The importance of having an off-exchange crypto wallet cannot be overstated.

While wallets hosted on centralized exchanges offer convenience for trading, they come with inherent risks such as hacks, security breaches, and potential restrictions on user accounts. These risks can result in a total loss of funds and personal data.

Off-exchange crypto wallets provide a secure and reliable alternative to their centralized peers. By allowing users to store their digital assets independently, these wallets eliminate the risk of third-party breaches and unauthorized access to funds. With complete control over their private keys and assets, users can mitigate the threat of hacking attempts and safeguard their investments effectively.

In this Guarda Wallet review, we'll tell you everything you need to know about this wallet, touch on its collaboration with Ledger, and give you the lowdown on its prepaid Visa card and various other products.

Before we begin, if you want to traverse down the self-custodial wallet rabbit hole, be sure to check out our picks for the best hardware wallets, desktop wallets and mobile wallets.

Guarda Wallet Review Summary

Guarda Wallet provides users with a secure platform to manage a wide range of cryptocurrencies, including Bitcoin, Ethereum, and many others. With its non-custodial approach, Guarda ensures that users retain full control over their funds.

The Key Features of Guarda Wallet Are:

- Multi-Platform Software Wallet

- Stake Crypto

- Buy and Sell Crypto

- Crypto Loans

- Token Generator

- Prepaid Visa Card

Guarda Wallet Overview

| Type of Wallet | Multi-platform software wallet (web, Chrome extension, software, mobile) |

|---|---|

| Price | Free |

| Number of Cryptocurrencies Supported | Over 400,000 |

| Staking | Yes, with support for 14 assets |

| Mobile App | Yes, Android and iOS |

| Fees | 4.5% to 5.5% if you purchase crypto in-app with a card |

Benefits of a Software Wallet

Software wallets are widely favoured for managing cryptocurrencies due to several key advantages:

- Easy Access: Think of them as your crypto pocket on your phone or computer. You can download and install them whenever you want, giving you access to your funds wherever you go — as long as you're online.

- You're the Boss: With software wallets, you're in charge. You control your private keys, so no one else can touch your digital fortune without your say-so. It's like having your own bank vault, but with easier access.

- Safety First: These wallets often come with nifty security features like fingerprint scans or two-factor authentication to keep your funds safe from any unwanted intruders.

- Mix and Match: Love variety? A vast majority of software wallets support several hundred different cryptocurrencies, so you can store and manage all your favourite coins in one place.

- Keep It Private: Privacy is key, and software wallets get that. They don't ask for your life story or personal info, so you can keep your financial business to yourself.

- Budget-Friendly: Best of all, many software wallets won't cost you a dime. They're often free or super affordable, making them perfect for anyone looking to manage their crypto without breaking the bank.

- Stay Updated: Just like our favourite apps, software wallets get regular updates to keep them running smoothly and securely. and to ensure your funds are always protected.

