Tezos is a blockchain network with a history as intriguing as its technology. The network was first proposed in a whitepaper back in 2014 and was conceived by Arthur Breitman and his wife, Kathleen Breitman. The protocol described a Proof of Stake, an uncharted water in the early days of the blockchain industry.

What started as a vision to avoid the pitfalls of Bitcoin and Ethereum through adaptability and community-driven innovation soon found itself mired in controversy when a public dispute broke out between the Breitmans and Johann Gevers, the president of the Tezos Foundation back in the day.

This Tezos Network review will explore how Tezos works and what made it revolutionary in the early days of DeFi. Furthermore, we will also examine the relevance of Tezos as Ethereum strengthens its position as the epicentre of DeFi.

Tezos Network History

The history of Tezos has been quite a rollercoaster ride for investors and backers. It had its wildly successful ICO on July 14, 2017. It raised an astounding $232 million in one day, ten times the founder's expectations. Things were indeed going well for Tezos.

Unfortunately, that wasn’t the case, as things soon spiraled rapidly out of control for founders Arthur and Kathleen Breitman. Like many cryptocurrency projects, Tezos had created a Switzerland-based Foundation due to the relaxed banking regulations in the region. What the pair failed to factor in is that under Swiss law, the board of directors of a foundation has complete control of all the assets of the foundation.

Arthur and Kathleen Breitman | Image via WSJ

Arthur and Kathleen Breitman | Image via WSJTezos ICO Completion

Johann Gevers, as a member of the board, quickly locked the Breitmans away from Tezos’ assets. Since then, the Breitmans have been fighting to regain control of Tezos, attempting to oust Johann Gevers and dealing with no less than 4 class action cases. The Breitmans did retain control of the source code of the project via a Delaware-based company, Dynamic Ledger Solutions, but that did them little good without control of the ICO assets.

Meanwhile, all the investors of Tezos were also locked out of their investments, with no way to claim the tokens, let alone trade or sell them. It’s interesting to note that the XTZ token was listed on Coinmarketcap.com on October 2, 2017, at $1.66 per token and was trading at $4.44 on June 30, 2018, even though no one had yet been able to claim a single Tezos token. Also, due to the rise in the price of Ethereum and Bitcoin since the ICO, the $232 million raised had grown to $555 million.

Regaining Control of Tezos

After months of fighting to remove Gevers from the board, in February 2018, he added a new board member to help keep himself in power. That was short-lived, and by the end of February, the entire foundation board had resigned, including Gevers.

With the financial doors finally open for the Breitmans, they regained control of the Tezos assets. The community was quick to step in and get ready to launch. According to a February 22, 2018 press release:

“The [Tezos] foundation is preparing itself to assist in the timely launch of the Tezos network.”

Four Months of Silence

Following that press release and a promise from Kathleen Breitman to go rogue and simply release the token within weeks, there needed to be more communication from the Tezos founders. It was understandably frustrating to investors, who had seen their investments inaccessible yet more than double since the ICO.

Despite claims that there was a lack of technical progress as developers couldn’t be paid and left the project, Tezos finally launched the betanet nearly one year following the ICO. The protocol finally released tokens.

