SafeMoon exploded onto the scene as one of the fastest-growing altcoins when it launched during the hype-fueled 2021 bull market, which saw a good number of tokens increase in value by thousands or even tens of thousands of percent in 2021.

Launched on March 8, 2021, SafeMoon is a BEP20 token that exists on the Binance Smart Chain. It’s also quite unusual in a world of cryptocurrencies trying to reduce transaction fees to promote trading because it actually taxes sellers, thus penalizing users for trading the token.

In some respects, it seems like SafeMoon is following the same approach to cryptocurrencies that value investors like Warren Buffet and Charlie Munger take to stocks. That is to follow a buy-and-hold philosophy, where those who hold the longest receive the greatest rewards.

Featured Image via Shutterstock

Featured Image via ShutterstockThe development team hopes this approach will help cryptocurrencies move away from the wild west perception they currently have. As it says on the SafeMoon Facebook page:

Remember, getting to the moon takes time, and the longer you hold, the more tokens you pick up.

With the prospect of infinitely increasing token generation (so long as you don’t sell), and with a price that’s jumped thousands of percent in just under three months, and a unique take on rewarding investors, it’s no wonder the project has attracted a good deal of attention.

Chances are it’s caught your attention too, which is why you’re here reading this SafeMoon review. If you are considering adding SAFEMOON to your holdings, then read on and be sure to take your grain of salt.

Remember that cryptocurrencies are inherently risky investments, even the oldest and most stable. New projects like this can create new fortunes almost overnight, but they can just as easily crash and burn. So make sure you never invest more than you are able to lose and be sure to do your research and due diligence before making any investment.

That said, maybe you’re just here because you’ve heard the hype over SafeMoon and just want to learn more about what it is and what problem it solves. If that’s the case, then read on.

What is SafeMoon?

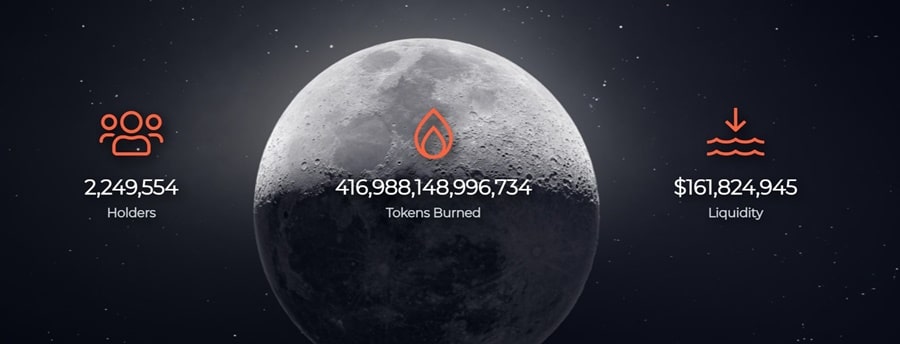

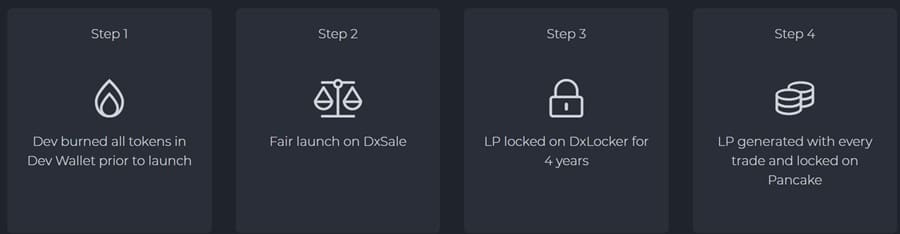

SafeMoon is an altcoin created on the Binance Smart Chain. It was launched on March 8, 2021, in a fair launch where the devs burned all their tokens and participated in the coin offering just like everyone else. In the short time SafeMoon has been in existence, it has added nearly 2.5 million users to its protocol while burning over 40% of the total token supply.

SafeMoon has already burned nearly half its supply. Image via SafeMoon.net

SafeMoon has already burned nearly half its supply. Image via SafeMoon.netSafeMoon was created to address the issue of impermanent loss. As an additional feature, it promotes buying and holding its token rather than speculating to drive up the price. It does this through a “tax” on any transaction where SAFEMOON tokens are sold.

