In this Bitpanda review, we will take a look at a relatively established European cryptocurrency exchange.

They are well known for being a Fiat exchange which accepts a range of different Currencies and payment options. Moreover, they are probably one of the only Fiat exchanges that offers such an extensive list of cryptocurrency assets to purchase.

Yet, the most important question is whether Bitpanda is a safe exchange to use?

In this exchange review, we will take in-depth look at the Bitpanda product. We will take a look at the security, fees, platform functionality and customer support among other things. We have also gathered many different perspectives from current and previous Bitpanda clients.

Bitpanda Overview

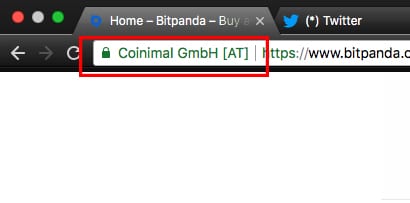

Bitpanda is based in Vienna, Austria. They are located at Burggasse 116/3+3A, 1070. They were established in 2014 and are owned and operated by Bitpanda GmbH. In the relatively new world of cryptocurrency exchanges, this makes it one of the older exchanges in Europe.

They were previously called Coinimal before rebranding to Bitpanda in 2016. The main reasons given for the rebranding was to start a fresh with a completely new service. They claim to currently have over 850,000 registered.

Bitpanda was founded by three individuals. They are Eric Demuth, Paul Klanschek and Christian Trummer. They claim to be cryptocurrency enthusiasts who got the idea to start Coinimal in 2013. Since then, Bitpanda has grown its team to over 60 members from 21 different countries.

The founders seem to be completely transparent with their operations. This is a good sign in today's day and age when cryptocurrency projects and exchanges will operate with a relative degree of opaqueness. Moreover, they are a registered Austrian company which makes them subject to EU laws and regulations.

Founders of BitPanda. From Left: Eric Demuth (CEO), Paul Klanschek (CEO), Christian Trummer (CTO)

Founders of BitPanda. From Left: Eric Demuth (CEO), Paul Klanschek (CEO), Christian Trummer (CTO)This means that Bitpanda can take users from the EU including Iceland, Liechtenstein, Norway, Switzerland, and Monaco.

Bitpanda Fees

Bitpanda has a pretty standard and flat fee structure. They will charge 1.49% for a buy order and 1.29% for a sell order. This will be for all of the cryptocurrencies on their platform.

If we were to compare that to some other exchanges with which they compete, then these are a bit above average. For example, if you were to use Bitstamp, their exchange fee for trades below $20,000 is a mere 0.25%.

However, there do not appear to be any fiat deposit fees at Bitpanda. There may be card fees that your credit card company will charge. Also, if you are sending them money in a currency other than GBP, USD, EUR and CHF then you will have to pay an FX exchange fee which is not determined by Bitpanda.

If you are sending cryptocurrency to Bitpanda, then you may be subject to a deposit fee depending on the amount that you send. This should not really be a problem though as the amount is so small (0.05BTC). There is also a tiny cryptocurrency "wallet withdraw" fee that is added on top of the mining network fees.

When it comes to Fiat withdrawals, they are free if you are to make a payment in SEPA to a Euro based account. If you are withdrawing funds that are other than Euros, then you may be charged for inward payments depending on your bank.

Is Bitpanda Safe?

When using a cryptocurrency exchange, one of the most important requirements is the safety of funds. We have seen plenty of examples in the past of exchange hacks and other severe security breaches.

They do not go into too much detail about their security procedures online so we had to reach out to their support. Given that Bitpanda is a registered Austrian company, we can assume that this information is indeed valid.

Cold Storage

They claim to store all of their coins in an offline environment in secure cold storage. This is something that is standard on all exchanges these days and is the most secure form of storage. What this entails is the exchange taking most of their coins offline and storing them in an environment that cannot be accessed electronically.

The main advantage of this is that the coins are inaccessible to hackers. This is something that many exchanges have learned in the past when they stored their coins on hot wallets that have been hacked. The prime example of this is perhaps the Mt. Gox Saga.

DDoS Protection

Dedicated Denial of Service (DDoS) attacks are one of the most common forms of cyber-attacks known today. They are usually quite effective at bringing websites down and impacting the business in question. They have also been used with great effect on exchanges before such as Bitfinex.

