Cryptocurrencies have sure come a long way in a few short years, going from not knowing whether or not they would be squashed under the boots of authority, to becoming a viable institutional-grade investment product and becoming the asset of choice for many people’s pensions, savings, and paychecks.

While getting paid in Bitcoin and other cryptocurrencies may sound like a forward-thinking fantastic idea, it may not be for everyone. This article is going to cover some of the pros and cons and things that should be considered to help you figure out if getting paid in crypto is right for you.

Disclaimer: I hold Bitcoin as part of my personal crypto portfolio and this article simply outlines my opinions on what I feel are the best crypto practices that I follow. This is in no way meant to be a guide for you to follow or financial advice, simply things to consider depending on your own situation.

Forget Cash, Get Paid in Crypto!

We have seen an insanely fast-growing trend in 2021 and 2022 of celebrities, politicians, and pro athletes opting to get paid in Bitcoin. It is seriously head-spinning how fast this trend has been picking up speed!

Paid in Bitcoin. Image via Forbes

Paid in Bitcoin. Image via Forbes News headlines started popping up all over the place around mid-2021 during the peak crypto bull market, highlighting public figures choosing to ditch cash and take their salary in Bitcoin and other crypto; here are a few prominent examples:

- Eric Adams- Mayor of New York Announced that his first 3 paychecks will be converted to Bitcoin.

- Francis Suarez- Mayor of Miami said he would take his paycheck 100% in Bitcoin and has pressed to allow Florida government employees to receive a portion of their salaries in Bitcoin if they choose.

- Russell Okung- Carolina Panthers NFL player received half his salary in Bitcoin.

- Trevor Lawrence- Jacksonville Jaguars player received his signing bonus in Crypto.

- Sean Culkin- Kansas City Chiefs player will be converting his entire salary to crypto.

- Aaron Rodgers- Green Bay Packers quarterback announced he would be taking his salary in Bitcoin.

- Saquon Barkley- New York Giants player will take 100% of his endorsement money in Bitcoin.

- Vivek Ranadive- Owner of the Sacramento Kings announced that anyone in the organization (coaches, players, etc.) can earn their salary part, or fully in Bitcoin if they wish.

- The UFC has announced that Bitcoin payouts will be awarded to the top three fighters on every UFC Pay-per-view event.

Image via Bloomberg

Image via Bloomberg - Belgian MP Cristophe De Beukelaer became the first European Politician to convert their salary to Bitcoin.

- 50 Cent- Rap star 50 Cent will be accepting Bitcoin for his fifth studio album.

- Mel B- Former Spice Girl Mel B became the first British artist in history to accept her payment in Bitcoin in 2013. (What an OG!)

- Lionel Messi- Football (Soccer) legend Lionel Messi received crypto as part of his new two-year contract.

- Cristiano Ronaldo- Another football (Soccer) legend received partial payment in JUV fan tokens, making him the first footballer to earn a portion of their salary in this way.

Crypto payments for the cool kids. Image via onjuno

Crypto payments for the cool kids. Image via onjuno - And the list goes on… It is like a stream that turned into a raging river in no time.

And it isn’t just high net worth individuals getting paid in crypto either, there have been a few companies choosing to pay their staff salary in crypto as well.

Exodus crypto wallet company pays their employees in Bitcoin. Exodus is a pretty cool company and, in my opinion, is one of the most innovative and forward-thinking crypto companies around. They were also the first company in history to tokenize shares on the Algorand network for their Regulation-A public shares offering, and their crypto wallet is top-notch; you can read more about Exodus in our Exodus review.

Exodus is one of many companies paying salaries in Bitcoin. Image via YouTube/Exodus

Exodus is one of many companies paying salaries in Bitcoin. Image via YouTube/Exodus GMO internet group focuses on developing internet infrastructure, advertising, internet finance and crypto. GMO declared that its employees would start receiving their payments in Bitcoin and the offer was made available to over 4,000 employees.

IM (AKA OpenWeb, Spot.IM) looks to improve online conversations. The platform uses AI and machine learning to encourage positive dialogue online to decrease the toxicity and polarizing communication exchanges found all over the internet. The company opened its own cryptocurrency exchange where employees’ salaries can be converted to Bitcoin.

SC5 is a Finnish internet tech company that builds applications and software. These guys were one of the first to offer crypto payments to their staff in Bitcoin way back in 2013! Imagine working for a company that started paying you in Bitcoin way back when 1 BTC was worth less than $100. This would have been like winning the lottery for their staff members, they must be rolling in it! I wonder if they still have any employees left from those days or if they all retired and are kicking back on a beach somewhere.

This Would Definitely be me If I was Earning a Salary in BTC back in 2013. Image via Shutterstock

This Would Definitely be me If I was Earning a Salary in BTC back in 2013. Image via Shutterstock Other companies paying in Bitcoin are Fairlay, Purse.io, Bitwage, and the list goes on…

Why Would you Want Your Salary Paid in Crypto?

If you are already considering receiving your salary in crypto then I am assuming that I don’t need to explain why Bitcoin is exponentially better than traditional fiat in nearly every way.

Bitcoin is an amazing asset to hold; here are some of the main reasons why someone may want to earn their Salary in Bitcoin:

- They would rather earn in Bitcoin as fiat currency is subject to inflationary damage. Check out our article on Bitcoin as an inflation hedge.

- Bitcoin is the best performing asset class in history.

- Bitcoin is the “Apex Property” of the human race.

- Getting paid directly in crypto saves on the hassle and exchange fees and needing to convert fiat to crypto every paycheck.

- Makes dollar-cost averaging automatic.

- Is an escape from the corrupt legacy banking and financial system.

- Provides a financial system to the unbanked population.

- Is a marketing gimmick for celebrities and gives them extra press and attention, putting their names in the headlines

There are so many great reasons why people are choosing to hodl Bitcoin, but is it right to receive your salary in it?

I think it is important not to get too caught up in these celebrity crypto deals. Just because highly respected and notable politicians and athletes are earning crypto that doesn’t mean it is right for the average person.

Remember that for many celebrities and athletes, receiving their salary in Bitcoin or receiving some sort of crypto bonus is a way to make headlines, and we know that many celebrities like nothing more than being in the spotlight.

When I see celebrities such as Paris Hilton getting involved in crypto, I often wonder if these people actually care about the world benefitting potential of crypto, if they understand anything about it and that it is saving lives, or if they are just doing it for attention, money, and popularity as crypto is the flavour of the week.

Well Said Dorothy! I Couldn’t Agree More. Call me Sometime, Let’s Collaborate on an Article! Image via thetyee.ca

Well Said Dorothy! I Couldn’t Agree More. Call me Sometime, Let’s Collaborate on an Article! Image via thetyee.ca The line between celebrity and athlete has become blurred and pro athletes such as Tom Brady and Tony Hawk who have retired from sports have taken the plunge into crypto and NFTs. Is this foray just a way to stay relevant, perhaps as a hobby, or as a way to further increase their masses of wealth? Snoop Dogg has also become one of the most prominent figures in the metaverse NFT space and leaves one to wonder what they are doing it for?