One criticism of Bitcoin and similar cryptocurrencies is that they’ve strayed from their purpose. Initially created as an alternative to the centralized fiat currencies controlled by central bankers, Bitcoin and many other cryptocurrencies have become little more than commodities, with traders, investors, and speculators simply using them as investments and tradable assets.

However, some critics have come forward to attack SafeMoon, saying the token is a Ponzi scheme, a scam, and a shitcoin. That’s a serious accusation and one we will look at in more detail later in this piece.

What Problem Does SafeMoon Address?

With the explosion of DeFi has come the problem of impermanent loss. Because so few investors understand the mechanisms that create impermanent loss, many have been sucked into the high APY yield-farming trap. It’s not surprising.

Seeing an APY of 100% or greater brings out the greed in most of us. But unfortunately, what inevitably happens is the greedy trader gets pushed out by early investors who collect their profits and create the bursting of the valuation bubble.

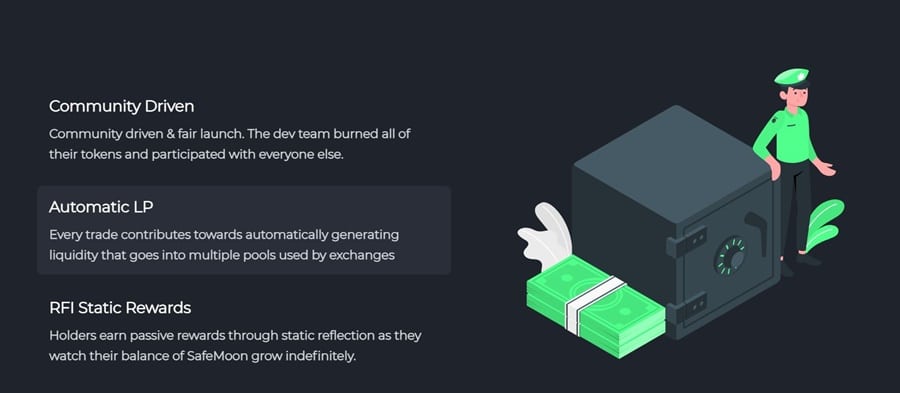

Three pillars of the protocol. Image via SafeMoon.net

Three pillars of the protocol. Image via SafeMoon.netDue to this dynamic, the adoption of static rewards, also known as reflection, is gaining increasing popularity. Reflection seeks to eliminate the problem of impermanent loss caused by yield-farming.

And SafeMoon uses three simple functions in each trade to combat impermanent loss and create a better protocol. These are Static Rewards (Reflection), Manual Token Burns, and Automatic Liquidity Pools.

Static Rewards

The SafeMoon developers feel that using static rewards, also known as a hold-farming model, can solve several problems associated with yield-farming. For one thing, because the reward amount is conditional on the trade volume of the token, there is a reduction in selling pressure of the token caused by early adopters selling tokens after farming the insanely high APYs.

Secondly, the mechanism is an incentive for users to continue holding their tokens, thus collecting an even greater number of tokens, similar to the way dividends work for stockholders.

The rewards work like a type of auto-compounding that doesn't require the user to actively hunt for yields, incurring transaction fees along the way. In addition, large wallets with exchanges, dapps etc., are excluded from getting the rewards, incentivising individual wallet holders to contribute, thereby making the system more decentralised and less prone to whale activity.

Manual Burns

Burns have been used by a number of protocols, and sometimes they can make a difference, but not always. For example, continuous automated burns tend to have a positive impact in the project's early days; however, the effect slowly loses its momentum since the burn can't be controlled to maximise its impact.

By contrast, a burn controlled by the team and based on project achievements can help keep community engagement high and the impact on the token just as high. In addition, Crypto communities appreciate the transparency that comes with advertised burns that can be tracked.

SafeMoon has implemented a burn strategy that's meant to benefit the community in the long term. This is achieved by distributing some rewards to a public burn address. The community is fully informed regarding the burns, and the total amount of tokens burned is always located on the homepage of the SafeMoon website, making it a simple task to identify the circulating supply at all times.

