Choosing a crypto exchange should feel like picking a bank account, not solving a puzzle. This guide compares Kraken and Coinbase with a clear focus on fees, asset coverage, security, and day-to-day usability.

If you are brand new, our Coinbase review shows why its app feels familiar. If you plan to trade more actively, our Kraken review explains the deeper toolkit and lower tiers. We will keep things practical with real examples, quick tables, and a verdict that you can gain a better perspective from. Let's help you find the right fit for your goals and location with clarity and confidence.

Quick Verdict

If you want the smoothest first trade, pick Coinbase. If you care about lower trading costs, deeper tools, and broader market access, pick Kraken.

Winner by Category

| Category | Winner |

|---|---|

| Beginners | Coinbase — clean interface and built-in education via Advanced Trade. |

| Advanced traders | Kraken — margin and futures plus granular orders on Kraken Pro. |

| Fees | Kraken — tiered fee schedule with lower average costs. |

| Crypto selection | Kraken — wider pairs and market coverage. |

| Staking | Kraken — broader coverage and lower commissions. |

| Mobile experience | Coinbase — most beginner-friendly app experience. |

| Security | Tie — both maintain strong controls and independent audits. |

| Global users | Kraken — supports 9 major fiats versus 3 on Coinbase. |

Bottom Line

Choose Coinbase for the fastest start and simple funding. Choose Kraken when you need lower fees, more pairs, margin or futures, and multi-fiat flexibility.

Opening an Account: Kraken vs Coinbase

Getting started should feel as straightforward as opening a modern banking app. Here is what to expect on each platform.

Both Platforms Require Users to be at least 18 and Located in Supported Regions. Image via Kraken

Both Platforms Require Users to be at least 18 and Located in Supported Regions. Image via KrakenVerification Requirements

Age and residency limits

- Both platforms require users to be at least 18 and located in supported regions. Kraken’s eligibility and levels outline who can join and which features unlock at each tier.

- Coinbase identity requirements confirm that identity checks are mandatory before full access.

KYC structure, tiered versus instant

- Kraken follows a tiered model with level requirements for Intermediate and Pro limits.

- Coinbase performs KYC during account creation through in-app verification that activates features once approved.

ID types and address proof

- Accepted documents on Kraken are listed under document requirements, including government ID and proof of address.

- Coinbase accepts similar documents as described in its ID guide.

Typical verification times

- Kraken Intermediate usually clears quickly, while Pro can require manual review per the level requirements.

- Coinbase verification is typically swift, though some funding methods can take additional time, as noted in the account and security.

Depositing before full verification

- Kraken enables cash and crypto deposits once the deposit prerequisites at Intermediate are met.

- Coinbase limits funding and trading until the KYC flow is complete.

Geographic restrictions

- For Kraken, major US limitations include Maine account closures and a halt on new service for residents per Kraken’s Maine notice, plus restricted transfers in states such as New York and Indiana, and limited USD rails in Massachusetts and Louisiana, as outlined under licensing and state access.

- For Coinbase, access is unavailable in comprehensively sanctioned markets, including Iran, North Korea, Syria, Cuba, Russia, and the Crimea, Donetsk, and Luhansk regions of Ukraine, per prohibited regions. Product availability can also vary by country, even where accounts are allowed.

Coinbase often feels faster for a first deposit. Image via Coinbase

Coinbase often feels faster for a first deposit. Image via CoinbaseStep-by-Step Signup Flow

Coinbase: instant KYC, card linking, under 24 hours approval

- Create an account, complete in-app ID checks, then link a bank or card for funding.

Kraken: tier selection, Intermediate or Pro, one to three days verification

- Register, choose a tier in verification levels, submit documents, then trade once approved per limits and access.

A prepared government ID and a recent proof of address usually make onboarding smooth. Coinbase often feels faster for a first deposit, while Kraken’s tiered path offers an easy start with room to scale.

