn’t expect bang-on accuracy with the comparison, but that “something like a 100% to 300% rally is highly probable into year-end.”

“After that, it’s a tougher call but I think it possibly elongates and sees significantly higher prices.”

Pal has been adamant that during this cycle, ETH will be the better bet, mostly because of the aforementioned adoption cycle theory. Last month, he said his portfolio allocation was something like “70% ETH, 5% Bitcoin, and then a tail of others.”

“So why that allocation? Nothing against Bitcoin, it’s not against anything else, it’s because I’m a financial markets guy and we use risk curves. So at certain points in the cycle, in the middle of the bull market you want to take as much risk as possible, so you want to go to the more speculative end of the market.”

Time will tell if Pal’s “ETH vs BTC in 2013” model continues to play out, but other analysts are also on board with a sudden rally after the current correction bottoms out.

Using Elliot Wave theory, analyst Crypto Ed says that the bottom is more or less in for Bitcoin and that a powerful price impulse to $90,000 is setting up.

"Maybe a bit early to post as the bottom might not be in yet, but I'm getting excited when checking next targets which don't seem to be that far away!

In case I'm right with bottom in already or around $57k, the target is more or less the same.....

$90.000 and a little bit."

CryptoEd/Twitter

CryptoEd/Twitter