Blockchain technology and artificial intelligence are now being integrated into every industry and nearly every aspect of our economy. Both of these technologies are concerned with the usage and storage of data, which has become critical as data in the modern world is immense and growing.

One thing that hasn’t been accomplished though is the combination of blockchain and artificial intelligence. Combining the two can provide even greater value as adding artificial intelligence to blockchain will allow for analyzing data, which will generate more insight about that data.

Overview of Oraichain's AI Powered Oracles

Overview of Oraichain's AI Powered Oracles One area where this could be particularly useful is in smart contracts. These are protocols or programs that are created to automatically execute, either documenting or controlling relevant actions and events. It does this based on its programming and the terms of a contract that’s been specified.

Smart contracts are increasingly used on blockchains as they have a number of useful benefits, particularly in the increasingly popular decentralized finance space. However they remain under one limiting constraints in that they must follow strict rules, which prevents the use of an artificial intelligence model in any smart contract.

The solution to this problem is being developed by Oraichain. This is a data oracle platform and it is designed to connect artificial intelligence APIs with smart contracts or other applications.

With Oraichain a smart contract can be enhanced to securely access external artificial intelligence APIs. The focus of blockchains currently is the use of price oracles, but with Oraichain smart contracts will have access to reliable AI data, providing new and useful functionality to blockchains.

What is Oraichain?

As a data oracle platform Oraichain is concerned with the aggregation and connection of smart contracts and AI APIs. It is the very first AI-powered data oracle in the world. Currently there are six major areas or features that Oraichain is bringing to the table.

Oraichain Announcing its Recent Mainnet. Via Blog

Oraichain Announcing its Recent Mainnet. Via BlogAI Oracle

As we’ve already mentioned, Oraichain is designed to enhance the utility of smart contracts by allowing them access to external APIs which are AI-driven. Current oracle blockchains are primarily focused on price oracles, but Oraichain plans on changing all that.

With Oraichain dApps gain new and useful functionality by being able to use reliable external AI data. This is accomplished by sending requests to validators who acquire and test data from various external AI APIs. Once confirmed the data is stored on-chain, ensuring its reliability and allowing it to be used as proof in the future.

AI Marketplace

The AI Marketplace on Oraichain is where AI providers are able to sell their AI services. This brings AI to Oraichain and rewards the providers with ORAI tokens. There are a number of services that are provided, including price prediction, face authentication, yield farming, and much more.

The AI providers benefit from hosting their models directly on Oraichain without the need for third-parties. Using this mechanism allows small companies or even individuals to compete with larger entities in having their work featured in the AI Marketplace. Developers and users get to choose the AI services they require and pay for them with ORAI tokens.

AI Ecosystem

The AI Marketplace is not the only piece of the AI ecosystem of Oraichain. There is additional AI infrastructure to support the AI model developers. The ecosystem includes a fully developed and functional web GUI to assist in publishing AI services more rapidly and with less trouble.

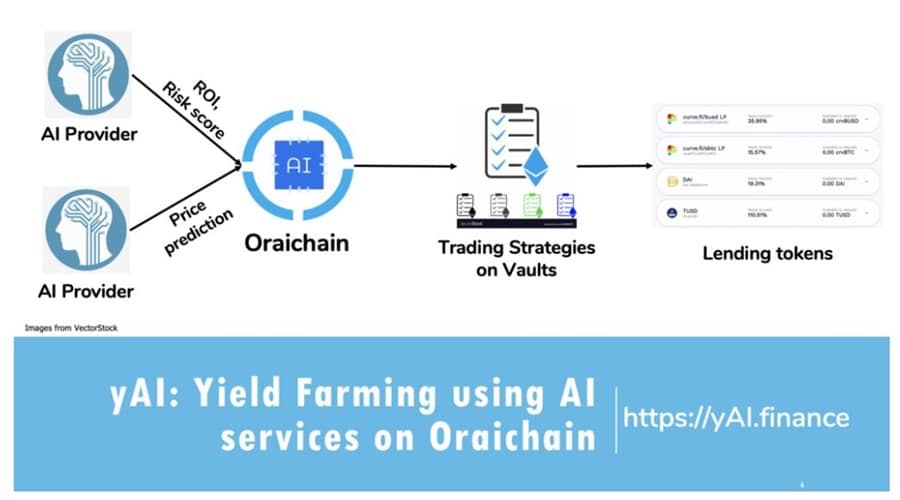

Yield farming is just one potential use case for Oraichain. Image via Oraichain Docs.

