XBTFX is a relatively new Crypto CFD broker that offers trading on a number of different assets and has grown quite considerably since inception.

They offer leveraged trading of up to 500x on the MT5 trading platform. They have consistently been expanding their asset coverage to include most of the major asset classes. They are an STP broker that also has ECN functionality.

However, are they really safe?

In this XBTFX review, we will attempt to answer that and give you everything you need t know. We will also give you some top tips that you need to know before trading there.

XBTFX Overview

XBTFX is owned and operated by XBTFX LLC which is a company that is based in St Vincent and The Grenadines. It has a company number of 155 LLC 2019 with an office address at First St. Vincent Bank Ltd Building, Kingstown.

Although their head office is in this location, they have several remote offices around the world. They were established in 2019 and since their inception they have grown considerably. There are over 20 employees now working there.

As a CFD broker, they offer leveraged trading of up to 500 times on a number of different assets classes. This is all through the MT5 trading platform which comes from the same MetaTrader trading stable as the MT4 platform.

They are a True STP broker. STP stands for Straight Through Processing and means that the broker will send your order direct to their liquidity providers. This means that orders are not routed through a dealing desk of any sort.

Given the popularity of the broker, they have expanded to a number of different countries. There are, however, some countries where they do not take traders and that includes the likes of the USA, Québec, Belgium, North Korea, Sudan. You can see the whole list on their website.

Is XBTFX Safe?

Before anyone can start trading with a broker, one of the most important things that they can ask is whether it is safe? They are, after all, holding your funds.

This is why it is one of the most important criteria for us and we look at a number of factors to determine that. These include broker, user and fund security.

Coin Security

When it comes to the funds sent to XBTFX, they store most of their coins (95%) in cold storage. This means that most of their crypto is kept disconnected from the internet and cannot be accessed by hackers.

Security Protocols at XBTFX

Security Protocols at XBTFXThen, when it comes to the remaining 5%, these are in a "hot" environment and these are used in order to pay withdrawals or take deposits. These are manually managed with multi sig wallets. Hence, when you are requesting a withdrawal, it could take a bit of time initially.

Risk Management

Given that XBTFX offers leverage of up to 500x, they need to make sure that they are protecting all their traders from market swings. This is why they have built up an insurance fund. This will act as a buffer in extreme market movements.

The concept of an insurance fund is not a new one and has been used by a number of other leveraged exchanges including the likes of Bybit, BitMEX etc. At XBTFX, the fund is replenished with 10% of the commissions going towards the funds.

Communication Security

You will notice that all communication with XBTFX is fully encrypted. They have full SSL encryption on their site which means that all of your personal data is secure and cannot be snooped on.

Secure Certificate at XBTFX

Secure Certificate at XBTFXThis is also great tool for you to spot any phishing attempts. If you land on a website that looks like XBTFX but you cannot see that secure padlock in the browser, you can be sure that you are on the wrong site and you need to leave immediately.

User Security

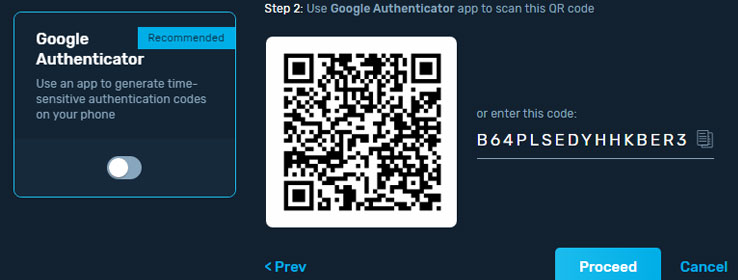

Most often, the most vulnerable component in the security of a broker or an exchange is the user themselves. Hence, XBTFX has provided their users with a bunch of tools in order to prevent your account getting compromised.

Setting up 2FA on XBTFX

Setting up 2FA on XBTFXOne of the most important of these is two factor authentication. When you link your phone up to this, you are ensuring that no one can access your account without your phone. This way, even if a hacker was to have your password, you would be safe.