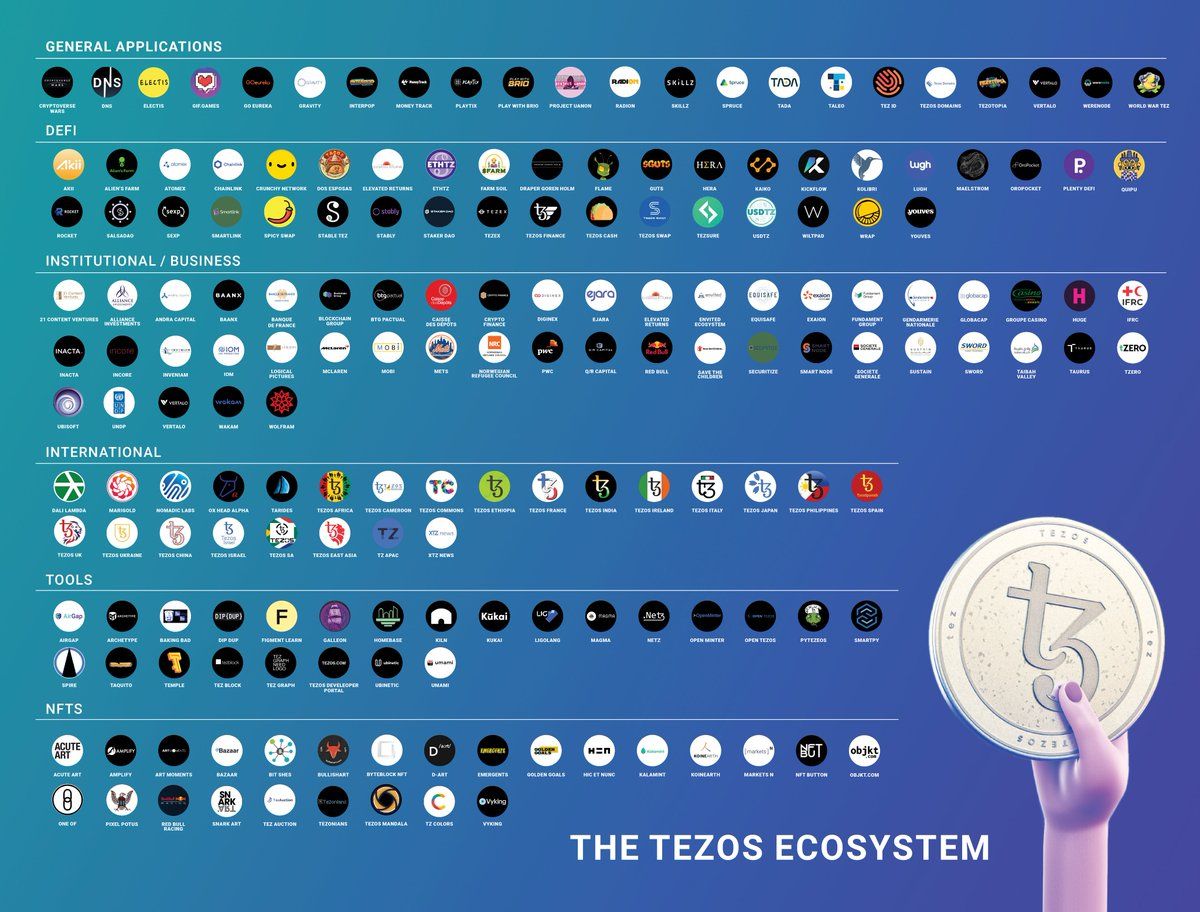

Fortunately, after the initial hurdles, Tezos has grown to become one of the most cemented long-standing reputable and respectable blockahins in the industry. It has a flourishing ecosystem, has achieved impressive technological milestones and is one of the most popular cryptocurrencies for those looking to stake.

Tezos In Recent History

Tezos is one of the very few blockchain projects that has managed to stay relevant since it's early inception. Not many blockchain projects from all the way back in 2017 are relevant today, but Tezos has firmly planted its flag as a top 100 project.

This has been partly thanks to the project's advancements and milestones. Some of the prominent updates and milestones are:

February 2021- Tezos undergoes major upgrade Tenderbake, increasing the network's scalability and security. This protocol upgrade enabled lower block times, faster transactions, and prepared the Tezos blockchain for scalability rollouts such as rollups for WebAssembly and Ethereum Virtual Machine (EVM) compatibility. Impressively during this time, smart contract calls on Tezos increased from 100k per month to over 6.2 million in January 2022.

Early 2021 also saw the rollout of Delphi, an upgrade that reduced the cost of XTZ transactions by a whopping 75%. The Edo upgrade enabled the addition of the Sapling protocol, which enables developers to power new types of DApps by incorporating voting or supporting asset transactions with selective disclosures.

The Tezos ecosystem has had several foundational upgrades over the last five years. All are meant to address the evolving needs of users in the cryptosphere. For instance, the Edo upgrade from February 2021 introduced privacy-preserving smart contracts, or the Jakarta upgrade from June 2022 introduced Optimistic Rollups.