Image via Fortune.com

Image via Fortune.com For many of us “average Joe’s,” crypto is a way of preserving what little wealth we manage to accumulate, protecting against inflation, or is the only access to a financial system for those in parts of the world where there are no banks. When I read about these celebrities who have hundreds of millions of dollars, more than they could ever possibly spend, it leaves one wondering what their reason for getting into crypto is and how often is it just another ploy to increase their wealth status.

I am not saying that crypto is only for the average person or is a tool only to be utilized by the poor and underprivileged, of course not! The beautiful thing about crypto is that it gives equal opportunity to everyone regardless of background and social status, that is one of the things I love about it!

Many of the world’s elite are using crypto for good, one incredible example of this is rapper Akon who has dedicated his life and fortune to empowering Africa through blockchain technology and crypto. A serious standing ovation to you, good sir!

Image via Fortune.com

Image via Fortune.com Similar to when someone only does something charitable when there are cameras and members of the press around, I guess that I have become skeptical when some celebrities get into a trend as I can’t help but wonder what their true intentions are. Not all good deeds need to come with an army of headlines and press that shows the world what an amazing person you are.

Meme Generated via imgflip.com

Meme Generated via imgflip.com Attention seeking and greedy money grabbing aside, of course, the rich and elite are just as concerned about diversification and inflation hedges as the rest of us, so they have just as much of a need to get into crypto as anyone else for the same reasons. This Segway’s me into an important point.

When we hear about a celebrity or athlete earning 100% of their salary in crypto, remember that they likely already have a few million dollars stashed in the bank; they likely have properties paid off, no credit card debt etc.

For many of them, they could likely toss the next ten years’ worth of paychecks into Bitcoin and probably still be sitting on fat cash reserves, so many of them will be just fine financially regardless of what happens to the price of crypto or the asset class as a whole.

I will cover this in more detail in my arguments against earning a salary in Bitcoin, but one major consideration to keep in mind is that most of the names in the headlines are already financially set for life and can afford to ape into crypto as they already have a strong, lasting financial foundation that was built with cash and have everything they need. Many of them are not risking nearly as much by opting for crypto as someone who does not already have that financial foundation built.

Why Crypto Salaries May not be a Great Idea

There are very few scenarios that I come across where I don’t think some crypto exposure is a good idea. It is my personal opinion that some exposure to Bitcoin is a goal that everyone should aspire towards eventually, but there is a time and place when holding crypto assets is responsible, and a time it is irresponsible.

The Value Can and Likely Will Drop

I generally feel that the only money that should be put into blue-chip cryptos like Bitcoin and Ethereum is money that someone doesn’t intend to touch for the next 6 months to 1 year at the very minimum, depending on price action of course. If you put money into a crypto project and the next day the token goes 10x in value then that is obviously an exception to the rule, and I would be taking profits for sure.

Because crypto is volatile, it is not a great place to be used as a short-term savings account. We have seen Bitcoin drop 50% in as little as a week, so if you intend on needing a certain amount of money in the short term, it is probably not a good idea to put it into something that can crash so severely as that would eliminate your ability to meet those anticipated financial obligations.

Image via Tradingview

Image via Tradingview On a long enough time frame, we know that Bitcoin has historically always increased in value so the key is to make sure you can hold those funds in your crypto asset of choice until it is in profit, and understand that it may take 6 months, a year, two years, five years maybe? Can you afford to go that long without accessing those funds?

Not to mention there is always a risk that your crypto asset of choice may never reach those all-time highs again. How many people lost funds during the dot-com bubble? There was no recovery and reaching new all-time highs for the majority of dot-com companies.

This is an important consideration as some of the crypto payroll services that I cover later on allow customers to choose which cryptocurrency they want their salaries converted into, and not all crypto projects are created equal.

“But I Was Told There Would be Moon?” Image via Reddit.com/Bitcoin

“But I Was Told There Would be Moon?” Image via Reddit.com/Bitcoin I mention blue-chip cryptocurrencies being a long term hold and many people in the crypto community view the major cryptos in the same light. I consider major cryptos like BTC and ETH as places that I like to put money that I don’t anticipate needing to use for a long time, while I consider money put in smaller cap coins and NFT projects as money I can afford to lose.

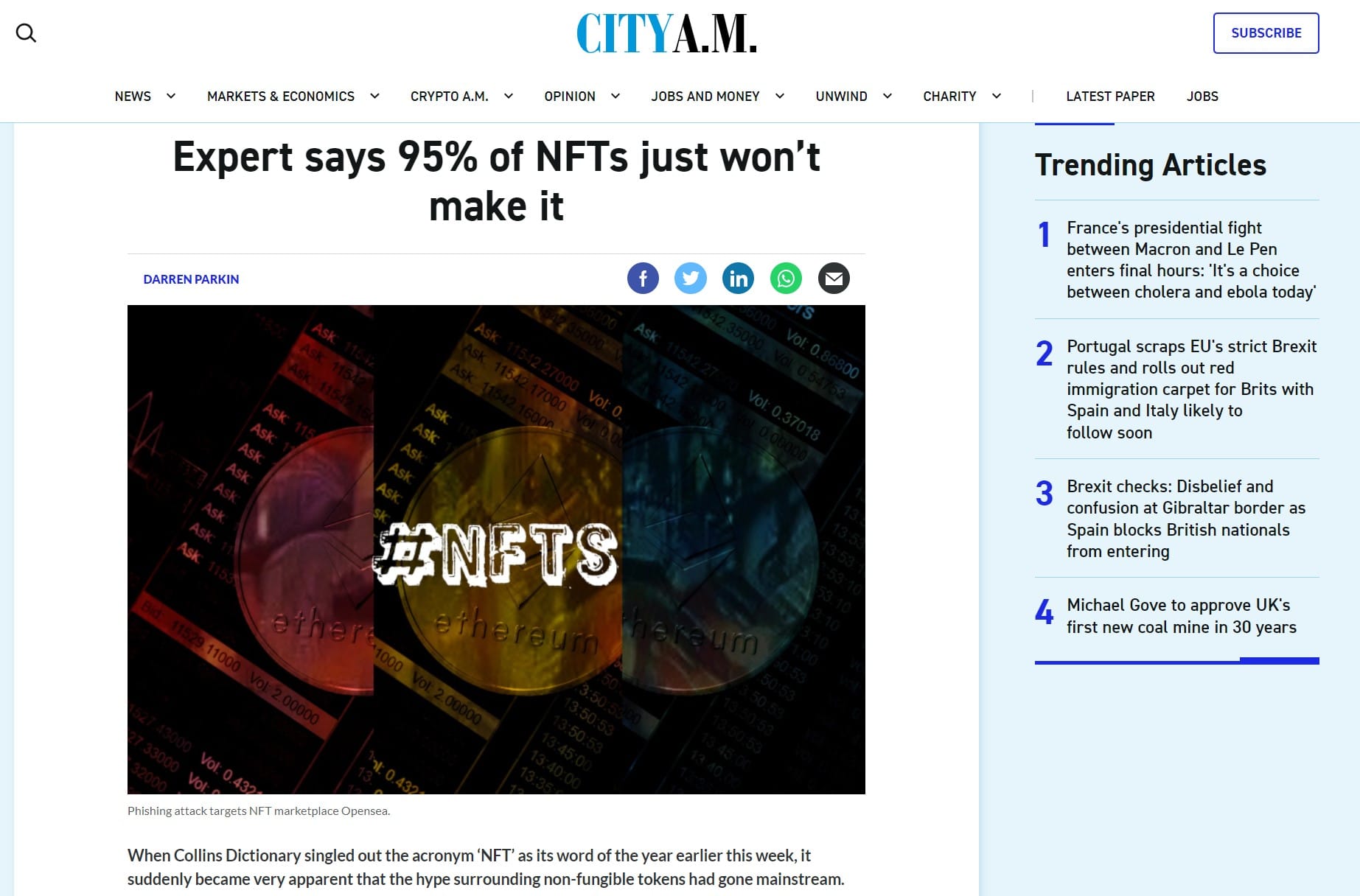

There is no sugar coating the fact that over 90% of crypto projects and over 95% of NFTs have crashed and burned and any money invested in them is about as good as gone.