This is not enabled by default so we would advise you to set this up the moment that you create an account. It can be done in your account settings tab in your main administration panel.

Asset Coverage & Instruments

XBTFX is a CFD broker which means that you are trading what are called "Contracts for Difference". These are essentially leveraged trading instruments that give you exposure to some underlying asset.

With a CFD, you are trading on the margin. This means that you will only ever have to put down a fraction of the total notional size of the trade in order to enter a position. So, when the margin is 1%, you will have an effective leverage of up to 100x.

XBTFX Asset Coverage

XBTFX Asset CoverageGiven the unique nature of the XBTFX offer, you can trade with leverage of up to 500x. This is more than we have seen at nearly all other leveraged crypto exchanges. Even many other forex brokerages only go up to a maximum of 400x.

Warning ⚠️: There is no need for you to take high leverage to start. It is very risky and new traders should start on lower levels and work your way up

When it comes to the assets that you can trade, there is a multitude of options really. Below are some of the traditional asset classes that you can trade:

- Forex: There are close to 100 different forex pairs including all of the major and minors out there.

- Commodities: Some of the commodity assets include WTI, Brent, Copper and Natural Gas

- Indices: There are a number of different indices that you can trade from Asia, Europe, and the Americas.

- Metals: This includes the likes of Gold, Silver, Palladium and Platinum

- Stocks: There are plethora of stocks that you can trade from all of the global stock markets. These include both large and small cap. You can see all of the assets here.

Then, when it comes to cryptocurrency, you have most of the major coins and altcoins. These include the likes of Bitcoin, Litecoin, Ethereum, Bitcoin Cash, XRP and BNB.

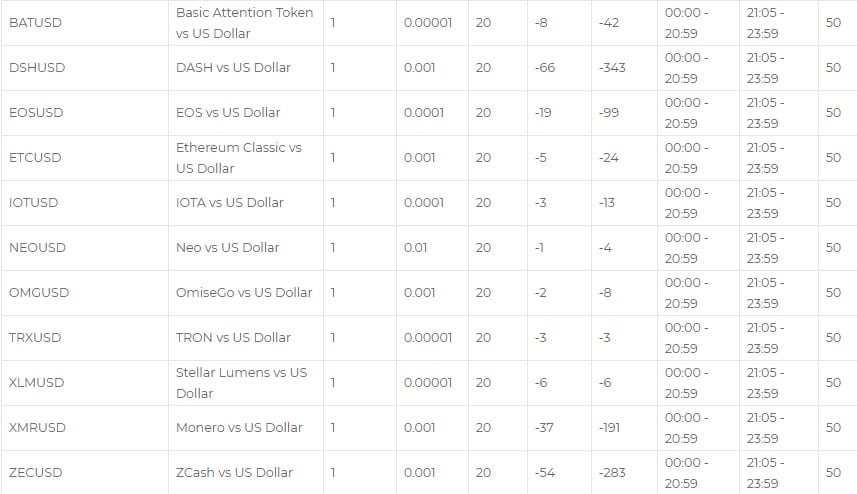

You then also have a pretty decent selection of smaller altcoins. You can see a selection of them over here:

Extended List of Altcoins at XBTFX

Extended List of Altcoins at XBTFXSo, when it comes to asset coverage, XBTFX really does shine. They have more assets in general than all of the other forex brokers and also have more cryptocurrency than we have seen at other exchanges.

Note on Leverage & STP

Although XBTFX is an STP broker, this becomes increasingly hard to do for leverage of up to 500x. The reality is that with this much risk on the books, the liquidity providers cannot manage the risk.

It is in these situations with such high risk that XBTFX will have to act as a dealing desk and be the counterparty to the trade. They have stated as much as they would like to be transparent and have disclosed it on this page.

True STP For Leverage under 100

True STP For Leverage under 100Of course, there are many traders that are vehemently against the notion of a dealing desk. Hence, XBTFX offers what is called the "STP Lock". What this does is that it sets a maximum on your leverage of 100x. This will ensure that all of your trades are done straight to the liquidity provider and will never be routed through any dealing desk.

