Energi (NRG) has been one of the biggest movers in the cryptocurrency space over the last couple of days - catapulting into the top 100.

At its core, the NRG blockchain is trying to take distributed ledger technology to the masses and achieve widespread adoption. Energi wants to build a secure, user-friendly platform that is trusted and globally accepted.

However, are these ambitions too lofty? What makes this project so valuable to investors now?

In this Energi review, I will attempt to answer that. I will also look at the use cases and potential for their native NRG coin.

What is Energi?

Like most other cryptocurrencies, Energi is decentralized and blockchain based. Its focus is on decentralized applications and smart contracts, and it has a good method of governance along with a self-funding treasury model intended to assist in making it the largest, most popular blockchain platform in the world.

The Energi project began in the summer of 2017 as a fork of the Dash blockchain. At the time it used a Proof-of-Work consensus mechanism, with an ASIC resistant algorithm called Energi hash that is similar to Ethereum’s Ethash.

Since then it has transitioned to a Proof-of-Stake consensus with a network of masternodes. These masternodes provide usability and some of the notable features of Energi.

Masternodes ❓: If you are uncertain as to what masternodes are and how they work you can read our comprehensive Masternode guide.

Although Energi is a fork of Dash, it has been highly modified and has enhanced privacy, lower fees and higher scalability when compared with Dash.

The self-funding treasury system of Energi and on-chain governance system was enacted to ensure the long-term development of the project and serves as a means to attract contributors and developers.

Energi Features

Energi has the same basic features you will find with nearly any blockchain project; decentralization, an on-chain governance model, its own HD wallet, and trustless transactions.

It has also put a spin on some common features to make them more useful.

Self-Funding Treasury

A self-funding treasury isn’t an unusual feature in a masternode blockchain, but Energi has one of the largest percentage allocations to the treasury of any masternode blockchain. A full 40% of the released NRG goes to the treasury.

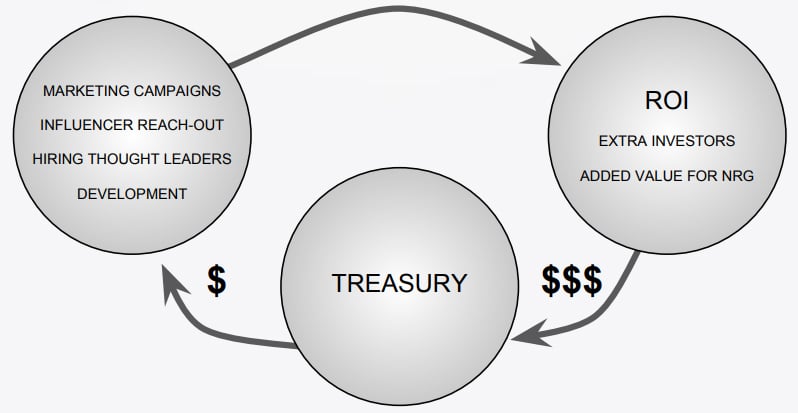

The Treasury Cycle at Energi. Image via Whitepaper

The Treasury Cycle at Energi. Image via WhitepaperSince there are 1 million NRG released every month, and there’s no cap on the total coin supply, this gives the treasury 400,000 NRG every month to be used for marketing and development of the project. This is meant to ensure longevity for the project, providing funds to improve technology, grow the community, and to compensate developers.

Because there is no supply limit Energi has allocated this large percentage to the treasury to improve the decentralization of the blockchain, and to maintain the performance of the network.

Built-in Governance

Like many of the other more recent blockchain projects, Energi has included a community-based governance model. In the Energi model, any stakeholder can submit a proposal for open consideration by the community.

Then, once done, the masternode owners then vote on the proposals to determine whether they will be implemented or not. This governance model was chosen because it not only encourages adoption by giving users a voice, it also helps with scalability and increases the stability of the network.

Masternode Benefits

As a fork of Dash, the Energi network includes both the Instant Send and Private Send transaction features, but the masternodes of Energi allow this with improved transaction speed and with lower fees.

