Cryptopia is a cryptocurrency exchange that offers one of the largest selections of altcoins on the market today. Traders often turn to the exchange when they are looking for promising low market cap altcoins.

However, is Cryptopia safe and can they be trusted?

In this comprehensive review of Cryptopia, we will take look into this exchange and everything that it has to offer. We will analyse the platform, security, fees and trader experience.

We will also walk you through the platform and give you insight into the dos and don’ts of Cryptopia.

Cryptopia Overview

Cryptopia is a New Zealand based cryptocurrency exchange that is based in Christchurch. The exchange operates as a legitimate New Zealand company with registration number of 5392901.

In terms of New Zealand based regulations, Cryptopia is not registered as a "financial service". The company is listed as a "software development service" which most likely ties into the lack of general global regulation for digital assets.

It was started in 2014 by two founders called Rob Dawson and Adam Clark. They initially started the exchange as a hobby but decided to quit their jobs last year and run the exchange full time.

As the price of Bitcoin has exploded over the past year, Cryptopia has undergone an immense expansion. For example, last year they only had the two founders operating the exchange. Now, the team has expanded to over 50 as they try to cope with demand in the market.

They are a peer to peer exchange where users are trading on directly among themselves on the platform. They are also pretty unique as they include a marketplace where Bitcoin can be spent on just about anything.

Is Cryptopia Safe?

Like many other exchanges in the past, Cryptopia has been the victim of a pretty large hack. This happened on the 14th of January 2019 which saw the hackers gaining access to 17,000 of the exchange's wallets.

Although it was reported to the police on the 14th of January, the hack continued for over two weeks after that. This means that the hackers had managed to extricate thousands of private keys some of which Cryptopia did not even know about.

The result of this was that the hackers were able to siphon off anywhere between $16m to $23m from the exchange. However, it seems as if the exchange was able to stem the flow and police said the exchange could begin operations again on the 13 of February.

So, while the exchange was able to stop the hack and pave the way for coming back online, it does not instill a great deal of confidence. At least Cryptopia is being open about it and have been regularly updating users as to the status of the investigation and exchange.

What does this mean going forward?

Well, as mentioned, there have been a number of other exchanges that have been hacked and have managed to come back pretty effectively. These include the likes of Poloniex and Bitstamp. What is most important for Cryptopia is that they have learned from this experience and have patched their systems as well as the vulnerabilities that allowed it to happen.

There is still sparse information on the internal security protocols that are followed by Cryptopia and we can only hope that they are following best practices when it comes to wallet cold storage and multi signature protocols.

There are, however, important user security protections that are in place.

User Security

Firstly, we can see immediately that the exchange is SSL protected. This means that all of your traffic with the exchange is encrypted.

Cryptopia SSL Certificate

Cryptopia SSL CertificateIt is quite important that you make sure that you are visiting the correct site that has the SSL padlock in the browser address bar. Hackers often use phishing to send you to illegitimate sites.

When it comes to login security, Cryptopia appears to have all the standard 2 factor authentication procedures. This is not set as default so it is advised that that you enable this feature the moment that you create an account. This is because numerous users have reported unknown login attempts on their Cryptopia accounts.

Irrespective of the security procedures on an exchange, you should never make a habit of leaving large amounts of coins on an exchange. From the Bitgrail hack to the Mt. Gox one, people have learned the hard way of leaving funds on an exchange.

Cryptopia Asset Support

Probably one of the best selling points of the Cryptopia Exchange is it’s extremely broad asset support. In fact, the number of assets supported is so broad that it is unlikely that any one trader would need even half of them.

For example, on Cryptopia, you can buy PutinCoin (which as of today had a daily trading volume of 0.6 bitcoin) MagnetCoin (with a volume of 0.28 bitcoin today) and even something called King 93 (with a volume of 0.04 bitcoin).

Not only is the asset choice incredibly wide, but the site also allows for direct exchanges between various popular currencies such as Litecoin and Ethereum. This is important because it means that traders do not need to convert everything into Bitcoin first before they can convert into another cryptocurrency. This can potentially save on fees, as each time a currency is traded, a fee is charged.

