Though fairly new and not even close to reaching its full potential, blockchain technology has already revolutionized the world in so many ways, even going as far as leading global economists to contemplate the possibility of a Bitcoin reserve currency.

Whether it's in the form of a decentralized Web 3.0, saving us from authoritative internet monopolies, decentralized finance saving us from the corrupt legacy financial system, sound money, saving us from inflation and the devaluation of fiat currencies, or providing a framework with the capabilities of advancing and saving the human race. Yes, crypto and blockchain technology wear a lot of different capes in terms of the potential it has for the betterment of humanity and even our planet.

Another way that cryptocurrencies have had a fundamental change that not many people think about or appreciate is the financial literacy and education it has provided to younger generations and folks not typically interested in finance.

Bitcoin is Striking an Interest in Finance Among Younger Generations Image via Shutterstock

Bitcoin is Striking an Interest in Finance Among Younger Generations Image via Shutterstock Ten years ago, it was not as common among younger people or even many average people to take much interest in their financial health, investments, monetary/fiscal policies, or macroeconomics as it is today. Traditional finance was often considered a rigged game only played by the wealthy, and many people felt it was either too complicated or quite dull and not worth exploring.

But with the popularity of assets such as Bitcoin and Ethereum becoming more mainstream, these have attracted tens of thousands of people who may not have taken an interest in financial topics prior.

For many, Bitcoin has acted as a rabbit hole. First intriguing people to learn more about what it is, then from there, they begin to understand the role it plays, and why it is needed, then the trail of breadcrumbs leads to learning more about the issues that exist within our current system and all the ways that Bitcoin and digital assets can revolutionize and overcome the overwhelming issues that exist within our society.

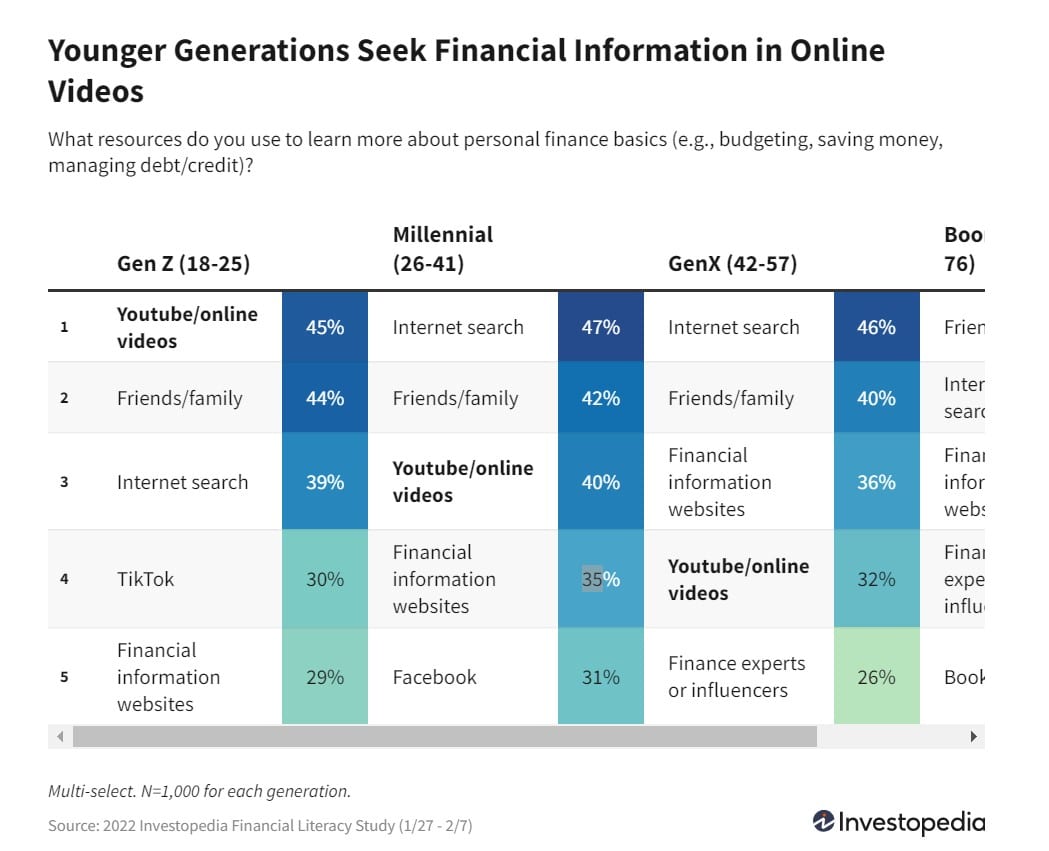

Investopedia Study States that Gen Z is far Ahead of Previous Generations in Terms of Financial Literacy Image via Investopedia

Investopedia Study States that Gen Z is far Ahead of Previous Generations in Terms of Financial Literacy Image via Investopedia There have been some interesting articles written, and studies conducted that highlight that the common consensus is that financial literacy is increasing among average people, and financial literacy rates are higher on average among crypto users.

In addition, search trends for things like “inflation” and “interest rates” are trending much higher on average than they were in years prior, showing that people are taking more of an interest in global monetary and fiscal policies, which I believe is part in thanks to people dipping their toes into crypto, then wanting to understand how these events will affect their holdings.

Some of the search terms that have been increasing since the adoption of Bitcoin have been around reserve currencies and whether or not it is possible for Bitcoin to someday become a global reserve currency. This is a fascinating topic that we are going to explore here today. But first, we need to clear up some misconceptions about reserve currencies.

Disclaimer: I hold Bitcoin as part of my personal investment strategy.

What are Reserve Currencies?

In your best impersonation of a southern United States accent, you might be thinking: “That’s easy! It’s the good ol’ ‘Merican Dollar, right? Uncle Sam’s greenback!”

Well, yes, and not quite. A reserve currency is simply any currency held in large quantities and maintained by central banks and other major financial institutions. These currencies are held on “reserves” ready to be deployed for investments, trade transactions, international debt obligations, or used to influence global exchange rates.

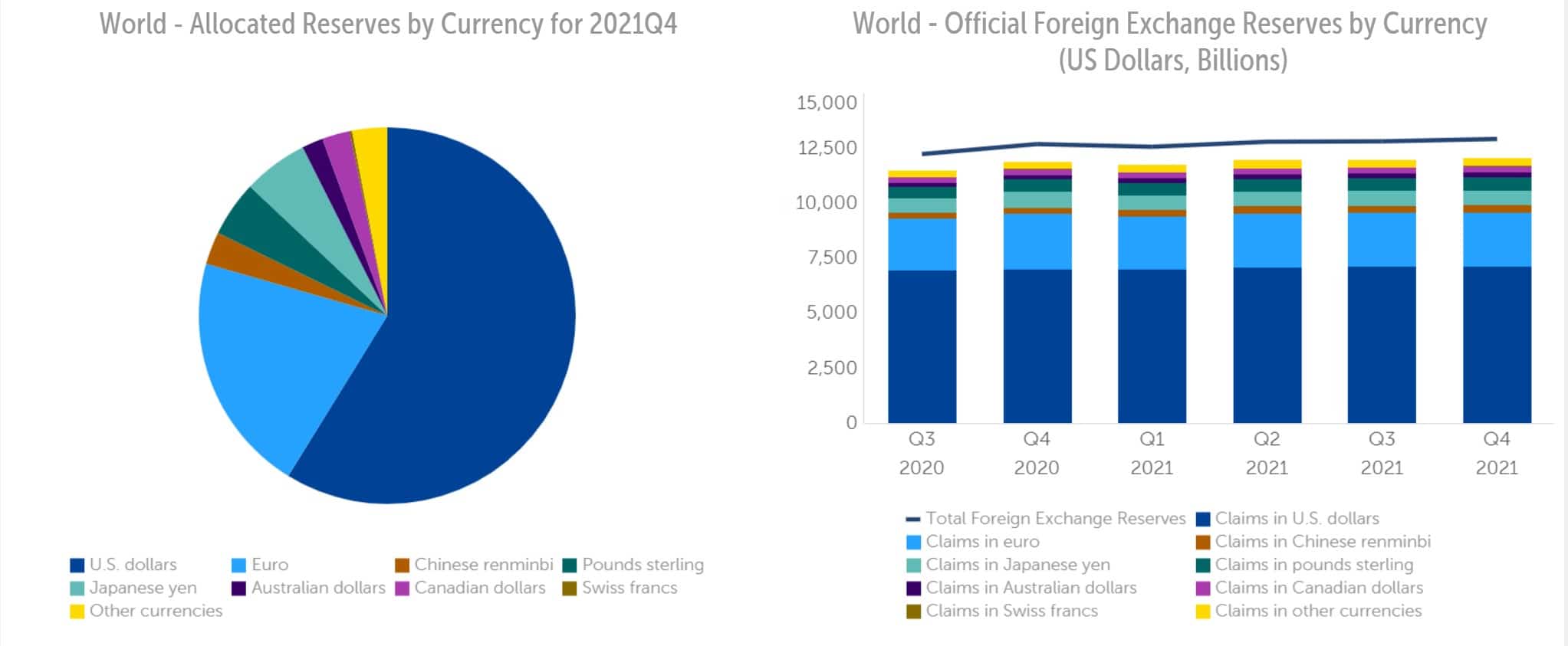

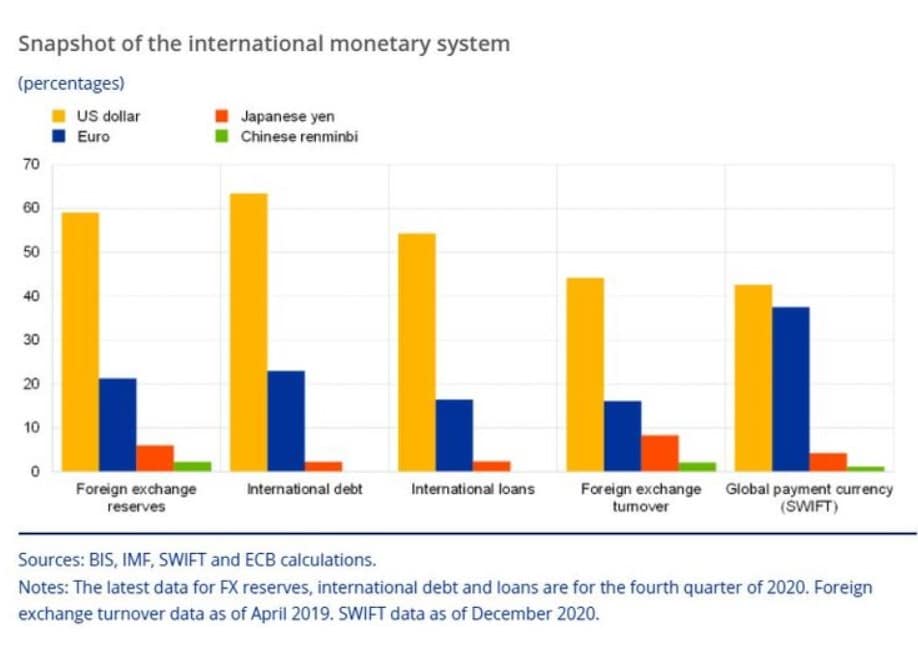

The U.S dollar is one of many reserve currencies currently held by central banks and is the largest one held by a large margin because many commodities such as gold and oil are priced in USD. By pricing commodities in USD, global central banks and governments need to hold substantial amounts of USD to pay for these commodities on the global market. Here is a look at the global reserve currencies held by global central banks in 2021.

Image via data.imf.org

Image via data.imf.org The graph shows that global fiat reserves are allocated as follows:

- United States Dollar= 58.81%

- Euro= 20.64%

- Japanese Yen= 5.57%

- Pounds Sterling= 4.78%

- Chinese Renminbi= 2.79%

- Canadian Dollar= 2.38%

- Australian Dollar= 1.81%

- Other= 3.01%

Central banks hold onto these currencies in reserves for these main reasons:

- To reduce exchange rate risk. Banks do not need to use current global exchange rates when tapping into their own reserves.

- To facilitate global transactions.

- To purchase goods priced in certain currencies, mainly USD.

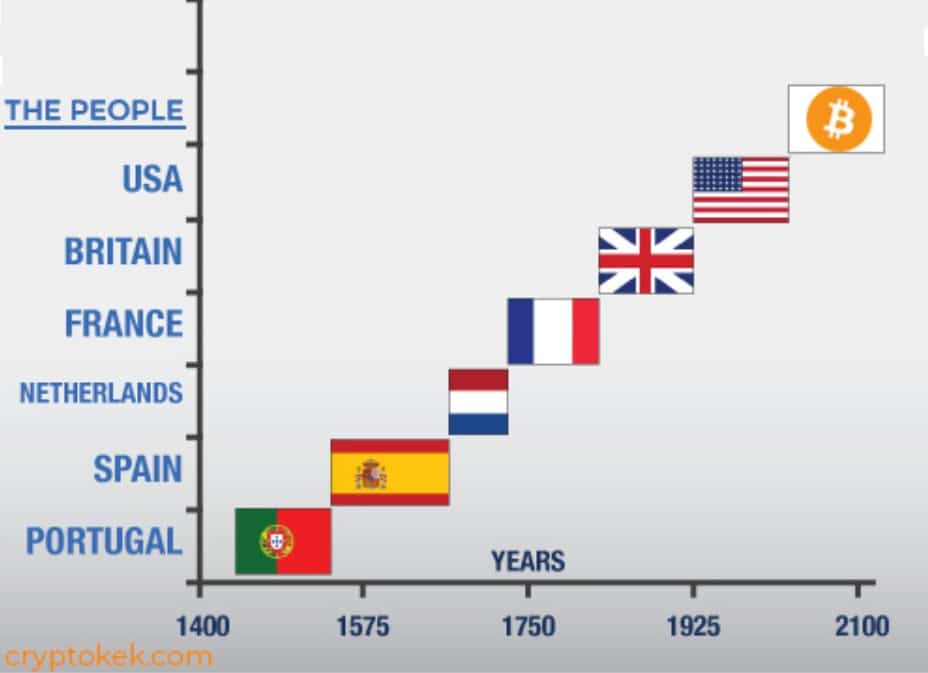

The history of world reserve currency dominance is also fascinating to look at. Long before the United States was founded, other countries held the title of issuing the primary reserve currency, dating back to the ancient Romans. The countries that held primary reserve currency status before the United States were:

- Rome: 1st (BCE)- 4th c.