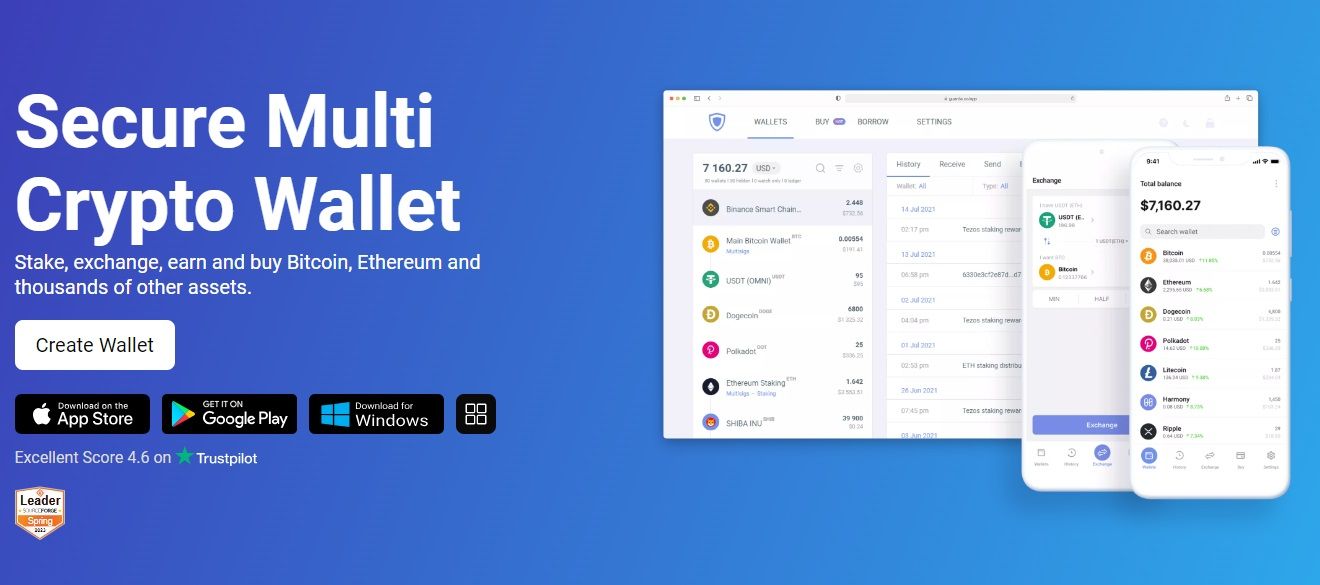

What is Guarda Wallet?

Guarda Wallet is a non-custodial, multicurrency wallet that provides support for numerous popular cryptocurrencies.

Guarda is a Non-Custodial, Multicurrency Wallet. Image via Guarda Wallet

Guarda is a Non-Custodial, Multicurrency Wallet. Image via Guarda WalletOne of Guarda's primary functions is as an interface for direct interaction with various blockchain networks. When users create a wallet on Guarda, public and private keys for each supported currency are generated locally within the user's browser. This ensures that Guarda does not store any private keys, passwords, or personal data, placing full control of funds in the hands of the users.

The wallet offers essential functionalities such as sending and receiving cryptocurrencies, tracking transaction history, and accessing built-in exchange services for asset swaps. Additionally, users have the option to purchase cryptocurrencies with fiat currencies and participate in staking activities for select coins, enabling them to earn rewards by contributing to a blockchain's consensus mechanisms.

Security is a paramount concern in crypto, an industry where scams and hacks are rampant. Prospective users can rest easy knowing that Guarda employs robust encryption algorithms, including AES, to safeguard user data and transactions. Speaking of security, your Guarda Wallet can connect to dedicated offline storage devices made by Ledger (Nano X and S Plus)

Which Cryptocurrencies Does Guarda Wallet Support?

Guarda supports over 400,000 cryptocurrencies, which means whatever niche token you're looking to safely store, Guarda can likely take care of it. In addition to mainstream coins, you can store the following coins:

- Expanse (EXP)

- Aryacoin (AYA)

- Bithereum (BTH)

- Creamcoin (CRM)

- Gulden (NLG)

- Ravencoin (RVN)

Again, this is just a small sampling of the vast coverage Guarda offers.

Guarda Token Creator

The Token Creator by Guarda Wallet provides users with a streamlined process to generate ERC-20 tokens, which are compatible with Ethereum's blockchain.

You Can Now Create Your Own Memecoin. Image via Guarda Wallet

You Can Now Create Your Own Memecoin. Image via Guarda WalletThrough this service, users can easily name their token, set its total supply, and deploy the contract in just a few steps. Guarda ensures the security and audit readiness of the smart contracts, which are thoroughly checked to meet ERC-20 standards. Users receive full technical support throughout the token creation process, with assistance available 24/7.

Guarda's service is not free, however. Users pay a service fee using cryptocurrency from their wallet, with the option to pay in different cryptocurrencies, which are converted to ETH for fee payment.

Once the tokens are generated, users can list them on platforms like Uniswap, a decentralized exchange protocol based on Ethereum smart contracts, enabling integration into the decentralized finance (DeFi) ecosystem.