100x Leverage is also quite reasonable for most people and it is the same leverage factor that exchanges like Prime XBT use. If you wanted to request an STP lock on your account then you will have to email them on [email protected] with your account number stating you want STP Lock.

XBTFX Fees & Spreads

As a trader, something that directly impacts on your profitability is the fees that you pay. This is something that you may not notice at first but will eat into your profitability in the long run.

So, this is something that we like to examine intently.

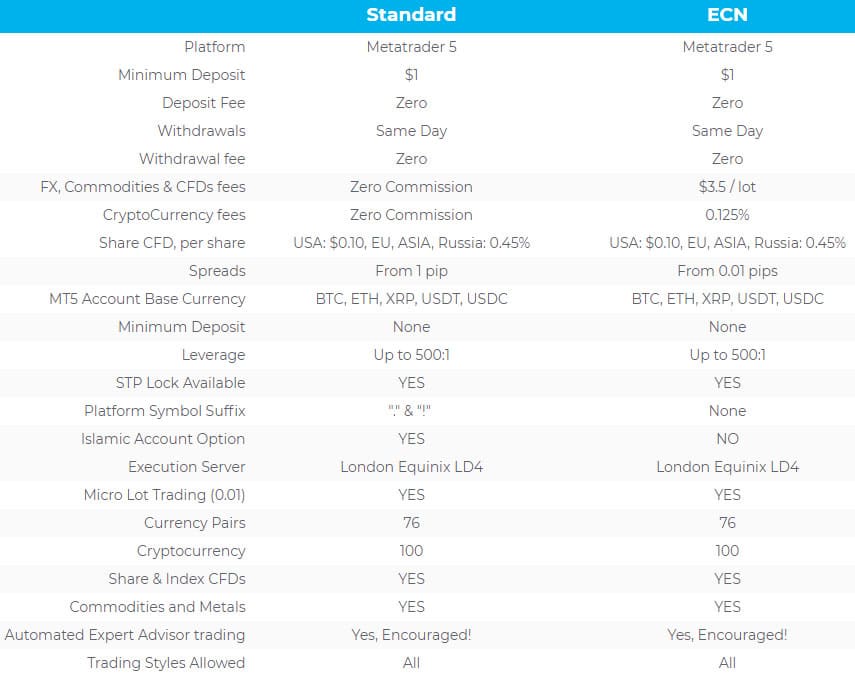

When it comes to the trading fees at XBTFX, it will depend on the type of account that you decide to open. As we cover in the accounts section below, there are two different types with unique fee structures.

Trading Fees at XBTFX

Trading Fees at XBTFXIf you go for the standard account, then you do not have any commissions on the lots that you trade. However, you will face a slightly wider spreads. For example, on the Standard account you have spreads that start at 1 pip whereas on the ECN account they are 0.01 pips.

However, if you are going to be trading on the ECN account you will have a "lot commission". For FX, Commodities and CFDs the lot commission is $3.5. If you are trading crypto CFDs, the commission on this ECN is 0.125%.

For both the standard and the ECN account, you will have fees to trade on the shares. These are $0.10 for US, EU and ASIA while you will have to pay 0.45% for Russia.

Other Fees

The only other fees that you are likely to incur are the exchange fees. These are the fees that you will have to pay to swap two different cryptocurrencies. This ranges from between 2-4% depending on the cryptocurrency. This is quite high if we were to compare it to other exchanges.

They say that there are no fees for Deposits and Withdrawals. However, I do happen to think that you will be charged a minor miner fee.