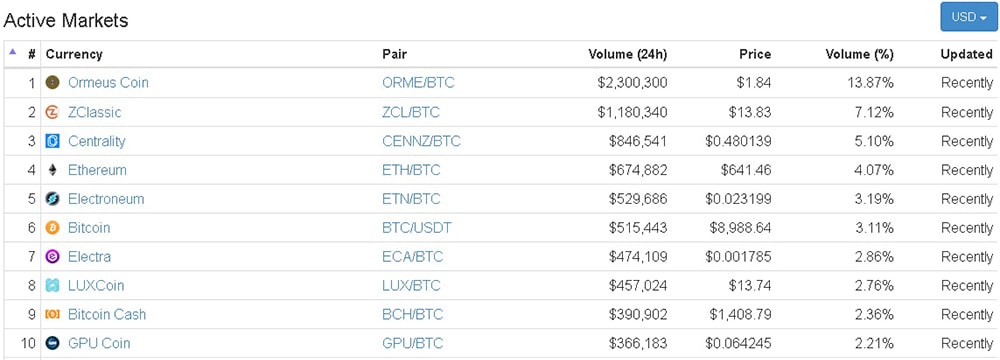

In terms of the volume on the exchanges at Cryptopia, you have total 24 hour volume at about $16m currently. Below you can see a breakdown of the largest volume over the past day. What you will probably notice is that some of the more obscure altcoins have larger volume than established coins.

Source: coinmarketcap.com

Source: coinmarketcap.comWhen it comes to Altcoin volume, Cryptopia had roughly 50% of all the daily volume for Ormeus coin. This shows that it would be the right exchange to go to if you had any particular interest in trading this coin.

Cryptopia Fees

Cryptopia charges a fee of 0.20% of the total value of each trade. Comparing this to other exchanges, Binance charges 0.1% and Polonium charges between 0% and 0.25%. This implies that Cryptopia fees are mid range, and not particularly high or low.

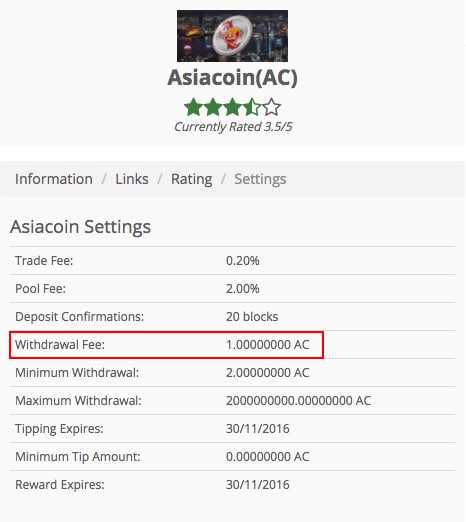

When it comes to funding and withdrawal, Cryptopia has a fee for a withdrawal of your coins. These vary according to the coin and are a flat rate. For example, they are 0.01 BTC for the withdrawal of 1BTC or equivalent.

You can view the withdrawal fee for the coin in question in your dashboard by clicking on the "settings". Cryptopia claims that these are based on the fees for the blockchain of the particular coin.

Funding / Withdrawl

Cryptopia is based in New Zealand and the bank that they use is also based in the country. This means that they only have fiat funding options for people who live in New Zealand and are funding in NZD.

However, if you would like to trade on Cryptopia and you are not based in New Zealand you can still use cryptocurrency funding. You would have to use another Fiat gateway in your country that will allow you to buy Bitcoin or Ethereum with your currencies.

As a new account, you have a Level 1 verification level. This allows you to withdraw up to $5,000 NZD per day without any form of identification. If you want a higher level of verification then you can request for a Level 2 verification.

This requires you to provide documentation such as an ID card as well as your residential address. If you have been verified to level 2 then you are entitled to withdraw up to $500,000 NZD. There is a third tier of verification that is available for high net worth individuals and business accounts.

Cryptopia Customer Support

Like many other popular exchanges, the customer support category is one where Cryptopia seems to fail. A quick search of the internet reveals many hundreds or even thousands of customers that are angry with not receiving any response, often for days or even weeks.