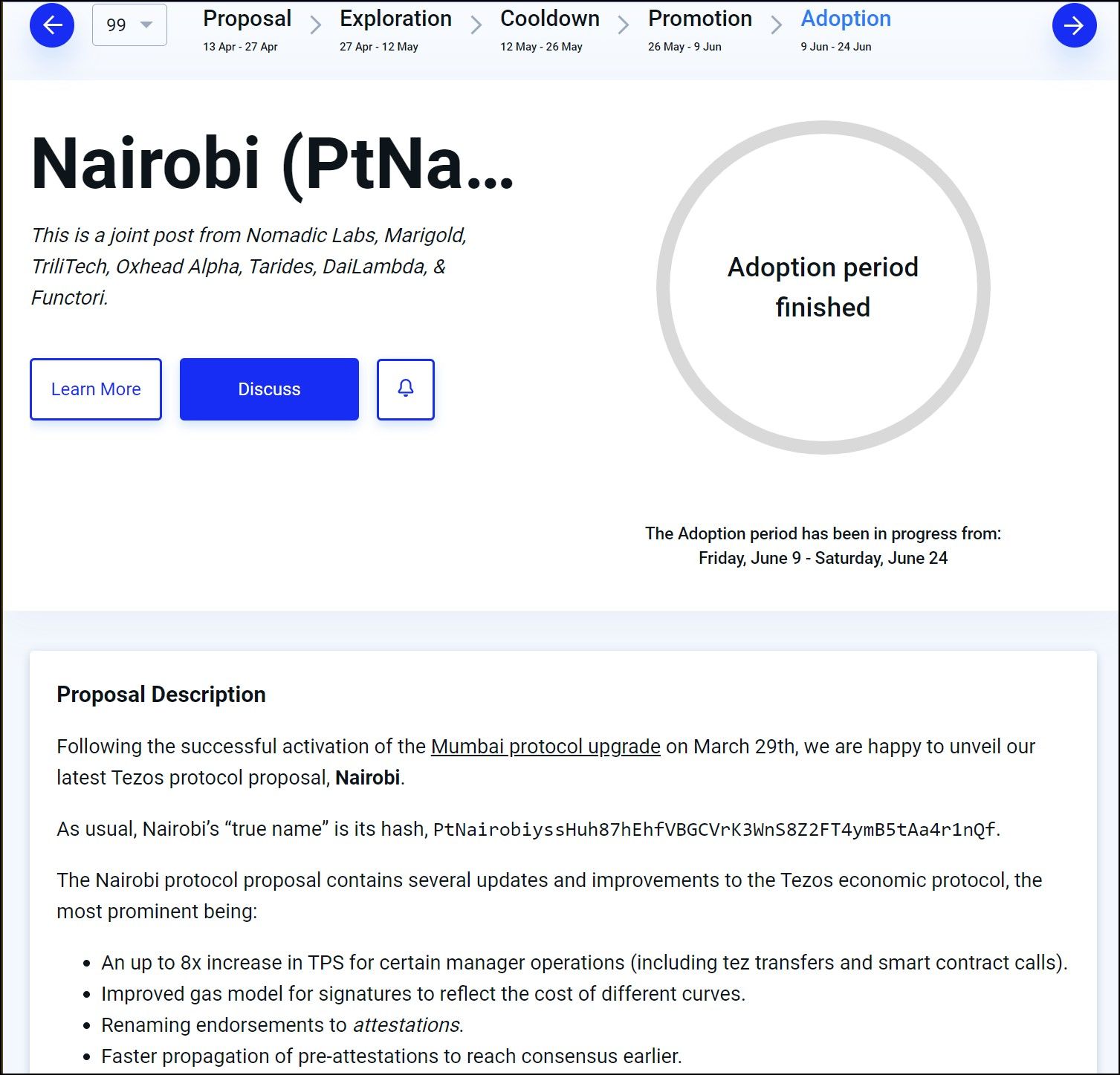

2023 - The last three Tezos upgrades, namely Lima, Mumbai, and Nairobi, were all about scalability and thoroughput. They implemented several infrastructural improvements to the Tezos network, like smart contract rollups and smaller block times, to make the network faster and more responsive.

Partnerships and Collaborations

Tezos formed several partnerships with businesses to cement its relevance in the growing DeFi industry, and also to explore new usability frontiers for the network, here are some noteworthy ones:

- In February 2023, Google Cloud partnered with the Tezos Foundation to grow its web3 application development and provide new services for its customers. The partnership enables Google Cloud customers to become Tezos "bakers" or network validators, and Google Cloud itself has become a baker, joining existing bakers like gaming company Ubisoft.