- Byzantium: 4th- 12th c.

- Florence: 13th – 15th c.

- Portugal: 1450- 1530

- Spain: 1530- 1640

- Netherlands: 1640 – 1720

- France: 1720- 1815

- England: 1815 – 1944

- United States: 1944 – Current

Here is a cheeky timeline chart I found showing the lifespan of primary reserve currencies, Bitcoin added for dramatic effect.

Image via cryptokek

Image via cryptokek Interestingly, you will notice that dominant reserve currencies seem to have a life expectancy of around 100 years. While the figures show the U.S dollar as taking the title in 1944, many argue that this date should go as far back as the 1920s as the dollar was already the dominant global currency. If we go by that figure, the U.S dollar is nearing that 100-year shelf life, is time running out for the dollar?

Many economists agree that the United States Dollar has entered its “twilight years” and that it’s only a matter of time before the curtains close on its status as the global dominant reserve, as happened to all those that came before it. For example, Stanley Druckenmiller, who is known for being a legendary investor thanks to his study of history and macroeconomics, believes the USD will lose reserve currency status within the next 15 years, stating:

“I can’t find any period in history where monetary and fiscal policy were this out of step with economic circumstances, not one.”

- Stanley Druckenmiller

There are many factors and events that lead to the crumbling of a currency and losing reserve status, such as war, conquest, the formation of new alliances, and inflation. Later on, we will look at what toppled the first domino for the U.S dollar. These dominos are falling faster for the greenback, made exponentially worse by the irresponsible fiscal policy regarding money printing and inflation in the United States.

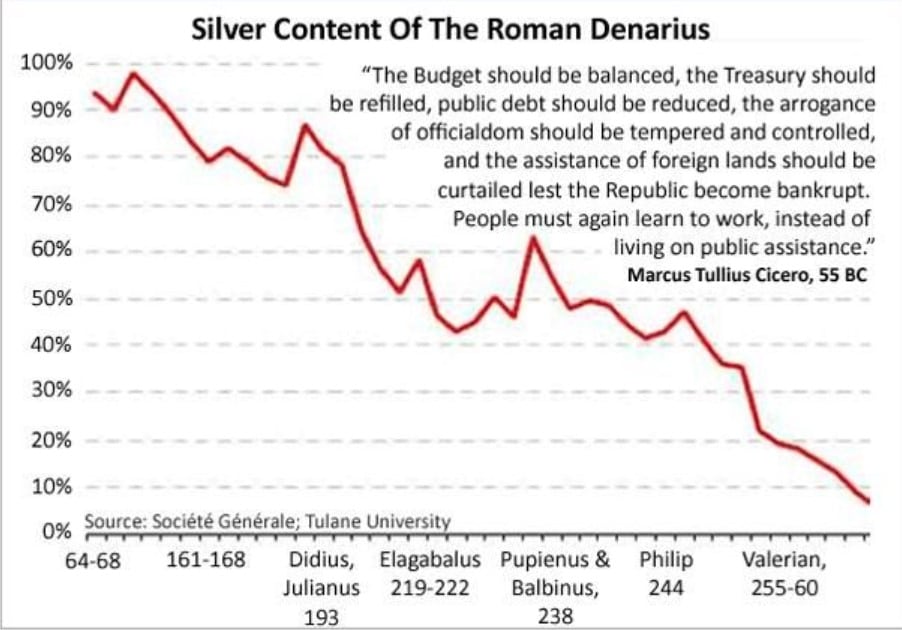

Interesting Fact: Did you know that one of the major factors contributing to the fall of the Roman empire was excessive money printing and inflation? Well, by “money printing,” what I mean is they continually lowered the amount of silver in the Denarius coin that gave it value so more coins could be pumped into circulation, which was their version of printing money. That sure sounds familiar. You’d think today’s governments would have learned from their mistakes.

Take a look at the statement made by Marcus Tullius Cicero in 55 BC. This is no different to many of the conversations still happening today. Notice the similarities between this chart and the similar devaluation of the U.S Dollar and British Pound charts that we will look at later.

Image via Business Insider

Image via Business Insider So, we know what reserve currencies are and why they are needed. How did the U.S dollar become so dominant?

U.S Dollar Dominance

To understand the U.S dollar’s journey to becoming the world’s dominant currency, we need to start way back in the dark years of World War 1.

Image via historyhit.com

Image via historyhit.com Running out of money and desperate to defend their countries and continue the war effort, allies turned to the United States for aid, paying the U.S. for much-needed supplies in gold. This led to the States becoming the largest holder of gold in the world, gold which would back the dollar's strength for years to come. It's quite an interesting story, but this isn't history class, so let's skip ahead to WWII.

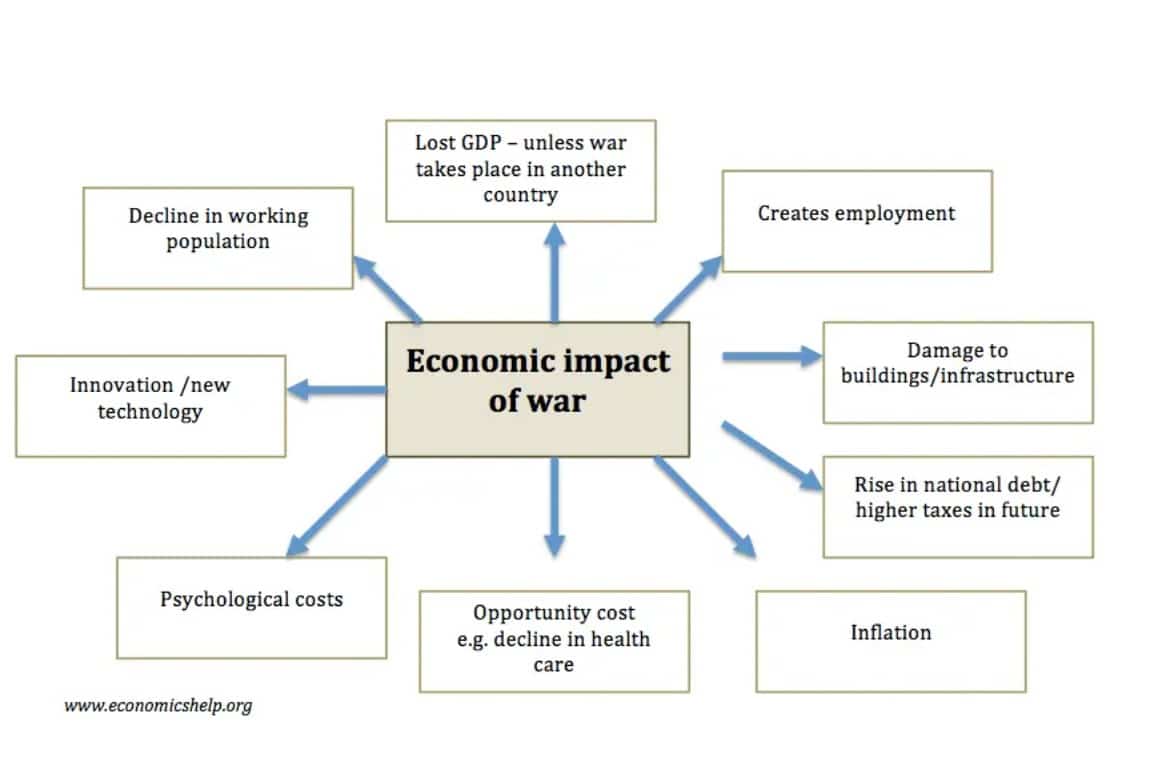

The United States emerged from the ashes of World War II with the strongest economy still intact. Not only was the economy intact, but they were the only country actually thriving post-war. Much of Europe, the U.K., Japan, and Russia had spent nearly everything they had to fuel the war effort, a war which left hundreds of their cities destroyed along with their abilities for industrial manufacturing, crippling their output capabilities. Here are some of the economic impacts of war; note the top centre one.

Image via economicshelp.org

Image via economicshelp.org By the middle of the second war, countries were already tapped for money as funding a war is an incredibly expensive endeavour. Moreover, European economies had still not fully recovered from the first world war, leaving many nations needing to borrow significant amounts of money from the United States.

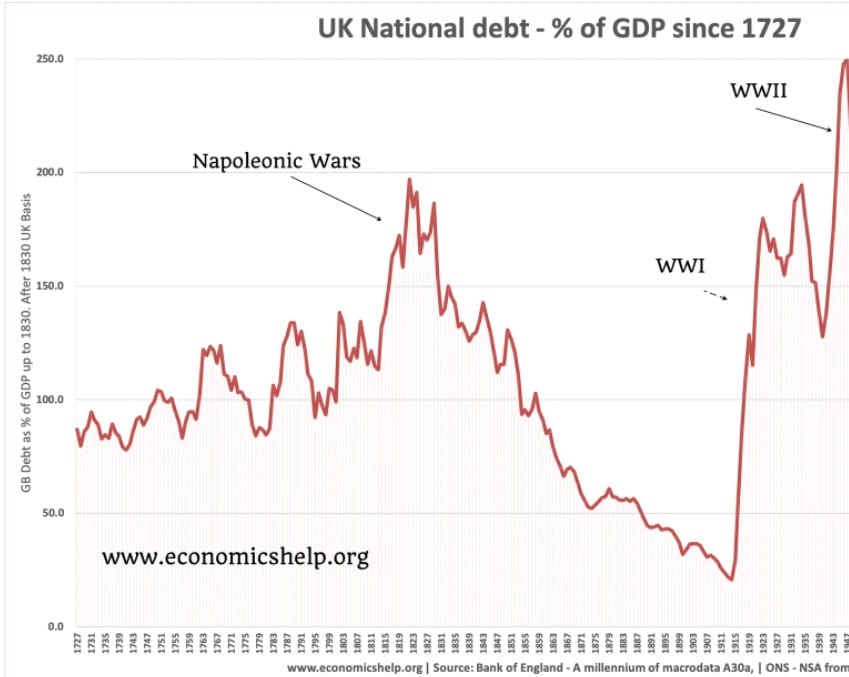

The Anglo-American loan, for example, was a loan from the United States to the United Kingdom for a whopping $3.75 billion at an interest rate of 2% to help the UK continue the fight. Countries were also left with very little funds post-war to rebuild their ravaged countries and sought financial aid to help in their recoveries. Here’s a look at the severity of the UK’s national debt increase as they had to find a way to fund two world wars and rebuild post-war.

Image via economicshelp.org

Image via economicshelp.org After the war had ended, the States were sat on a comfy cushion of cash, the largest pile of gold in the world, and a robust economy, partly thanks to their position as the world’s leading creditor during the war and partly due to an incredibly impressive home front effort to industrialize the nation during the war. During the war, the American home front effort is often cited by historians as one of the most successful mobilization efforts of a united people in history.

This momentous effort was sparked years prior by the New Deal Program signed by Franklin Roosevelt. The New Deal Program already saw a strengthening American economy, then with soldiers returning home post-war and entering the job market, along with the introduction of the G.I. Bill of Rights; this was like adding jet fuel to American industry, causing unemployment rates to plummet and the economy to thrive.

America used their new economic power to promote more spending and, therefore, more growth. America shifted from a wartime economy to a consumerist economy that was unattainable by the rest of the world, who were left reeling from the war, further launching the United States to the top spot on the economic podium.

Roosevelt signs the G.I Bill 1944 Image via Wikipedia

Roosevelt signs the G.I Bill 1944 Image via Wikipedia The American economy was enjoying unrivalled strength. At one time, the U.S Gross Domestic Product (GDP), a measure of total output from a country, represented a staggering 50% of the entire world’s economic output! So it made sense that the U.S dollar would become the global currency reserve. When world leaders from 44 countries met in 1944 for the Bretton Woods Agreement, adopting the U.S dollar as the official reserve currency was the only logical choice.

Meeting for the Bretton Woods Agreement Image via Britannica

Meeting for the Bretton Woods Agreement Image via Britannica The Bretton Woods Agreement solidified the U.S dollar as the primary reserve currency. The countries who participated in the agreement pegged their exchange rates to the U.S dollar, which was backed by gold. Because gold-backed dollars were considered stable, other countries could stabilize their currencies as well.

