Inflation is a nasty topic that continues to dominate headlines as we venture further into 2022. Unfortunately, it is an ongoing concern that will not solve itself as world governments turn to increase interest rates and tapering to fight the inflation blaze as investors seek a life raft.

As people are growing more and more concerned about inflation eating away at the value of their money, investors are looking for places to park their money, seeking sanctuary in an asset that will either hold its value or increase in value as we watch the purchasing power of fiat currencies slowly drift downstream and straight into the gutter.

Where are investors turning to protect their wealth? Traditionally, the primary investment vehicles to hedge against inflation have been real estate, which has done its job as an inflation hedge incredibly well with a record-setting year in 2021. Average housing prices increased 15-30% in many parts of the world. The housing market became a frenzy of buying and selling activity as many investors enjoyed some of the best one-year real estate returns in history. The cause of this was two-fold:

Housing Market had a Record-Breaking Year Image via mansionglobal.com

Housing Market had a Record-Breaking Year Image via mansionglobal.com With governments injecting cash into society, people had more money to make big purchases. The other factor was that investors piled into real estate in droves as many anticipated that inflation was right around the corner due to the excess money printing.

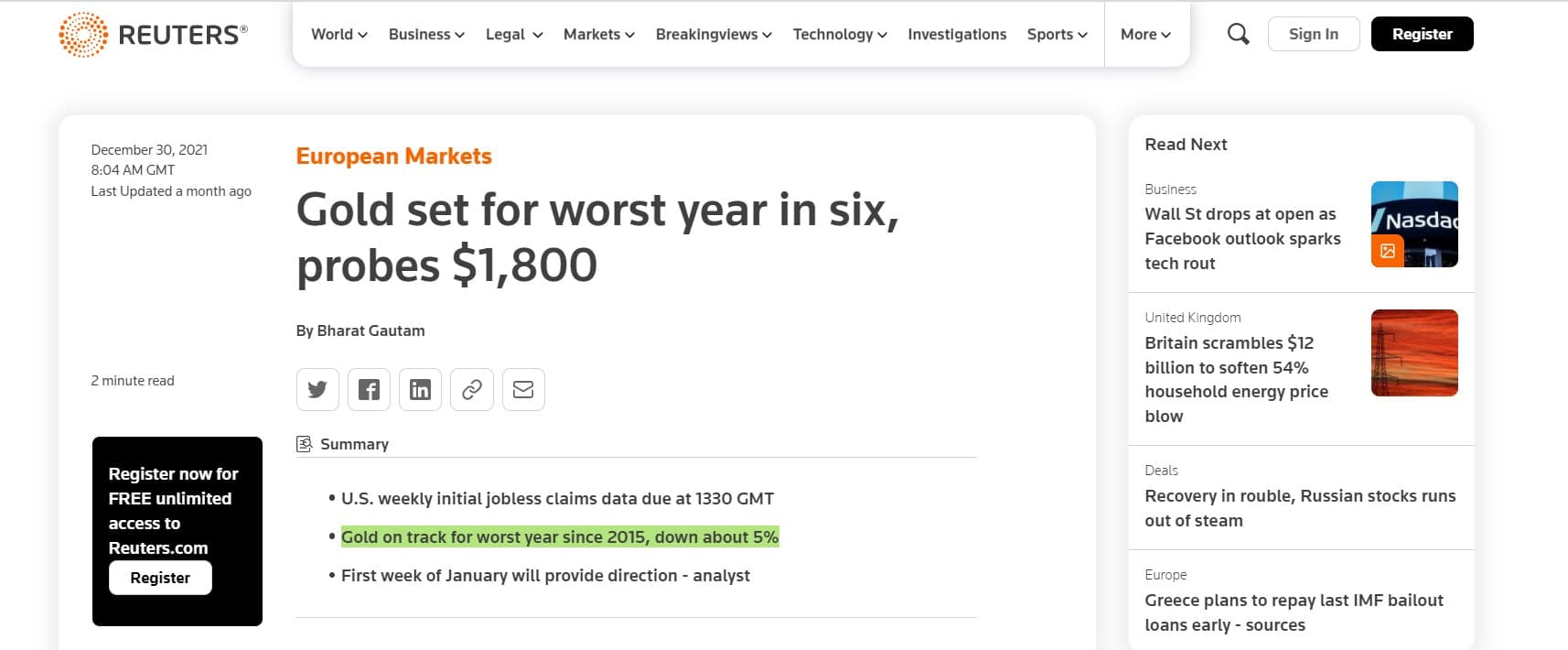

The other major inflationary hedge has traditionally been gold which saw an astonishing return of….wait for it…. About -5%.

Ouch.

Image via reuters.com

Image via reuters.com So, what on Earth happened that caused gold to drop while other asset classes like real estate, stock markets and crypto enjoyed a record-setting year with many assets reaching new all-time highs? Should gold still be considered a viable inflation hedge, and how do gold bars stack up against Bitcoin? Read on to find out the answers to those essential questions. If you want to learn a bit more about what inflation is and what causes it, feel free to check out my article on what makes Bitcoin a Good Inflation Hedge.

Disclaimer: I hold Bitcoin as part of my personal investment strategy.

Gold as an Inflation Hedge: A Brief History

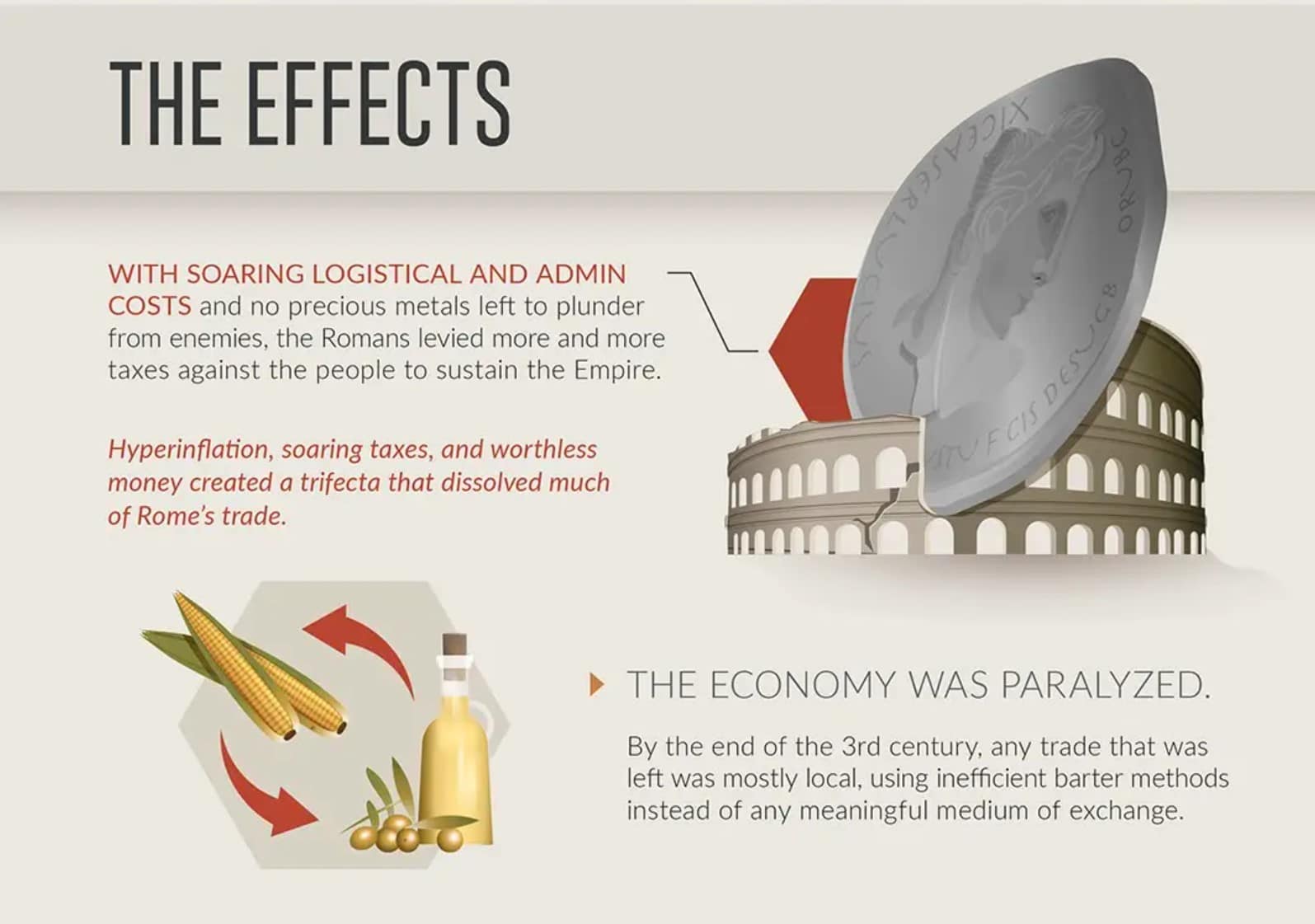

The concept of an “inflation hedge” is as old as currency itself. Inflation has been a known side effect of a financial system that utilizes physical assets since ancient times. For example, many historians attribute run-away inflation as one of the leading causes contributing to the fall of the Roman Empire. The earliest known use of gold as a form of currency dates back to 560 BC, as merchants needed a standardized and easily transferrable form of value to make global trade easier. Standardized, easily transferrable, easy global trade, heck, that sounds like Bitcoin!