These complaints are often in relation to deposits or withdrawals not working or not appearing. This can be a very unnerving experience when a customer feels that their money has essentially disappeared and no one seems to care.

In addition to customers, those seeking to have their assets listed on the exchange also have complaints of their own.

Speaking on the condition of anonymity, one highly respected individual who worked with several blockchain projects that wanted to be listed on the exchanged noted the following:

"..trust me: stay away from Cryptopia", and "it's NOT a professional company and I expect a lot of trouble in times to come".

The source went on further to say

...I know their customer service is unprofessional as fuck - making sex jokes and such while you want to list your coin.

The source informed us that the price for listing on Cryptopia is already over $400,000 USD in equivalent cryptocurrency.

It should be noted, however, that it is likely that only those with bad experiences will go on the internet to leave comments about the support. If someone had a good experience, most likely will not leave comments about it. However, the sheer number of negative comments implies that there are still a lot of issues with Cryptopia customer support.

To Cryptopia's credit, this is something that they are taking note of. We have seen that the Cryptopia team has gone from 2 people one year ago to over 50. The following was posted on their support page:

Due to continued unprecedented growth we are receiving support tickets faster than we can train new staff to deal with them

As the cryptocurrency markets have cooled down since the intense demand of December / January, it is likely that response times at Cryptopia support would have improved.

Trading Platform

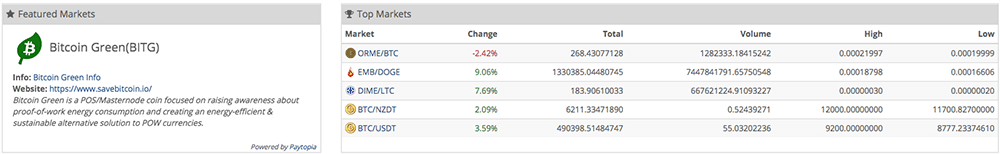

Let’s move to the engine of the beast. When we navigate to the exchange tab on Cryptopia, you can see the range of markets that are open to trade with. They also have a nice summary of the coins that are trending for the day.

This is needed because the amount of coins that are listed on the exchange can be slightly overwhelming. At the time of this review, there were 1,737. One has to wonder whether it is necessary to have all these coins listed especially those that have almost no volume to speak of. This is a Cryptopia business decision no doubt.

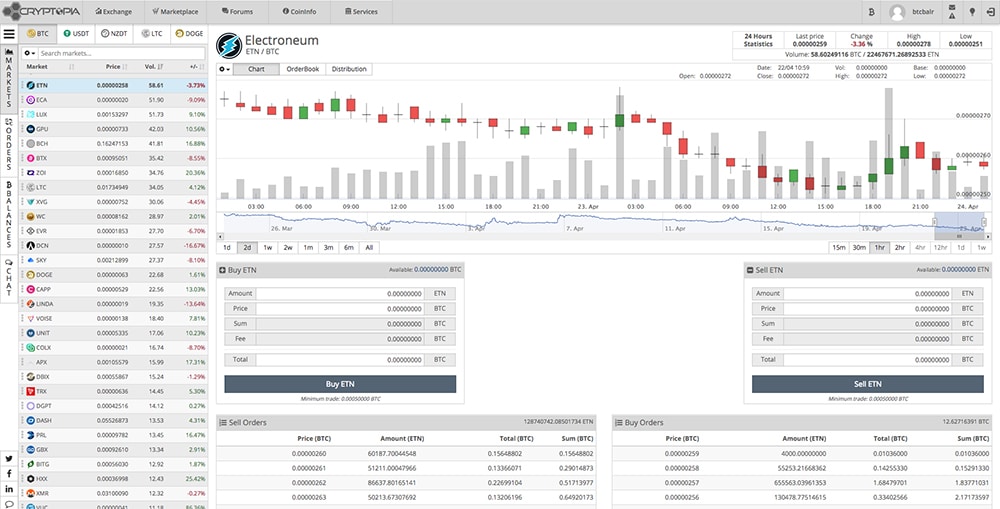

If you want to trade a particular coin, you will select the market to the left. Once you have selected the market then you will be taken to the order books and charts of the market in question. Below we have a screenshot of the market for Electroneum.

