Every so often a cryptocurrency is released that makes you a do a double take. Efforce (WOZX) is certainly one of those cryptocurrencies. Efforce was founded by world famous Apple co-founder Steve Wozniak, and WOZX cryptocurrency token went from a price of 10 cents USD to over 3$USD in its first days on the market. In just the first 13 minutes of trading, WOZX had an unrealized market cap of 950 million USD.

Although this price action made the headlines both inside and outside of the cryptocurrency space, it seems that not a single article or YouTube video has managed to properly unpack Efforce or the WOZX token.

This is unfortunate because there are certainly many people who want to know whether the price action of the WOZX token is warranted or if it is all just namesake hype. This is what we are here to find out.

A brief history of Efforce

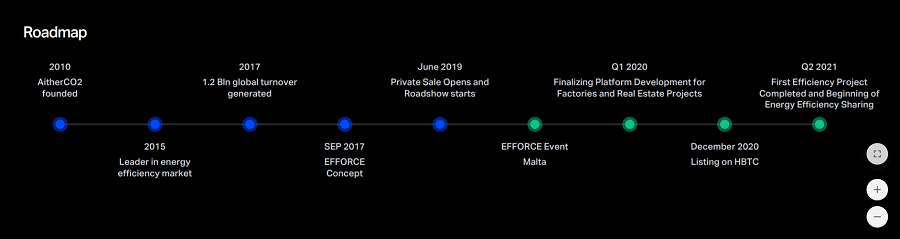

While the face of Efforce may be Apple co-founder Steve Wozniak, according to the Efforce roadmap the project has its roots in an Italian company called AitherCO2. Founded in 2010, AitherCO2 is a “provider of financial services to the world’s environmental and energy markets offering consultancy and trading solutions”.

AitherCO2 seems to be the primary entity behind Efforce.

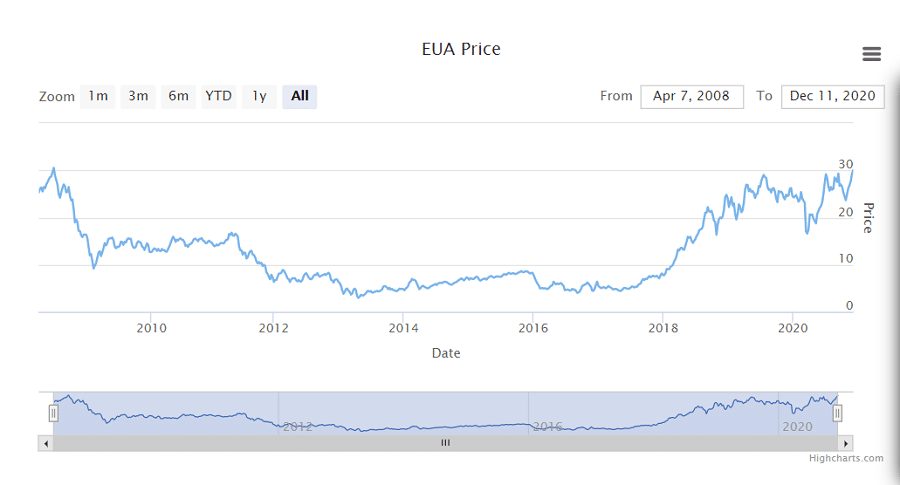

AitherCO2 seems to be the primary entity behind Efforce. The exact financial services AitherCO2 provides are not the sort that you would expect nor the type that the average person would use. AitherCO2 essentially buys, sells, and offers trading services (spot, futures, etc.) of energy and carbon allowances issued to European companies by the European Union.

In an interview, Steve noted that he has been “working in stealth with this group for a couple of years”. Whether he was around when the Efforce concept was created by AitherCO2 in September 2017 is not entirely clear. Efforce Limited was incorporated in Malta in June 2018 but was not publicly revealed until July 2019 when a Maltese newspaper published an article about Steve and his new startup, Efforce.

There have been many questions as to what exactly Steve’s role is at Efforce. In an interview he noted that he is “in an engineering role, contributing to the blockchain thinking and accessibility of WOZX.” This is also reflected on the Efforce website which lists various members of AitherCO2 as being the co-founders of Efforce along with Steve.

