Welcome to this insightful exploration into the ever-evolving world of cryptocurrencies, where innovation and novelty never cease. In this piece, I aim to share a curated list of the best new coins and promising new crypto projects (as well as some underrated established projects) that have captured my interest. These tokens represent a spectrum of groundbreaking ideas and technological advancements in the blockchain domain. However, it's crucial to acknowledge that this list is far from exhaustive.

The cryptocurrency space is a hotbed of innovation, with new projects emerging regularly. Thus, while highlighting specific tokens piqued my curiosity, I encourage you, the reader, to delve deeper and discover more gems in this dynamic landscape.

It's essential to clarify that the information provided here is purely educational and informational. The intention is not to offer financial advice but to present an overview of these new cryptocurrencies, each with unique value propositions and potential impacts on the blockchain ecosystem. As these tokens are relatively new, they have yet to face the multifaceted and volatile nature of crypto markets across multiple cycles.

The world of cryptocurrency is a testament to human ingenuity and the relentless pursuit of innovation. Each token listed here has a story, a purpose, and a potential that makes it noteworthy. But remember, the field is vast, and what's covered here is just the tip of the iceberg. Remember that exploring cryptocurrency is a personal and ongoing journey as you read through the piece. The tokens I find fascinating are shared with the hope that they will ignite your curiosity and inspire you to explore further, uncovering the vast potential and diversity of the cryptocurrency world.

Celestia (TIA)

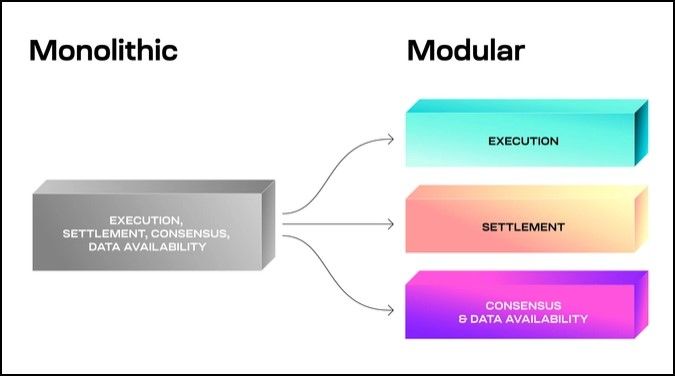

Celestia is a groundbreaking blockchain framework that introduces a modular data availability layer. This layer addresses a significant challenge in blockchain development: bootstrapping a decentralized and secure validator network for data availability and consensus. Instead of building this infrastructure from scratch, new blockchain projects can utilize Celestia to "rent" the necessary data availability capacity, simplifying launching a new chain.

Celestia Modular Blockchain Framework | Image via Celestia

Celestia Modular Blockchain Framework | Image via CelestiaA standout feature of Celestia is its support for sovereign rollups. These unique rollups can set their execution rules independently, unlike Ethereum rollups, which must adhere to the Ethereum Virtual Machine's (EVM) regulations. This independence allows for greater flexibility (like the ability to fork) and innovation in blockchain development.

Utility of TIA Token

The TIA token is integral to Celestia's ecosystem, serving multiple purposes:

- Data Availability Payment: Chains integrated with Celestia use TIA to pay for the data availability space they utilize, making TIA essential for the operation of these chains.

- Consensus Participation: TIA holders can engage in Celestia's Proof of Stake (PoS) consensus process, contributing to network security and decision-making.

- Staking and Governance: Besides securing the network, staking TIA enables token holders to participate in Celestia's governance, influencing the platform's development and future direction.

- Demand Correlation: As more networks adopt Celestia for data availability, the demand for TIA will likely increase, reflecting its value in the ecosystem.

Where to Buy TIA

TIA tokens are accessible through various platforms:

- Wallets: Keplr Wallet, Cosmostation, Leap Wallet, and Ledger Wallet support TIA, providing secure storage options for users.

- Centralized Exchanges (CEXs): TIA is available on major exchanges like Binance, Coinbase, Kraken, and OKX, making it easily accessible to a broad audience interested in participating in the Celestia ecosystem.

These avenues offer users multiple options to acquire TIA tokens, whether they prefer the security of hardware wallets or the convenience of centralized exchanges.

