While the cryptocurrency world has progressed swiftly since the emergence of Bitcoin in 2008, there is still some way to go before digital currencies are fully implemented as a present day mediums of exchange.

Cryptocurrency debit cards play a key role in helping cryptocurrencies obtain mass adoption and help bridge the more traditional financial infrastructure with the cutting edge technology that underpins currencies such as Bitcoin, Litecoin, and Ethereum.

STACK promises to help allow cryptocurrency enthusiasts to spend their digital funds via the use of their mobile payment system.

What is STACK?

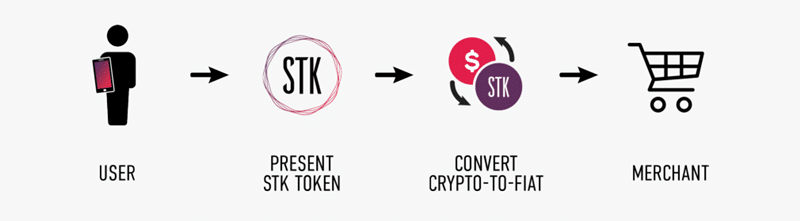

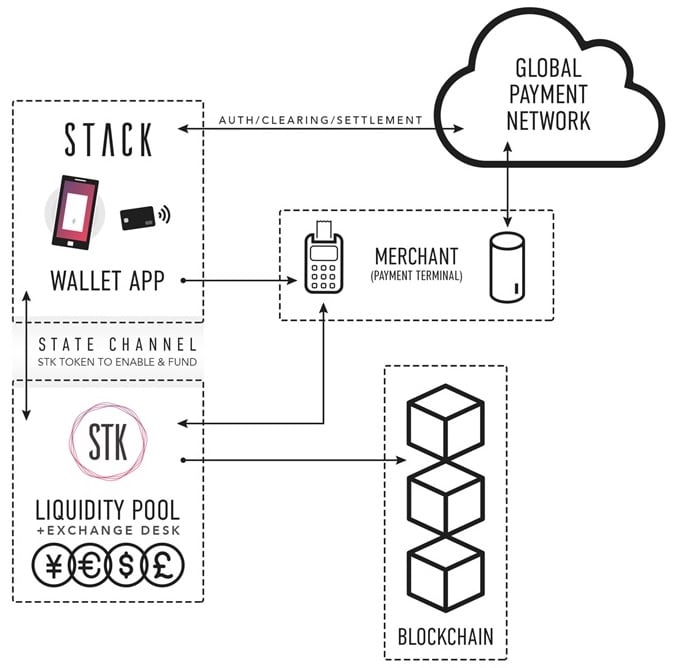

STACK is a personal finance platform that combines mobile tap to pay functionality with a multi currency wallet that is compatible with both cryptocurrencies, and traditional fiat currencies. The wallet provides users with access to the more established cryptocurrencies such as Bitcoin and Ethereum while also allowing payments to be made via STACK’s native STK token, and STK works within the STACK app to enable instant cryptocurrency payments at point of sale.

How Stack will work

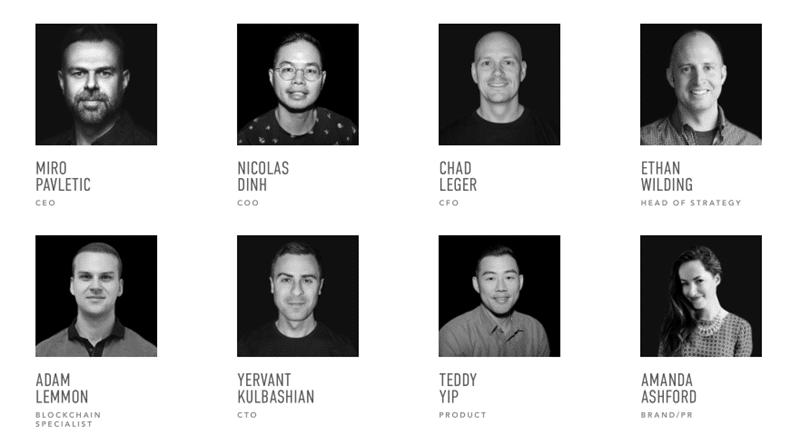

How Stack will workThe team behind STACK are focused on providing a full-service payments solution that allows users to spend, share, and save their money. The team is led by CEO Miro Pavletic, and combines a wealth of industry specific experience, with numerous team members having worked in the financial services, marketing, and technology sectors.

Stack Team Members

Stack Team MembersA significant number of the team have experience of working at companies such as Deloitte, MasterCard, Sprint, TD Bank, and Virgin Mobile. The Canadian company is currently rolling out its finance platform across Canada and has plans to expand into additional markets later in the year.