On December 1st 2020, Efforce announced that their WOZX token would be listing for trading on HBTC on December 3rd and on Bithumb shortly afterwards. The impressive price action of the token made the headlines in major newspapers, especially after Steve noted that he considered the WOZX token to be equivalent to shares of Efforce’s stock.

What is Efforce?

Efforce seeks to increase the energy efficiency of various industries by making it possible for companies to crowdfund their energy redevelopment projects using cryptocurrency (e.g. install solar panels). Contributors who fund these initiatives will in turn receive a portion of the energy savings of the company.

This is accomplished via the Efforce platform which uses smart contracts on the Ethereum blockchain to create agreements between contributors and the companies whom they are crowdfunding. Efforce also uses Ethereum to create tokenized energy savings. These can be freely traded and even used to offset energy costs for the contributors who hold the token.

How does Efforce work?

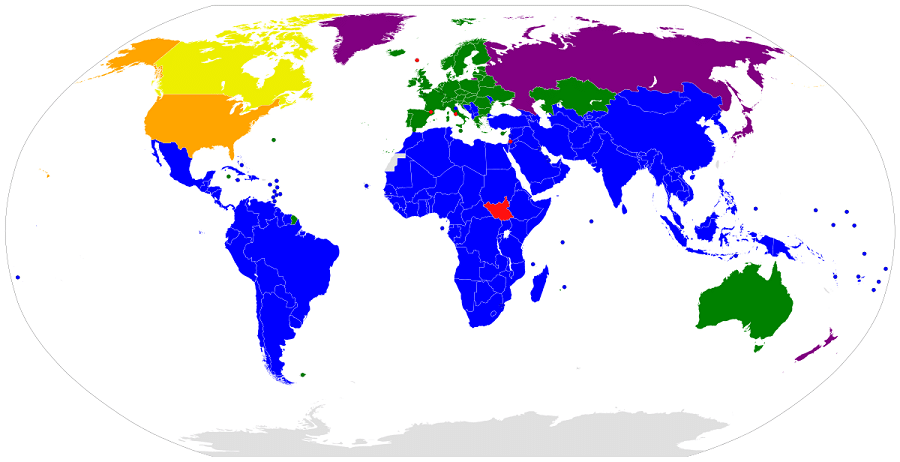

To understand how Efforce works, it is helpful (if not necessary) to understand the Kyoto Protocol. Far from being a cryptographic program, the Kyoto Protocol is an international treaty created by the United Nations in the early 90s to reduce carbon emissions to fight climate change. The treaty was signed in 1997, introducing something called Carbon Credits to many developed nations.

Current signatories to the Kyoto Protocol. All countries except those in red are a part of it in some form.

Current signatories to the Kyoto Protocol. All countries except those in red are a part of it in some form. Each Carbon Credit represents “the right to emit one ton of carbon dioxide or the equivalent amount of a different greenhouse gas”. Companies earn carbon credits from governments and regulatory bodies when they engage in practices that reduce their emissions.

Oddly enough, the introduction of Carbon Credits has created an entirely new market. Carbon Credits cost anywhere between 4$USD to over 30$USD depending on demand from traders and other companies. Fun fact: Tesla makes most of its money from selling the Carbon Credits and is projected to earn 1.5 billion USD from selling Carbon Credits in 2020 alone.

Carbon Credits are just one type of energy credit that can be traded, and this energy credits market is the focus of the Efforce platform. Investors (Contributors) can crowdfund developments which reduce energy expenditures at a given company (Saver). In return, Contributors are given a tokenized representation of the energy credits as a company receives them.