Sui Network (SUI)

Sui is a new smart contract-capable layer 1 blockchain built on the Move language, distinguishing itself with rapid transaction times due to its parallel execution capabilities. The platform has gained significant traction, with its Total Value Locked (TVL) surpassing $600 million, ranking it among the top 10 DeFi ecosystems.

Sui is a New Smart Contract-Capable L1 Blockchain Built on the Move Language. Image via Sui

Sui is a New Smart Contract-Capable L1 Blockchain Built on the Move Language. Image via SuiSui has seen significant funds moving from Ethereum through the Wormhole cross-chain protocol, indicating a solid adoption curve. It hosts various applications across DeFi, NFTs, and gaming, further evidencing its growing ecosystem.

SUI Token Utility

The SUI token serves multiple essential functions within the Sui network:

- Network Consensus: It is used for staking and facilitating network consensus. The network operates a Delegated Proof-of-Stake (DPoS) consensus mechanism, where SUI token holders can delegate their tokens to validators to secure the network and earn rewards.

- Gas Fees: SUI pays transaction fees (gas) in the Sui network.

- Governance: SUI holders can participate in network governance.

With Sui achieving up to 120,000 transactions per second and its parallel transaction execution, the utility and demand for SUI tokens are poised to grow as the network's adoption increases.

Where to Buy SUI

SUI is accessible through many platforms:

- Centralized Exchanges: It is available on every major centralized exchange, including KuCoin, OKX, and Bybit. Binance also had a significant staking event for farming SUI tokens, highlighting the token's accessibility and popularity.

- On-chain: Additionally, the Sui network supports the Wormhole bridge, facilitating the use of stablecoins from Ethereum to acquire SUI tokens on-chain, enhancing its liquidity and ease of access for a broader user base.

Sui's innovative approach, leveraging parallel transaction execution and the Move programming language, alongside its strategic partnerships and integrations, positions it as a significant player in the blockchain space. Its rapid growth in TVL and diverse application across various sectors underscore its potential for continued adoption and utility enhancement for the SUI token.

If this piques your interest, check out the Sui network review on Coin Bureau.

Ethena Stablecoin (USDe)

Ethena is pioneering a new approach to stablecoins with its synthetic dollar, USDe. Unlike traditional stablecoins, USDe is non-custodial, censorship-resistant, and crypto-native, offering a unique alternative in the digital currency landscape. Enabled by Ethena Labs, USDe leverages advanced financial strategies, including hedging the delta of spot assets backing the token during its minting process to achieve price stability. This innovative method aims to ensure stability and reliability in the volatile world of cryptocurrency.

Ethena is Pioneering a New Approach to Stablecoins With its Synthetic Dollar. Image via Ethena

Ethena is Pioneering a New Approach to Stablecoins With its Synthetic Dollar. Image via EthenaUtility of USDe

USDe stands out in the stablecoin market with a unique issuance design that subjects it to several benefits:

- Scalability: It is efficiently scalable since it is collateralized with Ethereum and ETH derivative positions.

- Censorship resistance: USDe is separated from the banking system, placing it outside the purview of traditional financial institutions and regulators, allowing it to operate in a trustless environment on the blockchain.

- Impressive Yields: A standout feature of USDe is its impressive yield offering of 33.3% APY on USD, a rate that's remarkably high compared to other stablecoins. This yield is driven by USDe's backing through Ethereum and ETH derivatives, capitalizing on the liquidity and market presence of one of the most traded and widely held assets in DeFi.

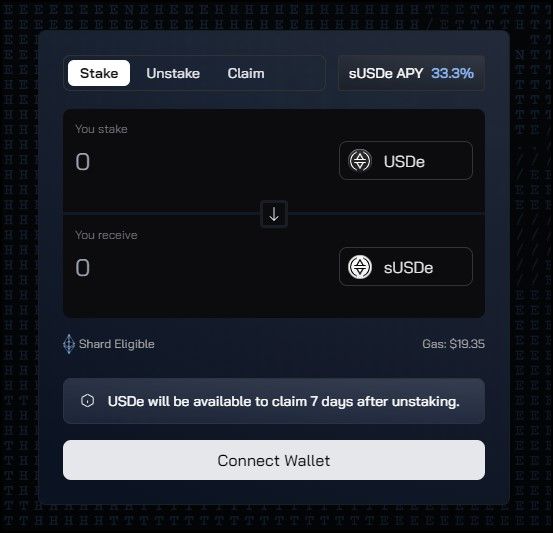

Ethna Staggering Returns | Image via Ethena App

Ethna Staggering Returns | Image via Ethena AppWhere to Buy USDe

Currently, USDe is available on on-chain platforms such as Uniswap and Curve, catering to users who prefer decentralized trading environments. For those looking to engage more deeply with the Ethena ecosystem, staking USDe to receive sUSDe is an option, offering additional rewards and benefits. By participating in this way, users can contribute to the ecosystem's liquidity while earning returns, enhancing the overall utility and appeal of USDe within the Ethena platform.