Image via cityam.com

Image via cityam.com When speculating on these riskier assets it is important to understand that you are essentially gambling, and this should only be done with the understanding that you stand a good chance of losing that money. Nobody walks into a casino confident that they are walking out rich, there is a reason crypto and NFTs are referred to as “speculative” assets and it is wise to consider these projects in a similar fashion.

Cash Provides Quick Access for Emergency Purchases

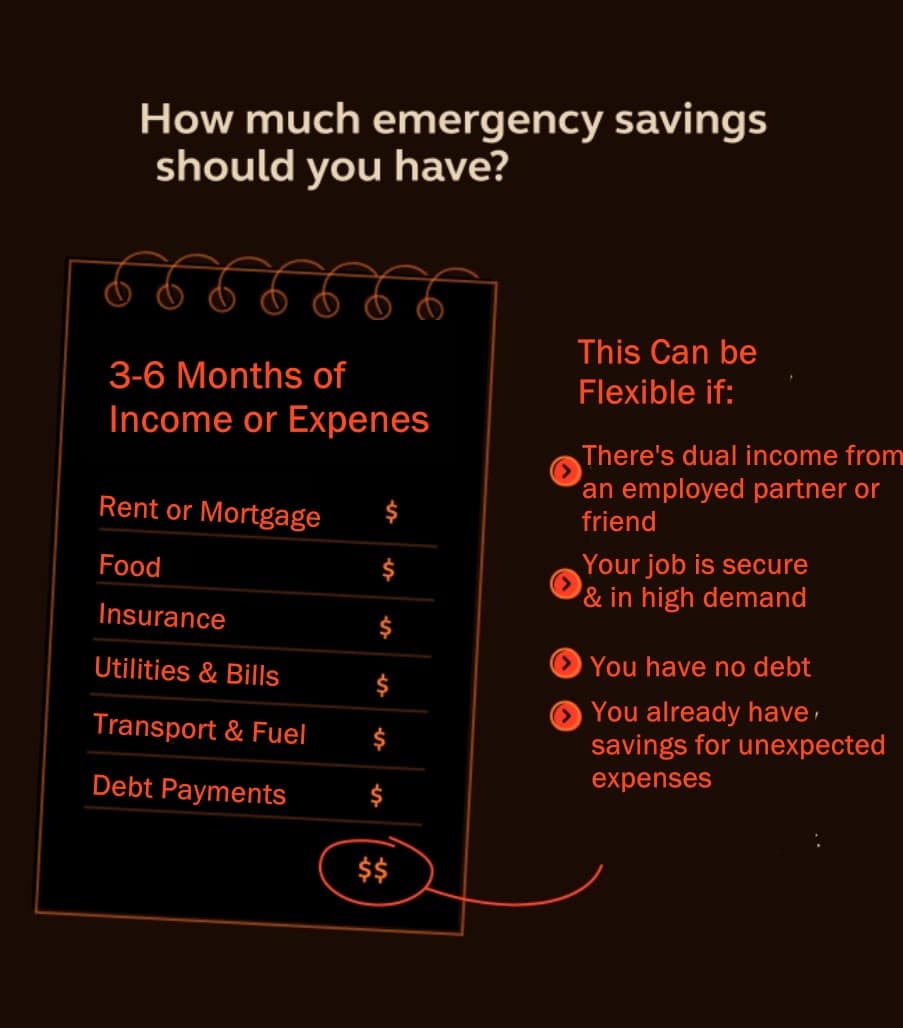

Nearly any financial advisor will tell you that you should always have a minimum of 3-6 months’ worth of “emergency” funds held in cash to cover unexpected expenses; I think this is a very important step in achieving financial health.

If your car breaks down on the side of the road, your water heater explodes, the furnace in your house breaks down in the middle of winter, your roof starts leaking etc., you are going to want some cash on hand to be able to make some quick repair purchases.

I don’t think you can pay a tow truck driver in the middle of the highway or a furnace repair person at 3 am in Bitcoin to come to the rescue, especially if that Bitcoin just lost half of its value in the past 3 days as you might not have enough in your Bitcoin wallet to cover the costs.

A common rule of thumb that many people follow to figure out how much cash they should have on hand is to figure out exactly how much they need to survive for one month, including payments like rent, fuel, food, etc., and times that by 3-6 to make sure you would be able to survive for 3-6 months depending on how secure you want to feel.

Then try and double this amount for extra expenses that may come up and that should be the amount of “emergency funds” that are kept in safe and non-fluctuating savings accounts just in case.

Volatility Makes Financial Planning Very Difficult

This is probably the main argument against receiving your salary in crypto. This goes back to the volatility of cryptocurrency again; if you are someone who lives paycheck to paycheck and your salary barely covers your monthly expenses, then it may not be the best idea to receive your pay in something that can fluctuate so dramatically.

Let’s look at an example:

Say your monthly salary is $2,000 per month and your total debts, expenses, and bills come to $1,900. If you are paid that salary in crypto, then the value of the asset drops 10% which is a common occurrence in crypto, your $2,000 dollar salary is now only worth $1,800, which is not enough to cover your monthly living expenses.

