April 2022: Our updated Algorand Review

Algorand is a project that has rocketed onto the scene and into the top 100. There has been intense interest in the project across the crypto community.

This has been touted as one of the most exciting projects currently being worked on. Backed by VC capital and a team of Phds and professors, they are trying to re-imagine the blockchain technology and make it infinitely scalable.

However, are they something that you should consider?

In this Algorand review, I will give you everything you need to know about the project. I will also analyse the price potential of ALGO tokens.

What is Algorand?

Algorand is a blockchain platform that is aiming to create a borderless economy through its decentralized, permissionless public blockchain.

In other words, Algorand wants a blockchain ecosystem that allows everyone to participate and succeed. The platform is being built with the core principles of simplicity, instant transactions, direct usage and adoption, and performance.

Algorand is also taking on one of the biggest challenges in blockchain technology. That is how to build a platform that is both fast and scalable, without sacrificing decentralization.

The Algorand team knows that without a scalable solution there will be no mass adoption. We’ve seen that with both Bitcoin and Ethereum, which are popular, but fail to reach mass adoption because they are simply too slow for the modern economy.

Yet scalability can’t be at the expense of decentralization and security. All three are vital to the successful blockchain platform, and Algorand is looking to bring all three to its platform, finally solving the Blockchain Trilemma.

And Algorand will also minimize the computational cost of transacting, giving the world a scalable, secure, decentralized platform with low transaction fees.

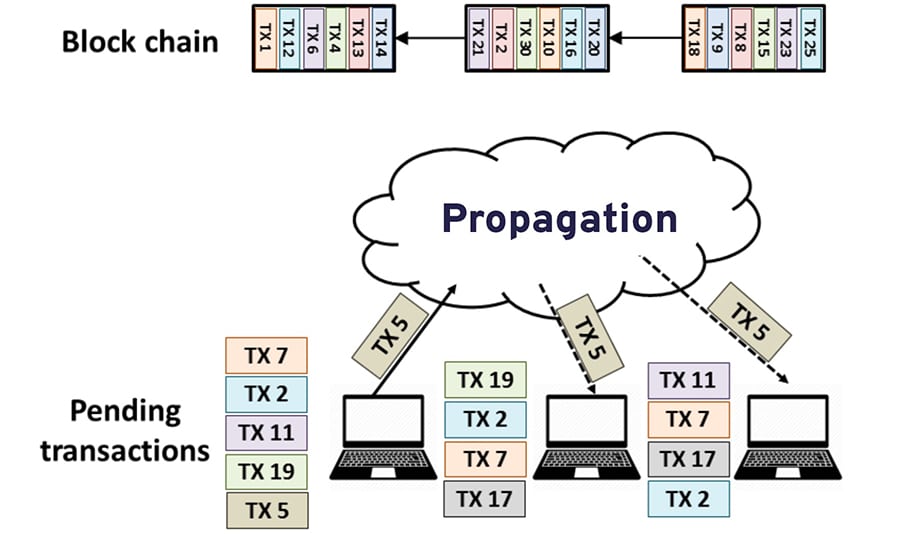

The Algorand Network

The protocol being used by Algorand is designed for speed. In theory, the developers have reached the optimal efficiency by finalizing blocks in just one round of voting.

This ensures each block is finalized instantly and will increase the transactions per second handled by the network dramatically. The mainnet has launched with the capability of handling 1,000 transactions per second with a latency of fewer than 5 seconds.

Algorand Fast Agreement on the Fly. Image via Algorand Blog

Algorand Fast Agreement on the Fly. Image via Algorand BlogBecause speed without security is useless, the Algorand network has been architected to withstand elongated network partitions and recover quickly, which addresses a number of potential real-world attack vectors. A network partition is an attack at the network level that makes it difficult or even impossible for users to interact on the network.

No matter how a blockchain is designed a network attack is always a possibility. Anytime an attacker is powerful enough to maintain a network partition indefinitely, no blocks can be produced, effectively shutting down the network. The only way to combat this is to increase the cost to the attacker until they cannot hold.

Proof-of-Work blockchains have it worst in these scenarios. A PoW blockchain will form two separate chains, one in each partition. When the partition closes the lesser chain disappears, taking all the transactions from that side away. What’s worse is that a network attack can be done on specific protocol messages, making it nearly impossible to detect a network partition.