The burn rate is affected by "three important factors: reflection rate, token quantity and market volume.", as mentioned in their white paper.

Automatic Liquidity Pool (LP)

The SafeMoon team calls the Automatic Liquidity Pools the "secret sauce" of SAFEMOON. What happens is that a portion of the 5% fee from market activity, mainly swaps and transfers, is captured in a smart contract. These tokens sit in their own standalone pool. As the tokens accumulate to a certain point, currently set at 500 billion tokens, they will automatically get converted back to the liquidity pool, thus ensuring liquidity is flowing in on its own and not 100% reliant on liquidity providers. The team points out that Automatic LP provides two benefits to SAFEMOON holders.

The first is that the smart contract attracts tokens from buyers and sellers and adds them to the LP, thus creating a floor for price.

Secondly, the 10% tax on SAFEMOON sales acts as an arbitrage resistant mechanism that maintains SAFEMOON as a reward for holders, not as a speculative tool.

How safe is this moon ride really? Image via SafeMoon.net

How safe is this moon ride really? Image via SafeMoon.netBoth of these functions were included to alleviate some of the troubles seen with current DeFi reflection tokens.

SafeMoon V2

Evolving from being a holding token primarily with the 10% tax for buying/selling, V2 can whitelist certain contracts and adjust the rate to 2%, which is helpful for contracts with commercial use-cases.

This could encourage future partnerships with other projects to view Safemoon as a utility token. The whitelisting ability would also make Safemoon better able to respond to smart contracts threats, thus enhancing its security measures.

Due to the lower rates offered, the team projects increased volume and demand for the token for its utilitarian benefit.

Holders of the V1 token do not need to pay any fees to migrate their tokens to the V2 version. However, they need to ensure they have sufficient BNB for the Binance blockchain to process the transaction. The team encourages the migration of tokens by offering more V2 tokens when migrating, mainly to make up for the fee percentage charged for the original V2 buy/sell order.

More details about how migration works in wallets and exchanges can be found here.

SafeMoon PRODUCTS

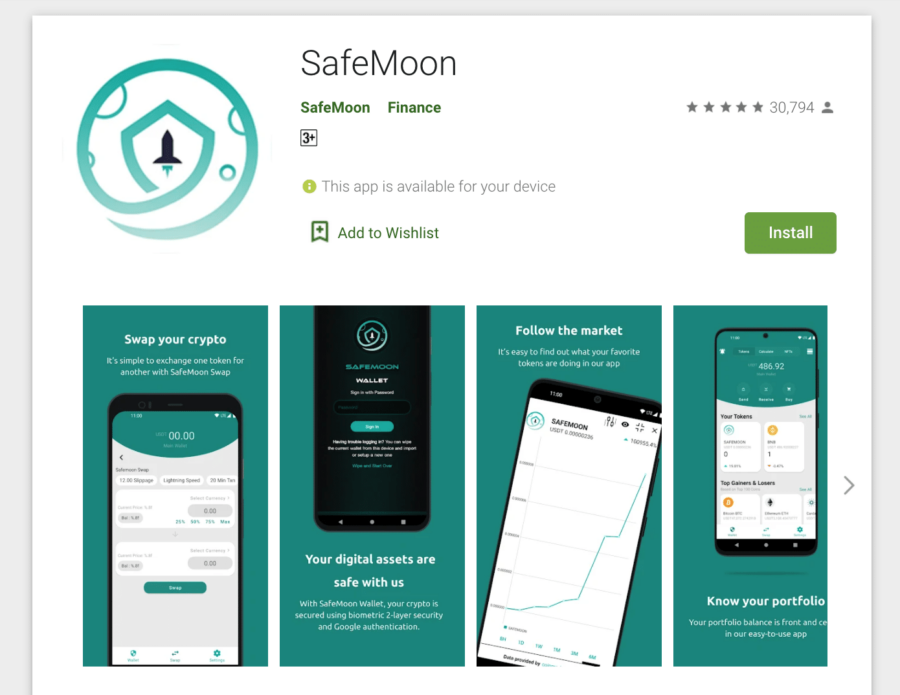

SafeMoon Wallet

A key product in their lineup is the SafeMoon Wallet, available on Android and iOS for both desktop and mobile. The app provides a choice of 12 or 24-word seed phrases for security. The wallet allows you to hold, swap and trade various cryptocurrencies. It is separated into three main sections:

Overview - shows you all the crypto held in the wallet and the top 100 currencies and their info. Click on each currency to show past transactions. A handy calculator lets you figure out how much your crypto is worth based on market price. You can also buy crypto with Moonpay on the app or move between the Binance Smart Chain (BSC) and the ETH network.