Ordinals (ORDI)

ORDI, a token within the Bitcoin network, leverages the Ordinals protocol, which introduced a novel method of inscribing data directly onto individual satoshis, Bitcoin's smallest units.

The Taproot upgrade facilitated Ordinals project development, which enhanced Bitcoin's scripting capabilities and privacy features, enabling more complex data types and smart contract-like functionalities to be built on Bitcoin. The first set of ORDI tokens was minted using this protocol, marking each satoshi with unique data and transforming them into non-fungible assets. This innovation represents a significant step forward in utilizing Bitcoin's blockchain for more than just financial transactions, opening up new avenues for digital ownership and asset representation.

What is the Utility of ORDI?

The primary utility of ORDI lies in its application within the NFT space, representing a unique convergence of Bitcoin's security and the burgeoning world of digital collectables. Each ORDI token, tied to a distinct satoshi, can represent various forms of digital assets, making them uniquely identifiable and tradable on the Bitcoin network.

The introduction of ORDI has broadened the scope of Bitcoin's utility, enabling it to host a variety of digital assets, including art, collectables, and other forms of media. Additionally, the limited supply of ORDI, mirroring Bitcoin's capped supply of 21 million, adds a scarcity aspect to these tokens, potentially enhancing their value and appeal as collectable items or investments.

Where to Buy ORDI

ORDI tokens are accessible on prominent cryptocurrency exchanges such as Binance, OKX, KuCoin, Bybit, and Gate.io. These platforms provide a marketplace for buying, selling, and trading ORDI, allowing users to engage with this new asset class within the Bitcoin ecosystem.

The availability of ORDI on these major exchanges not only underscores its growing popularity and acceptance but also facilitates liquidity and price discovery for interested participants in the cryptocurrency market.

Jupiter (JUP)