- Ubisoft, a leading creator, publisher, and distributor of interactive entertainment and services, has joined the Tezos ecosystem as a corporate baker. Ubisoft's involvement in this capacity is facilitated through its Strategic Innovation Lab, which has been working with Nomadic Labs, a France-based research and development center that also uses the Tezos ecosystem. The Lab team is exploring the opportunities that blockchain offers gaming, both for players and developers, as well as the long-term potential of the technology.

- Fireblocks, a platform specializing in crypto custody and settlement services for financial institutions, has expanded its support for the Tezos blockchain. This expansion extends institutional access and support to the growing DeFi and Web3 ecosystem. Fireblocks users can securely custody FA1.2 and FA2 token standards on Tezos and leverage the Fireblocks’ Web3 Engine to build new products and services on the Tezos blockchain.

- In October 2023, Deloitte Luxembourg announced that it would become a Tezos Corporate Baker. As a Corporate Baker, Deloitte Luxembourg is responsible for validating, securing, and adding transactions (blocks) to the Tezos blockchain, allowing the two organizations to explore synergies in Web3-related topics.

- In September 2023, the Tezos Foundation announced a year-long partnership with the Musée d'Orsay, a leading art and culture institution. The partnership includes collaboration on a series of conferences and educational programs aimed at bringing web3 to the museum's wider audiences. The museum chose to partner with the Tezos Foundation due to its robust web3 arts & culture ecosystem and commitment to the digital art community and sustainability.

What is Tezos?

Tezos is an open-source blockchain that can host smart contracts and describes itself as a ‘self-amending’ network that can ‘upgrade itself’ without having to hard fork into two different blockchains. Tezos is a layer-1 blockchain network that can run smart contract applications with censorship resistance in a decentralized environment secured using a Proof of Stake consensus model.

The Tezos Network Logo

The Tezos Network LogoHere are some key features of the Tezos network:

Self-Amending Network

Self-amendment is a fancy way of saying that the improvement proposals for the Tezos network follow a formal on-chain governance process where any stakeholder can vote, test, or propose changes to the protocol. Since the community achieves a consensus about the upgrade before its implementation, the chances of a hard fork are significantly reduced.

On-Chain Governance

The governance proposals on Tezos follow an election cycle where all stakeholders have the time and means to express their views. The proposals include the rationality behind the proposed upgrade, as well as details of the infrastructural alterations required to achieve it. If the community agrees on a proposal, the developers are bound to implement it on the blockchain.

Incentivized Innovation

The improvement proposals submitted by the community can also include a reward payment to its original contributors as an incentive to make the network more capable and efficient. On-chain incentives are transparent and rewarded when the community agrees through votes, encouraging organic growth of the Tezos ecosystem.

Delegated Proof of Stake

The Tezos network propagates blocks by deploying a Delegated Proof of Stake consensus. The validators on Tezos are called bakers. Bakers can stake XTZ, the native token of the Tezos ecosystem, to participate in consensus.

Formally Verified Smart Contracts

Michelson is a domain-specific programming language developers use to write smart contracts on Tezos. Using a domain-specific language means Michelson is tailored to the domain of smart contracts in the Tezos ecosystem. It includes the primitives and constructs that directly correspond to operations commonly required in smart contracts on Tezos.

Formal verification is a capability of a smart contract that enables the developers to mathematically verify if the contract works as intended, which potentially reduces instances of error and eases contract debugging.

Tezos Blockchain Design

The Tezos blockchain’s self-amending nature stems from its modular design architecture. The Tezos whitepaper decomposes the layer-1 blockchain into separate components that perform foundational duties in a blockchain network. Tezos defines three distinct blockchain components:

- The network protocol discovers blocks and broadcasts transactions.

- The transaction protocol specifies what makes a transaction valid.

- The consensus protocol forms consensus around a unique chain.

Tezos implements a generic network shell that is agnostic to the transaction protocol and the consensus protocol. What does this mean?