By allowing crypto to be sent/received via QR code scanning, this setup has been designed, perhaps, with the idea of making it easy for businesses to integrate them into their daily operations.

Rewards from holding SFM can be seen in the Reflections section of the app.

Swap - this section is where you can swap your tokens to/from Safemoon. There is the ability to adjust transaction speed transaction limit time and set the slippage amount to a level you find acceptable. Each swap carries a 0.25% fee broken down as follows, according to their blog:

- 0.17% going into the LP

- 0.05% SafeMoon Ecosystem - the pool of cash to pay for devs and upkeep of the SafeMoon project

- 0.03% Buy and Burn Automatically

Settings - this is where you change your password view your seed phrases and private keys.

Collectibles - although not official, this could be where NFTs are stored in the future whenever they decide to launch it. Just a quick heads-up!

Hodl your SFM in the Safemoon Wallet Image via Google Playstore

Hodl your SFM in the Safemoon Wallet Image via Google Playstore Mooncraft

While not technically a product, Mooncraft is a project that's part of the SafeMoon ecosystem, so I thought it made sense to list it here.

Mooncraft is based on the Minecraft concept. They have their own server for players to log into, and you can purchase in-game items, similar to what you would do in Minecraft. The website currently works with PayPal to accept all forms of fiat currency. Incidentally, the original idea is about purchasing the items with crypto. With the recent announcement from PayPal saying that they might be accepting crypto soon, that would help them advance their goal of transacting in crypto. However, how does that benefit the SFM token?

One idea proposed was for an established company like Riot Games to integrate with the SafeMoon ecosystem. This might mean using the SFM token in the stable of games by Riot and somehow getting static rewards for it, thus creating a new use case for the token. However, it's quite a sketchy idea at the moment.

The idea for Mooncraft was first mentioned during an AMA on May 9, 2021, in which the team said they had plans for a "community testbed" that Karony called "a fun, inclusive way to incorporate the community with our testing of […] different technologies."

The team added that they have created a server within the Minecraft video game that will be part of this testbed and that more details would be available on Twitter and on the online chat platform Discord. The server will be used to "stress test" new developments, including non-fungible tokens (NFTs).

The way NFTs work in Mooncraft is mainly as skins for items. These skins can be used within different levels. In this case, it's being able to move back and forth between the Alcatraz and Azkaban prisons. Not sure how much of a secondary value the skins will have in an NFT marketplace, or even if it's tradeable right now.

Coming Soon

On the Product page of the Safemoon site, there are two upcoming products listed: a cold wallet (hardware-based) and the SafeMoon exchange. Unfortunately, little info can be found on these.

SAFEMOON Tokenomics (SFM)

There was 1 quadrillion SAFEMOON tokens created at genesis, of which 223 trillion were immediately burned by the developers. The remaining 777 trillion tokens were released to the community in a fair launch event on DxSale. Since then, more tokens have been burned, and as of May 27, 2021, there are a total of just over 583 trillion tokens in circulation.

The SafeMoon protocol is unique in that each sale transaction has a 10% fee levied, which is meant to incentivize holding rather than selling. The 10% fee is distributed as follows:

- 4% fee = redistributed to all existing holders

- 3% fee is split 50/50, half of which is sold by the contract into BNB, while the other half of the SAFEMOON tokens are paired automatically with the previously mentioned BNB and added as a liquidity pair on Pancake Swap.

- 2% = sent to Burn wallet to keep the token deflationary.

- 1%= SafeMoon Eco System to keep the lights running.