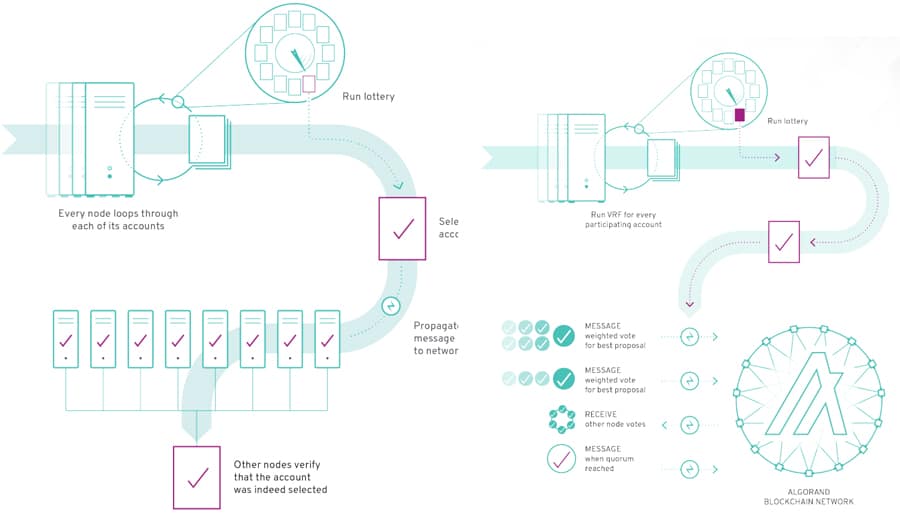

Algorand Consensus Protocol

In the case of Algorand, Byzantine Agreement is used, but it is optimized for high-performance and massive scale. This works as long as there is greater than a two-thirds honest majority, and participants do not need to be synchronized.

When the elected leader is honest consensus is reached in just two steps, and when the elected leader is malicious consensus can still be reached within a constant number of steps.

This keeps the protocol resilient even in the face of arbitrary network partitions that are of unknown length. The network also recovers rapidly once the partition is resolved. This near-instant recovery from partitions makes it expensive for an attacker to stall the network since the attacker would need to frequently pay the cost for disrupting the network.

Overview of the Algorand consensus Mechanism. Image via Algorand

Overview of the Algorand consensus Mechanism. Image via AlgorandIf you have an honest leader proposing a block the first vote occurs immediately when network participants receive the block. This means once the block propagates through all the participating nodes it is approved after just one round of voting.

In order to scale this to a large number of network nodes, Algorand has developed a unique mechanism based on Verifiable Random Functions. This solution allows a participant to check privately and see if they have been selected to participate in agreement for the next block, and then include proof of selection in their network messages.

Algorand’s protocol doesn’t require users to keep any private state other than their private keys. This means the network is able to replace participants immediately after a network message is sent, and avoids attacks that could be targeted on individuals once their identity is known.