Yield farming is just one potential use case for Oraichain. Image via Oraichain Docs. The ecosystem also allows AI providers to follow the flow of any requests for their services from start to finish. This is included as a means to increase the transparency of the system. With this level of transparency, users can easily see which validators are best at execution, and if there are any malicious providers.

Staking & Earning

Validators stake their tokens and receive rewards for securing the network. Other users are also able to delegate their tokens to existing validators and share in those rewards proportionally. It’s important that delegators do understand that this is not passive income.

Delegators need to actively monitor the validators to ensure they continue to perform well within the ecosystem. If they are delegating to a malicious validator they risk having their delegated tokens slashed. So, delegators are equally responsible for ensuring the Oraichain ecosystem remains secure and of high quality.

Test Cases

The test cases are provided to Oraichain to verify the integrity and correctness of any AI services on the blockchain network. It is possible for third parties to become test case providers and then examine specific AI models to determine if they are qualified to operate on Oraichain and charge fees. Users can provide expected outputs and see if the AI model results are similar. These test cases providers encourage the AI providers to continue providing the best quality services.

Orai DAO

Governance on Oraichain is done by the community in a DAO model. Anyone owning ORAI tokens is able to participate in the governance of the network. They can also participate in the ongoing development and the future plans for the Oraichain ecosystem. While the project development team was responsible for creating the foundation for governance, it has now been automated and will forever remain in the hands of the community.

OraiDEX

In March 2022, Oraichain launched the OraiDEX, a smart contracts-based decentralized exchange on Oraichain. ORaiDEX features the following capabilities:

- Token Bridging - Cross-chain bridging of the network token between Ethereum, Binance Smart Chain, and other supported networks.

- OraiSwap - Token swapping and farming services.

- IBC integration - Seamless connectivity with the IBC network, allowing trustless communication between ORAI, OSMO, CRO, ATOM, and other tokens in the IBC network.

- NFT bridge - Dedicated to helping users relocate NFTs from one network to another.

The OraiDEX operates with the ORAIX native token, used for settlements, paying DEX fees, and participating in NFT airdrops.

What Prevents Blockchain From Using AI Models?

Smart contracts in the way they are developed currently are unable to run AI models, and developers have found it to be nearly impossible to integrate an AI model into a smart contract. AI models are typically very complex constructions based on neural networks, SVM, clustering and other approaches. Smart contracts include three characteristics that prevent the inclusion of AI models:

Three things keep blockchains from using AI models, but Oraichain will fix that. Image via Defi.cx

Three things keep blockchains from using AI models, but Oraichain will fix that. Image via Defi.cx Strictness: Smart contracts are developed in such a way that they must always follow the strict rules put in place for them. All input for the smart contract must be 100% accurate if an output is expected. However, AI models don’t necessarily provide 100% accurate inputs. Oraichain will overcome some of the aspects of smart contract strictness, giving a better user experience and enhanced smart contract functionality.

Environment: Typically smart contracts are created using high-level programming languages, such as Solidity and Rust. This provides better security and syntax for the smart contracts. By contrast, most AI models are written in Java or Python.

Data size: Due to the gas costs of running smart contracts on most networks they are usually created with very small storage allowances. Comparatively, the AI models are quite large and use a lot of storage space.