Is it fair to tax users for selling and give that tax to other holders? Image via SafeMoon.net

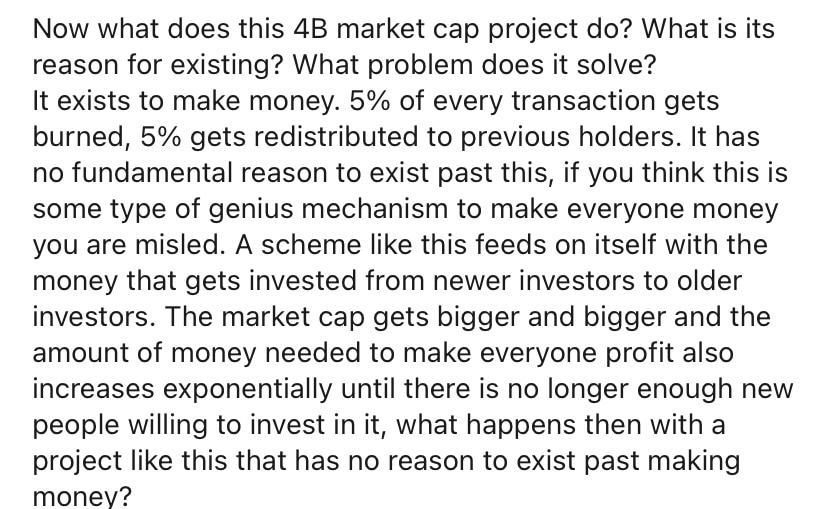

Is it fair to tax users for selling and give that tax to other holders? Image via SafeMoon.netThis mechanism has the crypto community calling the project out as a Ponzi scheme since it rewards the early adopters and requires more and more money to flow into the protocol to continue rewarding those who join later.

In V2, they have adjusted the rate to be 2%, perhaps with an eye on encouraging integrations with commercial enterprises. With the new fee, the breakdown is as follows:

- 1% to all holders

- 0.5% to the liquidity pool (for the SafeMoon/BNB pool, 0.25% for each token)

- 0.5% to the SafeMoon Ecosystem - "keep lights running" fee

There is no Burn wallet in this version of the tokenomics.

SafeMoon Token History

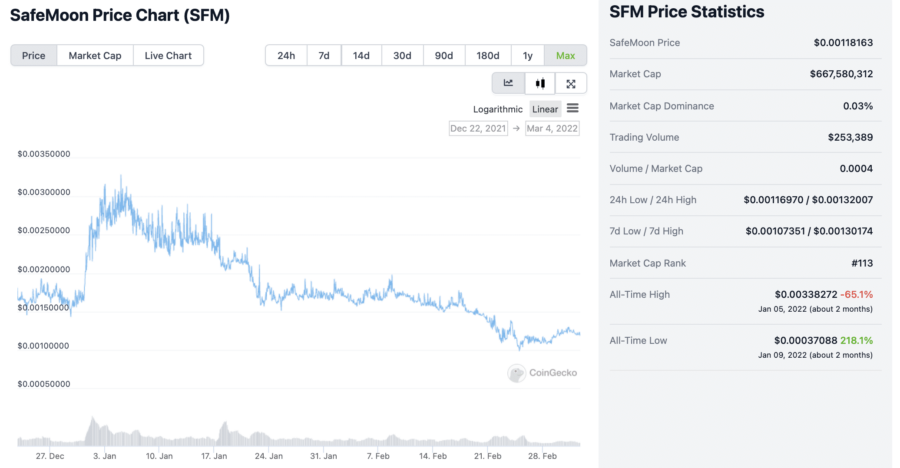

Since they underwent a swap from V1 to V2, what this chart shows is basically life after V2. From a low of $0.00142931 days after Christmas, it shot upwards to $0.00328754 in just one week, which is a 56% increase. Even with the 10% tax in place, it was not enough to stop the unhurried descent of the price.

A volatile coin trending downwards Image via Coingecko.com

A volatile coin trending downwards Image via Coingecko.com It's been on a somewhat gentle decline since its heyday, and while there may be a few spikes here and there, it's not enough to stop things from going south. However, recently, there's been a bit of an uptick. After hitting $0.00098406 around the end of February, it's like it's had enough of staying down and managed to yank itself off the ground a bit, but not by much, resting at around 0.00118163.