Bitpanda claims that they have protection in place to prevent the threat of DDoS attacks. This could reduce any downtime that could by external actors.

Communication Protection

SSL Protection on BitPanda

SSL Protection on BitPandaOne of the most important protections for any site that handles sensitive information is that all of encryption through SSL. This is in order to stop the threat from any man in the middle type attacks where someone can get your information.

Bitpanda has full SSL encryption on their website. This can be seen with their green browser padlock. You should always make sure that when you are about to log into Bitpanda that you see this green padlock.

In case a hacker was trying to conduct any form of a phishing attack, this would alert you to a malicious website.

User Security

Speaking of phishing attacks, the final flaw in any exchange security is of course the user. In the case of Bitpanda, they make use of two factor authentication procedures. This is not enabled by default so you should probably do this the moment that you log in.

They also track the device login history and will lock the account when a new device has been used. You will need to confirm that the new device is indeed authorised in an email. This is similar to the security practices of Coinbase if you have used it before.

Irrespective of the security on an exchange, you as a user, should always make sure that you do not keep a large amount of coins on an exchange. This is cryptocurrency best practices 101.

Bitpanda Asset Coverage

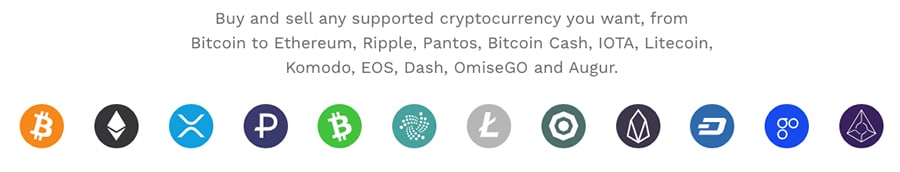

One of the advantages of Bitpanda is their relatively comprehensive list of coins that you can buy with Fiat currency. They have over 12 cryptocurrency assets that you can buy which include the likes BTC, LTC, ETH, XRP, BCH and MIOTA. You can see a complete list below:

Asset Coverage at BitPanda

Asset Coverage at BitPandaIf we were to compare this to some of their competitors, Bitstamp only has coverage for 5 cryptocurrency assets for example. This is perhaps down to the ease with which a relatively smaller exchange is able to list newer assets.

Hence, if ever there is a reasonable amount of demand for them to add a new coin, they would be able to do it with a lot more ease than other exchanges.

Payments & Withdrawals

Bitpanda has a range of different Fiat funding and withdrawal options. These will depend on what currency you plan on funding your account with. If you are in the EU and would like to fund in Euros, then a SEPA wire would be your best bet. This is free and will take only a few hours.

If you are based in Austria, Belgium, Italy, the Netherlands or Spain then you can use a SOFORT transfer. This will usually take between one or two days and is also relatively quiet cheap. This option is also available for withdrawals.

You can also use your credit card if you find this to be the easiest option. They take both Visa and mastercard. However, there may be fees that your credit card provider will charge if you do choose to use this. This option is also only available for payments and not withdrawals.

Bitpanda also lets you make payments and take withdrawals with two popular web wallets. These are Skrill and Neteller. However, this will require you creating an account with one of these services. You will then still have to withdraw from these wallets if you would like your funds in your bank.

Lastly, one more withdrawal only option you can use is Amazon.de. It is worth noting that with all of these withdrawal options, you can only withdraw to an account in your name (no third party accounts).

All of these payment and withdrawal options as well as individual limits depend on whether your account is verified. For example, below are the limits on SEPA payments / withdrawals.

| Limits (EUR) | Unverified | Verified | ||

| Method | Deposit | Withdraw | Deposit | Withdraw |

| Daily Limits | 0 | 1,000 | 500,000 | 500,000 |

| Monthly Limits | 0 | 7,500 | 5,000,000 | 5,000,000 |

| Total Limits | 0 | 30,000 | 100,000,000 | 100,000,000 |

You are also not allowed to make any purchases with credit cards, SoFort or online web wallets unless you are verified. Whether you want to verify your account will really depend on how much you want to withdraw vs. your requirement for privacy.

If you would like to verify your account, then you can create an account and follow these steps.