You can switch between the different markets here. The buy / sell order forms are pretty straightforward. You can also see the order books below the order form. Unfortunately, for those professional traders who want advanced charting, Cryptopia does not seem to offer this.

We also do not like the fact that the market depth is on a separate tab. You will have to navigate there in order to see the buy / sell walls before you place your trade.

In terms of trading speed, the engine seems to be quite responsive and pushes your order to the books relatively effectively. Assuming that there is a reasonable amount of liquidity for the market that you have interest in, your order should be executed relatively effectively.

In summary, the trading platform seems to be relatively easy to use but does leave something to be desired for the more advanced traders.

Adding New Coins

Given Cryptopia's reputation for having an extensive list of traded coins, there are many people who would be interested in the procedure that is required in order to add coins. This could either be users in the community who want their coin added or project team members.

Adding New Coins at Cryptopia

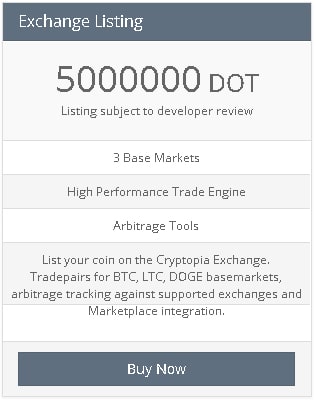

Adding New Coins at CryptopiaIf you want to add the coins, you will have to head over to the Paytopia section. This is where you will order all of the services and products that are offered directly by the exchange. You will select the "Exchange Listing" option.

As you can see, this costs 5m DOT (Dotcoin). At current market rates that costs about $95,000. While still pricey, this is considerably less than the cost of listings on larger markets such as Binance (close to $1m).

Once listed with this package, your coin will be traded against three pairs (LTC, BTC and Doge). Your coin will also make use of Cryptopias trading engine and Arbitrage tools. There are also a range of other exchange services that you can purchase which we won’t go into here.

Is this a good idea by Cryptopia? Yes and no.

While it is great that the exchange makes it easy for anyone to list their coins, it does mean that a whole host of really low quality coins could get listed. As long as a team is able to scrape together 5m DOT then they can get any random coin listed.

Once some of these coins are added, they may in fact languish with little volume as we have seen.

Other Features

As you may have picked up, Cryptopia is quite a weird exchange in the range of goods and services that they offer. While there is no doubt that the most important part of the exchange is their trading platform, they have a few other features which warrant some coverage.

Cryptopia Marketplace

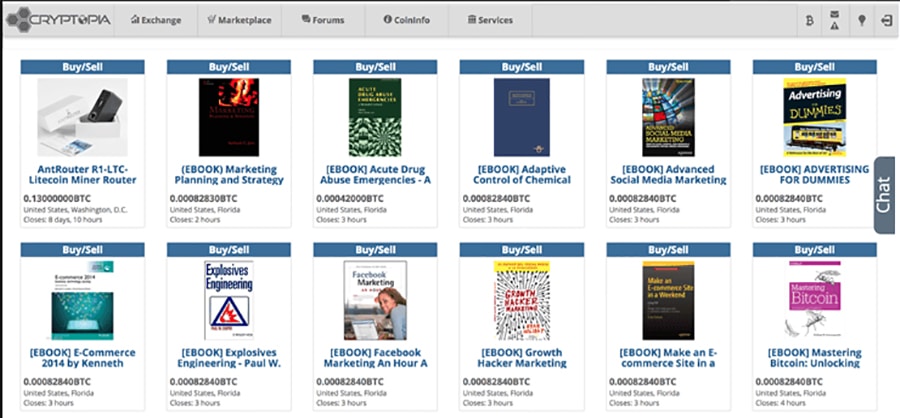

As mentioned, Cryptopia was started more as a hobby by the two Kiwis back in 2014. One of the interesting extensions that they included was a cryptocurrency marketplace. Based loosely on the Ebay model, users can buy or sell a range of goods for cryptocurrency on the platform.

The Cryptopia Marketplace

The Cryptopia MarketplaceAs you can see, there are a range of different items put up for sale. Some of them are software related like Bots and signal services. There are also extensive trading guides and educational material.