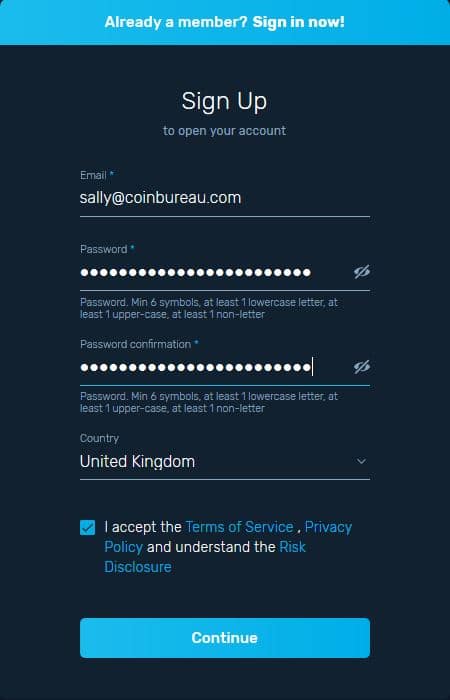

XBTFX Registration

If you have decided that you would like to try XBTFX then you will have to create an account. This is pretty simple and all it requires is an email address. Once you have submitted your email you will have to confirm your registration in the link they send to the email.

Registration Form at XBTFX

Registration Form at XBTFXOnce that is done your account is set up. You can now start trading although I would recommend that the first thing you do is that you set up that two factor authentication and protect your account.

KYC

If you are going to be funding your account in any cryptocurrency apart from stablecoin then you do not have to complete KYC. You can merely send your crypto into the broker and start trading. However, you will have a limit of $10,000 withdrawals.

If you would like to withdraw more than that in a day or if you are going to either be funding or withdrawing in stablecoin then you will have to complete the KYC. This is the level 2 KYC and they require you to provide them your basic information, copy of your ID and proof of address (utility bill, bank statement etc). Do take note that this proof has to have been in the past 3 months.

Account Types

Once you have registered you can create your account type. As mentioned, there are two basic types on offer at XBTFX. These are the Standard and the ECN.

So, what do these mean?

Well, with the standard account XBTFX is adding a minor spread to the pairs that you are trading and earning their fees in that way. ECN stands for Electronic Crossing Network and when you place an order on this account it is routed directly to the market and you will get the raw spread.

XBTFX Account Type Overview

XBTFX Account Type OverviewAs you can see from the above, both accounts are nearly identical but only differ according to their spreads. Some of the most important points that both of these accounts share that I can glean include the following:

- Both have a low minimum deposit of only $1.

- Both use state of the art servers at Equinix London LD4

- Both allow for expert advisors and automated trading strategies

- You can scalp with both of these

You will also notice that on the standard account you have the option to open an Islamic account. This is an account that is fully compliant with Sharia law and does not include any sort of carry over fees.

Demo Accounts

You may not be entirely sure what type of account you want or if you even want to fund an account at XBTFX. That is exactly the reason that they offer a demo account. This is a trial account that is funded with demo funds.

The benefit of this is that you can trade as much as you want and get a feel for the platform / broker. Its a risk free way for you to trade and see how the broker performs. This can be created for both the standard and the ECN account and can be done right there on your dashboard.

Deposits / Withdrawals

If you would like to start trading here on a live account then you will have to fund in with cryptocurrency. Unfortunately, they have no fiat funding options currently.

If you would like to fund your account in a dollar backed method then you can use one of the stablecoins that they offer. These include Tether (USDT), USDC, Paxos Standard and Gemini Dollar. Do take not though that these will require you to complete KYC.

If you want to fund your account then it is pretty easy. You will head on over to the "wallet" section in your account then you will hit "Deposit" on the coin that you would like to send in. Then you will select the amount and you will hit "proceed".

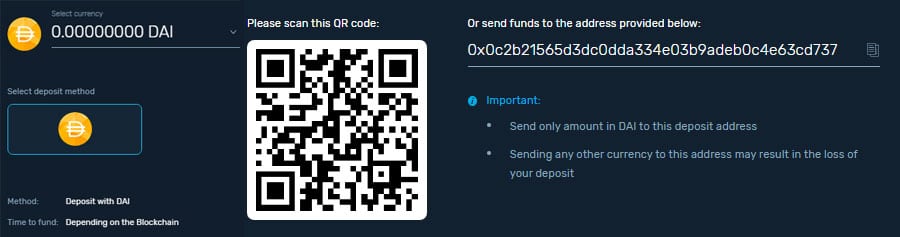

Depositing Funds at XBTFX

Depositing Funds at XBTFXThis should then take you to the wallet deposit address as well as the QR code. This is the address where you should send the funds. Once you have processed the deposit you will need to make sure that it is fully confirmed before it will be credited to your account. Here are the confirmations required per coin:

- BTC: 2

- LTC: 4

- ETH & ERC20: 7

- USDT: 4

- Cardano: 8

Block Explorer 🔎: If you want to track your deposit then you will need to use a block explorer.