Mobile App Comparison

Mobile apps are where most users trade, so usability and ratings matter. Here is how Coinbase and Kraken compare for everyday use.

Kraken better Serves Advanced Users who Value Granular Control. . Image via Kraken

Kraken better Serves Advanced Users who Value Granular Control. . Image via KrakenRatings & Reach

- Coinbase iOS: 4.7 out of 5 from about 1.8 million ratings on its App Store listing.

- Coinbase Android: 3.3 stars with about 920,000 reviews and 50 million plus installs on Google Play.

- Kraken iOS: 4.7 out of 5 from about 27,000 ratings on its App Store listing.

- Kraken Android: 4.1 stars with about 47,800 reviews and 5 million plus installs on Google Play.

Ratings and download bands were checked on Feb. 3, 2026.

Coinbase is Friendlier for Beginners who want a Clean Start. Image via Coinbase

Coinbase is Friendlier for Beginners who want a Clean Start. Image via CoinbaseExperience & Features

- Coinbase focuses on simplicity, with clear navigation and quick funding, plus support for Apple Pay and Google Pay through the Coinbase Card. Note that Learn and Earn rewards ended in May 2025. See the Coinbase Card with Apple Pay and Google Pay and the Learning rewards update.

- Kraken offers a fuller trading toolkit inside the app, including advanced order types and deeper market views suited to active traders, with margin and futures where eligible. Explore Kraken Pro order types or the official mobile apps overview.

Who each suits:

- Choose Coinbase for the smoothest first experience. Coinbase is friendlier for beginners who want a clean start.

- Kraken better serves advanced users who value granular control. Use Kraken when you want more powerful trading tools later on.

Trading Costs and Real Fee Examples

Costs add up over time. The first table shows headline spot, instant, derivatives, and staking fees with clear 30-day volume thresholds. The second table converts fees into simple USD examples.

Always Check your 30-day Volume Tier and Regional Eligibility before Placing Orders. Image via Freepik

Always Check your 30-day Volume Tier and Regional Eligibility before Placing Orders. Image via Freepik Fee Overview

| Item | Coinbase | Kraken |

|---|---|---|

| Spot maker (base) | 0.40% (maker), per Coinbase Exchange fee tiers | 0.25% (maker), per the Kraken fee schedule |

| Spot taker (base) | 0.60% (taker). | 0.40% (taker) |

| Spot maker (lowest with volume) | 0.00% at $250M–$400M; 0.00% at $400M+ 30-day volume | 0.00% at $10M+; 0.00% at $100M+ (institutional loyalty tier) |

| Spot taker (lowest with volume) | 0.05% at $400M+ | 0.10% at $10M+; 0.08% at $100M+ (institutional loyalty tier) |

| Instant or simple buy | Spread plus disclosed charges under Pricing & fees | About 1% trading fee + spread; Kraken+ waives the 1% up to a $10,000/month limit (spreads/card fees still apply) |

| Bank transfers and wires (USD) | ACH deposit/withdrawal: Free; Wire deposit: $10; Wire withdrawal: $25 (see Exchange fees page above) | ACH withdrawal: Free; FedWire: $4; SWIFT: $13 (USD), per withdrawal options |

| Derivatives maker/taker (base) | Perpetuals (International Exchange): 0.020% / 0.040% base; tiers step down with volume. See International Exchange fees | Futures: 0.020% / 0.050% base, stepping to 0.005% / 0.025% at $30M+ 30-day volume (lower at higher tiers) |

| Staking commission | Standard 35% commission on major assets (varies by asset; Coinbase One discounts apply). See Pricing & fees | No stake/unstake fee; Kraken takes a commission on rewards that varies by asset. See staking overview |

As of Feb. 3, 2026.

