Following in the footsteps of its larger rival Binance, the HTX cryptocurrency exchange (previously Huobi Global) created its own token, as one of the top three cryptocurrency exchanges worldwide (July 2018) this could make very good sense for the exchange.

The value of the token has been tied to the performance of the exchange, but also to other factors such as coin supply and the internal factors within the HTX ecosystem. So far it’s been a success, but will it make a good long-term investment?

The Binance Coin (BNB) has reached a market cap of nearly $1.5 billion, and smaller exchange KuCoin (KCS) has seen its token rise to $300 million in value. So, can the Huobi Token (HT) rise from its current value of $160 million to match KuCoin, or more optimistically the Binance Coin?

When you consider that the value of HT is largely tied to the profits of the exchange, which continue growing with trade volumes, no matter if cryptocurrencies are rising or falling, it seems like a good investment.

The exchanges are one area that isn’t very concerned with the success or failure of any one coin. As long as cryptocurrencies remain a traded asset (and I don’t believe they are going to disappear), the cryptocurrency exchanges will continue to see profits.

Note: Users located in the US and UK are not supported.

Voting & Rewards from the Huobi Token

One of the benefits of holding the Huobi Token is the ability to participate in the Huobi Autonomous Digital Asset Exchange (HADAX). This is a hybrid exchange that allows its users to vote on which coins they’d like to see listed.

Brand new HADAX Sub Brand of Huobi Exchange. Source: Hadax

Brand new HADAX Sub Brand of Huobi Exchange. Source: HadaxThat voting is done with the Huobi Tokens. HTX then conducts a minimal audit, and investment firms such as ZhenFund and Draper conduct due diligence to ensure the projects meet minimal quality standards and are compliant with any existing regulations.

Users benefit from being able to get their favorite projects listed on an exchange platform, but they benefit further by receiving free coins if the project gets listed. This provides an incentive to voting.

One scenario might see a project offering 5 free tokens airdropped for every vote they receive, and as long as the project gets listed the voters receive the airdropped tokens. If the project isn’t able to get enough votes to be listed the tokens may be returned. So, it’s a win-win for users no matter what outcome.

HTX Reduced Trading Fees

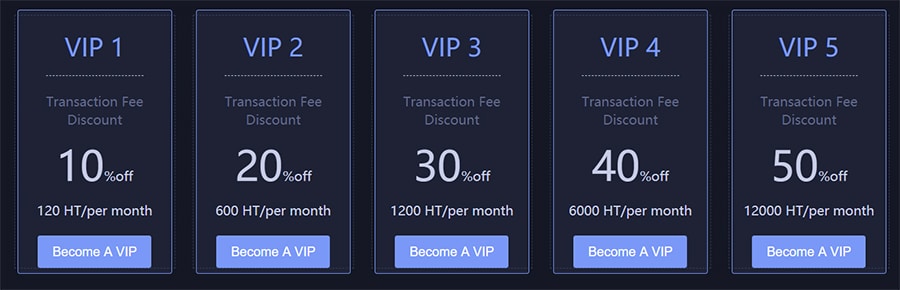

HTX is following a different scheme than Binance when it comes to fees. At Binance, as soon as you own BNB tokens you’re entitled to trading fee discounts. Huobi is proposing a subscription model though, with five tiers of subscription, and each tier offering lower trading fees.

Currently, HTX has a fee of 0.2%, while the Binance fee for BNB holders is 0.1%. However, with a monthly subscription of 12,000 HT you qualify for the fifth tier of subscription, which entitles you to a reduced trading fee of 0.1%, which matches the Binance fee. You can read more in our full Binance review.

HTX VIP Levels for Trading

HTX VIP Levels for TradingInitially, it may seem as if Binance has the better fee structure, however the Binance offer is temporary, and by the fifth year there is no longer any fee reduction and the Binance fees match those at HTX.

While you may argue that 12,000 HT is a lot to pay for a 50% reduction in trading fees, and you’d be correct if you’re discussing small investors, you have to remember that HTX is aiming its service more for the institutional investor. For these large investors a savings of 0.1% on trading fees can be equivalent to thousands of dollars a month.

Potential Growth for the Huobi Token

The two use cases mentioned above will give investors good reason to buy and hold the HT token, and should provide good upside potential for the token on their own. As with any asset though, the price will be ultimately determined by supply and demand. Looking at an asset such as the Huobi Token the three primary drivers for demand will be:

- How many institutional investors join the HTX platform

- How many traders believe the value of HT will rise

- Interest from investors looking to join in on voting rounds for new projects

All of these demand drivers are closely correlated with the overall cryptocurrency markets, and a bear market like we’re experiencing now can hold back exchange tokens like the HT. If the markets get back to moving strongly higher it’s likely that crpytocurrencies will see greater mainstream adoption, and HTX will see greater interest from institutional investors who can sign up for VIP subscriptions.

HTX Token Benefits

HTX Token BenefitsA rising market will also help the airdrops reward program, since it will increase the competition to be listed on HADAX. That increased competition will lead to greater rewards being offered to voters, which in turn will incentivize more people to buy HT so that they can vote on projects and get free tokens.

HTX itself has also been supporting the price of the HT through their buyback program. Every quarter Huobi does a buyback where 20% of the exchange profits are used to purchase Huobi Tokens and lock them away in an Investor Protection Fund. This acts to reduce the supply of HT, making the remaining HT more valuable.

Huobi Token vs. Other Exchange Tokens

HTX isn’t the first exchange to issue its own token. Binance (BNB), Bibox (BIX), KuCoin (KCS) and Coss (COSS) have all issued their own tokens as well. All three of these exchange tokens have seen success, with the Binance token reaching nearly $1.5 billion in market cap, while KuCoin has a market cap of $300 million and Bibox has seen its token rise to $75 million in market cap. COSS is valued at just $10 million.

By contrast, the Huobi Token has a $160 million market cap already. That’s double the Bibox value, and we can imagine it will soon close in on the KuCoin market capitalization as well.

Huobi Token compared to other Exchange Tokens

Huobi Token compared to other Exchange TokensOthers may be in agreement, as the Huobi Token is seeing about 25% of its market cap in daily volume, showing that there is a large amount of trading volume. By contrast, the other coins have less than 10% of their market cap in daily trading volume, and in the case of KuCoin, less than 1%. It seems investors are most interested in exchange tokens that pay investors directly through airdrops and token burns, rather than through dividend payments.

HTX has one additional chance to increase its token value, and that’s through its marketing efforts. As a South Korean exchange most of its efforts have been directed towards marketing in Asia, and many Europeans and those in North and South America are unaware that Huobi even has a token. If it increases its marketing efforts to a global scale it could see adoption levels close to those of the Binance token.

Conclusion

The Huobi Token bears a serious look from anyone who believes cryptocurrencies are here to stay. It has many use cases that would work to increase its value, as well as several that decrease supply. It also appears currently undervalued compared with other exchange tokens, while also enjoying a large degree of popularity among traders.

The fact that it is relatively unknown outside of Asia also works in its favor, and could see significant upside if it becomes more well known throughout Europe and North America. This would be similar to the growth seen from Binance and KuCoin when they increased their marketing and spread the word about their coins further afield.

Finally, I believe that exchange coins are worth serious consideration in general. As long as you believe cryptocurrencies aren’t going away, the exchanges make perfect sense. They will continue to make profits no matter which cryptocurrencies prevail. The only question is whether an exchange will survive, and HTX certainly seems well-positioned to continue providing its services long into the future.