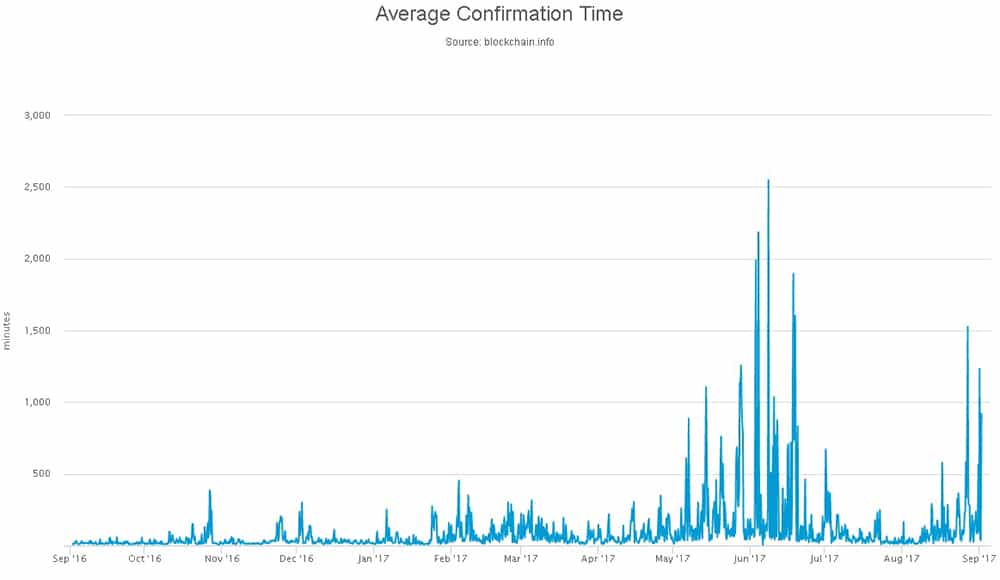

One thing that is increasingly taking centre stage in the Bitcoin ecosystem is the scaling issue. As more and more coins are mined, the mining algorithms become that much harder and hence take longer to complete. The block size limit means that transactions are taking a considerable amount of time to confirm.

Given the network congestion, users are being forced to either wait a really long time for their transactions to be propagated or, they are having to pay increasingly larger fees to make their transactions a priority for the miners. As you can see in the below image, average confirmation times for Bitcoin transactions are still really high.

This scaling issue was the main driver behind the Bitcoin hard fork in early August of 2017. The implementation of Segregated Witness was one of steps taken in order to speed up the transaction times. However, even after this activation, there has not been a marked difference in transaction times or fees.

If only there were a way for users to speed up their transaction times…

Enter Transaction Accelerators

Transaction accelerators allow users to reduce the waiting time for their transaction by placing their it in a prioritised queue. This is usually provided by the miners directly and they do it by adding your transaction onto their mining network to ensure that the transaction is included in the first block mined.

Although these services are offered, it is important to state that there is no guarantee that the transaction will be expedited 100% of the time. This is why a fee is usually charged for these transactions. Although, certain providers like ViaBTC, do offer a limited free offer. Below are three of the best mining acceleration options you may have.

ViaBTC

ViaBTC were one of the first mining pools to offer this service as part of a protest against the current limitations that there are on the network. If you submit a transaction request through their online portal then it is given priority in the next blocks that are mined in the ViaBTC pool. There is only one requirement and that is that the transaction has a fee attached to it of 0.00001BTC per kilobyte.

This is a free to use service and as such has made it incredibly popular among Bitcoin users. This means that it is also on occasion pretty clogged up. If there are a number of other people who are also trying to send funds then you will get an alert that says "Submissions are beyond limit, please try again later". You will then have to wait for the next block to be mined.

BTC.com

This is not offered exclusively on BTC.com but rather in collaboration with a number of other mining pools. With this service, BTC.com are offering the user a 75% chance that their transaction will be included in the next block in an hour from submission. They offer a 98% chance that this will be included in the next block within 4 hours from submission. BTC.com terms stipulate that the fees will be fully refunded if the transaction is not confirmed in 12 hours.

As they have these guarantees in their terms, this requires an acceleration fee. The user will pay a price which is calculated based on the amount of BTC that has been sent. This is paid separately via credit card. Although this may perturb some users, they should note that BTC.com does not have any minimum bitcoin fee requirements when sending (unlike ViaBTC).

SosoBTC

SosoBTC works in a similar way to BTC.com. They do, however, charge a lower fee rate at only $2.9 per kilobyte. This is also the minimum fee that you can pay to use the service. Once you have sent them the commission, the transaction is usually confirmed within 2 hours. If this does not occur then they will refund you the commission.

SosoBTC is different from the other two options as they do not have their own mining pools. Yet, they cooperate with a number of other mining pools in order to provide the accelerated service. Unfortunately there is no page where you can insert your transaction information. You have to add their customer service on WeChat (it is a Chinese company).