The Tezos whitepaper was written in 2014 when smart contracts were not mainstream and Bitcoin was generally considered synonymous with blockchain technology. The modular architecture of Tezos is better understood when viewed in contrast with more recent blockchain designs, like Ethereum 2.0.

Similarities Between Tezos and Ethereum 2.0

The Ethereum network recently underwent a monumental upgrade to transition to the Proof of Stake consensus model. Major improvement proposals have also been laid out that define a rollup-centric roadmap and prime the network to adopt a modular architecture. The Ethereum model for modularity abstracts the network into Data availability, Consensus, and Execution layers, which is similar to Tezos in principle, so let’s explore Ethereum, a network we are familiar with, to understand better the vision behind Tezos, which is about a decade old entering 2024.

The Ethereum Modularity Model

A typical blockchain network performs three core functions to keep the network performant. These are defined as follows:

Data Availability

Data availability refers to the confidence that all the network participants have access to the data required to verify a block during the consensus process. Verifying a block involves independently calculating the state of the block by executing all the transactions included in it.

Therefore, for every block a validator proposes during consensus, it must ‘make available’ the necessary transaction data to all other network participants to let them independently calculate the block state and reach the same conclusion as the initial proposer to have their vote for that block during consensus, making the blockchain network trustless.

Data availability ensures validators are not tricked into accepting invalid transactions. It is how full nodes, with access to all block data since the genesis block, keep the network secure and tamper-proof. This data-sharing principle gets more nuanced and complex when rollups and light nodes enter the scene; therefore, we will only talk about full nodes for simplicity. The network layer achieves data availability by having the validators propagate necessary information across the network.

Consensus

Contrary to popular belief, ‘consensus’ and ‘verification’ are two related but distinct concepts conceived at different stages in a transaction’s life. Typically, nodes perform pre-consensus verification, including verifying digital signatures to ensure that the transaction was created by the rightful owner of the funds, ensuring that the transaction does not attempt to double-spend coins, and related security checks.

The consensus process in a blockchain is the method by which the network nodes agree on the state of the blockchain — which transactions are included in the next block and in what order. One agreed-upon order is crucial for maintaining a single, consistent ledger across a distributed system where no single party is in complete control. Therefore, consensus is primarily concerned with having all nodes agree upon one order of the transactions.

Execution

After a block has been agreed upon through the consensus process and added to the blockchain, the transactions within that block are executed. Execution means that the effects of the transactions (transfers of cryptocurrency, smart contract operations, etc.) are applied to the blockchain's state. While this is not a verification step per se, it is the point at which the transactions have a tangible effect on the ledger.

A typical rollup on Ethereum achieves scalability by outsourcing data availability and consensus to the Ethereum mainnet while it handles the execution on layer 2. When the rollup block data is made available to Ethereum validators during consensus, they can use it and agree upon the right order of transactions of the rollup batch. This process is how the Ethereum network lends its security to high throughput layer-2 networks.

Tezos Was Ahead of its Time

The three blockchain components defined in the Tezos whitepaper resemble Ethereum’s modularity principle. The network protocol makes adequate data available for Tezos nodes to calculate blocks and participate in consensus. The consensus protocol conducts a formal voting process to agree upon the right order of transactions, and the transaction protocol is where smart contract execution occurs.

By abstracting these functions into separate layers, Tezos aligns with the modular approach, aiming for a clear separation of functions, which can lead to several benefits, such as:

- Focused Optimization: Each layer can be optimized independently without affecting the others. For example, improvements to the consensus algorithm don't necessarily require changes to the network layer.

- Easier Upgrades: Protocol upgrades can be implemented in a more controlled and less disruptive manner. For instance, upgrading the transaction layer to allow for more complex smart contracts is possible without altering the consensus mechanism.

- Enhanced Security: By isolating the consensus mechanism from the transaction execution, there's a reduced risk of cascading failures. Issues in one layer can be contained without compromising the entire system.

- Specialization: Developers can specialize in one particular layer without needing expertise in the others, potentially accelerating development and innovation within that layer.

Tezos' architecture reflects a thoughtful approach to blockchain design, one that acknowledges the need for both robustness and flexibility as the technology and its applications continue to evolve.

The notion that Tezos was ‘ahead of its time’ can be viewed as a compliment and a critique. On the one hand, Tezos was an innovative leader in the nascent years of blockchain technology by introducing features that the Ethereum ecosystem is embracing nearly a decade later.