Inflation, Increased Taxes and Worthless Money Being Created Contributed to the Fall of Rome. Sounds a Bit Like What we are Experiencing Today Image via money.visualcapitalist.com

Inflation, Increased Taxes and Worthless Money Being Created Contributed to the Fall of Rome. Sounds a Bit Like What we are Experiencing Today Image via money.visualcapitalist.com Following Rome hundreds of years later, the British empire would also develop a monetary system based on precious metals with the current “British Pound,” having its name derived from representing a pound of silver.

Even the United States Dollar was backed by physical gold until 1971, before the US abandoned the gold standard. Though in all these financial systems, one trait remained constant throughout the centuries as it still does today: susceptibility to inflation. That trait causes investors to look to park money in assets that are less susceptible to being degraded as a result.

The average global inflation rate experienced during average economic periods ranges between 2-5% during modern times. This means that the money sitting in a bank loses about 2-5% of its purchasing power per year. To combat this, investors seek to have less in cash and put capital into assets that appreciate in value at least as much as inflation dissipates their net worth. For centuries, this asset has been gold.

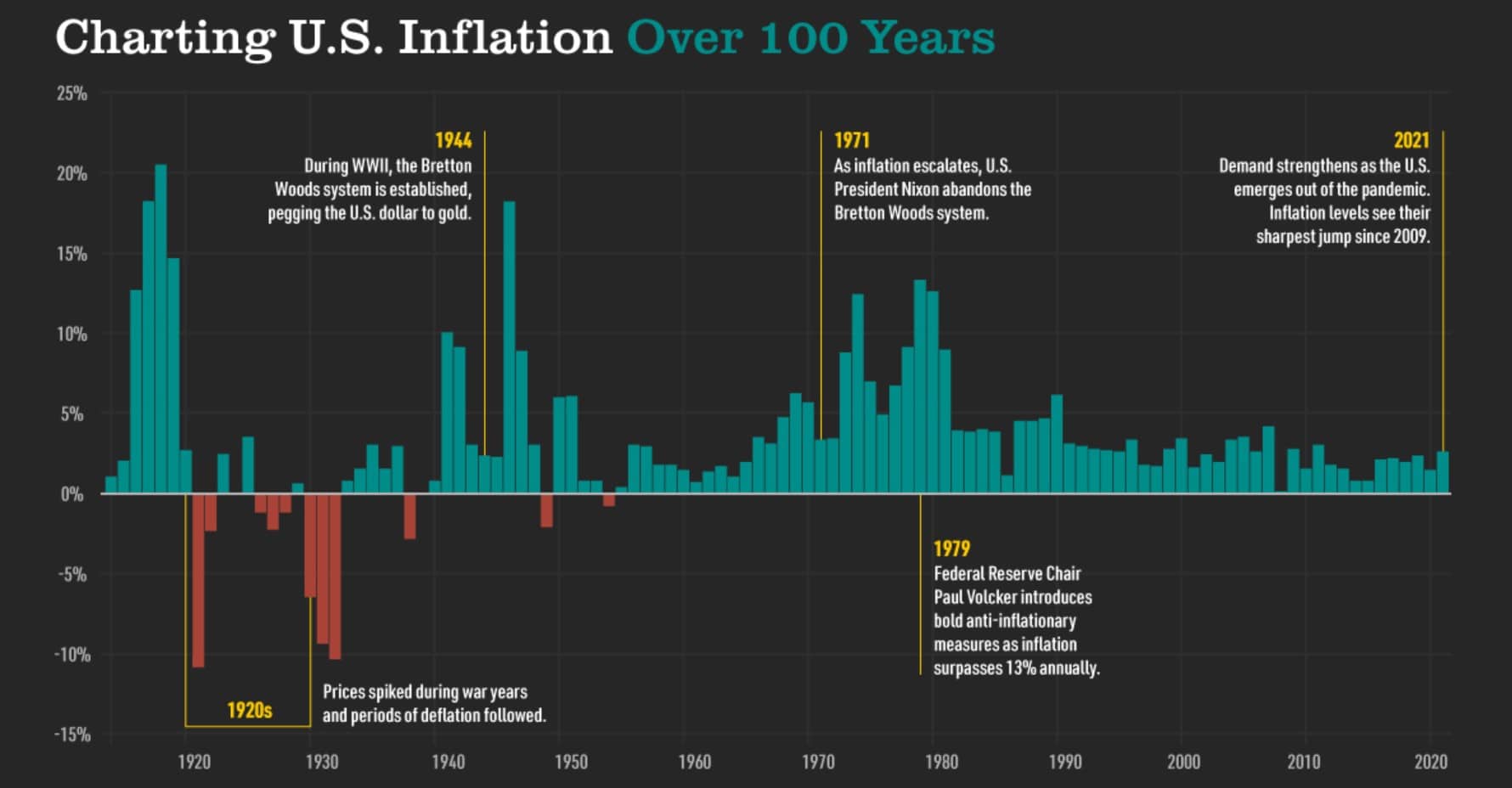

US Inflation Rate Over 100 Years Image via advisor.visualcapitalist.com

US Inflation Rate Over 100 Years Image via advisor.visualcapitalist.com Since the world has moved away from gold-backed government-issued currencies, many now argue that gold is an outdated relic and no longer holds the monetary qualities it once did. Historically, gold was valuable as it could be used to make purchases. The value of a coin depended on how much gold or silver was fuzed into it, and gold was (and still is) used to showcase wealth and store value.

Due to its finite supply, the simple economic principles of supply and demand gave gold value. These days, many see it as having little use outside of simple jewellery and some electronic components.

While Gold Cannot Tarnish, Its Reputation Certainly Has

I don’t want to come across as “anti-gold” here. I certainly am not. I think diversified portfolios are essential, and I held gold as part of my portfolio diversification strategy. I truly wish it had the same investment qualities as it once did. I also hope that one day it will regain a more purposeful role in investment strategies and provide better returns while being less correlated to other markets.