The Dollar Ditches Gold

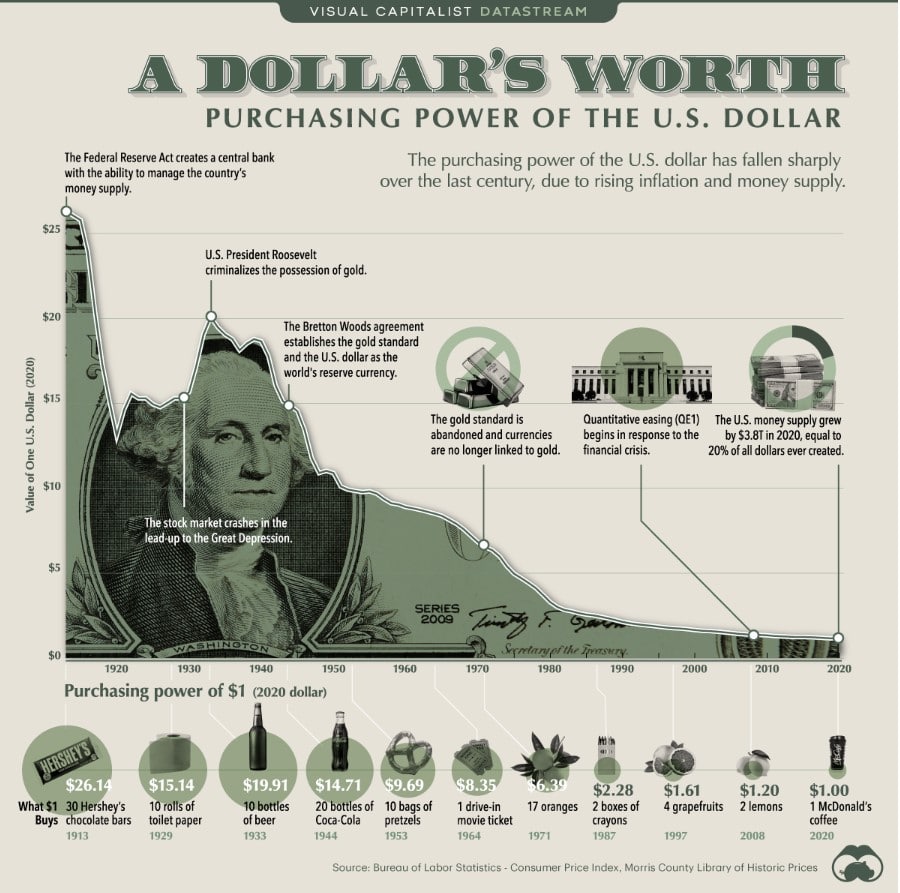

Come 1971, the U.S dollar did not glitter, nor was it gold. As the United States escalated money printing to fund the war in Vietnam, countries became cautious about America’s excess printing and spending. As a result, nations started converting their dollar reserves into gold at an accelerated pace. This mass exodus from the U.S dollar to gold was so severe that President Nixon was encouraged to step in and decouple the dollar from the gold standard, which led to the floating exchange rates that are in place today. This sparked the decades-long decline of the U.S dollar that is easily seen today.

Image via visual capitalist

Image via visual capitalist Though no longer backed by gold, the U.S dollar would remain the world’s primary currency reserve simply because countries had already accumulated so much of it, and it remained the most stable and liquid form of exchange. After ditching gold, the U.S dollar was backed primarily by U.S Treasuries, which are seen as the most stable paper asset.

The Decline of the Dollar and the Rise of Bitcoin

Alright, so we know that the Dollar started its decades-long decline with no signs of recovery after being removed from the gold standard in 1971. Many believe that the U.S dollar may have eventually been able to recover if it were not for two black swan events that drove the final nails into the coffin for not only the United States fiat system but global fiat systems. If you are new to the concept of the end of modern fiat systems, I recommend the following resources to learn more:

- Read: The Death of Money: The Coming Collapse of the International Monetary System by James Rickards

- Watch: End of the Road: How Money Became Worthless- ENDEVR Documentary

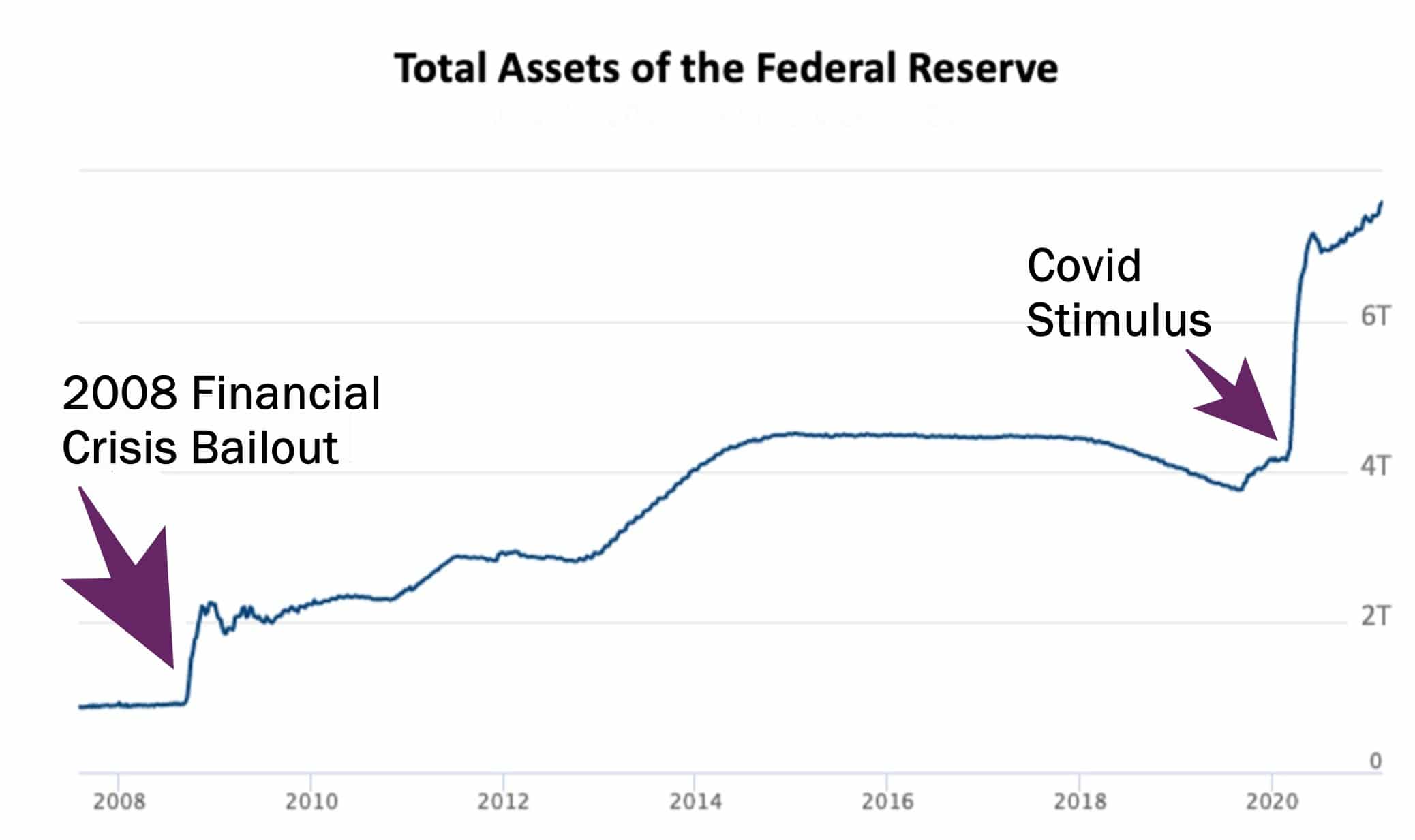

The 2008 financial crisis forced the Fed to hit the switch on the most extensive fiscal stimulus package ever seen prior to covid. First, the U.S government committed a total bailout of an insane $7.77 trillion to rescue the financial system, then just 12 years later, due to the pandemic, the Fed pumped another $9 trillion (and counting) into the U.S economy to stimulate it after lockdown measures were put into place. There is just no recovery from such excess printing.

Image via federalreserve.gov

Image via federalreserve.gov With everything that has happened since 1971, the financial crisis, the economy damaging lockdowns, the irresponsible monetary and fiscal measures deployed regarding low-interest rates which promote over-borrowing, and now the high levels of inflation, that is a recipe for a bad economic cocktail anyway you look at it, which has accelerated the Dollar’s journey on the road to ruin.

Much of this next part is pure speculation on my part. None of this can be “known” for certain. Still, there are topics that are being hotly debated among politicians, economists, central banks, and historians alike today. These topics revolve around the question: How much time can the U.S dollar keep its faltering stranglehold on world reserve status?

Another Look at the Dominance of USD in the International Monetary System Image via longfinance.net

Another Look at the Dominance of USD in the International Monetary System Image via longfinance.net We have already seen moves from many countries to “de-Americanize” or “de-dollarize,“ which is the act of removing themselves from U.S dollar dependency. The most dramatic act was seen with El Salvador’s adoption of Bitcoin as legal tender.

In addition, Argentina and Paraguay have used Bitcoin to settle export deals traditionally done in USD, Venezuela has turned to Bitcoin for domestic and global trade, Malaysian officials are trying to spark legislative action to adopt Bitcoin, Chile is introducing non-USD backed investment instruments to entice investors, and there are large movements allegedly underway in Central and South America to become crypto-friendly.

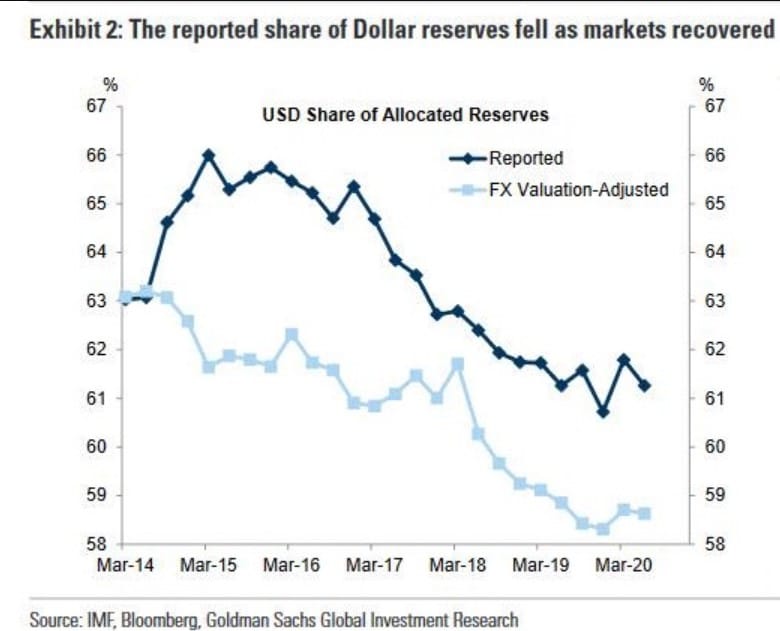

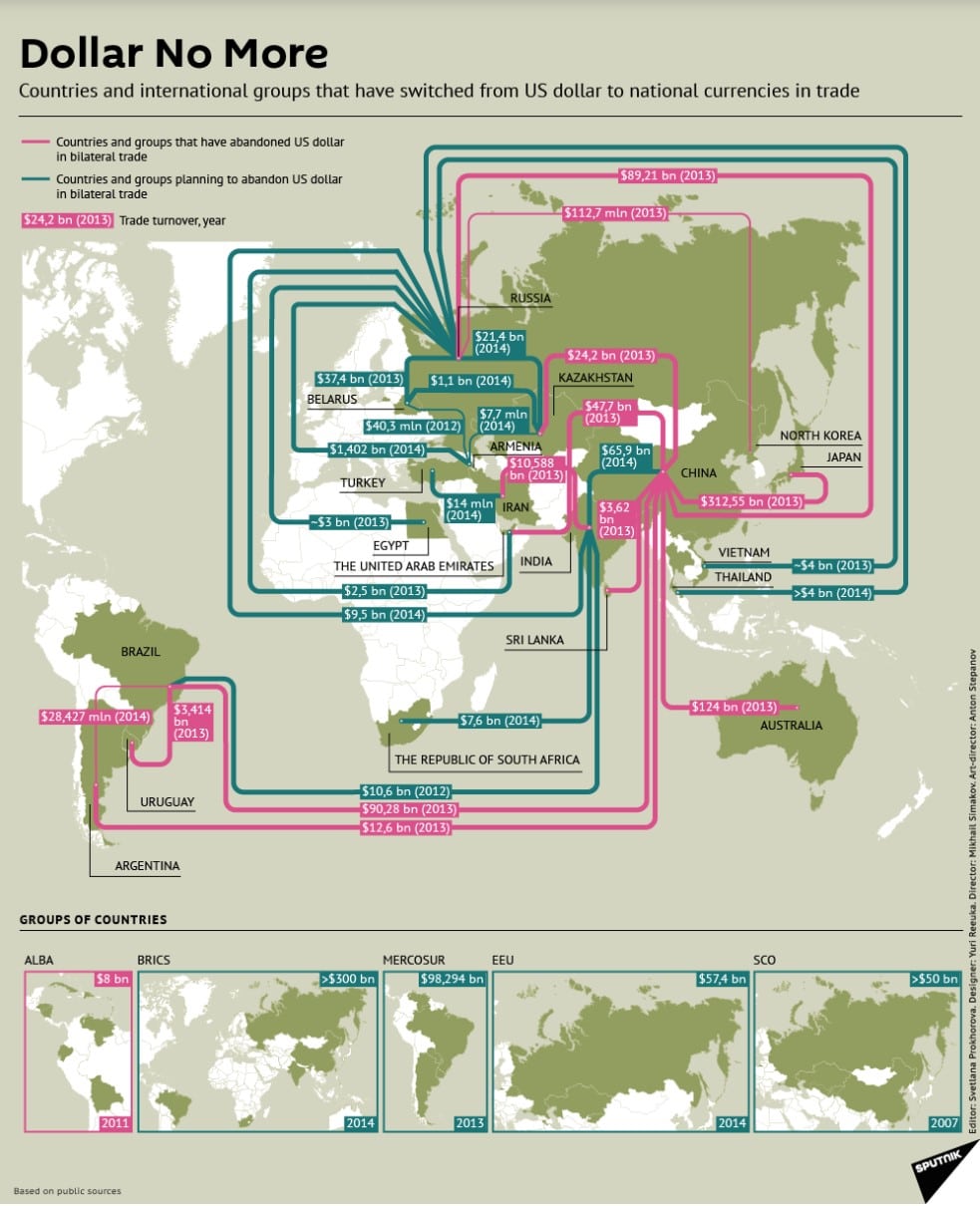

Here is a look at the de-dollarization trend since 2014:

Replacing the USD as the Global Reserve Currency

In 2009, China made a proposal to global governments to move away from the U.S dollar as the global reserve currency, imploring that the world should replace the U.S dollar as the international reserve currency with a basket of global currencies that would be controlled by the international monetary fund (IMF).