On the other hand, a critique may sweep these innovations under the rug, claiming that the industry did not realize the potential of modular architecture as there was no demand for it or simply because modularity was not well understood. One may call Ethereum’s gradual innovation to what it is today a well-placed roadmap to introduce features as the industry grew in users and use cases that called for those innovations.

How Tezos Works

Tezos Operational Model | Image via Tezos Developer Resources

Tezos Operational Model | Image via Tezos Developer ResourcesThe diagram above shows a clear separation of the protocol layers within the Tezos blockchain. Expressed as a giant blue octopus, the network layer (P2P) and the consensus layer (validator) sit below the protocol (transaction) layer, the green eye of the octopus.

The Shell

The network and consensus layer together comprise the protocol shell. Now, notice the tentacles of the octopus. It depicts the various block proposals the Tezos blockchain receives at every consensus process. The consensus and network layers work together to choose one of these tentacles as the next block that propagates the canonical chain forward.

The shell consists of blockchain elements that allow the nodes to transmit the chain data to new nodes and the versioned state of the ledger, including a peer-to-peer layer, disk storage, and a distributed database that abstracts the fetching and replication of new chain data to the validator. This abstraction is necessary to keep the operations in the shell distinct from the protocol layer.

The Protocol Layer

The protocol layer comprises the so-called self-amending properties of Tezos, which is possible without affecting the network and consensus layers beneath it. Notice how the protocol layer can see only one blockchain, which is the consensus-accepted linear sequence of the Tezos blockchain. As the Tezos blockchain has never had a hard fork, this liner sequence traces back to the genesis block. The responsibilities of the protocol layer include administrative operations like interpreting the transactions and processing the smart contracts.

The RPC Layer (in yellow)

For the sake of simplicity, all we need to know is that the RPC layer is a part of the node infrastructure that allows third-party applications to interact with the node. The RPC layer establishes the connection between the user and the node network.

Modular Architecture

With the core functions of Tezos abstracted from one another, the economic protocol of the chain can be amended with an on-chain voting procedure. For instance, the on-chain operations could change by switching between different protocol layers without affecting the operations beneath them.

Tezos Consensus Process

The Tezos blockchain is secured using a Delegated Proof of Stake consensus process. The Tezos documentation brands their consensus as Liquid Proof of Stake. However, it is essential to understand that the definition of liquid staking has evolved over the decade to refer to creating artificial liquidity by minting synthetic assets pegged to one’s stake.

The Tezos network does not mint any wrapped or synthetic assets. Still, it does allow XTZ token holders to delegate their funds to other validators, known as bakers within the ecosystem, who distribute token inflation and fee rewards to its delegators proportionately.

Tezos Governance Process

The Tezos ecosystem has adopted an on-chain process to propose, select, test, and implement protocol improvements. Every upgrade undergoes community vote and approval, dramatically reducing the chance of hard forks, as these upgrades are only sanctioned if the community signs off on them.

Bakers, the validators of the Tezos network, are also the voters in the formal upgrade process, where their votes are proportional to the size of their stake. Anyone with 6000 XTZ tokens available for staking on the network can become a baker. Others who do not have these funds may delegate their tokens to bakers, who can then vote on their behalf.

The Five Stages of Tezos Governance

The Tezos improvement proposal process comprises five stages, each lasting five baking cycles, or roughly two months and ten days. The stages are as follows:

Proposal Period

Bakers can submit their proposals in the Proposal period for the rest of the community to review. Each period allows up to 20 proposals, which the rest of the bakers vote on. At least 5% of the voter quorum must agree on the proposal for it to get promoted to the next stage.

TZIP Nairobi Proposal Period Results on Tezos Agora

TZIP Nairobi Proposal Period Results on Tezos AgoraExploration Period

In this second phase, bakers vote on whether to advance the top-ranked proposal from the previous period to a testing phase. This vote is the first of two supermajority votes required to adopt a change. If a proposal receives an 80% supermajority, it moves forward. This phase serves as a preliminary filter to ensure that only proposals with significant support proceed. Any proposal that fails to achieve supermajority is demoted to the first stage to restart the proposal process.