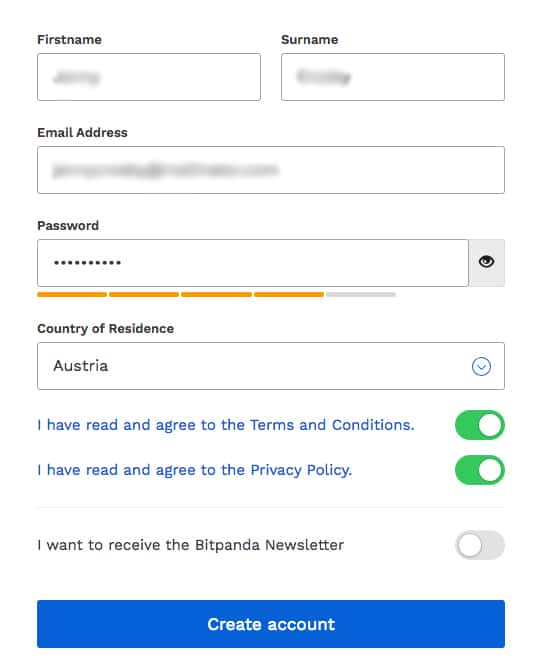

Registration & Verification

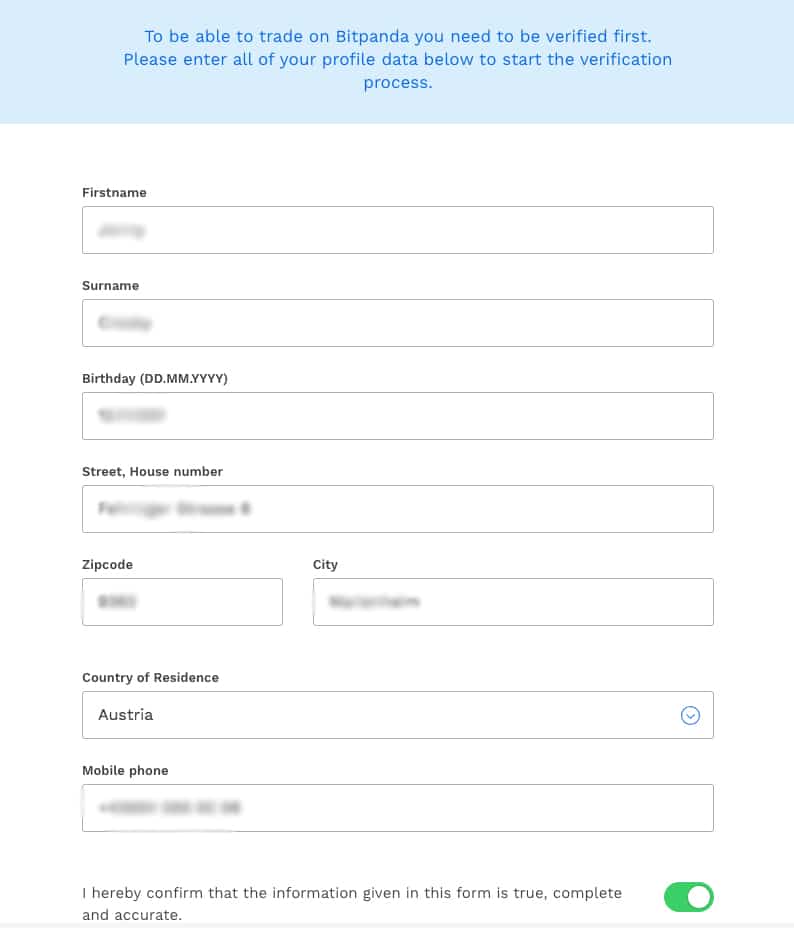

When you go to the registration screen you will be asked for details such as your name, email address and country of residence. You will need to use an active email address in order to confirm the account.

Registering at BitPanda

Registering at BitPandaBitpanda will send a verification email to the email that you have provided. Once you follow the verification link in the email, your account will be active and you can login. You can make your way around the platform and get a lay of the land.

However, before you can fund your account with fiat currency, you will need to get verified. Bitpanda will require you to complete their verification and KYC procedures. This is needed in order to combat money laundering and fraud.

Bitpanda has made it pretty simple to verify your identity. They have outsourced this to external identity verification providers. In this case they are identityTM and IDNow. Click on "verification" and Bitpanda will present you with the below screen.