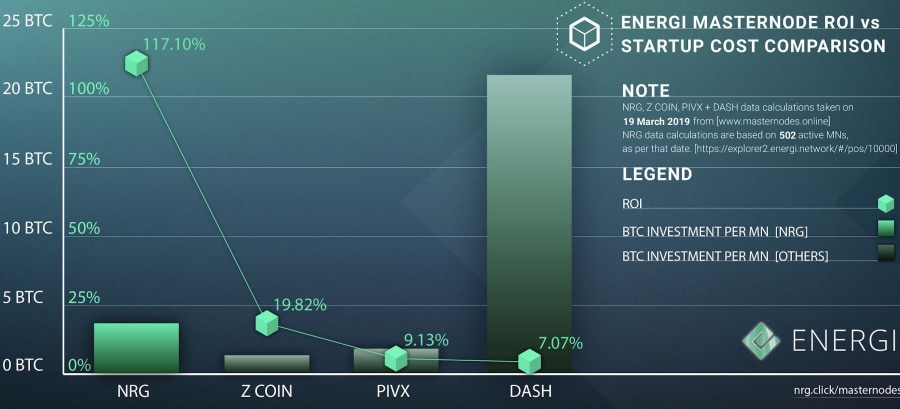

Masternode returns for Energi blockchain. Image via whitepaper

Masternode returns for Energi blockchain. Image via whitepaperBecause Energi has a 2 Mb block size and 1 minute block time users benefit with minuscule fees and quick transactions. Scalability is also improved by using masternodes, with the scalability of the network growing as the number of active masternodes grows.

DApps and Smart Contracts

The planned network of dApps will give the Energi network usability that will help it realize its goal of global adoption. And the addition of smart contracts will increase trustlessness, security, speed, efficiency and transparency for the entire Energi ecosystem.

Smart contracts will also help promote development, which in turn will bring in new users and investors to increase the value of NRG as it becomes increasingly valuable as a currency for developing and powering dApps, as well as the base currency in the planned Energi X exchange.

Masternodes

Anyone is able to host a masternode by staking 10,000 NRG. At current prices, this amounts to an investment of $86,100 as of July 5, 2019.

The masternodes provide several of Energi’s features, including the Private Send and Instant Send functionality, as well as self-funding and self-governance and increased scalability and security for the network.

Masternode owners are rewarded for securing the network with NRG. 40% of the NRG generated is allocated to masternodes. This is roughly 400,000 NRG per month. Currently, there are 798 masternodes, which means each masternode is receiving around 500 NRG per month, which is equivalent to just over $4,300. That’s $51,600 annually or an annual return of 60%.

Setting up a masternode is not extremely straightforward and you need a bit of command line experience to do it. The Energi team have tried to make it as easy as possible with this pretty intuitive guide.

Alternatives ❓: Those who have less than 10,000 NRG can also stake their coins and receive staking return. The minimum required to stake a coin is only 1 NRG and it is also that much easier to set up and configure.

The Energi Team

The Energi team consists of 18 dedicated and knowledgeable individuals, all of whom are committed to blockchain technology and the creation of a decentralized network that is self-funding and community governed. They come from a wide variety of disciplines, including development, operations, marketing, and of course entrepreneurship.

The CEO and founder of Energi is Tommy, also known as TommyWorldPower from his Twitter and YouTube accounts. He is a well-known blockchain evangelist and educator within the blockchain space. His understanding of how blockchain functions and its prospective uses were the inspiration and foundation of the Energi platform.

Some Energi Team Members. From Left: Tommy, Ryan Lucchese & Andrey Galkin

Some Energi Team Members. From Left: Tommy, Ryan Lucchese & Andrey GalkinThe president of Energi is Ryan Lucchese who oversees the day-to-day operations. He has a strong background in software development which is no doubt an asset for the Energi project. Prior to starting at Energi, he was an engineer at Hyland Software and NCH Software.

In the lead developer seat is a guy called Andrey Galkin. His linkedin does not list his experience on Energi but perhaps that is an omission. Andrey has a long engineering background and has held numerous roles in both Enterprise and startup environment.

These are only some of the team members but you can view the rest of their credentials over on their team page.

Community

When a cryptocurrency launches with no ICO or premine, it does not have I large marketing budget to spread awareness of the coin. This is where a strong and engaged community can help.

To that end, Energi has a pretty sizable community behind it.