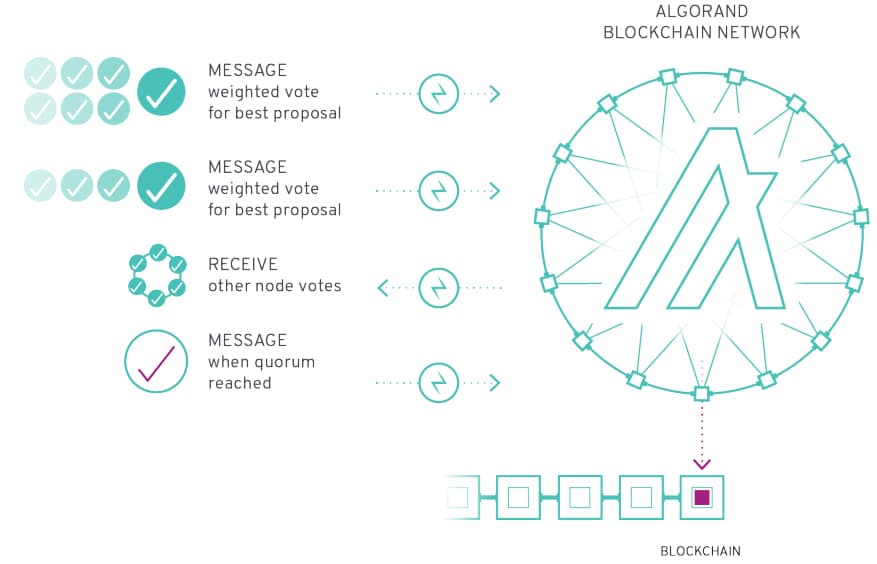

Vote Certification at Algorand

Vote Certification at AlgorandEven in the case where an attacker gains control of the network and can dictate which messages are delivered to which users and when the Algorand agreement protocol will not fork, which will keep user’s account balance secure.

In this way, Algorand has been designed to work securely and efficiently in a permissionless environment consisting of a random number of participants, all of whom can join or leave the network at any time, and all without any approval or vetting process.

Algorand Team & Partners

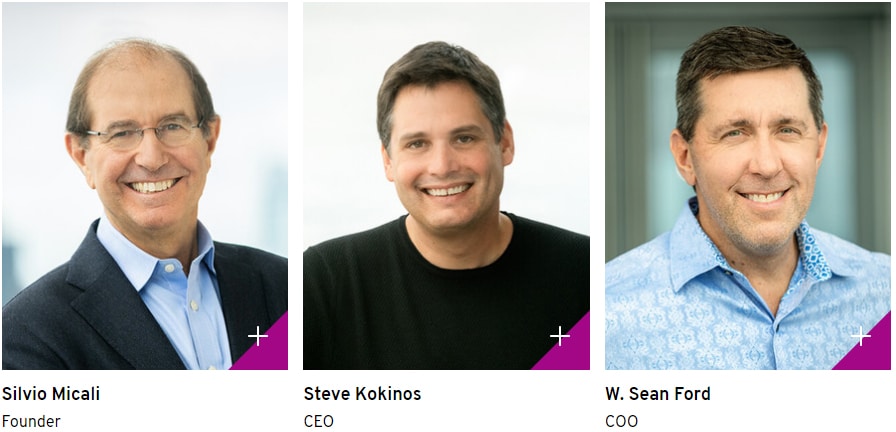

Algorand was founded by Silvio Micali, an MIT professor who has put together a very strong team. Unlike some projects that consist mostly of entrepreneurs at the head of the project, Algorand consists primarily of researchers and scientists. Because of the connection to MIT, most of the Algorand team is located in Boston.

In addition to the core Algorand team, there is also the Algorand Foundation, which is the governance and research organization leading the development of the Algorand platform.

Here are the three members of the Algorand executive team:

Some Members of the Algorand Team

Some Members of the Algorand Team- Silvio Micali is the founder of Algorand. He is an expert in cryptography, secure protocols, and pseudo-random generation and he oversees all of the research and security involved with Algorand. He is the co-inventor of a large number of protocols, including Verifiable Random Functions, Zero-Knowledge Proofs, and Probabilistic Encryption.

- Steve Kokinos serves as the CEO at Algorand. He was previously the CEO at the global enterprise communication platform Fuze, and he brings a wealth of business and entrepreneurial experience to Algorand.

- W. Sean Ford is the COO at Algorand, and he also brings a wealth of business experience, having previously been the CMO at LogMeIn.

In addition to the above core members you also have Keli Callaghan who is head of Marketing at Algorand. She has a vast amount of experience in Marketing and customer relations from her prior experience at Avid, where she was responsible for the collaborative marketing partnership with Microsoft as well as the field marketing teams and global customer engagement strategies.

You also have Sergey Gorbunov who is Head of Cryptography at Algorand. He is a prize-winning researcher and wrote his dissertation on the construction of advanced cryptographic protocols using lattice-based cryptography. He also has interests in blockchain protocols, computer networks, and secure large scale systems.

These are only a small sample of the people who are currently working on Algorand. You can see a more thorough breakdown in their team page.

Some of the Algorand Partners

Some of the Algorand PartnersAs mentioned, Algorand has received a number of investments from numerous Venture Capital funds. These range from crypto specific funds to more general tech focused investors. Algorand also has also invested in their own VC fund called Algocapital. This fund has raised $100m and will support projects that aim to build on the Algorand protocol.