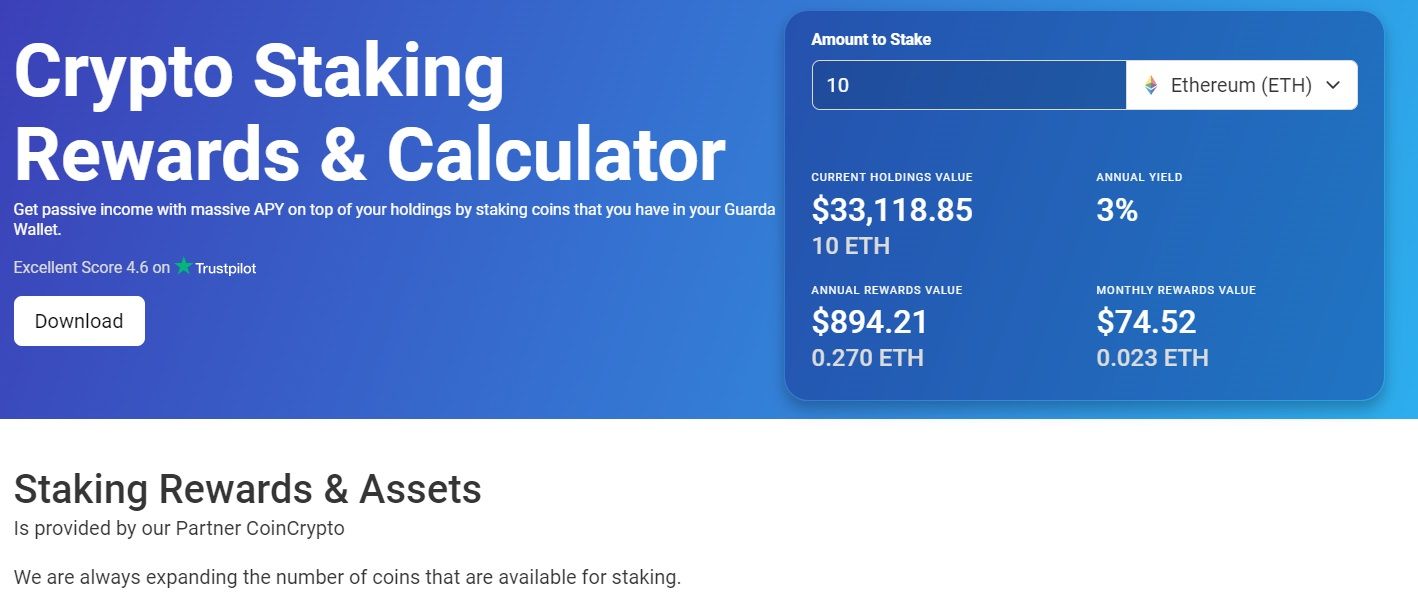

Guarda Wallet Staking

You can stake 14 crypto assets through Guarda Wallet. This includes household names like Ethereum, Cardano and Tron, and several other coins.

Guarda Lets You Stake 14 Assets. Image via Guarda Wallet

Guarda Lets You Stake 14 Assets. Image via Guarda WalletHere's a full list of coins you can stake via Guarda.