Blockchain-Based Oracle AI

Oraichain is being developed as a way to create smart contracts that are able to use AI models. On the surface the mechanism being used by Oraichain seems similar to those used by Chainlink or the Band Protocol, but Oraichain is more heavily focused on AI APIs and the quality of the AI models.

Each user request includes attached test cases, and in order to receive payment the providers API must pass a specified number of test cases. Validators manage the test case features, and the quality of the AI models, making Oraichain quite different and unique from other solutions.

Oraichain System Overview

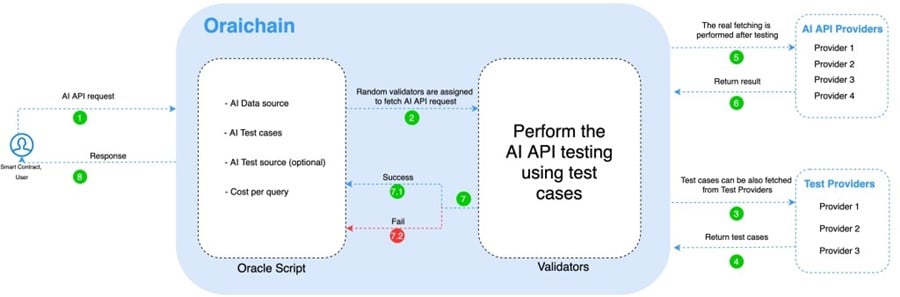

The Oraichain public blockchain allows for a number of user-generated data requests. In addition to users requesting data the blockchain also allows smart contracts to request data securely from artificial intelligence APIs that are external to the blockchain. The blockchain has been built using the Cosmos SDK and utilizes Tendermint’s Byzantine Fault Tolerance (BFT) as a consensus mechanism to ensure transaction confirmations are handled rapidly.

In terms of consensus mechanism, the Oraichain protocol is similar to Delegated Proof-of-Stake (DPoS). The network is constructed of validators, each of which owns and stakes ORAI tokens, while other users who hold ORAI tokens are able to delegate them to the nominated validators. In this way, both validators and delegators receive rewards proportional to their stake with each newly created block.

Validators have the task of collecting data from AI Providers and validating the data before it is stored to the blockchain. In order to validate the AI API each validator is required to do testing based on the test cases provided by users, test providers, or the smart contracts. Any time a user is unsure which test case might be good they are able to request additional test cases from the test providers. Thus the validity of the AI APIs can always be verified.

Therefore, the validators of the Oraichain network earn rewards for two essential services they provide:

- Staking their ORAI tokens and participating in consensus to propagate the blockchain network.

- Executing oracle scripts consumes resources. Validators that execute oracle scripts and publish their reports earn 20% of the rewards from those scripts.

A representation of the inner workings behind Oraichain. Image via Oraichain Docs

A representation of the inner workings behind Oraichain. Image via Oraichain Docs You can see above how the flow of requesting an AI API works in the Oraichain system. When performing a request the smart contracts or users are required to call an oracle script which is available from the AI Marketplace or from the Oraichain gateway. These oracle scripts include external AI data sources, provided by the AI providers, along with test cases and optional test sources. There is also a transaction fee required to complete each request.

Whenever a request is submitted a random validator is chosen to complete the request. This validator then retrieves the necessary data from one or more AI providers and executes test scenarios to verify the validity of the data. If the tests pass the data can be passed along, but if the tests fail the request is canceled.

When a request is successful the results of the test are written to the Oraichain blockchain. This result can be fetched from smart contracts or regular applications and serves as the proof of execution. A successful request is also required to pay the necessary transaction fees, which are used to reward validators and delegators.

There is an overhead of reading results from Oraichain’s transactions, but it helps ensure that the AI API quality is good and there is no data tampering during the process of fetching data from AI providers.

If we compare this testing with Chainlink and Bank Protocol we see that API testing using test cases is unique to Oraichain. Because Oraichain is focused on AI APIs it is crucial that testing is included to control the quality of the AI providers in the ecosystem. Plus users and test providers can submit new and suitable test cases to properly verify any AI API. These test cases incentivize the AI providers to improve the quality and accuracy of their AI models.

