2021 was a great year for NFTs. It was one of the most talked-about topics in crypto that seeped into mainstream society and netted mentions in general entertainment programs such as SNL and Jimmy Fallon.

In the NFT space, what catches the most number of eyeballs is usually the launch of a new NFT art project. What's the next best thing to buy that will, after a few flips, hit the moon - the metric that most people use to measure the value of a NFT. Therefore, it is a nice surprise that the biggest NFT event to end 2021 was the $SOS token airdrop to the users of OpenSea, the largest NFT marketplace in terms of users, trading volume and number of artworks for sale. If you're like me, scratching your head asking: what's the big deal? Free money raining on folks in crypto is the norm, right? Well, read on to find out why this particular rainfall is not just the average one resulting in a piddly flood or two.

An NFT user blessed with $SOS tokens Image via Shutterstock

An NFT user blessed with $SOS tokens Image via Shutterstock OpenSea, OpenDao and the SOS Airdrop

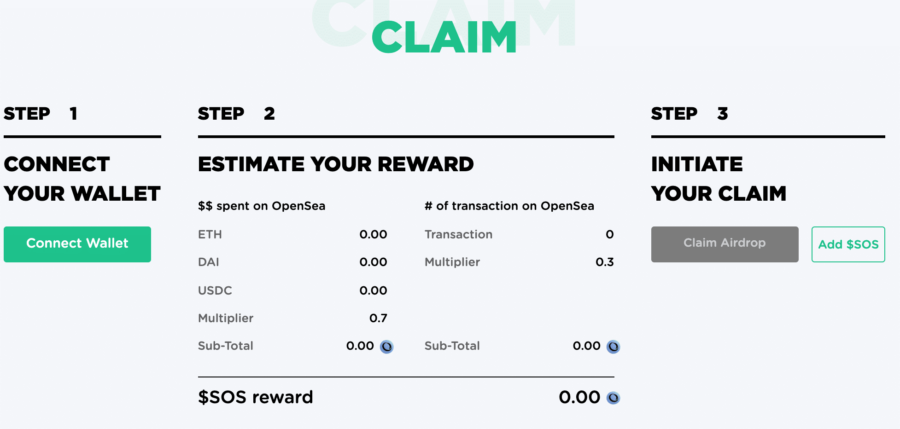

Basically, anyone who has bought, sold, listed anything on OpenSea before Dec 23, 2021, are eligible to receive $SOS tokens rewarding them for their participation and support. The distribution period starts from Dec 13th through to June 30, 2022. The distribution of the token is dependent on the amount of ETH, DAI, USDC transacted, which carries about 70% weight, and the total number of transactions, according to the official website, theopendao.com. For the individual users, it's proportionate to their own activity on the platform based on the distribution allocation.

To claim your tokens, simply browse to the website, connect your NFT wallet (Metamask, Coinbase, WalletConnect), and the website will inform you how many tokens you can get.

Here's how you can calculate your $SOS token claim Image via theopendao.com

Here's how you can calculate your $SOS token claim Image via theopendao.com Tokenomics for $SOS

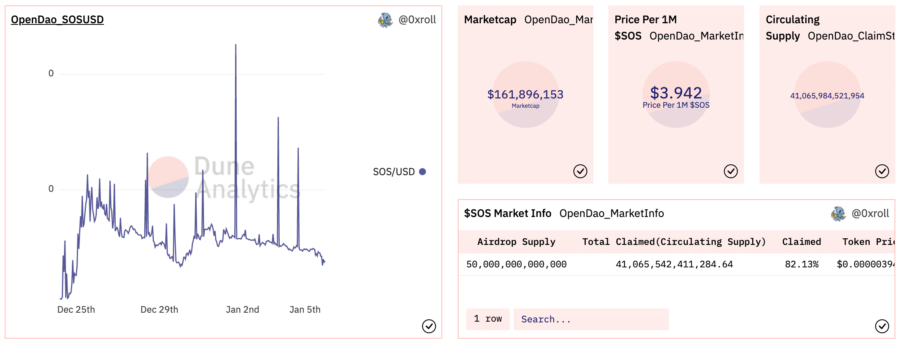

According to Coinmarketcap, 91% of the 100 trillion tokens are already in circulation since its inception little more than 2 weeks ago. Listed at an initial price of $0.000000674 per token, it went on a roller-coaster ride, peaking at $0.00001108 a day after its airdrop, went through a few swings, and finally settling at its current trading price of $0.00000418, indicating a downward slide thus far.

Did I miss out on not selling earlier? Image via Coinmarketcap

Did I miss out on not selling earlier? Image via Coinmarketcap Out of the 212,858 addresses holding the token, three of them possess 63.57% of the supply. The distribution plan outlined in the OpenDAO website lists the following:

- 50% to OpenSea users

- 20% to OpenDAO

- 20% for staking incentives

- 10% for LP incentives

Those top three wallets are likely related to the organisers. Meanwhile, rank-and-file users would consider themselves lucky to have more than 1% of the tokens, if that. Is it worrying? A little. It's still early days yet, so let's keep an open mind. As to where it could go? Well, depends quite a lot on the momentum, really. Despite having some partnerships announced, the general direction is still unclear. As is frequently mentioned by traders, the market doesn't like uncertainty. Once some concrete plans are in place, we could see some upward movement that might at least place it back at the starting price if not beyond.

