When you want to hold savings in a particular currency, choosing one currency over the other often depends on how correlated they are.

There is no point in putting your savings in another currency if it is likely to move in similar ways to the currency it is currently in. Hence, you would be looking for those currencies that have very little correlation to those that you hold.

If this is the case, it means that cryptocurrencies should be your best bet.

The study in question was conducted from September 2015 until the end of December 2017. It has concluded that there was almost no correlation between the leading fiat currencies and a range of different crypto pairs.

Let's take a closer look at the analysis.

Statistical Correlation

Correlation is one of the most important statistical measures of relation between two events or data sets. They are used extensively in a number of different disciplines including in the financial markets where they play a pivotal role.

What is important to note about correlation studies is that they are a based on analysing past data and measuring the correlation over that period. This means that the more data that you have, the better your analysis of the correlation.

Given that cryptocurrencies are such a new asset class, with some only having been around for 2-3 years, comprehensive studies have been hard to come by. Now, economic researchers have released one of the first crypto / fiat correlation studies.

Results of the Study

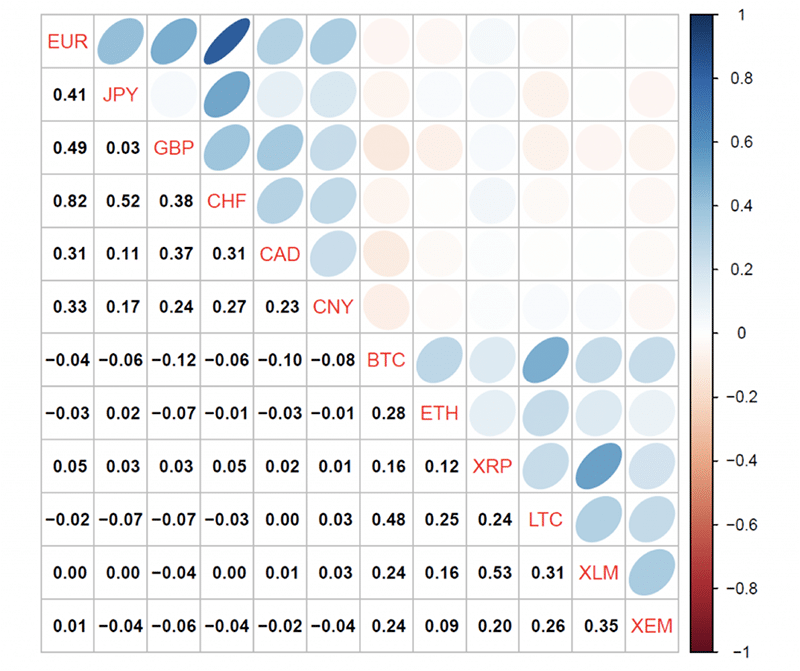

The researchers ran their correlation numbers and presented them in something called a "correlation matrix". This is when all of the assets are run through correlation calculations with each of the other assets.

Correlation Matrix. Crypto vs. Fiat. Source: econstar.eu

Correlation Matrix. Crypto vs. Fiat. Source: econstar.euAs you can see, they have run the calculations with all pairs including the Fiat pairs against themselves. There is little surprise then that many of the Fiat currencies are correlated with the other fiat currencies.

For example, the correlation between the Euro and the Swiss Franc is the highest with an 82% correlation. This makes sense given that Switzerland's greatest trading partner is the Euro Zone. What happens in the European economy is likely to have a great impact on the Swiss and hence their currency.

The only fiat currency pairs that did not show any meaningful correlation were the Japanese Yen and the British Pound. This is probably why so many investors consider these currencies as safe havens away from less stable currency pairs.

The most interesting result though, is how little correlation there is between the cryptocurrency pairs and the traditional fiat currencies. There appears to be a minor inverse relationship with Bitcoin and CAD / GBP. Yet, this is a weak statistical relationship.