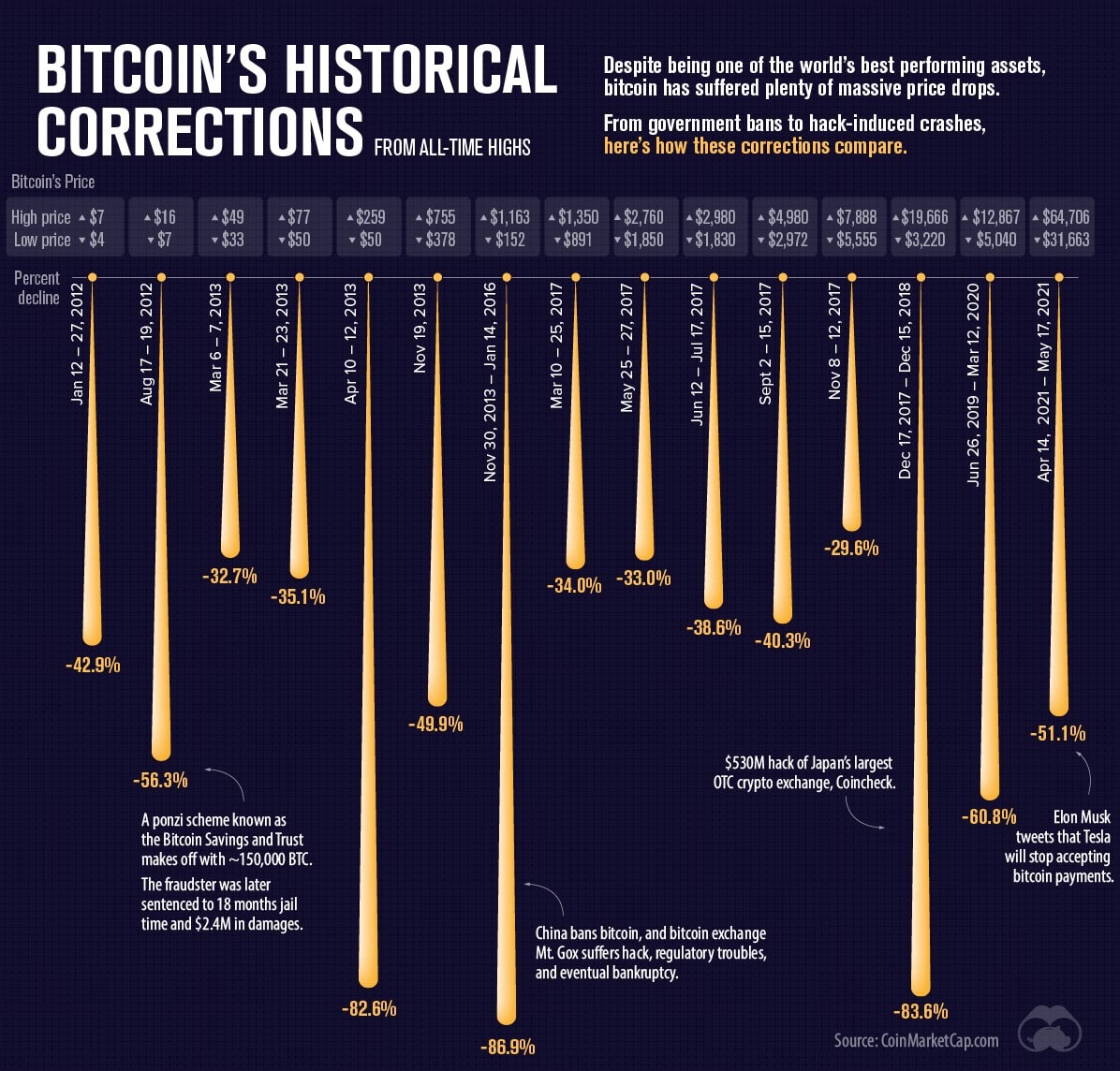

Here is a diagram from Visual Capitalist showing the severity and frequency of Bitcoin price drops. Imagine relying on the value of an asset this volatile to meet financial obligations:

Image via visualcapitalist.com

Image via visualcapitalist.com Imagine trying to plan your finances if your boss decided to pay you a completely random amount based on nothing every month and you never knew what the amount would be until it was deposited in your account. Say your boss just randomly pulls a card out of a deck and that is how they decide how much to pay you, it would be impossible to properly plan your finances.

If you choose to earn your entire salary in crypto and don’t convert it to cash, the fluctuations of the crypto markets would be like being paid by that wacky card playing boss.

The World Still Isn’t Crypto-Friendly

Getting paid in crypto is still a bit of a hassle and requires some thought and preplanning and preparation. When you get paid into a bank account, and you have a card for that bank account which is accepted everywhere, then you don’t need to think much about how you can spend your money.

If your salary gets paid into a crypto wallet or crypto exchange, most of the world isn’t set up to accept crypto payments…Yet.

Getting paid in Bitcoin doesn’t help at the grocery store, or when I am out at the pub…I mean milkshake establishment on a Friday night with some friends, and it is my turn to buy a round of milkshakes.

Don’t Try Impressing Your Date by Asking the Waiter if You can Pay in Bitcoin. The Answer is Probably No and Your Date Probably Won’t be Impressed When They Need to Pay the Bill Because You Have No “Real Money” Image via Shutterstock

Don’t Try Impressing Your Date by Asking the Waiter if You can Pay in Bitcoin. The Answer is Probably No and Your Date Probably Won’t be Impressed When They Need to Pay the Bill Because You Have No “Real Money” Image via Shutterstock You need to make sure that you have a crypto to fiat payment conversion method in place which is an extra step that needs to be taken into account when opting to get paid in crypto. Fortunately, the rise of crypto debit cards is making this much easier; I will cover that more in the “How to get Paid in Crypto” section.

How Important is Your Net Worth?

I know I already covered the volatility of crypto, but I think this needs to be mentioned again and thought of from another perspective. If your salary is being paid in crypto, your net worth and capital are affected by its volatility.

For anyone who was receiving a Bitcoin salary while it hit its all-time high of over 68k, any money that was kept in BTC when it dropped to nearly half that amount has lost a significant amount of their net worth. It has nearly been a year and price has still not recovered.

Image via Tradingview

Image via Tradingview Can you afford for your net worth and purchasing power to be reduced by over 50 percent and have it remain that way for months or years? If you opt to receive 100% of your salary in crypto, keep it in crypto, and it drops by 50%, that is similar to you working all those hours for half your actual salary.

Oh Yeah, That Tax Thing Again

Taxes are another important consideration, and you should consult a tax professional about the implications before deciding whether or not a crypto salary is a good idea.

Where I used to live, the tax on income is 22% while capital gains tax is 50%. The selling of Bitcoin is treated as capital gains, so if I got paid in fiat my tax was 22% but if I got paid in Bitcoin which needs to be converted to cash to cover expenses, that would have been taxed at 50%, ouch!

If you live in a jurisdiction with similar tax laws, getting paid in Bitcoin can severely increase your tax obligations. Want to know which jurisdictions are tax-friendly? Take a look at our Tax-Friendly Crypto Jurisdictions article.

On the topic of tax, even if crypto receives favourable tax treatment where you live, if you get paid $2,000 in crypto and the value of that crypto drops 50% and it is now only worth $1,000, guess what? The taxman doesn’t care that the price dropped, you’re still getting taxed on the original salary amount.

Debt Considerations

Earning a salary in crypto while being burdened by debt is also a consideration that should be…well…considered.

There is nothing worse than credit card debt as rates are often around 20%. For me, I would want to make sure I did not have any credit card debt before opting to get paid in crypto.

If you need to make monthly credit card payments at 20% interest, and your crypto paycheck just dropped 10%, that is similar to your credit card debt now jumping to 30% as your salary just lost 10% of its purchasing power and ability to pay off your credit card debt.

This same idea goes for other debt and mortgages.

And on the topic of mortgages, do I have a personal story for you! Pull up a chair and listen to some sage wisdom dropped on you from someone who realized this the hard way.

Those Pesky Banks

I like Bitcoin, you like Bitcoin, we all like Bitcoin and can have a Bitcoin party, but let’s not invite the banks.

Before writing for the Coin Bureau, I had a job that paid me purely in Bitcoin. I loved it, I thought it was the best thing in the world and was pumped. What a great way to stack some sats and dollar cost average into my favourite asset.

I was feeling good, flying high and was ready to apply for a mortgage and I tell ya, I basically got laughed right out of the bank.

