Bitcoin has been showing a strong relationship to the stock market in recent months, with a notably strong correlation in performance with the Nasdaq. But last week’s market data suggests that this correlation is weakening and could be coming to an end.

For a long time, crypto enthusiasts have been keen to see a decoupling in the relationship between Bitcoin and traditional financial markets so Bitcoin can live up to its potential narrative of being an inflation hedge, strong store of value, and a useful asset to hold as part of a diversified portfolio.

Bitcoin’s performance in recent months has gone hand in hand with the greater stock market, reducing its effectiveness in the mentioned narratives. When stocks are up, BTC price has gone up, and when stocks drop, Bitcoin typically follows suit.

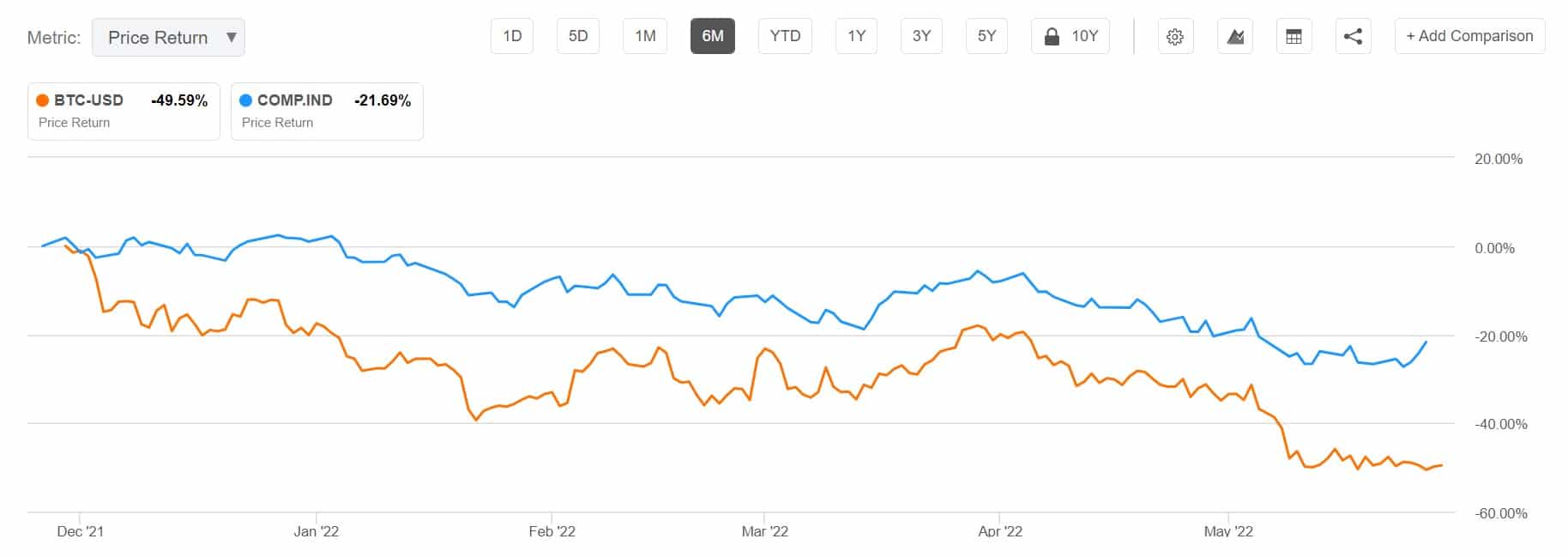

A Look at Bitcoin vs the Nasdaq composite index. Image via Seeking Alpha

A Look at Bitcoin vs the Nasdaq composite index. Image via Seeking Alpha

This past week saw green action across the stock markets, with the Nasdaq up 3.1%, while Bitcoin has fallen 3%, not exactly the sort of decoupling we have been hoping for.

The United States Commerce Department released figures on May 27th, showing that personal savings rates fell to 4.4% in April, reaching the lowest levels since 2008. This has sparked fear among investors and crypto traders that worsening global macroeconomic conditions could lead to further aversion for capital allocation to “risk-on” assets, which is how Bitcoin is viewed by many institutional investors.

One of Bitcoin’s strongest narratives that we are yet to see play out is as a viable “risk-off” asset class, a store of value similar to the likes of Gold that could lead to further inflows of institutional money into the asset. A further decoupling could help drive this narrative to fruition.

As institutional investors have been cautiously dipping their toes into the Bitcoin pool, the asset has been largely treated as a risk-on asset, along with tech and speculative growth stocks, which has led to Bitcoin seeing similar buying and selling patterns. Bitcoin holders often argue against the asset being treated as a similar speculative gamble and feel that institutions are failing to see Bitcoin’s true potential.

While one week of data is not enough to make any definite conclusions, this new inverse correlation is interesting to see. It appears that for the past week, for better or for worse, Wall Street agreed with the sentiment that Bitcoin should not be placed in the same basket as other assets.