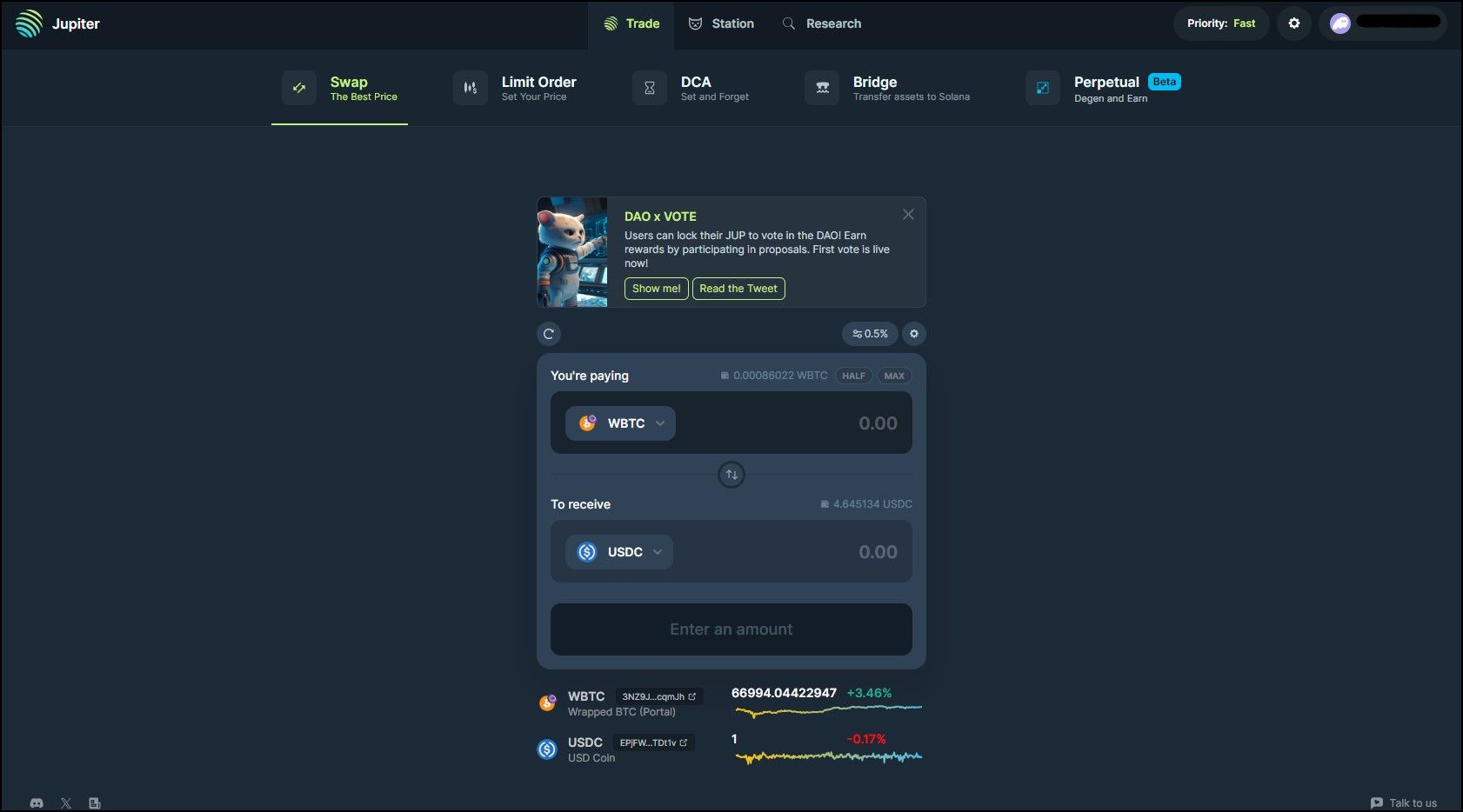

Jupiter is a new crypto project marking itself as a leading decentralized exchange (DEX) liquidity aggregator and perpetual exchange on the Solana blockchain. It offers a comprehensive suite of DeFi services and amalgamates liquidity from various DEXs across Solana to provide users with the best possible token swap rates.

Since its inception, Jupiter has processed a substantial trading volume and conducted millions of swaps, illustrating its widespread adoption and efficacy within the Solana ecosystem. The platform's array of services includes token swaps, limit orders, perpetual futures, dollar cost averaging, cross-chain bridging, and the creation of new tokens.

Jupiter is a Leading DEX Liquidity Aggregator and Perpetual Exchange on Solana. Image via Jupiter

Jupiter is a Leading DEX Liquidity Aggregator and Perpetual Exchange on Solana. Image via JupiterJUP Token Utility

The JUP token is pivotal to Jupiter's ecosystem, serving as a governance token that empowers its community. Token holders can influence the platform's direction by voting on various aspects, such as liquidity plans, token issuance, and projects within the ecosystem. This participatory governance model ensures that Jupiter's development is aligned with its community's interests, enhancing the platform's decentralized nature.

Additionally, JUP's introduction followed a significant airdrop, distributing a large portion of its supply to the community, fostering widespread token distribution, and engaging a broad base of users in its governance processes.

Where to Buy JUP

JUP tokens are available for trading on major centralized exchanges (CEXs) such as Binance, OKX, KuCoin, Bybit, and Gate.io, providing various avenues for interested investors and users to acquire and trade JUP. Additionally, within the Solana ecosystem, JUP can be traded on DEXs like Orca and Raydium, offering users flexibility in how they choose to engage with the token.

Mantle Network (MNT)

Mantle Network is an Ethereum Layer 2 (L2) solution designed to enhance scalability, reduce latency, and lower gas fees, thanks to its modular architecture and a proprietary data availability layer called MantleDA, powered by EigenDA. By optimizing these aspects, Mantle Network aims to provide a more efficient and cost-effective platform for decentralized applications and users, addressing some of the main challenges faced by the Ethereum blockchain.

Mantle Aims to Provide a More Efficient and Cost-Effective Platform for DApps. Image via Mantle

Mantle Aims to Provide a More Efficient and Cost-Effective Platform for DApps. Image via MantleMNT Token Utility

- Governance Role:

- $MNT token holders can participate in DAO voting.

- Each token provides equal vote weight, ensuring democratic decision-making.