Verification of Account at Bitpanda

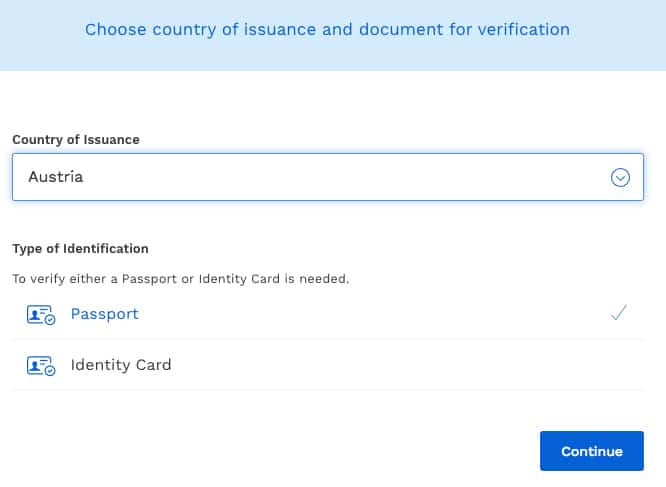

Verification of Account at BitpandaOnce you have filled out these details you will need to choose a form of ID. For those people who are based in Europe, you can use a passport or an ID card (some EU individual EU countries may not work. For those that are outside of Europe a passport will have to do.

Choose a Form of ID for Identity Verification

Choose a Form of ID for Identity VerificationOnce you have selected the form that you would like to use then you can select the identity verification provider that you would prefer. They are both relatively legitimate and would serve your purposes. These will take you off of the site and to the verification provider.

We chose identityTM and they required us to start a video session. They then asked us to hold our ID document next to our faces while they recorded the video. This is pretty standard for most identity verification agencies.

Once we completed this, the agency used their internal algorithms and were able to verify us remotely. This took only a few minutes and once we were verified, our funding option became fully enabled on the platform.

Bitpanda Trading Platform

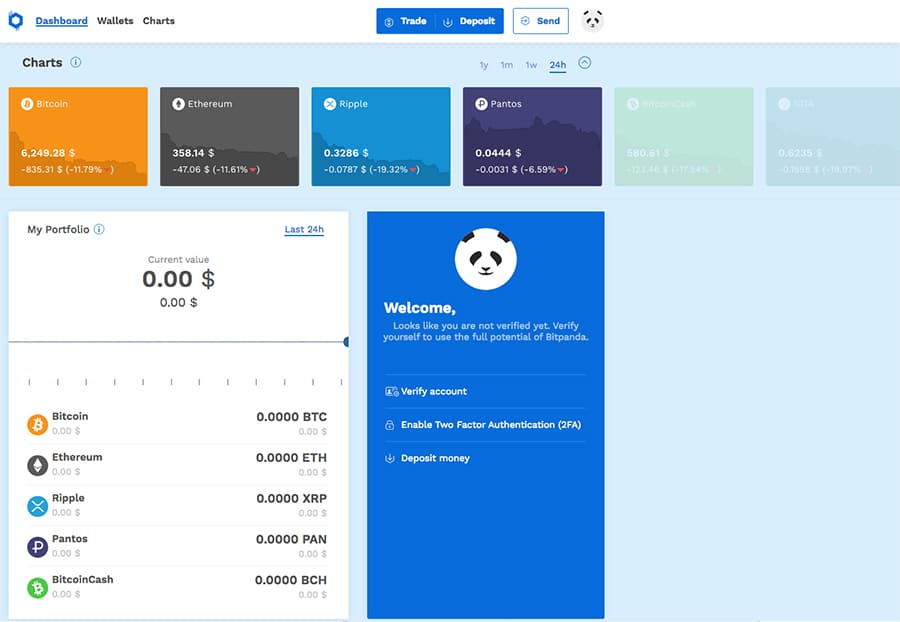

Let us take a deeper look at the underlying trading platform. This is perhaps the most important as it is where you will most likely be spending a lot of your time while using the exchange. Below is a screenshot of the homepage of Bitpanda.

Overview of BitPanda Trading Platform

Overview of BitPanda Trading PlatformIt seems as if everything is relatively well laid out and you can easily manage your entire account from here. For example, you can fund your account in the "deposit" section in the header. Once you have sent Bitpanda the funds then you can move directly to the "trade" section and place an order.

Bitpanda does not operate an order book based exchange like Bitstamp or Kraken etc. They are more like a Coinbase that is the market maker for the orders. This means that they will present you with the price to buy / sell the coins with their fee included.