If you would like to create a listing yourself, you will click on the "Add" button. Once you have completed the information, you have the option to either set a fixed price for the listing or to let it run as an auction.

Coininfo

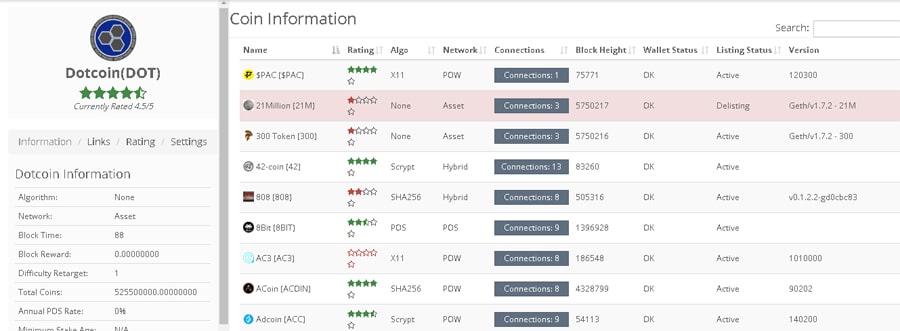

If you wanted a nice and succinct summary of all the coins that are on the market as well as some technical information about them, then you can head on over to the coininfo section. This is in the top header bar of the exchange.

Coininfo Section on Cryptopia Exchange

Coininfo Section on Cryptopia ExchangeIt will give you information on the coin including the hashing algorithm, user rating, consensus algorithm as well as the current block height. You can also click on a particular coin and it will give you a more detailed breakdown on the left.

This information includes things such as wallets, coin supply, mining and relevant project links. The coininfo page is indeed a great way for you to get an overview of smaller cap coins. The best thing is you don't even have to have an account at Cryptopia to view this information.

Arbitrage

Looking to take advantage of price differences in numerous cryptocurrency markets?

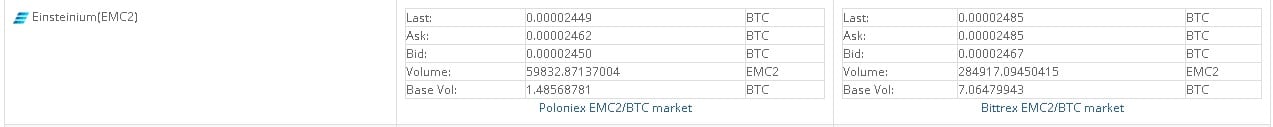

Cryptopia offers you the exchange arbitrage service. This will basically provide you with information on the prices that numerous popular cryptocurrencies are listed at on other exchanges. This could give you an opportunity to "arbitrage" the different rates if you identify a mispricing.

While making money on the arbitrage of crypto can be quite tough these days on larger cap coins, numerous opportunities may still exist with the smaller cap cryptocurrencies. As a general rule of thumb, those coins that have less liquidity and volume will have more glaring Arb opportunities.

Arbitrage Tracker

Arbitrage TrackerFor example, in the above image there appears to be a slight arbitrage opportunity in Einsteinium (EMC2). You can buy it on Poloniex (Ask) and then immediately sell it on Bittrex (Bid) for a small profit. Of course, this does include the exchange and network fees.

Cryptopia Rewards

Another interesting add on at Cryptopia is their reward bot. Essentially this will reward traders who complete a number of tasks on the platform. The tasks as well as coin and reward amount are really all random in nature and must be completed in a certain period of time.

For example, rewards can be given for finding certain blocks, for voting on some outcome and tipping or trading.

It seems as if the latest rewards are all the way back in March so perhaps the number of users deciding to take part in the program are focused on other things.

Conclusion

You will need to use a Fiat gateway to get Bitcoin in order to fund your account. While the trading engine seems to be relatively effective, you may want to consider another exchange if you are interested in more advanced charting.

You will also need to practice patience with their customer support as they are known for being quite slow when it comes to their tickets. Thankfully, they have a forum on the site so that you can ask other traders who may have some insight.

In short, this is a great exchange for smaller market cap Altcoins that are not available on larger exchanges and is usually the testing ground for brand new coins.