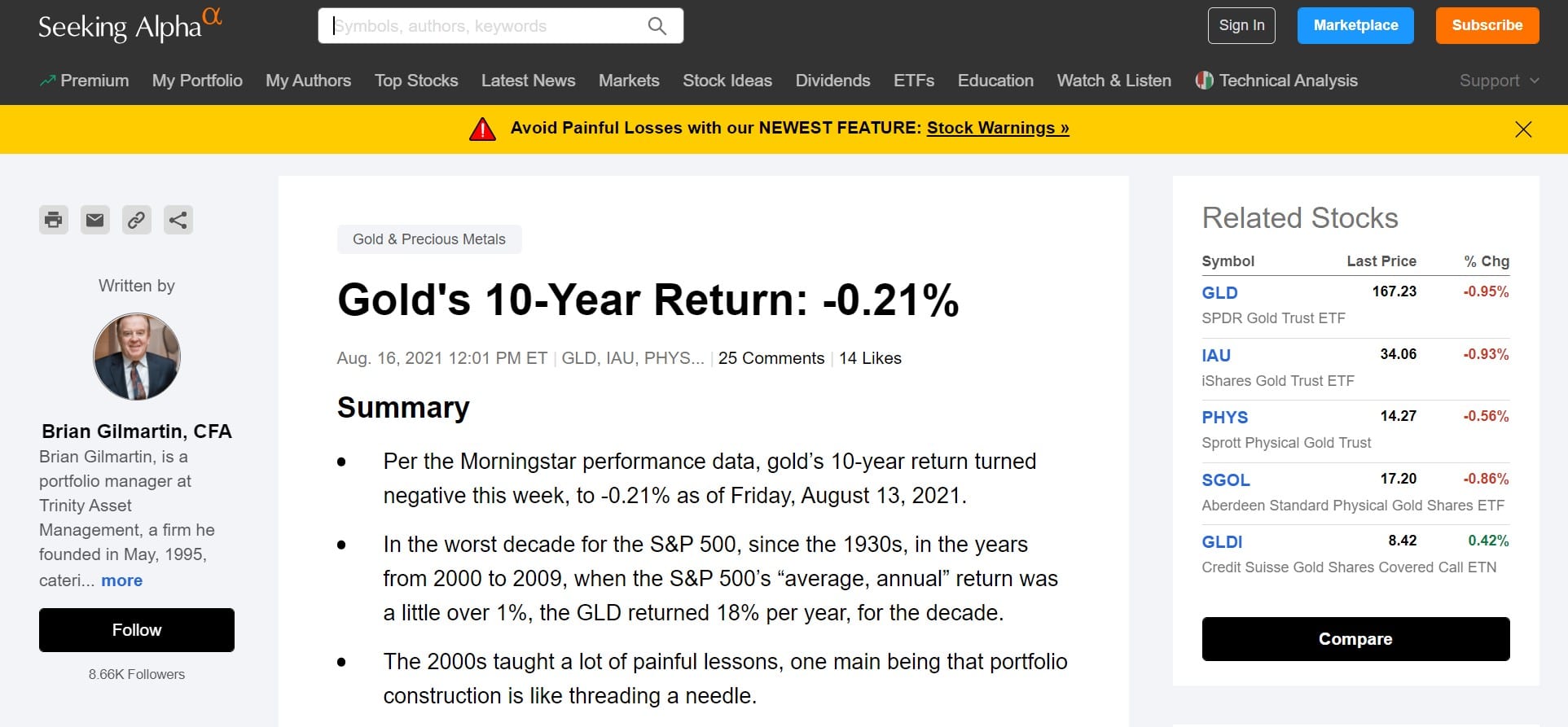

Though we cannot tiptoe around the dismal reality of gold’s performance over the past decade. 10 years is a long time to hold onto an asset that has not appreciated in value. In fact, at the time of writing, gold has actually lost value over the past decade. Imagine investing in an asset for a decade only to have it lose value, yet that is the unfortunate reality.

Ouch….Image via seeking alpha

Ouch….Image via seeking alpha Despite the performance, many investors remain bullish on gold. They are convinced that as inflation continues, more people will flock to this “safe haven” asset and that gold will shine once again.

A year or two ago, I would have agreed with them, and I seriously considered adding gold back into my portfolio. Like many investors, I was confident that the gold price would start significantly appreciating as more sought a finite asset to park their capital among inflationary fears. I had a tough choice to make: Buy more Bitcoin, or pick up some gold? I put my money on the future as opposed to the past, and it seems to have been the right choice.

Why has Gold Performed so Poorly?

There is no single fundamental reason to pinpoint why gold no longer shines as it once has. Bond yields and digital transformation are key factors. Many economists and investors agree that the cause likely derives from many reasons, the foremost being human sentiment as we enter into a digital era.

Gold has lost its lustre for younger investors. New money is no longer flowing into the asset as younger investors prefer Bitcoin, other crypto-assets and stocks due to their accelerated performance versus gold. A recent article from Moneyweek paints an interesting picture as they predict that hundreds of years from now, historians will likely look back on this time as the transformation period where the world stopped caring about “shiny objects,” as we focus on our transformation into the digital space and digital assets.

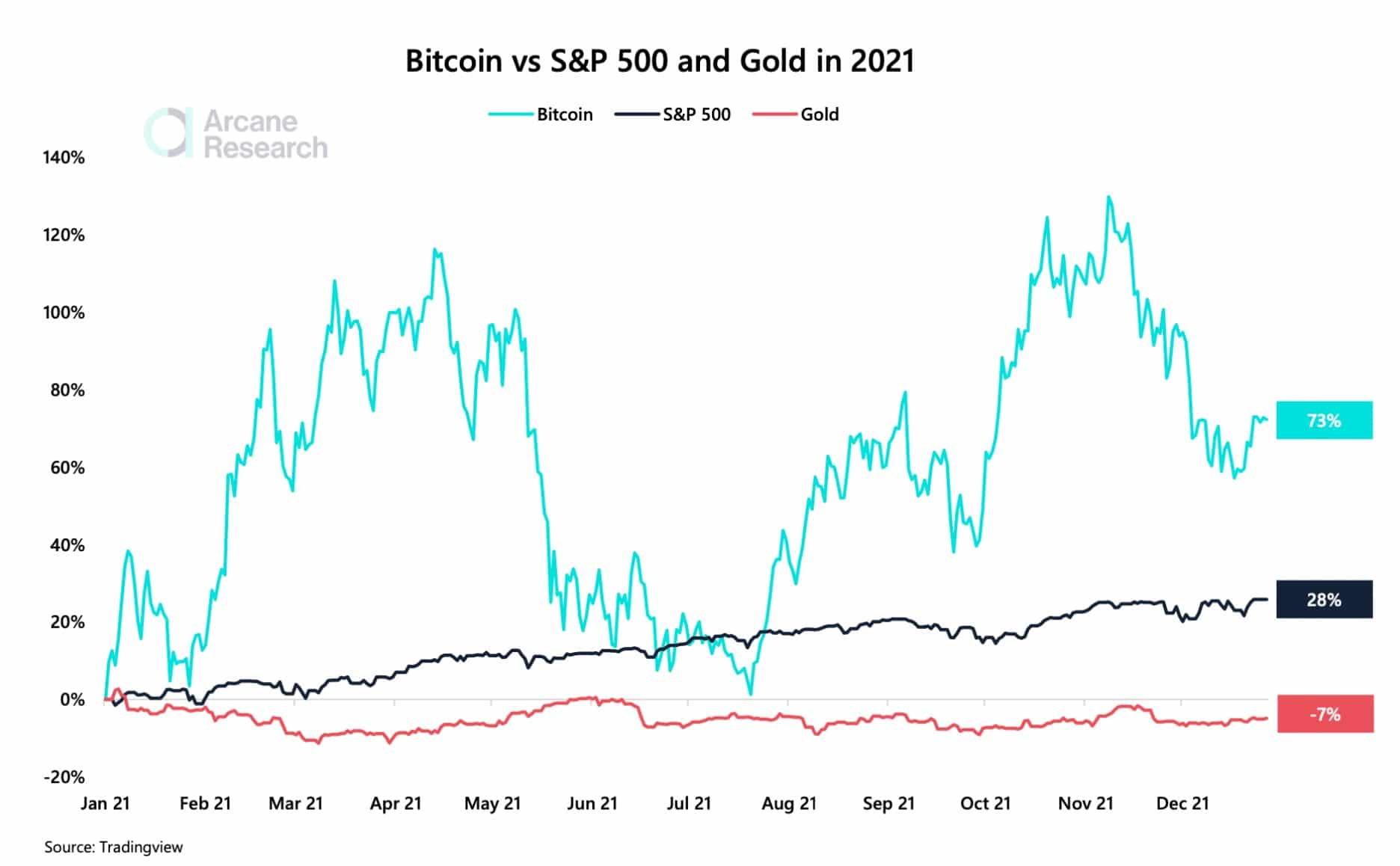

Hard to Get Excited About Gold With Returns Like These Source: Arcane Research, TradingView

Hard to Get Excited About Gold With Returns Like These Source: Arcane Research, TradingView There is an interesting comparison to be made as we know that some ancient nations once considered seashells as highly valuable and a means of payment. Is it time for gold to become an outdated relic? Is Bitcoin essentially gold 2.0, replacing gold similar to how the operating system Windows 10 replaced Windows 8?

The Argument For Gold

Let's take a look at some of the bullish arguments for gold, its usefulness and utility as an investible asset and why it is still considered by many as the ultimate safe haven and inflation hedge.

Preserves Wealth

While many critics believe that Gold is no longer a viable inflation hedge, there are still those who point out that gold has been an excellent way to preserve wealth for generations and has protected against inflation for centuries. To a degree, they are not wrong, but in the modern age where tech stocks, real estate and crypto often fly with double-digit returns, many investors are wondering why they should bother with gold which simply preserves their wealth when they can grow their wealth instead with other assets.