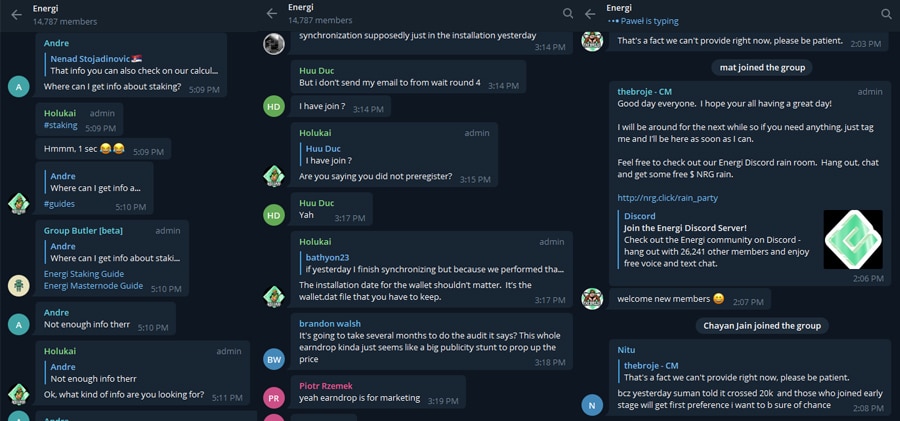

For example, they have a large member count in their Telegram channel with over 14k members. I decided to jump into the channel to get a better sense of the ongoing conversation.

Energi Telegram Channel

Energi Telegram ChannelAs you can see, the Admins are quite helpful to the community member and the conversation above. There is also a distinct lack of your typical "moon boys" in this channel which is a good sign.

Apart from their telegram channel, they also have a Discord server which could be an attractive alternative for those users who prefer this platform.

On the social media front, Energi has a pretty decent following on Twitter with over 30k followers. They regularly keep their users up to date here with the latest developments. There is decent engagement with these tweets.

Finally, it is worth mentioning that Energi also has an official blog that they contribute to regularly. This helps to keep the broader cryptocurrency community informed.

The NRG Token

NRG began as a Proof-of-Work coin with no ICO and no pre-mine. The mainnet launch was announced and mining began fairly.

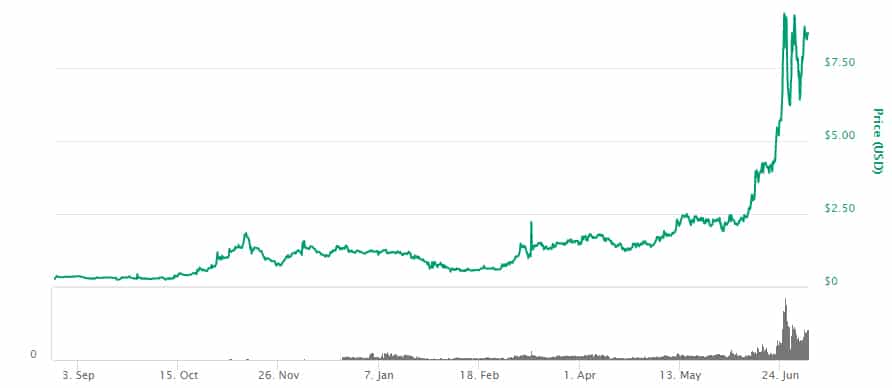

The first listing for NRG on CoinMarketCap was August 24, 2018, with an opening price of $0.264592. Price jumped higher by around $0.10 immediately and spent several months trading between the all-time low of $0.244958 and roughly $0.40.

In October 2018 the coin began trending higher after masternode payments began, and reached levels over $1 as November began. This rally is much earlier than the Bitcoin rally and the end of the crypto bear market for the broader cryptocurrency space.

NRG Coin Price Performance. Image via CMC.

NRG Coin Price Performance. Image via CMC.Price dipped in January and February 2019, but never below $0.54 and by March NRG was trading above $1 again. It remained between $1 and $2 in April 2019, then moved to a range of $2 to $3 in May 2019.

The real rally began in June 2019, with NRG reaching an all-time high of $9.90 on June 25, 2019. Since then it has pulled back somewhat and trades at $8.61 as of July 5, 2019.

For those interested, the Energi team has been conducting airdrops of the coin and there is one final round of 1 million NRG to be airdropped. Details can be found here once the airdrop round begins.