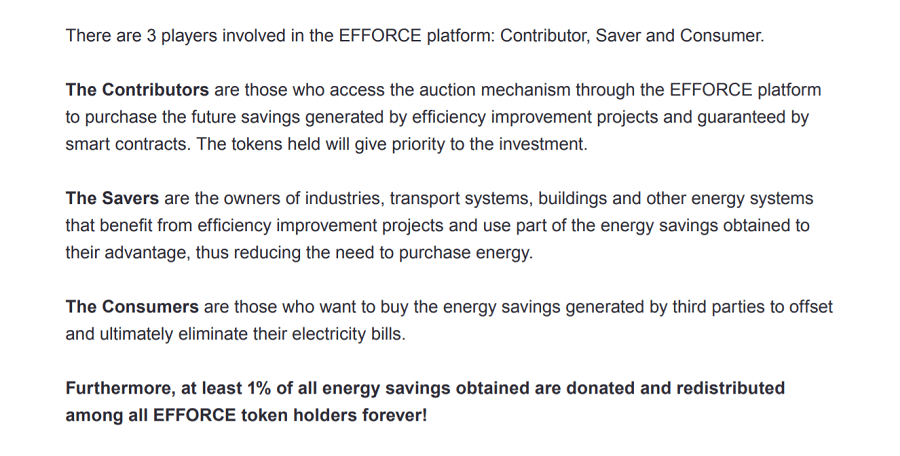

The three participants of the Efforce platform and their roles.

The three participants of the Efforce platform and their roles. Like Carbon Credits, the tokenized energy credits on Efforce can be freely traded, and a third party (Consumer) could opt to purchase these tokenized credits to reduce their own electrical costs. As such, regular people like you and me will likely not be participating on the Efforce platform anytime soon. It is geared towards large corporations which deal with these energy credits.

Although services like Efforce already exist (notably AitherCO2, the company which co-founded the project), what sets Efforce apart is that it can streamline an otherwise costly and complicated process. As with other cryptocurrency projects, it can achieve this by using smart contracts in lieu of middlemen such as banks, brokers, and lawyers.

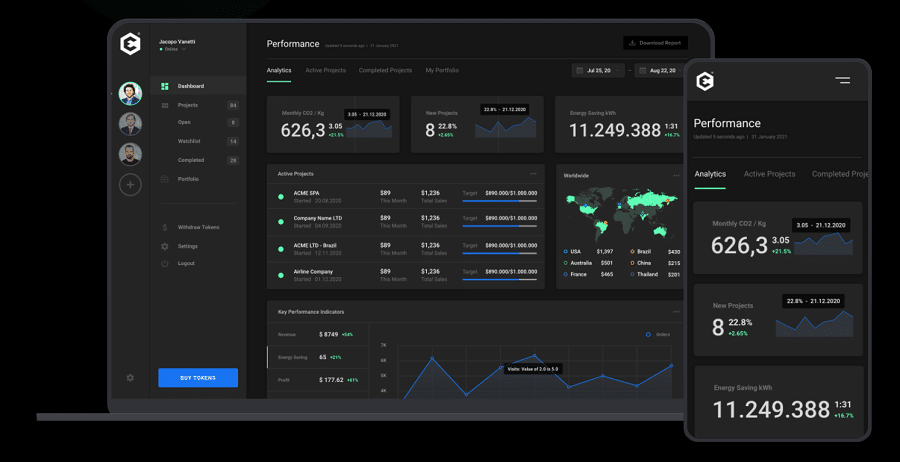

Efforce Platform

The Efforce platform is intended to be an energy credits marketplace. Not much is known about the Efforce platform as it is not clear whether it has been completed at the time of writing. The Efforce roadmap seems to suggest that the platform was completed in Q1 this year and if it was then it is not available to the general public.

The Efforce whitepaper suggests that some sort of KYC process will be required to use the platform, which again is likely reserved to corporations and high net worth individuals. The three parties on the platform have already been described (Contributors, Savers, and Consumers), which leaves the criteria for listing an energy saving project.