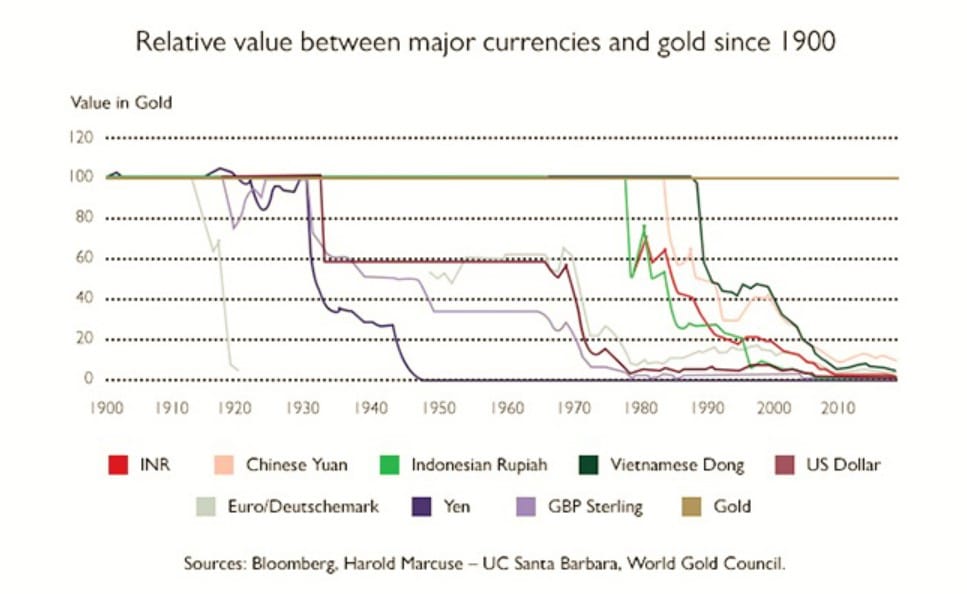

One clear argument to support gold investors is that holding gold has proven beneficial over holding any major nation's fiat over the past 100 years. Take a look at how inflation has eaten away the purchasing power of every major currency, showing how superior gold is to a store of value than fiat.

Gold has Held Value Far Better Than Global Fiat Currencies Image via mygoldguide

Gold has Held Value Far Better Than Global Fiat Currencies Image via mygoldguide In the 1990s, one ounce of gold was worth around $400. At that time, if an investor had the choice of holding gold or simply keeping the $400 in the bank, that $400 in the bank would have lost a substantial amount of purchasing power due to inflation, while the value of the gold would have increased. The gold would have also been the safest bet out of many investment options available at that time. While gold's poor performance vs other assets is apparent, let's think about this from another perspective.

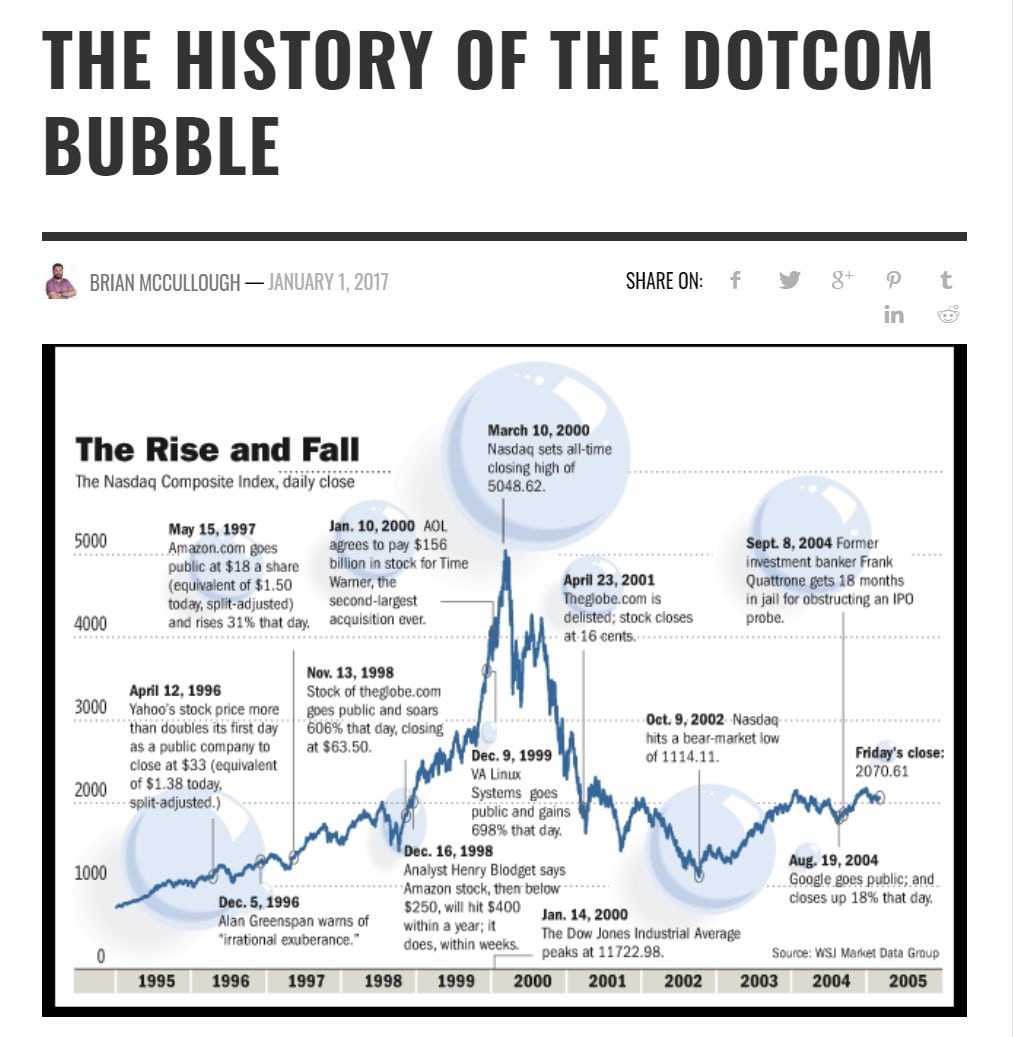

Many investors made an absolute fortune during the dot-com boom, but far more investors lost everything. An estimated 90% of early internet companies in the 90s and 2000s are not around today as titans like Google and Facebook (or Meta) dominated the markets.

Investors in the '90s and early 2000s had a choice: Invest in the internet and the future of innovation (as we do with crypto today) or stick to the good old safety of gold. If 90% of internet companies failed, imagine how many investors lost fortunes while those who played it safe thank their lucky stars that they invested in gold and not risked speculating on risky assets.

How Many Investors in the 2000s Regret Not Playing it Safe with Gold? Image via internethistorypodcast.com

How Many Investors in the 2000s Regret Not Playing it Safe with Gold? Image via internethistorypodcast.com So, investing in gold may not make you rich, but you know what else doesn’t make you rich? Investing in companies and assets that go bust as so many do. Investing can really be a roll of the dice, with many investors making the safe play, choosing to preserve wealth rather than speculating (or gambling), and gold has done that incredibly well.

Hedge Against the Dollar

Gold has been used as a hedge against the US dollar for decades. Gold has been especially important in its role in protecting the wealth of Americans, more so than many other nations, and this is for two reasons. First, the US dollar faces both rising inflation and declining purchasing power.

Historically, gold has had periods of hedging against both of these scenarios as gold is priced against the US dollar. As inflation rises, gold typically appreciates, and when investors realize that their money is losing value, they look to acquire a hard asset that at least maintains its value.