Trading & Storage of NRG

If you would like to buy or trade your NRG, then there are a limited number of exchanges that you can use. These include the likes of Digifinex, Kucoin and Cryptobridge.

Digifinex has the bulk of the volume though and turnover rates appear to be on the lower end for a coin with such a large market cap. This means that liquidity could provide a challenge for those traders who are trying to execute large block orders.

Once you have got your NRG tokens, you are going to want to move them off of the exchanges. We are all too aware of the risks that come from a large centralised exchange hacks.

If you are looking to merely send / receive the coins and "hodl" them for price appreciation then you can use the Coinomi wallet. This is a third party wallet that has support for an additional 500+ cryptocurrencies. It is available on mobile and desktop across multiple operating systems.

Unfortunately, the Coinomi wallet cannot be used to stake coins. If you would like to do this then you will have to download and install their core wallet. There are also a whole host of more advanced functions that the core wallet can execute.

Energi Development

I consider project development progress as a critical metric that one should track. This can give you an idea of just how much work is actually being done on a daily basis.

Although some developers may work in private, those projects that are open source should use a public code repository. Thankfully, Energi has a public GitHub that allows us to dig into their code.

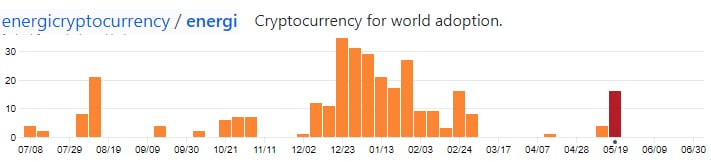

Below are the GitHub commits for the main core Energi Protocol repository:

Commits for Energi over the past 12 months

Commits for Energi over the past 12 monthsAs you can see, the developers have been quite busy sending coding updates to their core protocol. Its also worth noting that there are a further 14 repositories in their GitHub although only 4 have any code commits over the past year.

Comparing the coding commits for the core repository with that of the rest of the cryptocurrency complex, it is reasonably positioned. For example, they are ranked at 134 on this site which is just between Bytom and the Request Network.

Indeed, this coding activity could make more sense when you take a look at the broader roadmap. The Energi team has been meeting a number of key milestones and there are some really interesting updates that are planned...

Energi Roadmap

I include this section because I feel it’s relevant to know what the team has planned for the future. The reason this is relevant is that Energi depends on a dApp platform and smart contract functionality, but so far it has neither of these. Currently, the project is little more than another masternode blockchain with its own cryptocurrency.

The Energi roadmap is complete and gives good details of the development plans for the coming 18-24 months.

The most important item on the roadmap now is the launch of Energi 3.0 in the fourth quarter of 2019. This will include smart contracts and will allow for the migration of Ethereum dApps and is the first real step towards the goal of global adoption.

Worth Considering?

Energi has rocketed into many traders awareness as it has come from over 200th in market cap to 58th as of July 5, 2019. Its listing on the popular DigiFinex and KuCoin platforms is certainly positive too.

Considering the rally in NRG began back in October it may not follow the lead of Bitcoin. It could also pullback leading up to the launch of Energi 3.0, which I would expect will spark a new rally as smart contract and dApp functionality are core features of the platform.

You might wonder why this coin has gained 300% in June when right now it’s little more than a PoS masternode coin. There’s been no earth-shattering news from the project and no major developments. Does that mean this has been a manipulated pump of the coin? There’s no way to tell for sure, but if that’s true these gains will quickly evaporate.

Energi - Yay or Nay?

Energi - Yay or Nay?Consider too that even though Energi says their launch was fair, there was actually no public announcement of the mainnet until block height 171897. That’s hardly fair, and with the treasury getting 40% of rewards and the founders receiving 10% of rewards there’s no reason for this type of trickery.

The runup in price has made it more expensive to run a masternode, but the return is still quite good. That might not continue to be the case as new investors setup masternodes to take advantage of the 60% annual returns being generated.

Energi says they want to be the leading global cryptocurrency, but nearly all blockchain projects have that goal. Energi has certainly made great strides recently, but what makes the project different or unique?

There will be more possibilities with the introduction of smart contracts and dApps, but Energi still won’t be unique. And they’ve already pushed back the launch of these features from Q3 2019 to Q4 2019.

So, you will have to decide whether NRG are still attractive at these levels or whether a retracement is imminent - which could present additional opportunities.