TZIP Nairobi Exploration Period Results on Tezos Agora

TZIP Nairobi Exploration Period Results on Tezos AgoraCooldown and Test Period

The cooldown period is meant for developers and delegates to examine the proposal and discuss its finer details off-chain or perform additional tests to ensure everything works as intended. During this time, a fork of Tezos, running in parallel to the main network, is activated to test the proposed upgrade. The fork functions like a testnet environment that allows bakers and developers to evaluate the changes in a live environment without affecting the mainnet.

Promotion Period

After the Testing Period, bakers engage in a second vote, the Promotion Vote, to decide if the proposal should be implemented on the main network. Another 80% supermajority is required for the proposal to pass. This vote is the final approval step before an upgrade is enacted, ensuring that only thoroughly vetted and broadly supported changes are implemented.

TZIP Nairobi Exploration Period Results on Tezos Agora

TZIP Nairobi Exploration Period Results on Tezos AgoraAdoption

If the Promotion Vote is successful, the proposal enters the Adoption Period, where the protocol upgrade is prepared for activation. This period allows bakers, end-users, and developers to update their software and prepare for the transition. At the end of this period, the new protocol is automatically activated on the main network, completing the upgrade process.

TZIP Nairobi Promotion Period Results on Tezos Agora

TZIP Nairobi Promotion Period Results on Tezos AgoraEach of these stages is designed to ensure that changes to the Tezos protocol are made democratically and with careful consideration, reflecting the community's collective decision-making.

The Tezos network went under the following major improvement proposals over the years:

- Athens (May 2019) – Increased the gas limit per block.

- Babylon (October 2019) – Introduced a finer version of the consensus algorithm dubbed Emmy+, simplified smart contract development, and improved the delegation process.

- Carthage (March 2020) – Increased gas limit per block; improved baking rewards calculation.

- Delphi (September 2020) – Dramatically reduced storage costs.

- Edo (February 2021) – Added privacy-preserving smart contracts.

- Florence (May 2021) – Doubled the permissible size of smart contracts, introduced gas optimizations and several more infrastructural improvements.

- Granada (August 2021) – Introduced liquidity baking.

- Hangzhou (December 2021) – Several smart contract improvements and measures against MEV-related practices.

- Ithaca (April 2022) – Introduced Tenderbake, an upgraded Tezos consensus algorithm with fast finality and improved scalability. Improved baking experience and more.

- Jakarta (June 2022) – Introduced Transaction Optimistic Rollups.

- Kathmandu (September 2022) – Enabled smart contract optimistic rollups on testnets.

- Lima (December 2022) – Pipeline improvements separating validation from the application of operations to enable higher throughput.

- Mumbai (March 2023) – Block times cut in half to 15 seconds. Smart rollups fully activated on the mainnet.

- Nairobi (June 2023) – Increase in network throughput, refined smart contract calls, and smart rollup maintenance operations with an improved gas model for cryptographic signatures.

Tezos Tokenomics

Tezos (XTZ), often referred to as "tez" or "tezzies," is the native cryptocurrency of the Tezos blockchain. The tokenomics of XTZ are designed to support and incentivize the operation and security of the Tezos network. Here are some key aspects of Tezos tokenomics:

- Staking (Baking): Tezos uses a Liquid Proof-of-Stake (LPoS) consensus mechanism. Token holders can "stake" their XTZ by participating in the network as bakers. Bakers are responsible for creating new blocks and securing the network. In return for their services, they receive staking rewards in the form of newly minted XTZ.

- Delegation: XTZ holders who do not wish to bake can delegate their tokens to a baker, allowing them to participate in the staking process and earn a portion of the baking rewards without having to run a node themselves.

- Inflation Funding: The network mints new XTZ as rewards for bakers, which leads to inflation. However, because all stakeholders can participate in staking, the inflation is effectively distributed to those who are securing the network, aligning the incentives of token holders and network validators.

- On-Chain Governance: XTZ is used in the governance process of the Tezos network. Holders of XTZ can vote on proposed protocol upgrades, and the weight of their vote is proportional to the amount of XTZ they hold (or are baking/delegating).

- Transaction Fees: While the primary incentive for bakers comes from the block rewards, they also collect transaction fees. However, the fees on Tezos are generally lower compared to networks like Ethereum, partly because of its more efficient consensus mechanism.