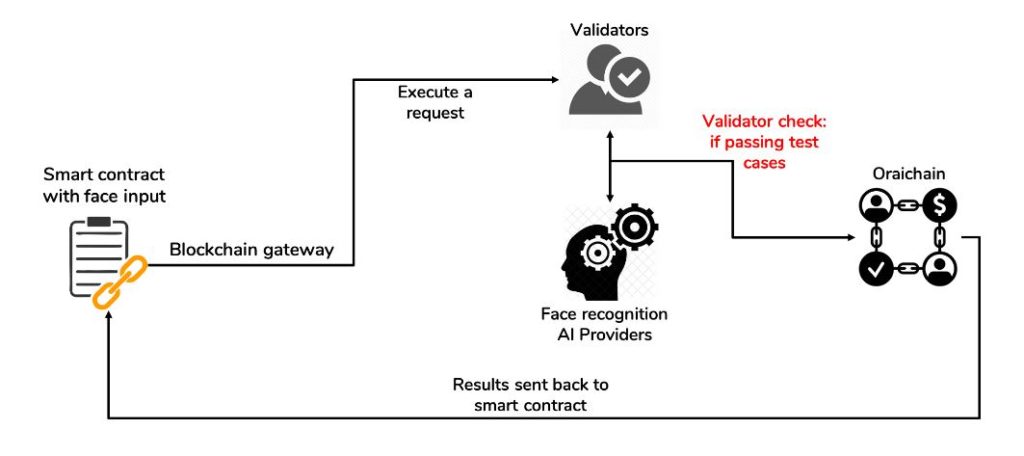

Validating test cases to complete a request. Image via Oraichain Docs

Validating test cases to complete a request. Image via Oraichain Docs Another unique feature added to the Oraichain model is the ability of the community to rate the reputation of each validator in regard to the improvement of the quality of the AI APIs. In this way, validators can be slashed if they are found to have low availability, slow response times, failure to validate AI providers, failure to perform test cases properly, or any other bad behavior.

One warning is that a large number of validators are needed to prevent the system from becoming centralized. A greater number of validators serves to increase the availability of the network, while also improving on scalability and successful request performance.

At the same time block reward and transaction fees need to be sufficient to incentivize a large number of validators to join and participate in the Oraichain ecosystem. Otherwise, the network could become centralized, and will certainly slow to the point of being unusable.

The Oraichain Team

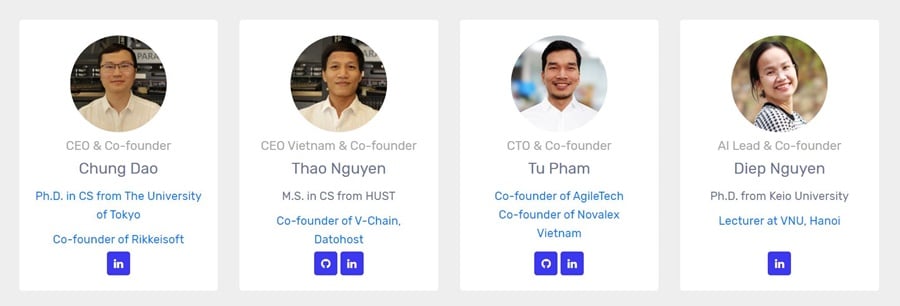

Oraichain recently made some changes to their leadership, moving the former CTO of Orachain into the position of CEO for Oraichain Vietnam and welcoming Mr. Tu Pham as the CTO of Oraichain.

The impressive leadership team at Oraichain. Image via Orai.io

The impressive leadership team at Oraichain. Image via Orai.io Chung Dao continues as the CEO of Oraichain. As one of the co-founders of the project he has been instrumental in its growth since the very beginning. He is also the co-founder of Rikkeisoft and has achieved a PhD in Computer Science from The University of Tokyo.

