For those who are not too familiar with QLC Chain, it used to be called Qlink until a recent re-branding gave it's new moniker.

The project is quite an interesting one that is building a platform for distributed telecommunications. They want to take the power out of the hands of the mobile providers and give users the ability to buy connectivity from their peers.

This is no doubt quite ambitious, but can they really meet their goals?

In this review of QLC Chain, we will take an in depth look into the project and their long term potential. We will analyse the technology, road map, team members and development work. We will also look at the potential for long term adoption of the QLC tokens.

What is QLC Chain?

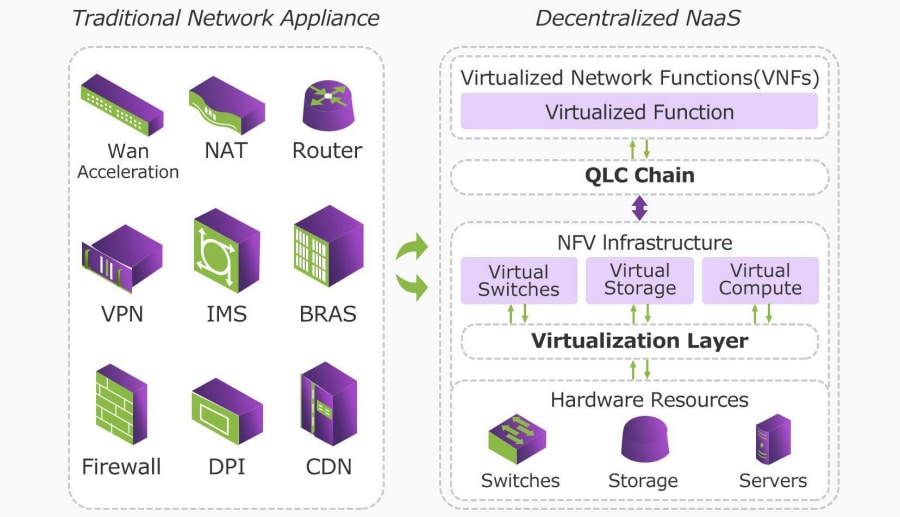

QLC Chain (previously Qlink), is working on decentralized telecommunications in a Network as a Service (NaaS) model. This model hopes to use smart contracts to enable network functionality and access to dApps.

If the QLC Chain project is successful, in the future you’ll purchase and sell telecommunications services from your peers rather than from monopolistic telecommunication companies. The QLC Chain model might have you selling unused data to other, running your own cell signal booster, or buying access to someone’s wifi connection.

QLC Chain is based in China and is built on the NEO blockchain. It has already launched a mobile application for VPN access and wifi sharing, and is running on its testnet, with plans to launch the main net early in 2019.

QLC Chain Identifies the Telecom Problem

Telecom services are more expensive than you might hope, and that’s largely due to the cost of building the infrastructure needed to provide their service. Fiber-optic lines and cell towers aren’t cheap, and that is especially true when trying to provide solid coverage over a large area, such as in rural communities, or in cities where large buildings often block the direct path of signals.

A larger problem is that because the telecom companies need o make ever larger profits for their shareholders they have become known to be expensive, inflexible, and worst of all monopolistic. Yes there are multiple providers, but they have become adept at locking up areas and giving you little choice other than to sign their multi-year contract and pay their excessive charges.

How QLC Chain will Fix Telecom

QLC Chain plans on resolving many of the issues relating to telecom providers by decentralizing the marketplace and putting the service back into user’s hands.

One way it is planning on doing this is by allowing anyone to operate a small base station from their home to magnify signals and provide wifi and cell service to a small surrounding area. Anyone using that base station to connect pays a small fee to the base station operator, which is the incentive for installing a base station.

Image Source: QLC Presentation

Image Source: QLC PresentationIn the case of wifi services the smart contracts of QLC Chain will manage the time-limited connectivity and payments. In fact, eventually the service could be used to offer access to any telecommunications services. One proposed use-case has been selling unused SMS to large companies so they can text their customers more cost effectively.

It is also possible for advertisers to use the QLC Chain network. When ads are shown to a consumer the advertiser is charged for the consumer’s data usage.

It is quite a challenge being faced. Telecom companies are some of the largest and most powerful corporations on Earth. Taking their business away from them will almost certainly prompt a huge blowback, and for this reason QLC Chain is working with some large providers, bringing them into the decentralization framework.