| Asset | APY | Available on |

|---|---|---|

| Ethereum | 3% | Web, Desktop, Mobile |

| Qtum | 6% | Web, Desktop |

| Tron | 3.58% | Web, Desktop, Mobile |

| Cardano | 5% | Web, Desktop |

| Ontology | 23.94% | Web, Desktop |

| Harmony | 7.94% | Web, Desktop, Mobile |

| Kusama | 14.3% | Web, Desktop |

| Cosmos | 10% | Web, Desktop, Mobile |

| Tezos | 6% | Web, Desktop, Mobile |

| ChangeNOW | 25% | Web, Desktop |

| Callisto | 8% | Web, Desktop |

| NEO Gas | 1% | Web, Desktop, Mobile |

| Komodo | 5% | Web, Desktop |

| Zilliqa | 13.74% | Web, Desktop, Mobile |

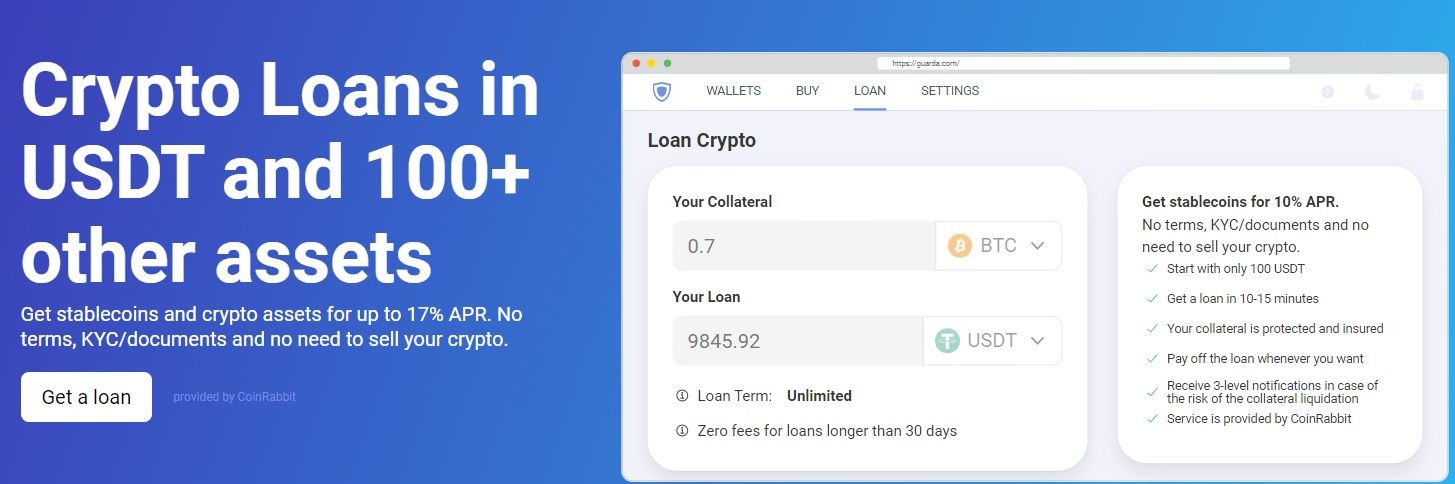

Guarda Wallet Loans

Guarda offers a crypto loan service allowing users to borrow stablecoins like USDT and other assets using their cryptocurrency holdings as collateral. The process is rapid, with loans typically processed within 15 minutes and collateral released within an hour, depending on deposit speed and network conditions.

You Can Get Stablecoins and Cryptoassets for Up To 17% APR. Image via Guarda Wallet

You Can Get Stablecoins and Cryptoassets for Up To 17% APR. Image via Guarda WalletInterest rates for loans range from 12% to 17% APR, providing borrowers with competitive rates and flexibility in managing their assets. Users can choose to borrow stablecoins or other supported cryptocurrencies like BTC, ETH, DOGE, and more. Loans can be used for various purposes, such as accessing liquidity without selling assets or making purchases with stablecoins.

Getting started is a breeze. Just pick your preferred collateral from a wide range of cryptocurrencies, confirm your loan amount, provide a payout address and boom — you're good to go! After the loan is repaid, users receive their collateral back within 10-15 minutes.

And don't worry about hidden fees — Guarda keeps it transparent with a simple 10% service fee. Plus, your collateral is safe and sound, with automatic liquidation kicking in only if its value dips below a certain threshold.

Guarda Wallet Fees

Users do not incur fees for utilizing the platform's services. However, there are fees associated with specific actions:

- Transfer: When transferring funds between addresses within the same blockchain, users are only subject to network fees, which are charged by the blockchain network itself. Here's a complete guide to crypto network fees.

- Exchange: Exchange fees are determined by Guarda's exchange partners and typically amount to approximately 0.5% per transaction. Additionally, users are required to cover network fees. These fees are already factored into the exchange rate displayed to the user.

- Buy Crypto: For fiat-to-crypto and crypto-to-fiat transactions, fees are determined by Guarda's partners and can range from 2% of the transaction value downwards based on transaction volume.

Drawbacks of a Software Wallet

While software wallets are awesome for managing your crypto, they do have a few quirks to keep in mind:

- Internet Dependency: Since they're online, you'll need an internet connection to access your funds. So, if you're away from civilization, you will run into trouble getting to your crypto stash.

- Security Concerns: While they come with security features, software wallets can still be vulnerable to cyber threats like hacking or malware.

- Device Risks: If your device gets lost, stolen, or damaged, there goes your wallet too.

- Tech Glitches: Sometimes, software wallets can be a bit glitchy or buggy, leading to potential headaches.

- Limited Support: Not all cryptocurrencies are supported by every software wallet, so you might not be able to store all your favourite coins in one place.

- User Responsibility: With great power comes great responsibility. Since you control your private keys, there's no backup if you forget or lose them.

