OST (Simple Token) is a blockchain as a service (BaaS) platform striving to bring blockchain technologies to the masses. One way it is doing this is through its branded token creation that allows businesses to create their own token, without having to worry about the technology behind the token or the legal requirements such as Know Your Customer.

OST also provides developers with all the APIs and SDKs needed, and with the inclusion of the OST wallet, dashboards and protocols, OST partners are already reaching over 300 million people.

However, with so many competing BaaS blockchains, can it rise above the fold?

In this review of OST we will take an in-depth look at the project technology, team members and roadmap. We will also look at the OST token use cases and its longer term cases for mass adoption.

OST Simple Token Use Cases

There are numerous ways that the Simple Token can be used by both businesses and consumers in applications to real-world problems. In fact, many businesses are already doing just that, which is why OST partners already reach 300 million users.

One of the goals of Simple Token is to reduce Ethereum blockchain congestion. It is doing this through the OpenST Mosaic protocol, which is planned to launch in its alpha state in the first quarter of 2019. OpenST Mosaic introduces metablockchains to enable internet-grade transaction throughput on Ethereum.

Transactions will run at lightning speed on auxiliary blockchains with economic finality secured asynchronously on the Ethereum blockchain. This will improve transactional throughput for the Ethereum blockchain and will benefit the entire Ethereum ecosystem.

Another goal is to simplify the process for consumer applications to build a thriving community based around the incentives of a branded token. It wants to not only make the technology easily accessible, but will also remove the regulatory and financial burdens of creating and maintaining a branded token. This will allow companies to focus on their own software or platform, essentially their strengths, while Simple Token and the OpenST protocol handle all the blockchain related aspects of the token economy.

One of the main use cases for these branded tokens is similar to frequent flyer programs and other loyalty programs. There are already a handful of companies partnered with OST and exploring the release of their own blockchain based loyalty programs.

Potential partner industries for OST Network Token

Potential partner industries for OST Network TokenFor example, suppose Uber decided to create a loyalty program based on the OpenST protocol and OST technology. They could offer rewards in their own branded Uber token for things such as leaving reviews, contributing to online discussions, or even as a percentage rebate on Uber trips.

Moreover, they could further make using the tokens a more attractive option to using fiat. By also bringing the drivers into the mix by offering them tokens for various actions, or paying them in Uber tokens an entire ecosystem would be created.

OST Simple Token Technology

The OpenST protocol is a technology that makes it possible for any company to launch their own token and create a token economy that is scalable and safe for its users. It also includes a suite of tools that make it easy for developers to interact with all of the features offered by the blockchain.

In practice it is used like this:

- The Simple Token blockchain is comprised of Simple Token sidechains that connect to the Ethereum blockchain through the OpenST protocol.

- These sidechains have their own minting contracts that are connected to staking contracts on the Ethereum mainnet. This allows for the transfer of branded tokens.

- There is a two-phase implementation included in the OpenST protocol to establish token utility by proving intent of minted tokens.

- After establishing the utility of the token there are a series of REST APIs issued by the OpenST protocol so developers are able to manage the new tokens and create applications around them. The REST APIs enable interaction with the tokens in a number of ways. For example:

- Managing private keys

- Finalizing settlements

- Invoking smart contracts

- Provide incentives and rewards for consumers

- Generate analytics and transaction history

The OpenST protocol already enables developers to create an impressive array of applications and features, and one can guess the power of the platform will only increase over time.

The OST Team

While OST isn’t an ‘old’ project, it has a team with a huge amount of experience and talent. That team is led by founder and CEO Jason Goldberg, who is a serial entrepreneur who has created a number of successful internet based business, beginning with Jobster in 2004. Over nearly two decades he has created products that have been scaled to tens of millions of users.

Some of the OST Team Members. Image via OST Team

Some of the OST Team Members. Image via OST TeamThe OST project was spawned from an earlier project called Pepo, which began in 2016 and is still active today. Many of the original team came from Pepo, but the team has grown dramatically since the inception of OST. In fact, when begun the project had roughly 30 team members, but in the year since launching it has doubled to 60 team members. There are an additional dozen or so advisors working closely with OST to ensure the project stays on track.

One outstanding accomplishment aside from the technological leaps being made by OST is in the realm of finance. Some have called the OST ICO the most professional ICO executed to date. The OST leaders spared no expense and in addition to a team of over 70 full and part-time members they also engaged two law firms, a dozen community managers, three economists, and a big four accounting firm. Needless to say they were looking for a successful ICO and as you’ll see later that’s exactly what they got.