And before you start thinking that the only countries wanting to reduce their reliance on the U.S dollar are those unfriendly to the States, think again.

In 2010, a report by the United Nations called for the abandonment of the U.S dollar as the single primary reserve currency. Then, in 2019, Bank of England Governor Mark Carney showed frustration about the disproportionate amount of power that the dollar gives to the U.S. This statement was supported by allies Germany and many other countries in the European Union. A proposal was put forth to adopt an alternative payment system. Despite these efforts, little progress has been made in this regard.

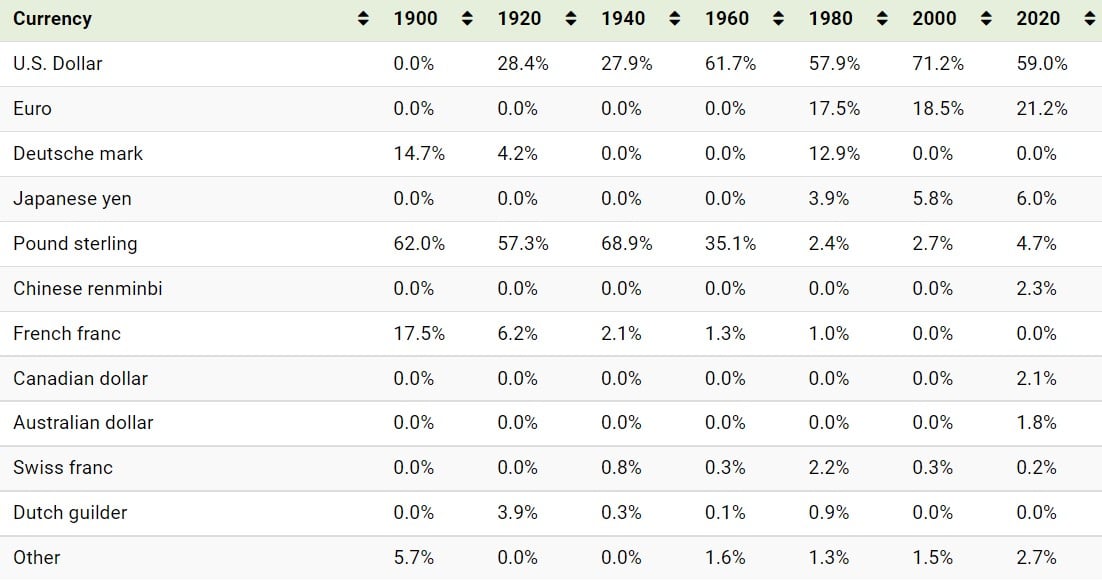

There has been a steady decline in the interest of global countries to hold the U.S dollar since the collapse of the Bretton Woods Agreement. In recent decades, strong currencies like the Euro, the Yen, and others have slowly chipped away at the U.S dollar's dominance. Here is a look at how reserve currency allocations have shifted from 1900 to 2020:

Image via Visual Capitalist

Image via Visual Capitalist One of the most impactful moves in this direction has been the recent formation of the Asian Infrastructure Investment Bank (AIIB). This China-led initiative looks to rival the World Bank and IMF. The AIIB involves 57 founding countries and has over $100 billion in capital. The United States was not invited to this party and is actively lobbying its allies to not join due to governance issues.

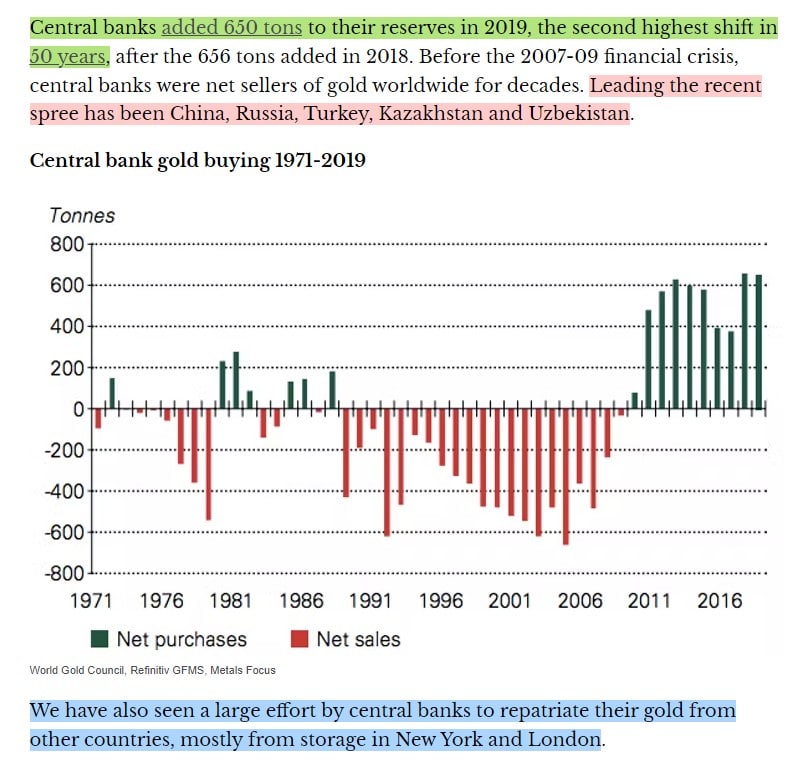

Interesting Fact: Russia and many other nations have been stockpiling gold for years. Russia now holds more gold than the United States for the first time as part of its effort to de-dollarize. Looks like Russia may have been anticipating the dollar's fall from reserve currency status for a long time. Amidst the Russia-Ukraine conflict, Russia has also announced the acceptance of cryptocurrency for commodities in an attempt to further reduce its dependency on the dollar.

Image via Bloomberg

Image via Bloomberg This trend has undoubtedly concerned the International Monetary Fund (IMF), which has been pushing an agenda to bring in new while keeping existing countries in a western dominated banking system and is avidly anti-crypto due to being incredibly bullish on the USD.

Strong evidence of this is evident with their recent bribe... I mean "financial support" to Argentina, which came with the terms and conditions discouraging crypto usage. The IMF has recently released a paper titled "The Stealth Erosion of Dollar Dominance," which is worth reading if you want to dive deeper into this topic. Interestingly, nowhere do they state anything about crypto playing a role in this trend. Hmmm, almost like they don't want to direct attention to the fact that crypto is playing a role in the fall of dollar dominance.

Erosion of the U.S Dollar Paper Image via IMF.org

Erosion of the U.S Dollar Paper Image via IMF.org The paper released by the IMF goes into deep levels of detail regarding many other factors attributing to the decrease in dollar dominance, such as global imports decreasing and governments looking to diversify, I won’t bore you with. Still, one thing that did catch my eye is in the fifth part, which is all about the rise of “non-traditional” currencies taking the place of USD on central bank’s balance sheets.

This section starts with the crazy statistic that the dollar value of non-traditional currencies on central bank balance sheets has exploded from $30 billion in 1999 to over $1.2 trillion as of 2022. That is a whopping 20X! Non-traditional currencies now make up for around 10% of bank balance sheets. The paper breaks down the amounts of these non-traditional currencies that have been being accumulated as follows:

- Chinese Renminbi- 25%

- Canadian Dollar- 23%

- Australian Dollar- 20%

- Swiss Franc- 2%

- Other- 29%

Russia has been the most vocal about de-dollarizing for a long time, years before the current Ukraine conflict and sanctions that are now crippling its economy. Russia has even put forth global de-dollarization campaigns, accusing the States of abusing their control over the dollar.

The desire to move off the U.S dollar has become so strong that in 2009, China and Russia came together and called for a new global currency. They campaigned to world leaders and plead to the IMF to create a new reserve currency that would replace the dollar and create a currency that was disconnected from individual nations. (Sounds like Bitcoin!)

The IMF's reluctance to compromise may turn out to be a mistake as countries appear to have taken matters into their own hands in this regard. For example, Russia has recently announced that they are happy to now accept Bitcoin for oil, and here is a look at bilateral trade agreements between countries who have chosen to trade outside the dollar:

Image via Visual Capitalist

Image via Visual Capitalist To quote Bob Dylan, “The times, they are a-Changin.”

National Fiat Currencies = Huge Conflict of Interest

But this trend leaves a heck of a conundrum, if not the United State's dollar, then whose? Although many feel that China has already made its powerplay move to take up the mantle by creating its digital Yuan Central Bank Digital Currency (CBDC), we know that Russia is also working on their own CBDC. So will America play ball, scrap the current dollar and replace it with a digital alternative?

The problem with any national currency being used as a global reserve currency is that the country now has too much power and authority over other countries. We have witnessed this countless times when the United States has used its influence to bully other countries into submission. Many countries have spoken out over the years in protest of how the U.S "weaponizes the dollar," another factor contributing to why governments are keen to reduce their dependency on it.

Image via The Hill

Image via The Hill To highlight the point of U.S economic and diplomatic power and how they use their power to enforce agendas, any wire transfer that involves U.S dollars, which is about 88% of them as most commodities are traded in dollars, needs to be cleared by a U.S bank before they can be settled.

The U.S government can quite easily mandate U.S banks to freeze these payments if they choose, which is one of the ways the United States can enforce economic sanctions, and how they have managed to cripple the Russian economy in a matter of days in the current Ukraine conflict.

I am not here to state that anything that has been done regarding sanctions has been right or wrong; just saying that this has been a massive global wakeup call to just how quickly and easily the U.S can damage foreign economies if they do something that the States does not like. This only accelerates the trend of global central banks reducing their dollar dependency and cashing out USD for gold, and hopefully Bitcoin soon.

Image via theconversation.com

Image via theconversation.com Troubles regarding having one nation holding the primary reserve currency were predicted dating back to the original Bretton Woods Agreement. In 1959, Yale professor Robert Triffin met with the Joint Economic Committee and said the Bretton Woods system was doomed to fail.

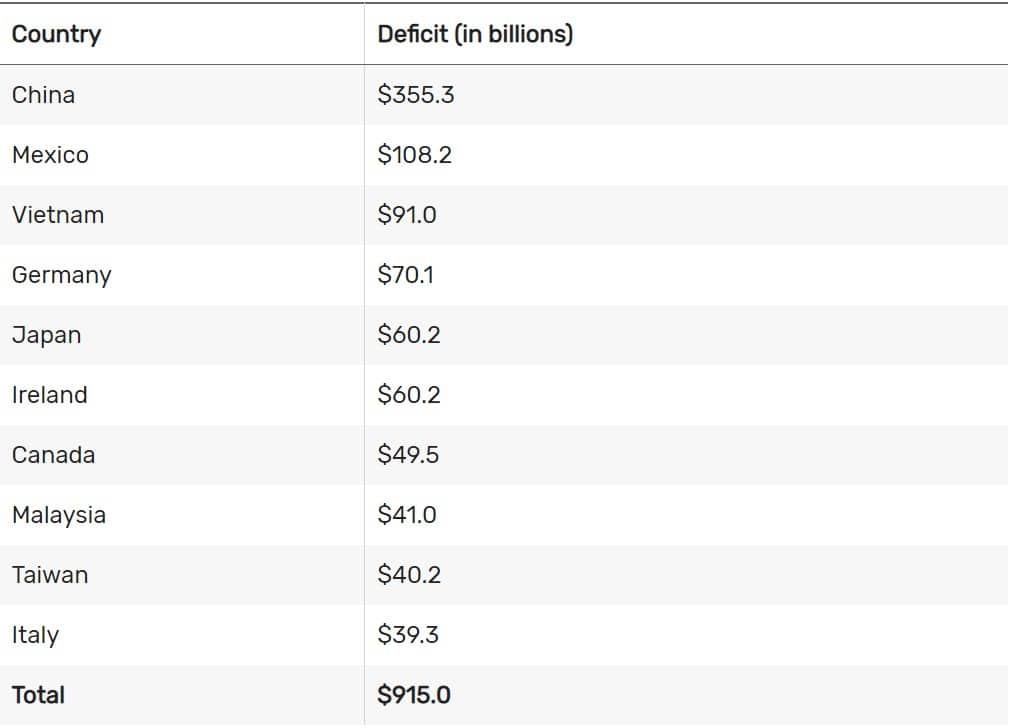

Triffin understood that the conflict of interest would lead to trade deficits and tensions between nations and that America’s national policy and the global monetary policy would not be able to find balance, and it appears that he was correct. Humans are selfish and tribal creatures, after all, one cannot expect that we will always do what is best for our own nation while simultaneously being able to do what is best for foreign nations; one is bound to come out on top more often than not.