Real-World Scenarios

| Item | Coinbase | Kraken |

|---|---|---|

| Buy 1,000 dollars of BTC | 0.60% → $6.00 | 0.40% → $4.00 |

| Trade 10,000 dollars per month | 0.60% → $60/month → $720/year | 0.40% → $40/month → $480/year |

| Stake 5,000 dollars in ETH | Example net ≈ 1.25% → $62.50/year (uses Coinbase ETH estimated reward with 35% commission) | Example net ≈ 2.10% → $105.00/year (assumes 3.00% gross ETH reward and a 30% commission) |

| Assumptions (applies to both) | Entry-tier taker on advanced interfaces; ignores spreads, instant-buy premiums, and bank fees. | Entry-tier taker on advanced interfaces; ignores spreads, instant-buy premiums, and bank fees. |

Note: Figures are illustrative and vary by asset and region.

At entry tiers, Kraken Pro often lowers spot trading costs, while Coinbase’s funding rails and ecosystem can feel simpler for first-time users. For derivatives, international Coinbase users may access zero-fee perps during active promos, while Kraken posts clear laddered futures fees. Always check your 30-day volume tier and regional eligibility before placing orders.

Supported Assets and Fiat Currencies

Breadth determines what you can buy and how easily you can fund your account. Here is a concise view of asset depth and fiat on-ramps.

Kraken usually Offers Wider Market Coverage. Image via Kraken

Kraken usually Offers Wider Market Coverage. Image via KrakenAsset Coverage

Kraken lists 500-plus cryptocurrencies on its platform-wide listings hub and markets pages, while Coinbase shows about 341 listed assets on its public listed assets directory. That means Kraken offers roughly 45 percent more listed coins.

For trading pairs, Coinbase advertises 500-plus spot pairs on Advanced Trade, whereas Kraken cites around 1,183 spot pairs across Pro markets in its Learn materials for day traders, so Kraken typically has about twice as many spot combinations.

For everyday activity, “top traded” pairs tend to center on major USD books. On Coinbase, BTC/USD and ETH/USD consistently rank at the top on the exchange markets page.

On Kraken, USDT/USD, XBT/USD and ETH/USD are frequent leaders on the Kraken markets view.

Kraken usually offers wider market coverage, while Coinbase focuses on a narrower, high-liquidity list that remains easy to navigate.

Coinbase Focuses on a Narrower, High-Liquidity List. Image via Coinbase

Coinbase Focuses on a Narrower, High-Liquidity List. Image via CoinbaseFiat and Payment Methods

Kraken supports 9 fiat currencies for funding and settlement, including USD, EUR, GBP, CAD, AUD, CHF, ARS, BRL and MXN, with corridor-specific rails such as ACH, SEPA, Faster Payments and SWIFT documented under its cash funding guides and withdrawal options.

Coinbase primarily supports USD, EUR and GBP balances, with ACH or wire in the US, SEPA in the EU and Faster Payments in the UK, detailed under funding methods. Coinbase also enables PayPal in supported regions via its PayPal FAQ, while Kraken offers PayPal for select USD deposits within its cash funding flows above.

If you need multi-fiat flexibility across North America, Europe and parts of APAC, Kraken is generally easier to fund in local currency. If you only use USD, EUR or GBP with common banking rails, Coinbase remains straightforward.

Trading Experience and Leverage Options

A good trading interface should feel calm and predictable, with the right tools a tap away. Here is how the two platforms handle execution, charts, and leverage.

A Good Trading Interface should Feel Calm, Intuitive and Predictable. Image via Freepik

A Good Trading Interface should Feel Calm, Intuitive and Predictable. Image via FreepikCoinbase Advanced

Coinbase keeps the experience simple, with clean charts, quick ticket entry, and an interface that mirrors the main app so beginners are not overwhelmed. The Advanced Trade layout focuses on market and limit tickets, plus basic stops, which lowers complexity for first orders.

US customers can access retail perpetuals with up to 10× leverage, while eligible users can get a maximum of 50×, depending on the asset. The design aims for speed and clarity rather than a long list of settings, which is helpful if you place occasional marketable orders and want minimal configuration.