How to Buy SafeMoon

There are a few ways to buy SafeMoon: through the SafeMoon wallet via swapping, a BSC-linked DeX such as PancakeSwap and Bakery Swap, or other exchanges. The process is similar to yield-farming, but it is more involved than just buying Bitcoin at Coinbase.

When buying with the BSC way, you need to purchase Binance Coin (BNB) first and then deposit it to a wallet that supports the BSC. These include MetaMask and Trust Wallet. Once you have BNB, you visit the DEX and swap from BNB to SAFEMOON.

Swap BNB for SAFEMOON on PancakeSwap. Image via PancakeSwap

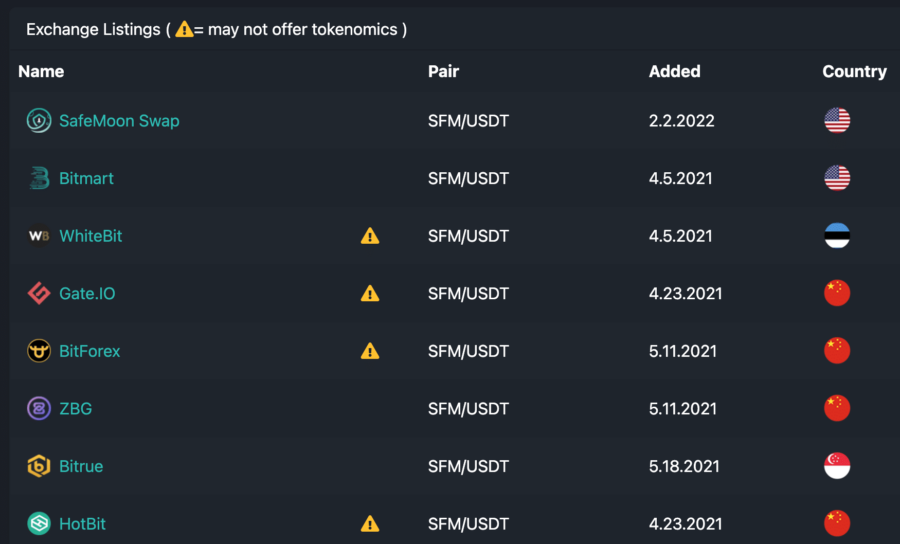

Swap BNB for SAFEMOON on PancakeSwap. Image via PancakeSwapBelow are some of the exchanges that allows you to get your hands on some SafeMoon:

Here's where you can get some SFM tokens Image via SafeMoon

Here's where you can get some SFM tokens Image via SafeMoon The SafeMoon Team

The SafeMoon team remains small as the project is new, but they are looking to expand that team as they move into the DEX and NFT spaces in the future.

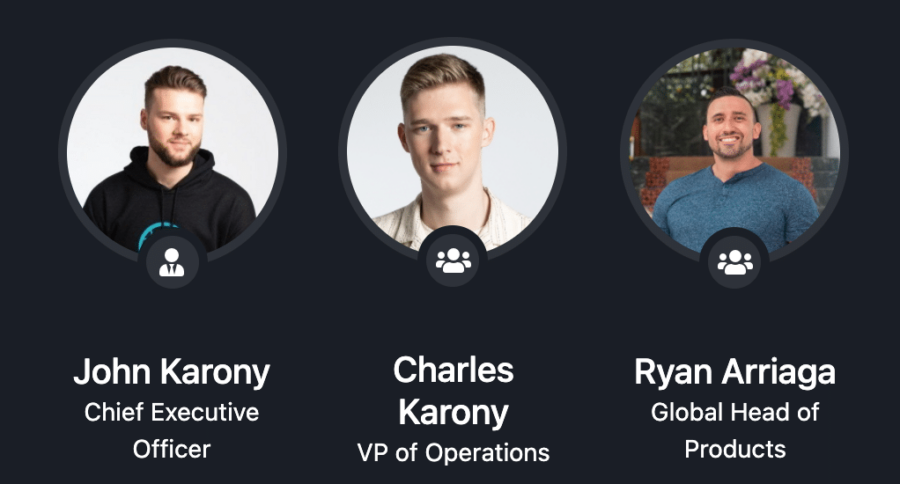

The key personnel in the SafeMoon Team Image via Safemoon.net

The key personnel in the SafeMoon Team Image via Safemoon.net The current CEO of SafeMoon is John Karony, an ex-analyst for the U.S. Department of Defense. He is also the founder of TANO, a newly created game streaming platform. However, he has no background in blockchain or finance.