In the top right of the platform you can take an in-depth look at your portfolio balances from the "wallet" link. This will give you an overview of all the funds that are in your fiat and cryptocurreny wallets.

Lastly, you can also monitor the price performance of a particular cryptocurrency by clicking on the "charts" tab. You can click on a chart that you would like to explore more in depth and it will give you a standard overview.

Charting overview at BitPanda

Charting overview at BitPandaOne thing to note though, is that this is not an exchange for the advanced trader or technical analyst. These charts are really basic and only give one the functionality to look at a cryptocurrency price over a certain period.

Moreover, all you can really do on this platform is set a price alert. You cannot place limit orders or stop losses. Hence, the Bitpanda platform is most likely suited for a new cryptocurency trader or someone who would just like to buy for HODLing purposes.

If you are a trader that would like more functionality from an advanced exchange, then you can always make use of an exchange such as Kraken. They accept clients from Europe and have a recently revamped trading engine and platform.

Of course, if Bitpanda is the easiest option for you to buy cryptocurrency with your Fiat then you can always use it as a "Fiat Gateway" and move your funds onto a dedicated trading exchange such as BitMEX. If you would like to cash out your crypto into Fiat again you could move your funds back onto BitPanda.

Customer Support

This is another really important criteria for us. When it comes to dealing with an exchange, the responsiveness and helpfulness of an exchange's support staff is essential. So we wanted to test out how effective this was at Bitpanda.

Currently, Bitpanda only has one option when it comes to reaching their support staff and that is through an online ticket system and telegram. This can be reached by hitting the "support" link in the footer of the site. In order to make sure that they address your request effectively, make sure you select the appropriate topic area. If this is in relation to a deposit that you send, there is an option to insert your transaction ID.

We wanted to find out about the Fiat withdrawal fees and options at Bitpanda so we sent a support ticket. It took the Bitpanda support team about 4 hours to get back to us. This is actually considered about standard for a cryptocurrency exchange. Bitpanda makes use of zendesk as they outsource their customer support.

Generally, there is no need to reach out to their customer support if the question has been asked before by one of their other users. This is why their "helpdesk" section is particularly useful. Here they have a list of frequently asked questions that other users have had.

Bitpanda to Go

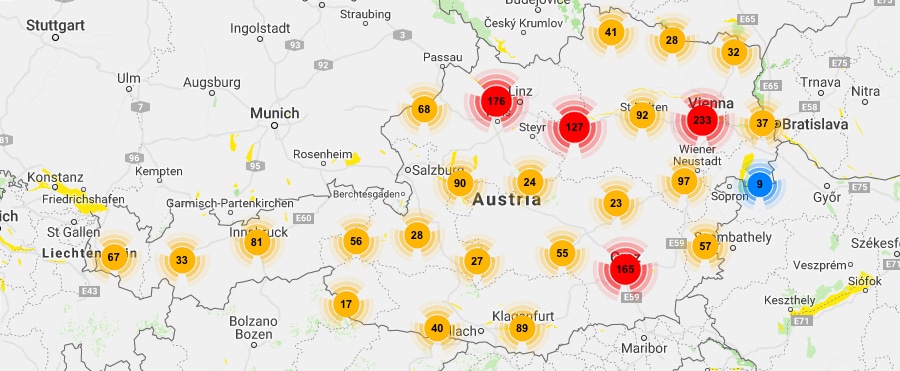

Something that we found quite interesting with Bitpanda was their "To Go" options. This allows those users in Austria who would like to purchase cryptocurrency anonymously with cash to do so. In order to buy crypto with the To Go option you have to buy a code from a post office.

There are over 400 post offices in Austria that you can use as well as 1,300 post partners. When buying from the post office, you will be given a code that you can use to redeem on the Bitpanda platform. These come in €50, €100 and €500 denominations.

BitPanda to Go Post Office Locations in Austria

BitPanda to Go Post Office Locations in AustriaOnce you have your code, you can create a new and anonymous account on Bitpanda. You do not need to give over anything except for an email. Once you login you will click "redeem voucher" in the "trade" tab. This will open up a new screen that will allow you redeem the voucher for a coin in question. Once complete, Bitpanda will send the funds directly to your cryptocurrency wallet.

Of course, this option is only really for those users who are in Austria. We have previously covered buying Bitcoin anonymously for those users who are based in other jurisdictions.