Kraken Pro

Kraken Pro is built for active traders. You get spot margin up to 10×, access to futures where eligible, and a deep toolkit that includes advanced order types such as stop, take profit, OCO, iceberg, and trailing. The order book view is dense, charts are configurable, and hotkeys can accelerate order entry.

High-volume users qualify for tiered pricing and maker rebates under the fee schedule, which can meaningfully reduce trading costs once monthly turnover rises. The learning curve is steeper, yet once mastered it supports precise entries and exits with fewer clicks.

Verdict

Choose Coinbase Advanced if you value a straightforward ticket and familiar layout. Choose Kraken Pro if you want futures access, and granular order controls with pricing that improves at higher volumes.

Earning and Staking: Kraken vs Coinbase

Earning on idle assets comes down to three levers: what you can stake, what it pays after platform fees, and how quickly you can access rewards or unstake.

US Users Face Additional Limitations on Certain Assets and Staking Programs on both Platforms. Image via Freepik

US Users Face Additional Limitations on Certain Assets and Staking Programs on both Platforms. Image via FreepikStaking & Earn Features

- Kraken supports a broad menu of assets, including ETH, DOT, SOL, ADA and more on its staking overview, with asset specific details such as ETH on Kraken ETH staking.

- Coinbase focuses on a shorter list of majors, led by ETH, SOL and ADA, outlined under staking information.

APYs are variable and depend on network conditions:

Kraken displays indicative APR ranges per asset, with a platform commission applied to rewards. Coinbase presents estimated APYs in the app and applies a platform commission per its pricing and fees.

Payout cadence and access differ:

- Kraken generally credits rewards on a frequent schedule that tracks on chain cycles, while bonded staking may involve protocol lockups or unbonding windows detailed on asset pages.

- Coinbase distributes rewards regularly to your account balance, and unstaking timing follows each network’s rules as described in its staking help materials.

Note: Availability varies by region. US users face additional limitations on certain assets and staking programs on both platforms.

Net Reward Example

A simple illustration with ETH using round numbers:

Kraken: 4.0% gross – 15% fee → ~3.4% net on the amount staked.

Coinbase: 3.5% gross – 25% fee → ~2.6% net on the amount staked.

These figures are examples to show how platform commissions reduce headline yields. Always check the current in app estimate for your region before committing funds.

Kraken tends to offer broader coverage and more frequent reward crediting, while Coinbase keeps staking straightforward inside a familiar app experience.

NFT Marketplaces

NFT support has shifted since 2024. Let's look at the current state so you don’t chase legacy features.