The AI Lead and another co-founder of the project is Diep Nguyen, a lecturer at VNU in Hanoi and holder of a PhD from Keio University.

In addition, Oraichain’s total workforce has now been expanded to 25 people including the core team, AI and blockchain specialists, data scientists and developers.

Oraichain & Binance Chain Integration

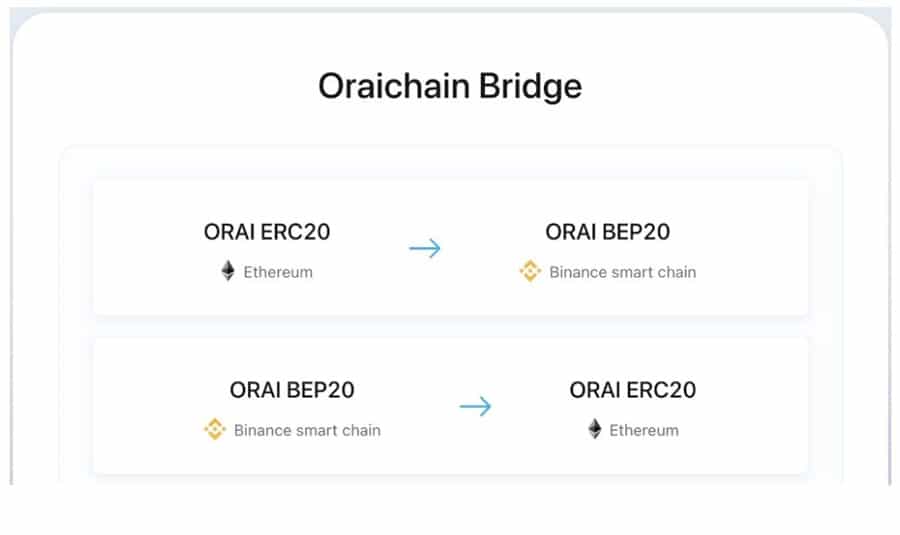

Around the same time as making changes to the leadership at Oraichain, the team also completed an integration with Binance Chain. This integration creates a bridge from Ethereum to Binance Chain for the ERC-20 ORAI tokens. Oraichain has committed to providing the necessary liquidity for trading the BNB/ORAI pairing on PancakeSwap.

Swap easily from ERC-20 to BEP-20 tokens and vice versa. Image via Oraichain Blog.

Swap easily from ERC-20 to BEP-20 tokens and vice versa. Image via Oraichain Blog. Anyone who wishes to swap between the ERC-20 ORAI token and the BEP-20 ORAI token can do so at https://bridge.orai.io.

Further information regarding the new BEP-20 token and instructions on swapping can be found here.

ORAI Token Economics

Anytime an AI request is sent to the Oraichain network there is an associated transaction cost that needs to be paid in ORAI tokens. In fact, the token plays a role as the transaction fee that is paid for request executing validators, AI-API providers, test case providers, and block-creating validators.

The transaction fee is not set, but varies based on the fee requirement of the validators who execute the requests, the AI API providers, and the test case providers. This means that anytime there is a request made the validators can choose whether or not to execute the request based on the transaction fee offered.

Once validators have decided whether or not to be included in the pool of willing participants the system randomly chooses one of the validators that have expressed a willingness to execute the request. The validator is also responsible for clarifying the fee paid to AI-API providers, test case providers, and block-creating validators in the MsgResultReport.

It is possible for more than one validator to be included in a request, in which case the transaction fee is divided equally among the validators who participated in the request. Again, the validators must decide if they are willing to accept such a transaction fee.

The ORAI token is rewarded for each newly created block, so to keep the value of ORAI token, holders must stake their token to the Oraichain network. The rewarding token is divided based on the number of tokens that a holder is staking to a validator. Moreover, there is a mechanism to punish bad behaviors of validators in aspects of AI API quality, response time, and availability.