Robert Triffin was a brilliant man, and his prediction about trade deficits also became true. America has been running the world’s largest trade deficit since 1975, with the current trade deficit sitting at $859 billion. I am no economist, heck, I would probably fail a high school math test if I had to take one today, but even I know that these numbers are not sustainable. To put this into context, here is a look at how other countries’ trade deficits compare to the States:

America Has Nearly as High a Trade Deficit as These Nations Combined Image via The Balance

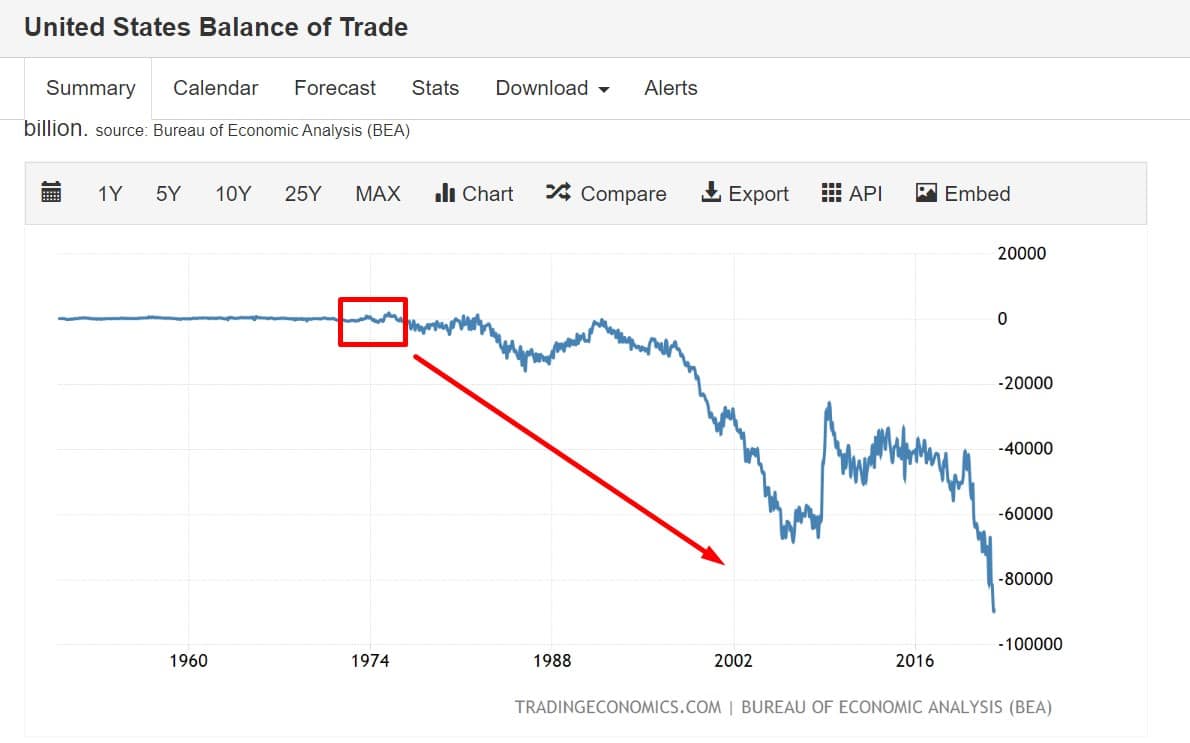

America Has Nearly as High a Trade Deficit as These Nations Combined Image via The Balance For another perspective, take a look at what happened to the U.S trade deficit as soon as the Dollar moved off the gold standard:

Image via tradingeconomics.com

Image via tradingeconomics.com So, within a few short decades, America has managed to have the highest level of government debt in the world, has gone from being the largest creditor nation in the world to being the largest debtor nation, and also has the highest trade deficit. Couple that with the dramatically devaluating currency, and you know that bad cocktail recipe I mentioned earlier? Not even a fancy little cocktail umbrella can make this drink any better now.

Bitcoin Reserve Currency: Is BTC the Answer?

The weaponizing of currency and the totalitarian style of authority it gives governments are some of the reasons that many feel that Bitcoin should take the place as the world reserve currency as it is not owned by anyone, it levels the playing field and has less of an impact in raising the strength of one country while suppressing another. But there is another glaringly obvious advantage.

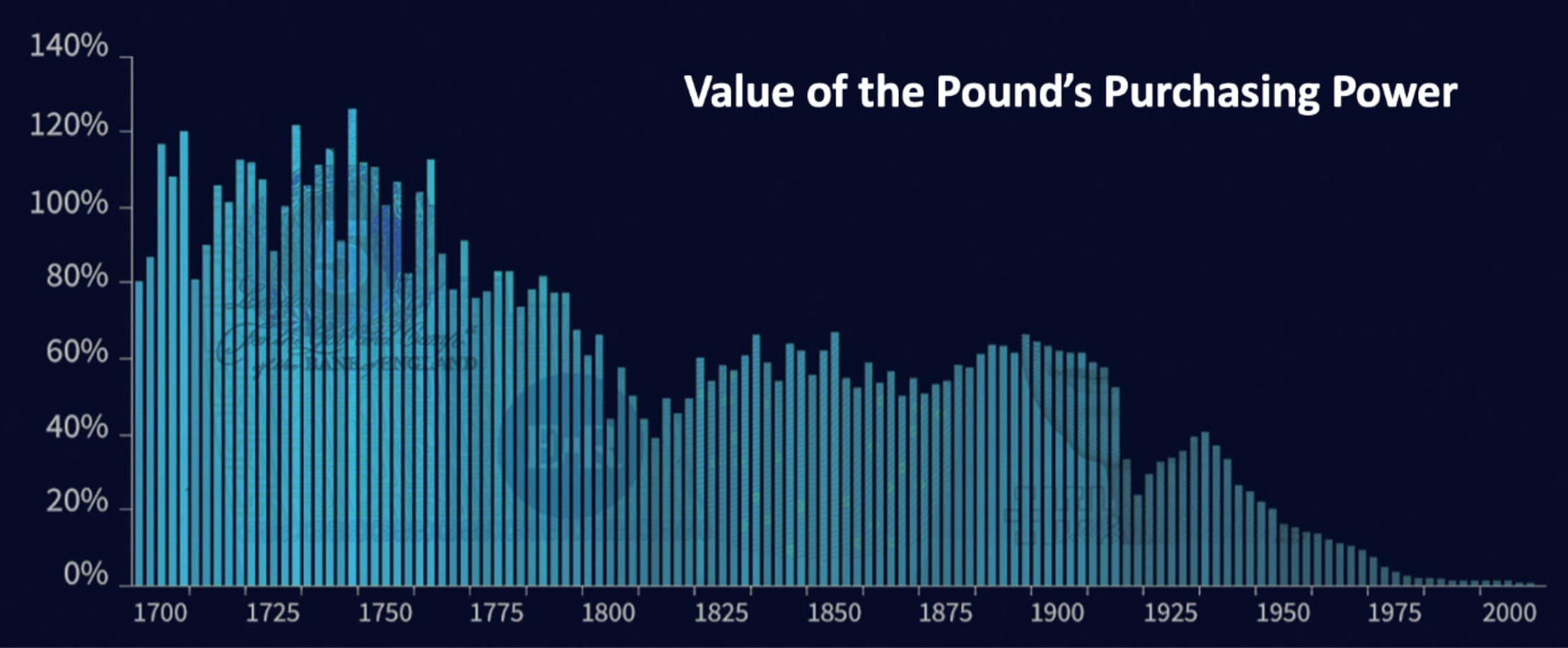

Every fiat currency that has ever existed has failed, and all the ones that exist today have lost significant purchasing power over the years, which means that it is only a matter of time until they fail as well.

The British Pound, for example, is the most successful currency that humanity has ever created. It holds the title of being the longest currency ever in use at 326 years. But even our most “successful” currency has lost an astounding 99.5% of its purchasing value over its lifetime, and we already looked at the decline of the U.S dollar earlier.

Image via blog.bitstocks.com

Image via blog.bitstocks.com That is why the concept of “sound money” has been so intriguing and desirable, something that hasn’t been realistically attainable or possible until the creation of Bitcoin. The Sound Money principle is just one of the many reasons that MicroStrategy’s Michael Saylor refers to Bitcoin as the “apex property of the human race.”

One of my favourite quotes from Saylor states:

“Bitcoin is property rights. It’s technology to deliver property rights to eight billion people for the first time in the history of the human race and that’s life, liberty, and property.”

- Michael Saylor

Saylor explains that half the world doesn’t have any hope of accumulating property, while the other half has their property at risk. Bitcoin is a technology that gives everyone a right to their own personal sovereignty and their own property.

Image via Shutterstock

Image via Shutterstock If you are new to Bitcoin or need a recap, here is a quick summary of what makes Bitcoin superior to fiat currencies and gold:

- Capped supply of 21 million- meaning money printing and runaway inflation cannot happen.

- Can be sent anywhere globally within seconds to minutes for a fraction of the cost of fiat.

- Decentralized- Bitcoin is not subject to the arbitrary policies or needs of governments, third parties, or those with corrupt intent. Nobody can stop or control Bitcoin or Bitcoin transactions.

- Current global payment networks are a mess of complexity, incredibly inefficient, slow, and expensive.

- Bitcoin is more secure and transparent.

- Nobody owns the Bitcoin network, which therefore creates a more level playing field between countries, corporations, and people.

- Billions of dollars worth of Bitcoin can be transported on something as small as a USB device, or mobile phone, making it ultra-portable. The same cannot be said of gold or cash.

- The Bitcoin network can be used for so much more than just using Bitcoin as currency, there are endless possibilities to leverage the network itself for the betterment of humanity.

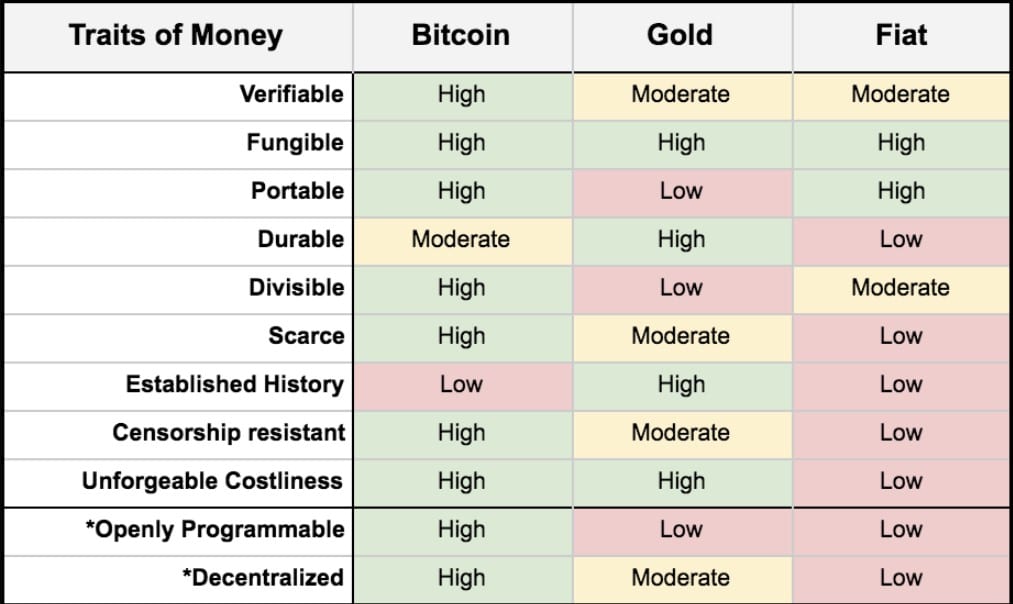

There are well-defined criteria that a currency needs to meet in order to be considered a viable and valuable asset. It is agreed that a successful currency needs to be:

- Durable

- Portable

- Divisible

- Uniform

- Scarce

Bitcoin, ladies and gentlemen, is the only asset that has ever existed that checks all those boxes, hence the “Apex property,” argument and belief in Bitcoin being sound money. Let's take a look at how Bitcoin compares to fiat and gold for some of these metrics:

Image via medium/coinmonks

Image via medium/coinmonks

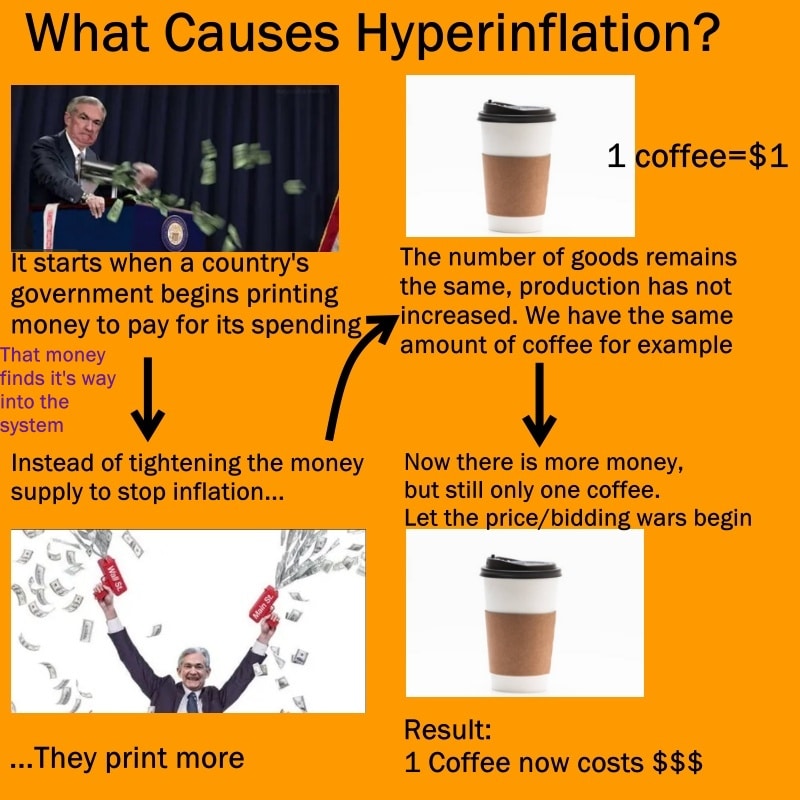

We know that one of Bitcoin's most powerful traits is the capped supply. So you may be thinking that if it is that simple, why have no governments simply capped their money supply? Unfortunately, that answer is incredibly complex, and I am in no position to provide an adequate response. However, I can dumb it down to a level where I understand it, but this is a topic debated among economists and monetary theorists.