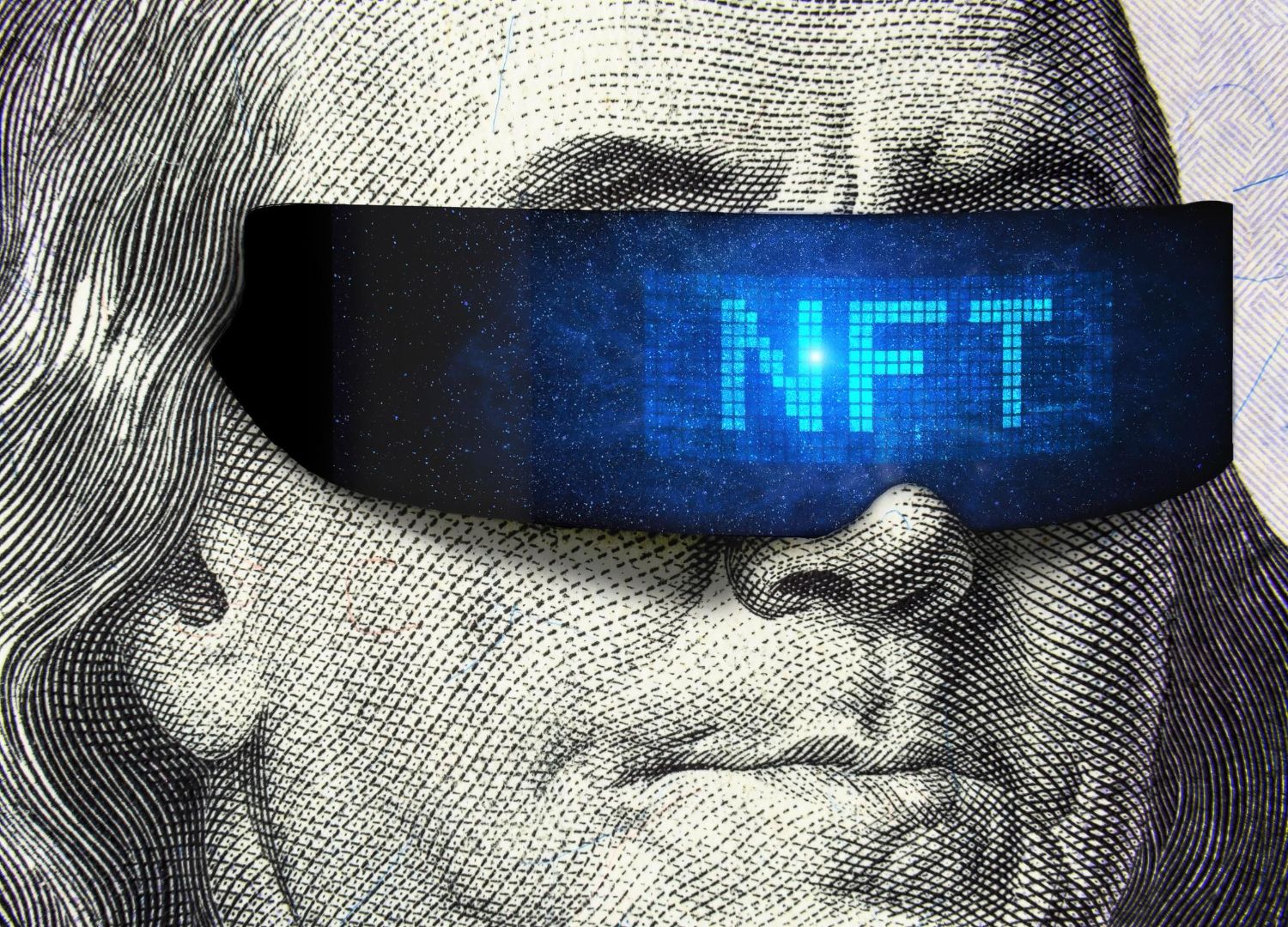

Kraken no longer Offers NFT Trading, and Coinbase no longer Operates a Standalone NFT Marketplace. Image via Freepik

Kraken no longer Offers NFT Trading, and Coinbase no longer Operates a Standalone NFT Marketplace. Image via FreepikKraken NFT

Status: Discontinued. Kraken placed its marketplace into withdrawal-only mode on November 27, 2024, with a final shutdown on February 27, 2025, per Kraken’s NFT marketplace closure FAQ.

What it means: No listing, buying, bidding, or selling on Kraken; users were advised to withdraw to self-custody before the deadline.

Quick History: At launch, Kraken highlighted zero gas fees, Ethereum and Solana support, and the ability to list or offer NFTs in multiple fiat/crypto options, per its press release.

Coinbase NFT

Status: The standalone Coinbase NFT marketplace began sunset on July 10, 2024, and was turned off on August 1, 2024, with users redirected to Coinbase’s on-chain experience, per Coinbase NFT Migration.

How to engage now: Coinbase directs users to access NFT features in the Base app (browse collections and trending mints), and the migration page notes you can list on third-party marketplaces going forward.

Bottom line: Kraken no longer offers NFT trading, and Coinbase no longer operates a standalone NFT marketplace. NFT activity is routed to Coinbase’s Base app rather than a dedicated marketplace.

Security and Compliance

Strong security blends cold storage, strict account controls, and independent audits. Here is a concise snapshot for both exchanges.