Bitpanda Plus

This is another interesting offer by Bitpanda. Their "plus" service is more of a bespoke OTC option for those traders who would like to trade much larger volumes that are currently on offer on their retail products. Over the Counter (OTC) trading is where you will co-ordinate directly with someone at the exchange who will try and find a buyer / seller for you.

OTC traders are made because most order books on public exchanges are not liquid enough to fully execute large block trades without an impact on the price. There are quite a few exchanges which are opening similar services.

This service is reserved for those traders who are buying or selling over €1 million. Hence, this is unlikely to be a solution for most traders but it is great to know that they offer this currently. If you wanted to find out more about Bitpanda plus then you can reach out to them here.

Bitpanda vs. Coinbase

For European traders, there are now quite a few options for a cryptocurrency exchange. One of those exchanges that is actively increasing their market share for Euro crypto pairs is Coinbase. They are also probably one of the most comparable competitors with their standard Coinbase platform.

So how do the two exchanges stack up? We take a look in the below table.

| Bitpanda | Coinbase | |

| Established | 2014 | 2012 |

| Jurisdiction | European Economic Area | Global |

| Buy / Deposit Methods | SEPA Wire, SOFORT, Visa / Mastercard, Skrill, Neteller, Cryptocurrencies | Credit Card, Debit Card, Wire Transfer (SEPA), Cryptocurrencies |

| Sell / Withdrawal Methods | Giro-Pay, EPS, SEPA Wire, SOFORT, Cryptocurrencies | PayPal, Wire Transfer, Cryptocurrency |

| Available Crypto Pairs | BTC, BCH, ETH, XRP, REP, DASH, OMG, EOS, KMD, MIOTA, 0x, LTC, XLM | BTC, ETH, ETC, LTC, BCH, ETC |

| Fiat Currencies Accepted | EUR, GBP, CHF, USD | USD, EUR, GBP |

| Trading Platform | Only buy / sell (No Charting) | Advanced (Coinbase Pro) |

| Languages | English, German | English |

| Customer Support | Online Tickets, Support Emails and Telegram | Email, Contact Form, Support Number |

| Trading Fee | 1.49% for BUY, 1.29% for SELL | 1.49% |

| Security | Standard | Advanced |

| Mobile App | Coming soon... | iOS and Android |

Which service you should use really comes down to your own preferences. While Coinbase has a much more advanced trading platform in Coinbase Pro, they have less coin coverage than Bitpanda. They both have similar fees although Bitpanda has slightly lower fees for the sale of coins.

Coinbase currently has a mobile application but Bitpanda claims that they are about to launch their own within the next couple of weeks. Although we do like the fact that Coinbase has more support options, they do not have cash purchase options.

What We Didn't Like

While Bitpanda seems like a relatively secure, easy to use exchange with good coin coverage, there are a few things that we thought warranted improvement. These are particularly necessary if Bitpanda is to compete with some of the larger and more established exchanges.

Firstly, they need to offer users slightly more advanced functionality when it comes to their trading charts and software. While Bitpanda is no doubt trying to make their platform as simple and easy to understand, there is no reason that they can't include an "advanced" trading platform where users can at least place stop or limit orders.

Secondly, although they have Telegram support, they could also consider adding telephone support for users in Europe. This is something that both Coinbase and Bitstamp have and helps ease client's concerns.

We also thought that the fees at Bitpanda were on the higher end of things. Although they are about in line with Coinbase, they are still much higher than exchanges such as Bitstamp and Kraken. Given how cost conscious cryptocurrency traders have become, this could be a deciding factor.

Conclusion

Our Bitpanda review was relatively easy to conduct. This was due to the transparency of the business as well as their stable track record. We were impressed with their coin coverage as they are the only Fiat exchange we have seen with so many coins to choose from.

They are also one of the most user friendly exchanges that we have covered recently and they seem to be relatively well regarded in the community. We really found the cash buying options to be quite refreshing especially given that many other exchanges are moving away from this.

As mentioned, there is room for improvement and hopefully they are likely to address these points in due course. We are waiting to see how the mobile application turns out so that we can also review it (watch this space).

In summary, Bitpanda is a great option for cryptocurrency users in Europe. Their emphasis on being user friendly is perhaps one of the main reasons that they have such a unique name. “As friendly as a Panda”

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.