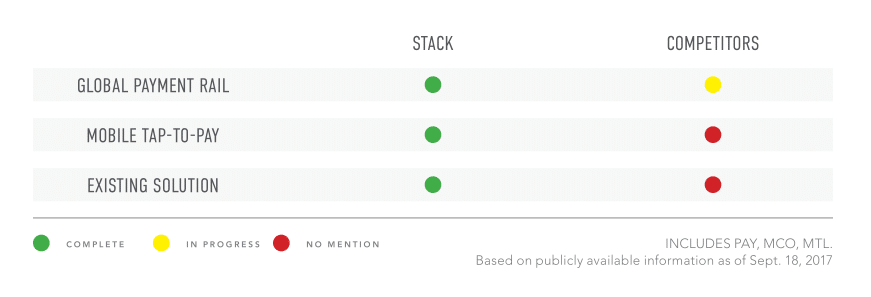

What Makes STACK Stand Out?

The crypto debit card market is rife with competition; and anyone looking for a way to spend some of their crypto holdings at traditional retail outlets has a choice of companies such as Wirex, Zapo, and Uquid, in addition to options provided by TenX, Monaco, TokenCard, and Change.

However, a recent policy change by Visa with regards to their relationship with WaveCrest Holdings has left many crypto debit card companies unable to provide their users with any services in Europe. Towards the end of last year, the credit card giant directed WaveCrest to immediately close all the accounts of its prepaid Visa® debit card programs which left companies such as Wirex and TenX scrambling for options.

This followed an announcement made in August 2017 that WaveCrest would no longer issue and maintain Visa® prepaid cards to cardholders outside of the European (EEA) territory. As a result, a number of crypto debit card providers have been completely nullified by the developments.

Stack & Competitors

Stack & CompetitorsSTACK has the ability to bypass these restrictions as it has entered into a unique partnership with MasterCard that sees the STK mobile app coupled with a chip-and-pin MasterCard prepaid card. STK account holders have access to point of sale interaction with retailers in addition to purchase protection on every transaction.

Also, as a result of the MasterCard partnership, STK cardholders have access to a worldwide network of ATMs, alongside free ATM withdrawals. The STACK team also aim to provide access to a full range free services which include account activation, prepaid card delivery, contactless purchases, and payroll deposits.

How Viable is the Project?

As a Canadian company, STACK is the first North American Fintech company to provide its users with a mobile tap-to-pay option that is attached to a digital money account. However, the STACK team find themselves in the unique situation of operating in a market segment that is almost saturated while also having no direct competition.

Their strong ties with MasterCard have provided them with an edge over their competition and their focus on harnessing tap-to-pay technology for smartphones in conjunction with providing physical debit cards may also prove to be extremely attractive to prospective customers.

The Stack Ecosystem

The Stack EcosystemWhile the STACK project has its obvious benefits as a payments service, the native STK token also provides crypto investors with the ability to realise significant gains. STACK’s STK token was highly anticipated and during the ICO, early tokensale rounds were oversubscribed.

As a result, STACK hit its hard cap of $17m prior to its public crowdsale and this was cancelled and replaced by an airdrop of up to 1,250,000 STK tokens for STK community members.

Despite the obvious interest in the project, STK token has quite a bit of ground to make up on the coins offered by competing projects in the sector. TenX leads the way with a market cap of approximately $170m and its PAY token currently trades at a price of approximately $1.60.

Monaco’s MCO token currently retains a market cap of around $96m and trades at a price of just under $7.50, while Centra’s CTR token holds a market cap of approximately $56m. STK enjoys a market cap of just over $44m as its circulating supply of just over 325m tokens trade at a price of approximately $0.13.

Potential Headwinds

It's not all plain sailing for STK token and the STACK team must deliver on their early promises in order to catch up with and possibly overtake their competition. The crypto debit card providers affected by Visa’s decision to drop WaveCrest Holdings are all actively seeking viable alternatives while TenX has decided to pursue obtaining a full banking license.

In addition, as the market is currently going through a downturn it’s easy for newer projects to get quickly overlooked as cryptocurrency investors choose to focus on the more trusted coins on the market.

As a result, despite having a number of clear advantages, there is still the possibility that without the correct task execution and focus on marketing the project could actually stagnate and tread water for a prolonged period.

What to Look Forward To

STACK has a number of events lined up for 2018, which includes the launch of the crypto wallet in Canada during Q1, and the launch of the commercial fiat gateway in the USA during Q2.

Over the course of the year, the personal payment platform will be made available in Canada, the USA, and across Europe. STACK has also announced an official partnership with i2c, a processing platform that will help facilitate the secure payment functionality within the STACK app.

On top of this, features such as STACK UP Savings and Financial IQ are scheduled to be implemented which will allow users to create unique savings goals aligned with automated round-ups that help users to develop saving plans that can be categorized and attract offers and rewards based on the set savings goals.

Personalized tools will also allow users to track their spending patterns and users will be able to index their spending habits against similar peer sets or social groups.

This wide range of possibilities may see the STK platform compete with traditional banks with the younger, more technically advanced generation, happy to incorporate more modern methods of money management.

In addition to acting as a competitor to companies such as Wirex, TenX, and Monaco, STK also has the ability to utilise aspects of Virgin Galactic Rewards, Mobile Banking, and Instagram. The STK personal finance platform may prove to be a viable alternative to services such as Apple Pay and Android Pay.

Disclaimer: These are writer opinions and should not be considered investment advice