Withdrawals

Withdrawals are just as simple as funding your account and are done in the same way. You will head on over to the "wallets" section and you will then hit "withdraw". Here you can insert your wallet address and withdrawal amount.

Processign a Withdrawal

Processign a WithdrawalOnce you have authorized the withdrawal then it is sent to the team. You should note that these withdrawals are processed manually by them so you may need to initially be patient. This is all done in order to keep funds secure.

When you are processing that withdrawal you should not forget the KYC requirement. You have a limit of $10,000 on withdrawls for the first stage of the verifications.

Exchange

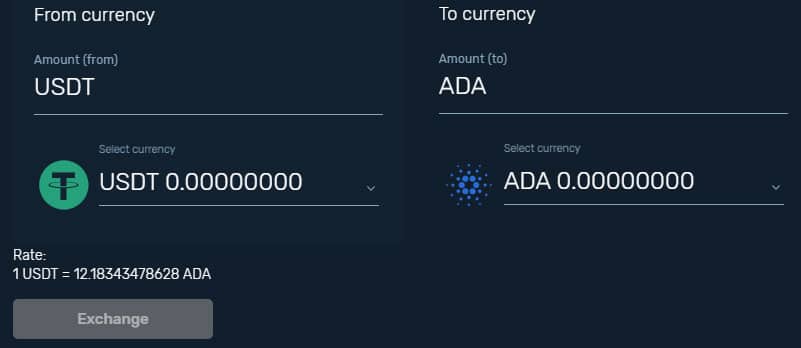

This is a feature that will allow you to exchange particular coins right there in your dashboard. This is quite simple and can be done from wallet to wallet. You will hit the "Exchange" button and it will pull up the below:

Making an Exchange of Crypto

Making an Exchange of CryptoHere you will select the source and the destination currency. This is instant but do take note though that you will be charged that 2-4% fee.

XBTFX Trading Platform

This is the real meat of the matter as it is where the traders will be 90% of the time when using the broker.

As mentioned, XBTFX uses the MetaTrader 5 platform. This is third party trading software that was developed by the same company that developed the wildly popular MT4 platform.This is used by thousands of brokers and millions of traders worldwide.

The MT5 platform is available on a number of different devices and operating systems. You can download it on both iOS and Android and you can also download it for Linux and Windows. The final option is that you can trade it through your web browser and this is perhaps the most easy.

Below you have the layout for the standard MT5 web platform. On the left you have all of the markets that you can trade. You can also add other pairs and assets below that if you wanted to trade them. Then, below that you have all of your previous orders as well as the live trades and running PnL.

XBTFX MT5 Platform

XBTFX MT5 PlatformIn the middle you have the MT5 charts. These are super effective and they have a number of features that all technical analysts will appreciate. These include studies and indicators which can help to establish key trends in the markets.

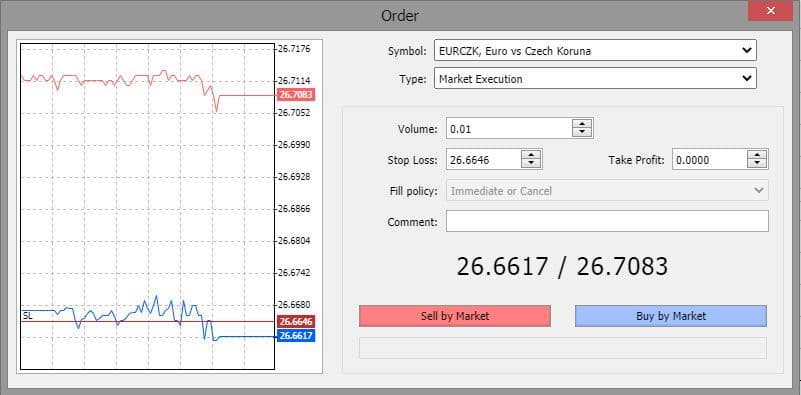

When it comes to the order functionality at XBTFX, you can either place a market order or a limit order. The former is placed at the most recent trade amount whereas the latter is at some level that is away from the market rate and will be executed once it reaches that level.