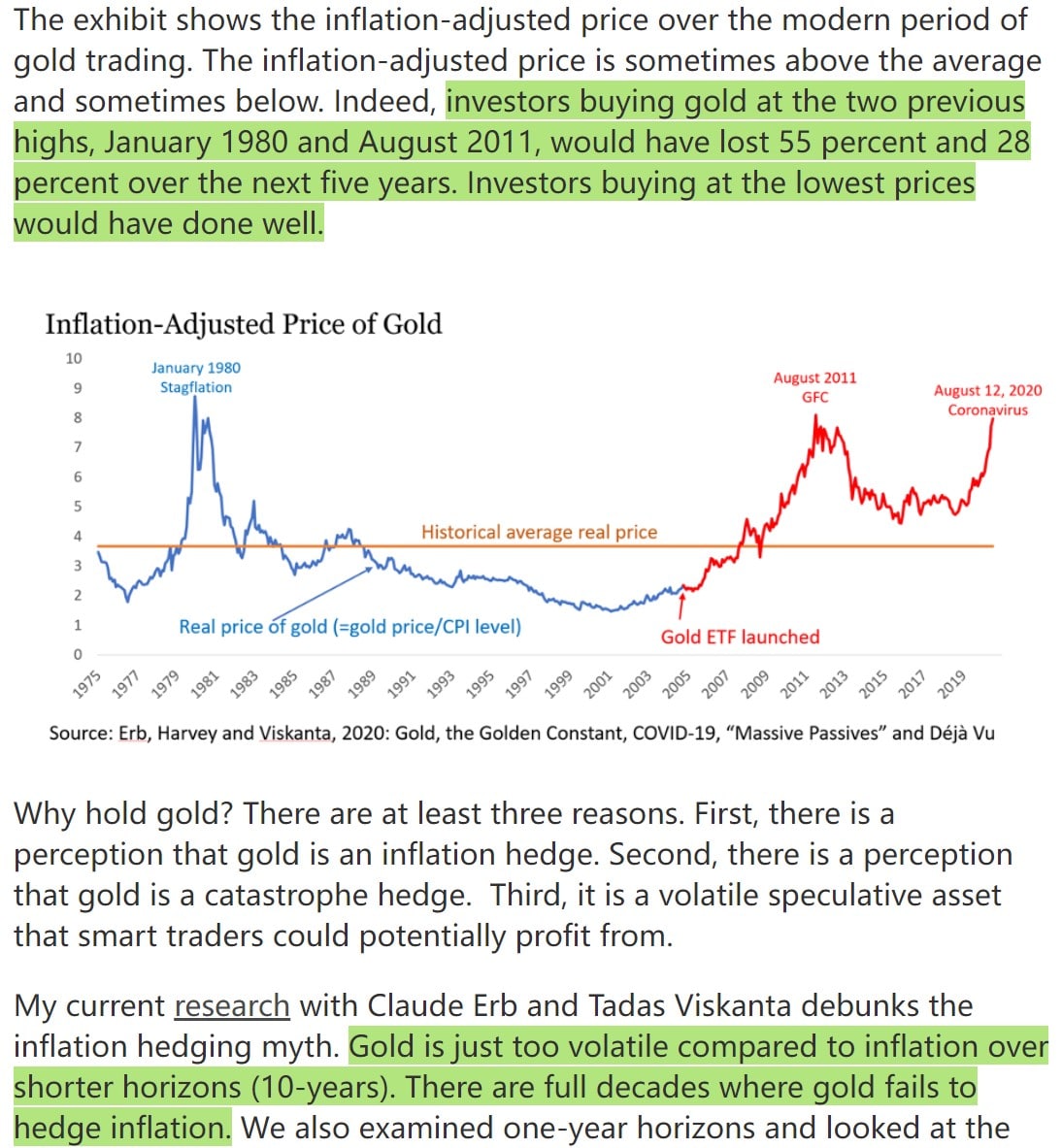

A recent study from Claude B. Erb, Tadas E. Viskanta of Ritholtz Wealth Management, and Campbell R. Harvey of Duke University argues that the belief in gold as an effective dollar hedge is a narrative that is not accurate due to…believe it or not, gold is too volatile. The chart below shows that the argument of gold being a good currency hedge is highly dependent when investors buy in. So similar to Bitcoin, the asset’s ability to be a hedge depends on whether or not investors “bought the dip,” aka bought low. Quite ironic.

Image via news.cgtn

Image via news.cgtn Though gold has been shown to perform poorly over the past decade, many economists and investors are buying up gold like there is no tomorrow as they feel that precious metals are extremely mispriced and undervalued or “cheap.”

It seems that many investors these days are becoming greedy and obsessed with the search for double-digit returns. As fiat continues to lose its value, investors not allocating any funds into precious metals seems short-sighted to many.

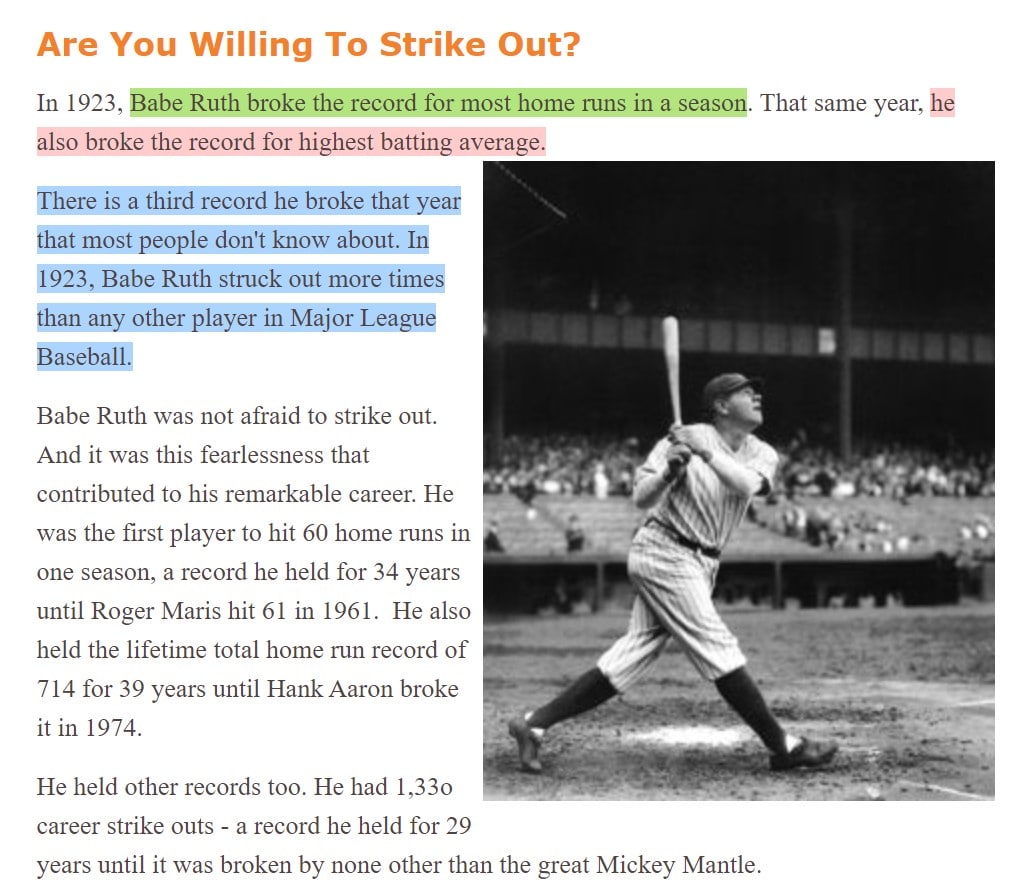

If we compare investing to Baseball, a habit has formed that shows us that many investors have gotten obsessed with looking for a home run hit on every swing and that taking the safe one-base hit has fallen out of fashion.

Investors are no longer satisfied with safe and stable returns; many investors are only interested in finding the home run equivalent of investments. But as home run legend Babe Ruth has shown us, as he led the league in his day in both home runs and strike-outs, the more you swing for the fences, the more you are going to miss.

Swing For the Fences or Play it Safe? Risk vs Reward is as important in Investing as it is in Baseball Image via sinekpartners

Swing For the Fences or Play it Safe? Risk vs Reward is as important in Investing as it is in Baseball Image via sinekpartners It may not be wise to be looking for home run investments at every turn. Once fiat loses so much of its value that investors can no longer adequately chase massive returns due to decreased purchasing power, there is an argument that money will flock back into gold and other precious metals at breakneck speeds.