- Influences the governance and future direction of the Mantle Ecosystem.

- Utility Functions:

- Utilized for transaction gas fees on the Mantle Network.

- It can be used as collateral for participating nodes on the network.

- Supports network security and incentivizes user participation.

- Tokenomics:

- Functions as an ERC-20 token with advanced functionalities on Layer 1.

- Layer 2 version operates as a standard bridge-wrapped ERC-20 token.

- No significant vesting schedules align with Mantle ecosystem's governance proposals.

- Treasury and Circulation:

- $MNT held in the Mantle Treasury is considered out of circulation until governed otherwise.

- Token distribution from the treasury follows a strict governance-led process.

- The Mantle Core Budget funds are allocated for ongoing development and adoption phases.

Where to Buy MNT

$MNT tokens can be purchased on decentralized and centralized exchanges like Uniswap, ByBit, and KuCoin. These platforms provide accessibility to the token, allowing users to engage with the Mantle Network's offerings and participate in its governance.

Manta Network

Manta Network is a unique blockchain ecosystem specializing in zero-knowledge (ZK) applications, operating across two distinct networks:

- Manta Pacific: L2 ecosystem on Ethereum

- Manta Atlantic: ZK L1 chain on Polkadot.

The network has attracted investments from notable funds like Binance Labs and Polychain Capital. Manta Pacific, built as an L2 chain, focuses on facilitating the development of ZK-based applications, utilizing Celestia for data availability, while Manta Atlantic provides a ZK L1 solution on Polkadot, broadening the ecosystem's reach and functionality.

Manta Network Specializes in Zero-Knowledge Applications. Image via Manta

Manta Network Specializes in Zero-Knowledge Applications. Image via MantaMANTA Token Utility

$MANTA Utility on Manta Pacific:

- Value Accrual for Token Holders: Sequencer revenue and gas savings enhance the value for $MANTA holders.

- Builders and Contributors: Funding from on-chain activities and markets supports builders and contributes to the ecosystem's growth.

- Users and Community Members: Users benefit from ecosystem incentives, driving engagement and network growth.

- Revenue Generation: Demand for $MANTA block space generates revenue, with initial funding supporting the Manta Foundation and potential future funding directly benefiting the protocol.

$MANTA Utility on Manta Atlantic:

- Network Usage Fee: $MANTA is used for transaction fees, with a significant portion supporting ecosystem projects and network development.

- Medium of Exchange: Acts as the native currency within Manta Network, facilitating transactions and access to network services.

- Governance Rights: Token holders can influence network decisions, participate in governance, and contribute to the network's strategic direction.

- Network Security: $MANTA incentivizes collators for their role in maintaining network integrity and security.

Where to Buy MANTA

$MANTA tokens are available on various leading cryptocurrency exchanges, including Binance, HTX, ByBit, and KuCoin, providing ample opportunities for interested investors to engage with the Manta Network ecosystem.