Order Forms on MT5

Order Forms on MT5You will also have the option to set a Stop-Loss and a Take-Profit at predefined levels away from your execution level. We would always advise that you do this at it removes the emotional component from the trading space.

Note ✍️: XBTFX keeps their trading servers at Equinix London LD4. These are some of the best known datacentres in the industry and serve high frequency trading firms

Something else that you should note about the MT5 platform is that it will allow you to develop your own trading bots and algorithms through the use of the MQL5 coding language. These are called "Expert Advisors" and they allow you to trade while you are asleep.

Mobile App

As mentioned, MT5 is also available as a mobile app for both Apple and Android devices. It has been downloaded over a million times and is still one of the most popular apps on the market.

It is also a pretty functional app and includes some of the following features:

- Switching between financial instruments on charts

- Customizable Forex & Stock chart color schemes

- Trade levels visualizing the prices of pending orders, as well as SL and TP values on the chart

- Free financial news — dozens of materials daily

- Chat with any registered MQL5.community trader

This is also great for technical analysis as you have the interactive charts that you can zoom into and scroll through. The mobile charts include 30 of the most popular indicators that traders use to get a bearing on the market.

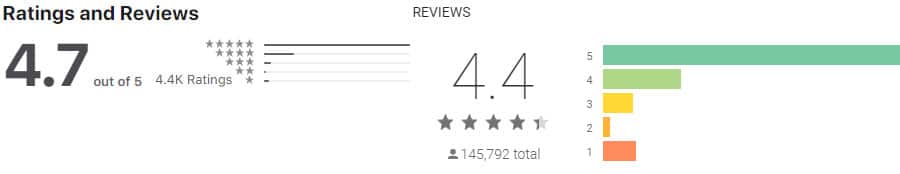

You only need look at the ratings of the apps in both the iTunes store and Google Play to get a sense of just how popular it is and what the other traders think about it.

MT5 App Ratings on iTunes store & Play Store

MT5 App Ratings on iTunes store & Play StoreAs you can see, from over 4,400 ratings on the iTunes store and over 146,000 in the Google Play store, it is a popular app. On the former you have a combined rating of 4.7 and on the latter the rating is 4.4.

Now, while mobile trading on the MT5 app may be quite functional, it still does not beat the effectiveness of trading on a desktop machine. You cannot observe multiple markets and chart at the same time on an app.

Customer Support

Something that can be incredibly frustrating for any trader is a lack of customer support. There have been many times when we have had to wait for hours or even days on end to get any sort of feedback from other brokers.

So, how does XBTFX stack up?

Well, it appears to be quite responsive. There are a number of ways in which you can reach out to them but perhaps the most direct way is through their online chat. This is connected to a facebook messanger window.

While this is great, it does exclude those who do not have a Facebook account from reaching out. Either way, when we did reach out we were usually helped in only a few minutes. They were informed and knew how to address our query instantly.

Support Responses from XBTFX Customer Support

Support Responses from XBTFX Customer SupportIf you would prefer to use something old school then you could always reach out to them via a support ticket. This can be done in your online dashboard and is perhaps the most effective way to deal with an ongoing issue.

You could also email them on [email protected]. When we tried this with a more general account related query, they responded to us in under 3 hours which is pretty decent. Do note though that there is no phone support.

Finally, if your question is more routine in nature then you can always look into their Frequently Asked Questions and knowledge base. There is a plethora of resources there that could save you a whole host of time.

Proprietary Trading

If you are a really good trader then there is an opportunity for you to get funding from the broker. This could be a great way for you to augment your capital and increase your trading returns.