Charles Karony, most likely related to the CEO, is listed as the VP of Operations - Europe, based in London since Oct 2021. If I thought that John's resume is flimsy, Charles is flimsier as SafeMoon is the only listed position on LinkedIn. Prior to this, he'd just graduated from Brigham Young University with a degree in Financial Economics.

Ryan Arriaga, the third member of the leadership team, is the Global Head of Products for the team. His resume is probably the most solid of the three. A quick glance on LinkedIn reveals that he's quite an entrepreneur, having started and sold 2 companies, while a third one had its license sold. Of all the companies he's worked for, the 2-year stint at Oracle stands out the most.

Other than the three leads mentioned, it is also telling that there is no CTO, and only a handful of people listed in the SafeMoon LinkedIn site is on the tech side. As much as it bills itself as a community-led initiative, key positions are still important, especially on the tech side. The lack of tech expertise in this area is definitely an area of concern.

Is SafeMoon Safe?

The volatility of the cryptocurrency market is well known, and judging by the existing price action of the SAFEMOON token, it is no different. So those who are interested in investing can look forward to massive gains over short periods, and just as massive drops, usually even more rapidly.

While gains and losses are typical for any investment, the moves seen in SafeMoon are truly excessive. In addition to that, the project has been called a Ponzi scheme by various people and a shitcoin by others. Still, others have just called it an outright scam.

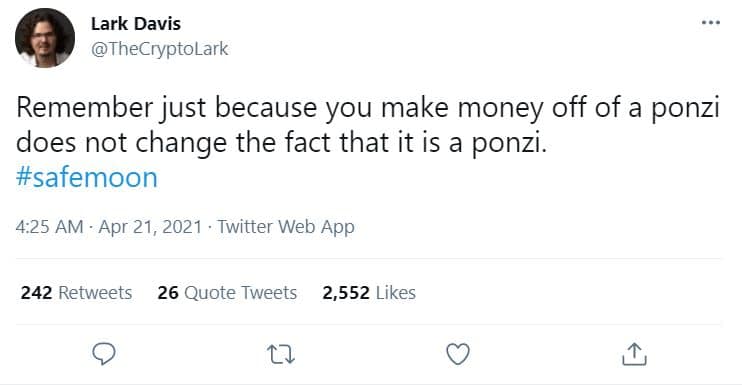

Calling it a Ponzi scheme is accurate since it follows a model whereby the profits made by early adopters are based on others paying more for the token at a later date. And the distribution of the selling fee definitely looks like the pyramid type-structure you’d see in a Ponzi scheme.

That said, it is still possible to make money from SafeMoon as a trader. Just understand what you’re getting into.

A Ponzi is still a Ponzi. Image via Twitter

A Ponzi is still a Ponzi. Image via TwitterSafeMoon has also been compared with BitConnect, a well-known crypto Ponzi scheme shut down in 2018 after two U.S. state securities regulators warned investors of the similarity to a Ponzi scheme.

There have been other criticisms of SafeMoon based on the founders locking away over 50% of its own liquidity pool. There are claims that this could lead to a “rug pull” by the developers.

This is a type of exit scam where liquidity is intentionally drained from the market, leaving those holding the token unable to sell. SafeMoon’s CEO John Karony claims that the liquidity is being held to keep the token more secure.

Is SafeMoon a Good Investment?

We’ve already discussed the possibility of SafeMoon being a Ponzi scheme, which should raise some red flags and make you cautious over participating in this project. However, there’s another reason to be wary that was discovered more recently.

On May 25, 2021, it was reported that the blockchain audit and consulting firm HashEx claimed it has discovered a dozen vulnerabilities in SafeMoon (SAFEMOON) which puts more than two million investors at risk.

There’s more than 1 problem with SafeMoon’s code. Image via HashEx blog

There’s more than 1 problem with SafeMoon’s code. Image via HashEx blogAccording to their findings, the project has several vulnerabilities that include:

- The smart contract allows for setting the commissions for the transfer of SAFEMOON up to 100%;

- Rug pulling, excluding holders from commissions distribution. A rug pull refers to liquidity theft by the developer;

- Temporary blocking of token transfers;

- Rendering token smart contract permanently inoperable.