How is OpenDAO Involved?

This is where things get interesting and here are the salient facts:

- The organisation behind the $SOS token airdrop, OpenDAO, is not officially affiliated with OpenSea.

- The team behind the OpenDAO project is spearheaded by a collector known as 9x9x9eth. Together with a small group of people, they pooled together some money to do the airdrop.

- A plausible reason for the airdrop may be linked to the rumours of OpenSea, the company behind the platform, looking to get listed in an IPO. There was community backlash because the platform's success is based on the users' participation but they are not getting rewarded for their efforts.

At first glance, it may not seem like much. Look deeper though, and you can see that the ramifications of this particular event is huge and here's why.

People and the DAO

Before we go too far ahead of ourselves, let's start with the concept. An acronym for Decentralized Autonomous Organization, the DAO was a key concept that gained awareness last year, aside from NFT and the Metaverse. Although it was first coined in May 2016, according to this Medium article, it got the most traction last year as more and more projects embraced this concept.

An easy way to understand the DAO concept is to think of it as "...an internet community with a shared bank account,” says Cooper Turley, an investor and heavily-involved in several DAOs, on CNBC Make It program. From a technical point of view, it is an entity running entirely on smart contracts with the blockchain serving as its spine. The rules governing the DAO's operations are written in the smart contract. Any changes to the code will need to be voted on by the members of the DAO. MakerDAO, the project behind the DAI stablecoin, maybe one of the more prominent DAOs that are familiar to the general crypto public pre-2021.

What Does a DAO look like?

For most of us working for an organisation, few are in the position to make decisions determining the direction of the organisation we work for. In general meetings we are usually told about things. Even if we disagree with the direction, we typically have two choices: go with it or leave.

In a DAO though, we would have a much more active voice in the organisation. Everyone is clear about their contribution to the organisation's well-being and growth. There would likely be regular voting sessions on matters that affect everyone. It's like an entire class of students being tasked with the job of painting a mural of the school walls. Everyone would volunteer to do the job best suited to their ability. This is a loose form of organisation but there wouldn't be too much pressure exerted from the top. The success of the mural is dependent upon each student's contribution. The ownership of the project is shared with everyone involved.

OpenDAO and $SOS

In the case of OpenDAO, this is a project jumpstarted by a handful in the community "to pay tribute, to protect, to promote" the OpenSea NFT users. It's an entirely community-led effort to give the users a voice since OpenSea wasn't doing anything of that sort. You can't blame OpenSea for this as it is, after all, a traditional company acting in the standard way like all companies do. Even though the success of the platform is contingent on the users' participation, as evidenced with the 90% market share in NFT trading, they're not big enough like Amazon where people couldn't not participate in the platform.

The DAO's mission as stated in its website, should its community choose to accept it, is to:

- Compensate verified scam victims on OpenSea with $SOS

- Support emerging artists and their original work

- Support NFT communities

- Support art preservation

- Provide a developer grant for participating in $SOS ecosystem

We can already see that current plans include staking and LP, which is indicative of some foresight of wanting this to be sustainable in the long-term, instead of just airdropping free stuff and leaving it at that.

Already, the first proposal has been voted through for a 1-year linear vesting schedule, striking a balance between early adopters being rewarded, while latecomers don't feel like the ship has already sailed. The voting for this proposal happened on Christmas, and managed to garner a 64.36% approval rating from 634.25 billion tokens. How many of these are unique users, well, that's kinda hard to tell, hopefully not a handful. For the data geeks, feel free to geek out about the data here.

Geek out on these stats! Image via Dune Analytics

Geek out on these stats! Image via Dune Analytics For a 100% community-led effort, getting the results we've seen so far, I find it pretty amazing. Not only were the organisers able to mobilise people to rally together in such a short time, the enthusiasm of the community for this event is gosh darn impressive. This level of fervor is also largely in part, an expression of a group of active and loyal users who sincerely want what's best for the platform and the community. You could say that they have almost "hijacked" OpenSea's own strategic direction, which comes from the company's C-Suite execs.

OpenDAO and OpenSea

Thanks to the rumours flying around about an IPO, this lit a bonfire under every user, some more than most, to incentivise them to do something about it, thus taking matters into their own hands. Basically, it's a "if you won't do the right thing, we will", resembling a kind of pre-emptive action from the community. From the company's point of view, I don't know if those in management could have foreseen this kind of outcome. Although they still own the platform, one can't help thinking how much of the control over the product got diluted when the user base is as strong as that of OpenSea.