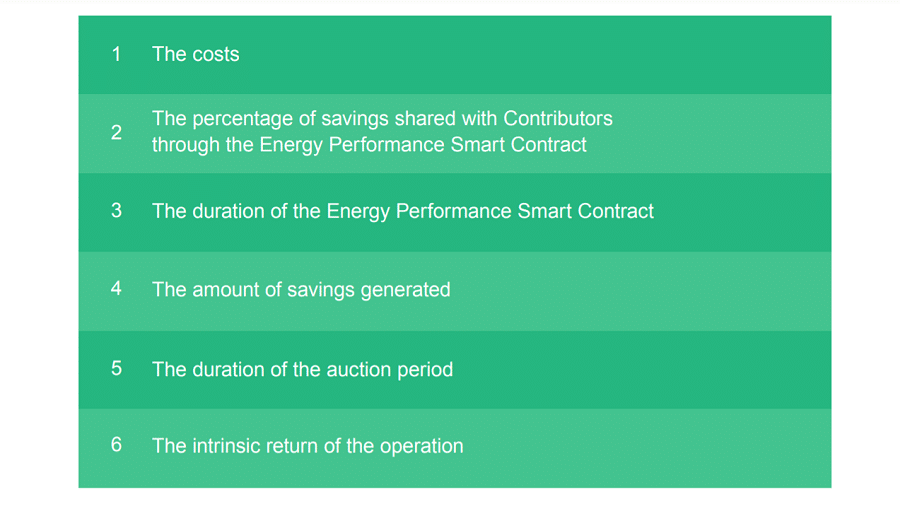

What Efforce requires to list a project on their platform.

What Efforce requires to list a project on their platform. The Efforce team will decide which project gets funded and will help Savers come up with ideas if they are adamant about reducing their energy expenditure. To this end, the Efforce team will help estimate the required investment, the return on investment (how many energy credits they will get) and the duration of the contract.

Once the details have been hammered out, Efforce creates an Energy Performance Smart Contract on the Ethereum blockchain which is implemented onto their platform. At that point, Contributors will be able to fund the project using stablecoins (apparently USDT – let us hope that was just an example).

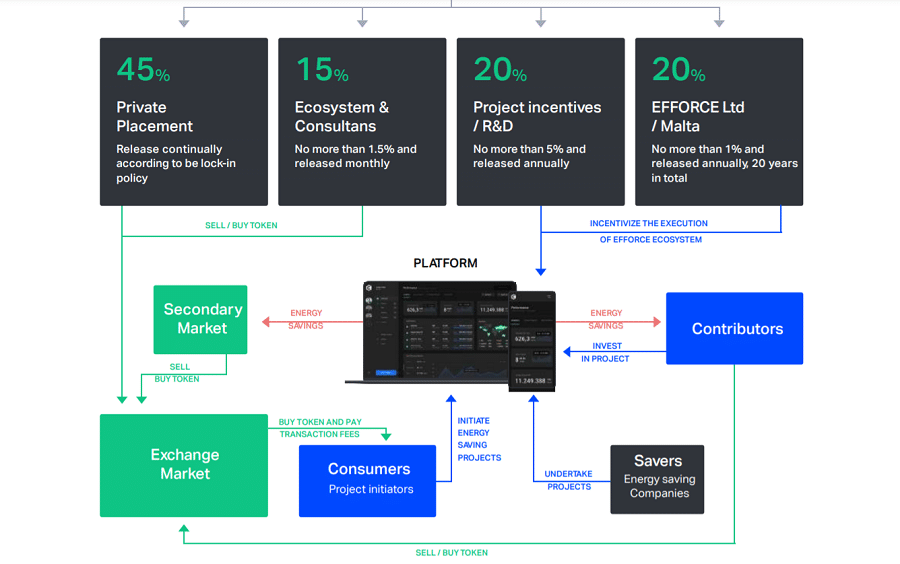

The incentive structure of the Efforce Platform.

The incentive structure of the Efforce Platform. Since each project has a fixed funding amount (e.g. 1 million USD), which Contributor gets to invest first is determined by how many WOZX tokens they have. The whitepaper suggests WOZX might need to be staked relative to the funding provided (1:1 WOZX/USDT). Once funding is completed, the Saver begins to accumulate a tokenized representation of the energy they are saving in their own Ethereum wallet.

The Efforce whitepaper repeatedly refers to tokenized energy savings but does not make it clear whether the WOZX token will represent those energy savings.

The Efforce whitepaper repeatedly refers to tokenized energy savings but does not make it clear whether the WOZX token will represent those energy savings. It is unclear whether the energy savings generated are themselves tokenized or if the WOZX token is itself a representation of the energy saved. However, the Efforce whitepaper repeatedly states that 1% of all energy savings from projects on the platform will be redistributed to WOZX token holders. It is again unclear as to how this will be done (most likely WOZX airdrops that are equivalent to 1% in USD).

Efforce Mining

Efforce mining is not at all like cryptocurrency mining. Efforce mining involves getting Savers and Contributors to use the Efforce platform. As such, there are two types of ‘mining’ incentives on Efforce: Major Partners Sign Up and Funding Partners Contribution.

