As part of John McAfee‘s coin of the day program, an up-and-coming tipping currency called Reddcoin won the honor on December 24th.

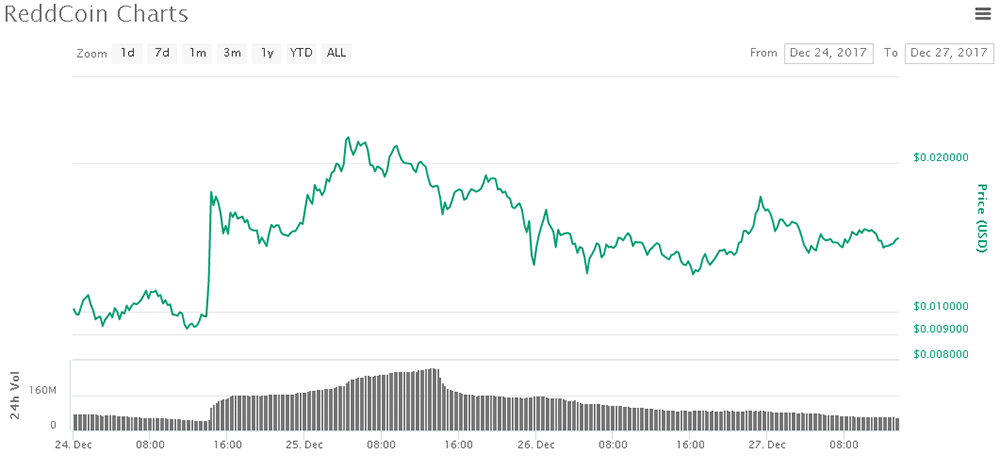

Following the mention on McAfee‘s Twitter feed, prices for the coin shot up sharply and then dipped again. Even after the dip, however, prices for Reddcoin are still much higher than they were before the pump.

So what is Reddcoin, and should you get involved in it?

Comparing Reddcoin to alternatives

A good rule of thumb when looking into a new cryptocurrency is to compare it to Dogecoin. What does this new asset offer that Dogecoin doesn’t?

Does it offer fast transactions? Dogecoin has those. Are there very low fees? Dogecoin has that as well. It is unusual for a currency to have so much in common with Dogecoin, and yet be fundamentally different.

So is Reddcoin sufficiently different?

Unlike Dogecoin, Reddcoin uses proof-of-stake as opposed to Dogecoin's proof of work. Proof of stake means that the coin is mined not through high-end computing power, but by proof of ownership of a certain amount of the tokens. Holders of the token are then rewarded periodically with small payouts.

Reddcoin is designed to be a low-cost social media and tipping themed currency, exactly like Dogecoin.

Today, Dogecoins are selling for about $0.009. Reddcoins were trading at $0.001 each before the mention on McAfee's Twitter feed, that was followed by a pump to over two cents each. This was followed by a slide back to $0.014 each.

Pump in RDD Price. Source: Coinmarketcap.com

Pump in RDD Price. Source: Coinmarketcap.comAt the same time, Dogecoins also saw a similar pump at the same time and went from $0.002 to a peak of $0.01. It is possible that the sudden burst of popularity for one tipping token increased the popularity of the other.

Should you invest in Reddcoin?

To answer this question, you need to ask yourself what the future value of these so-called tipping currencies will be once transaction fees on major cryptocurrencies become a thing of the past.

Let’s propose a hypothetical scenario.

Let's say that bitcoin fees drop to a fraction of a cent as a result of either a blockchain upgrade or a second layer solution like Lightning Network. With that in mind, what would be the value of these tipping currencies, when their main selling points are their incredibly low transaction fees?

So far history has shown us that cryptocurrencies can continue to exist even if they are usurped by supposedly more useful or widely deployed assets. For example, bitcoin continues to thrive at the number one position even though from a purely technological perspective, it is inferior to many new offerings.

What will likely happen is that these tipping currencies will act as training wheels for newcomers to cryptocurrency. Because of their low-cost, it is a lot less of an issue if you were to lose 1000 Reddcoin or Dogecoin due to typing in the wrong address, as opposed to losing a Litecoin or an Ether unit due to such a mistake.

Additionally, it is a lot more accessible to tell someone that they have 10,000 Reddcoins or Dogecoins as opposed to something like 0.000001 bitcoin. It’s just easier for people to keep track of whole numbers as opposed to decimals.

As people using these tipping currencies understand them better, they can exchange them for more sophisticated assets and then other newcomers can pick up the tipping currencies to learn.

To Invest, or Not to Invest?

To summarize, if you were already very familiar with cryptocurrencies, and you have no particular interest or enthusiasm for these tipping currencies, it’s safe for you to avoid them as you are unlikely to miss much. At least not much other than a periodic pump and dump as nearly all cryptocurrencies see on a monthly basis.

If you are interested in tipping, then Reddcoin or other tipping currencies could be for you. If not, you are better off sticking to more sophisticated assets and investments.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.