While the company is still able to dictate the platform's operations and inner workings, how could they not be wary of the feedback from the community, which could either push the platform to newer highs or end up falling by the wayside when another competitor that is more community-friendly appears? Perhaps this is giving too much weight to the community. However, I'm also certain that key decisions regarding the platform, while not yet at the point of seeking a vote outright from the community, are not taken in ignorance of the community's wishes. Could OpenSea end up being a victim of its own success? Only time will tell.

Taking this line of thought one speculative step further, would it be too difficult to imagine some kind of official co-existence between OpenSea and OpenDAO? Maybe having the latter play the role of the canary in the coal mine? It would be interesting to see if something like this would come to pass, for example:

- Day-to-day operations remains solely in the hands of company while certain strategic decisions affecting users gets voted on or seeks some kind of consensus from the DAO.

- The company leveraging on the user base to garner feedback for prototypes of new products or features, testing them out in the community before launching them officially. This kind of measure might even further enhance the level of participation amongst core users.

- A NFT issued by the company denoting some kind of membership club to eligible users, giving rise to different levels of users based on frequency of participation or other kind of criteria, might be an interesting experiment for the company to try walking the talk.

Lack of a Roadmap

One thing that has investors and some holders being cautious about is what sort of life OpenDAO and the token could have after the initial hype has died down. As the organiser so poignantly puts it on Discord, according to Decrypt:

“Coz it is a DAO, we are undergoing set up for the DAO (getting candidates for muti-sig), it is not a COMPANY with ROADMAP, decisions are decided by all $SOS holders.”

This could turn out to be a double-edge sword for all intents and purposes. Currently, other than voting rights and staking rights, which yields ve$SOS that also carries full voting rights, not much else has been planned. All sorts of speculation are flying around, such as having $SOS be used to pay fees etc., but nothing concrete yet which might be cause for concern. On the other hand, there exists an open canvas as to how $SOS could be used to further bring value to the project and the community that could likely be proposed and decided by its holders. The scope of the token's usage is only limited by the holders' imagination.

In summary, the community has shown OpenSea what they are capable of without the company's benediction. It's now up to the company to decide whether or not to keep the rally going, and if yes, how that would look like.

If I were the head of a company offering a similar kind of service, especially the kind that relies on community participation to achieve success for the product, I'd do well to take heed of what's going on and glean whatever lessons I can out of it. This could point to a type of outcome that I would not like to be caught unaware of.

The Other Forms of DAO

All DAOs share the following elements:

- Mission

- Way to communicate

- Community treasury

- Governance framework for the treasury

Aside from OpenDAO that has the potential to extend into an organisation more focused on the governance of the community, there are also other DAOs that have a narrower focus. One such project is PleasrDAO, a DAO that's about buying "culturally significant pieces and then creating fundamentally additive to the soul of the piece before sharing it with the community.", according to their About profile.

Artwork collected by the members of PleasrDAO Image via PleasrDAO

Artwork collected by the members of PleasrDAO Image via PleasrDAO Then there are those that are much more short-lived. The most shining example is ConstitutionDAO, a single-purpose DAO organised for the sole purpose of bidding for a copy of the US Constitution put on auction at Sotheby's. Upon failure of the mission, the crowdfunded tokens are being returned to the holders and the DAO itself disbanded. If there are others who wanted to extend the life of the $PEOPLE token, these would be ad-hoc efforts unrelated to the original organisers.

Another group, likely drawing inspiration from the GameStop event, call themselves BlockbusterDAO with the purpose of buying the Blockbuster video chain from its parent company Dish Network for $5 million and reviving it as a decentralized streaming platform for films and funding film projects.

This level of community efforts and get-together is somehow reminiscent of the guilds and campaigns in video-gaming. People getting together and pooling resources, whether it's time, volunteering for tasks, coordinating attacks and strategies etc., all in order to achieve a shared goal. In some ways, DAOs can almost be seen as a more organised form of these ad-hoc groups. With the blockchain acting as the most neutral intermediary and smart contracts executing all the rules coded in the system, what makes it enticing is a very plausible sense of fair play for every participant.

Conclusion

A DAO can be:

- a crowdfunding project like what's available on Kickstarter and more.

- an organisation looking to achieve a temporary singular purpose.

- a nonprofit organisation.

- a company where jobs are broken down into tasks that employs contractors to do each task based on their abilities.

- a community where the residents vote on proposals and the management team implemented measures voted-on by everyone.

- a country where citizens cast their votes for policies instead of candidates and politicians act as stewards of the country on behalf of the people instead of running it for the sake of the people.

In order for a DAO to succeed, active participation is needed from everyone. Voting sensibly entails understanding what is the proposal, able to weigh the pros and cons for and against it, and drawing one's own conclusions through a vote. This requires a change in the education system. It's no longer about having good memory and being able to recite facts. It's about having the facility to think critically and make the kind of decisions that's beneficial for all, not just the individual.

The future is bright for the DAO. The top-down hierarchy format has long ruled the roost. Now, it's about to have some stiff competition. There will always be space for both to exist. Like all things crypto, it's not a zero-sum game but about having options.