As the name suggests, Major Partners Sign Up involves introducing a company to Efforce that successfully launching a crowdfunding round for their energy project. This incentive earns 30% of the WOZX tokens allocated to mining each year.

How to 'mine' WOZX cryptocurrency on Efforce.

How to 'mine' WOZX cryptocurrency on Efforce. In contrast, the Funding Partners Contribution reward is given to Contributors who invest the most into energy projects on the Efforce platform. They are given the remaining 70% WOZX tokens allocated to mining each year. Under certain market conditions, their allocation of WOZX tokens could be worth more than their initial stablecoin investment.

WOZX Cryptocurrency Explained

WOZX is an ERC-20 token used by Contributors on the Efforce platform as an auctioning tool to fund energy saving developments and receive tokenized energy credits. WOZX may also represent these tokenized energy credits though this is not entirely clear at the time of writing.

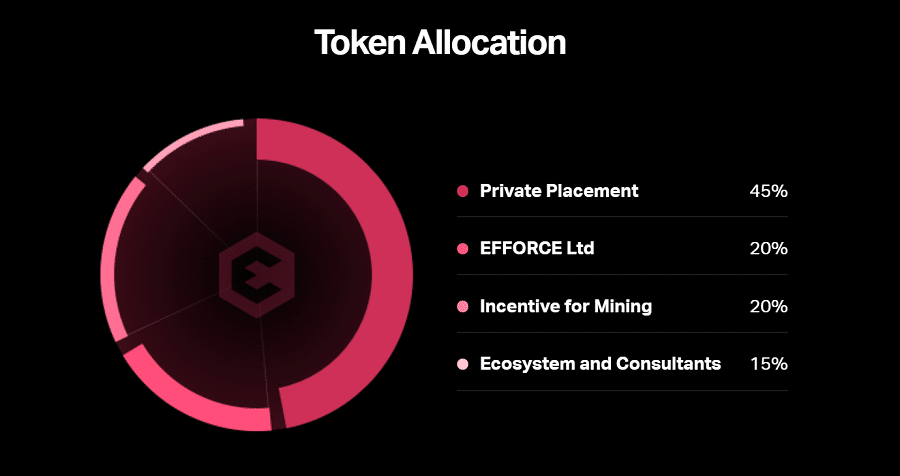

WOZX has a maximum supply of 1 billion and is neither inflationary nor deflationary. Of WOZX’s total supply, 20% were allocated to Efforce with a vesting schedule of 1% per year. When asked in an interview, Steve Wozniak noted that he does not hold any WOZX tokens.

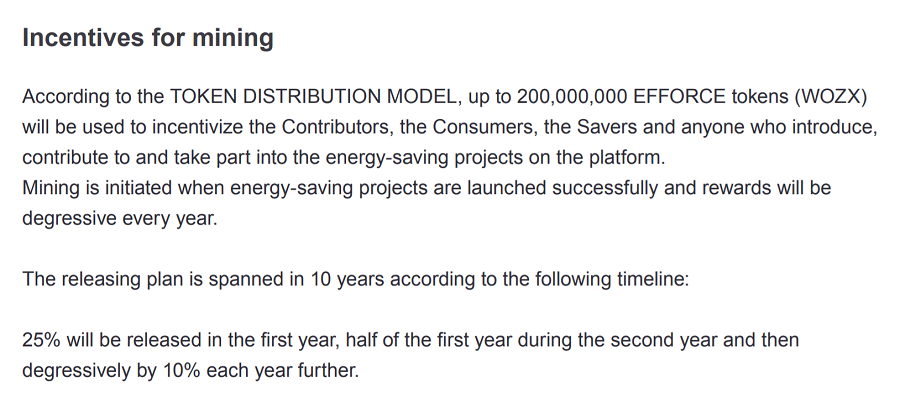

The release schedule for WOZX tokens allocated to mining.

The release schedule for WOZX tokens allocated to mining. 20% of WOZX’s total supply was allocated to research and mining incentives. These tokens will be released at a rate described in the image above. Another 15% of the total supply was allocated to ecosystem growth and to pay for consulting. These tokens will be released at a rate of 1.5% per month. The remaining 45% of WOZX tokens were sold during a private sale detailed in the next section.