Crypto vs. Crypto Correlation

Something else that the study is able to illustrate is the correlation amongst the cryptocurrency pairs. This would not really be news to anyone who has followed the cryptocurrency markets recently.

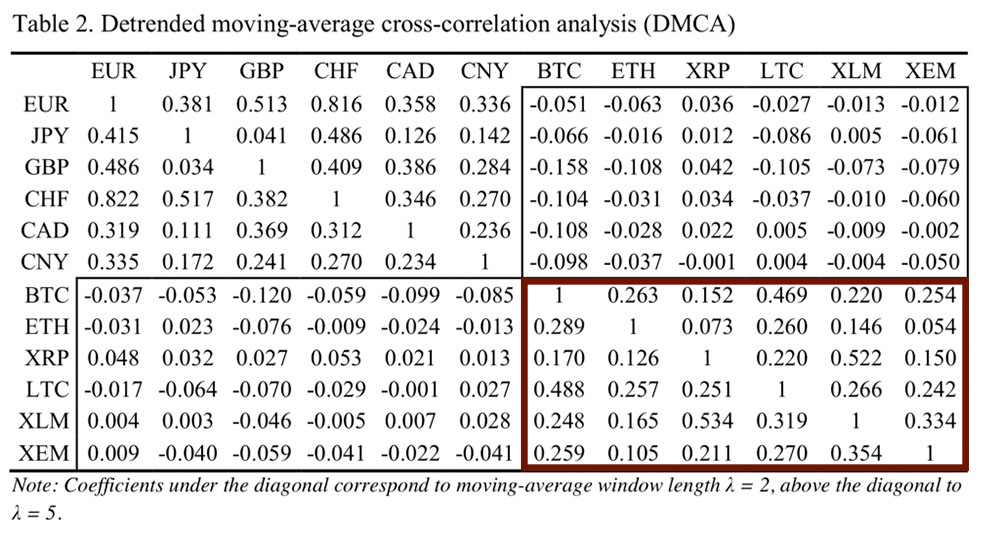

They conducted a second analysis that used Detrended moving-average cross-correlation analysis (DMCA). Below is the DMCA results with the cryptocurrency correlations highlighted in red.

DMCA Analysis of Crypto and Fiat

DMCA Analysis of Crypto and FiatAs you can see, there is a relatively high "coherency" between Bitcoin and Litcoin at 0.48 which is statistically significant. However, when they excluded the correlation impact in severe positive / negative returns, the coherency between the pairs wise 0.7. The authors therefore concluded:

Thus, these two cryptocurrencies are connected to some extent in the short- term period, irrespective of the current market situation

One of the highest correlations among the cryptocurrency pairs was that of Ripple (XRP) and Stellar Lumens (XLM). This had a correlation of 53.4% which is most likely due to the similarities between the coins. Although they cater to different end users, they both want to aim to be a payment solution.

There is also a high correlation with Bitcoin and Ethereum at the extreme lower quintile and in median dependence. This is despite the fact that the technology underpinning these cryptocurrencies is substantially different.

Impact on Investing Strategy

What this shows is that most of the cryptocurrencies will offer you diversification benefits away from the traditional fiat currency. They do not follow the same returns and hence their returns should be unrelated to the traditional fiat holdings.

If you are someone who holds a great deal of your assets in Cryptocurrencies, then XRP appears to be the best bet for diversification of returns. This is the cryptocurrency that had the least correlation with the other crypto pairs.

One clear trend that the study seems to suggest is that cryptocurrencies are more correlated with Bitcoin when the latter is falling as compared to when it is rallying. The authors erred more on the side of caution and concluded the study advising investors that

It is beneficial to diversify among forex currencies and cryptocurrencies because in times of distress, extremely low returns are negatively associated

It is also important to note that although correlation is a great way to identify related assets, it is a based on past information and assumes that relationships remain the same in the future. While this is often the case, statistical relationships can break down as time progresses.

Hence, the investor should use correlation analysis much like the trader uses technical studies. It should help inform an opinion but not be the entire basis for the investment.