The new tokenomics supports the growth of ORAI tokens. Image via Oraichain Blog

The new tokenomics supports the growth of ORAI tokens. Image via Oraichain Blog The team also changed the tokenonmics by burning 73% of the total supply of ORAI tokens in December 2020. They also extended the emission schedule to 2027, thus flattening the release curve and protecting from sudden supply shocks. It also helps to minimize inflation in the early years of the project.

The ORAI Token

There was a seed sale conducted in October 2020 with ORAI tokens being sold for $0.081 each. There was a goal of $70,000 for the sale, however, no data regarding the total funds raised was released. In November 2020 there was a private sale scheduled, but it was never held. Finally, there was a public sale scheduled for February 2021, but after the team changed the tokenomics and burned 73% of the circulating supply the public sale was cancelled.

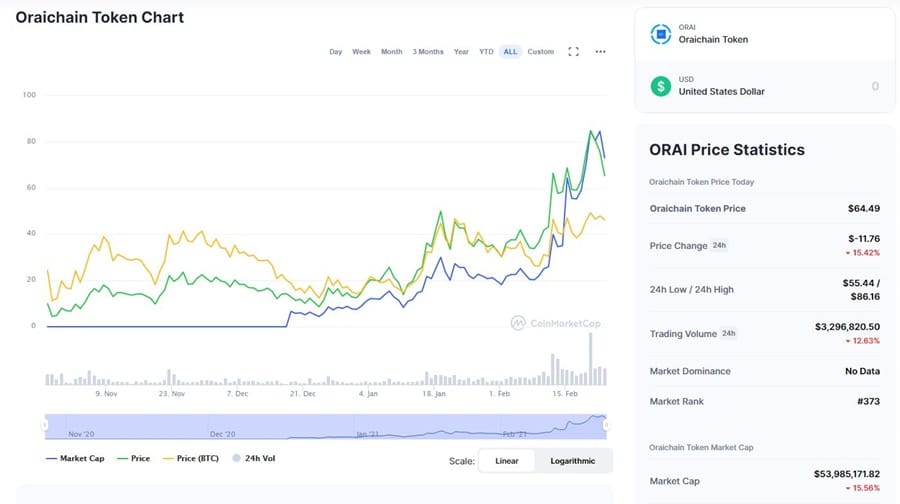

The price of the ORAI token has surged in 2021, reaching an all-time high of $107.48 on February 20, 2021. That contrasts with the all-time low of $2.83 just four months earlier on October 29, 2020.

The ORAI token has soared higher in just 4 months. Image via Coinmarketcap.com

The ORAI token has soared higher in just 4 months. Image via Coinmarketcap.com As of February 23, 2021, the price has retreated substantially from its all-time high, trading at $65.06. There are very few exchanges handling the token, with the majority of transactions occurring on Uniswap. There is also a small amount of activity on KuCoin, Gate.io, and Bithumb Global.

Oraichain Use Cases

There are already a number of use cases that have generated interest in Oraichain.