- No Hard Cap: Unlike Bitcoin, Tezos does not have a hard cap on the total supply of XTZ. The supply will continue to grow as new blocks are baked, and rewards are distributed.

- Smart Contract Platform: XTZ is used to interact with smart contracts on the Tezos blockchain. This includes executing contract functions and paying for transaction fees associated with smart contract execution.

- Utility and Participation: Beyond staking and governance, XTZ can be used within the Tezos ecosystem for various purposes, such as participating in DeFi applications, NFT marketplaces, and other services built on the Tezos blockchain.

The tokenomics of Tezos are designed to encourage active participation in the network's security and governance while also supporting a growing ecosystem of decentralized applications. The inflationary model through staking rewards aims to ensure that the network remains secure and that validators are compensated for their efforts without the need for high transaction fees.

Applications on Tezos

The Tezos Ecosystem | Image via X

The Tezos Ecosystem | Image via XTezos is a versatile blockchain platform that supports various applications and products. Here are some notable examples:

- Dexter: Dexter is a decentralized exchange (DEX) built on Tezos that allows users to trade tokens directly from their wallets.

- Kolibri: Kolibri is a platform on Tezos that allows users to create kUSD, a stablecoin pegged to the US dollar. Users can lock up XTZ as collateral to mint kUSD.

- QuipuSwap: QuipuSwap is a protocol for decentralized exchanges on Tezos. It provides an interface for the exchange of Tezos-based tokens and an opportunity for anyone to earn rewards by becoming a liquidity provider.

- tzBTC: tzBTC is a tokenized version of Bitcoin on the Tezos blockchain. It brings the liquidity and value of Bitcoin to the Tezos ecosystem, enabling new use cases like lending and staking.

- Homebase: Homebase is a project that enables the creation and management of DAOs (Decentralized Autonomous Organizations) on Tezos. It allows anyone to create a DAO, propose decisions, and vote on them.

- OneOf: OneOf is a green NFT (Non-Fungible Token) platform built on Tezos, designed for the music industry. It is backed by music producer Quincy Jones and offers a wide range of music-related NFTs.

- Tezsure: Tezsure is a decentralized insurance platform built on Tezos. It allows users to create and manage insurance policies using smart contracts.

- Tezos Domains: Tezos Domains is a distributed, open, and extensible naming system using the Tezos blockchain. It simplifies the user experience by providing human-readable names instead of complex alphanumeric addresses.

These applications and products showcase the versatility of the Tezos blockchain and its ability to support a wide range of decentralized applications and services.

Where to Buy Tezos

Tezos is available on most of the major reputable exchanges. Some of our top picks are Bybit, OKX, SwissBorg and Binance, or Kraken if you live in the US.

Tezos Review Closing Thoughts

As one of the pioneering platforms in the blockchain space, Tezos has demonstrated remarkable resilience and adaptability. Its early embrace of modularity—nearly a decade before Ethereum's transition to a rollup-centric roadmap with Ethereum 2.0—showcases Tezos's innovative spirit and foresight. While Ethereum initially stood out for its developer-friendly Solidity language, which drew on familiar concepts from Java and C++, Tezos was navigating legal complexities that delayed its launch. This timing meant that Ethereum had a head start in catalyzing the DeFi movement, a lead that has since translated into a more decentralized network with a larger number of validators, higher total value locked (TVL), and a robust community of businesses and developers.

Despite these challenges, Tezos has not only persisted but continued to evolve and expand. Real-life examples of its growth include the increasing adoption of its native token XTZ for staking and governance, the flourishing of its NFT marketplace, and the steady growth of DeFi applications on its platform. Tezos's ability to upgrade seamlessly without hard forks has kept it at the forefront of technological innovation within the blockchain space.

The growth of blockchain networks in the realm of DeFi is indeed not a zero-sum game. The ecosystem is vast and varied, with ample room for multiple platforms to thrive. Both Ethereum and Tezos contribute unique strengths and innovations, enriching the blockchain landscape. As the industry matures, the continued evolution of Tezos alongside Ethereum is a testament to the dynamic and diverse nature of blockchain technology, where each platform can carve out its niche and succeed.