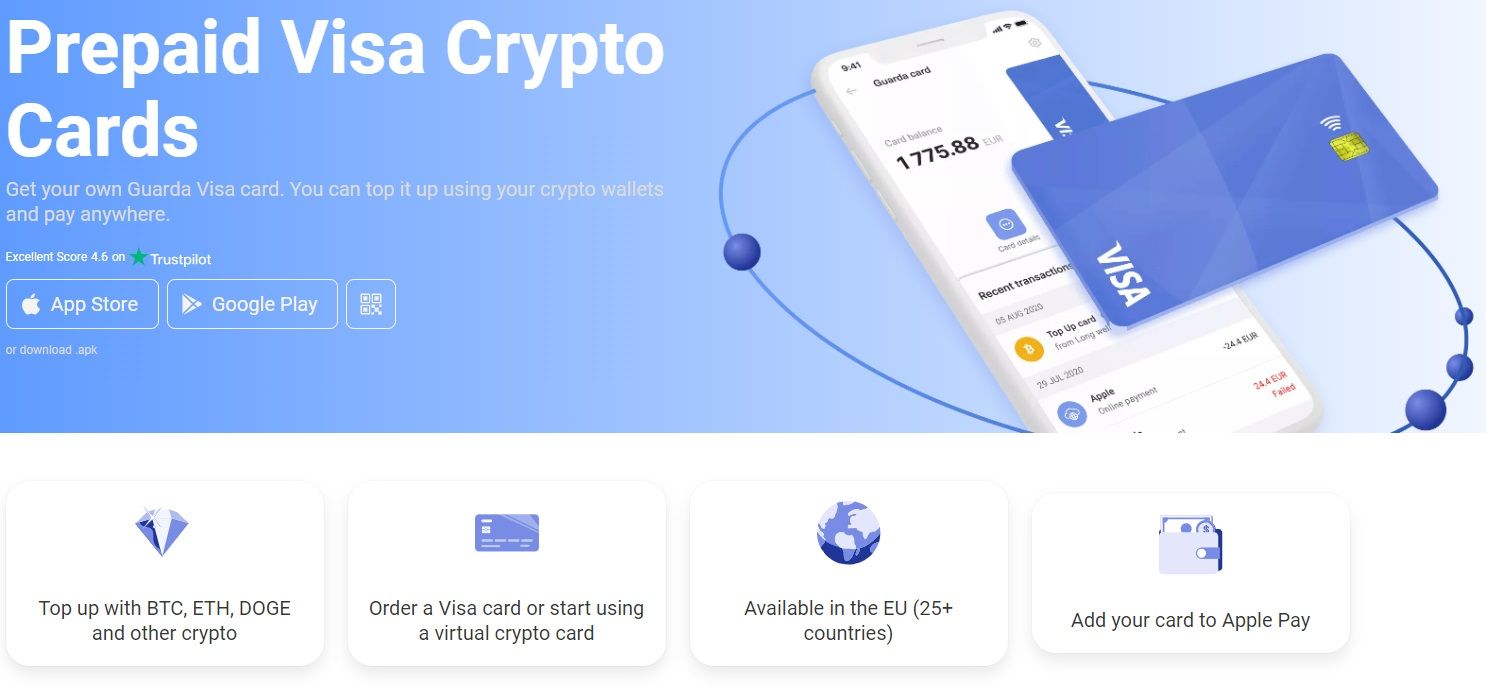

Guarda Visa Card

Guarda offers a prepaid crypto card, available in both virtual and plastic formats. As a Visa-branded card, it is accepted globally, ensuring seamless transactions wherever you go. Upon activation, users receive a €20 bonus.

Guarda's Prepaid Crypto Card is Only Available in Select Regions Across Europe. Image via Guarda Wallet

Guarda's Prepaid Crypto Card is Only Available in Select Regions Across Europe. Image via Guarda WalletWith Guarda's prepaid Visa card, users can easily withdraw cash from ATMs worldwide, facilitating convenient access to their funds whenever needed. Additionally, Guarda ensures fast delivery of the card.

The card supports a diverse range of cryptocurrencies, including popular options like BTC, ETH, ADA, BCH, TRX, and more. Guarda's prepaid Visa card can be ordered and activated in select regions across Europe.

Here's what the fees for this card look like:

- For users in the EU zone, the initial top-up amount must be a minimum of €10

- Issuing a plastic payment card incurs a fee of €20.00, while issuing a virtual payment card costs €15.00

- A monthly service charge of €3.00 per card is applicable

- Balance inquiries at ATMs (not applicable for virtual cards) are charged at €0.47

- ATM withdrawals (not applicable for virtual cards) incur a fee of €1.90 plus 2.5% of the transaction amount

- Successful POS transactions are subject to a fee of €0.20

- Account funding through card-to-card transactions results in a fee of €0.99

- Foreign exchange (FX) mark-up is set at 2.5%

- Card load transactions incur a fee of 1.5%

- A cancellation fee of €25 applies

Additionally, there are certain restrictions imposed on cards:

- ATM withdrawals have a daily limit of €500 and a monthly limit of €2,500.