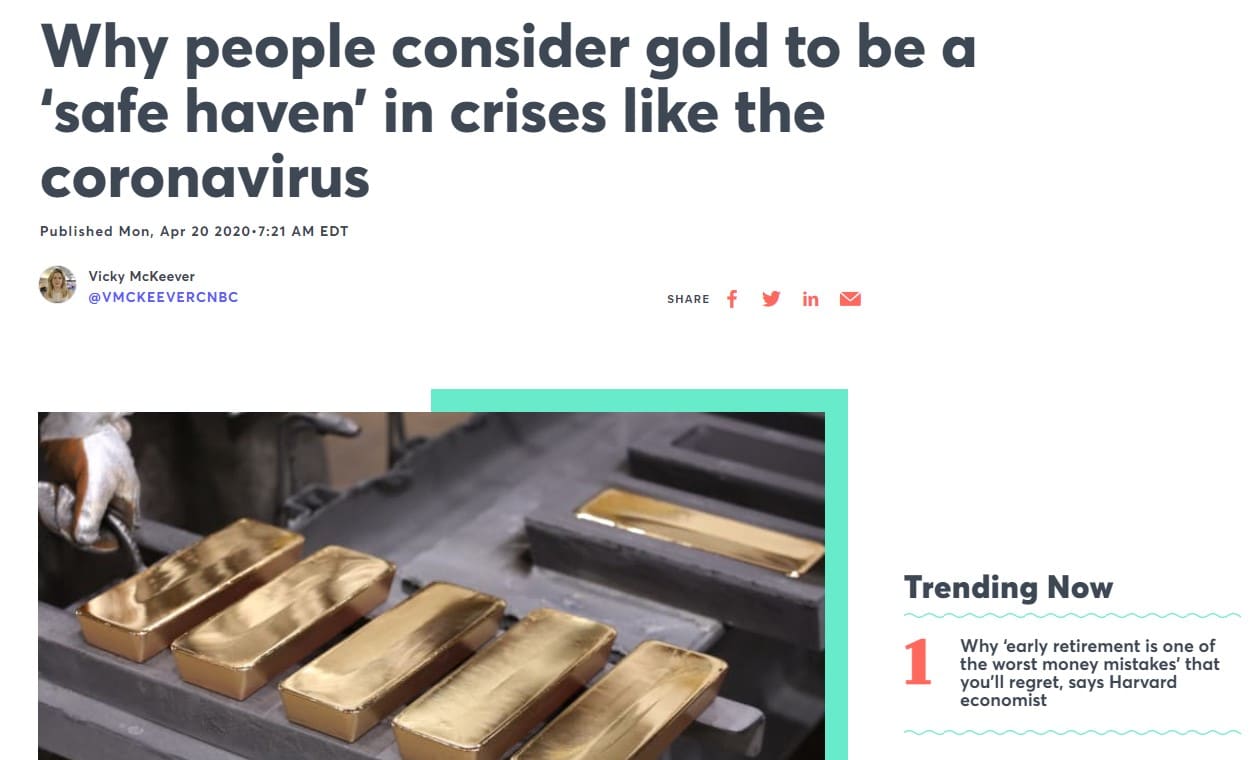

Gold as a Safe Haven

The world often faces economic hardships and uncertainties resulting from high impact events such as tensions rising in the Middle East, relationship breakdowns between major countries, natural disasters and others. Political and economic uncertainty is a reality in our modern global economic environment, and gold has typically been considered a safe haven when investors are worried.

Gold has achieved this reputation due to the countless instances of collapsing empires throughout history. There have been many currencies that have simply withered away and disappeared over the centuries, but gold has always held value which has transcended across nations and time. We have seen empires rise and fall, maps have been redrawn as nations have collapsed or conquered, but gold has remained a constant way to hold value regardless of the strife faced by humanity.

Even During Modern Concerns, Gold Retains its Reputation as a “Safe Haven” Image via cnbc.com

Even During Modern Concerns, Gold Retains its Reputation as a “Safe Haven” Image via cnbc.com Gold Diversifies

This is one of the most popular arguments for holding gold. To use the tired cliché about eggs and baskets, no smart investment strategy has ever begun with Yolo-ing all in on one asset. It is important for investors to have their wealth spread out across multiple different asset classes, which is why we are hearing a growing number of recommendations from hedge fund managers and institutions stating that investors should look to keep 1%-5% of their wealth in Bitcoin while their other funds are in gold, real estate, stocks, etc.

Gold is historically highly uncorrelated to other assets as well. When stock markets and real estate have had periods of poor performance, gold has often held up surprisingly well as other markets were in a downward spiral.

The Argument for Bitcoin as "Digital Gold" and the Ultimate Inflation Hedge

Now Let's take a look at some of the bullish arguments for Bitcoin, its usefulness and utility as an investible asset and why it is considered by many as being superior to gold as a store of value and inflation hedge.

Utility

Bitcoin has far more utility and innovation happening as it is a revolutionary technology as opposed to gold which experiences fewer and fewer use cases with each passing decade. Aside from as an investment, gold's primary use case is that it is something "pretty" for people to hold and show off their wealth as opposed to Bitcoin, which is capable of solving nearly endless real-world problems.

If you don't know what "real-world" problems I am referring to, take a quick watch of this inspiring 15-minute Ted Talk about how Bitcoin makes the world a better place for humanity.

Scarcity

Bitcoin's scarcity is known and absolute. While much of gold's value is derived from the fact that it is scarce, the truth is we do not know how much gold actually exists. As technology advances, we may start developing underwater mining capabilities and asteroid mining, meaning we have no idea how much gold we may be able to harvest. Bitcoin, on the other hand, is capped at a finite supply of 21 million. Therefore, we know without any doubt that Bitcoin's scarcity will remain.

Check and Mate, the Importance of Bitcoin Scarcity Cannot be Understated Image via mimesiscapital

Check and Mate, the Importance of Bitcoin Scarcity Cannot be Understated Image via mimesiscapital Apex Property

Bitcoin has received the title as “The Apex Property of the Human Race” because the ideal asset needs to be valuable, store value, be easy to store and transfer, be quick and cheap to transfer anywhere in the world. Before Bitcoin, no other asset could meet those requirements. Billions of dollars worth of Bitcoin can be held on something as small as a USB device, and a billion dollars of Bitcoin can be transferred anywhere in the world nearly instantaneously and incredibly cheap. That use case alone makes Bitcoin immeasurably more valuable and useful than gold or fiat.

Bitcoin is divisible by eight decimal places, making it easy to pay for cheap items like a cup of coffee or a meal out, especially since the upgrade of the lightning network. Imagine carrying a gold bar and carving off a chunk of it to pay for a meal at a restaurant; no thanks.

Bitcoin also remains largely uncorrelated to gold, making Bitcoin and gold both enticing assets for investors to hold in a diversified portfolio.