A Bitcoin Bank, I Could Sure Use one of Those! Image via Shutterstock

A Bitcoin Bank, I Could Sure Use one of Those! Image via Shutterstock I had been earning a salary in BTC for about a year, and in that year I went to 4 different lending institutions trying to get approved for a mortgage. I had enough for a down payment, an immaculate credit score, strong employment history and a stable job…But I got paid in Bitcoin.

Not only did the banks have NO IDEA how to do an earnings assessment with Bitcoin, but also, they couldn’t perform a proper net worth assessment as both my salary and my net worth fluctuated dramatically with the price of Bitcoin and other crypto.

The banks are very old school in thinking still. Within the year that I tried repeatedly to get a mortgage, I had met with both bank and district banking managers at their request as they wanted to approve my mortgage but needed to understand my situation. They make money off of mortgages after all, so of course, they wanted to approve it.

I was asked to host a presentation to help them understand my situation better. I taught them how to verify crypto holdings through blockchain explorers, track BTC transactions, read crypto exchange statements, understand self-custody and hardware wallets, everything to verify income and asset holdings and more.

Even after all that, while the managers I had met with were eager to play ball, not a single lending facility ended up being able to approve a mortgage for someone paid in Bitcoin. A serious bummer.

Image via Shutterstock

Image via Shutterstock I should have known the moment the bank manager asked to see a bank statement from my “Trezor Bank” that it wasn’t going to fly. Seriously, try explaining to someone who works in a bank that crypto holders can keep their money in a place that is non-custodial, where it is impossible to get a company generated and verified statement and watch their brains short circuit.

Even though I could not get a mortgage, I do not regret for one moment earning my salary in Bitcoin as that encouraged me to save more money and stack more sats than I would have been able to otherwise, so at the end of the day, no regrets from this crypto guy.

Image via Shutterstock

Image via Shutterstock Anyway, those are some of the things that should be considered when deciding if earning your salary in crypto is right for you. If you are someone with plenty of cash in savings, have no unmanageable debt obligations, have plenty of money left over after each paycheck, have nobody such as children or dependents reliant on your financial stability, and have no intention of trying to get a loan or mortgage in the near future then I think earning a salary in crypto is a great idea.

Also, understand that everything I mentioned above is a more serious consideration if you are wanting to receive 100% of your salary in crypto. It doesn’t need to be all or nothing. As I will cover next, there are ways of having just a percentage of your salary converted to crypto each paycheck as that may be a more reasonable approach.

If I haven’t scared you off earning in crypto yet, and you are keen to ditch dollars for sats, let’s look at how you can make it happen!

How to Get Paid in Crypto

If you have weighed up the pros and cons and have decided that earning your salary in crypto is right for you, there are a few great tools you can leverage.

The first way to achieve this is by finding a company that pays in crypto and applying there. Companies that pay in crypto can send your salary directly to a cryptocurrency wallet or exchange. There are an increasing number of job boards hiring for crypto, a simple search for “crypto jobs” will start you in the right direction.

You don’t even need technical skills to work in crypto; take a look at our article on How to Launch your Blockchain Career and I think you will be surprised. There is something for everyone!

If you are seriously considering a career in cryptocurrency, I would definitely recommend reaching out to Coin Bureau Recruitment as we have team members who specialize in helping people find their crypto dream jobs, or if you fancy a job working with us, you can check out the Coin Bureau Careers page.

Cryptocurrency jobs are in high demand, you can start your search on a job site like cryptocurrencyjobs.co and see if something strikes your fancy.

Image via cryptocurrencyjobs.co

Image via cryptocurrencyjobs.co But if that isn’t an option there are a few crypto companies that allow your regular salary to be converted partially or fully into crypto which is very cool.

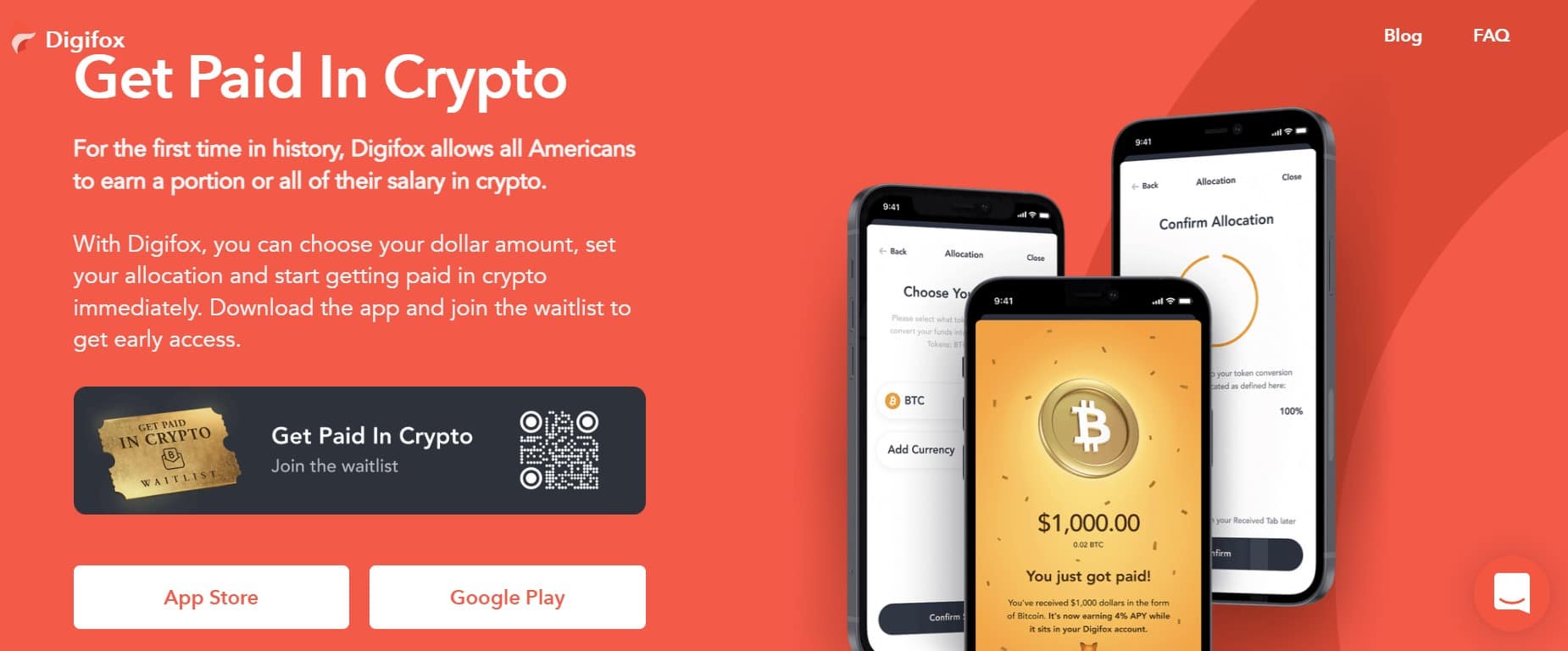

Nicolas Merten is a popular influencer and crypto advocate. Along with his popular YouTube channel Datadash, he is also the CEO and co-founder of the company Digifox.

Image via digifox.finance

Image via digifox.finance Digifox will allow all Americans to earn a portion or all of their salary in cryptocurrency. This will work by employees asking their employer to pay their salary into a GPIC account with Digifox, and when those dirty dollars roll in, those dollars can automatically be converted to crypto and sent straight to a crypto wallet of your choice.