WOZX ICO

Efforce did not hold an ICO for its WOZX token. Instead, 450 million WOZX tokens were sold during a private sale which took place in June 2019. One YouTube video suggests the ICO price was 10 cents USD per WOZX.

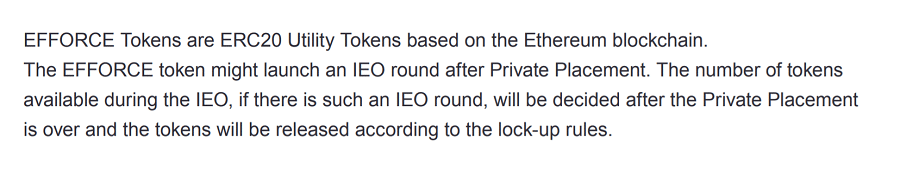

The Efforce whitepaper suggests a possible IEO in the coming months.

The Efforce whitepaper suggests a possible IEO in the coming months. The Efforce whitepaper indicates that these tokens are also subject to an unspecified lockup period. The whitepaper also highlights that future WOZX token sales are on the table, including an IEO.

WOZX Cryptocurrency Price Analysis

Assuming the ICO price of 10 cents is correct, the WOZX token has managed to pull a 36x move in its first week of trading, peaking at over 3.60$USD. Most of this price action appears to have been driven by hype, which has begun to die down and has been exaggerated by the recent slump in the crypto market.

Image via HBTC

Image via HBTC Although the use case for WOZX suggests that the token should see impressive price performance in the future, there is one very important thing to keep in mind. Nearly 95% of all WOZX tokens are held by just three wallets, with the top two accounting for 85% of the total supply.

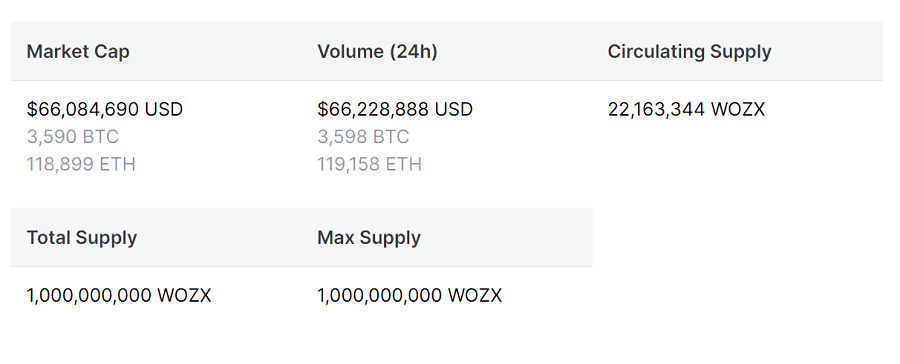

Only about 2.2% of WOZX total supply is currently on the market.

Only about 2.2% of WOZX total supply is currently on the market. According to CoinMarketCap, only around 22 million WOZX are currently in circulation, accounting for 2.2% of its total supply. If you decide to invest, exercise great caution as it would be very easy for a whale to crash this market by selling just a few million WOZX tokens.

Where To Get WOZX Cryptocurrency

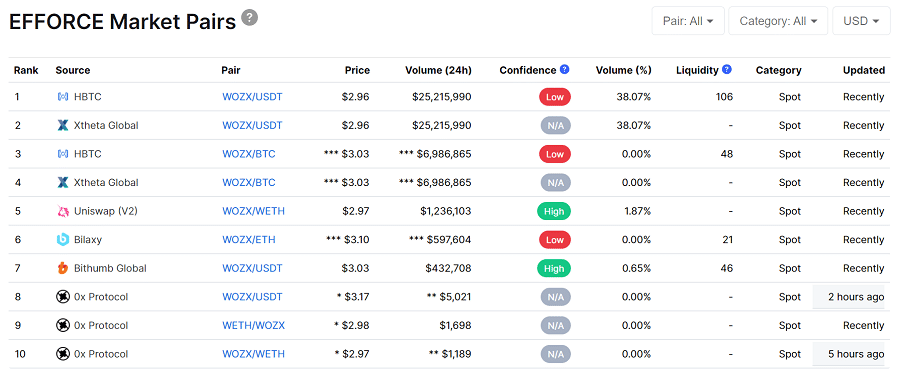

The WOZX token is not trading on very many reputable exchanges. At the time of writing, your only option for centralized exchanges is Bithumb.