The simple answer is that countries print money to get richer and increase their purchasing power and global status. Greed and power are human conditions that drive us to want more. Having a capped money supply would lead to a scenario where governments would not be able to create money out of thin air and spend it. They would need to provide value to their citizenry equal to the amount of tax revenue collected.

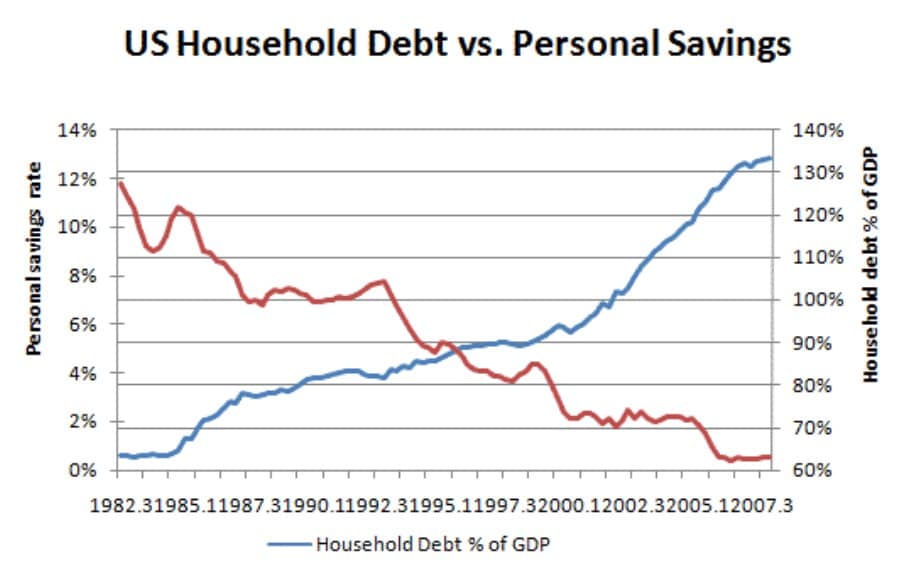

It is much easier and quicker to simply print money. We can easily zoom in and see this level of greed and the temptation to access easy money on an individual level as well. Humans just love borrowing and spending money that we don't have to buy things we cannot afford.

Case in point, nearly everyone has more debt than savings, almost nobody owns homes or cars outright, everyone takes out loans and borrows to fund purchases for items that are out of our price range, and the reason these things are so wildly out of our price range is partially due to the fact we can over-borrow and get easy access to money in the first place, driving prices up!

Our governments do the same thing. This topic gets much more complex when we start discussing things like the relationship between supply and GDP etc., which I won't go into any more detail on here as we are getting way off-topic. Back to Bitcoin!

“Well hold on Mr. Writer, what is wrong with just printing more money?”

Let me see if I can make up a quick diagram to answer that question quickly…One moment.

There we go:

Interesting Fact: The figures vary depending on where you look, but 60-80% of all U.S dollars in existence were printed since the start of the pandemic as a response to lockdown measures. This essentially means that the value of every single dollar in existence prior to printing lost significant value. In fact, the U.S dollar has lost over 96% of its purchasing power since its creation.

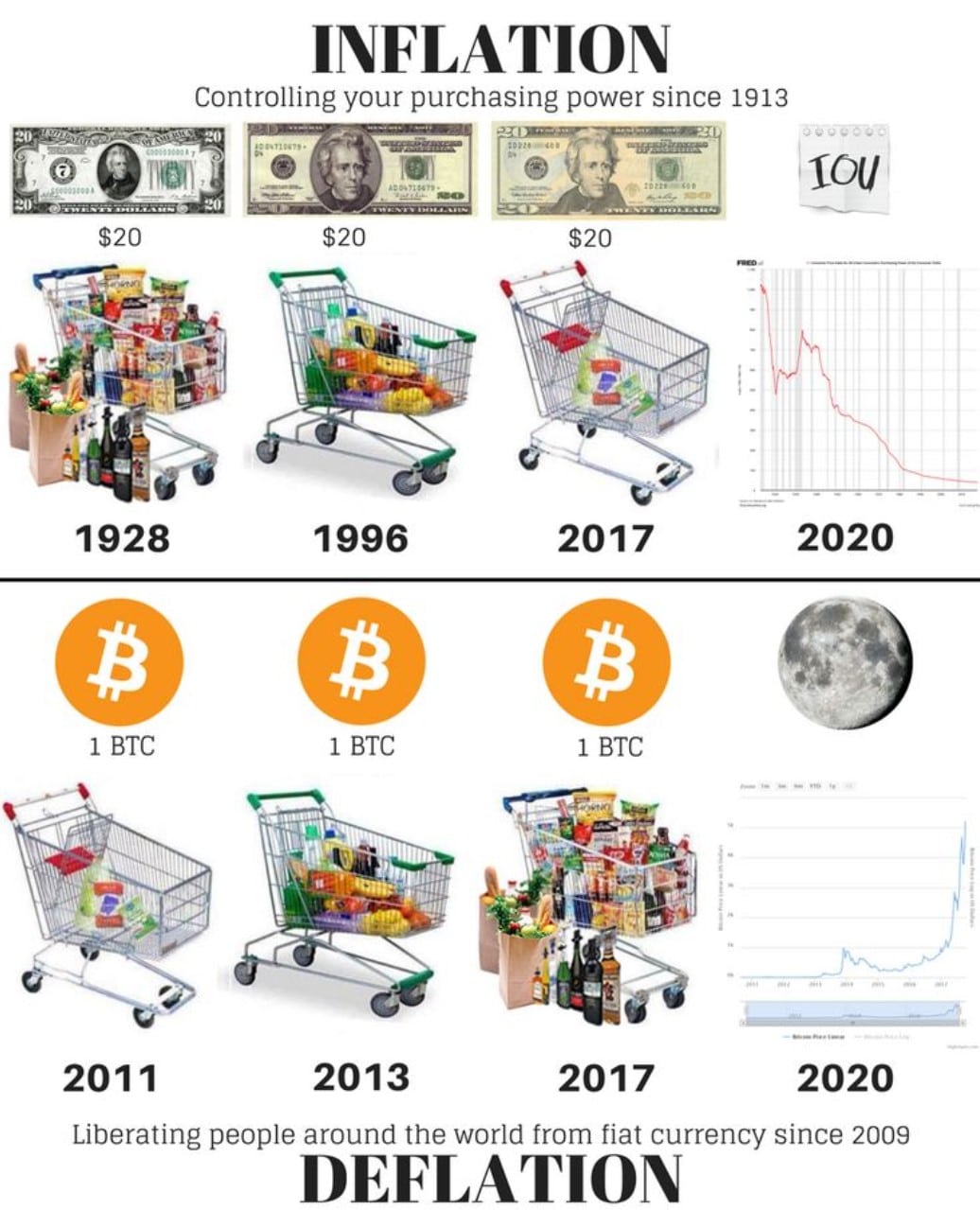

With sound money such as Bitcoin, the opposite phenomenon to inflation/decrease in purchasing power occurs. With a capped supply, value is stored into the future without debasement so purchasing power increases over time:

Image via studygroup.moralis

Image via studygroup.moralis Many theorize that economies will flourish under sound money systems. When a unit of currency is stable and not manipulated by governments, there is increased ease of trading, people tend to save, and there are higher levels of prosperity. In addition, the efficient sound money economy will lead to societies, businesses, and individuals being able to plan more effectively for the future and not being forced to react to the whims of the changing monetary policy, which then leads to advancements in industrial output, innovation, and most everything.

Sound money benefits individuals as they do not have to work twice as hard to try and keep up with the inflation that is devaluing their currency faster than they can earn it. In current society, we see savings among individuals and families at record lows, borrowing is at record highs (because nobody has savings), and what little savings there are, again, is being chipped away in purchasing power because of inflation.

Consider the alarming amount of social unrest that currently exists within our societies. Political polarization is at extreme levels. We seem ready to war over any slight difference of opinion, mental health problems are running rampant, and our home countries often feel like powder kegs ready to explode with the slightest spark as tensions are constantly high between neighbours.

When individuals are less concerned about lack of wealth, less stress leads to stronger bonds between people. They are also not forced to work as many hours just to feed their families, which can lead to more freedom to explore arts, sciences, engineering, literature, and more, leading to breakthroughs that can benefit society. We saw evidence of this with the surge in entrepreneurial ventures and start-up businesses that grew while societies were in lockdown. There isn’t much room for innovation when over 90% of the population is barely scraping by, and all they can focus on is working 80-hour work weeks to make ends meet.

Image via creditwritedowns

Image via creditwritedowns Now I do want to point out that this is all theory, and we have little historical evidence to base this on, but there are two periods in history that offer some fascinating insight that supports this theory:

The golden age in Rome existed under a sound monetary system that used the Aureus as the base monetary unit of value from 1 BCE to the 4th century AD. The Aureus was made of gold, the soundest monetary asset in existence before Bitcoin. As a result, Rome’s Golden Age flourished and helped propel the nation to superpower status, leading to some of humanity’s most impressive achievements that we still use today. Thus, Rome’s Golden Age may be the most influential period in human history.

The Golden Age Led to Many Advancements Including the Colosseum Image via Shutterstock

The Golden Age Led to Many Advancements Including the Colosseum Image via Shutterstock The United States, from 1879 to 1933, was on the gold standard. All dollars in circulation were backed by gold held by the Federal Reserve. America saw unmatched growth and prosperity during much of that time. The United States has a comparatively impressive history for such a young country.

America rose to an economic superpower and the world's most powerful nation in just a couple hundred years. They were doing great until they were removed from the gold standard, and we have covered the immense downhill trip they have been undertaking ever since. Take a quick read of the sight wtfhappenedin1971 for some mind-blowing charts showing the rapid decline in America's financial health.

I know this is dubious speculation, armchair macroeconomics at best, but two of the most impressively innovative, flourishing, and revolutionary times in human existence were experienced by countries that utilized gold as a sound monetary system. Both the fall of Rome and the decline in the United States occurred after being removed from a gold standard. Coincidence?

How Might the World Look Running on Bitcoin?

The world would look very different, that is for sure. A system that runs on Bitcoin would be beneficial to the majority of global participants. There would be close to no inflation, no currency manipulation or governments blocking citizens' access to their bank accounts, less mistrust between nations for abusing power, and no complex and inefficient global payment systems.

It would promote a fairer financial market for every nation, the wealth gap would be reduced, and people would be incentivized to save. Societies will simply thrive if you believe in the sound money theory discussed above.

Image via Shutterstock

Image via Shutterstock Corporate bailouts would become less common, increasing corporate responsibility to practice responsible wealth management to succeed. This would lead to corporations needing to create value before seeking capital, no more irresponsible borrowing massive amounts based on promises and “what ifs.” Unfortunately, irresponsible wealth management and over-borrowing also lead to more desperation, which leads to temptation for corruption to meet financial obligations and overly ambitious unattainable aspirations.

Bitcoin could also restore health to global equity markets. As equity markets are currently measured in dollars, which continue to magically appear into existence as the Fed prints money, it is impossible to perform rational valuation analysis as the value of a dollar fluctuates on a whim. By adopting Bitcoin as a standard, the unit of measurement that cashflows and valuations are measured in would be constant.

If It Happens, It Won’t be Easy

Anyone who assumes that they understand all the variables and every working component of the current global monetary system is either impossibly brilliant or completely ignorant. Humanity has created such an overwhelmingly complex house of cards that, in truth, nobody really fully comprehends how it’s all held together, nor all the intricacies of the inner workings or what ripple effects slight changes may have on the overall structure. You know the old saying, “The right hand doesn’t know what the left is doing.”?

This saying is often used to convey confusion or disconnect between two parties. We see this all the time with different departments within governments and across nations. Now take that confusion and disconnect between two parties, multiply it by thousands to represent all the global participants involved, and now you have our global financial system. I am not naïve enough to confidently state that if you replaced one component of the current system with Bitcoin, you wouldn’t be risking a potential collapse of the entire infrastructure.

How it Feels Trying to Understand the Global Financial System Image via Shutterstock

How it Feels Trying to Understand the Global Financial System Image via Shutterstock One of the reasons I believe society is slow in reacting to adopt a new system, aside from greed and the elite wanting to hold all the power, is that nobody wants to disrupt the working status quo. Everything works right now (barely); nobody really knows how entirely, but things are trucking along. People may be thinking that if it isn’t broken, why fix it? But we know that the system is broken…Very broken, and it is likely that Bitcoin can repair it, or it needs to be knocked down and rebuilt.

There is further hesitation to adopt Bitcoin as many people do not quite understand it, but compared to the current systems in place, Bitcoin is actually beautifully simple and will remain that way forever. The simplicity of Bitcoin lies in its mathematics; the “human factor” is completely removed. Once nations take the time to understand Bitcoin and everyone adopts a standardized unit of value, the entire global financial system will become exponentially more transparent and more straightforward for everyone.

Another reason why global governments are slow to move on this is that they are all sitting on millions, if not billions of dollars worth of USD. It is unknown how much those dollars may drop in value if another primary reserve currency was adopted; there is minimal incentive for governments to risk the value of their reserves to try something experimental and adopt Bitcoin.