Both maintain Active Bounty Programs and Modern MFA. Image via Freepik

Both maintain Active Bounty Programs and Modern MFA. Image via FreepikCustody & Controls

- Cold storage: Coinbase holds 98% plus of customer crypto offline in cold storage, as described in its security blog. Kraken states that client assets are kept primarily in offline custody with layered physical protections on its security page.

- MFA methods: Coinbase supports SMS, authenticator apps, and hardware security keys such as YubiKey through 2-step verification. Kraken supports FIDO2 passkeys and app-based 2FA, and documents its program alongside ISO and SOC.

- Withdrawal controls: Coinbase offers address allowlisting on Exchange and International Exchange in its allowlist guides. Kraken provides Global Settings Lock to freeze sensitive changes and protect withdrawals in its GSL guide.

Certifications & Insurance

- Independent certifications: Kraken lists ISO/IEC 27001 and SOC 2 reports for its programs and has announced a SOC 2 Type 2 report for custody in a recent update.

- Insurance: Coinbase notes crime insurance that covers a portion of hot-wallet digital assets on its insurance page.

- Bug bounties: Kraken runs a public bug bounty through its program page. Coinbase maintains a bounty with high value on-chain scopes as outlined in its program announcement.

Coinbase emphasizes large-scale cold storage and insured hot wallets, while Kraken highlights audited controls and hardened account safeguards such as Global Settings Lock. Both maintain active bounty programs and modern MFA, which are essential for day-to-day protection.

Customer Support: Head-to-Head

Good support is about fast access to a human, clear escalation, and realistic timelines. Here is how both exchanges compare today.

Coinbase has Mixed Public Reviews while Kraken in General, has a Poor Score on Trustpilot. Image via Freepik

Coinbase has Mixed Public Reviews while Kraken in General, has a Poor Score on Trustpilot. Image via FreepikSupport Channels

Kraken provides 24/7 live chat and phone support through its dedicated global support hub.

Coinbase offers live chat and the ability to request a call in supported countries via the Help Center contact flow, and Coinbase One members receive 24/7 priority support per the Coinbase One benefits page.

Response Times & User Feedback

Typical reply windows depend on issue type. Kraken notes that complex complaints can take 30 to 35 business days to conclude, as described in its complaint handling policy.

Coinbase publishes country phone lines and indicates 24/7 coverage in the United States and the United Kingdom on its account security help, with regional hours elsewhere.

Public Sentiment Snapshots

Coinbase shows a TrustScore of about 3.9 with roughly 20,000 reviews on Trustpilot, while Kraken shows a TrustScore of about 1.6 with roughly 3,400 reviews on Trustpilot. Common themes persist. Users frequently mention account locks on Coinbase, visible across recent Trustpilot entries, and verification or ticket delays on Kraken, which Kraken itself flags can occur during high-demand periods in its verification timing guidance shared before.

Kraken makes it easiest to reach a human at any hour, while Coinbase’s coverage improves meaningfully with a Coinbase One subscription. Coinbase has mixed public reviews, while Kraken, in general, has a poor score on Trustpilot.

Which Exchange Should You Choose?

Use this quick guide to match your needs with the right platform. Follow the prompts and choose the first rule that fits you.

- New to crypto? Choose Coinbase for a clean start and simple funding via Advanced Trade.

- Need margin or futures? Choose Kraken for spot margin up to 10× and futures in eligible regions.

- Trade more than 5,000 dollars per month? Choose Kraken for lower entry-tier spot fees.

- Care most about mobile experience? Choose Coinbase for a familiar, beginner-friendly app.

- Outside the US, EU, or UK, or want multiple fiat currencies? Choose Kraken for broader fiat coverage.

- Still unsure? If fees matter most, lean Kraken. If simplicity matters most, lean Coinbase.

Final Verdict

Here is the quick, persona-based wrap-up so you can choose with confidence.