You can also get WOZX on Uniswap but be mindful of the additional fees you will need to pay in ETH gas. Trading volume on both exchanges is likewise not all that great.

WOZX Cryptocurrency Wallets

Since WOZX is an ERC-20 token, it can be stored on just about any wallet that supports Ethereum-based assets. As far as hardware wallets go, your best options are Trezor and Ledger devices. These are good to get if you plan on holding the WOZX token for a long time.

For software wallets, consider the Exodus Wallet or Atomic wallet. Both are available on mobile and desktop and are optimal if you are planning to trade WOZX regularly.

Efforce Roadmap

Although Efforce has a roadmap, it does not provide many details about upcoming developments. The only milestone noted takes place in Q2 of 2021 and involves launching the first crowdfunded energy redevelopment program on the Efforce platform.

The project which launches will presumably be one of the two mentioned in the Efforce whitepaper. The first is the optimization of an “industrial tri-generation plant” located in Italy. The second involves renovating a hotel complex on the southern coast of France.

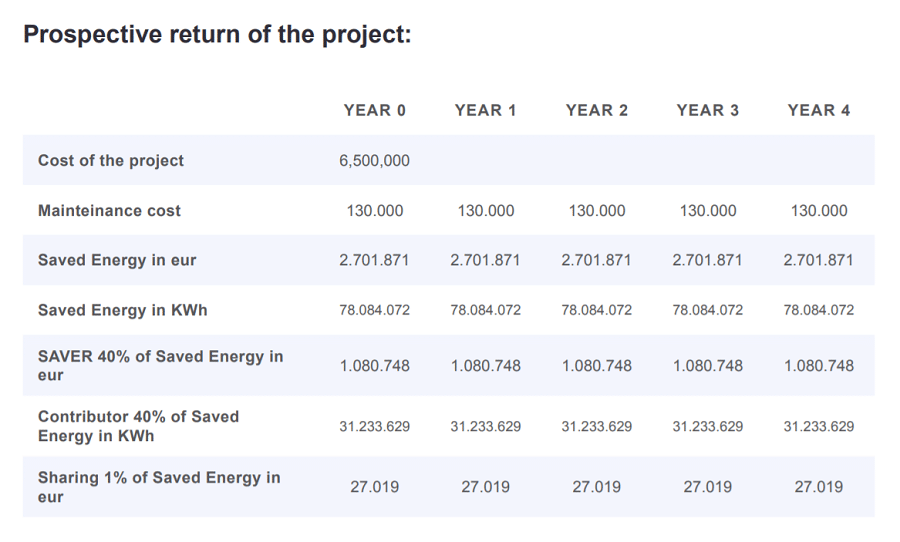

Efforce's projected returns on the energy redevelopment of the Italian industrial building.

Efforce's projected returns on the energy redevelopment of the Italian industrial building.Efforce seems to suggest that the projects it hopes to fund will all be in Europe for the time being (this is AitherCO2’s current market). However, there is some evidence to suggest that Efforce is looking to expand to Asia next.

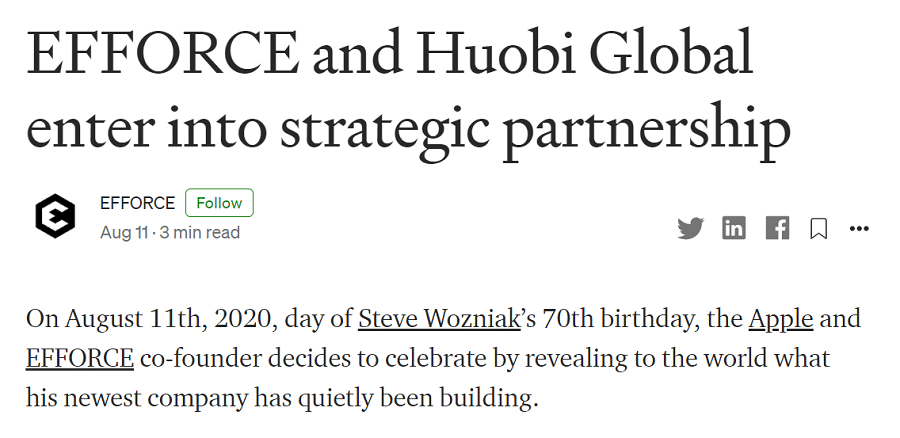

Could Huobi be the exchange Efforce will use for an IEO?