OST Partnerships

OST has announced over 30 partnerships already, and those partnerships now ensure OST’s technology reaches more than 300 million users. Even though the cryptocurrency market endured a brutal bear market in 2018, OST was able to continue signing new companies to use their technology. This is very promising for the long-term utilization of the OpenST protocol and OST technologies.

If you wanted you could get more of an overview of the types of projects that OST has managed to sign you can head on over to their partners page. These operate in a number of different industries and have numerous different use cases.

Some of the 30+ OST Partners

Some of the 30+ OST PartnersYou have the likes of The Brightly Co which is change the world through conscious shopping. You also have the Fainin which is developing an application and ecosystem where you can try a product before you buy it. Another interesting project which is building on the OST network is that of Touriocity which is trying to break the mold of stale city tours and trips.

The OST Token

The OST ICO was held on December 1, 2017 as the massive rally in the cryptocurrency markets was just getting fully underway. Not surprisingly, OST was able to raise $21.7 million, which was 109% of their $20 million goal. Tokens were sold at $0.0889 and there were a total of 240 million tokens offered for sale, which was 30% of the total supply of 800 million OST tokens.

With the cryptocurrency rally fully underway, OST rose rapidly, hitting an all-time high of $1.11 on January 10, 2018. Unfortunately 2018 hasn’t been kind to cryptocurrencies and as of January 4, 2019, nearly one year from its all-time high, OST is trading at just $0.023993, giving early investors a roughly 75% loss on the ICO price.

Register at Binance and Buy OST Tokens

Register at Binance and Buy OST TokensYou can buy OST on Upbit or Binance easily, and there is also small trading volumes of the token on IDAX, IDCM, Bittrex and Huobi. Eventually OST plans to launch the BT Exchange, which will allow for liquidity across the branded tokens created on the platform. In addition to OST and branded tokens, the exchange is also expected to work with fiat currencies.

Because OST is an ERC-20 token it can be stored in any ERC-20 compliant wallet. MyEtherWallet and MetaMask are two of the most popular, but there are many others that could be used.

OST Development & Roadmap

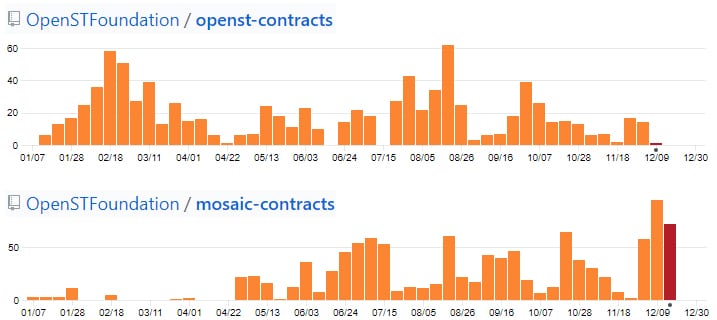

In order to determine how much work is being done on a project, it helps to take a look at their GitHub repositories. This can give you a good overview of the amount of code that the developers are pushing and hence how much the technology of the project is progressing.

Delving into the OST repositories, it is quite clear that they are busy at work with a number of their seperate initiatives. Given the size of OST there are quite a number of repositories but we will look at the top 2.

Some of the Commits for the OST Repositories

Some of the Commits for the OST RepositoriesThere also seems to be quite a bit in the pipeline in terms of dev work as the developers have an interesting roadmap and timeline especially for next year.

For example, in the first quarter of 2019 they are due an OpenST and OST Mainnet security audit. They will also release the OpenST Protocol Mainnet Beta and the OpenST Mosiac in Alpha. In parralell with this, they hope to incorporate the functionality to redeem BT for in-app purchases (alpha stage).

Later in the year, they are excepted to release the OpenST Protocol live as well as the OST KIT in Beta. They will also be releasing the OST wallet SDK and the OST KYC integration. In Q2 it is also hoped that they will be able to release the in app BT live.

The OST team has quite an extensive roadmap that extends all the way into 2020 with detailed miletones. It will be interesting to see whether the team is able to meet these objectives and what it could mean for the interest in the project.

Conclusion

The drop in price of the OST token doesn’t inspire confidence, but we have to remember the severity of the 2018 bear market in cryptocurrencies. The Simple Token still has a strong team behind it, and has been moving forward with new features and partnerships despite that bear market.

With blockchain projects recently beginning to fail in increasing numbers Simple Token looks even more attractive for its growth trajectory. The project continues hitting its deadlines and is actively adding new team members.

With new partners being added all the project needs is for the bear market to finally loose its hold on cryptocurrencies. The project is well positioned for explosive growth once that happens.