Image via Shutterstock

Image via ShutterstockWe know that around 90% of the world trade is settled in USD, and with supply chain issues plaguing the planet, there are often urgent needs to settle global transactions ASAP. Governments are likely unwilling to slow the process down even further to try and get both parties to understand how to settle the transaction in Bitcoin vs the already established method…Even though it would lead to significantly faster transactions for the next transaction and each one subsequentially. People are slow to change because change involves a learning curve and learning slows initial progress.

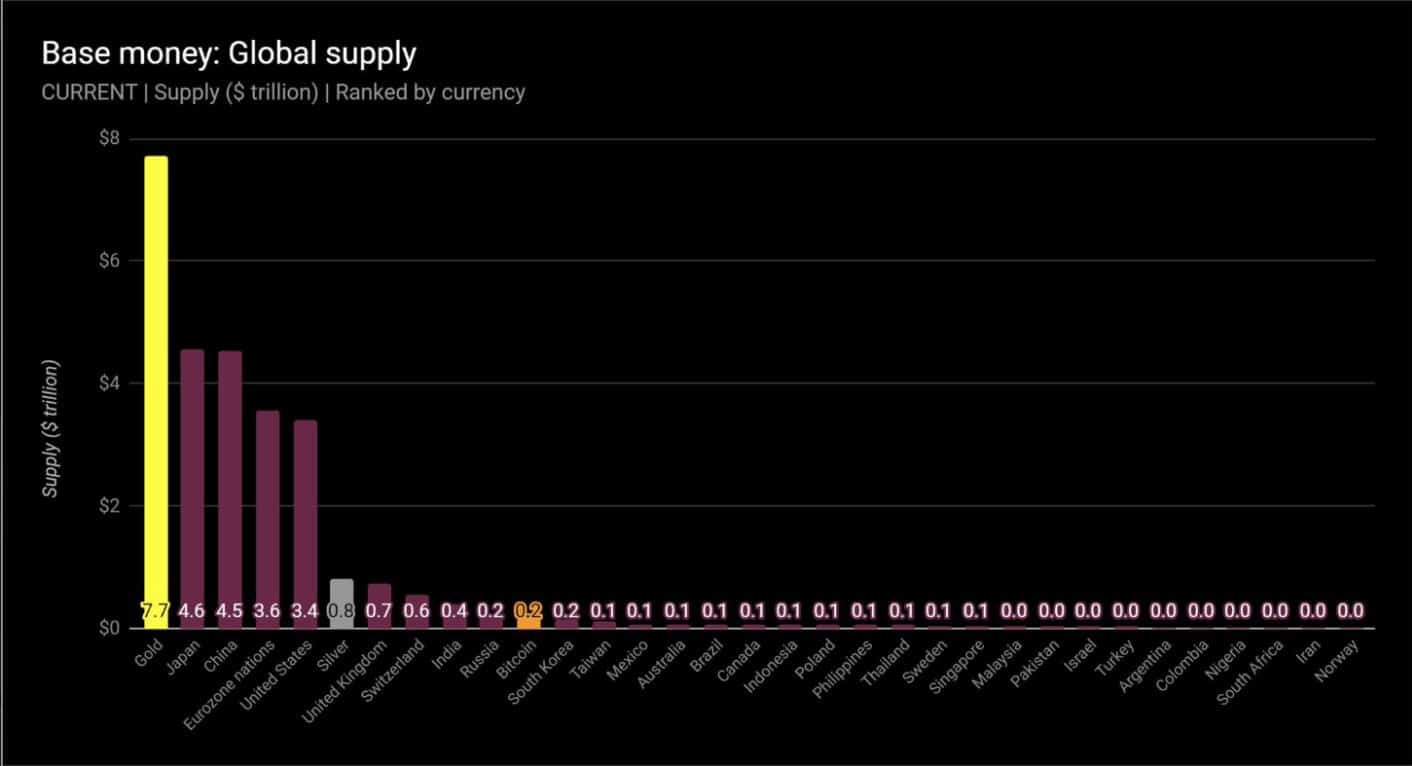

Liquidity is another major factor why it will be incredibly difficult for Bitcoin to replace the almighty dollar. There need to be mass amounts of liquidity available to make big purchases. By far, the dollar has the most liquidity in the global markets. In addition, there is an estimated $7.2 trillion in USD reserves held that can be deployed at any time, making the currency incredibly liquid.

Though an argument for Bitcoin is that as Bitcoin’s market cap increases, so will its liquidity. Bitcoin’s market cap is already nearing many of the largest fiat currencies being held by central banks; it has passed the Canadian and Australian dollar, the Mexican peso, and is closing in on the Russian ruble.

Image via Bitcoinist.com

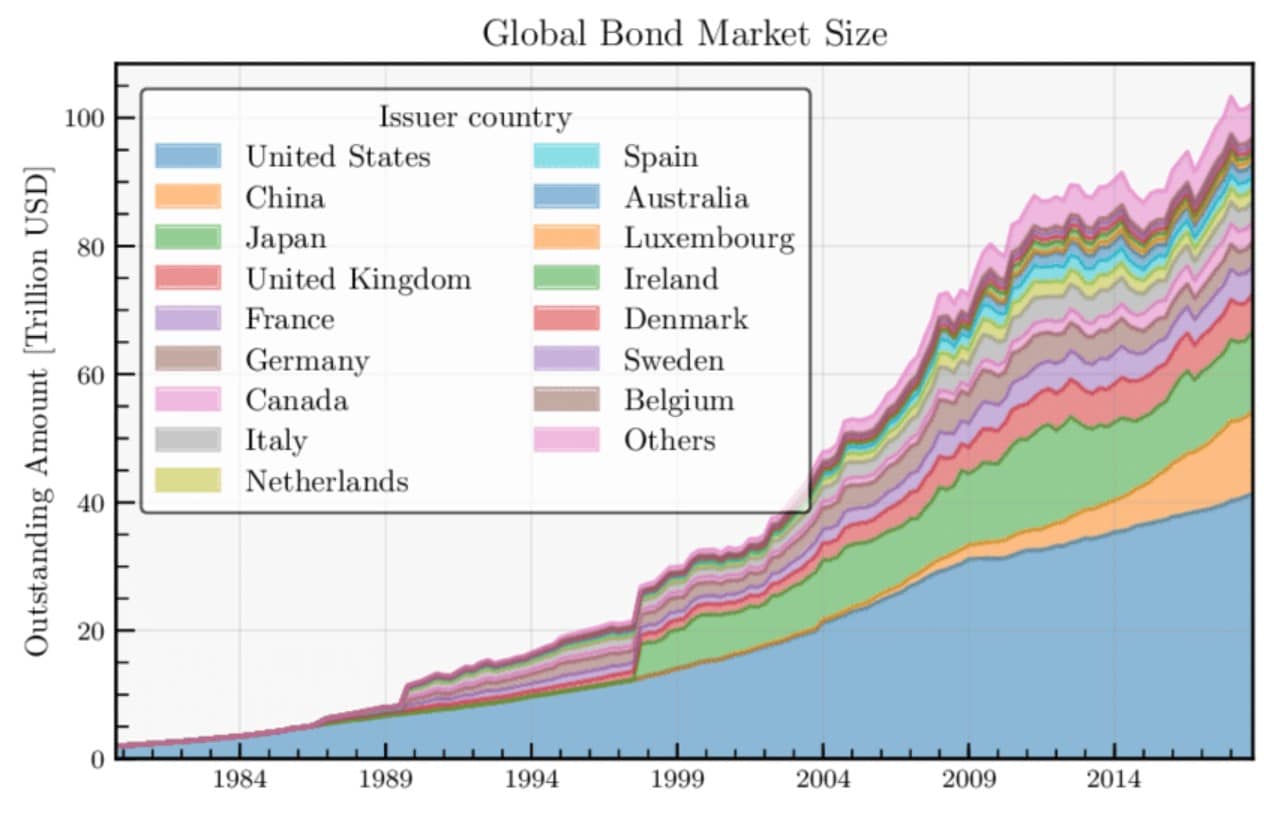

Image via Bitcoinist.com The United States bond market also plays a significant role in solidifying the dollar as the primary reserve currency. Very few countries have a bond market large enough to replace the dollar, and Bitcoin, of course, is an entirely different entity. The only two countries with a large enough bond market to challenge the U.S. are Japan and China. Japan has shown no interest in stepping up for this role as they insist on running a current account surplus, and China holds over 1 trillion in U.S. reserves, so there is little incentive for them; plus they also insist on running an account surplus.

The European bond market is out of the running as their bond market is too fragmented among all the different countries. So that only leaves the United States, and really, I have not heard any solutions or arguments for how Bitcoin could resolve U.S. bond market dependency.

Image via researchgate.net

Image via researchgate.net Another uphill struggle for Bitcoin will be world governments rolling out their own Central Bank Digital Currencies (CBDCs) that may slow the adoption of Bitcoin. People in the crypto community understand why Bitcoin will be immensely superior to CBDCs in nearly every regard, but for the average person, if they see their national digital currency that "does the same thing" as Bitcoin, they are likely to go for the familiar national currency that they recognize. Without the people's support of Bitcoin and governments preferring their own CBDCs, Bitcoin may have a more difficult path to travel.

An interesting consideration is that as governments move towards digital currencies, there is a possibility that just as dollars used to be backed by gold, what if CBDCs become backed by Bitcoin? Wouldn't that be something?

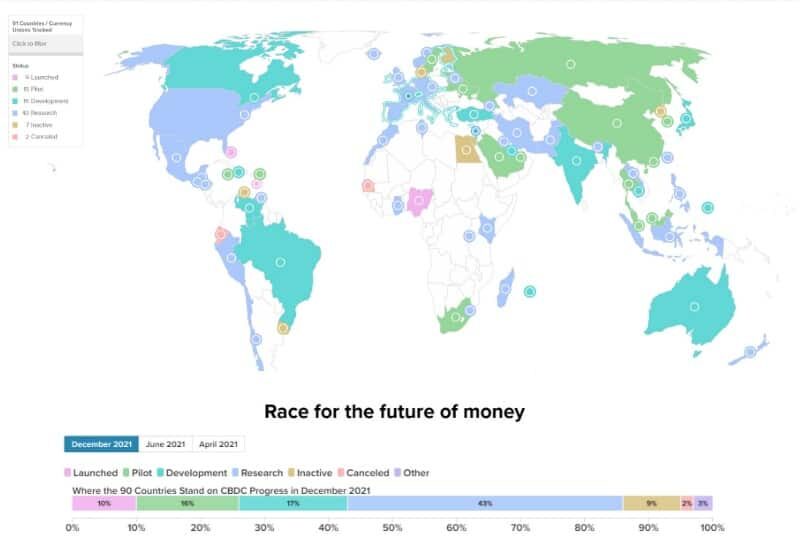

With countries rushing to create CBDCs and explore blockchain solutions, there is a very high-risk game where the winner will enjoy potential centuries of dominance. Losing this game may result in being held back in the dark ages. Here is a map showing the 91 countries currently exploring CBDCs:

Image via atlanticcouncil.org

Image via atlanticcouncil.org I know it's starting to sound like Bitcoin as a reserve currency is never going to happen after the reasons just stated or that adoption will be a long and sluggish uphill battle at best, but there are also clues to suggest that this all may kick off much quicker than we think.

It is fascinating to watch the current "space race" that is taking place in our digital era. Just as there was a race between countries to be the first one to successfully launch into space and reach "space superiority" in the 1960s and 70s, there is an even fiercer race at the moment for countries to reach "financial superiority" and blockchain technology is the metaphorical rocket ship being used to achieve that status.

One of those rocket ships is, of course, Bitcoin.

Another argument for this all happening sooner rather than later is that we are seeing unprecedented levels of Bitcoin adoption among retail investors and institutions, pension funds, REITs, banks, and even governments.

Aside from El Salvador going all in, we also see the government in Laos supporting Bitcoin mining, many U.S. State governors have stated their support for Bitcoin mining and blockchain innovation, Tonga is drafting legislation to make Bitcoin legal tender as we speak, Mexico is pushing to adopt Bitcoin as legal tender, regions of Portugal and Honduras just announced at the 2022 Bitcoin conference their plans to adopt Bitcoin as legal tender, Argentina was considering adopting Bitcoin as legal tender until they were "convinced" not to by the IMF.

Panama, Zimbabwe, and Ukraine, among many other nations, are allegedly looking into possible adoption.

The U.K. and Singapore have also stated their intentions of becoming world leaders in blockchain innovation, so the dominos of government adoption are already toppling.