Algorand Community

The Algorand team keeps up quite well on various social media platforms, such as Twitter, Facebook, and Telegram. They also maintain a blog on Medium and provide frequent updates for the community. They are especially good at providing in-depth technical information to give users a deeper understanding of the project and its goals.

On Twitter, the team has nearly 12,000 followers, and the Facebook page has close to 800 followers. Those numbers are ok, but the team’s Telegram channel has over 10,000 users, which more accurately shows the strength of the Algorand community.

There is also a platform specifically for the Algorand community, which includes various developer resources, a forum, SDKs, information about upcoming events, and more.

The ALGO Token

Algorand held a Dutch Auction ICO in June 2019, and raised over $60 million, selling 25 million tokens at $2.40 each. The ICO date coincided with the launch of the Algorand mainnet.

That’s just the beginning though, as Algorand has said they will auction off 600 million tokens per year, using the same Dutch Auction system each time. The total token supply will be 10 billion ALGO.

ALGO Price Performance. Image via CMC

ALGO Price Performance. Image via CMCUnfortunately for those who participated in the ICO, the token has not held up well over the summer. As of September 1, 2019, ALGO is priced at $0.393337, which still puts the token in 47th spot based on a market capitalization of $113 million.

However, if the price had remained at the ICO price of $2.40 the token would have a market cap of $690 million, which would put it in 18th place.

Buying & Storing ALGO

Although ALGO is listed on Binance, the greatest trading volumes by far are coming from Hotbit, followed by MXC, CoinEx, Bilaxy, and Bit-Z. The token is also listed on quite a few other exchanges, including Huobi Global, OkEx, Coinbase, and BitMax.

Across these exchanges, there is healthy volume which is well spread out and reduces the reliance on any one exchange. On each of the exchange books you also have strong order books.

For example, on Binance, the ALGO / Bitcoin markets are quite deep and there is high turnover. This makes it that much easier to execute large block orders with limited slippage.

Register at Binance and Buy ALGO Tokens

Register at Binance and Buy ALGO TokensOnce you have your ALGO tokens, you are going to want to take them off the exchange and store them in an offline wallet. We are all too aware of the risks that come from storing large quantities of coins on a centralised exchanges.

Algorand has created mobile wallets for both Android and iOS devices, and Coinomi also supports ALGO tokens, so you could use that for a desktop wallet. Unfortunately, ALGO is not supported by either the Trezor or Ledger hardware wallets as of the date this article was written.

The ALGO Staking Rewards

Algorand has announced a 200 million ALGO staking rewards program, which required the registration of an ALGO wallet containing a minimum of 25 ALGO by block height 1,618,450.

Only the first 200 million ALGO were able to be registered, and the program will be paying out 200 million ALGO over the course of four 6-month periods. The staking rewards will be paid based on the number of ALGO staked by each registered wallet, and the required stake will increase with each payment.

Initially, it has been calculated that this staking program amounts to a 14.39% annual return, but that should increase as wallets are disqualified from the program later, or they simply drop out.

Conclusion

Algorand was created by a highly respected cryptography professional from MIT, and is supported with a world-class team of research scientists, business and marketing professionals. While this obviously brings high expectations for the project, thus far the team has delivered excellent results.

The token got off to a great start with the June 2019 Dutch auction, although it has fallen significantly from its ICO price. Time will tell how well the token holds up as the Algorand team plans on auctioning off 600 million ALGO tokens per year until the entire 10 billion token supply has been released.

The mainnet has launched with an impressive 1,000 transactions per second, and that has allowed the team to create some strong partnerships, with others in the finance and real estate industries in the works. That shows there is actual real-world demand for the product offering of Algorand.

Algorand has already improved the blockchain landscape through its technological developments, and it now looks to further improvements through its recovery mechanism for network partition attacks, which is a groundbreaking method for making it economically unfeasible for an attacker to disrupt the network for any appreciable amount of time.

Algorand has been impressive in their speed of development, and in the lack of significant bugs. The mainnet launched very quickly, and the code base, which was only recently released, has been deemed to be well documented and obviously from a serious and professional development team.

At this point, Algorand appears to be both technically and commercially positioned to be a success in the blockchain space. Of course, it remains quite early in the development of this industry, but this is one project that bears watching going forward.