Before you can be considered for this funding you will need to meet a number of criteria before applying. These include the following:

- One year track record

- Will need to have your account returns linked up to some verified trading software

- Will need to have completed an audited report

If you meet these criteria then they will give you $2,000 which you can trade for them according to some very specific criteria. You cannot withdraw any of these funds and you will have risk limits of cap to 10:1 and 10% drawdown cap. You are also prohibited from trading on news events or over the weekend.

If after the end of the trial period they determine your trading record to be sufficient then they will further fund your trading account with $10,000. You will have a 50:50 profit split that will be done via a High Water Mark Basis with 20:1 leverage cap.

Affiliates

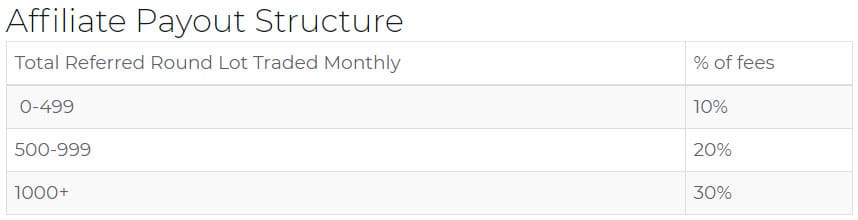

If you have been impressed with your experience on XBTFX then you can start referring friends, family and other traffic. This is all through their affiliate program where you will earn a share of the commission generated.

Earnings from the affiliate commissions are paid every hour for every lot traded. Apart from having different commission structures dependent on volume, you can also earn commission from those partners who you refer.

Affiliate Payout Structure at XBTFX

Affiliate Payout Structure at XBTFXYou should also note that these commissions are earned for the lifetime that you have the trader under you and you will not increase the cost of the traders themselves.

If you want to start referring people then you will first have to get yourself your affiliate link. This can be accessed inside your admin panel right there under "partner". When you click here it will bring up your affiliate link as well as a snapshot just of what you have been earning over the past month as well as your balance.

Areas for Improvement

Now while there was a lot of things that we really liked about XBTFX, we have to run through some of the things that we think need improvement.

Firstly, the most obvious drawback is that they do not have fiat currency funding or withdrawal support. While one can easily fund in crypto or stablecoin, this still means that the trader has to get hold of it which will require the use of another crypto exchange - less than ideal.

Keeping with crypto, if you do have funds in your account and would like to trade it for another crypto, their exchange fee is really quite high. At between 2-4% this is a much higher than you will pay at any other crypto exchange service.

It was also quite hard to get a sense of just how large and well stocked their insurance fund is. All the other leveraged exchanges allow traders to view the daily balance and assess just how much is protecting the trader pool - it would be great to have this colour.

In terms of support, while this was incredibly quick and concise, it is a bit unfortunate that they only use Facebook messenger to communicate. There are many people around the world who do not have accounts and are not always willing to create one.

Finally, this is still a brand new broker and as such, they do not have a track record. Of course, this is a bit of a chicken and egg scenario for most of the new brokers. If they are able to maintain the level of professionalism that they held when we tried it then that reputation will come.

Conclusion

In summary, this is a great broker with extensive asset coverage. We also love the fact that they offer trading through the wildly popular MT5 platform - one cannot go wrong with this established technology.

We were also quite impressed with their speedy customer support as well as their low fees for deposits / withdrawal of crypto. We also love the fact that they are transparent with their STP service and offer their traders the ability to request an "STP Lock".

Moreover, the entire user experience is pretty simple. Account registration was quick and did not require too much to get going. The user interface is also uncluttered and a breath of fresh air among some of the other brokers.

Yes, there were a few things that we thought warranted improvement but they can be worked on. Hopefully they are receptive to this feedback and consider possible improvements.

So, should you consider XBTFX?

Well, if you are looking for a broker with a highly functional trading platform where you can trade a multitude of assets in a relatively simple manner, then it should definitely be considered.

Warning ⚡️: Trading leveraged futures products is incredibly risky. Make sure that you practice adequate risk management

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.