QLC Chain Two-Chain Consensus

Telecommunications networks require a registry for all the devices on the network, and this is true for decentralized telecommunications networks too. And it requires enough capacity to transmit data across its entire network and to all the connected devices. QLC Chain is proposing a multi-dimensional block lattice architecture and dual consensus solution to achieve this.

Multidimensional Block Lattice

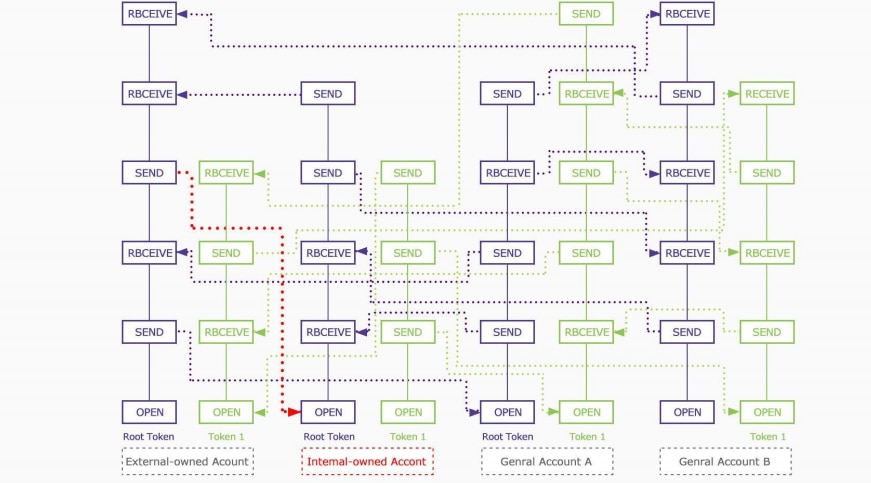

Multidimensional Block LatticeThe public chain is built on top of the NEO network and will be used to hold asset registration information and digital identities. The public layer can share information with parties as needed through gateways. Thousands of transactions can be processed rapidly and with finality using NEOs Byzantine fault-tolerance consensus.

The second consensus mechanism is proprietary and was developed by the QLC Chain team. It handles transfer of data and assets between users and asset owners and contains the smart contracts that control many of the relationships and transactions on the network. This chain uses a hybrid proof of stake / proof of work consensus called Proof of Shannon.

The multi-dimensional block lattice architecture allows for cross chain communication as well as allowing for massive scaling. This architecture is used in other projects such as Nano for example.

