Today, not many stores are able or willing to accept cryptocurrency as a payment. Additionally, as retailers are seeking flexibility in payment options, the desire for being able to take credit card payments while on the road is growing.

A new blockchain project that is based on Ethereum called Beluga Pay aims to offer a solution to both of these issues and more. Beluga Pay will be launching a token sale in about a month.

Spending cryptocurrency can be difficult

If you own bitcoin or any other cryptocurrency, you probably already know that there is a limit to the number of companies that will accept cryptocurrency as payment. While those numbers are growing every day, the vast majority of shops and businesses still do not accept cryptocurrency payments.

Beluga Pay, a fin-tech company that currently has a functioning product, is getting ready to launch an ICO for its ERC-20 tokens. Beluga Pay has several major goals, so let's go over those now.

The first main feature of the network is a point-of-sale software package that allows for fast and easy cryptocurrency and credit card payments. In its explainer videos, the company specifically uses some popular choices like bitcoin, Litecoin, Ethereum, and Dash among a few others. The software package should be fully functional on mobile devices to allow for flexibility in payment collection.

Beluga Pay seems to be targeting various developing parts of the world where the only payment infrastructure that's easily available could be a mobile phone. Thus this gives a lot of room for growth in a number of areas such as Southeast Asia, Africa, Latin America, and the Caribbean as mentioned in the explainer video.

Get paid in crypto for credit card payments

How Beluga Pay Works – Image Source: Beluga Pay Whitepaper

How Beluga Pay Works – Image Source: Beluga Pay WhitepaperThe second feature of the network relates to traditional credit card payments. Normally, if someone paid with a credit card, the retailer will only receive payment after several days have passed. This delay can present a problem, especially for new or small companies and retailers.

Beluga Pay is offering a solution in which a retailer could receive payment from a credit card transaction "nearly instantly". This feature relies on Beluga Pay's native ERC-20 tokens.

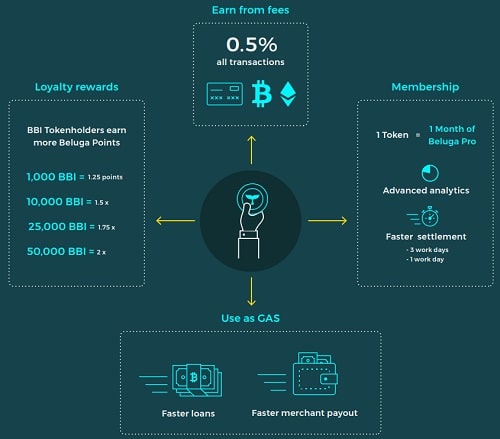

The tokens for the network will offer a few different features of their own which tie into instant credit card payments. Beluga Pay describes using the tokens as paying a "gas cost". A retailer may choose to spend Beluga Pay tokens in order to process a credit card transaction instantly and receive an equivalent amount of cryptocurrency back shortly thereafter.

It's important to note that doing so would not result in the actual credit card transaction itself finishing instantly, but rather that the retailer could receive the payment in the form of cryptocurrency instantly.

Finally, owners of Beluga Pay tokens will supposedly be entitled to a portion of all transaction fees collected by the network. At the present time, the official site states this percentage to be 0.5%. Many other fee earning tokens will net the holder 50-100% of network fees, so 0.5% seems unusually low.

Connections with a major bank

Beluga Pay Business Partners – Image Source: Beluga Pay

Beluga Pay Business Partners – Image Source: Beluga PayThe official site for Beluga Pay states that the currently operating product has already received the endorsement and cooperation from a major bank.

The company has also stated that at least one of their current customers is a Fortune 50 company, but they do not provide any more specific details than that.

Finally, Beluga Pay claims that they have been certified by both Visa and Mastercard. This is somewhat odd, however, as Visa has been cracking down on cryptocurrency credit cards.

Beluga Pay ICO coming soon

Beluga Pay will be performing an ICO in about 30 days. The goal is to sell their own BBI tokens to early investors with a bonus. Unsold tokens will be burned. The sale itself seems to have garnered a fair amount of attention.

It is unknown if buyers are primarily interested in the potential gain in value for the tokens or if they are looking to get a piece of the divided like transaction fee sharing scheme.

The total supply of tokens is 100 million, and they are going for a rate of 1 ETH = 288 BBI.

Is this a good investment?

Beluga Pay's offering certainly sounds compelling, since not only would token owners have a chance for the asset value to appreciate, but they could also potentially get a steady return through the dividend like features. What we don't know, is how this would actually pay out in real life.

In total, there is a very large amount of Beluga Pay tokens, therefore it is conceivable that in order to receive any reasonable amount of money through the dividend system, one may need to own thousands or tens of thousands of tokens to get even a dollar or two.

We won't know until the system goes live sometime later this year. Since unsold tokens will be burned, a large token burning could influence the payout of each individual token greatly.

Beluga Pay's business strategy is potentially targeting a set of customers that may not be interested in adopting this technology. In countries with poor electronic payment infrastructure, cash is usually king. While this doesn't mean change is impossible, it could mean that many years to be necessary before a new payment method is widely adopted.

This is not guaranteed, however, as we have recently seen in China. Recently, mobile payments have gone from almost nonexistent to getting close to replacing cash in many aspects. This happened in a very short time span, and so it's possible that something similar could be replicated in other parts of the world.

Beluga Pay is certainly worth a second look. As for whether it will be a good investment are not in the long-term, we won't know until it's already happened.

Disclaimer: These are writer opinions and should not be considered investment advice