Another great service that offers this is onjuno. Onjuno is a FinTech company that combines traditional banking services and crypto.

Image via onjuno

Image via onjuno Paychecks can be deposited directly into a bank account with Onjuno and a portion, or all can be swapped for crypto and withdrawn to a crypto wallet. Onjuno also has a sleek metal debit card that allows you to spend with your cash or crypto

Revolut is also a notable mention as you can have your paycheck sent into a Revolut bank account, just as any regular bank account, then you can purchase crypto directly through Revolut as well, though they have pretty steep fees for crypto purchases.

Revolut has become my go-to international “bank” for fiat currency after my traditional bank account and Transferwise both decided to block any and all payments to and from crypto services. Naturally, I closed my accounts because it is ridiculous for a bank to be able to dictate where and how we can and can’t spend our money. We are all adults after all, and I should be able to choose to access the crypto solutions that are right for me. I am looking forward to banks going the way of Blockbuster if they continue these draconian measures and don’t evolve with the times.

Sorry, rant over.

Deel is another cryptocurrency company that specializes in cryptocurrency payroll solutions for companies that hire staff from various parts of the world.

Image via letsdeel.com

Image via letsdeel.com Deel handles all the boring complicated tax, GDPR and compliance headaches that come with having a globally staffed team and now also supports crypto payroll solutions.