Telco Partnerships

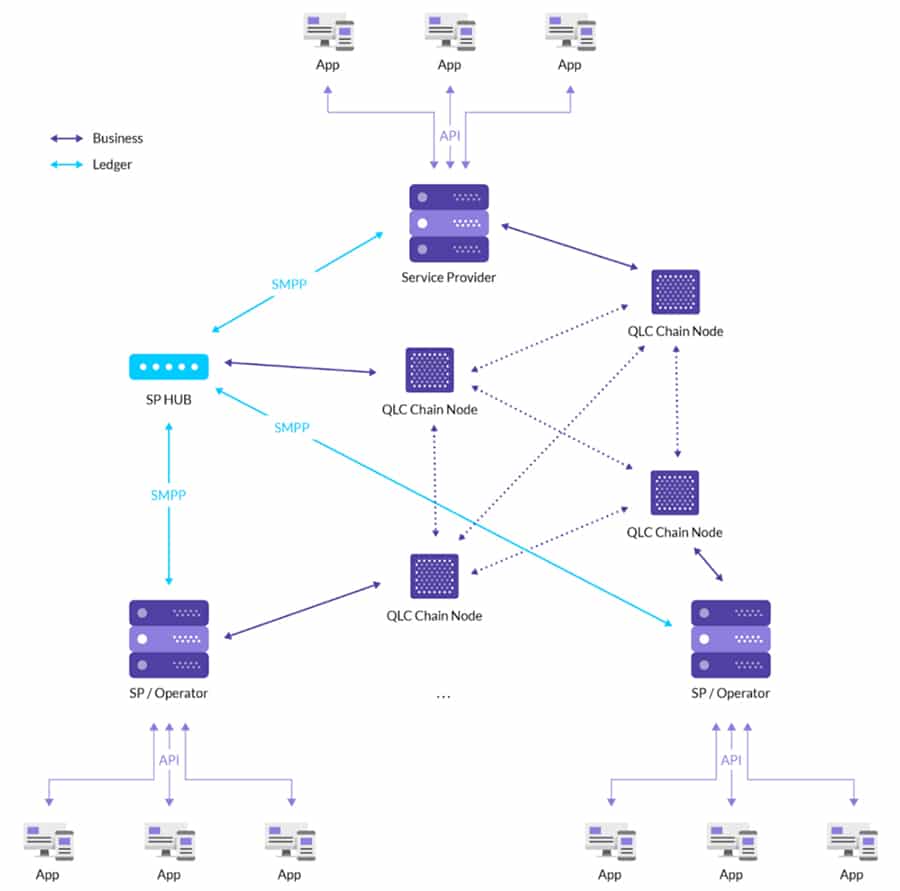

The QLC Chain team knows they aren’t going to be able to take on the telecom giants and defeat them directly. In fact, QLC regards the infrastructure in place as valuable to a decentralized approach too. Instead they will be looking to integrate the telecom providers into their system. They’ve already begun with Montnets Group, a leading Chinese cloud communications service.

By providing Montnets Group with services they are also working more closely with the top three telecom providers in China. One benefit that they provide with a blockchain based solution is the trustless nature of the blockchain. Traditional gateway services are often less than transparent, leaving telco’s virtually unable to determine service levels or actual costs.

The QLC Service Provider marketplace. Image via QLC Chain Blog

The QLC Service Provider marketplace. Image via QLC Chain BlogQLC Chain gateways will do away with the web of third-party providers, and unprovable service level agreements. Instead smart contracts on the blockchain will set terms and service agreements. Payments will be automated, and everything will be auditable on the blockchain.

While the telecom giants likely won’t immediately appreciate QLC Chain entering their sphere of influence, they should quickly come to see the potential cost savings they can realize through the efficiencies gained with blockchain and smart contracts.

QLC Chain Business Model

Users will also be able to make money from the network, and as it grows the opportunity will grow as well since the amount possible will be dependent on supply and demand of QLC Chain users in the area.

Wifi sharing will be one source of income, and that feature is already being tested in the testnet. This feature allows you to rent your wifi to other users in return for QLC tokens. Simply list your wifi connection on the app and the smart contracts handle everything else. You can even set limits on how many users can access your wifi, and for how long.

Another possibility for getting paid comes from sharing your mobile data or creating a mobile hotspot. One area that QLC Chain believes will be huge is selling your unused SMS to enterprises, but this feature hasn’t been implemented yet, so we don’t know how successful it will be. Some areas of the world, such as the U.S. have been moving towards unlimited data and SMS plans which would make these features unnecessary.

The WinQ App

There is a WinQ app that was released on the testnet and is available on both Google Play for Android and the Apple App Store for iOS. It’s one of the first dApps integrated on the NEO blockchain, but since it is on the testnet it can’t be used with your actual QLC tokens.

The app currently functions as a QLC wallet, as a VPN node and as a wifi asset. Users can download the app and create a wallet which will be credit with 100 testnet QLC that can be used to test the VPN and wifi functionality. Users can register their wifi and VPN on the network and earn QLC for sharing their wifi.

The team at QLC Chain has said that testnet funds will be partially converted to mainnet funds when it launches, so this is an early way to earn some actual QLC that will be creditd to you once the mainnet launches.

There are also plans to create a desktop app with the same functionality once the mainnet launches.

The Base Station

QLC Chain will release a hardware base station that can be used by anyone to boost signals from cell providers. The base station will allow users to earn QLC tokens in two ways:

1. By boosting cell provider signals for others to use;

2. Through use as a mining rig to participate in the proof-of-stake mining.

Ultimately QLC would like to see people all across the globe operating base stations, sharing signals, earning QLC and replacing the old-fashioned cell towers in some areas.

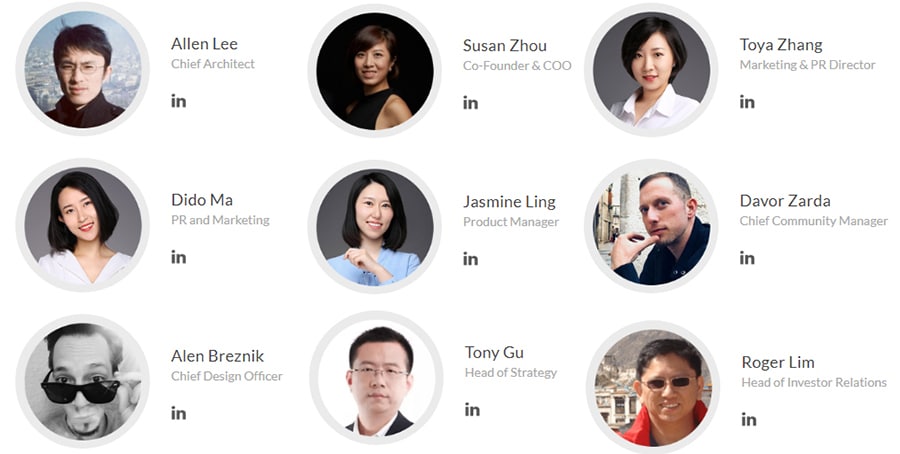

QLC Team Members

The QLC team is comprised of people with experience in software development, investment banking and fintech. For example, the chief architect and core develop at QLC Chain is Allen Lee. Prior to starting QLC Chain he used to work at a Huawei as a systems engineer.