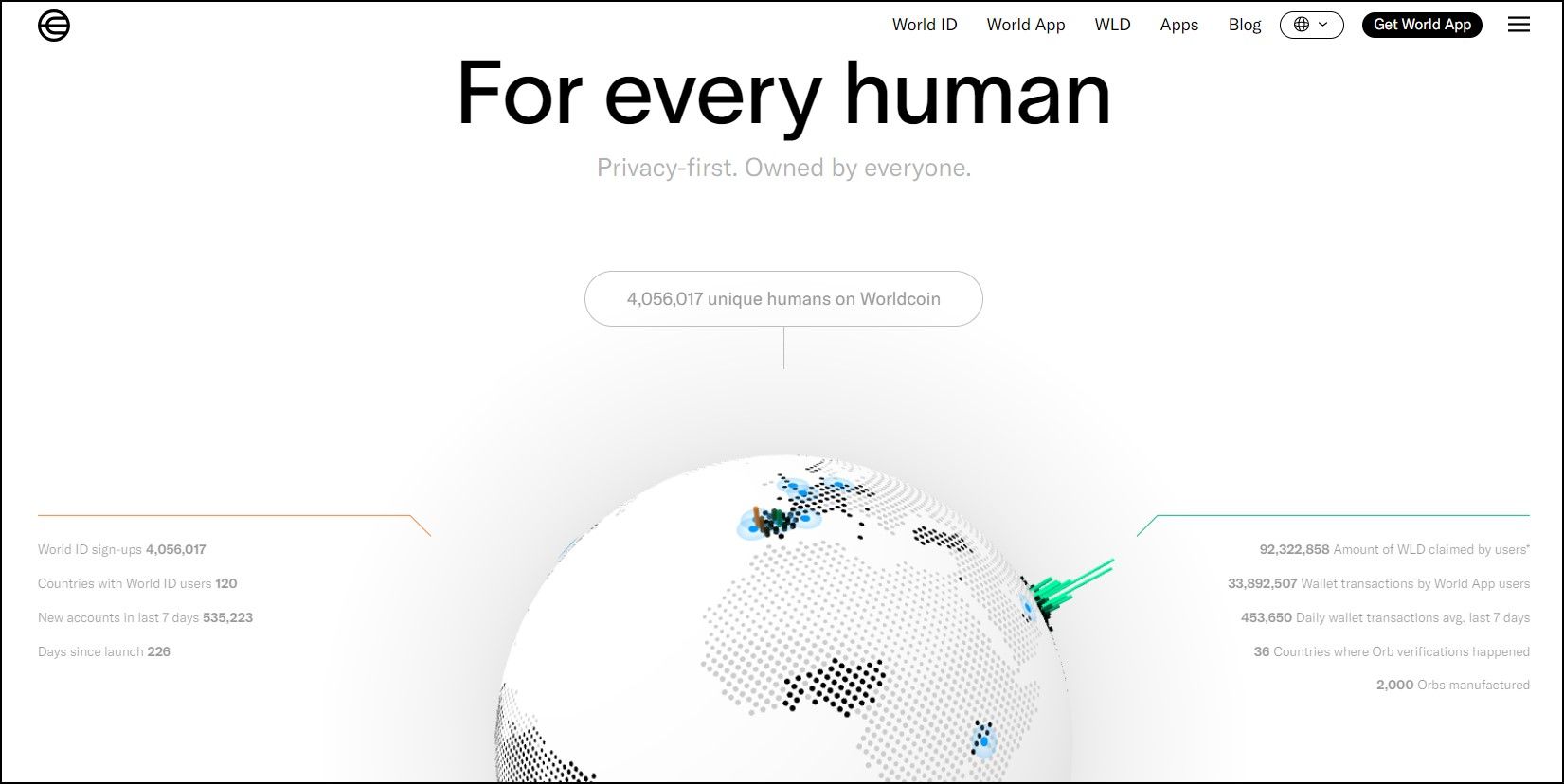

Worldcoin (WLD)

Worldcoin is a global cryptocurrency initiative aimed at distributing a new digital currency, WLD, to every person on the planet. It is distinguished by its use of a novel biometric identification system to ensure that each human being receives their share only once, promoting fairness and inclusivity in the cryptocurrency space. The project involves using an "orb," a device designed to securely confirm individual human identity without compromising privacy. Worldcoin's vision extends beyond merely creating a new crypto with potential; it aims to establish a foundation for a more inclusive global economy and to explore the potential for a new form of digital identity verification.

Worldcoin Aims to Distribute Its Native WLD Token to Every Person on the Planet. Image via Worldcoin

Worldcoin Aims to Distribute Its Native WLD Token to Every Person on the Planet. Image via WorldcoinWLD Token Utility

- Universal Basic Income (UBI): Worldcoin's distribution mechanism is often likened to a form of UBI, where WLD tokens are granted to individuals globally, aiming to provide financial inclusivity.

- Identity Verification: The unique biometric data collected can potentially create a new standard for secure and private identity verification across various platforms and services.

- Transactional Currency: WLD serves as a medium of exchange, enabling users to transact and engage in the digital economy with a universally accessible cryptocurrency.

Where to Buy WLD

WLD tokens can be acquired through participation in Worldcoin's unique distribution mechanism or traded on various cryptocurrency exchanges. WLD is also available on major exchanges like Binance, OKX, KuCoin, and Bybit.

Check out the full Worldcoin review on Coin Bureau.

Stacks (STX)

Stacks is a layer-1 blockchain solution designed to bring smart contracts and decentralized applications (DApps) to Bitcoin, enhancing its utility without altering its core features. By integrating with Bitcoin, Stacks aims to address scalability issues and expand Bitcoin's functionality with smart contracts. The network operates using a unique consensus mechanism known as Proof of Transfer (PoX), which connects the Stacks and Bitcoin blockchains. The recent Nakamoto hard fork in the Stacks network has further optimized its performance, offering faster transaction speeds and Miner Extractable Value (MEV) protection and reinforcing the security and reliability inherent to Bitcoin transactions.