- Other transactions have a daily limit of €2,500 and a monthly limit of €5,000.

- Online transactions also have a daily limit of €2,500 and a monthly limit of €5,000.

Here are our top picks for the best crypto debit cards.

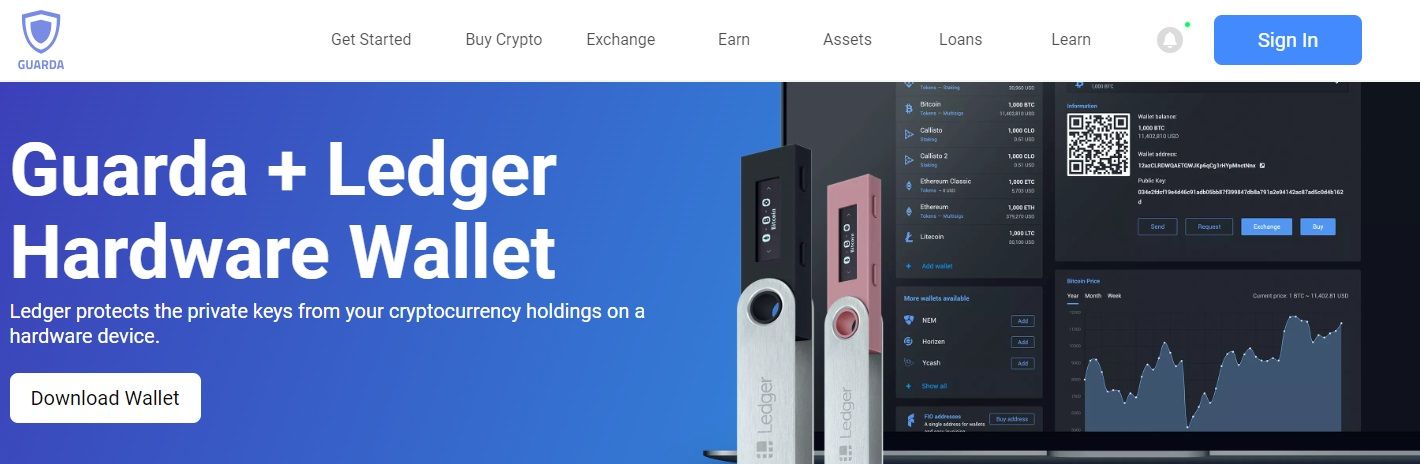

Guarda Wallet x Ledger

Guarda and hardware wallet maker Ledger joined forces to offer users a solution for managing and securing their cryptocurrency assets. Ledger employs advanced encryption techniques to safeguard private keys, ensuring that only the rightful owner can access and authorize transactions.

Guarda Complements Ledger's Security With its User-Friendly Interface. Image via Guarda Wallet

Guarda Complements Ledger's Security With its User-Friendly Interface. Image via Guarda WalletGuarda complements Ledger's security features with its user-friendly interface and extensive functionality. Through Guarda's platform, users can interact with their Ledger devices, viewing real-time balances, transaction histories, and managing their cryptocurrency portfolios.

Guarda enables users to buy, exchange, send, or stake cryptocurrencies directly from their Ledger hardware wallets. To connect a Ledger device to Guarda, users must utilize browsers with 2-factor authentication enabled, such as Chrome, Firefox or Opera.

Supported assets are:

- Bitcoin

- Ethereum

- Binance Coin

- Ethereum Classic

- Litecoin

- Callisto

Guarda Wallet Review: Closing Thoughts

Guarda Wallet is a versatile and secure solution for managing many cryptocurrencies. With its non-custodial approach, users retain full control over their funds, mitigating the risks associated with centralized exchanges.

Guarda's collaboration with Ledger enhances security further, while features like staking, crypto loans, and the prepaid Visa card offer added flexibility and convenience. Despite some drawbacks inherent to software wallets, Guarda's robust encryption algorithms and user-friendly interface make it a compelling choice for both novice and experienced crypto enthusiasts.

Whether you're looking to store, trade, stake, or spend your digital assets, Guarda Wallet proves to be a reliable companion.