Image via dailyhodl.com

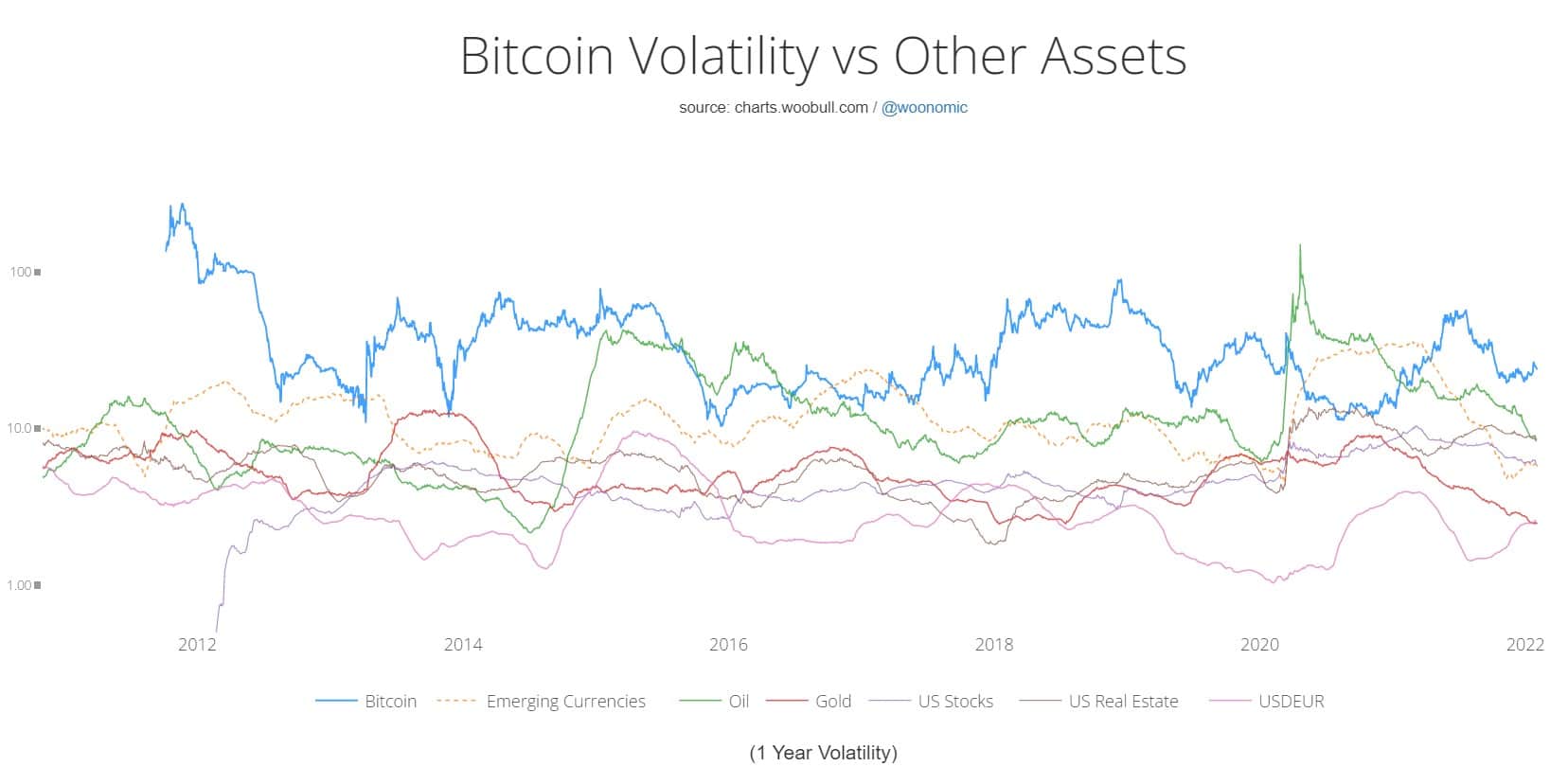

Image via dailyhodl.com Argument against Bitcoin

Bitcoin’s biggest criticism is its volatility. Many people think it is ridiculous to invest in something that can lose 10% of its value overnight. Though this is a concern that will become less and less relevant as more invest into Bitcoin and the market cap grows. Once Bitcoin reaches a 5 trillion-dollar market cap and beyond, this will make Bitcoin effectively start behaving more similar to gold regarding much lower levels of volatility. Here is an interesting insight into just how volatile Bitcoin is compared to other assets:

Image via charts.woodbull

Image via charts.woodbull The other major argument is fear over regulation and control. There is a valid argument that Bitcoin poses a serious risk to traditional fiat currencies and can replace the USD as the world reserve currency. The last thing governments want is to lose control over their economies by determining monetary supply and regulating interest rates.

Governments have a lot to be concerned over regarding Bitcoin disrupting the status quo. If it was possible to stop Bitcoin, they likely would have, though many still fear that they do not want to invest in anything that world governments may come together and effectively regulate and tax into oblivion to the point where nobody wants to use it. Of course, there is also the argument that governments do not want to ban Bitcoin as it may stifle innovation, but that is a topic for another article.

While it is impossible to stop Bitcoin as a peer-to-peer means of payment, it would not be too difficult for world governments to come together and effectively penalize, regulate, and tax Bitcoin use to the point where it is no longer desirable. This risk still concerns many investors to the point where they do not feel Bitcoin is a safe option.

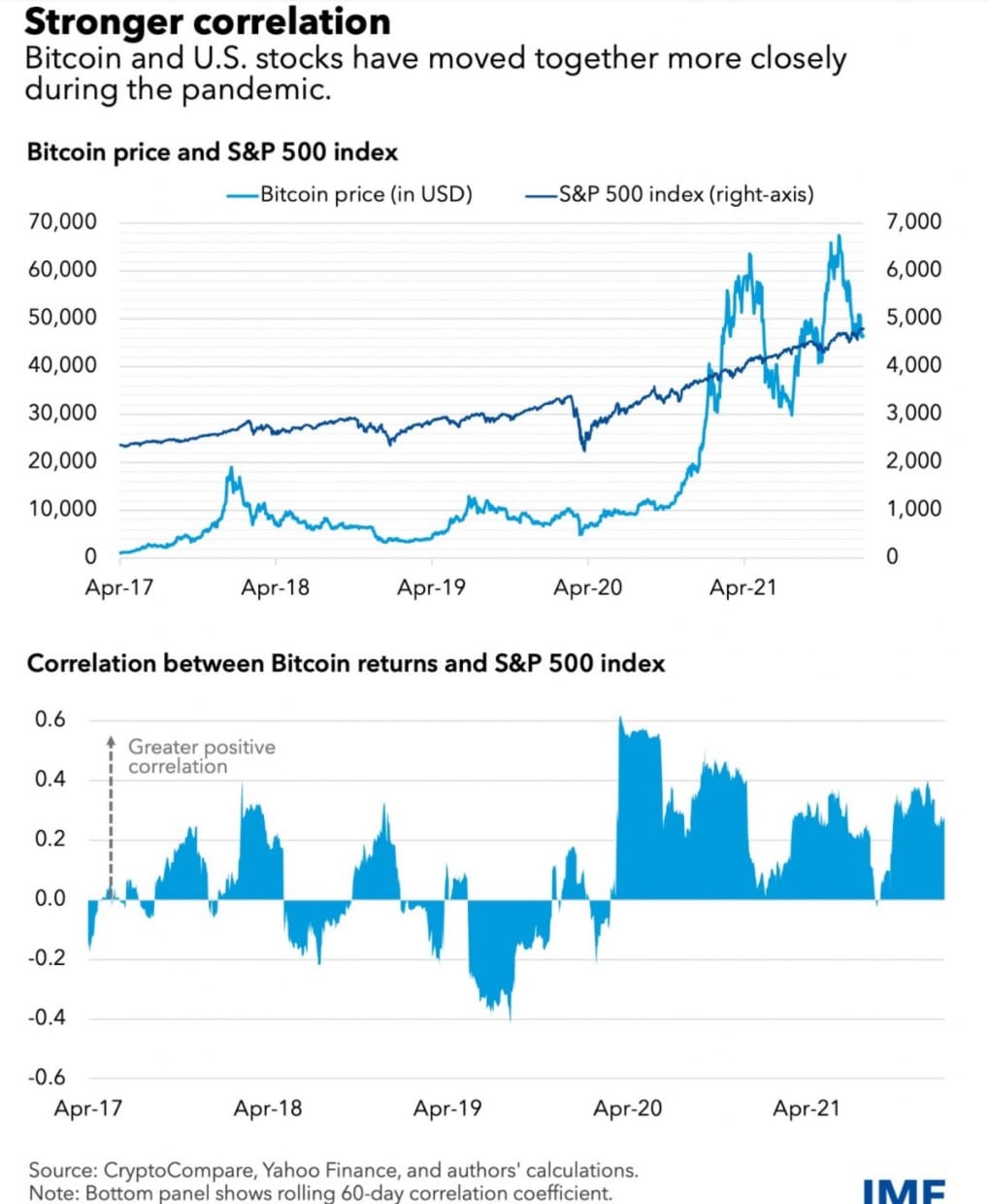

The final argument against Bitcoin is that, to the disappointment of many in the crypto community, Bitcoin has become heavily correlated to the stock market indices such as the Nasdaq and S&P 500. One of the strongest arguments to invest in gold is its lack of correlation with traditional markets, and in the early days, many investors were ecstatic to see that Bitcoin was uncorrelated to both gold and the indices, providing investors with yet another option for diversification.

Sadly, as more institutional investors pour into Bitcoin, both stocks and Bitcoin are considered by institutions as “risk-on” assets treated similarly from an investor thesis. This results in Bitcoin behaving more and more akin to stocks, and many feel that Bitcoin has lost the benefit of being uncorrelated. When investors start panic selling, both stocks and crypto get dumped hard.

Crypto Faces new Risks Among Rising Correlation to Stocks Image via blogs.imf.org

Crypto Faces new Risks Among Rising Correlation to Stocks Image via blogs.imf.org This trend has only started occurring mainly within the last two years and is relatively recent. It is too early to tell if this is a trend that will continue. It is possible that as investors start learning more about Bitcoin and its use cases and utility as a store of value, it may become seen less as a “risk-on” asset and start being viewed more similar to a safe haven asset that may result in it becoming ultimately less correlated to other risky assets.