Could Huobi be the exchange Efforce will use for an IEO? In addition to having team members who are designated with onboarding potential clients in Asia, Efforce entered into a “strategic partnership” with Chinese cryptocurrency exchange, Huobi, in August. Huobi chairman Leon Li noted that Huobi “will support EFFORCE growth process with its best tools and resources.” Steve Wozniak’s own comment suggests that it was Huobi who reached out to Efforce.

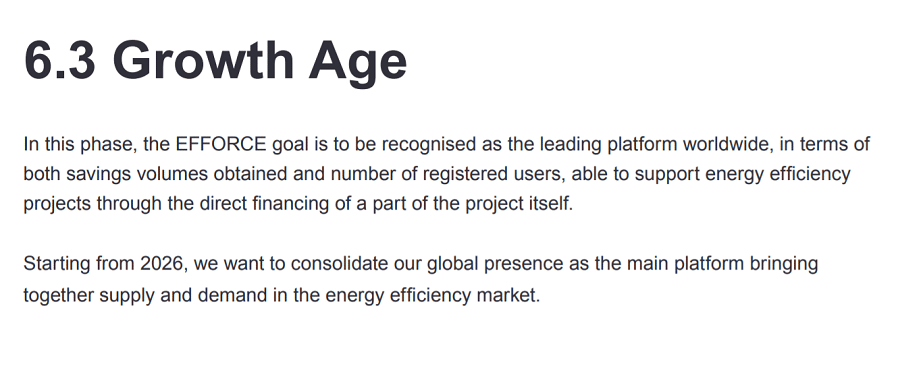

The Efforce whitepaper offers a few insights into goals not noted on their roadmap.

The Efforce whitepaper offers a few insights into goals not noted on their roadmap. It appears that for the foreseeable future Efforce will continue to lean on AitherCO2 for growth. The Efforce whitepaper notes that until the platform becomes readily available, it will be possible to pay for services at AitherCO2 using WOZX tokens. AitherCO2 will also try onboard companies from the transport industry and the marine industry in Q1 2021. By 2026, Efforce hopes to have a global presence.

Why We Aren't Forcing Efforce

A cryptocurrency project created by the co-founder of one of the world’s largest companies seems like a no brainer. As humans, we have a tendency to follow personalities and Steve Wozniak is certainly one of those personalities. However, at the end of the day a project such as Efforce should be judged on its merits and potential.

First and foremost, it is somewhat disappointing that Efforce seems to be a platform that will be off-limits to the average person. The only potential gain for regular folks comes from the price action the WOZX token whose supply is heavily concentrated in the hands of the sorts of investors that are allowed to use Efforce in the first place.

Efforce's Medium/Blog is filled with platitudes and very little information about the details of the project.

Efforce's Medium/Blog is filled with platitudes and very little information about the details of the project. Second, Efforce is not very transparent. Never mind the opaqueness of their whitepaper, Efforce also has no Github and does not appear to have the open-source ethos found in most crypto projects. Lastly, given the apparent size and significance of the project, there is a remarkable absence of useful documentation which one could use to understand it.

The lack of information could simply be because Efforce is very much in its infancy. However, it is more likely a consequence of the fact that they are marketing to an exclusive type of consumer. On a positive note, the project might unlock a new marketplace for the cryptocurrency space, one that is currently out of reach for the average person: energy credits via the WOZX token.

Perhaps Efforce is a project to watch closely for this reason alone. While Steve insists that he is involved with the project, he clearly plays an auxiliary role. Thankfully, AitherCO2 seems to have a solid track record and their founders and team are very well trained and capable.

It will be interesting to see what happens going forward, but a token that takes its namesake from Steve Wozniak is bound to do well in the upcoming bull market. After all, who really looks at fundamentals, right?