Stacks is Designed to Bring Smart Contracts and DApps to Bitcoin. Image via Stacks

Stacks is Designed to Bring Smart Contracts and DApps to Bitcoin. Image via StacksSTX Utility

- Stacking: STX holders can lock up their tokens in the protocol to participate in Stacks block production and earn BTC in a process called stacking.

- Transaction Fees: STX is used to pay transaction fees within the Stacks network, facilitating various operations and interactions with smart contracts.

Where to Buy STX

STX tokens are widely available on major cryptocurrency exchanges, providing various options for interested buyers. You can purchase STX tokens on platforms like:

- Binance

- Coinbase

- OKX

- Bybit

- KuCoin

- Kraken

These exchanges offer accessibility to STX, enabling users to buy, sell, and trade the token, participate in the Stacks ecosystem, and utilize its unique features built on the Bitcoin network.

Check out the Stacks review on Coin Bureau.

Bonus: Upcoming Tokens I Am Excited About

Here are two upcoming token launches and most promising new cryptocurrency projects that I am excited for:

EigenLayer Token

In the realm of blockchain technology, EigenLayer stands out as a revolutionary project poised to redefine the landscape of decentralized networks. EigenLayer introduces a unique approach by enabling the reuse of already staked assets on existing blockchains to secure new and innovative protocols. This concept not only enhances the utility of staked assets but also fosters a more interconnected and efficient blockchain ecosystem.

The potential of EigenLayer is vast, aiming to address critical challenges such as scalability and security in the blockchain space. By leveraging the security of established networks, EigenLayer offers a platform for developing decentralized applications and protocols without the need for additional staking, thereby reducing entry barriers for new projects and accelerating innovation in the sector.

As EigenLayer progresses toward its token launch, the anticipation within the crypto community is palpable. The EigenLayer token is expected to play a pivotal role in this ecosystem, serving as a key component in the governance and operational aspects of the platform. The innovative use of staked assets to secure multiple layers presents a promising avenue for the future of blockchain technology, making EigenLayer a project to watch closely.

LayerZero Token (ZRO)

LayerZero stands at the forefront of cross-chain communication, certainly a new crypto to watch, aiming to bridge the isolated islands of various blockchain networks. By providing a protocol for decentralized applications to interact seamlessly across different blockchains, LayerZero is setting the stage for a more interconnected and unified blockchain environment.

The introduction of the LayerZero token is highly anticipated, as it is poised to play a central role in facilitating this cross-chain communication. The token is expected to be utilized within the LayerZero ecosystem for various purposes, including transaction fees, governance, and incentivizing network participants.

The potential impact of LayerZero is significant, as it promises to enable a new level of interoperability between blockchains, enhancing the overall functionality and reach of decentralized applications. The LayerZero token is not just a cryptocurrency but a key to unlocking a more integrated and efficient future for blockchain technology.

Both EigenLayer and LayerZero represent cutting-edge developments in the blockchain space, each with its unique approach to enhancing the ecosystem's capabilities. As these projects move closer to their respective token launches, the excitement within the crypto community is a testament to their potential to shape the future of blockchain technology.

Best New Cryptocurrencies: Closing Thoughts

As we explored the best new cryptocurrencies of 2024, it's evident that the landscape of blockchain and digital assets continues to evolve at a breakneck pace with new coins and new crypto projects. From the novel blockchain modularity design of Celestia to the intriguing data privacy solutions offered by Manta Network, each project brings a unique value proposition to the table. The anticipation around EigenLayer and LayerZero tokens further underscores the industry's move towards more interoperable and efficient blockchain ecosystems.

These tokens and networks represent just a glimpse into the burgeoning world of crypto innovation. While they have sparked my interest, the vastness of the crypto space guarantees that there are many more projects out there pushing the boundaries of what's possible. As we venture into this new era of digital finance, remember that the journey is as much about discovery as it is about investment.

Stay curious, stay informed, and, most importantly, navigate this ever-changing world with a keen eye on education and a cautious approach to the inherent risks and volatility of the crypto markets when trying to find new cryptocurrency projects.