HashEx claims that the Safemoon smart contract owner is an externally owned account controlled by a particular person.

The firm said that this account has a market value of $20 million, with the sum constantly increasing since the smart contract transfers part of the transfer commissions to the owner account.

If the owner's address is compromised, a rug pull of over $20,000,000 can happen at any moment. Moreover, because it's about 15% of all liquidity held in liquidity pools, the $SAFEMOON exchange rate can go down rapidly.

HashEx said that if SafeMoon's external account is compromised, an attacker can drain the liquidity pool and prevent SafeMoon developers from sending tokens to a burn address.

SafeMoon appears to exist only to make money. Image via Twitter.

SafeMoon appears to exist only to make money. Image via Twitter.The combination of such critical vulnerabilities in SafeMoon is a sobering reminder of the risks that DeFi projects still bear on the market. Messari recently reported that a total of $285 million has been stolen due to DeFi hacks over the past two years.

A recent example is the case of the DeFi100 decentralized finance protocol that is being reported to have turned out to be a scam that ended with the theft of $32 million in user funds.

Future Plans

Although there isn't a roadmap per se for SafeMoon, there are a few things the team is planning to implement in the near and not-so-near future.

Swap and Evolve

Currently, the mechanic is known as Swap and Liquify (S&L). This works by setting aside a portion of SFM tokens from market activity. Upon hitting a threshold, half of the tokens are swapped for BNB. Both are then paired in a liquidity pool for borrowers. However, they found out that converting to BNB sends a negative signal to the market for the SFM token because it looks like a massive dump. So they decided to do things the other way round.

This entails them stocking up on BNB tokens instead of SFM tokens beforehand. Upon hitting the agreed threshold, they will then convert the BNB tokens to SFM tokens, thus generating a buy signal which won't spook the market but will instead push the price higher due to perceived demand.

Technically, there's nothing wrong with the mechanism, but this kind of buy signal can be misleading to those unfamiliar with the mechanics.

ETA: not sure.

Operation Phoenix

Announced as an initiative covering a number of projects, what is outlined looks quite ambitious and also... ambiguous. Take the wind turbine project, for example. The team wants to decentralize turbine energy technology. Since no one in the team seems to have any iota of a background in this field, why pick this one to work on? And how?

Another project mentioned is obtaining an EU e-money license. This is the first step to issuing a Safe Card, which I consider a kind of credit card. Earlier on, this was something they had mentioned working with Simplex on. Once this piece of the puzzle is in place, they will be able to launch SafeMoon Exchange.

Reading about all this doesn't make me feel assured. If anything, it raises even more questions that I don't think I'm likely to get answers to.

Image via Shutterstock

Image via ShutterstockConclusion

SafeMoon has undoubtedly made some people quite rich in its first months of existence. Of course, that's very attractive, but it is also how all Ponzi schemes get started and build momentum.

People learn of early adopters making 500% or 5,000% returns, and they get excited and pour their money into the scheme. Maybe it even keeps going for years, but eventually, all Ponzi schemes go bust.

As it stands, SafeMoon has no utility other than to make money. And that only works if people remain excited and the token's price continues rising. Only you can decide if that's a risk you can afford to take. Because you could end up holding a bag of worthless shitcoins.

On the other hand, the team has said they have plans to provide utility to the platform. Linking it with online gaming could undoubtedly bring in tens of millions of new users, but keep in mind that already well-established projects are tackling the online gaming vertical.

There's no lack of ambition for what they want the ecosystem to encompass, what with a DEX, an NFT marketplace, and even a cold wallet, not to mention the many initiatives under Operation Phoenix. However, given the team they have assembled so far, I do have my reservations about how much of that can become a reality. Also, how actively are they pursuing commercial entities to accept SFM in their daily operations?

And then there are the smart contract vulnerabilities that have been uncovered that certainly do point to the likelihood of a rug pull at some point in the future.

Yes, you might make money with SafeMoon, but you might get burned as that rocket tries to shoot to the moon too. So be careful out there, folks.