Bitcoin vs Gold: Which One is the Ultimate Inflation Hedge?

One of my favourite ways to consider this question goes back to the same principle that exists in nearly every other investment class in terms of risk and reward. Do you invest in the past or the future? The past is often safer, has been tried and tested, is less volatile and more secure. The inverse of this is investing in the future, fuelled by innovation, new use cases and unknown upside potential. But, as every investor knows, there is a decision that needs to be weighted in terms of how much risk they are willing to take.

As discussed earlier, investing in the future is akin to investing in the unknown, an understandably risky frontier similar to investing in early dot-com companies. On the flip side of that argument is whether or not one can afford not to invest in the future, especially if competing nations or businesses are making the first move.

The risk with gold lies in the fact that it has a real possibility of becoming “Block-bustered” with Bitcoin doing to gold what Netflix did to Blockbuster. Gold is primarily held by the wealthy elite in the later stages of life, while younger and more tech-savvy investors prefer Bitcoin and digital assets. In fact, a recent survey conducted by CNBC shows that nearly half of millennial millionaires have at least 25% of their wealth in crypto and are ditching traditional assets like gold at a faster rate.

Image via CNBC

Image via CNBC As the older generations pass wealth down to younger generations, we will likely see more money find its way into Bitcoin and digital assets as they have many superior features to gold, and gold investing may become more of an outdated style of investment thinking.

Though gold still has one claim to fame that Bitcoin cannot touch now and likely won't for years, gold's reputation as a safe haven. Gold has already survived government regulatory scrutiny, world wars, the rise and fall of empires and has withstood the test of time. As a result, gold has been firmly placed as one of the cornerstones of the financial industry. It is about the safest place anyone can park their wealth. Bitcoin is still incredibly risky in this regard, which is why many investors are still uncomfortable investing in an asset that could still see significant barriers to adoption.

While everything in this article is purely my opinion and in no way am I able to give financial advice, I think investors need to consider that this decision ultimately comes down to what they are looking for in terms of an inflation hedge, and there is no reason why both gold and Bitcoin cannot be utilized. So, as an investor, do you want to hold an inflation hedge that has the potential to vastly increase your wealth over time, or are you more concerned with preserving what wealth you have?

The investors' time frame should be considered before making this decision, as many feel that Bitcoin is far too volatile to invest in for the short term as it dropped over 50% in just two months in the back half of 2021. Many consider this unsuitable for investors nearing retirement age or investors who anticipate needing to access funds in the short term. In contrast, gold is far more stable in price.

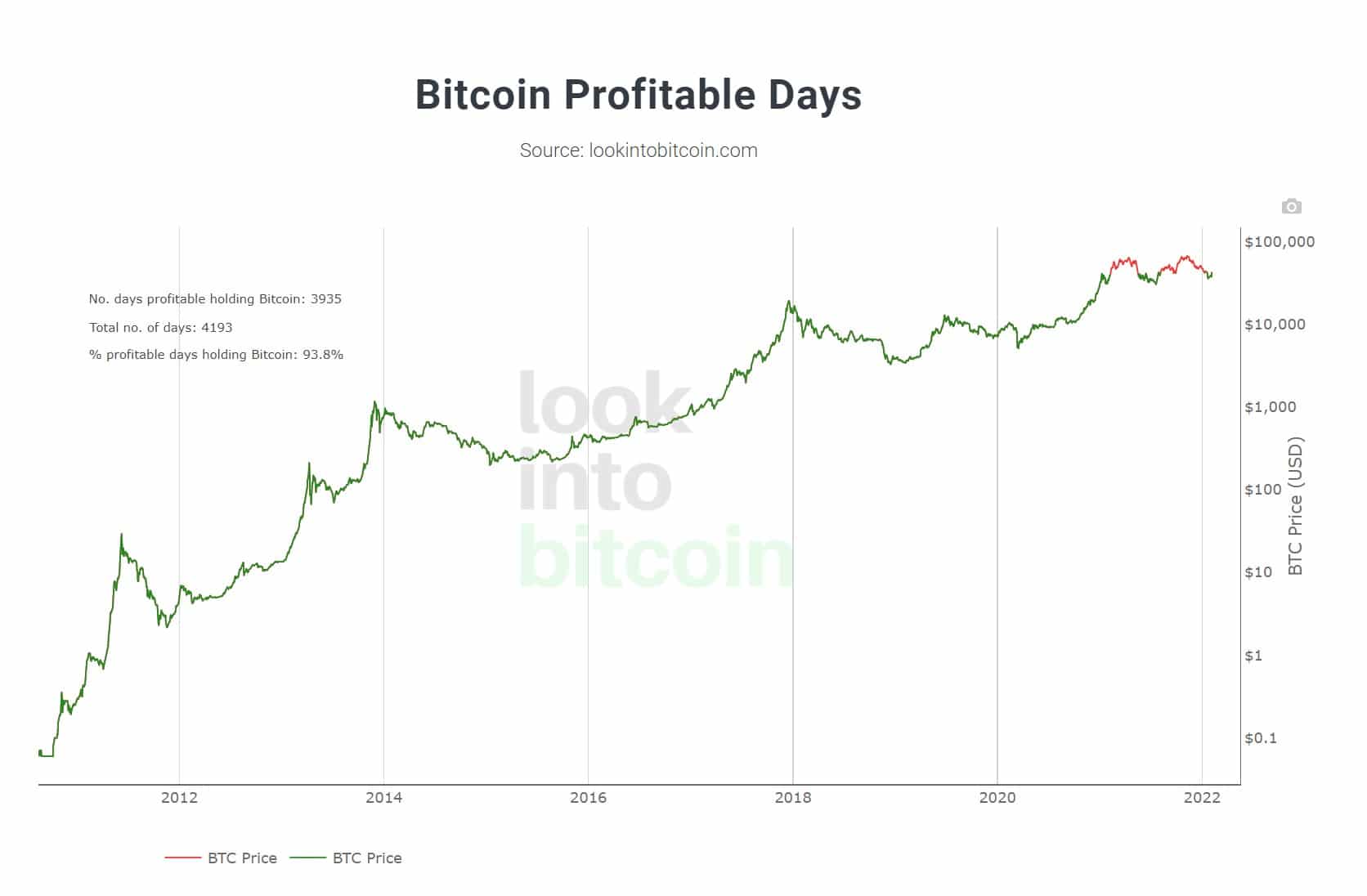

Though no investor who has held Bitcoin for longer than two years has ever seen a negative return, gold investors have now experienced a negative return for an asset that has been held for a decade. Here is an incredible chart showing that since Bitcoin's inception, 93% of the days in Bitcoin's life have been profitable. No other asset class can come close to competing with that.

Image via lookintobitcoin.com

Image via lookintobitcoin.com One of the main things people look for in an inflation hedge is to invest in an asset that appreciates faster than fiat depreciates. There is no argument that Bitcoin is a far superior inflation hedge in that regard. Are Bitcoin investors going to be concerned about 5% inflation if their money is in Bitcoin as it continues to skyrocket faster than any other traditional asset class? Anyone would be crazy not to at least consider some exposure to Bitcoin as a viable inflation hedge when faced with figures like this:

Image via pbs.twimg.com

Image via pbs.twimg.com For a more in-depth comparison of how crypto investing returns compare to the returns of traditional markets, be sure to check out our article on Crypto vs S&P 500.

Closing Thoughts

Technology has a habit of disrupting and replacing the status quo. Just as cars replaced horses and buggies, video/audio streaming and downloading replaced physical disks, and mobile phones replaced house phones, so too may Bitcoin replace gold as the superior inflation hedge and store of value, with many investors believing it already has.

If anything is going to help Bitcoin achieve the mainstream narrative as the ultimate store of value and inflation hedge, it will be the innovation, adoption, education and use cases that continue to grow on the Bitcoin network. The exciting thing about the blockchain revolution is that we cannot even conceive of what future use cases may be born out of Bitcoin, just as early internet creators likely did not anticipate the utility of platforms like Uber and Netflix, or just how revolutionary the internet would become. We too are still at the early cusp of Bitcoin and blockchain technology.

Bitcoin has truly disrupted the entire financial landscape and has thrown many traditional investor theses out the window, fundamentally changing what was once thought possible. If that isn’t enough to give Bitcoin credibility as the ultimate inflation hedge and store of value, then I don’t know what can.