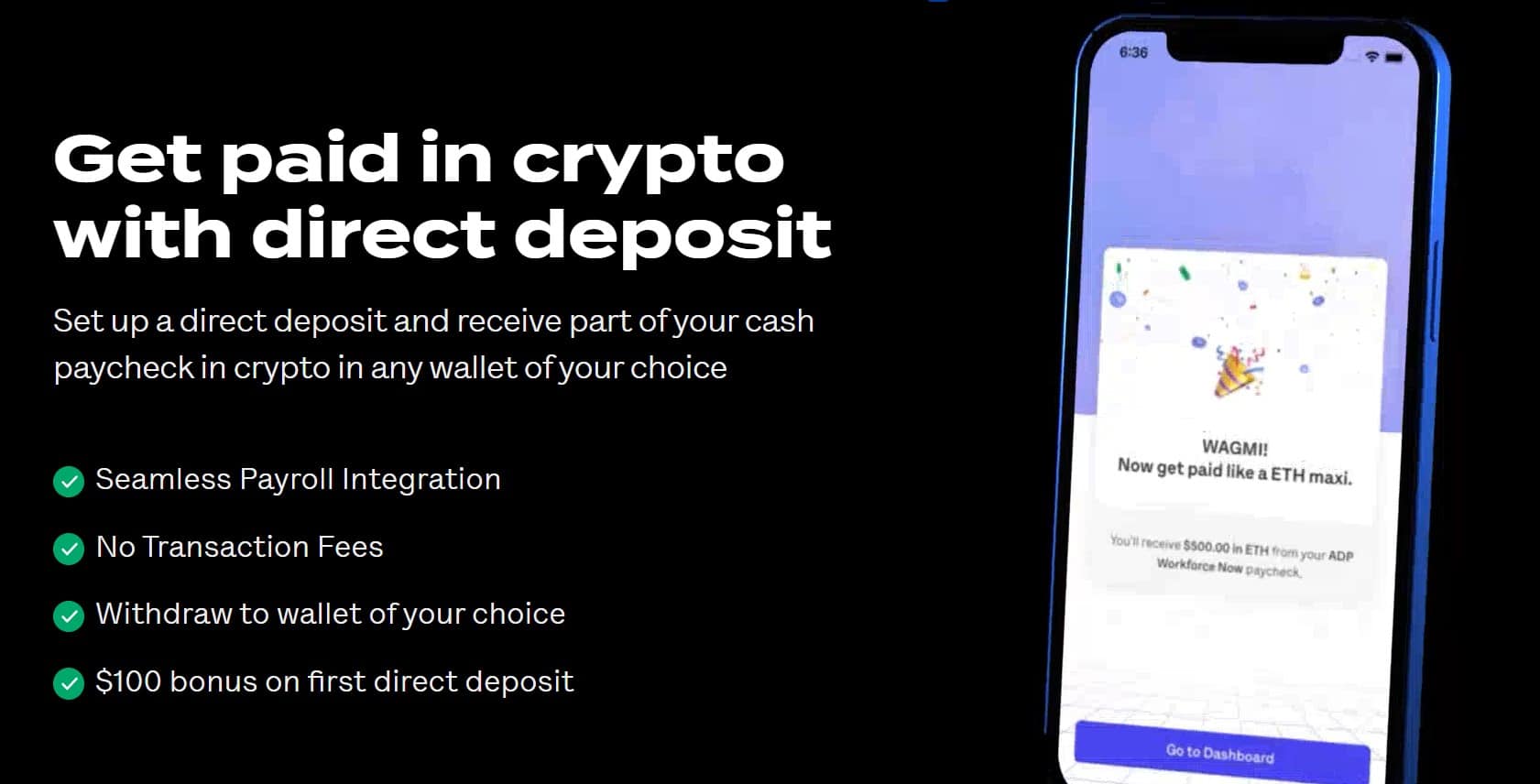

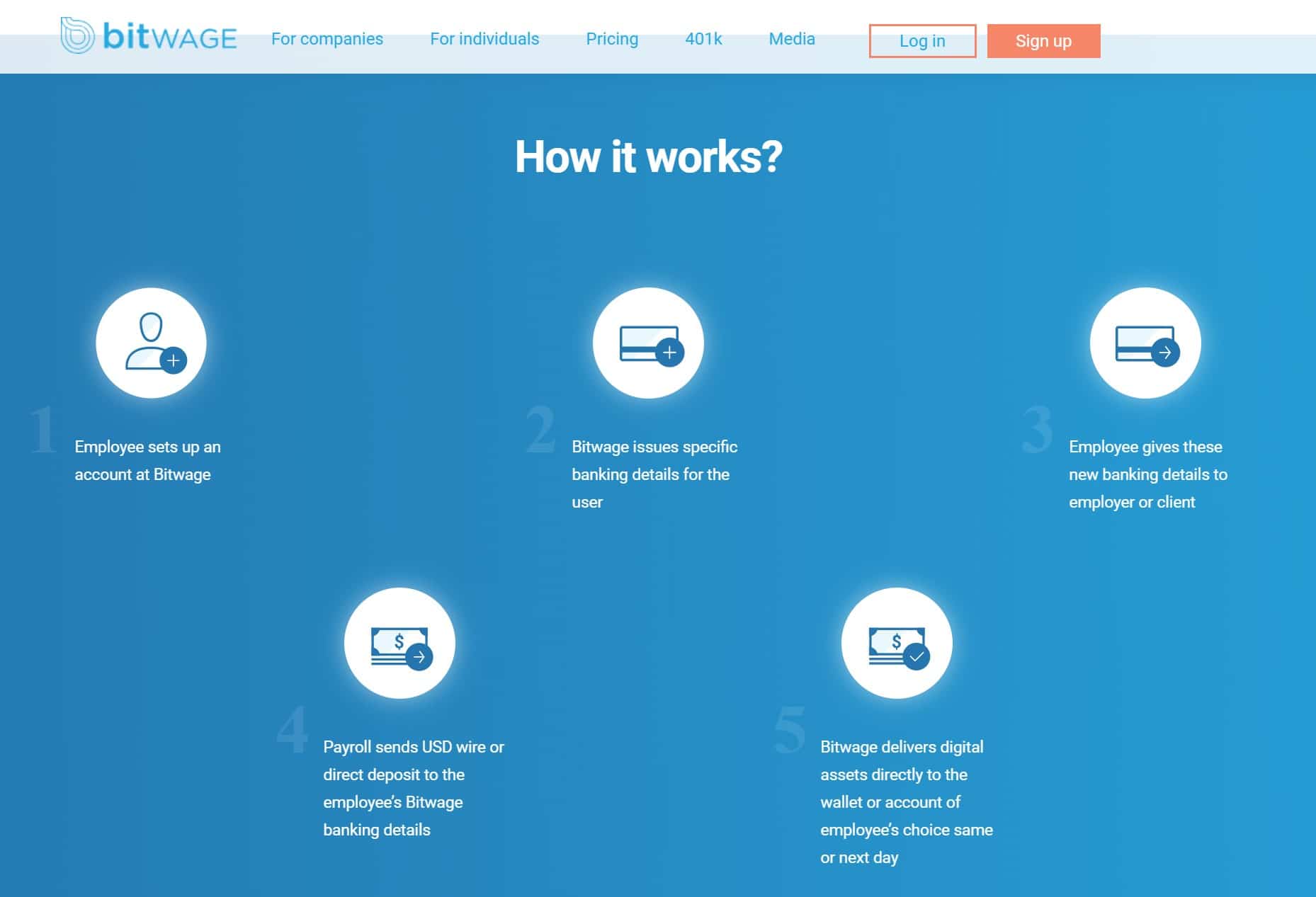

Bitwage offers crypto salary services for both individuals and companies looking to pay or get paid in crypto. Here is a look at the easy 5 step process for individuals looking to get paid in crypto with Bitwage:

Image via bitwage.com

Image via bitwage.com This is an ideal solution for companies who want to pay their staff and freelancer salaries in crypto, and for individual contractors and freelancers who provide an invoice to clients and wish to receive their payments in crypto.

If you are lucky enough to find an employer that pays in crypto already, I would recommend signing up for an exchange that has a crypto debit card. For me, I am a fan of Crypto.com and their crypto debit card. When I was receiving my salary in Bitcoin, my company sent it to my Crypto.com Bitcoin address and from there I could just convert it to cash and spend away as needed, no bank required!

I must say… that felt great being able to completely eliminate my dependency on those dirty dastardly banks.

If you are in the market for a crypto card, I recommend checking out our article on the Top Crypto Debit Cards. If you prefer video format, Guy also has a great video on his top crypto card picks.

These are only a few of the dozens of crypto payment solutions available to individuals and companies, you could also look into Strike, Choice and BitPay. If I were US-based, I would definitely be looking into Strike. I am looking forward to Jack Mallers launching Strike's services globally.

If you have a job that you like and don’t want to sign up for some of these fiat to crypto payroll solution companies, you could also try taking a crack at convincing your employer to consider paying you in crypto. There are some advantages for employers paying in crypto such as:

- Saving on fees- Traditional fiat payroll systems have significantly higher fees on average than crypto payroll systems as there are fewer intermediary fees involved when dealing with crypto.

- Hiring companies such as Bitwage or Deel removes many of the headaches, compliance, and regulatory hurdles involved with payment solutions as they are a complete end to end crypto payment solutions.

- Companies offering to pay in crypto can attract top and unique talent from forward-thinking people seeking work.

- Paying international staff, contractors, and freelancers in crypto is instantaneous and significantly cheaper as you can completely avoid outdated, slow, and expensive international payment systems.

- Can have tax benefits for the employer.

Though as we all know, the compliance and regulatory issues around cryptocurrencies are complex and changing all the time, so before you convince your boss to pay you in Bitcoin it is best that they speak to an accountant and assess the feasibility of paying salaries in crypto in their jurisdiction.

Closing Thoughts

I know it sounds like there are a lot more cons than pros in terms of receiving a salary in Bitcoin, but it all comes down to your lifestyle, financial obligations and circumstances.

And I can’t help but realize the irony in the fact that the biggest risk in earning your salary in Bitcoin is a problem that was created by the traditional financial system in the first place that Bitcoin is meant to save us from.

What I mean is that we know that the majority of the population is struggling financially. Much of the world has no access to a banking system at all, and those of us in the west have been stuck in a growing issue of our debts increasing while inflation is outpacing our income, which leaves the majority of the people in the west living paycheck to paycheck and drowning in debt, which makes having money in a volatile asset much riskier than it should be.