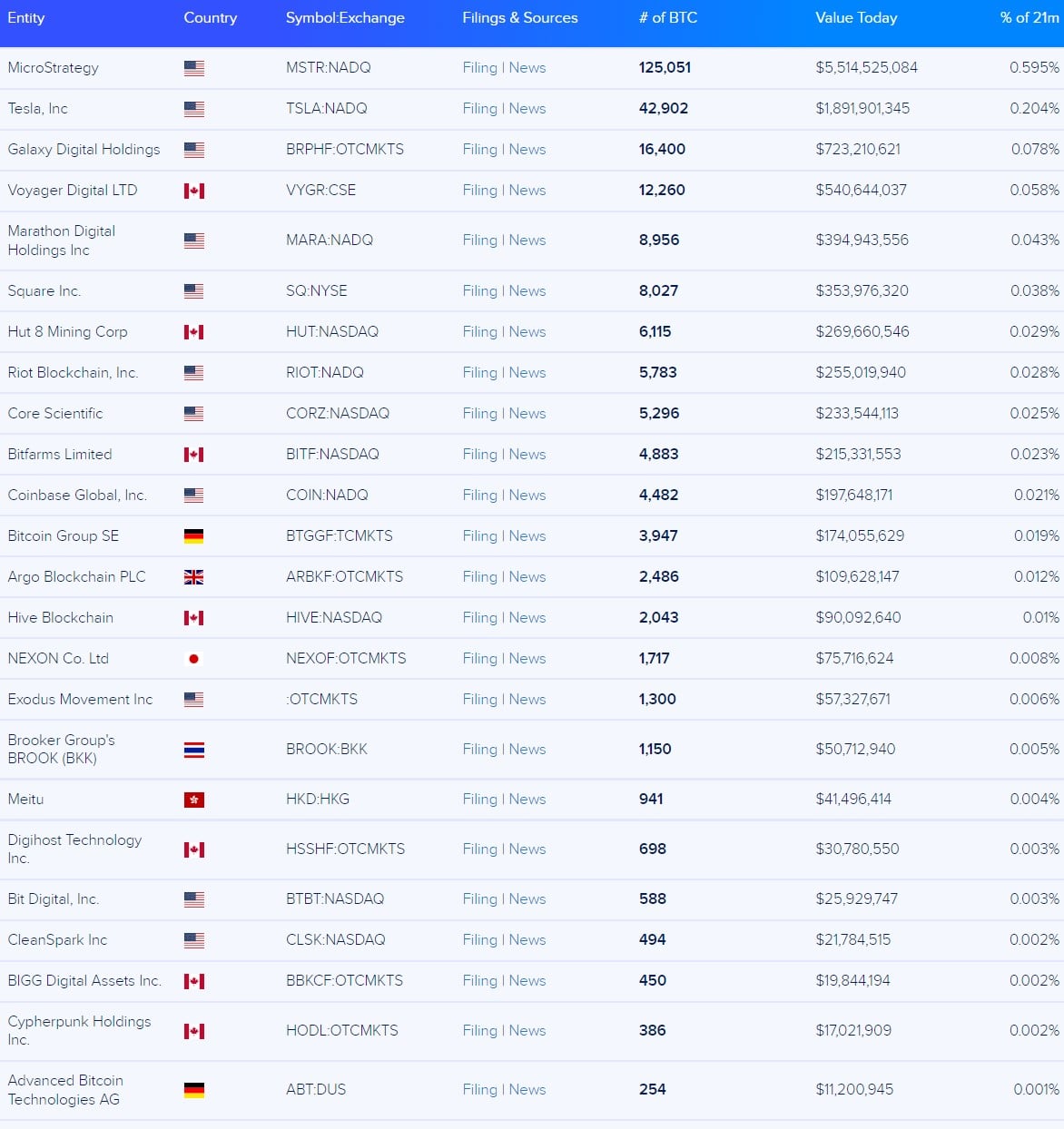

Here is a look at just some of the public companies that own Bitcoin:

Image via buybitcoinworldwide

Image via buybitcoinworldwide And here is a look at countries and governments that have publicly filed their Bitcoin holdings. In reality, this chart does not tell the whole story as we know government agencies belonging to the USA, UK, Germany, Sweden, North Korea, and Bulgaria hold significant quantities of Bitcoin and other digital assets that have been confiscated and seized. For example, Bulgaria is currently in possession of 200,000 Bitcoin as a result of an organized crime crackdown in 2017.

Image via buybitcoinworldwide

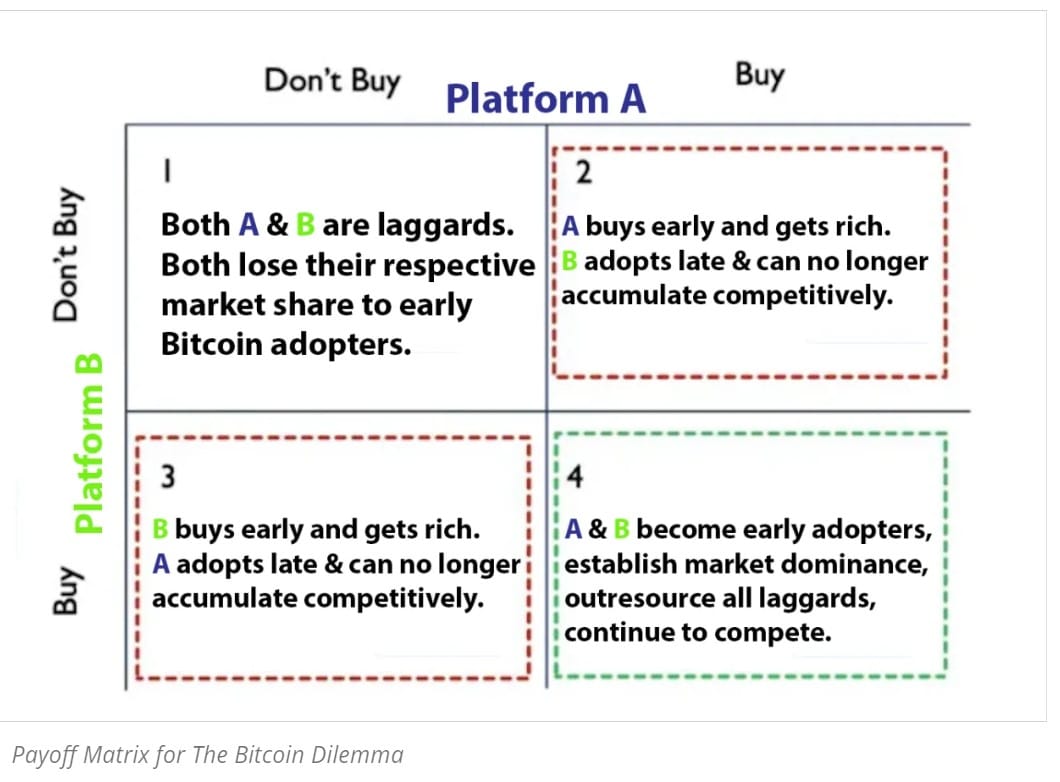

Image via buybitcoinworldwide We also cannot ignore the powerful effects of game theory on Bitcoin adoption. I can’t go into detail on game theory in this article, but it is essentially the science of multi-person decision-making, using mathematics to study the strategic interactions of rational decision-makers. It has social, logical, and scientific applications at the individual and national levels. For example, a diagram from Bitcoin Magazine.com shows the “buy or not to buy” risk payoff matrix for the Bitcoin dilemma that makes up part of Bitcoin’s game theory analysis.

Image via bitcoinmagazine

Image via bitcoinmagazine Bitcoin is considered one of the most powerful, innovative and impactful inventions of all time, meaning Bitcoin’s game theory could significantly accelerate its adoption.

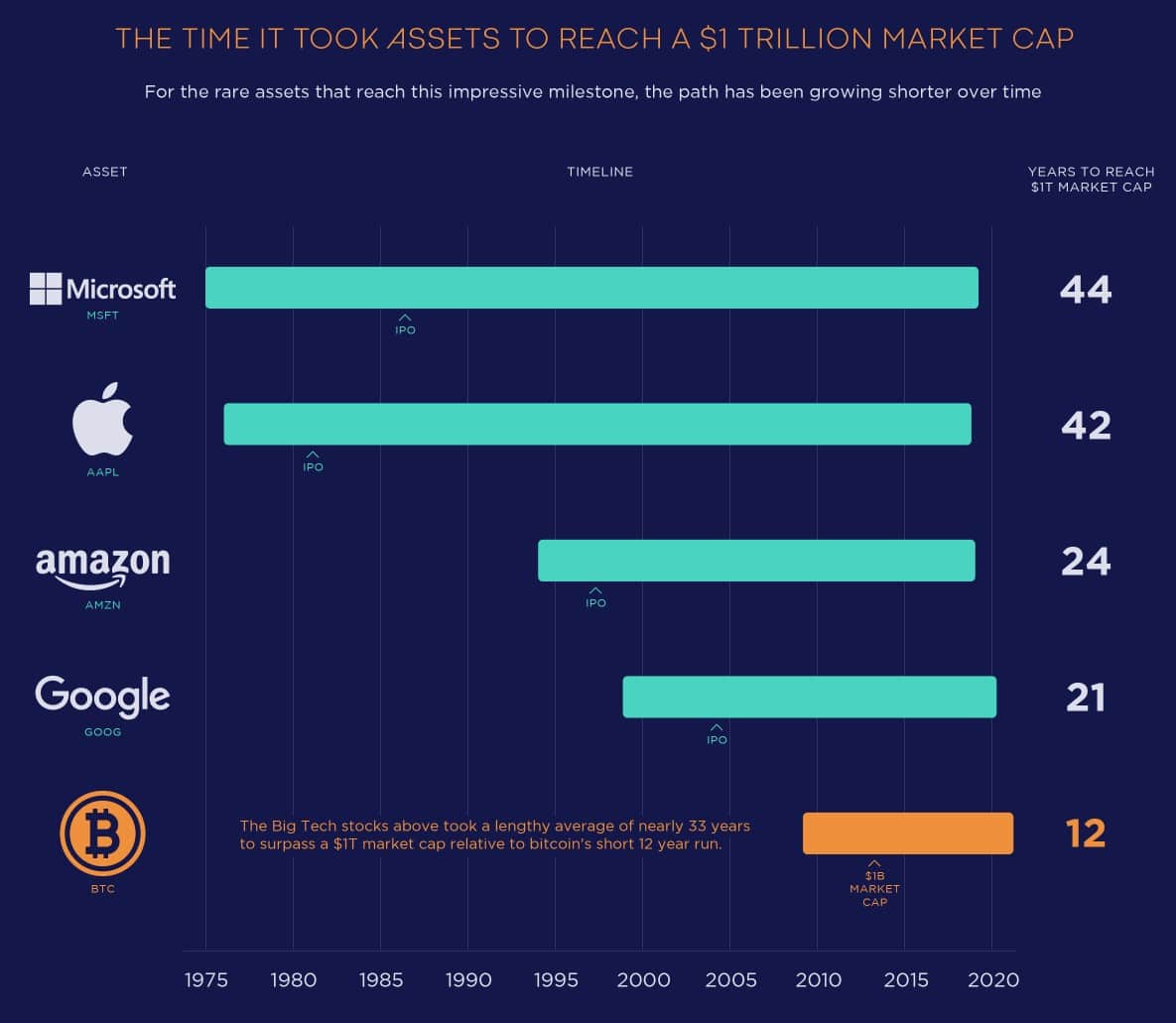

Imagine the state of a country today if they decided not to adopt the internet in the 1990s/2000s. They would be completely cut off from the rest of the world in nearly every regard. Choosing not to adopt Bitcoin could lead to similarly severe detriments, which is something that every government is slowly becoming aware of. We have already seen that Bitcoin is experiencing faster global adoption than the internet did in the first decade. It is the only asset in history to hit a trillion-dollar market cap in as little as 12 years.

Image via Visual Capitalist

Image via Visual Capitalist Bitcoin Reserve Currency: Closing Thoughts

I will be the first to admit that I do not have the answers, and I have no idea if or how this may all play out. I do not know if the world would become a better place if we adopted a Bitcoin standard or if Bitcoin became the world reserve currency, but it's hard to believe it wouldn't. We are running a fragile ecosystem, and trying to "move fast and break things" could set us back by decades if things do, in fact, "get broke"…Well, more broken than they already are. An argument could also be made that humanity would build back better if the current system collapsed and we built the future with blockchain, and I would agree.

Though you know those tv shows about time travel where someone goes back in time, steps on a flower by accident, comes back to the present day, and suddenly, the entire world has changed? If the world agreed to such a dramatic change in global finance, this would lead to knock-on effects down the road, maybe months, years, decades, or even centuries down the line that we have no way of knowing the outcomes of.

We also need to be cautious as tools as powerful as Bitcoin have immense capability to do a lot of good or evil in the wrong hands. Bitcoin has the power to free us from corruption, but the technology also has the power to completely enslave us through things like CBDCs.

There is a possibility that by inventing Bitcoin, we may have opened Pandora's box, and now the genie cannot be put back in the bottle if the wrong powers decide to leverage this technology.

Co-founder of Ethereum and Founder of Cardano Charles Hoskinson has posted a fantastic yet terrifying video on why we should all be concerned about centralized cryptocurrencies in the hands of our governments. And U.S Senator Ted Cruz recently proposed a bill that would ban the U.S government from developing a CBDC because a government CBDC could not be further from what free nations stand for.

Charles Hoskinson Speaking at TEDx on why the Future Will be Decentralized. I hope so Charles, Image via YouTube

Charles Hoskinson Speaking at TEDx on why the Future Will be Decentralized. I hope so Charles, Image via YouTube Ultimately, I believe Bitcoin will undoubtedly benefit humanity greatly if adopted and utilized correctly. While it is up in the air whether or not Bitcoin will become THE world reserve currency, I am confident that it is only a matter of time until Bitcoin becomes part of the ""other currency"" status that the IMF mentioned in their report.

There is an excellent chance that we will see Bitcoin start making up small percentages on central banks' balance sheets, then possibly grow in dominance over time as fiat currencies continue their decline.

I do have immense hope for Bitcoin. I see the world as it is now as incredibly damaged and full of greed and corruption. Decentralized and immutable payment and information-sharing networks are the only logical solution that can save society from the predatory institutional powers embodied by the central banking system and world governments. Unfortunately, every year we seem to inch closer to a future that looks more and more like Orwell's 1984.

I have often said that blockchain technology is the best chance to avoid the abuse of power consistently practised by authorities and the totalitarianism within our societies that has dethroned true freedom and democracy. Bitcoin is often said to be the embodiment of a fair and just democratic society. If it can live up to that reputation, that is a future that I want to see for our future generations.