Members of the QLC Chain team and QLC Foundation

Members of the QLC Chain team and QLC FoundationAnother co-founder is Susan Zhou who has a long financial service background working at Bloomberg LLP, Augentius and Rhodium capital prior to joining QLC chain. She also hols an MBA from the London business school.

What is interesting to note about this is that there were quite a few changes with the re-branding to from Qlink. For example, two of the core developers are no longer on board. There also used to be quite a diverse advisor pool joining the team when it was Qlink. You will have to draw your own conclusions.

When it comes to their communication with the QLC Chain community, the team got a Binance Info gold rating. This is basically given to those projects that have exhibited clear and regular updates to their community about the progress of the project.

Development & Roadmap

In order for us to get the best idea of how much work is being done on the QLC chain project, we have have to head on over to their GitHub Page. The amount of Git commits that a project is making is important to determine whether they are actively meeting their development timelines.

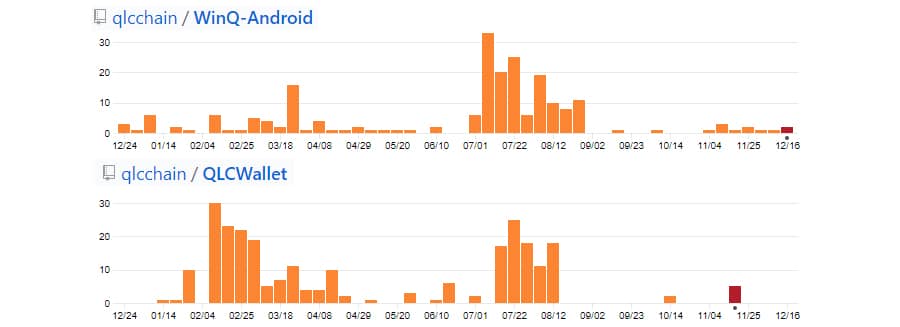

Git Commits to the Android WinQ and QLCWallet Repos. Source: GitHub

Git Commits to the Android WinQ and QLCWallet Repos. Source: GitHubAs you can see from their two most active repositories, they have been pushing code which is a sign. If we were to take a look at their total commits compared to other projects in the space they are ranked at 177.This is however only updated to the 31 of August.

In terms of the roadmap, they are currently in the process of implementing their DPoS consensus mechanism as well as the implementation of the internal service. January of 2019 could be interesting as they integrate the VM and smart contract. They are also planning to implement an RPC interface for the QLC chain wallet online.

The QLC Token

The QLC token was created as an NEP-5 token on the NEO blockchain. It will be the utility token used within the QLC ecosystem, incentivizing users and providing gas for dApps. The QLC token was released in an ICO in December 2017, with the project raising $19.3 million.

The token rose along with the rest of the market and hit an all-time high of $1.14 on January 9, 2018. It has also fallen with the broader market in 2018 and as of December 19, 2018 it is trading at just $0.022239. That’s a major hit for early investors as the ICO price was $0.3497 per token.

Register at Binance and Buy QLC Tokens

Register at Binance and Buy QLC TokensThe best place to buy QLC is at the Binance Exchange as they have most of the trading volume. There is also a small amount of volume at Kucoin and Gate.io.

Since QLC is an NEP-5 token you can store it in any NEO compatible wallet, and one option is the Neon wallet. Those who want more security than a software wallet provides might also consider the Ledger Nano S.

Conclusion

While the project is making progress there are still many questions surrounding the viability of the project. It is good to see they have a partnership, but taking on the big telecom companies won’t be easy. It’s also disappointing to see how far the token’s price has fallen since its ICO.

Long-term this project may have potential, but it is barely off the ground right now. With adoption of base stations, and the launch of a mainnet I think we could have more optimism regarding QLC Chain.

If you wanted to keep up to date with the project and the release of their roadmap milestones, you can keep an eye on their medium blog posts as well as their twitter accounts.