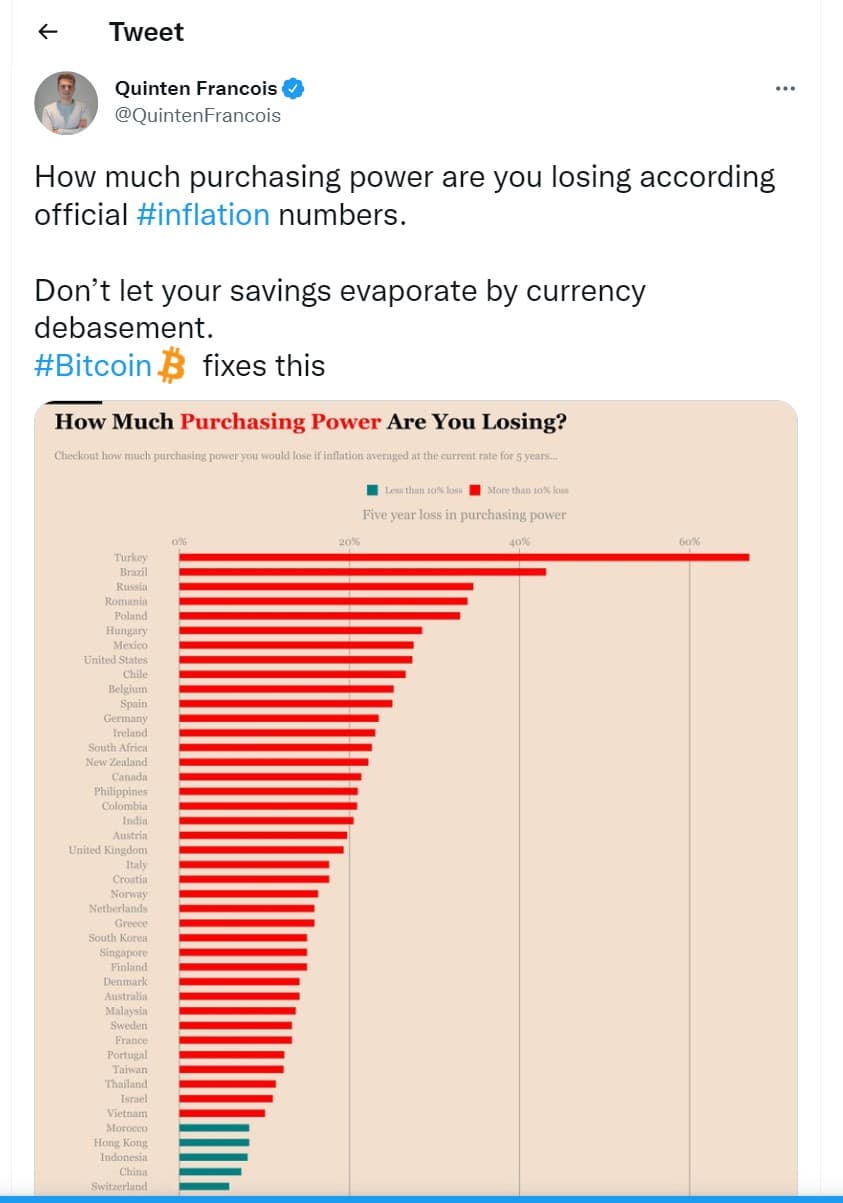

Image via Twitter/Quinten Francois

Image via Twitter/Quinten Francois For a deep dive into how we have gotten into such a financial mess, I recommend checking out our article on the feasibility of adopting Bitcoin as a world reserve currency, it’s a doozy.

It is these reasons that Bitcoin has become so popular, as digital assets are THE thing that can get us out of this hole that the legacy financial system has dug us into with their irresponsible monetary and fiscal policy that is causing gross amounts of inflation while encouraging irresponsible levels of over-borrowing.

That is why I almost always feel that exposure to Bitcoin is a good thing. It is the best chance we have at reaching financial freedom to escape this mess, but it is the mess that we are in that makes acquiring Bitcoin that much harder. When people need to decide whether to buy food, pay rent, or buy Bitcoin, crypto comes low on the priority list even though it is needed now more than ever.

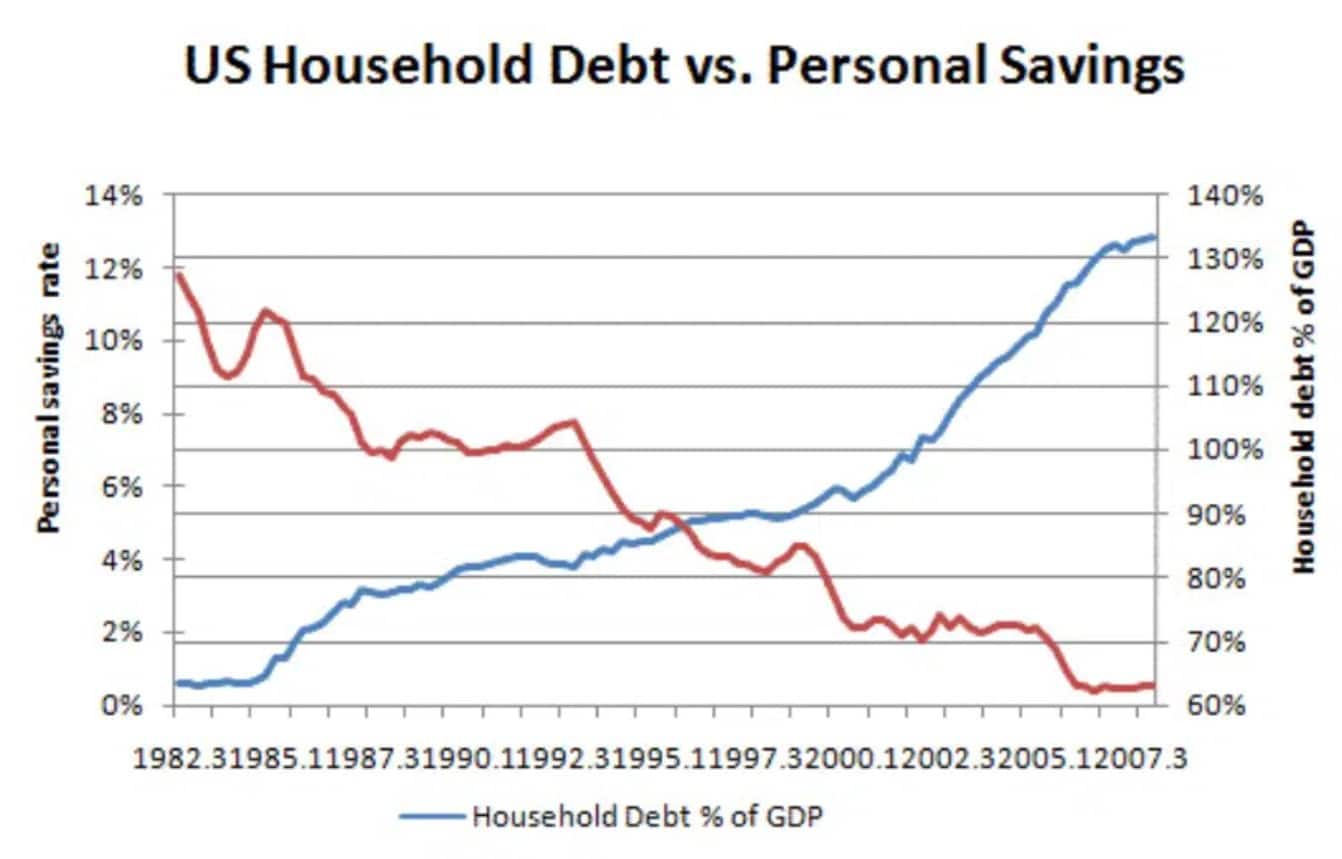

A Look at How Average Debt is Increasing vs Savings Image via creditwritedowns

A Look at How Average Debt is Increasing vs Savings Image via creditwritedowns It is the fact that many of us find ourselves in a struggling financial situation that makes earning your total salary in a volatile asset not ideal. If your bank balance is often in the red with your expenses outpacing your earnings, then finding any money to put into crypto is tough and can also be risky as you cannot afford to be holding an asset that can drop further without risking failing to meet financial obligations. You don’t want to end up like this guy:

Image via happyix.com

Image via happyix.com Fortunately, with the crypto payment solutions mentioned, customers can choose to only convert a fraction of their salaries into crypto, so if you work out that you consistently save about 5% of your paycheck, for example, you could consider having 1-2% paid into crypto and dollar cost average into it every month.

This can help to ensure that you are still able to cover your expenses and build up your emergency stash in cash while still stashing some funds away in a long-term store of value asset like Bitcoin.

Making the choice to convert some of your salary into crypto isn’t permanent either. You can always give it a try, dip your toes in only converting a small percent each month and you can change your mind at any time. Nothing is set in stone.

So, to summarize everything covered here today: Earning your entire salary in crypto may not be for everyone unless you are in a healthy financial position or understand the risks involved and have contingency plans. Know that there are options to convert a small amount of your salary into crypto so it doesn’t have to be all or nothing.

Also, understand that there is a learning curve and extra steps that need to be taken as the world isn’t quite set up for crypto payment solutions just yet, but this is changing, so crypto to fiat gateways and payment options need to be set up before taking this plunge.

If you are a believer in crypto for the long term, choosing to convert even a little bit of your salary is better than nothing, and your future self will likely thank you for it. Alternatively, you don’t need an automatic payroll solution either. If at the end of the month, you have a few extra bucks kicking around, you can always save that up and just buy your own crypto only when, and if, your financial situation deems fit.