Kraken

- Best for advanced, global, or cost-conscious traders who want lower tiers and deeper tools on Kraken Pro’s fee schedule with eligible access to margin and futures.

- Pros: Lower fees, leverage access, and broad markets.

- Cons: Steeper learning curve, regional feature limits.

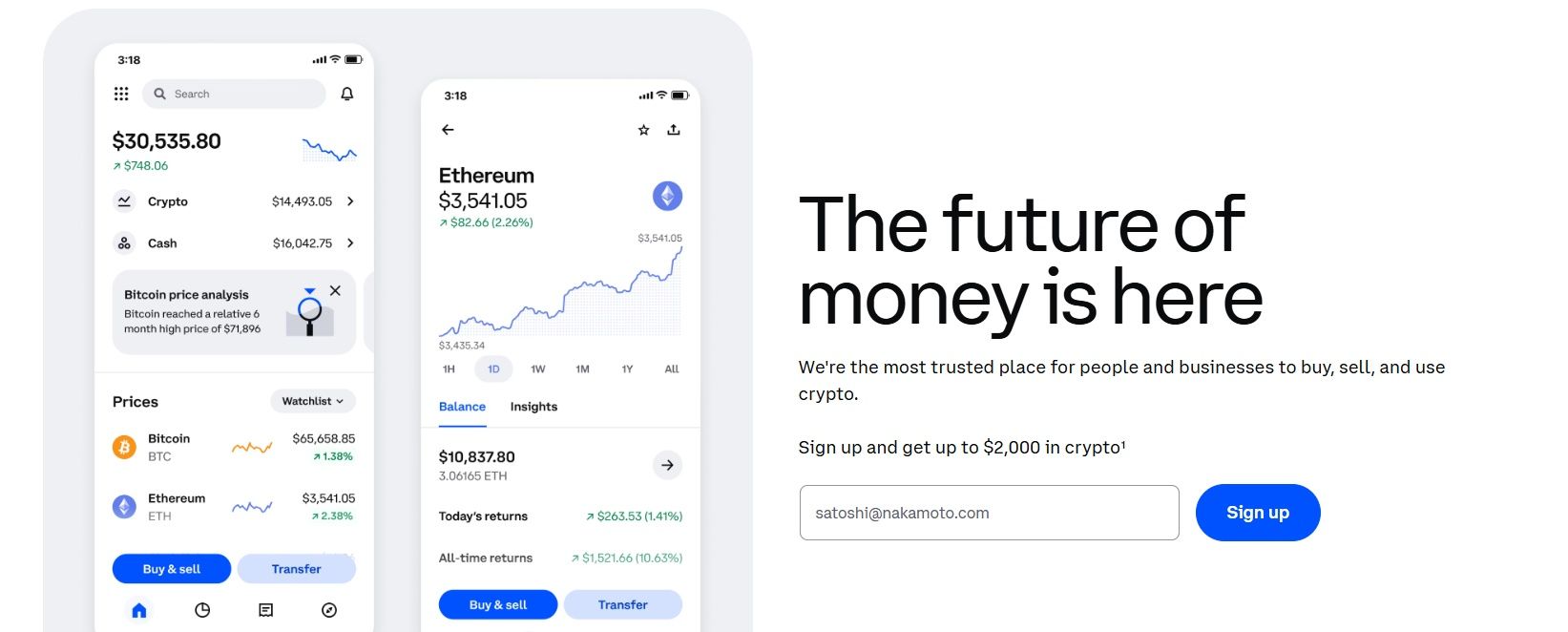

Coinbase

- Best for beginners, retail investors, and compliance-focused users who value the clean Advanced Trade interface and strong security posture.

- Pros: Simple onboarding, regulated brand, integrated wallet and funding.

- Cons: Higher entry tier trading fees, fewer pairs and fiat options.

If you want the fastest start, choose Coinbase. If you expect to grow into higher volumes or need multi-fiat support, choose Kraken and scale into its advanced toolset when ready.