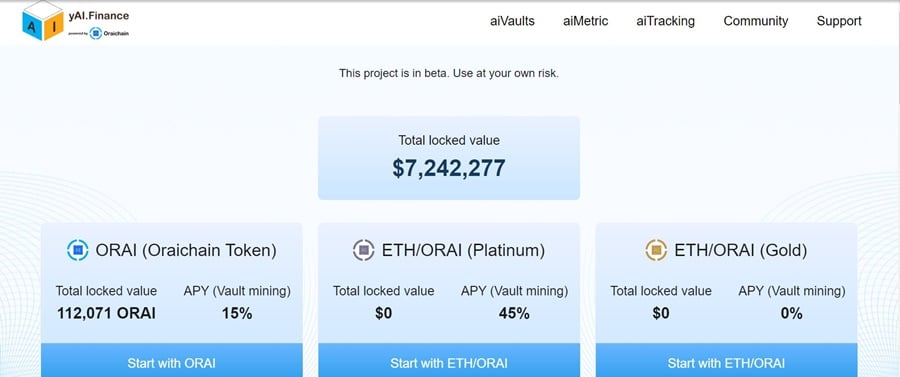

Yield Farming with AI

The yield farming based on Oraichain was inspired by the development of yearn.finance (YFI). Like yEarn, the Oraichain system helps reduce the complexity of yield trading. Where yEarn uses crowdsourcing knowledge, Oraichain provides AI-based price prediction APIs as inputs to smart contracts. The yield farming use case has two functionalities:

Earn: Get price prediction from Oraichain and automatically decide BUY/SELL tokens. Users choose the best-performing AI APIs.

Vaults: Apply automated trading oracle scripts on Oraichain. Deposit tokens and the assigned oracle script will find the best AI input to maximize yield.

AI powered DeFi platform. Image via yai.finance

AI powered DeFi platform. Image via yai.finance Compared to yearn.finance (crowdsource-based strategies), AI-based trading performance could be less efficient, but risk management could be better since all buying or selling decision is based on AI models (or by machine) and not by human psychology.

Flexible smart contracts & face authentication

There are several scenarios in which face authentication is very useful:

- using your face to get your balance instead of using a private key,

- withdrawing tokens to registered wallets using your face

- using your face in order to reset your private/public key pair

- using both your private key and face in order to execute a smart contract.

Using face authentication might be riskier than a private key, but it helps improve the user experience. In cases of checking balance and withdrawing tokens to registered wallets, face authentication is considered as safe and convenient.

Fake news Detection

This use case focuses more on a regular application that wants to check if the news can be trusted. Oraichain provides a marketplace in a decentralized manner in which combining results from different providers is possible. If the providers want to receive payments, their APIs must pass the test cases just as any other API provider.

More potential use cases

- Smart contracts help check if a product is fake in the supply chain

- Smart contracts deciding a loan based on users’ credit score

- Smart contracts automatically pricing game items based on their characteristics and DNA

- Marketplace of automated diagnostics for X-ray images, spam classification, handwriting detection using OCR, and citizen ID card detection using OCR.

Oraichain 2022 Roadmap

Here is an overview list of Oraichain Roadmap for 2022.

Q1 2022

- Foundation upgrade: Oraichain Mainnet 2.0

- AI oracle execution subnetwork with Layer 2 Rollup

- Upgrade AI Oracle mechanism

- OraiDEX

- Data Hub utilization and updates

- New AI Marketplace

Q2 2022

- Infrastructure as a service for Dapps and Metaverse projects

- Relaying Oraichain services to other chains

- Data Marketplace with Data Tunneling

Q3 2022

- 3rd-party AI Publishing Service and Integration on Data Hub

- AI Training Service on Data Hub

- Incubating Dapps on Oraichain

- Increase validator and executor communities on Mainnet and subnetwork

Q4 2022

- SDK for AI Oracle developers

- Launchpad & DeFi templates for creators

Conclusion

Just like other projects that have been built in the data oracle sector the demand for Oraichain should only increase as the DeFi economy continues to expand. Starting with the yAI DeFi product Oraichain is showing it is more than capable of competing in the space.

In addition, this platform fills a niche not served by crowdsourced projects like yEarn Finance. It’s also taking a unique approach that sets it apart from industry leader Chainlink.

The mainnet launch for the project is on February 24, which will be an exciting time to see how much demand there is for the project and its unique take on oracle protocols and DeFi. It could also reinvigorate the ORAI token, which has seen impressive growth over the past four months.

Oraichain is a young project, but it’s already made very impressive strides. The roadmap for the project is quite impressive, but the team is impressive as well. That could lead to unprecedented growth for Oraichain in 2021 and beyond.

As the lone project taking on the problem of adding AI to smart contracts Oraichain could be setting itself up as a leader in the blockchain space for some time to come.